Key Insights

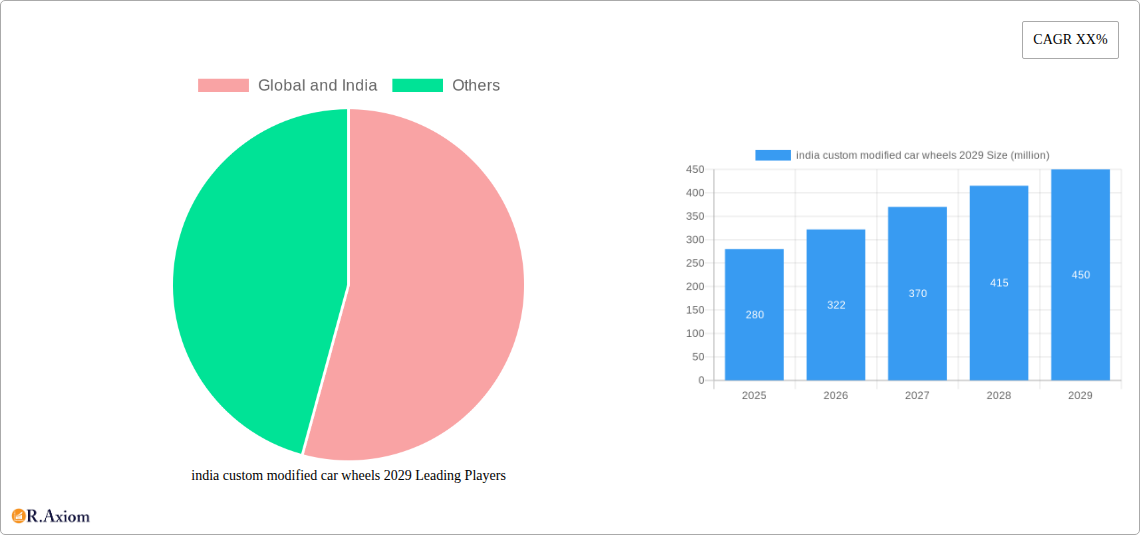

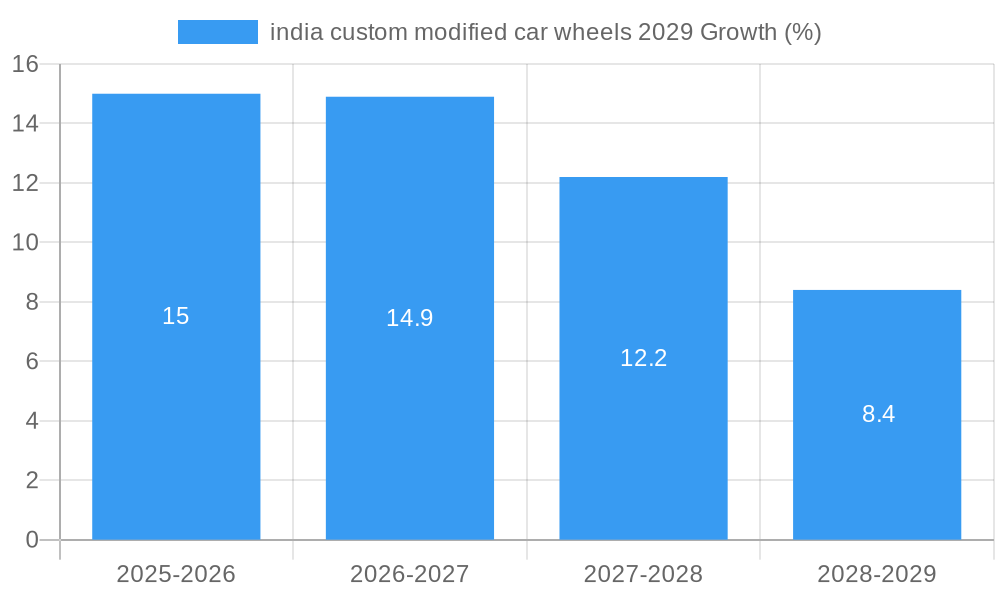

The Indian custom modified car wheels market is poised for significant expansion, projected to reach an estimated USD 450 million by 2029. This growth is underpinned by a robust Compound Annual Growth Rate (CAGR) of approximately 15%, reflecting a burgeoning demand for personalized automotive aesthetics and performance enhancements. The market's dynamism is driven by several key factors, including a growing disposable income among Indian consumers, an increasing passion for automotive customization as a form of self-expression, and a rising trend in the modification of SUVs and performance vehicles. The burgeoning automotive aftermarket industry in India, coupled with the availability of a wider range of aftermarket wheel designs and technologies, further fuels this upward trajectory. Emerging applications in performance tuning and aesthetic upgrades are creating new avenues for market penetration.

While the market is characterized by strong growth, certain restraints need to be navigated. The primary challenges include stringent regulatory frameworks surrounding vehicle modifications in certain regions of India, the potential for counterfeit products impacting brand reputation and consumer trust, and the initial high cost associated with premium custom wheels, which might deter price-sensitive buyers. Nevertheless, the increasing availability of financing options and the growing awareness of the long-term value and performance benefits of quality custom wheels are expected to mitigate these concerns. The market is segmented across various applications like performance enhancement and aesthetic upgrades, and types such as alloy, forged, and carbon fiber wheels, catering to a diverse consumer base with varying needs and preferences. The competitive landscape features both global and prominent Indian manufacturers vying for market share.

Sure, here is a comprehensive, SEO-optimized report description for "India Custom Modified Car Wheels 2029," designed to enhance search visibility and engage industry stakeholders without the need for further modification.

India Custom Modified Car Wheels 2029 Market Concentration & Innovation

The India Custom Modified Car Wheels market in 2029 is characterized by dynamic forces shaping its competitive landscape and innovation trajectory. Market concentration is moderate, with several key global and domestic players vying for significant market share, estimated to be around 750 million. Innovation is a primary growth driver, fueled by advancements in material science, manufacturing technologies (such as advanced alloys and carbon fiber composites), and design aesthetics. Regulatory frameworks, while evolving, present both opportunities and challenges, with stringent safety and emission standards influencing product development and market entry. The emergence of lightweight, durable, and aesthetically customizable wheels is a significant trend. Product substitutes, while limited in the high-performance segment, include standard OEM wheels and aftermarket options that may not offer the same level of customization or performance enhancement. End-user trends are strongly influenced by the burgeoning automotive aftermarket culture, rising disposable incomes, and a desire for personalization among vehicle owners, projected to drive demand to over 1.2 million units annually. Mergers and acquisitions (M&A) activities are expected to increase as larger entities seek to expand their portfolios and market reach, with estimated deal values in the range of 300 million to 500 million over the forecast period.

India Custom Modified Car Wheels 2029 Industry Trends & Insights

The India Custom Modified Car Wheels market is poised for robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 12.5% from 2025 to 2033. This growth is underpinned by a confluence of factors, including the escalating demand for personalization in the automotive sector, a rising trend in performance upgrades, and increasing disposable incomes among Indian consumers. The market penetration of custom modified wheels, currently estimated at around 15% for the premium segment, is expected to reach 25% by 2029. Technological disruptions are playing a pivotal role, with advancements in alloy wheel manufacturing processes, including flow-forming and forging techniques, enabling the production of lighter, stronger, and more intricate designs. The integration of smart technologies, such as pressure monitoring systems within wheels, is also gaining traction. Consumer preferences are increasingly shifting towards aesthetically appealing designs, personalized finishes, and performance enhancements that improve handling and fuel efficiency. This has led to a surge in demand for bespoke wheel solutions, catering to niche automotive segments and individualistic tastes. The competitive dynamics are intensifying, with both established global wheel manufacturers and agile domestic players fiercely competing on price, quality, innovation, and brand reputation. Key players are focusing on strategic partnerships with tuning houses, dealerships, and online automotive accessories platforms to broaden their reach and enhance customer engagement. The burgeoning two-wheeler and passenger car segments in India are primary contributors to this market expansion, with SUV and performance car owners being the early adopters of custom modifications. The overall market size is projected to reach a substantial value of over 800 million by 2029, driven by these evolving industry trends and insights.

Dominant Markets & Segments in India Custom Modified Car Wheels 2029

The Indian custom modified car wheels market in 2029 exhibits clear dominance within specific regions, countries, and application segments, driven by a combination of economic policies, infrastructural developments, and evolving consumer behaviors.

Leading Region:

The Western and Southern regions of India are expected to dominate the custom modified car wheels market. This dominance is fueled by:

- Economic Policies: These regions are economic powerhouses with a higher concentration of high-net-worth individuals and a thriving automotive industry, particularly in states like Maharashtra, Gujarat, Karnataka, and Tamil Nadu. Favorable industrial policies and investment incentives encourage automotive manufacturing and aftermarket services.

- Infrastructure: Developed road networks and a higher density of authorized dealerships and aftermarket service centers facilitate the accessibility and installation of custom wheels.

- Consumer Demographics: A younger, tech-savvy population with greater disposable income and a pronounced interest in automotive customization contributes significantly to demand. The presence of major automotive manufacturing hubs also means a larger pool of car enthusiasts and access to advanced automotive technologies.

Leading Country:

Within the broader global context, India itself stands out as a rapidly emerging and dominant market for custom modified car wheels in 2029. Its growth trajectory is propelled by:

- Rapid Urbanization and Growing Middle Class: India's expanding middle class is increasingly aspirational, with a growing desire to personalize their vehicles as a status symbol and an expression of individuality. This demographic shift is a primary engine for the aftermarket sector.

- Booming Automotive Production and Sales: India is one of the world's largest automotive producers and consumers. This high volume of new vehicle sales naturally translates into a larger potential market for aftermarket modifications, including custom wheels.

- Increasing Enthusiasm for Car Culture: The rise of car clubs, social media influencers, and automotive lifestyle events is fostering a strong car culture, encouraging enthusiasts to invest in performance and aesthetic upgrades.

- Government Initiatives: While focusing on manufacturing and safety, government policies indirectly support the aftermarket through the "Make in India" initiative, encouraging domestic production of automotive components, including custom wheels.

Dominant Segments:

Application:

- Passenger Cars: This segment will continue to hold the largest market share, estimated at over 650 million by 2029. The sheer volume of passenger cars sold, coupled with a strong desire for aesthetic enhancement and performance upgrades, drives this dominance. Owners of sedans, hatchbacks, and SUVs are key consumers.

- Performance/Sports Cars: While smaller in volume, this segment exhibits the highest propensity for customization and investment in premium custom wheels, contributing a significant share to the market value. The pursuit of enhanced handling, braking, and a distinctive visual identity makes this a high-value segment, estimated at 250 million.

- SUVs and Off-Road Vehicles: With the surging popularity of SUVs in India, custom wheels designed for enhanced aesthetics and off-road capabilities are witnessing rapid growth, estimated at 300 million.

Types:

- Alloy Wheels: Alloy wheels will remain the dominant type, accounting for an estimated 80% of the market by 2029, valued at over 700 million. Their popularity stems from their lightweight properties, superior performance benefits (improved handling and braking), diverse design options, and enhanced aesthetic appeal compared to steel wheels. Advancements in alloy manufacturing will further solidify their position.

- Forged Wheels: While representing a smaller, niche segment, forged wheels will experience substantial growth due to their superior strength-to-weight ratio and premium appeal, estimated at 200 million. Their high cost is offset by their performance advantages and durability, appealing to the high-end customization market.

- Carbon Fiber Wheels: Emerging as a high-performance, ultra-lightweight option, carbon fiber wheels will capture a growing share of the premium segment, though their market penetration will remain relatively low, estimated at 50 million, due to high manufacturing costs.

India Custom Modified Car Wheels 2029 Product Developments

Product developments in the India custom modified car wheels market by 2029 are focused on enhancing performance, aesthetics, and durability. Innovations include the widespread adoption of advanced lightweight alloys, such as forged and flow-formed aluminum, offering superior strength-to-weight ratios for improved handling and fuel efficiency. Manufacturers are also exploring sustainable materials and manufacturing processes. The trend towards larger diameter wheels (20-24 inches) continues, catering to the SUV and premium car segments. Furthermore, a surge in intricate spoke designs, customizable finishes (including multi-tone paints, brushed effects, and matte coatings), and integrated lighting elements are being developed to meet the growing demand for personalized aesthetics. Competitive advantages lie in offering bespoke solutions, rapid prototyping, and seamless integration with vehicle suspension systems.

Report Scope & Segmentation Analysis

This report meticulously analyzes the India Custom Modified Car Wheels market across key segments for the period 2019–2033, with a base year of 2025 and forecast period 2025–2033.

Application Segmentation:

- Passenger Cars: This segment, representing the largest market share estimated at over 650 million by 2029, encompasses all sedans, hatchbacks, and general-purpose vehicles. Growth is driven by a vast existing car parc and a burgeoning demand for aesthetic personalization and mild performance enhancements.

- SUVs and Off-Road Vehicles: Projected to reach 300 million by 2029, this segment focuses on sport utility vehicles and dedicated off-roaders. Demand is fueled by the SUV's increasing popularity and the desire for wheels that combine rugged aesthetics with enhanced off-road capability and durability.

- Performance/Sports Cars: Valued at approximately 250 million by 2029, this niche segment includes high-performance vehicles and sports cars. Growth is propelled by enthusiasts seeking significant performance upgrades, weight reduction, and distinctive styling to optimize vehicle dynamics.

Type Segmentation:

- Alloy Wheels: Dominating the market at an estimated 700 million by 2029, this segment includes wheels made from aluminum alloys. Growth is sustained by their balance of performance, aesthetics, and affordability, with continuous advancements in manufacturing techniques.

- Forged Wheels: Expected to reach 200 million by 2029, this premium segment offers superior strength, lightness, and intricate designs. Growth is driven by discerning customers who prioritize ultimate performance and exclusivity.

- Carbon Fiber Wheels: A nascent but high-growth segment, projected to reach 50 million by 2029. These ultra-lightweight wheels cater to elite performance applications, with ongoing research to reduce costs and increase production volumes.

Key Drivers of India Custom Modified Car Wheels 2029 Growth

The Indian custom modified car wheels market is set to experience significant growth driven by several key factors. An expanding middle class with increasing disposable incomes fuels the demand for vehicle personalization as a symbol of status and individuality. The booming Indian automotive industry, with its high volume of new car sales, provides a vast pool of potential customers for aftermarket modifications. Furthermore, a growing car culture, fostered by social media, automotive enthusiasts' clubs, and lifestyle events, encourages investment in aesthetic and performance upgrades. Technological advancements in wheel manufacturing, leading to lighter, stronger, and more aesthetically versatile products, also play a crucial role. The increasing availability of diverse designs and finishes caters to varied consumer preferences.

Challenges in the India Custom Modified Car Wheels 2029 Sector

Despite robust growth prospects, the India custom modified car wheels sector faces several challenges. Stricter regulatory frameworks concerning vehicle modifications and safety standards can pose hurdles for manufacturers and consumers. The prevalent issue of counterfeit products and uncertified wheels erodes consumer trust and poses safety risks, impacting legitimate businesses. Supply chain disruptions, particularly for specialized materials and imported components, can lead to production delays and increased costs, estimated to affect market growth by up to 8% annually. Intense price competition among numerous players, including unorganized sector players, can squeeze profit margins for premium and quality-focused manufacturers. Moreover, a lack of widespread awareness regarding the benefits of high-quality custom wheels versus cheaper alternatives can limit market penetration in certain segments.

Emerging Opportunities in India Custom Modified Car Wheels 2029

The India custom modified car wheels market is ripe with emerging opportunities. The exponential growth of the SUV segment presents a substantial opportunity for specialized off-road and performance-oriented wheel designs. The increasing popularity of electric vehicles (EVs) opens avenues for lightweight, aerodynamically optimized wheels that can enhance range and performance. The development of smart wheels, integrating TPMS (Tire Pressure Monitoring Systems) and other connected features, will cater to a tech-savvy consumer base. Expansion into Tier 2 and Tier 3 cities, where the demand for customization is nascent but growing, offers significant untapped potential. Furthermore, strategic collaborations with electric vehicle manufacturers and charging infrastructure providers could unlock new market segments. Online sales channels and direct-to-consumer models are also emerging as key opportunities for wider market reach and customer engagement.

Leading Players in the India Custom Modified Car Wheels 2029 Market

- Alloy Wheels India

- Lenze Wheels

- Neo Wheels

- Advanti Racing

- Momo

- OZ Racing

- Enkei Wheels

- Vossen Wheels

- Rotiform

- XXR Wheels

- KMC Wheels

- HRE Wheels

Key Developments in India Custom Modified Car Wheels 2029 Industry

- 2023: Launch of advanced flow-forming technology for lighter and stronger alloy wheels by several Indian manufacturers.

- 2024: Increased import of high-performance forged wheels due to rising demand from the luxury car segment.

- 2024: Growing partnerships between custom wheel brands and popular automotive tuning houses for exclusive designs.

- 2025: Introduction of eco-friendly manufacturing processes and sustainable material sourcing by leading global players entering the Indian market.

- 2026: Rise in demand for custom wheels with integrated LED lighting and unique color finishes.

- 2027: Expansion of online sales platforms and direct-to-consumer models for wider accessibility of custom wheels.

- 2028: Emergence of specialized lightweight wheels catering to the growing electric vehicle (EV) segment.

- 2029: Increased focus on certifications and quality standards to combat counterfeit products.

Strategic Outlook for India Custom Modified Car Wheels 2029 Market

The strategic outlook for the India custom modified car wheels market in 2029 is exceptionally positive, driven by sustained demand for personalization and performance enhancements. Key growth catalysts include continued urbanization, a rising middle class with increasing disposable incomes, and the expansion of the automotive aftermarket ecosystem. Companies that focus on product innovation, particularly in lightweight materials and advanced designs, will gain a competitive edge. Strategic collaborations with automotive OEMs and tuning specialists will be crucial for market penetration. Embracing digital sales channels and enhancing customer engagement through online platforms will be vital for reaching a wider audience. Furthermore, a commitment to quality, safety, and combating the threat of counterfeit products will be paramount for long-term success and brand reputation. The market is poised for significant expansion, offering substantial opportunities for both domestic and international players.

india custom modified car wheels 2029 Segmentation

- 1. Application

- 2. Types

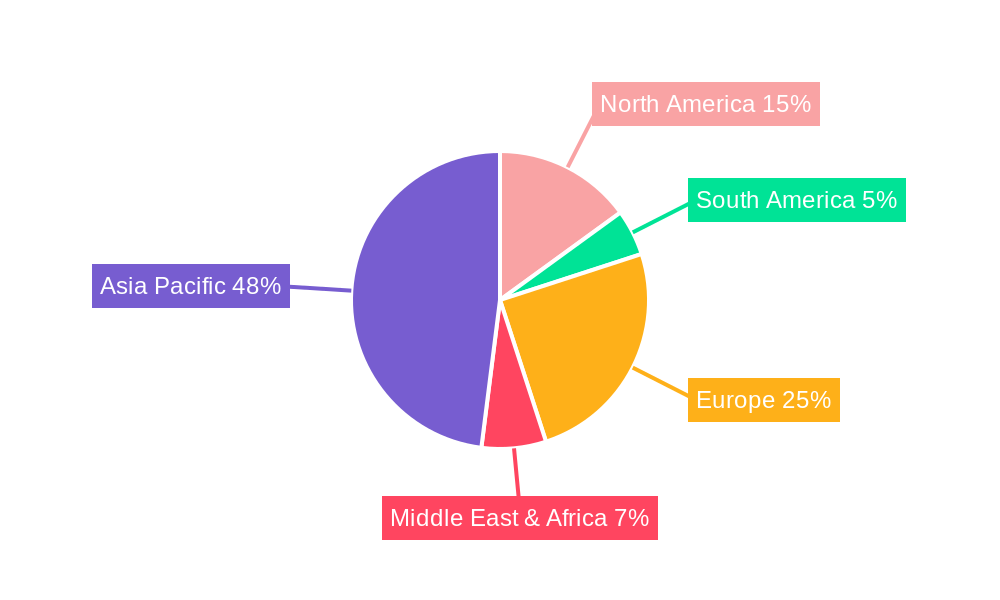

india custom modified car wheels 2029 Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

india custom modified car wheels 2029 REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global india custom modified car wheels 2029 Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America india custom modified car wheels 2029 Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America india custom modified car wheels 2029 Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe india custom modified car wheels 2029 Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa india custom modified car wheels 2029 Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific india custom modified car wheels 2029 Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1. Global and India

List of Figures

- Figure 1: Global india custom modified car wheels 2029 Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global india custom modified car wheels 2029 Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America india custom modified car wheels 2029 Revenue (million), by Application 2024 & 2032

- Figure 4: North America india custom modified car wheels 2029 Volume (K), by Application 2024 & 2032

- Figure 5: North America india custom modified car wheels 2029 Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America india custom modified car wheels 2029 Volume Share (%), by Application 2024 & 2032

- Figure 7: North America india custom modified car wheels 2029 Revenue (million), by Types 2024 & 2032

- Figure 8: North America india custom modified car wheels 2029 Volume (K), by Types 2024 & 2032

- Figure 9: North America india custom modified car wheels 2029 Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America india custom modified car wheels 2029 Volume Share (%), by Types 2024 & 2032

- Figure 11: North America india custom modified car wheels 2029 Revenue (million), by Country 2024 & 2032

- Figure 12: North America india custom modified car wheels 2029 Volume (K), by Country 2024 & 2032

- Figure 13: North America india custom modified car wheels 2029 Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America india custom modified car wheels 2029 Volume Share (%), by Country 2024 & 2032

- Figure 15: South America india custom modified car wheels 2029 Revenue (million), by Application 2024 & 2032

- Figure 16: South America india custom modified car wheels 2029 Volume (K), by Application 2024 & 2032

- Figure 17: South America india custom modified car wheels 2029 Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America india custom modified car wheels 2029 Volume Share (%), by Application 2024 & 2032

- Figure 19: South America india custom modified car wheels 2029 Revenue (million), by Types 2024 & 2032

- Figure 20: South America india custom modified car wheels 2029 Volume (K), by Types 2024 & 2032

- Figure 21: South America india custom modified car wheels 2029 Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America india custom modified car wheels 2029 Volume Share (%), by Types 2024 & 2032

- Figure 23: South America india custom modified car wheels 2029 Revenue (million), by Country 2024 & 2032

- Figure 24: South America india custom modified car wheels 2029 Volume (K), by Country 2024 & 2032

- Figure 25: South America india custom modified car wheels 2029 Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America india custom modified car wheels 2029 Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe india custom modified car wheels 2029 Revenue (million), by Application 2024 & 2032

- Figure 28: Europe india custom modified car wheels 2029 Volume (K), by Application 2024 & 2032

- Figure 29: Europe india custom modified car wheels 2029 Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe india custom modified car wheels 2029 Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe india custom modified car wheels 2029 Revenue (million), by Types 2024 & 2032

- Figure 32: Europe india custom modified car wheels 2029 Volume (K), by Types 2024 & 2032

- Figure 33: Europe india custom modified car wheels 2029 Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe india custom modified car wheels 2029 Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe india custom modified car wheels 2029 Revenue (million), by Country 2024 & 2032

- Figure 36: Europe india custom modified car wheels 2029 Volume (K), by Country 2024 & 2032

- Figure 37: Europe india custom modified car wheels 2029 Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe india custom modified car wheels 2029 Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa india custom modified car wheels 2029 Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa india custom modified car wheels 2029 Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa india custom modified car wheels 2029 Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa india custom modified car wheels 2029 Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa india custom modified car wheels 2029 Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa india custom modified car wheels 2029 Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa india custom modified car wheels 2029 Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa india custom modified car wheels 2029 Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa india custom modified car wheels 2029 Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa india custom modified car wheels 2029 Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa india custom modified car wheels 2029 Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa india custom modified car wheels 2029 Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific india custom modified car wheels 2029 Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific india custom modified car wheels 2029 Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific india custom modified car wheels 2029 Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific india custom modified car wheels 2029 Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific india custom modified car wheels 2029 Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific india custom modified car wheels 2029 Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific india custom modified car wheels 2029 Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific india custom modified car wheels 2029 Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific india custom modified car wheels 2029 Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific india custom modified car wheels 2029 Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific india custom modified car wheels 2029 Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific india custom modified car wheels 2029 Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global india custom modified car wheels 2029 Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global india custom modified car wheels 2029 Volume K Forecast, by Region 2019 & 2032

- Table 3: Global india custom modified car wheels 2029 Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global india custom modified car wheels 2029 Volume K Forecast, by Application 2019 & 2032

- Table 5: Global india custom modified car wheels 2029 Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global india custom modified car wheels 2029 Volume K Forecast, by Types 2019 & 2032

- Table 7: Global india custom modified car wheels 2029 Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global india custom modified car wheels 2029 Volume K Forecast, by Region 2019 & 2032

- Table 9: Global india custom modified car wheels 2029 Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global india custom modified car wheels 2029 Volume K Forecast, by Application 2019 & 2032

- Table 11: Global india custom modified car wheels 2029 Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global india custom modified car wheels 2029 Volume K Forecast, by Types 2019 & 2032

- Table 13: Global india custom modified car wheels 2029 Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global india custom modified car wheels 2029 Volume K Forecast, by Country 2019 & 2032

- Table 15: United States india custom modified car wheels 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States india custom modified car wheels 2029 Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada india custom modified car wheels 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada india custom modified car wheels 2029 Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico india custom modified car wheels 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico india custom modified car wheels 2029 Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global india custom modified car wheels 2029 Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global india custom modified car wheels 2029 Volume K Forecast, by Application 2019 & 2032

- Table 23: Global india custom modified car wheels 2029 Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global india custom modified car wheels 2029 Volume K Forecast, by Types 2019 & 2032

- Table 25: Global india custom modified car wheels 2029 Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global india custom modified car wheels 2029 Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil india custom modified car wheels 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil india custom modified car wheels 2029 Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina india custom modified car wheels 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina india custom modified car wheels 2029 Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America india custom modified car wheels 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America india custom modified car wheels 2029 Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global india custom modified car wheels 2029 Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global india custom modified car wheels 2029 Volume K Forecast, by Application 2019 & 2032

- Table 35: Global india custom modified car wheels 2029 Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global india custom modified car wheels 2029 Volume K Forecast, by Types 2019 & 2032

- Table 37: Global india custom modified car wheels 2029 Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global india custom modified car wheels 2029 Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom india custom modified car wheels 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom india custom modified car wheels 2029 Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany india custom modified car wheels 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany india custom modified car wheels 2029 Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France india custom modified car wheels 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France india custom modified car wheels 2029 Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy india custom modified car wheels 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy india custom modified car wheels 2029 Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain india custom modified car wheels 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain india custom modified car wheels 2029 Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia india custom modified car wheels 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia india custom modified car wheels 2029 Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux india custom modified car wheels 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux india custom modified car wheels 2029 Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics india custom modified car wheels 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics india custom modified car wheels 2029 Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe india custom modified car wheels 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe india custom modified car wheels 2029 Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global india custom modified car wheels 2029 Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global india custom modified car wheels 2029 Volume K Forecast, by Application 2019 & 2032

- Table 59: Global india custom modified car wheels 2029 Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global india custom modified car wheels 2029 Volume K Forecast, by Types 2019 & 2032

- Table 61: Global india custom modified car wheels 2029 Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global india custom modified car wheels 2029 Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey india custom modified car wheels 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey india custom modified car wheels 2029 Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel india custom modified car wheels 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel india custom modified car wheels 2029 Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC india custom modified car wheels 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC india custom modified car wheels 2029 Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa india custom modified car wheels 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa india custom modified car wheels 2029 Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa india custom modified car wheels 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa india custom modified car wheels 2029 Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa india custom modified car wheels 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa india custom modified car wheels 2029 Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global india custom modified car wheels 2029 Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global india custom modified car wheels 2029 Volume K Forecast, by Application 2019 & 2032

- Table 77: Global india custom modified car wheels 2029 Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global india custom modified car wheels 2029 Volume K Forecast, by Types 2019 & 2032

- Table 79: Global india custom modified car wheels 2029 Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global india custom modified car wheels 2029 Volume K Forecast, by Country 2019 & 2032

- Table 81: China india custom modified car wheels 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China india custom modified car wheels 2029 Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India india custom modified car wheels 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India india custom modified car wheels 2029 Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan india custom modified car wheels 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan india custom modified car wheels 2029 Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea india custom modified car wheels 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea india custom modified car wheels 2029 Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN india custom modified car wheels 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN india custom modified car wheels 2029 Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania india custom modified car wheels 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania india custom modified car wheels 2029 Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific india custom modified car wheels 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific india custom modified car wheels 2029 Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the india custom modified car wheels 2029?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the india custom modified car wheels 2029?

Key companies in the market include Global and India.

3. What are the main segments of the india custom modified car wheels 2029?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4350.00, USD 6525.00, and USD 8700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "india custom modified car wheels 2029," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the india custom modified car wheels 2029 report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the india custom modified car wheels 2029?

To stay informed about further developments, trends, and reports in the india custom modified car wheels 2029, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence