Key Insights

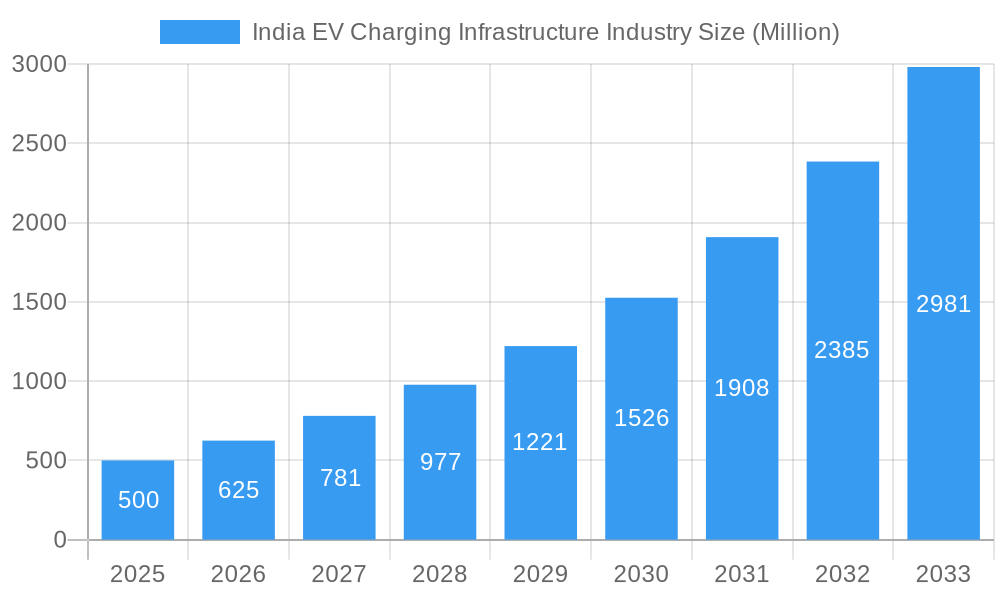

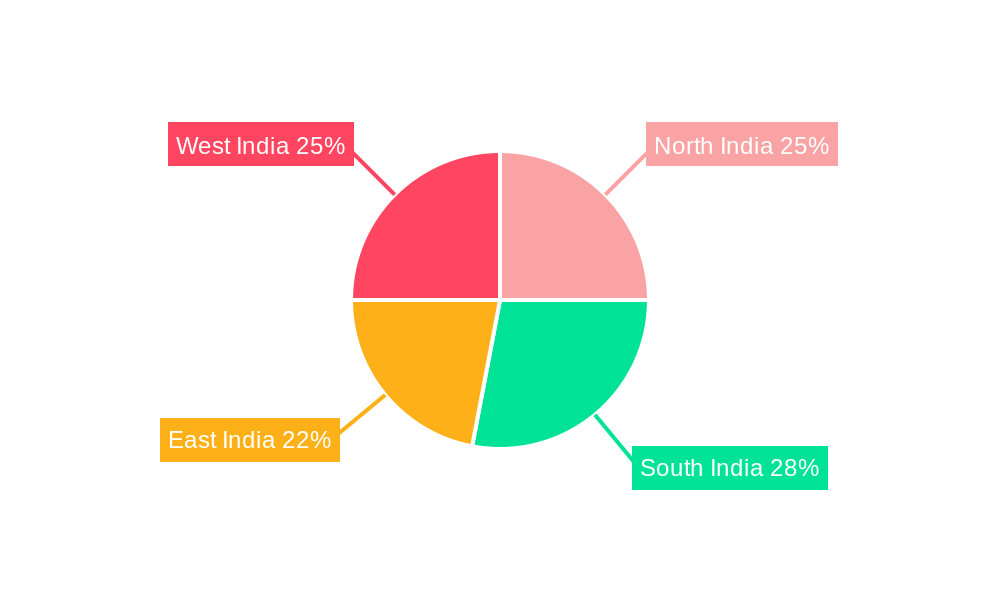

The Indian Electric Vehicle (EV) charging infrastructure market is experiencing robust expansion, driven by supportive government policies and increasing environmental consciousness. This sector is projected to achieve a Compound Annual Growth Rate (CAGR) of 22.2%, reaching a market size of $1.56 million by 2025. Key growth drivers include the accelerating adoption of EVs, leading to higher demand for charging solutions. Technological advancements in charging speed and efficiency, alongside significant public and private investments in charging station development across urban centers and major transit routes, are further propelling market growth. The market segmentation highlights a preference for fast chargers due to convenience, with three-phase chargers also gaining traction for their superior power output. Leading industry players such as Delta Electronics India, Kinetic Green Energy, ABB Ltd, and Tata Power are instrumental in shaping the market through strategic investments in manufacturing, deployment, and innovative charging technologies. This growth is observed uniformly across all Indian regions: North, South, East, and West, reflecting a nationwide commitment to EV adoption.

India EV Charging Infrastructure Industry Market Size (In Million)

Despite this positive trajectory, the market faces challenges. Uneven distribution of charging infrastructure, particularly the disparity between urban and rural areas, presents a significant hurdle. High upfront investment costs for establishing charging stations can deter smaller market participants. Furthermore, standardization and interoperability issues among different charging technologies require resolution for effective network integration. Addressing these challenges through strategic government policies, incentives for private investment, and technological standardization will be crucial for realizing the full potential of the Indian EV charging infrastructure market and ensuring its sustainable and inclusive development.

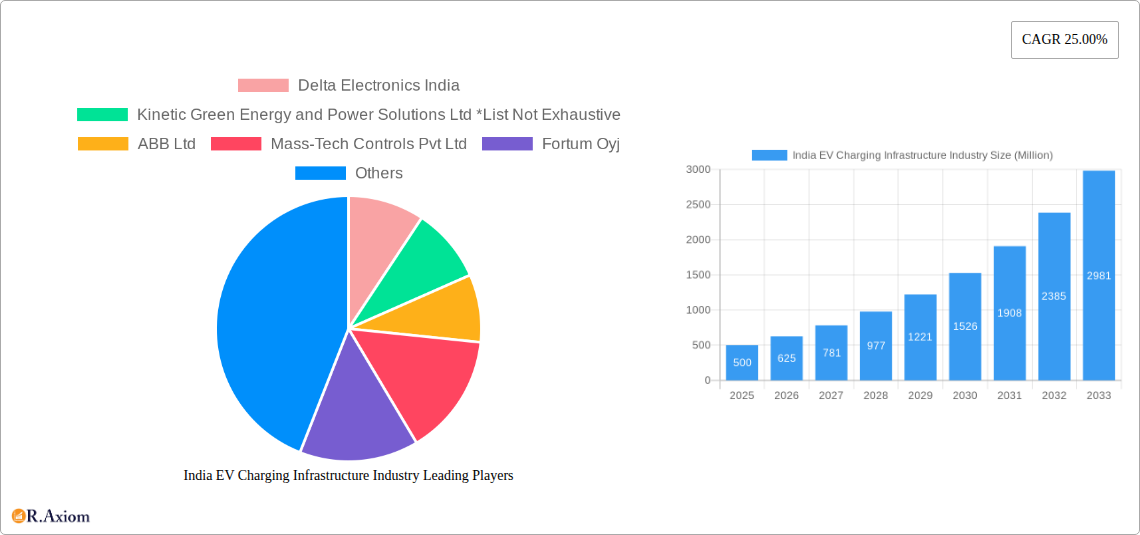

India EV Charging Infrastructure Industry Company Market Share

This report offers an in-depth analysis of the India EV charging infrastructure industry, detailing market size, growth drivers, challenges, and future prospects. The analysis covers the period from 2019 to 2033, with 2025 identified as the base year. The findings provide valuable insights for industry stakeholders, investors, and policymakers, leveraging comprehensive data and an understanding of key market developments in this dynamic sector.

India EV Charging Infrastructure Industry Market Concentration & Innovation

This section analyzes the competitive landscape of the Indian EV charging infrastructure market, exploring market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and M&A activities. The market exhibits a moderately concentrated structure with a few key players holding significant market share, though numerous smaller players are emerging. Innovation is driven by technological advancements in charging technologies (e.g., faster charging speeds, improved battery management systems), government incentives, and the growing demand for electric vehicles. Regulatory frameworks, while supportive, still face challenges in standardization and infrastructure development. The main product substitutes are petrol and diesel-powered vehicles, although their market share is expected to decline. End-user trends show a shift towards convenience and accessibility in charging solutions. M&A activity in the sector is expected to increase over the forecast period, with deal values potentially reaching XX Million by 2033, driven by consolidation and expansion strategies among industry participants. Market share data for key players will be presented graphically within the full report, including specific breakdowns.

India EV Charging Infrastructure Industry Industry Trends & Insights

The Indian EV charging infrastructure market is experiencing robust growth, driven by government initiatives promoting EV adoption, rising environmental concerns, and decreasing battery prices. The Compound Annual Growth Rate (CAGR) for the market is projected to be XX% during the forecast period (2025-2033). Market penetration is expected to increase significantly, with a projected XX% of new vehicle sales being EVs by 2033. Technological disruptions, such as advancements in battery technology and smart charging solutions, are further propelling market expansion. Consumer preferences are increasingly favoring convenient, reliable, and fast-charging options, leading to a higher demand for rapid and fast chargers. Competitive dynamics are intensifying, with established players facing competition from new entrants and innovative startups. The market is experiencing a shift towards integrated charging solutions that combine charging with other services, such as energy storage and grid management. Detailed analysis of these trends is provided within the report.

Dominant Markets & Segments in India EV Charging Infrastructure Industry

This section identifies the dominant segments within the Indian EV charging infrastructure market. The report will analyze market dominance across various parameters, including geographical location, power output, and charging phase. Key findings will include dominance analysis of specific regions within India with high EV adoption rates.

Key Drivers for Dominant Segments:

- Economic Policies: Government subsidies and tax benefits for EV adoption.

- Infrastructure Development: Investments in charging infrastructure by both public and private entities.

- Technological Advancements: Introduction of faster and more efficient charging technologies.

Dominant Segments:

- Power Output: Fast chargers are projected to dominate the market due to their increased convenience and efficiency, followed by rapid chargers. Slow chargers are anticipated to have a smaller market share.

- Phase: Three-phase chargers are anticipated to hold the larger market share due to their higher power output capabilities and suitability for commercial and public charging stations, with single-phase chargers predominating in residential applications. Detailed market share data and detailed regional analysis are included in the full report.

India EV Charging Infrastructure Industry Product Developments

The Indian EV charging infrastructure market is witnessing significant product innovation, driven by the need for faster, more efficient, and reliable charging solutions. Technological trends include the development of advanced charging technologies such as wireless charging, battery swapping, and smart charging systems which improve grid stability and optimize charging efficiency. These innovations aim to enhance user experience and address range anxiety concerns associated with EVs. The market is seeing increased integration of renewable energy sources with charging infrastructure and smart grid management for further optimization. The market fit for these new products is strong, owing to increasing government mandates and growing consumer demand.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Indian EV charging infrastructure market, segmented by power output (Rapid Chargers, Fast Chargers, Slow Chargers) and phase (Single Phase, Three Phase). Detailed growth projections, market sizes, and competitive dynamics are analyzed for each segment.

Power Output: Each power output segment (rapid, fast, and slow) will have its market size and growth projections analyzed, highlighting the variations in market dynamics, technological trends, and adoption rates for each segment.

Phase: The analysis of single-phase and three-phase chargers will focus on market penetration rates, infrastructure needs, and specific application scenarios for each charging type.

Key Drivers of India EV Charging Infrastructure Industry Growth

The growth of the Indian EV charging infrastructure market is driven by several factors. Government initiatives such as the Faster Adoption and Manufacturing of (Hybrid &) Electric Vehicles (FAME) scheme provide significant financial incentives for EV adoption and charging infrastructure development. The increasing awareness of environmental concerns and the decreasing cost of battery technology further fuel market growth. Technological advancements in charging technologies, such as higher charging speeds and improved battery management systems, enhance user experience and drive demand.

Challenges in the India EV Charging Infrastructure Industry Sector

The Indian EV charging infrastructure market faces several challenges. The lack of standardization in charging technologies poses interoperability issues. High initial investment costs associated with installing charging stations, and uneven distribution of charging infrastructure, especially in rural areas, presents a significant hurdle for widespread EV adoption. The grid infrastructure's ability to handle the increasing demand from EV charging needs improvement. Furthermore, competition from other transportation modes poses a challenge to the overall market.

Emerging Opportunities in India EV Charging Infrastructure Industry

The Indian EV charging infrastructure market presents numerous opportunities. The growth of the EV market creates a strong demand for charging infrastructure, leading to significant investment opportunities for private companies. Technological innovations such as battery swapping and wireless charging hold immense potential. The integration of renewable energy sources into the charging network presents opportunities for a cleaner and sustainable transportation sector. Expansion into rural and underserved areas holds significant market expansion potential.

Leading Players in the India EV Charging Infrastructure Industry Market

- Delta Electronics India

- Kinetic Green Energy and Power Solutions Ltd

- ABB Ltd

- Mass-Tech Controls Pvt Ltd

- Fortum Oyj

- Tata Power Company Limited

- Automovil

- Bright Blu

- Charzer Tech Pvt Ltd

- Exicom Telesystems Ltd

Key Developments in India EV Charging Infrastructure Industry Industry

- March 2022: Automovil announced plans to establish 500 EV charging stations across 11 Indian cities, partnering with Midgard Electric.

- March 2022: Exicom installed approximately 5000 EV charging stations (3600 AC and 1400 DC) in 200 cities.

Strategic Outlook for India EV Charging Infrastructure Industry Market

The Indian EV charging infrastructure market is poised for significant growth over the next decade. Government support, technological advancements, and increasing EV adoption will drive market expansion. Strategic partnerships between charging infrastructure providers and EV manufacturers are crucial for market success. The market's future depends heavily on addressing challenges related to standardization, infrastructure development, and grid integration. The potential for significant market growth presents attractive opportunities for investors and industry players willing to address these challenges.

India EV Charging Infrastructure Industry Segmentation

-

1. Power Output

- 1.1. Rapid Chargers

- 1.2. Fast Chargers

- 1.3. Slow Chargers

-

2. Phase

- 2.1. Single Phase

- 2.2. Three Phase

India EV Charging Infrastructure Industry Segmentation By Geography

- 1. India

India EV Charging Infrastructure Industry Regional Market Share

Geographic Coverage of India EV Charging Infrastructure Industry

India EV Charging Infrastructure Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 22.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; The High Amount of Waste Generation in the Country4.; The growing Focus on Non-Fossil Fuel Sources

- 3.3. Market Restrains

- 3.3.1. 4.; The Recycling Rate of Waste in Germany

- 3.4. Market Trends

- 3.4.1. Slow Chargers Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India EV Charging Infrastructure Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Power Output

- 5.1.1. Rapid Chargers

- 5.1.2. Fast Chargers

- 5.1.3. Slow Chargers

- 5.2. Market Analysis, Insights and Forecast - by Phase

- 5.2.1. Single Phase

- 5.2.2. Three Phase

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Power Output

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Delta Electronics India

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kinetic Green Energy and Power Solutions Ltd *List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ABB Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mass-Tech Controls Pvt Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Fortum Oyj

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Tata Power Company Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Automovil

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bright Blu

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Charzer Tech Pvt Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Exicom Telesystems Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Delta Electronics India

List of Figures

- Figure 1: India EV Charging Infrastructure Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: India EV Charging Infrastructure Industry Share (%) by Company 2025

List of Tables

- Table 1: India EV Charging Infrastructure Industry Revenue million Forecast, by Power Output 2020 & 2033

- Table 2: India EV Charging Infrastructure Industry Volume K Units Forecast, by Power Output 2020 & 2033

- Table 3: India EV Charging Infrastructure Industry Revenue million Forecast, by Phase 2020 & 2033

- Table 4: India EV Charging Infrastructure Industry Volume K Units Forecast, by Phase 2020 & 2033

- Table 5: India EV Charging Infrastructure Industry Revenue million Forecast, by Region 2020 & 2033

- Table 6: India EV Charging Infrastructure Industry Volume K Units Forecast, by Region 2020 & 2033

- Table 7: India EV Charging Infrastructure Industry Revenue million Forecast, by Power Output 2020 & 2033

- Table 8: India EV Charging Infrastructure Industry Volume K Units Forecast, by Power Output 2020 & 2033

- Table 9: India EV Charging Infrastructure Industry Revenue million Forecast, by Phase 2020 & 2033

- Table 10: India EV Charging Infrastructure Industry Volume K Units Forecast, by Phase 2020 & 2033

- Table 11: India EV Charging Infrastructure Industry Revenue million Forecast, by Country 2020 & 2033

- Table 12: India EV Charging Infrastructure Industry Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India EV Charging Infrastructure Industry?

The projected CAGR is approximately 22.2%.

2. Which companies are prominent players in the India EV Charging Infrastructure Industry?

Key companies in the market include Delta Electronics India, Kinetic Green Energy and Power Solutions Ltd *List Not Exhaustive, ABB Ltd, Mass-Tech Controls Pvt Ltd, Fortum Oyj, Tata Power Company Limited, Automovil, Bright Blu, Charzer Tech Pvt Ltd, Exicom Telesystems Ltd.

3. What are the main segments of the India EV Charging Infrastructure Industry?

The market segments include Power Output, Phase.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.56 million as of 2022.

5. What are some drivers contributing to market growth?

4.; The High Amount of Waste Generation in the Country4.; The growing Focus on Non-Fossil Fuel Sources.

6. What are the notable trends driving market growth?

Slow Chargers Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; The Recycling Rate of Waste in Germany.

8. Can you provide examples of recent developments in the market?

In March 2022, Automovil, the mobility start-up in India, announced that it has planned to establish 500 EV charging stations in 11 cities in India. The company has partnered with Midgard Electric as the EV charging partner to install Bharat AC-001 and DC-001 EV chargers for the Automovil's outlets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India EV Charging Infrastructure Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India EV Charging Infrastructure Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India EV Charging Infrastructure Industry?

To stay informed about further developments, trends, and reports in the India EV Charging Infrastructure Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence