Key Insights

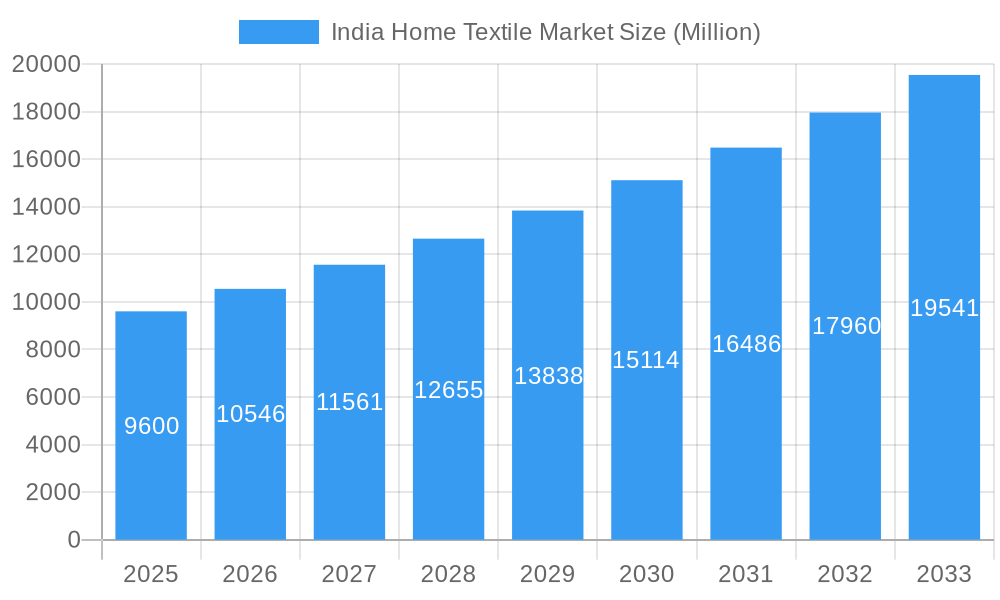

The India home textile market, valued at $9.6 billion in 2025, is projected to experience robust growth, driven by a burgeoning middle class, increasing disposable incomes, and a rising preference for home improvement and comfortable living spaces. The market's Compound Annual Growth Rate (CAGR) of 9.84% from 2025 to 2033 indicates significant expansion potential. Key drivers include the growth of e-commerce platforms offering a wider selection and convenient shopping experience, increasing urbanization leading to a demand for aesthetically pleasing and functional home textiles, and a growing preference for premium and sustainable products. Segments like bed linen and bath linen are expected to maintain a strong market share, fueled by consistent consumer demand. The online distribution channel is poised for rapid expansion, leveraging digital marketing strategies to reach a broad consumer base. However, factors like fluctuating raw material prices and intense competition from international brands pose challenges to market growth.

India Home Textile Market Market Size (In Billion)

Regional variations within India are expected, with North and West India potentially exhibiting higher growth rates due to greater urbanization and higher disposable incomes compared to East and South India. The competitive landscape is dominated by a mix of domestic and international players, with established brands like IKEA, Bombay Dyeing, and Trident Limited vying for market share. Smaller, specialized players are expected to focus on niche segments, emphasizing sustainability, unique designs, or specialized material offerings to differentiate themselves. Future growth will likely hinge on the ability of companies to adapt to evolving consumer preferences, embrace sustainable manufacturing practices, and effectively leverage digital marketing strategies to reach and engage target audiences. The forecast period (2025-2033) presents lucrative opportunities for players who can successfully navigate these dynamics.

India Home Textile Market Company Market Share

India Home Textile Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the India Home Textile Market, covering the period from 2019 to 2033. With a base year of 2025 and a forecast period spanning 2025-2033, this study offers invaluable insights for industry stakeholders, investors, and businesses operating within or planning to enter this dynamic market. The report leverages extensive data analysis and expert insights to paint a clear picture of market trends, opportunities, and challenges. The total market size in 2025 is estimated to be xx Million, with a projected xx% CAGR during the forecast period.

India Home Textile Market Market Concentration & Innovation

The Indian home textile market exhibits a moderately concentrated structure, with several large players commanding significant market share. Key players like Welspun Group, Trident Limited, and Indo Count Industries Ltd. hold considerable influence, driven by their large-scale production capabilities and established distribution networks. However, a significant number of smaller, regional players also contribute to the overall market volume. Market share data for 2024 indicates that Welspun Group holds approximately xx% market share, followed by Trident Limited at xx%, and Indo Count Industries at xx%. The remaining share is distributed among numerous other players.

Innovation in the Indian home textile sector is driven by several factors, including the growing demand for sustainable and eco-friendly products, technological advancements in fabric manufacturing, and changing consumer preferences towards specialized functionalities (e.g., antimicrobial, wrinkle-resistant fabrics). Regulatory frameworks, such as those related to labor practices and environmental sustainability, are increasingly influencing innovation strategies. Product substitutes, including alternative flooring materials and synthetic bedding, pose a moderate competitive threat. Furthermore, mergers and acquisitions (M&A) are shaping the competitive landscape. Notable M&A activities include Indo Count Industries Limited's acquisition of GHCL Ltd.'s home textile business in 2022, signifying a consolidation trend within the sector. The total value of M&A deals in the home textile sector between 2019 and 2024 is estimated at xx Million. End-user trends increasingly reflect a demand for higher quality, aesthetically pleasing, and functional home textiles, creating opportunities for innovative product development.

India Home Textile Market Industry Trends & Insights

The Indian home textile market is experiencing robust growth, primarily driven by rising disposable incomes, urbanization, and a burgeoning middle class with increased spending power on home furnishings. The market's growth is further fueled by factors such as government initiatives promoting the textile sector and increasing online retail penetration. Technological advancements, such as the adoption of automated manufacturing processes and innovative fabric technologies, are enhancing production efficiency and product quality. Consumer preferences are shifting towards premium, sustainable, and customized home textiles, creating opportunities for value-added offerings. The competitive dynamics are characterized by both intense rivalry among established players and the emergence of new, innovative entrants. The market displays a high degree of fragmentation, although the top players strive to maintain a strong market position through brand building, strategic partnerships, and acquisitions. Overall, the industry is characterized by a positive outlook, with a projected CAGR of xx% between 2025 and 2033, driven primarily by the aforementioned factors. Market penetration for online sales channels is steadily increasing, expected to reach xx% by 2033.

Dominant Markets & Segments in India Home Textile Market

Within the Indian home textile market, the bed linen segment dominates, accounting for approximately xx% of the total market value in 2025. This dominance is attributable to the high demand for bedding products across various income groups. The online distribution channel is rapidly gaining traction, exhibiting high growth potential driven by increasing internet and smartphone penetration.

Key Drivers of Bed Linen Segment Dominance:

- High consumer demand across all income groups.

- Diverse product offerings catering to varied preferences.

- Strong brand presence from major players.

Key Drivers of Online Distribution Channel Growth:

- Increasing internet and smartphone penetration.

- Convenience and accessibility offered by online platforms.

- Wider product selection and competitive pricing.

Other segments such as bath linen, kitchen linen, upholstery, and floor coverings are also significant contributors to the overall market, but their growth rates might vary due to differing consumer preferences and specific market dynamics. The urban regions, especially in major metropolitan areas, show higher demand compared to rural areas. Key drivers include increasing urbanization, rising disposable income, and the influence of western lifestyles.

India Home Textile Market Product Developments

Recent product innovations in the Indian home textile market emphasize sustainable materials, advanced functionalities, and enhanced aesthetics. Technological trends include the increasing use of smart textiles incorporating sensors and IoT capabilities for home automation. The market is witnessing a rising demand for eco-friendly, organic, and recycled materials, reflecting a growing consumer consciousness. Product development focuses on creating value-added features, such as antimicrobial treatments, wrinkle-resistant fabrics, and customizable designs, to enhance market appeal and command premium pricing.

Report Scope & Segmentation Analysis

This report segments the India Home Textile Market based on product type (Bed Linen, Bath Linen, Kitchen Linen, Upholstery, Floor Covering) and distribution channel (Supermarkets & Hypermarkets, Specialty Stores, Online, Other Distribution Channels). Each segment's market size, growth projections, and competitive dynamics are analyzed in detail. The Bed Linen segment is projected to maintain its dominant position throughout the forecast period, experiencing steady growth due to consistent demand. The online distribution channel is expected to witness the highest growth rate, driven by increasing e-commerce adoption. The other segments exhibit varying growth trajectories depending on consumer preferences and market conditions.

Key Drivers of India Home Textile Market Growth

Several factors contribute to the robust growth of the Indian home textile market. These include the rising disposable incomes of the burgeoning middle class, which fuels higher spending on home furnishings; increasing urbanization leading to a greater demand for home textiles in newly constructed homes and apartments; and government initiatives to promote the domestic textile industry, which includes providing financial incentives and improving infrastructure. Technological advancements that enhance production efficiency and product quality are also significant contributors.

Challenges in the India Home Textile Market Sector

The Indian home textile sector faces certain challenges, such as intense competition from both domestic and international players which leads to price pressures and reduced profit margins. Supply chain disruptions, especially those related to raw material sourcing, can affect production and timely delivery. Regulatory hurdles and compliance requirements relating to labor laws and environmental regulations can also create operational complexities. Fluctuations in raw material prices and energy costs add to the operational risks faced by players in the sector. The impact of these challenges can result in reduced profitability and market share for some businesses.

Emerging Opportunities in India Home Textile Market

The Indian home textile market presents numerous emerging opportunities, especially in the area of sustainable and eco-friendly products, as consumer demand for such products is rapidly growing. The increasing popularity of online shopping platforms offers a significant opportunity for expansion and market penetration. Innovations in smart textiles with integrated technology offer exciting opportunities for premium products. Exploring untapped rural markets with focused marketing strategies holds significant potential. Furthermore, focusing on niche segments, like customized and personalized home textiles, can attract affluent consumer groups.

Leading Players in the India Home Textile Market Market

- IKEA Systems B V

- Bombay Dyeing

- Alok Industries Ltd

- Himatsingka

- Trident Limited

- William Sanoma Inc

- S Kumars Nationwide Limited

- Vardhman Textiles Limited

- Raymond Group

- Indo Count Industries Ltd

- Welspun Group

- DCM Textiles

- Bed Bath & Beyond Inc

Key Developments in India Home Textile Market Industry

November 2023: Raymond launched "Regio Italia," a luxury wool suiting fabric, targeting the growing demand for international luxury fashion in India. This expands their product portfolio and targets a premium consumer segment.

April 2022: Indo Count Industries Limited acquired the Home Textile business of GHCL Ltd., significantly enhancing its production capacity and market share. This acquisition demonstrates a strategy of consolidation in the sector.

January 2022: Vandewiele NV and Savio India merged to form VANDEWIELE-SAVIO INDIA Pvt. Ltd., creating a comprehensive network of integrated services within the Indian textile industry. This merger strengthens the supply chain and improves service offerings.

Strategic Outlook for India Home Textile Market Market

The India Home Textile Market presents a compelling investment opportunity, driven by a combination of factors such as rising consumer spending, favorable government policies, and technological innovation. The market is poised for continued growth, with the potential for significant expansion in both established and emerging segments. Companies that embrace sustainable practices, leverage technology effectively, and cater to evolving consumer preferences are best positioned to thrive in this dynamic market. The focus on high-value, niche products, along with the expansion of online retail channels, will play a critical role in shaping the future of this sector.

India Home Textile Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

India Home Textile Market Segmentation By Geography

- 1. India

India Home Textile Market Regional Market Share

Geographic Coverage of India Home Textile Market

India Home Textile Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.84% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 The expanding middle-class population in India is contributing to the growth of the home textile market. As more households move into the middle-income bracket

- 3.2.2 they are investing in home furnishings and textiles to improve their living conditions.

- 3.3. Market Restrains

- 3.3.1 Price sensitivity among Indian consumers

- 3.3.2 particularly in lower-income segments

- 3.3.3 can limit spending on premium or luxury home textiles. Price fluctuations of raw materials and inflation can impact affordability and demand

- 3.4. Market Trends

- 3.4.1 There is a growing demand for sustainable and eco-friendly home textiles in India. Consumers are increasingly seeking products made from organic cotton

- 3.4.2 recycled materials

- 3.4.3 and eco-friendly dyes

- 3.4.4 reflecting a broader global trend towards environmental consciousness.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Home Textile Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. India

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 IKEA Systems B V

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bombay Dyeing

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Alok Industries Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Himatsingka

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Trident Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 William Sanoma Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 S Kumars Nationwide Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Vardhman Textiles Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Raymond Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Indo Count Industries Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Welspun Group

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 DCM Textiles

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Bed Bath & Beyond Inc

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 IKEA Systems B V

List of Figures

- Figure 1: India Home Textile Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Home Textile Market Share (%) by Company 2025

List of Tables

- Table 1: India Home Textile Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: India Home Textile Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: India Home Textile Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: India Home Textile Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: India Home Textile Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: India Home Textile Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: India Home Textile Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: India Home Textile Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: India Home Textile Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: India Home Textile Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: India Home Textile Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: India Home Textile Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Home Textile Market?

The projected CAGR is approximately 9.84%.

2. Which companies are prominent players in the India Home Textile Market?

Key companies in the market include IKEA Systems B V, Bombay Dyeing, Alok Industries Ltd, Himatsingka, Trident Limited, William Sanoma Inc, S Kumars Nationwide Limited, Vardhman Textiles Limited, Raymond Group, Indo Count Industries Ltd, Welspun Group, DCM Textiles, Bed Bath & Beyond Inc.

3. What are the main segments of the India Home Textile Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.60 Million as of 2022.

5. What are some drivers contributing to market growth?

The expanding middle-class population in India is contributing to the growth of the home textile market. As more households move into the middle-income bracket. they are investing in home furnishings and textiles to improve their living conditions..

6. What are the notable trends driving market growth?

There is a growing demand for sustainable and eco-friendly home textiles in India. Consumers are increasingly seeking products made from organic cotton. recycled materials. and eco-friendly dyes. reflecting a broader global trend towards environmental consciousness..

7. Are there any restraints impacting market growth?

Price sensitivity among Indian consumers. particularly in lower-income segments. can limit spending on premium or luxury home textiles. Price fluctuations of raw materials and inflation can impact affordability and demand.

8. Can you provide examples of recent developments in the market?

In November 2023, Raymond launched an international range of luxury suiting fabrics, "Regio Italia". Regio Italia is a luxury wool suiting fabric crafted and designed in Italy to meet the demand in India for international luxury fashion.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Home Textile Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Home Textile Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Home Textile Market?

To stay informed about further developments, trends, and reports in the India Home Textile Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence