Key Insights

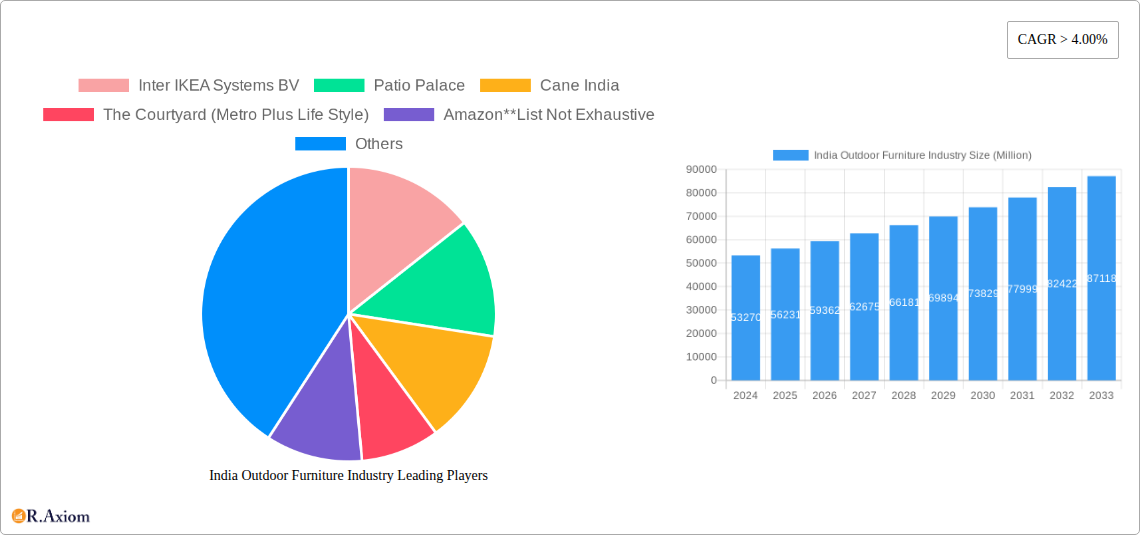

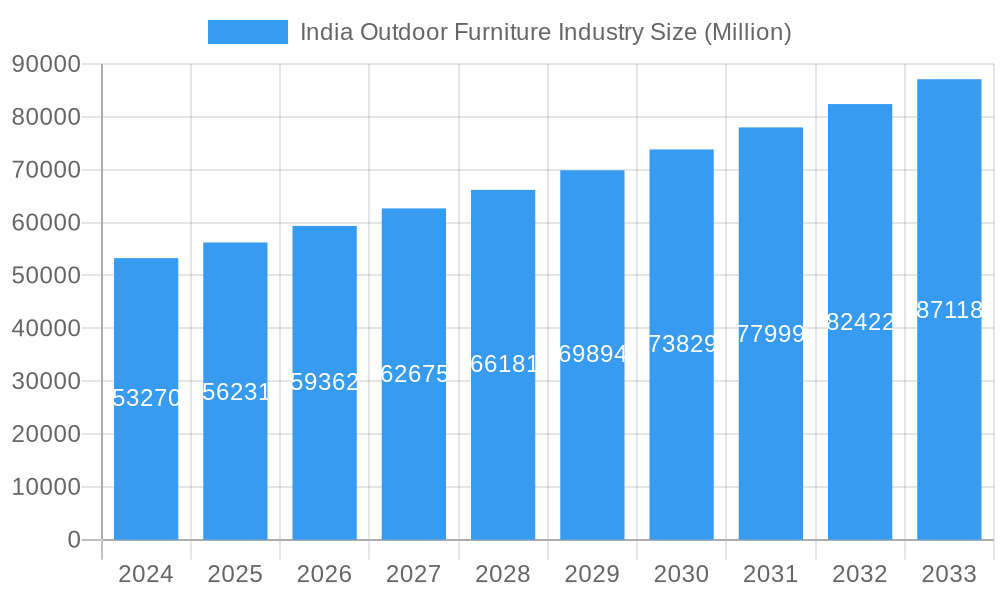

The India Outdoor Furniture Industry is poised for robust growth, projecting a market size of INR 53.27 billion in 2024, with a compelling Compound Annual Growth Rate (CAGR) of 5.5% anticipated through 2033. This significant expansion is fueled by a confluence of factors, including a rising disposable income among Indian consumers and an increasing desire to enhance outdoor living spaces for relaxation and entertainment. The burgeoning real estate sector, with a greater emphasis on balconies, patios, and garden areas in both residential and commercial properties, acts as a primary driver. Furthermore, the growing popularity of staycations and a renewed appreciation for nature are encouraging individuals and businesses to invest in comfortable and aesthetically pleasing outdoor furniture. The "Make in India" initiative also plays a crucial role, fostering domestic manufacturing capabilities and promoting local craftsmanship, which contributes to the market's expansion and diversification.

India Outdoor Furniture Industry Market Size (In Billion)

The market's growth is further supported by evolving consumer preferences towards durable, weather-resistant, and sustainable materials like treated wood and recycled plastics, moving beyond traditional options. Key trends include the increasing demand for modular and multi-functional furniture that optimizes space, especially in urban settings. The "Unorganised" sector, while present, is gradually giving way to organized retail and online platforms that offer greater transparency, convenience, and wider product selections, thereby expanding market reach. The commercial segment, encompassing hospitality, corporate offices, and public spaces, is a significant contributor, seeking to create inviting outdoor environments for customers and employees. The growing adoption of e-commerce channels is also a pivotal trend, making outdoor furniture more accessible to a wider demographic across the country, irrespective of geographical limitations.

India Outdoor Furniture Industry Company Market Share

This in-depth report provides a detailed examination of the India outdoor furniture industry, encompassing market size, growth drivers, trends, competitive landscape, and future projections. With a study period from 2019 to 2033, a base and estimated year of 2025, and a forecast period extending from 2025 to 2033, this analysis offers invaluable insights for manufacturers, retailers, distributors, and investors seeking to capitalize on the burgeoning demand for outdoor living spaces in India. The report leverages high-traffic keywords and a structured format to enhance search visibility and provide actionable intelligence for industry stakeholders.

India Outdoor Furniture Industry Market Concentration & Innovation

The India outdoor furniture market exhibits a moderate level of concentration, with a mix of established global players, large domestic manufacturers, and a significant unorganized sector. Innovation is a key differentiator, driven by evolving consumer preferences for aesthetic appeal, durability, and sustainability. Factors like increasing disposable incomes, a growing trend towards home improvement and outdoor living, and the influence of global design trends are fueling innovation. Regulatory frameworks, while evolving, are generally supportive of industry growth, with a focus on quality standards and sustainable sourcing. Product substitutes, such as traditional seating arrangements or improvised outdoor solutions, exist but are increasingly being displaced by dedicated outdoor furniture. End-user trends point towards a rising demand for multi-functional, weather-resistant, and aesthetically pleasing furniture. Mergers and acquisitions (M&A) activities are expected to increase as larger players seek to consolidate market share and expand their product portfolios. The overall market size is projected to reach USD 15 billion by 2025, with M&A deal values anticipated to grow significantly in the coming years.

- Market Concentration: Moderate, with key players like Inter IKEA Systems BV, Patio Palace, Cane India, The Courtyard (Metro Plus Life Style), Amazon, Outdoor India, Pepperfry, Urban Ladder, Wicker Delite, and KERNIG KRAFTS contributing significantly.

- Innovation Drivers: Growing disposable incomes, urbanization, focus on home aesthetics, demand for sustainable and durable materials, and influence of international design trends.

- Regulatory Frameworks: Evolving with a focus on quality, safety, and environmental standards.

- Product Substitutes: Traditional seating, DIY solutions, but facing increasing competition from specialized outdoor furniture.

- End-User Trends: Demand for weather-resistant, low-maintenance, aesthetically pleasing, and space-saving furniture for balconies, patios, and gardens.

- M&A Activities: Expected to rise as companies seek strategic expansion and market consolidation.

India Outdoor Furniture Industry Industry Trends & Insights

The India outdoor furniture industry is poised for remarkable growth, driven by a confluence of economic, social, and technological factors. The rising disposable incomes and a burgeoning middle class are significantly boosting consumer spending on home improvement and lifestyle products, with outdoor furniture emerging as a key category. The increasing urbanization and shrinking living spaces in cities are paradoxically fueling the demand for balconies, patios, and small garden areas to be optimized for relaxation and entertainment, thus driving the need for specialized outdoor furniture. Furthermore, the growing awareness and adoption of sustainable living practices are creating a demand for eco-friendly and responsibly sourced outdoor furniture. Technological disruptions, particularly in manufacturing processes and e-commerce, are reshaping the industry. Advanced manufacturing techniques are enabling the production of more durable, weather-resistant, and aesthetically superior products. The online furniture retail segment, including platforms like Pepperfry and Urban Ladder, is witnessing explosive growth, making outdoor furniture more accessible to consumers across the country. E-commerce in India is anticipated to expand by 96% between 2021 and 2025, reaching a transaction value of USD 120 billion, with online furniture sales forming a substantial part of this. Consumer preferences are increasingly shifting towards modern, minimalist designs, as well as comfortable and functional seating sets and dining sets. The competitive dynamics are intensifying, with both domestic and international players vying for market share. The market penetration of organized players is steadily increasing, driven by their ability to offer wider product ranges, consistent quality, and efficient distribution networks. The overall market is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 12% during the forecast period.

Dominant Markets & Segments in India Outdoor Furniture Industry

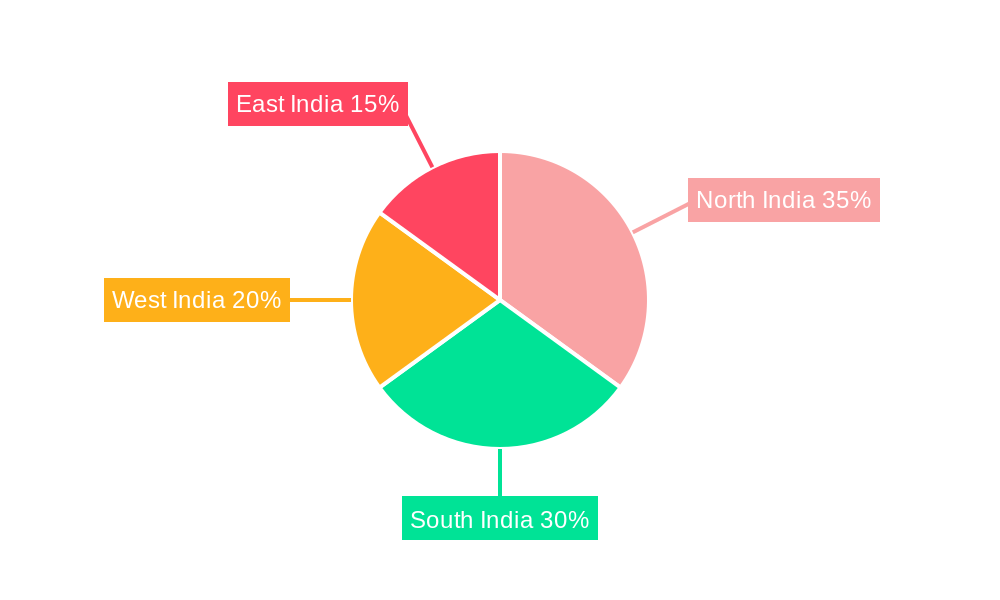

The India outdoor furniture industry is characterized by distinct dominant markets and segments, each contributing to the overall market dynamism. Geographically, the Northern and Western regions of India are emerging as dominant markets due to higher disposable incomes, greater adoption of Western lifestyle trends, and a concentration of urban populations. Within these regions, metropolitan cities and Tier-1 cities are leading the charge in demand for premium outdoor furniture.

Material Dominance:

- Wood: Continues to hold a significant market share due to its natural aesthetics and versatility, particularly teak and acacia wood for outdoor applications. However, its susceptibility to weather and maintenance requirements are leading to a gradual shift towards other materials.

- Metal: Especially wrought iron and aluminum, is gaining traction due to its durability, low maintenance, and modern appeal. Powder-coated finishes offer excellent weather resistance.

- Plastic: Remains a popular choice for budget-conscious consumers, offering lightweight, weather-resistant, and easy-to-clean options. Recycled plastic furniture is also gaining popularity due to environmental consciousness.

- Other Materials: Rattan, wicker (synthetic and natural), and composite materials are witnessing increasing demand for their unique aesthetic appeal and durability.

Product Dominance:

- Seating Sets: Including sofas, loveseats, and modular seating, are leading the market, catering to the need for comfortable outdoor lounging and entertainment spaces.

- Chairs and Tables: Both dining sets and individual pieces are highly sought after for creating functional outdoor dining and relaxation areas.

- Loungers and Daybeds: Demand for these products is growing, especially with the rise of resort-style living and increased focus on personal comfort and relaxation.

Market Type Dominance:

- Organised Market: Is witnessing rapid growth, driven by established brands, online retailers, and organized retail chains that offer standardized quality, wider product selection, and a better customer experience. The presence of companies like IKEA and the expansion of online platforms are significant contributors.

- Unorganised Market: While still substantial, is gradually ceding market share to organized players due to challenges in quality control, scalability, and brand building.

End User Dominance:

- Residential: Dominates the market, fueled by an increasing number of homeowners investing in creating comfortable and stylish outdoor living spaces, including balconies, patios, and gardens.

- Commercial: While smaller, this segment is growing, driven by the hospitality sector (hotels, resorts, restaurants), cafes, and corporate offices looking to enhance their outdoor ambiance.

Distribution Channel Dominance:

- Online: Is emerging as a dominant channel, driven by the convenience, wider selection, and competitive pricing offered by e-commerce platforms like Pepperfry, Urban Ladder, and Amazon. The projected e-commerce growth of 96% between 2021 and 2025 highlights its increasing importance.

- Offline (Specialty Stores & Retailers): Continue to play a crucial role, offering customers the opportunity to physically interact with products and receive personalized advice. Hypermarkets and supermarkets are also increasing their presence in this segment.

India Outdoor Furniture Industry Product Developments

Product innovation in the India outdoor furniture sector is primarily focused on enhancing durability, weather resistance, and aesthetic appeal. Manufacturers are increasingly utilizing advanced materials like UV-resistant plastics, powder-coated metals, and treated hardwoods to ensure longevity in varied climatic conditions. The integration of smart technologies, such as built-in lighting and charging ports, is also gaining traction. Furthermore, the trend towards modular and multi-functional furniture addresses space constraints in urban living. Competitive advantages are being derived from sustainable sourcing, eco-friendly manufacturing processes, and unique design collaborations, appealing to a growing segment of environmentally conscious consumers. The market fit is being optimized by offering furniture suitable for diverse outdoor spaces, from compact balconies to sprawling patios.

Report Scope & Segmentation Analysis

The India outdoor furniture industry report offers a comprehensive segmentation analysis covering key market segments.

- Material: Wood, Metal, Plastic, and Other Materials (Rattan, Wicker, Composite) are analyzed, with projections indicating a steady growth for metal and composite materials due to their durability and low maintenance.

- Product: This includes Chairs, Tables, Seating Sets, Loungers and Daybeds, Dining Sets, and Other Products. Seating sets and dining sets are expected to witness the highest growth rates, driven by evolving lifestyle needs.

- Market Type: The report differentiates between the Organised and Unorganised market sectors, highlighting the increasing dominance and projected growth of the organised segment, driven by brand presence and online retail expansion.

- End User: Commercial and Residential segments are examined, with the Residential segment projected to remain the largest contributor to the market revenue, although the Commercial sector is expected to see robust growth in the hospitality industry.

- Distribution Channel: Analysis covers Offline (Retail and Contractors, Hypermarkets, Supermarkets, Specialty Stores) and Online channels. The Online segment is anticipated to experience exponential growth, capturing a significant market share by the end of the forecast period.

Key Drivers of India Outdoor Furniture Industry Growth

The India outdoor furniture industry's growth is propelled by several key factors:

- Rising Disposable Incomes: A growing middle class with increased purchasing power is investing in home décor and lifestyle enhancements, including outdoor furniture.

- Urbanization and Small Space Living: The trend of smaller living spaces in urban areas is driving demand for functional and aesthetically pleasing outdoor furniture for balconies and compact patios.

- Evolving Lifestyle Trends: Increased focus on home-centric entertainment, wellness, and the desire for comfortable outdoor living spaces are significant drivers.

- E-commerce Penetration: The rapid growth of online retail platforms is making a wider variety of outdoor furniture accessible to consumers across India, driving sales volume.

- Sustainability Consciousness: Growing awareness of environmental issues is fostering demand for eco-friendly and sustainably sourced outdoor furniture.

Challenges in the India Outdoor Furniture Industry Sector

Despite robust growth, the India outdoor furniture sector faces certain challenges:

- Supply Chain Disruptions: Logistics and transportation issues, especially in reaching remote areas, can impact timely delivery and increase costs.

- Raw Material Price Volatility: Fluctuations in the prices of raw materials like wood, metal, and plastics can affect manufacturing costs and profit margins.

- Intense Competition: The market is characterized by intense competition from both unorganised local players and established international brands, leading to price pressures.

- Import Duties and Regulations: Import duties on certain furniture components and evolving regulatory landscapes can pose challenges for manufacturers and importers.

- Consumer Awareness and Education: In some segments, there is a need for greater consumer education on the benefits of specialized outdoor furniture and material care.

Emerging Opportunities in India Outdoor Furniture Industry

The India outdoor furniture industry is ripe with emerging opportunities:

- Smart and Sustainable Furniture: Growing demand for eco-friendly, recyclable, and smart furniture with integrated features like charging ports and lighting presents a significant opportunity.

- Customization and Personalization: Offering bespoke outdoor furniture solutions tailored to individual needs and aesthetic preferences can cater to niche markets and command premium pricing.

- Tier 2 and Tier 3 City Expansion: As disposable incomes rise in smaller cities, expanding distribution networks and product offerings to these regions presents a vast untapped market.

- Rental and Subscription Models: Exploring furniture rental or subscription services for temporary needs or for consumers who prefer flexibility can open new revenue streams.

- Hospitality Sector Growth: The continuous expansion of the hospitality sector (hotels, resorts, cafes) will drive sustained demand for durable and stylish outdoor furniture.

Leading Players in the India Outdoor Furniture Industry Market

- Inter IKEA Systems BV

- Patio Palace

- Cane India

- The Courtyard (Metro Plus Life Style)

- Amazon

- Outdoor India

- Pepperfry

- Urban Ladder

- Wicker Delite

- KERNIG KRAFTS

Key Developments in India Outdoor Furniture Industry Industry

- Nov 2022: Online Indian furniture brand Pepperfry cooperated with FarEye to improve order visibility, reduce delays, and raise overall consumer happiness throughout the last-mile delivery process. In India, e-commerce is anticipated to expand 96% between 2021 and 2025, reaching a transaction value of USD 120 billion. Pepperfry teamed with FarEye to give real-time visibility throughout the delivery path and eliminate delays and interruptions, ensuring every package arrives on time, every time.

- Nov 2022: IKEA India and electronic music artists Swedish House Mafia have produced an exclusive collection that honours music makers, performers, players, and fans' enthusiasm for music and creativity at home. The partnership is the outcome of OBEGRNSAD, a limited collection that will allow many aspiring musicians and digital artists to establish the ideal home studio at a fair cost.

Strategic Outlook for India Outdoor Furniture Industry Market

The strategic outlook for the India outdoor furniture industry is highly optimistic, driven by sustained economic growth, evolving consumer lifestyles, and increasing urbanization. The continued expansion of the e-commerce channel will democratize access to a wider range of products, fueling sales volume. Investments in sustainable manufacturing practices and innovative product designs will be crucial for market leadership. Companies that can effectively cater to the demand for durable, aesthetically pleasing, and space-saving furniture, while also focusing on efficient supply chains and customer experience, are poised for significant success. The growing emphasis on outdoor living, coupled with the increasing disposable incomes, ensures a robust growth trajectory for the industry in the coming years, with a projected market size of USD 25 billion by 2033.

India Outdoor Furniture Industry Segmentation

-

1. Material

- 1.1. Wood

- 1.2. Metal

- 1.3. Plastic

- 1.4. Other Materials

-

2. Product

- 2.1. Chair

- 2.2. Tables

- 2.3. Seating sets

- 2.4. Loungers and Daybeds

- 2.5. Dining Sets

- 2.6. Other Products

-

3. Market Type

- 3.1. Organised

- 3.2. Unorganised

-

4. End User

- 4.1. Commercial

- 4.2. Residential

-

5. Distribution Channel

-

5.1. Offline

- 5.1.1. Retail and Contractors

- 5.1.2. Hypermarkets

- 5.1.3. Supermarkets

- 5.1.4. Specialty Stores

- 5.2. Online

-

5.1. Offline

India Outdoor Furniture Industry Segmentation By Geography

- 1. India

India Outdoor Furniture Industry Regional Market Share

Geographic Coverage of India Outdoor Furniture Industry

India Outdoor Furniture Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in E-commerce is Driving the Market; Rise in Construction and Real Estate Sector Drives the Furniture Market

- 3.3. Market Restrains

- 3.3.1. Economic Fluctuations; High Competition in the Furniture Market

- 3.4. Market Trends

- 3.4.1. Wood Furniture is Majorly Preferred by Indians as Outdoor Furniture

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Outdoor Furniture Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Wood

- 5.1.2. Metal

- 5.1.3. Plastic

- 5.1.4. Other Materials

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Chair

- 5.2.2. Tables

- 5.2.3. Seating sets

- 5.2.4. Loungers and Daybeds

- 5.2.5. Dining Sets

- 5.2.6. Other Products

- 5.3. Market Analysis, Insights and Forecast - by Market Type

- 5.3.1. Organised

- 5.3.2. Unorganised

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. Commercial

- 5.4.2. Residential

- 5.5. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.5.1. Offline

- 5.5.1.1. Retail and Contractors

- 5.5.1.2. Hypermarkets

- 5.5.1.3. Supermarkets

- 5.5.1.4. Specialty Stores

- 5.5.2. Online

- 5.5.1. Offline

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. India

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Inter IKEA Systems BV

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Patio Palace

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Cane India

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 The Courtyard (Metro Plus Life Style)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Amazon**List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Outdoor India

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Pepperfry

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Urban Ladder

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Wicker Delite

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 KERNIG KRAFTS

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Inter IKEA Systems BV

List of Figures

- Figure 1: India Outdoor Furniture Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: India Outdoor Furniture Industry Share (%) by Company 2025

List of Tables

- Table 1: India Outdoor Furniture Industry Revenue undefined Forecast, by Material 2020 & 2033

- Table 2: India Outdoor Furniture Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 3: India Outdoor Furniture Industry Revenue undefined Forecast, by Market Type 2020 & 2033

- Table 4: India Outdoor Furniture Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 5: India Outdoor Furniture Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 6: India Outdoor Furniture Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 7: India Outdoor Furniture Industry Revenue undefined Forecast, by Material 2020 & 2033

- Table 8: India Outdoor Furniture Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 9: India Outdoor Furniture Industry Revenue undefined Forecast, by Market Type 2020 & 2033

- Table 10: India Outdoor Furniture Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 11: India Outdoor Furniture Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 12: India Outdoor Furniture Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Outdoor Furniture Industry?

The projected CAGR is approximately 5.5%.

2. Which companies are prominent players in the India Outdoor Furniture Industry?

Key companies in the market include Inter IKEA Systems BV, Patio Palace, Cane India, The Courtyard (Metro Plus Life Style), Amazon**List Not Exhaustive, Outdoor India, Pepperfry, Urban Ladder, Wicker Delite, KERNIG KRAFTS.

3. What are the main segments of the India Outdoor Furniture Industry?

The market segments include Material, Product, Market Type, End User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rise in E-commerce is Driving the Market; Rise in Construction and Real Estate Sector Drives the Furniture Market.

6. What are the notable trends driving market growth?

Wood Furniture is Majorly Preferred by Indians as Outdoor Furniture.

7. Are there any restraints impacting market growth?

Economic Fluctuations; High Competition in the Furniture Market.

8. Can you provide examples of recent developments in the market?

Nov 2022: Online Indian furniture brand throughout the last-mile delivery process, Pepperfry cooperated with FarEye to improve order visibility, reduce delays, and raise overall consumer happiness. In India, e-commerce is anticipated to expand 96% between 2021 and 2025, reaching a transaction value of USD 120 billion. Pepperfry teamed with FarEye to give real-time visibility throughout the delivery path and eliminate delays and interruptions, ensuring every package arrives on time, every time.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Outdoor Furniture Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Outdoor Furniture Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Outdoor Furniture Industry?

To stay informed about further developments, trends, and reports in the India Outdoor Furniture Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence