Key Insights

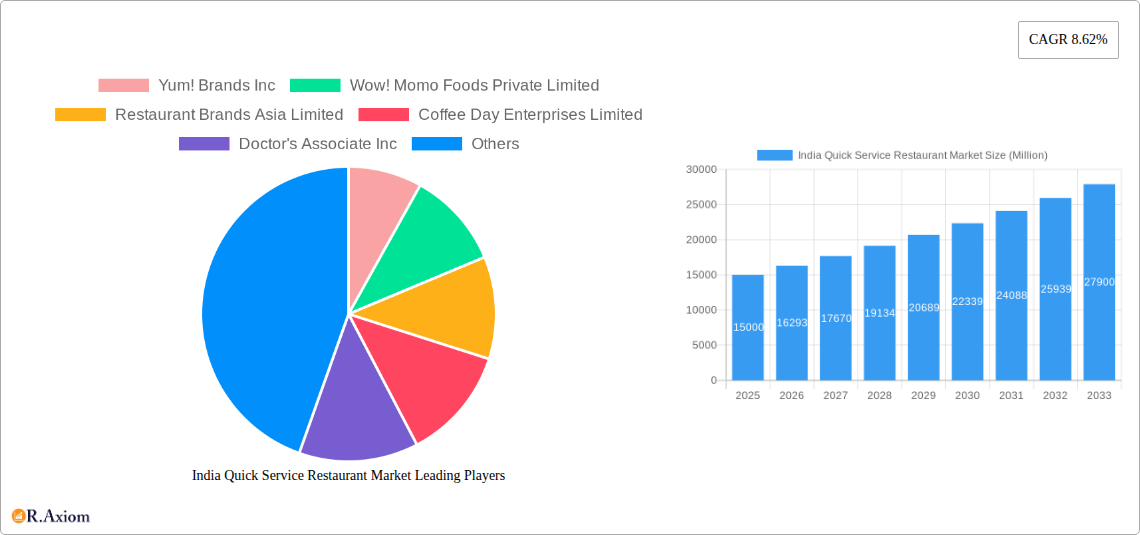

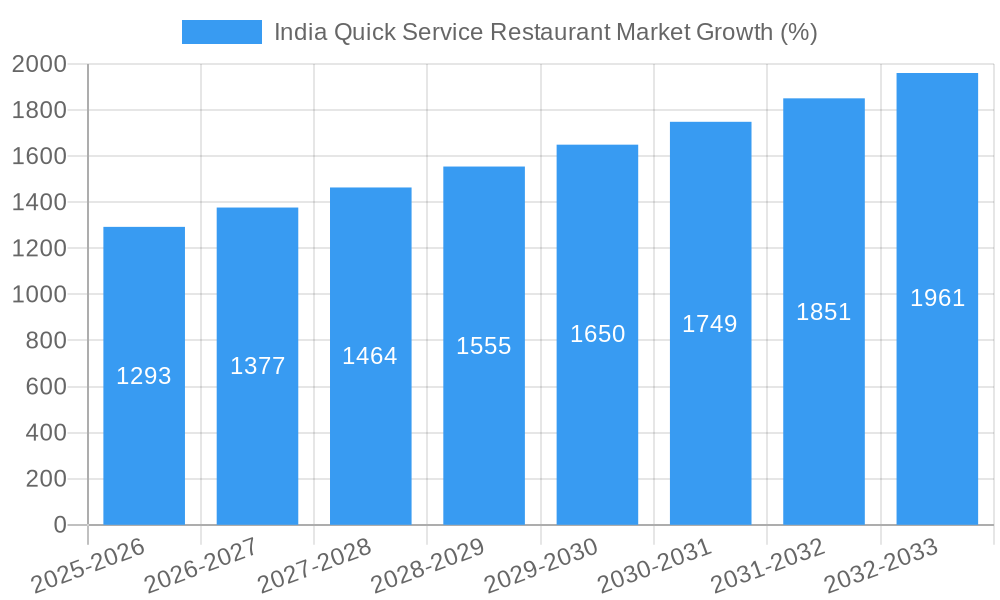

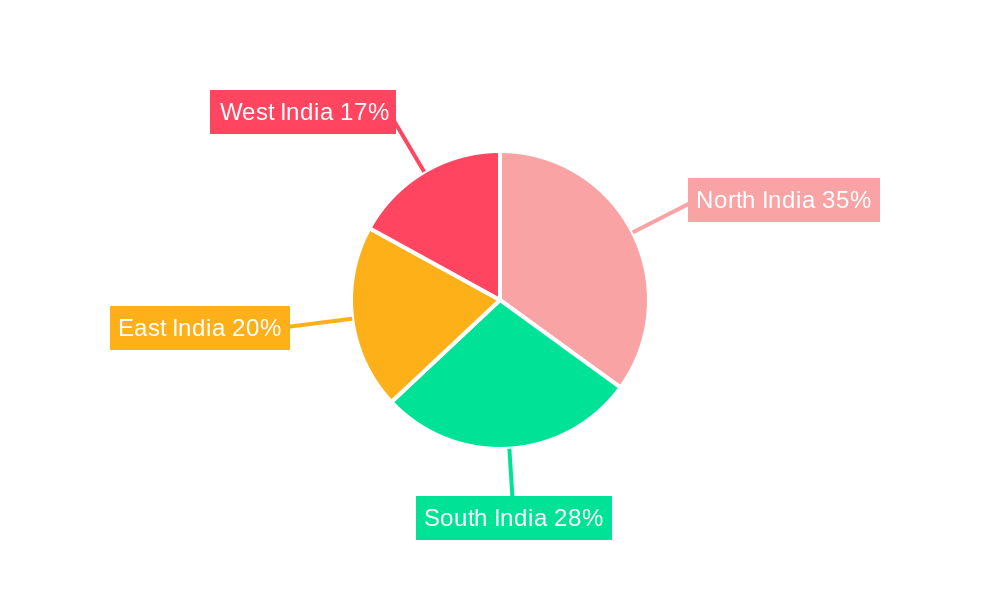

The India Quick Service Restaurant (QSR) market is experiencing robust growth, projected to reach a significant market size by 2033. A compound annual growth rate (CAGR) of 8.62% from 2019-2024 indicates a consistently expanding market driven by several factors. Rising disposable incomes, rapid urbanization, evolving consumer preferences towards convenience and diverse culinary experiences, and the increasing penetration of online food delivery platforms are key contributors to this growth. The market is segmented across diverse cuisines, including bakeries, burgers, ice cream parlors, meat-based cuisines, pizza outlets, and other QSR options. Outlet types vary, encompassing chained outlets, independent establishments, and locations spanning leisure, lodging, retail spaces, standalone units, and travel hubs. Major players like Yum! Brands Inc., Wow! Momo Foods, Restaurant Brands Asia, and Jubilant FoodWorks are driving innovation and competition, introducing new menu items and optimizing operations to cater to evolving consumer demands. The regional distribution reveals significant potential across North, South, East, and West India, each presenting unique opportunities and challenges based on consumer behavior, cultural preferences, and market saturation levels. While challenges exist in maintaining consistent food quality across diverse locations and managing operational costs, the overall growth trajectory remains positive.

The projected growth of the Indian QSR market over the forecast period (2025-2033) hinges on several factors. Continued economic expansion and increased consumer spending power will be crucial drivers. The success of existing players and the emergence of new entrants will heavily influence market dynamics. Technological advancements, particularly within the online food delivery ecosystem, will continue to shape consumer behavior and present opportunities for optimization and efficiency. Effective supply chain management and cost control will be critical for sustained profitability in a competitive landscape. Furthermore, adaptation to changing dietary preferences and health consciousness will be vital for QSR businesses to remain relevant and capture a larger market share. Government policies related to food safety and regulations will also play a significant role in shaping the future of the industry. By carefully navigating these dynamics, the Indian QSR market is poised for considerable expansion in the coming years.

India Quick Service Restaurant (QSR) Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the India Quick Service Restaurant market from 2019 to 2033, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The report covers market size, segmentation, key players, growth drivers, challenges, and future opportunities. It leverages extensive data analysis and expert insights to offer a complete picture of this dynamic market.

India Quick Service Restaurant Market Market Concentration & Innovation

The Indian QSR market exhibits a mix of established international chains and rapidly growing domestic players. Market concentration is moderate, with a few dominant players commanding significant market share, but a considerable number of smaller players contributing to the overall vibrancy. Yum! Brands Inc, McDonald's Corporation, and Jubilant FoodWorks Limited hold substantial market share, reflecting their established brand recognition and extensive network. However, the increasing popularity of smaller, specialized QSRs demonstrates a significant level of market fragmentation.

Innovation in the Indian QSR landscape is driven by several factors:

- Changing Consumer Preferences: The demand for healthier options, customized meals, and unique culinary experiences fuels innovation in menu offerings and service models.

- Technological Advancements: Online ordering platforms, delivery services, and digital marketing strategies are transforming the QSR industry. The use of data analytics to personalize customer experiences is becoming increasingly important.

- Regulatory Frameworks: Food safety regulations and licensing procedures impact operations and innovation within the sector.

- Product Substitutes: The rise of cloud kitchens and home-delivery services from smaller eateries represents a growing segment of substitute options.

- Mergers and Acquisitions (M&A): M&A activity reflects strategic moves by established players to expand their market reach and consolidate their position. Recent transactions, though not specifically detailed in the available information, are indicative of this trend. For example, the recent global acquisition of Subway suggests a significant level of investment and consolidation at the international level. The value of such deals varies considerably, ranging from millions to billions of USD, depending on the size and scale of the companies involved.

End-user trends demonstrate a strong preference for convenience, affordability, and diverse culinary options.

India Quick Service Restaurant Market Industry Trends & Insights

The Indian QSR market is experiencing robust growth, driven by several factors. Rising disposable incomes, increasing urbanization, and a burgeoning young population with a preference for convenient dining experiences are key drivers. Technological disruption, notably in online ordering and delivery services, is transforming customer behavior and market dynamics. The growing popularity of mobile payment solutions further enhances this trend. Consumer preferences are evolving towards healthier options, customized meals, and unique culinary experiences, forcing QSRs to adapt their menus and offerings. Competitive dynamics are intensifying, with both international and domestic players vying for market share through innovative product launches, aggressive marketing campaigns, and strategic expansions.

The compound annual growth rate (CAGR) for the India QSR market during the forecast period (2025-2033) is estimated to be xx%. Market penetration is steadily increasing, with QSRs expanding their reach beyond major cities into smaller towns and rural areas.

Dominant Markets & Segments in India Quick Service Restaurant Market

Analyzing the Indian QSR market across various segments reveals dominant trends.

Cuisine:

- Burger: This segment holds a significant share, driven by the popularity of international chains and the increasing acceptance of Western fast food.

- Pizza: Similar to burgers, pizza enjoys considerable popularity, particularly among the younger demographic.

- Other QSR Cuisines: This encompasses a diverse range of options, including Indian street food and regional specialties, which are gaining traction due to the emphasis on local flavors.

Outlet:

- Chained Outlets: Dominated by large multinational and domestic chains, these outlets benefit from brand recognition and standardized quality.

- Independent Outlets: This segment offers considerable variety but lacks the branding and consistent quality of larger chains.

Location:

- Retail: Locations in high-traffic retail areas, shopping malls, and commercial complexes drive significant customer traffic and revenue.

- Standalone: While standalone outlets offer more control over operations, they need strong brand recognition or location advantages to compete effectively.

Key drivers for these dominant segments include favorable economic policies that encourage foreign investment and boost consumer spending, rapidly growing urbanization that increases the density of potential customers, and significant advancements in infrastructure, including transportation networks, that ease accessibility.

India Quick Service Restaurant Market Product Developments

Recent product innovations in the Indian QSR market focus on customization, healthier options, and leveraging technology for enhanced customer experience. Many QSRs are introducing meal customization features that allow consumers to tailor their orders to their specific preferences. Healthier options, such as vegetarian and vegan choices, along with gluten-free and low-calorie options, are becoming increasingly prevalent. The integration of technology for online ordering, loyalty programs, and personalized recommendations enhances customer engagement and retention. This trend reflects the growing consumer demand for personalized experiences and convenient ordering, along with increasing concerns about health and wellness.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the Indian QSR market across various segments:

Cuisine: Bakeries, Burger, Ice Cream, Meat-based Cuisines, Pizza, Other QSR Cuisines. Each segment's growth projections, market size, and competitive dynamics are analyzed, showing different rates of growth and varying degrees of competitiveness.

Outlet: Chained Outlets and Independent Outlets. The report examines the differences in operational models, investment requirements, and target markets for each.

Location: Leisure, Lodging, Retail, Standalone, Travel. The strategic location of each outlet type is discussed and analyzed for its impact on market share.

Growth projections vary across these segments, reflecting differences in consumer preferences, market maturity, and competitive landscapes. Market sizes are estimated using various data points and projected forward based on historical trends and future expectations. Competitive dynamics are analyzed through examining the competitive strategies employed by key players in each segment.

Key Drivers of India Quick Service Restaurant Market Growth

Several factors propel the growth of the Indian QSR market: a young and growing population with increasing disposable incomes, rapid urbanization leading to higher population density in urban centers, and expanding consumer base with evolving tastes and preferences. Technological advancements, particularly in online ordering and delivery, enhance convenience and drive market expansion. Government initiatives promoting ease of doing business and supportive policies also contribute to market growth.

Challenges in the India Quick Service Restaurant Market Sector

Despite significant growth potential, the Indian QSR market faces several challenges: intense competition from established players and new entrants, fluctuating raw material costs impacting profitability, and stringent food safety regulations demanding high operational standards. Maintaining consistent quality and service standards across multiple outlets can be challenging, as can managing supply chain complexities, especially for sourcing fresh ingredients. The rise of home delivery services also represents competitive pressure. These challenges impact the industry’s ability to maintain profitability and sustainable growth.

Emerging Opportunities in India Quick Service Restaurant Market

Several opportunities exist for growth within the Indian QSR market. Expanding into Tier 2 and Tier 3 cities presents significant untapped potential. The increasing popularity of healthy and customized meals creates opportunities for innovative product development. Leveraging technology for enhanced customer engagement, personalized services, and efficient operations is vital. The growing preference for quick and convenient dining drives continued expansion in the market.

Leading Players in the India Quick Service Restaurant Market Market

- Yum! Brands Inc

- Wow! Momo Foods Private Limited

- Restaurant Brands Asia Limited

- Coffee Day Enterprises Limited

- Doctor's Associate Inc

- Jubilant FoodWorks Limited

- McDonald's Corporation

- Tata Starbucks Private Limited

- Graviss Foods Private Limited

Key Developments in India Quick Service Restaurant Market Industry

- August 2023: Subway was acquired by private equity firm Roark Capital for USD 8.95 billion. This acquisition signifies significant investment in the global QSR sector and could influence strategies within the Indian market.

- January 2023: Jubilant Foodworks announced plans to open 250 Domino's stores in India within 12-18 months, indicating substantial expansion within the market.

- January 2023: Popeyes launched a new Shrimp Roll, demonstrating the ongoing innovation in product offerings within the competitive landscape.

Strategic Outlook for India Quick Service Restaurant Market Market

The Indian QSR market is poised for continued robust growth, driven by favorable demographics, evolving consumer preferences, and technological advancements. Strategic opportunities lie in expanding into underserved markets, developing innovative products tailored to local tastes, and enhancing customer experience through technology integration. The market's dynamic nature and competitive landscape require a keen focus on operational efficiency, brand building, and adapting to changing consumer demands to achieve sustained success.

India Quick Service Restaurant Market Segmentation

-

1. Cuisine

- 1.1. Bakeries

- 1.2. Burger

- 1.3. Ice Cream

- 1.4. Meat-based Cuisines

- 1.5. Pizza

- 1.6. Other QSR Cuisines

-

2. Outlet

- 2.1. Chained Outlets

- 2.2. Independent Outlets

-

3. Location

- 3.1. Leisure

- 3.2. Lodging

- 3.3. Retail

- 3.4. Standalone

- 3.5. Travel

India Quick Service Restaurant Market Segmentation By Geography

- 1. India

India Quick Service Restaurant Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.62% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Health Consciousness among consumer

- 3.3. Market Restrains

- 3.3.1. High Cost of natural Ingredients

- 3.4. Market Trends

- 3.4.1. Fast-delivery options along with hygienic food and the essence of brand loyalty boost the sales

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Quick Service Restaurant Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Cuisine

- 5.1.1. Bakeries

- 5.1.2. Burger

- 5.1.3. Ice Cream

- 5.1.4. Meat-based Cuisines

- 5.1.5. Pizza

- 5.1.6. Other QSR Cuisines

- 5.2. Market Analysis, Insights and Forecast - by Outlet

- 5.2.1. Chained Outlets

- 5.2.2. Independent Outlets

- 5.3. Market Analysis, Insights and Forecast - by Location

- 5.3.1. Leisure

- 5.3.2. Lodging

- 5.3.3. Retail

- 5.3.4. Standalone

- 5.3.5. Travel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Cuisine

- 6. North India India Quick Service Restaurant Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Quick Service Restaurant Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Quick Service Restaurant Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Quick Service Restaurant Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Yum! Brands Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Wow! Momo Foods Private Limited

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Restaurant Brands Asia Limited

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Coffee Day Enterprises Limited

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Doctor's Associate Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Jubilant FoodWorks Limited

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 McDonald's Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Tata Starbucks Private Limited

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Graviss Foods Private Limited

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Yum! Brands Inc

List of Figures

- Figure 1: India Quick Service Restaurant Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Quick Service Restaurant Market Share (%) by Company 2024

List of Tables

- Table 1: India Quick Service Restaurant Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Quick Service Restaurant Market Revenue Million Forecast, by Cuisine 2019 & 2032

- Table 3: India Quick Service Restaurant Market Revenue Million Forecast, by Outlet 2019 & 2032

- Table 4: India Quick Service Restaurant Market Revenue Million Forecast, by Location 2019 & 2032

- Table 5: India Quick Service Restaurant Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: India Quick Service Restaurant Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: North India India Quick Service Restaurant Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: South India India Quick Service Restaurant Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: East India India Quick Service Restaurant Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: West India India Quick Service Restaurant Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: India Quick Service Restaurant Market Revenue Million Forecast, by Cuisine 2019 & 2032

- Table 12: India Quick Service Restaurant Market Revenue Million Forecast, by Outlet 2019 & 2032

- Table 13: India Quick Service Restaurant Market Revenue Million Forecast, by Location 2019 & 2032

- Table 14: India Quick Service Restaurant Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Quick Service Restaurant Market?

The projected CAGR is approximately 8.62%.

2. Which companies are prominent players in the India Quick Service Restaurant Market?

Key companies in the market include Yum! Brands Inc, Wow! Momo Foods Private Limited, Restaurant Brands Asia Limited, Coffee Day Enterprises Limited, Doctor's Associate Inc, Jubilant FoodWorks Limited, McDonald's Corporation, Tata Starbucks Private Limited, Graviss Foods Private Limited.

3. What are the main segments of the India Quick Service Restaurant Market?

The market segments include Cuisine, Outlet, Location.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Health Consciousness among consumer.

6. What are the notable trends driving market growth?

Fast-delivery options along with hygienic food and the essence of brand loyalty boost the sales.

7. Are there any restraints impacting market growth?

High Cost of natural Ingredients.

8. Can you provide examples of recent developments in the market?

August 2023: Subway was acquired by private equity firm Roark Capital for USD 8.95 billion. To fully receive the amount, Subway needs to achieve certain cash flow milestones within a period of two or more years after the deal is completed.January 2023: Jubilant Foodworks announced its near-medium-term outlook. The company plans to open 250 stores for Domino's in India in the next 12-18 months with a capital investment of INR 900 crore.January 2023: Popeyes introduced the new Shrimp Roll to its seafood menu.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Quick Service Restaurant Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Quick Service Restaurant Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Quick Service Restaurant Market?

To stay informed about further developments, trends, and reports in the India Quick Service Restaurant Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence