Key Insights

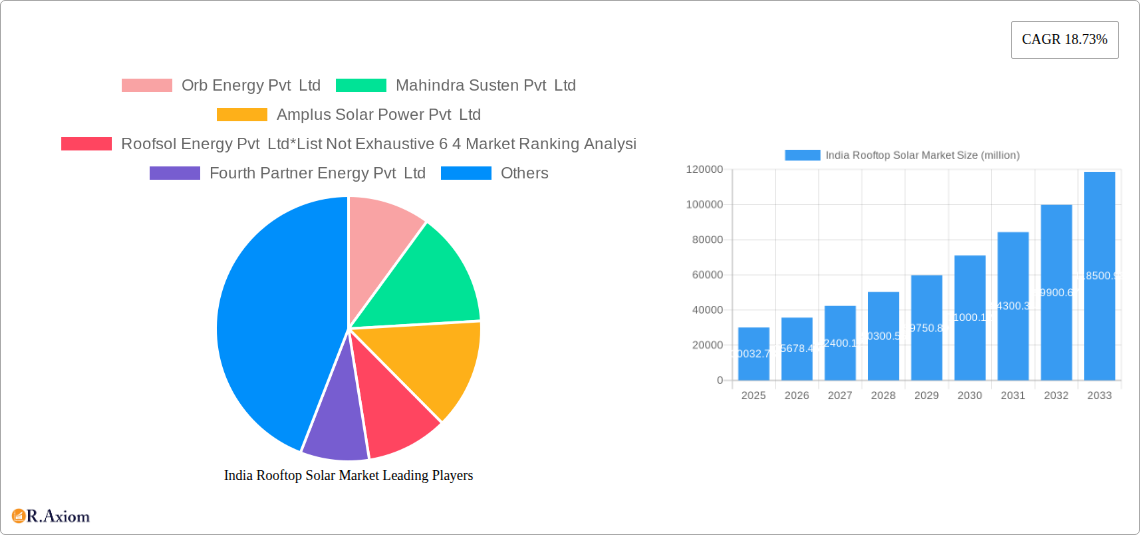

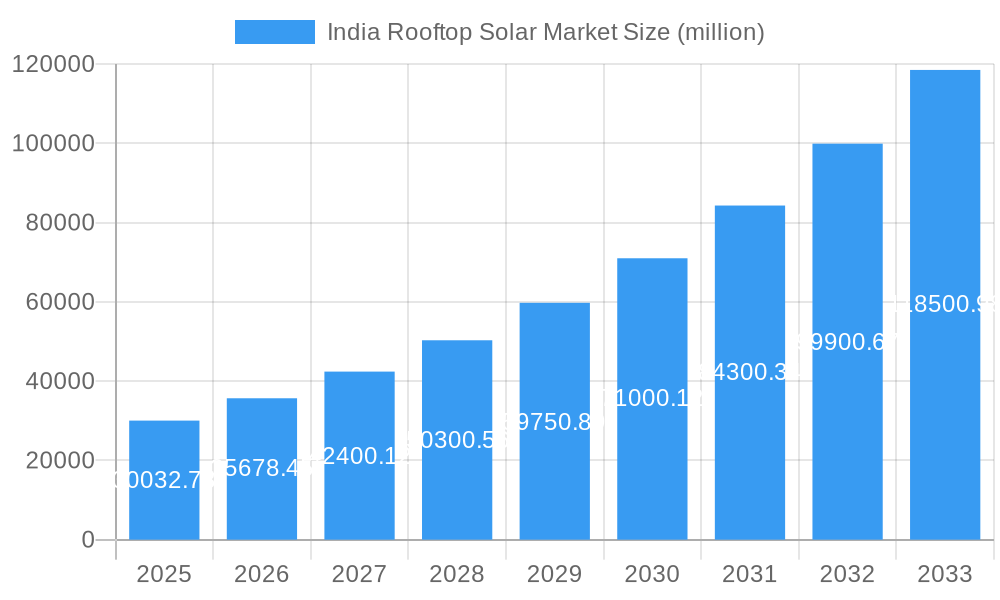

The India Rooftop Solar Market is poised for remarkable expansion, projecting a market size of USD 30,032.78 million by 2025, fueled by a robust CAGR of 18.73%. This impressive growth trajectory is driven by a confluence of factors, including government initiatives promoting renewable energy adoption, decreasing solar panel costs, and an increasing awareness of environmental sustainability. The demand for rooftop solar solutions is significantly boosted by the industrial sector, driven by the need for cost-effective energy and greater energy independence. Commercial establishments, including the public sector, are also embracing rooftop solar to reduce operational expenses and meet their corporate social responsibility goals. The residential segment is witnessing a surge in adoption as homeowners increasingly recognize the long-term financial benefits and the desire to contribute to a greener future. Innovations in solar technology and storage solutions are further enhancing the attractiveness and efficiency of rooftop solar installations, solidifying its position as a critical component of India's energy transition.

India Rooftop Solar Market Market Size (In Billion)

The market's dynamism is further characterized by a strong emphasis on grid connectivity, with on-grid systems dominating due to their seamless integration and net metering benefits, allowing consumers to feed surplus energy back into the grid. Off-grid solutions are also gaining traction in remote areas where grid access is limited, providing a reliable and independent power source. Key players such as Tata Power Solar Systems Limited, Amplus Solar Power Pvt Ltd, and Mahindra Susten Pvt Ltd are actively investing in research and development, expanding their manufacturing capabilities, and forging strategic partnerships to cater to the growing demand. These companies are instrumental in driving innovation, improving installation processes, and making rooftop solar more accessible and affordable across diverse end-user segments and geographical regions within India. The market's future looks exceptionally bright, aligning with India's ambitious renewable energy targets and its commitment to a sustainable energy landscape.

India Rooftop Solar Market Company Market Share

This detailed report provides an in-depth analysis of the rapidly expanding India Rooftop Solar Market. Covering the historical period from 2019-2024 and projecting growth through 2033, with a base and estimated year of 2025, this study delves into market concentration, innovation, industry trends, dominant segments, product developments, key drivers, challenges, emerging opportunities, leading players, and crucial recent developments. Leveraging high-traffic keywords such as "rooftop solar India," "solar energy India," "renewable energy India," "solar power capacity," and "solar PV market," this report is an essential resource for investors, policymakers, industry stakeholders, and businesses seeking to understand and capitalize on the burgeoning Indian solar landscape.

India Rooftop Solar Market Market Concentration & Innovation

The India Rooftop Solar Market exhibits a moderate to high concentration, with a few prominent players dominating a significant portion of the market share. Key companies like Tata Power Solar Systems Limited, Amplus Solar Power Pvt Ltd, and Clean Max Enviro Energy Solutions Pvt Ltd have established strong presences through strategic investments and large-scale project development. Innovation is a critical driver, fueled by advancements in solar panel efficiency, energy storage solutions, and smart grid integration. Regulatory frameworks, including government incentives, net metering policies, and renewable purchase obligations (RPOs), play a pivotal role in shaping market dynamics and encouraging adoption. Product substitutes, while present in the form of other renewable energy sources, are increasingly losing ground to the cost-effectiveness and scalability of rooftop solar. End-user trends are shifting towards sustainability, cost savings, and energy independence, particularly within the industrial and commercial sectors. Mergers and acquisitions (M&A) activities are on the rise, indicating consolidation and a drive for market expansion. For instance, recent M&A activities suggest deal values potentially in the tens to hundreds of millions of dollars as companies seek to acquire complementary technologies or expand their geographical reach.

India Rooftop Solar Market Industry Trends & Insights

The India Rooftop Solar Market is poised for remarkable growth, driven by a confluence of factors including decreasing solar panel costs, favorable government policies, and a growing awareness of environmental sustainability. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 18-22% during the forecast period. Technological disruptions, such as the integration of artificial intelligence for system optimization and the development of more efficient and affordable battery storage, are revolutionizing the sector. Consumer preferences are increasingly leaning towards reliable and cost-effective energy solutions, making rooftop solar a highly attractive option for both residential and commercial entities. The competitive landscape is intensifying, with both domestic and international players vying for market share. Key trends include the rise of distributed generation, the adoption of solar-plus-storage solutions, and the increasing demand from the industrial and commercial sectors for captive power generation. Market penetration is expected to accelerate, with significant growth anticipated in urban and semi-urban areas. The overall market size is estimated to reach over USD 5,000 million by 2025 and is projected to exceed USD 15,000 million by 2033, underscoring the immense potential.

Dominant Markets & Segments in India Rooftop Solar Market

The Industrial and Commercial (Including Public Sector) segment is the dominant force in the India Rooftop Solar Market, driven by significant energy consumption and a strong economic imperative to reduce operational costs. Businesses are increasingly recognizing the financial benefits of installing rooftop solar, including reduced electricity bills, hedging against rising grid tariffs, and enhanced corporate social responsibility (CSR) profiles.

- Key Drivers for Industrial & Commercial Dominance:

- Cost Savings: Significant reduction in electricity expenses, leading to improved profit margins.

- Energy Security: Reliable power supply, mitigating the impact of grid outages.

- Sustainability Goals: Alignment with environmental targets and enhanced brand image.

- Government Incentives: Various policies and subsidies available for commercial installations.

- Technological Advancements: Availability of scalable and efficient solar solutions.

The On-grid segment, by far, represents the largest portion of the market in terms of installed capacity and investment. This is primarily due to its inherent advantage of seamless integration with the existing power grid, allowing for efficient utilization of generated solar power and the sale of surplus electricity back to the utility provider through net metering mechanisms.

- Key Drivers for On-grid Dominance:

- Net Metering Policies: Facilitates revenue generation from excess power.

- Grid Stability: Provides a reliable backup and supplements grid power.

- Cost-Effectiveness: Eliminates the need for extensive battery storage in many cases.

- Ease of Integration: Simpler installation and operational processes compared to off-grid systems.

While the Residential segment is growing at a commendable pace, driven by falling system costs and increasing consumer awareness, it is yet to match the scale of industrial and commercial adoption. The Off-grid segment, though niche, is crucial for remote areas and applications where grid connectivity is absent or unreliable, though its market share remains considerably smaller.

India Rooftop Solar Market Product Developments

Product developments in the India Rooftop Solar Market are characterized by an unwavering focus on enhancing efficiency, durability, and cost-competitiveness. Innovations in photovoltaic (PV) cell technology, such as PERC, bifacial, and heterojunction cells, are continuously pushing the boundaries of energy conversion. The integration of advanced inverters and smart monitoring systems offers enhanced performance and remote diagnostics. Furthermore, the development of more robust mounting structures designed to withstand diverse weather conditions and the increasing adoption of building-integrated photovoltaics (BIPV) are noteworthy. The competitive advantage for manufacturers and developers lies in offering integrated solutions that include not only high-performance solar panels but also reliable inverters, efficient energy storage options, and intelligent management software, catering to the diverse needs of end-users.

Report Scope & Segmentation Analysis

The India Rooftop Solar Market is segmented across key areas to provide a granular understanding of its dynamics.

End-user Segmentation:

- Industrial: This segment encompasses manufacturing units, factories, and large industrial complexes. Projected market size for 2025 is estimated to be over USD 2,500 million, with significant growth driven by captive power requirements.

- Commercial (Including Public Sector): This segment includes businesses, offices, educational institutions, hospitals, and government buildings. Expected market size for 2025 is over USD 2,000 million, fueled by cost-saving initiatives and sustainability mandates.

- Residential: This segment covers individual homes and housing societies. The market size for 2025 is estimated to be over USD 500 million, with strong growth driven by declining costs and increasing awareness.

Grid Type Segmentation (Qualitative Analysis Only):

- On-grid: Systems connected to the national electricity grid, allowing for net metering. This segment is expected to dominate in terms of installed capacity and market penetration throughout the forecast period.

- Off-grid: Standalone systems independent of the grid, often incorporating battery storage. This segment caters to specific needs in remote areas and is expected to witness steady but slower growth compared to on-grid solutions.

Key Drivers of India Rooftop Solar Market Growth

The India Rooftop Solar Market's impressive growth trajectory is propelled by a synergistic interplay of technological advancements, supportive economic policies, and robust regulatory frameworks.

- Government Initiatives: Policies like the National Rooftop Solar Scheme, Renewable Purchase Obligations (RPOs), and various state-specific incentives provide financial impetus and encourage widespread adoption.

- Falling Technology Costs: A significant decline in the price of solar panels and associated components has made rooftop solar increasingly affordable and competitive.

- Growing Environmental Consciousness: Increasing awareness about climate change and the need for sustainable energy solutions is driving demand across all end-user segments.

- Energy Security and Cost Savings: Businesses and households are seeking to reduce their reliance on conventional grid power, thereby mitigating electricity cost volatility and ensuring energy independence.

- Technological Innovation: Advancements in solar panel efficiency, energy storage solutions, and smart grid integration are enhancing the performance and attractiveness of rooftop solar systems.

Challenges in the India Rooftop Solar Market Sector

Despite the robust growth, the India Rooftop Solar Market faces several challenges that can impede its full potential. Regulatory complexities and inconsistencies across different states can create uncertainties for developers and investors. Grid integration issues, including the capacity of the existing grid infrastructure to absorb distributed solar power and the lack of standardized evacuation policies, pose significant hurdles. Supply chain disruptions, particularly for imported components, and the availability of skilled labor for installation and maintenance are also concerns. Furthermore, the upfront capital investment, although decreasing, can still be a barrier for some residential consumers and smaller commercial entities. Competition from established power generation sources and the need for efficient waste management of solar panels at the end of their lifecycle are also areas requiring attention.

Emerging Opportunities in India Rooftop Solar Market

The India Rooftop Solar Market is ripe with emerging opportunities, driven by evolving consumer needs and technological advancements. The increasing demand for integrated energy solutions, combining solar PV with battery storage, presents a significant growth avenue, especially for ensuring uninterrupted power supply and participating in grid ancillary services. The development of floating solar projects on reservoirs and water bodies, alongside traditional rooftop installations, opens up new frontiers for solar deployment. Furthermore, the electrification of electric vehicles (EVs) creates a natural synergy with rooftop solar, enabling charging through renewable energy. The potential for smart grid integration and the development of microgrids powered by rooftop solar offers enhanced energy resilience and efficiency. The growing focus on green buildings and sustainable infrastructure also presents a substantial opportunity for widespread adoption of BIPV and solar integration in new constructions.

Leading Players in the India Rooftop Solar Market Market

- Orb Energy Pvt Ltd

- Mahindra Susten Pvt Ltd

- Amplus Solar Power Pvt Ltd

- Roofsol Energy Pvt Ltd

- Fourth Partner Energy Pvt Ltd

- Cleantech Energy Corporation Pte Ltd

- Tata Power Solar Systems Limited

- Sunsource Energy Pvt Ltd

- Clean Max Enviro Energy Solutions Pvt Ltd

- Growatt New Energy Technology Co Ltd

Key Developments in India Rooftop Solar Market Industry

- April 2024: Apple announced forming a joint venture with renewable energy developer CleanMax to invest in six rooftop solar projects to power its operations in India. The solar project is expected to have a total capacity of 14.4 MW and, when operational, will provide a local solution to power the company’s offices and two retail stores in Mumbai and New Delhi.

- March 2024: GAIL (India) announced an invitation for bids regarding a rooftop solar project. This project is expected to involve designing, supplying, installing, testing, and commissioning a grid-tied rooftop solar PV (photovoltaic) system. Additionally, this initiative includes a comprehensive 5-year Annual Maintenance Contract (AMC) to supply electricity generated by the project to the Krishna Godavari Basin area.

Strategic Outlook for India Rooftop Solar Market Market

The strategic outlook for the India Rooftop Solar Market is exceptionally bright, characterized by continued robust growth and evolving market dynamics. The increasing focus on India's renewable energy targets, coupled with a strong push for energy independence and sustainability, will act as primary growth catalysts. Innovations in energy storage and smart grid technologies will further enhance the value proposition of rooftop solar, driving greater adoption in the residential and commercial sectors. Strategic partnerships and collaborations between technology providers, developers, and financial institutions will be crucial for unlocking new investment avenues and overcoming existing challenges. The market is expected to witness further consolidation and technological advancements, leading to more efficient, affordable, and integrated solar solutions, solidifying rooftop solar's position as a cornerstone of India's clean energy future.

India Rooftop Solar Market Segmentation

-

1. End-user

- 1.1. Industrial

- 1.2. Commercial (Including Public Sector)

- 1.3. Residential

-

2. Grid Type (Qualitative Analysis Only)

- 2.1. On-grid

- 2.2. Off-grid

India Rooftop Solar Market Segmentation By Geography

- 1. India

India Rooftop Solar Market Regional Market Share

Geographic Coverage of India Rooftop Solar Market

India Rooftop Solar Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 18.73% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Government Emphasis Towards Renewable Energy Integration4.; Increasing Demand in the Commercial and Industrial Sector

- 3.3. Market Restrains

- 3.3.1. 4.; Slow-Paced Installation of Rooftop Projects

- 3.4. Market Trends

- 3.4.1. The On-grid Segment is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Rooftop Solar Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user

- 5.1.1. Industrial

- 5.1.2. Commercial (Including Public Sector)

- 5.1.3. Residential

- 5.2. Market Analysis, Insights and Forecast - by Grid Type (Qualitative Analysis Only)

- 5.2.1. On-grid

- 5.2.2. Off-grid

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by End-user

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Orb Energy Pvt Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mahindra Susten Pvt Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Amplus Solar Power Pvt Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Roofsol Energy Pvt Ltd*List Not Exhaustive 6 4 Market Ranking Analysi

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Fourth Partner Energy Pvt Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cleantech Energy Corporation Pte Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Tata Power Solar Systems Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sunsource Energy Pvt Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Clean Max Enviro Energy Solutions Pvt Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Growatt New Energy Technology Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Orb Energy Pvt Ltd

List of Figures

- Figure 1: India Rooftop Solar Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: India Rooftop Solar Market Share (%) by Company 2025

List of Tables

- Table 1: India Rooftop Solar Market Revenue million Forecast, by End-user 2020 & 2033

- Table 2: India Rooftop Solar Market Volume Gigawatt Forecast, by End-user 2020 & 2033

- Table 3: India Rooftop Solar Market Revenue million Forecast, by Grid Type (Qualitative Analysis Only) 2020 & 2033

- Table 4: India Rooftop Solar Market Volume Gigawatt Forecast, by Grid Type (Qualitative Analysis Only) 2020 & 2033

- Table 5: India Rooftop Solar Market Revenue million Forecast, by Region 2020 & 2033

- Table 6: India Rooftop Solar Market Volume Gigawatt Forecast, by Region 2020 & 2033

- Table 7: India Rooftop Solar Market Revenue million Forecast, by End-user 2020 & 2033

- Table 8: India Rooftop Solar Market Volume Gigawatt Forecast, by End-user 2020 & 2033

- Table 9: India Rooftop Solar Market Revenue million Forecast, by Grid Type (Qualitative Analysis Only) 2020 & 2033

- Table 10: India Rooftop Solar Market Volume Gigawatt Forecast, by Grid Type (Qualitative Analysis Only) 2020 & 2033

- Table 11: India Rooftop Solar Market Revenue million Forecast, by Country 2020 & 2033

- Table 12: India Rooftop Solar Market Volume Gigawatt Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Rooftop Solar Market?

The projected CAGR is approximately 18.73%.

2. Which companies are prominent players in the India Rooftop Solar Market?

Key companies in the market include Orb Energy Pvt Ltd, Mahindra Susten Pvt Ltd, Amplus Solar Power Pvt Ltd, Roofsol Energy Pvt Ltd*List Not Exhaustive 6 4 Market Ranking Analysi, Fourth Partner Energy Pvt Ltd, Cleantech Energy Corporation Pte Ltd, Tata Power Solar Systems Limited, Sunsource Energy Pvt Ltd, Clean Max Enviro Energy Solutions Pvt Ltd, Growatt New Energy Technology Co Ltd.

3. What are the main segments of the India Rooftop Solar Market?

The market segments include End-user , Grid Type (Qualitative Analysis Only) .

4. Can you provide details about the market size?

The market size is estimated to be USD 30032.78 million as of 2022.

5. What are some drivers contributing to market growth?

4.; Government Emphasis Towards Renewable Energy Integration4.; Increasing Demand in the Commercial and Industrial Sector.

6. What are the notable trends driving market growth?

The On-grid Segment is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Slow-Paced Installation of Rooftop Projects.

8. Can you provide examples of recent developments in the market?

April 2024: Apple announced forming a joint venture with renewable energy developer CleanMax to invest in six rooftop solar projects to power its operations in India. The solar project is expected to have a total capacity of 14.4 MW and, when operational, will provide a local solution to power the company’s offices and two retail stores in Mumbai and New Delhi.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Rooftop Solar Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Rooftop Solar Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Rooftop Solar Market?

To stay informed about further developments, trends, and reports in the India Rooftop Solar Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence