Key Insights

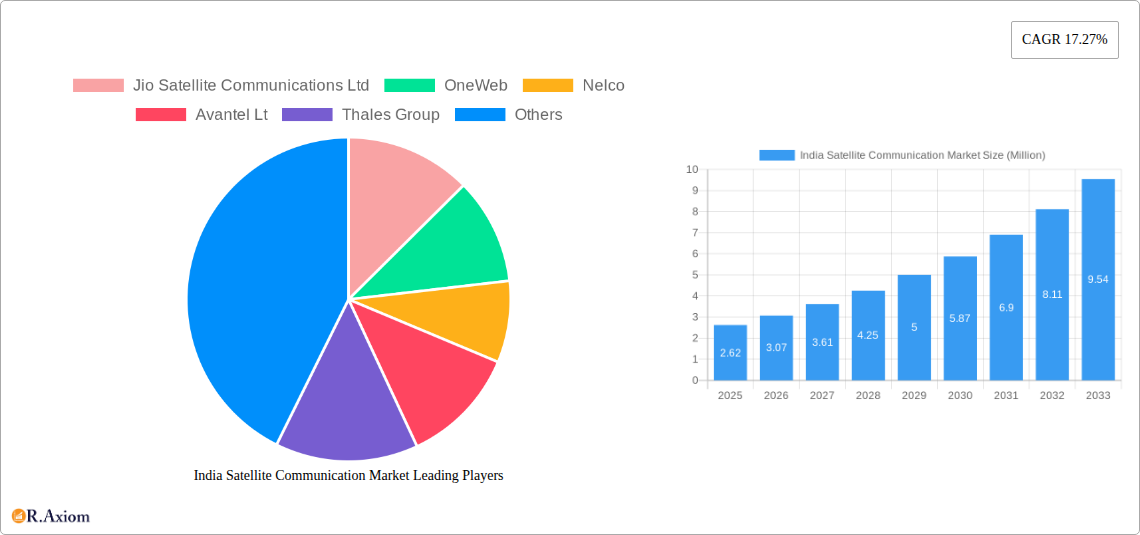

The Indian satellite communication market is poised for substantial growth, driven by increasing demand for robust and widespread connectivity across various sectors. With an estimated **market size of *2.62* million** in the base year of 2025, the market is projected to expand at an impressive Compound Annual Growth Rate (CAGR) of 17.27% during the forecast period of 2025-2033. This significant expansion is fueled by key drivers such as the government's push for digital inclusion, the burgeoning enterprise sector's need for reliable communication solutions, and the continuous evolution of defense and security requirements. The increasing adoption of satellite technology for internet access in remote and underserved areas, coupled with advancements in Very Small Aperture Terminal (VSAT) technology and Network Operation Centers (NOCs), are vital contributors to this upward trajectory. Furthermore, the growing demand for Earth Observation Services and the expansion of Mobile Satellite Services (MSS) for applications ranging from logistics to disaster management are creating new avenues for market penetration.

India Satellite Communication Market Market Size (In Million)

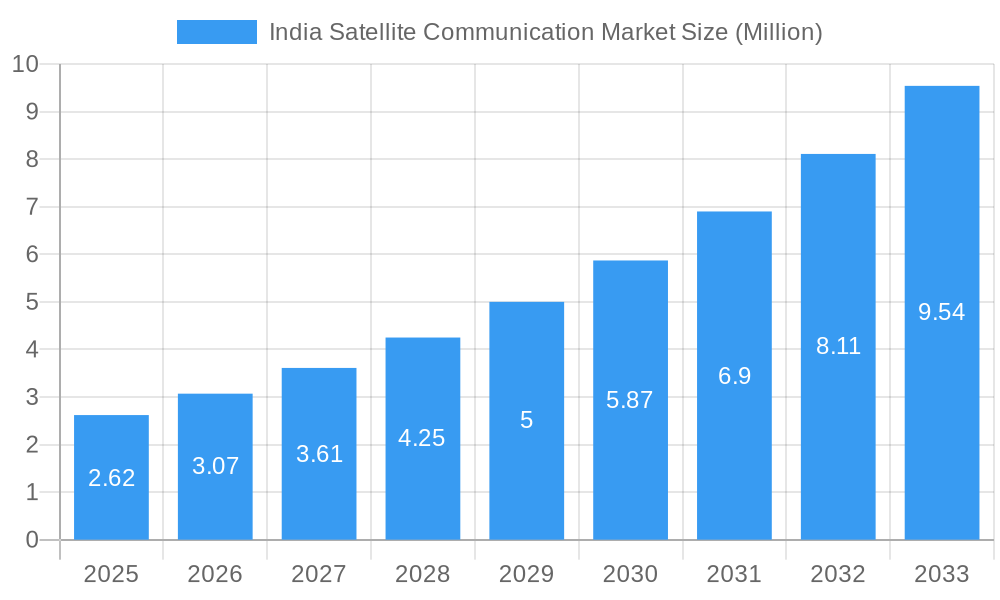

The Indian satellite communication landscape is characterized by a dynamic segmentation, encompassing a wide range of equipment and services. Within the "Type" segment, Ground Equipment, including Gateway, VSAT, NOC, and Satellite News Gathering (SNG) units, forms a critical foundation for satellite network infrastructure. The "Services" segment is equally robust, with Mobile Satellite Services (MSS) and Earth Observation Services playing pivotal roles in enabling diverse applications. The "Platform" segment highlights the versatility of satellite communication, catering to Portable, Land, Maritime, and Airborne deployments. This broad applicability is further underscored by the diverse "End-user Verticals," which span Maritime, Defense and Government, Enterprises, Media and Entertainment, and other emerging sectors. Leading companies like Jio Satellite Communications Ltd, OneWeb, Nelco, Avantel Ltd, Thales Group, Tata Communications, and Bharti Airtel Limited are actively investing and innovating within this space, fostering a competitive environment that will accelerate market development and technological advancements in India.

India Satellite Communication Market Company Market Share

This in-depth report provides a panoramic view of the India Satellite Communication Market, covering historical trends, current dynamics, and future projections. From groundbreaking product developments to critical industry trends, this analysis delves into the intricate landscape of satellite communication in India. We examine market concentration, innovation drivers, regulatory frameworks, and the impact of emerging technologies. The report offers actionable insights for stakeholders, investors, and industry participants looking to navigate this rapidly evolving sector. The study encompasses the period from 2019 to 2033, with a base year of 2025, offering a detailed forecast for the period 2025–2033, and an analysis of the historical period from 2019–2024.

India Satellite Communication Market Market Concentration & Innovation

The India Satellite Communication Market is characterized by a moderate level of market concentration, with a blend of established global players and burgeoning domestic companies vying for market share. Innovation is a key differentiator, driven by the increasing demand for high-speed internet, advanced connectivity solutions, and sophisticated earth observation capabilities. Regulatory frameworks, while evolving, play a significant role in shaping market entry and operational strategies. Product substitutes, such as terrestrial fiber optic networks and 5G mobile technologies, present a competitive challenge, though satellite communication offers unique advantages in remote areas and for specialized applications. End-user trends are increasingly favoring integrated solutions and on-demand services. Mergers and Acquisitions (M&A) activities, while not as prevalent as in some mature markets, are expected to gain traction as companies seek to expand their service portfolios and geographical reach. For instance, strategic partnerships and technology sharing agreements are becoming more common. The market is poised for growth, with key players investing heavily in research and development to stay ahead of the curve.

India Satellite Communication Market Industry Trends & Insights

The Indian satellite communication market is experiencing robust growth, propelled by a confluence of factors including government initiatives like Digital India and increasing demand from underserved regions. The projected Compound Annual Growth Rate (CAGR) for the forecast period is robust, indicating a dynamic expansion of the market. Technological disruptions are at the forefront, with the advent of Low Earth Orbit (LEO) satellite constellations promising to revolutionize broadband accessibility and latency. The adoption of Ka-band and Ku-band frequencies is accelerating, enabling higher data throughput and more efficient spectrum utilization. Consumer preferences are shifting towards seamless connectivity, reliable internet services for remote work and education, and advanced satellite-based applications for various industries. Competitive dynamics are intensifying, with both traditional geostationary (GEO) satellite operators and emerging LEO players introducing innovative service models and pricing strategies. The penetration of satellite broadband in rural and remote areas, traditionally lacking terrestrial infrastructure, is a significant growth driver. Furthermore, the increasing reliance on satellite imagery for disaster management, agriculture, and urban planning is fueling demand for Earth Observation Services. The government's supportive policies, including the National Space Policy, are fostering private sector participation and investment, creating a fertile ground for market expansion. The evolving landscape of satellite technology, from miniaturization of satellites to enhanced ground segment capabilities, is further shaping industry trends and offering new avenues for growth. The increasing affordability and accessibility of satellite services are also broadening the market reach and attracting a wider array of end-users.

Dominant Markets & Segments in India Satellite Communication Market

The satellite communication market in India is experiencing significant expansion across various segments, with the Ground Equipment segment, particularly Very Small Aperture Terminals (VSAT), holding a dominant position. This dominance is driven by their widespread deployment for enterprise connectivity, banking networks, and remote site communications. The continuous innovation in VSAT technology, enabling higher bandwidth and greater reliability, further solidifies its leadership.

- Ground Equipment:

- VSAT: The cornerstone of enterprise and remote connectivity, driven by increasing demand for reliable internet access in areas with limited terrestrial infrastructure.

- Gateway: Essential for establishing satellite network connectivity, with significant investment in expanding gateway infrastructure to support growing user bases.

- Network Operation Center (NOC): Crucial for managing and monitoring satellite networks, with increasing complexity necessitating advanced NOC solutions.

- Satellite News Gathering (SNG): Vital for media and entertainment, especially for live broadcasting from remote locations, experiencing steady demand.

The Services segment is witnessing rapid growth, with Mobile Satellite Services (MSS) and Earth Observation Services emerging as key growth engines. MSS is vital for critical communications in the defense and maritime sectors, while Earth Observation Services are gaining traction due to increasing demand for geospatial data in agriculture, urban planning, and environmental monitoring.

- Services:

- Mobile Satellite Services (MSS): Essential for critical communications, navigation, and tracking, particularly in the defense, maritime, and aviation sectors.

- Earth Observation Services: Driven by the increasing need for high-resolution imagery and geospatial analytics for agriculture, disaster management, infrastructure development, and climate change monitoring.

The Platform segmentation sees Land-based applications dominating due to widespread enterprise and consumer connectivity needs. However, the Maritime and Airborne platforms are experiencing substantial growth, driven by the increasing adoption of satellite communication for vessel tracking, crew welfare, and in-flight connectivity.

- Platform:

- Land: The largest segment, encompassing terrestrial-based applications for businesses, remote communities, and government agencies.

- Maritime: Rapidly growing with the demand for connectivity on ships for operational efficiency, crew welfare, and IoT applications.

- Airborne: Increasing adoption for in-flight connectivity, benefiting both passengers and airlines, as well as for government and defense applications.

- Portable: Growing demand for mobile and flexible communication solutions for field operations and emergency response.

In terms of End-user Vertical, the Defense and Government sector remains a significant consumer of satellite communication services, relying on them for secure and reliable communication, surveillance, and intelligence gathering. Enterprises are also major contributors, utilizing satellite solutions for their remote operations, business continuity, and specialized connectivity needs. The Media and Entertainment sector, while a consistent user, is seeing evolving demands for higher bandwidth for live streaming and content delivery.

- End-user Vertical:

- Defense and Government: Critical reliance for national security, communication infrastructure, disaster management, and intelligence.

- Enterprises: Extensive use for remote site connectivity, IoT applications, banking, retail, and broadband access in unserved areas.

- Media and Entertainment: Essential for broadcasting, live event coverage, and content delivery.

- Other End-user Verticals: Including agriculture, education, healthcare, and disaster relief, all leveraging satellite technology for enhanced reach and efficiency.

India Satellite Communication Market Product Developments

The Indian satellite communication market is witnessing a wave of innovative product developments aimed at enhancing service delivery and expanding market reach. This includes the development of more efficient and cost-effective ground equipment like advanced VSAT terminals with higher throughput capabilities. The integration of artificial intelligence (AI) and machine learning (ML) into network management systems is improving operational efficiency and predictive maintenance. Furthermore, the emergence of smaller, more agile satellites is enabling specialized services and faster deployment cycles. The competitive advantage lies in offering integrated solutions that combine connectivity with value-added services like data analytics and IoT enablement, catering to the diverse needs of various end-user verticals.

Report Scope & Segmentation Analysis

This report meticulously analyzes the India Satellite Communication Market across its key segmentation dimensions. The Type segmentation delves into Ground Equipment (Gateway, Very Small Aperture Terminal (VSAT), Network Operation Center (NOC), Satellite News Gathering (SNG)) and Services (Mobile Satellite Services (MSS), Earth Observation Services). The Platform segmentation covers Portable, Land, Maritime, and Airborne applications, while the End-user Vertical segmentation includes Maritime, Defense and Government, Enterprises, Media and Entertainment, and Other End-user Verticals. Each segment is analyzed for its current market size, projected growth, and competitive landscape, offering a granular understanding of market dynamics.

Key Drivers of India Satellite Communication Market Growth

Several key drivers are propelling the growth of the India Satellite Communication Market. Government initiatives focused on digital inclusion and infrastructure development, such as the BharatNet project, are creating significant demand for broadband connectivity, especially in rural and remote areas. The increasing adoption of IoT devices across various industries necessitates reliable and ubiquitous connectivity solutions, which satellite communication is well-positioned to provide. The growing need for resilient communication infrastructure for defense and national security, coupled with advancements in satellite technology like LEO constellations, are also significant growth catalysts. Furthermore, the expanding media and entertainment industry's demand for high-bandwidth connectivity for broadcasting and live events contributes to market expansion.

Challenges in the India Satellite Communication Market Sector

Despite its promising growth trajectory, the India Satellite Communication Market faces several challenges. Regulatory hurdles and spectrum allocation policies can sometimes impede market entry and operational efficiency. High upfront investment costs for satellite infrastructure and ground equipment can be a barrier, particularly for smaller players. Intense competition from terrestrial broadband providers, including fiber optics and 5G networks, poses a continuous threat, especially in urban and semi-urban areas. Supply chain disruptions and geopolitical uncertainties can impact the availability of critical components and the timely execution of projects. Furthermore, ensuring consistent service quality and addressing latency concerns for certain applications remain ongoing challenges.

Emerging Opportunities in India Satellite Communication Market

The India Satellite Communication Market presents a wealth of emerging opportunities. The growing demand for high-speed broadband in underserved rural and remote regions offers a vast untapped market. The proliferation of IoT devices in agriculture, smart cities, and industrial automation presents significant potential for satellite-based connectivity solutions. The increasing focus on space-based intelligence, surveillance, and reconnaissance (ISR) for defense and government applications will drive demand for advanced satellite services. The burgeoning space-tech ecosystem in India, with increasing private sector participation, is fostering innovation and creating opportunities for new business models. The development of integrated satellite-terrestrial networks and the adoption of cloud-based satellite services are also key areas for future growth.

Leading Players in the India Satellite Communication Market Market

- Jio Satellite Communications Ltd

- OneWeb

- Nelco

- Avantel Lt

- Thales Group

- Tata Communications

- Bharti Airtel Limited

- Precision Electronics Limited (PEL)

- Orbcomm Inc

- ViaSat Inc

- Hughes Communications India Ltd

Key Developments in India Satellite Communication Market Industry

- April 2024: SIA-India and ABRASAT formalized a partnership via a Memorandum of Understanding (MoU) to bolster cooperation and drive advancements in the space industries of both India and Brazil.

- April 2024: Tata Advanced Systems Ltd, in partnership with Satellogic, successfully launched India's inaugural private sector-designed sub-meter resolution earth observation satellite, TSAT-1A, from the Kennedy Space Centre in Florida, utilizing SpaceX's Falcon 9 rocket.

Strategic Outlook for India Satellite Communication Market Market

The strategic outlook for the India Satellite Communication Market is exceptionally positive, driven by strong government support, rapid technological advancements, and increasing demand across diverse sectors. The expansion of LEO constellations is set to democratize access to high-speed internet, bridging the digital divide. Continued investment in robust ground infrastructure, coupled with the development of integrated satellite-terrestrial solutions, will enhance service reliability and performance. The focus on niche applications such as IoT, precision agriculture, and advanced defense capabilities will create new revenue streams. Strategic collaborations and M&A activities are anticipated to consolidate the market and foster innovation. The increasing commoditization of satellite capacity, alongside the development of value-added services, will further fuel market penetration and adoption.

India Satellite Communication Market Segmentation

-

1. Type

-

1.1. Ground Equipment

- 1.1.1. Gateway

- 1.1.2. Very Small Aperture Terminal (VSAT)

- 1.1.3. Network Operation Center (NOC)

- 1.1.4. Satellite News Gathering (SNG)

-

1.2. Services

- 1.2.1. Mobile Satellite Services (MSS)

- 1.2.2. Earth Observation Services

-

1.1. Ground Equipment

-

2. Platform

- 2.1. Portable

- 2.2. Land

- 2.3. Maritime

- 2.4. Airborne

-

3. End-user Vertical

- 3.1. Maritime

- 3.2. Defense and Government

- 3.3. Enterprises

- 3.4. Media and Entertainment

- 3.5. Other End-user Verticals

India Satellite Communication Market Segmentation By Geography

- 1. India

India Satellite Communication Market Regional Market Share

Geographic Coverage of India Satellite Communication Market

India Satellite Communication Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 17.27% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Growth of Internet of Things (IoT) and Autonomous Systems; Increasing Demand for Military and Defense Satellite Communication Solutions

- 3.3. Market Restrains

- 3.3.1. Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data

- 3.4. Market Trends

- 3.4.1. Growth of Internet of Things (IoT) and Autonomous Systems

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Satellite Communication Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Ground Equipment

- 5.1.1.1. Gateway

- 5.1.1.2. Very Small Aperture Terminal (VSAT)

- 5.1.1.3. Network Operation Center (NOC)

- 5.1.1.4. Satellite News Gathering (SNG)

- 5.1.2. Services

- 5.1.2.1. Mobile Satellite Services (MSS)

- 5.1.2.2. Earth Observation Services

- 5.1.1. Ground Equipment

- 5.2. Market Analysis, Insights and Forecast - by Platform

- 5.2.1. Portable

- 5.2.2. Land

- 5.2.3. Maritime

- 5.2.4. Airborne

- 5.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.3.1. Maritime

- 5.3.2. Defense and Government

- 5.3.3. Enterprises

- 5.3.4. Media and Entertainment

- 5.3.5. Other End-user Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Jio Satellite Communications Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 OneWeb

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Nelco

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Avantel Lt

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Thales Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Tata Communications

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bharti Airtel Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Precision Electronics Limited (PEL)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Orbcomm Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 ViaSat Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Hughes Communications India Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Jio Satellite Communications Ltd

List of Figures

- Figure 1: India Satellite Communication Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Satellite Communication Market Share (%) by Company 2025

List of Tables

- Table 1: India Satellite Communication Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: India Satellite Communication Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 3: India Satellite Communication Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 4: India Satellite Communication Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: India Satellite Communication Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: India Satellite Communication Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 7: India Satellite Communication Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 8: India Satellite Communication Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Satellite Communication Market?

The projected CAGR is approximately 17.27%.

2. Which companies are prominent players in the India Satellite Communication Market?

Key companies in the market include Jio Satellite Communications Ltd, OneWeb, Nelco, Avantel Lt, Thales Group, Tata Communications, Bharti Airtel Limited, Precision Electronics Limited (PEL), Orbcomm Inc, ViaSat Inc, Hughes Communications India Ltd.

3. What are the main segments of the India Satellite Communication Market?

The market segments include Type, Platform, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.62 Million as of 2022.

5. What are some drivers contributing to market growth?

The Growth of Internet of Things (IoT) and Autonomous Systems; Increasing Demand for Military and Defense Satellite Communication Solutions.

6. What are the notable trends driving market growth?

Growth of Internet of Things (IoT) and Autonomous Systems.

7. Are there any restraints impacting market growth?

Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data.

8. Can you provide examples of recent developments in the market?

April 2024 - SIA-India, the premier space association in India, and ABRASAT, a key player in Brazil's Satellite Communications sector, have formalized a partnership via a Memorandum of Understanding (MoU). The primary goal of this collaboration is to bolster cooperation and drive advancements in the space industries of both nations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Satellite Communication Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Satellite Communication Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Satellite Communication Market?

To stay informed about further developments, trends, and reports in the India Satellite Communication Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence