Key Insights

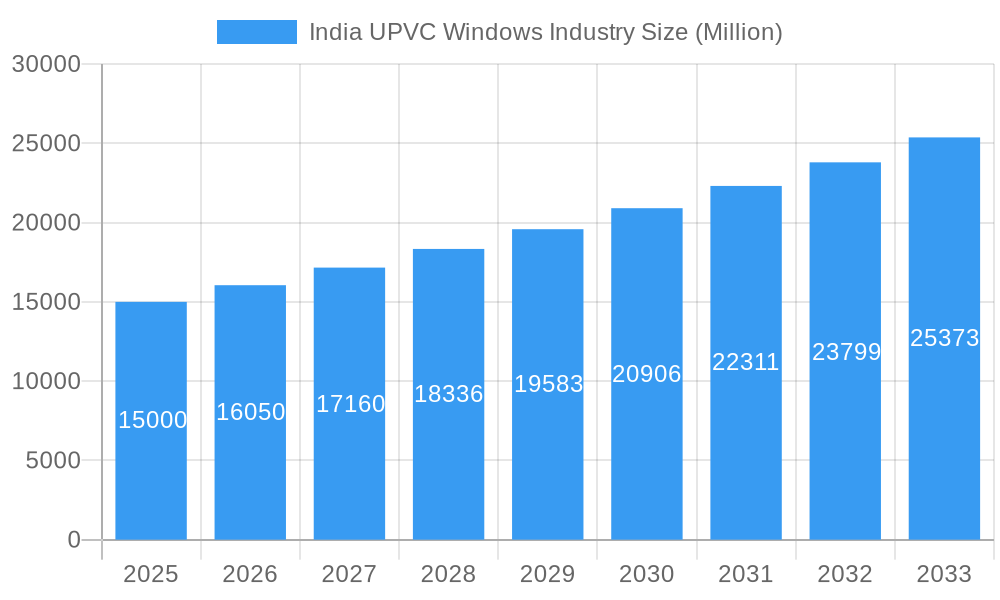

The India UPVC windows market, valued at approximately ₹15000 million (estimated) in 2025, exhibits robust growth potential, projected to expand at a CAGR exceeding 7% from 2025 to 2033. This expansion is driven by several key factors. Firstly, the burgeoning construction industry, particularly in residential and commercial sectors, fuels significant demand. Increased urbanization and rising disposable incomes are contributing to a preference for energy-efficient and aesthetically pleasing UPVC windows, surpassing traditional alternatives. Government initiatives promoting sustainable building practices further bolster market growth. Secondly, the increasing awareness among consumers regarding the benefits of UPVC windows – including superior insulation, durability, and low maintenance – drives adoption. The market is segmented by distribution channel (offline and online stores), product type (UPVC doors and windows), and end-user (residential, commercial, industrial, and construction). Online sales are experiencing a notable uptick, reflecting changing consumer preferences and the expanding reach of e-commerce platforms. Competitive pressures amongst established players like Koemmerling, Encraft, LG Hausys, Rehau, Fenesta, Dimex, ECUBE, Lingel India, NCL Wintech, Lesso, and Veka India further stimulate innovation and market dynamism. Regional variations exist, with North and South India exhibiting comparatively stronger growth due to higher construction activity.

India UPVC Windows Industry Market Size (In Billion)

While the market enjoys favorable trends, challenges remain. High initial investment costs associated with UPVC windows can present a barrier for price-sensitive consumers, particularly in rural areas. Fluctuations in raw material prices, primarily PVC resin, can impact profitability. Furthermore, overcoming existing consumer perceptions favoring traditional materials necessitates targeted marketing campaigns that highlight the long-term cost-effectiveness and advantages of UPVC windows. However, the overall market outlook is optimistic, with considerable scope for growth in the coming years, especially with ongoing infrastructural development and a growing preference for sustainable building materials across various segments of the Indian market.

India UPVC Windows Industry Company Market Share

India UPVC Windows Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the India UPVC windows industry, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. The report covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. It analyzes market trends, competitive dynamics, and growth opportunities across various segments, including product type, distribution channels, and end-user industries. The report also highlights key players like Koemmerling, Encraft, LG Hausys, Rehau, Fenesta, Dimex, ECUBE, Lingel India, NCL Wintech, Lesso, and Veka India, examining their market share, strategies, and recent developments. Expected market size figures are presented in Millions (INR).

India UPVC Windows Industry Market Concentration & Innovation

The Indian UPVC windows market exhibits a moderately concentrated landscape, with a few major players holding significant market share. However, the presence of numerous smaller players fosters competition and innovation. Market share data for 2024 suggests that the top five players collectively hold approximately xx% of the market. Consolidation through mergers and acquisitions (M&A) is a recurring theme, with deals often driven by the need to expand distribution networks and enhance product portfolios. For example, the 2019 formation of NCL VEKA, a joint venture between NCL Group and VEKA AG, significantly impacted market dynamics. This JV, involving an investment of xx Million INR, resulted in the commissioning of India's largest UPVC profile extrusion plant, boosting domestic production capacity. While precise M&A deal values for the period are not publicly available, the industry is characterized by strategic partnerships and acquisitions, aimed at increasing market penetration.

- Market Concentration: Top 5 players hold approximately xx% market share (2024).

- Innovation Drivers: Growing demand for energy-efficient solutions, technological advancements in UPVC profile design, and increasing consumer awareness of sustainability are key drivers of innovation.

- Regulatory Frameworks: Government initiatives promoting sustainable building practices influence market growth, although specific regulations vary by state and region.

- Product Substitutes: Aluminum and wood windows remain prominent substitutes, though UPVC's cost-effectiveness and energy efficiency are gaining traction.

- End-User Trends: A shift towards larger window sizes and improved aesthetics is observed, particularly within residential construction.

- M&A Activities: Strategic partnerships and acquisitions are increasing, driving market consolidation and capacity expansion.

India UPVC Windows Industry Industry Trends & Insights

The Indian UPVC windows market has witnessed significant growth in recent years, driven primarily by rising construction activity, increasing urbanization, and a growing preference for energy-efficient building materials. The Compound Annual Growth Rate (CAGR) for the historical period (2019-2024) is estimated to be xx%, with the market size in 2024 reaching approximately xx Million INR. This growth is fueled by factors such as government initiatives promoting affordable housing, rapid infrastructure development, and rising disposable incomes. Technological advancements, such as the introduction of smart windows and improved energy-efficient profiles, are further propelling market expansion. Consumer preferences are shifting towards customized solutions, improved aesthetics, and enhanced security features. Competitive dynamics are intense, with established players focusing on expanding distribution networks and smaller players emphasizing niche market segments. Market penetration remains relatively low, presenting significant growth potential. The forecast period (2025-2033) is expected to witness a CAGR of xx%, indicating sustained market expansion.

Dominant Markets & Segments in India UPVC Windows Industry

The residential segment dominates the Indian UPVC windows market, driven by factors like rising housing demand and improved affordability. The commercial and industrial segments show steady growth, with ongoing infrastructure development and expansion of commercial real estate contributing to the demand. Offline stores remain the dominant distribution channel, although online sales are gradually increasing. Metropolitan cities in states like Maharashtra, Gujarat, Tamil Nadu, and Karnataka represent key regional markets due to higher construction activity and consumer spending.

- Key Drivers for Residential Segment Dominance:

- Rising disposable incomes

- Increasing urbanization

- Government initiatives promoting affordable housing

- Key Drivers for Offline Store Dominance:

- Established distribution networks

- Customer preference for physical inspection and consultation

- Key Drivers for Metropolitan Region Dominance:

- Higher construction activity

- Increased consumer spending

India UPVC Windows Industry Product Developments

The industry is witnessing continuous product innovation, focusing on enhanced energy efficiency, improved sound insulation, and enhanced security features. New product applications are emerging in areas such as smart homes and integrated building systems. Technological advancements in UPVC profile design and manufacturing processes lead to enhanced durability, aesthetics, and cost-effectiveness. This focus on product differentiation enables companies to cater to diverse consumer preferences and compete effectively in a dynamic market.

Report Scope & Segmentation Analysis

This report segments the Indian UPVC windows market based on distribution channel (offline stores, online stores), product type (UPVC windows, UPVC doors), and end-user (residential, commercial, industrial and construction, other end-users). Growth projections vary across segments, with the residential segment projected for the fastest growth. Market size estimates are provided for each segment, along with analysis of competitive dynamics within each segment.

- Distribution Channel: Offline stores hold a larger share but online sales are expected to grow.

- Product Type: UPVC windows constitute the larger share, followed by UPVC doors.

- End-User: The residential segment currently holds the largest market share.

Key Drivers of India UPVC Windows Industry Growth

Several factors contribute to the growth of the Indian UPVC windows industry. These include rising construction activity, driven by urbanization and infrastructure development; increasing awareness of energy-efficient building materials, leading to higher adoption rates; government policies and initiatives promoting affordable housing and sustainable building practices; and technological advancements leading to better product features and cost reduction.

Challenges in the India UPVC Windows Industry Sector

The industry faces challenges, including intense competition, fluctuations in raw material prices, potential supply chain disruptions, and the need for skilled labor. These factors can impact profitability and overall market growth. Furthermore, variations in local building codes and regulations across different regions can create complexities for manufacturers.

Emerging Opportunities in India UPVC Windows Industry

Opportunities lie in expanding into Tier 2 and Tier 3 cities, leveraging the growing demand for energy-efficient and sustainable building materials in these regions. The integration of smart technologies into UPVC windows and doors presents further growth potential. A focus on customization and improved aesthetics can cater to evolving consumer preferences.

Leading Players in the India UPVC Windows Industry Market

- Koemmerling

- Encraft

- LG Hausys

- Rehau

- Fenesta

- Dimex

- ECUBE

- Lingel India

- NCL Wintech

- Lesso

- Veka India

Key Developments in India UPVC Windows Industry Industry

- February 2019: NCL VEKA, a 50:50 JV between NCL Group and VEKA AG, commissioned India's largest UPVC profile extrusion plant in Hyderabad, significantly increasing domestic production capacity.

- January 2019: REHAU planned to open 56 retail centers in India by 2020, expanding its distribution network.

Strategic Outlook for India UPVC Windows Industry Market

The Indian UPVC windows market presents a positive outlook, driven by sustained growth in construction activity, rising consumer preference for energy-efficient and aesthetically pleasing products, and continued technological innovation. The market is poised for significant expansion in the coming years, presenting lucrative opportunities for both established players and new entrants. Strategic investments in research and development, expansion of distribution networks, and focus on product differentiation will be crucial for success.

India UPVC Windows Industry Segmentation

-

1. Product Type

- 1.1. UPVC Doors

- 1.2. UPVC Windows

-

2. End User

- 2.1. Residential

- 2.2. Commercial

- 2.3. Industrial and Construction

- 2.4. Other End Users

-

3. Distribution Channel

- 3.1. Offline Stores

- 3.2. Online Stores

India UPVC Windows Industry Segmentation By Geography

- 1. India

India UPVC Windows Industry Regional Market Share

Geographic Coverage of India UPVC Windows Industry

India UPVC Windows Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Health and Wellness Trends are Driving the Market; Rising Disposable Income is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Market Saturation is Handering the Growth; Seasonal Nature of Sales is Challenging the Market

- 3.4. Market Trends

- 3.4.1. The Industrial and Construction Segment in India is Witnessing a Surge in the Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India UPVC Windows Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. UPVC Doors

- 5.1.2. UPVC Windows

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Industrial and Construction

- 5.2.4. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Offline Stores

- 5.3.2. Online Stores

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Koemmerling

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Encraft

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 LG Hausys

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Rehau

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Fenesta

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Dimex

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ECUBE

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Lingel India

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 NCL Wintech

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Lesso

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Veka India

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Koemmerling

List of Figures

- Figure 1: India UPVC Windows Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: India UPVC Windows Industry Share (%) by Company 2025

List of Tables

- Table 1: India UPVC Windows Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: India UPVC Windows Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 3: India UPVC Windows Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 4: India UPVC Windows Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 5: India UPVC Windows Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 6: India UPVC Windows Industry Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 7: India UPVC Windows Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 8: India UPVC Windows Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: India UPVC Windows Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 10: India UPVC Windows Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 11: India UPVC Windows Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 12: India UPVC Windows Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 13: India UPVC Windows Industry Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 14: India UPVC Windows Industry Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 15: India UPVC Windows Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: India UPVC Windows Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India UPVC Windows Industry?

The projected CAGR is approximately 3.3%.

2. Which companies are prominent players in the India UPVC Windows Industry?

Key companies in the market include Koemmerling, Encraft, LG Hausys, Rehau, Fenesta, Dimex, ECUBE, Lingel India, NCL Wintech, Lesso, Veka India.

3. What are the main segments of the India UPVC Windows Industry?

The market segments include Product Type, End User , Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Health and Wellness Trends are Driving the Market; Rising Disposable Income is Driving the Market.

6. What are the notable trends driving market growth?

The Industrial and Construction Segment in India is Witnessing a Surge in the Market Share.

7. Are there any restraints impacting market growth?

Market Saturation is Handering the Growth; Seasonal Nature of Sales is Challenging the Market.

8. Can you provide examples of recent developments in the market?

February 2019 - NCL VEKA, a 50:50 JV between city-based NCL Group and the German UPVC profile producer VEKA AG, commissioned the country's largest UPVC profile extrusion plant in Hyderabad.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India UPVC Windows Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India UPVC Windows Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India UPVC Windows Industry?

To stay informed about further developments, trends, and reports in the India UPVC Windows Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence