Key Insights

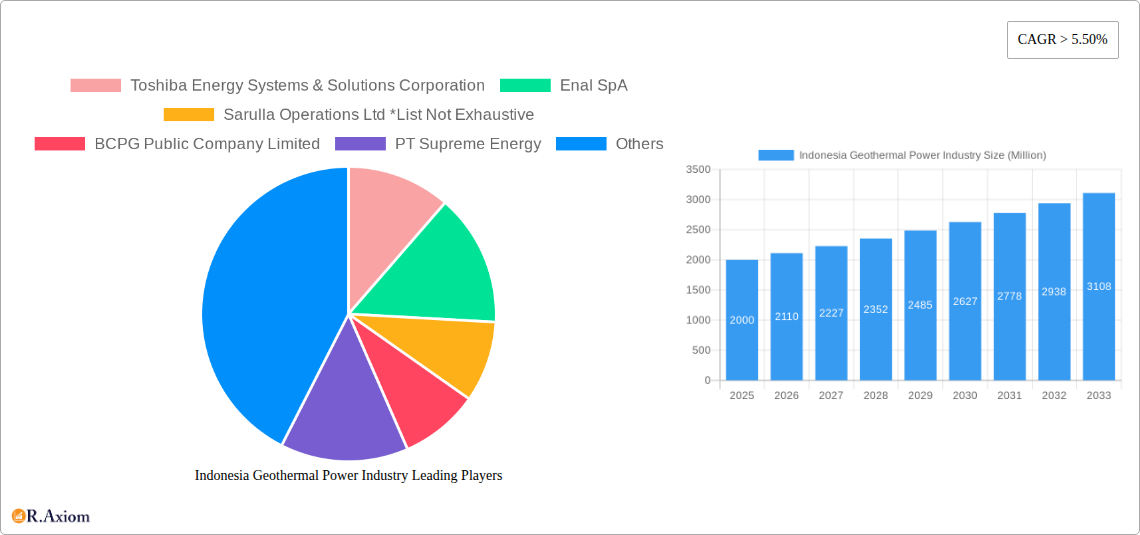

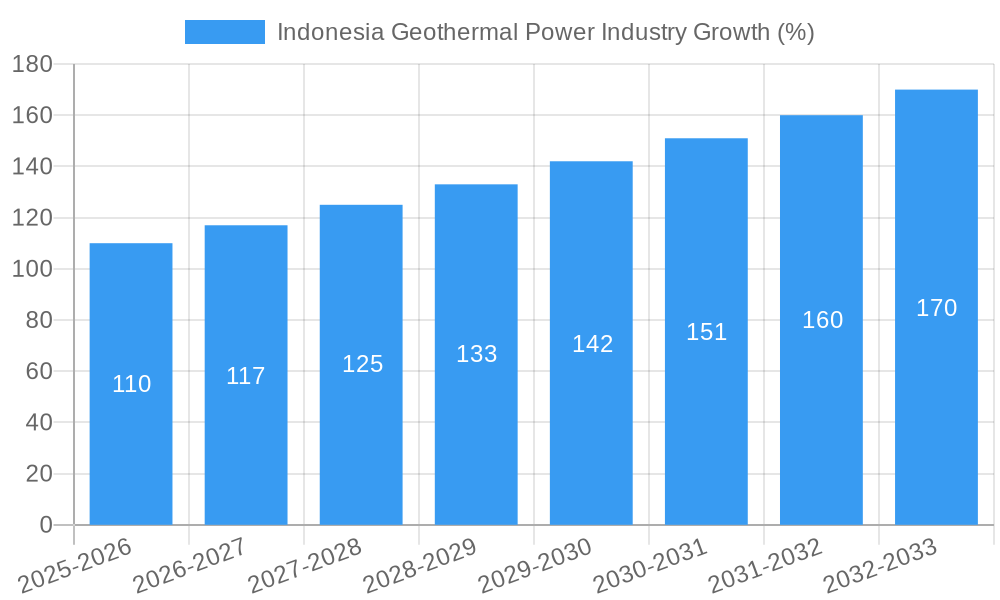

The Indonesian geothermal power industry presents a compelling investment opportunity, fueled by strong government support for renewable energy and the country's abundant geothermal resources. With a market size exceeding $XX million in 2025 and a compound annual growth rate (CAGR) exceeding 5.5%, the sector is poised for significant expansion through 2033. Key drivers include Indonesia's commitment to reducing carbon emissions, increasing energy demand, and the relative maturity of geothermal technology in the region. The sector is segmented by type (solar photovoltaic (PV) and solar thermal, though the provided data focuses primarily on geothermal) and application (power generation and heating), with power generation currently dominating the market share. While precise figures for individual segments are unavailable, it's reasonable to infer that power generation accounts for a significantly larger portion due to the scale of Indonesia's electricity needs. Challenges remain, however. These include the high initial capital investment required for geothermal projects, the logistical complexities associated with developing remote geothermal fields, and potential regulatory hurdles. Despite these restraints, the long-term outlook for the Indonesian geothermal power industry remains positive, particularly given the global push toward sustainable energy solutions and the continued exploration and development of new geothermal resources within Indonesia. Companies like Toshiba Energy Systems & Solutions Corporation, Enal SpA, and BCPG Public Company Limited are actively participating in this growth. The forecast period from 2025 to 2033 indicates a consistent expansion, driven by continuous investment and technological advancements. This growth trajectory is expected to significantly contribute to Indonesia's energy independence and its targets for renewable energy adoption.

The strategic location of Indonesia within the "Ring of Fire," a volcanically active zone, provides a consistent and reliable source of geothermal energy. This natural advantage, coupled with supportive government policies, incentivizes investment in exploration, development, and infrastructure projects. While challenges exist in terms of project financing, environmental impact assessments, and grid integration, the substantial long-term benefits of geothermal energy are evident. The continuous expansion of the geothermal power sector indicates Indonesia’s strong commitment to sustainable and environmentally conscious energy solutions. This creates opportunities for both domestic and international players seeking to participate in the development and growth of this rapidly evolving sector.

Indonesia Geothermal Power Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Indonesian geothermal power industry, offering valuable insights for stakeholders, investors, and industry professionals. The report covers the period from 2019 to 2033, with a focus on the base year 2025 and a forecast period of 2025-2033. It examines market trends, technological advancements, competitive dynamics, and future growth potential, providing crucial data points and actionable strategies for navigating this dynamic sector. The report's detailed segmentation covers various types (Solar Photovoltaic (PV), Solar Thermal) and applications (Power Generation, Heating) within the geothermal power industry.

Indonesia Geothermal Power Industry Market Concentration & Innovation

This section analyzes the competitive landscape of the Indonesian geothermal power industry, examining market concentration, innovation drivers, regulatory frameworks, and M&A activities. The report leverages detailed data from the historical period (2019-2024) and projected data to provide a complete picture. Key aspects covered include:

- Market Concentration: The report quantifies market share held by key players like Toshiba Energy Systems & Solutions Corporation, Enal SpA, Sarulla Operations Ltd, BCPG Public Company Limited, and PT Supreme Energy, assessing the degree of market concentration and identifying any potential monopolies or oligopolies. Market share data for 2025 is estimated at xx%.

- Innovation Drivers: The report identifies key technological and regulatory drivers influencing innovation, including government incentives, R&D investments, and advancements in geothermal technology.

- Regulatory Frameworks: A detailed analysis of Indonesian regulations impacting the geothermal power sector, including licensing, permitting, and environmental regulations, is provided. The impact of these regulations on market growth and investment is assessed.

- Product Substitutes: The report evaluates potential substitutes for geothermal energy, such as solar and wind power, assessing their impact on market competition and future growth.

- End-User Trends: Analysis of the evolving energy demands of Indonesian industries and consumers, and their impact on geothermal power adoption is provided.

- M&A Activities: The report documents recent mergers and acquisitions (M&A) in the industry, analyzing deal values (estimated at xx Million USD in 2024) and their impact on market consolidation. Specific examples of M&A transactions and their implications are detailed.

Indonesia Geothermal Power Industry Industry Trends & Insights

This section delves into the overarching trends shaping the Indonesian geothermal power industry, including market growth drivers, technological disruptions, evolving consumer preferences, and the competitive dynamics at play. The report uses a combination of qualitative and quantitative data analysis to provide a nuanced perspective.

- Market Growth Drivers: The report quantifies the Compound Annual Growth Rate (CAGR) for the forecast period (2025-2033), projecting a CAGR of xx%, driven by factors such as increasing energy demand, government support for renewable energy, and declining costs of geothermal technology. Market penetration rates for geothermal energy in Indonesia are also analyzed.

- Technological Disruptions: The impact of emerging technologies, such as enhanced geothermal systems (EGS) and improved drilling techniques, on the industry is assessed, considering their potential to unlock new geothermal resources.

- Consumer Preferences: The report examines the shifting consumer preferences toward sustainable energy sources and their implications for geothermal power adoption.

- Competitive Dynamics: A comprehensive analysis of the competitive landscape, focusing on strategies employed by leading companies, is presented.

Dominant Markets & Segments in Indonesia Geothermal Power Industry

This section identifies the leading regions, countries, and segments within the Indonesian geothermal power market. The analysis focuses on the different types (Solar Photovoltaic (PV), Solar Thermal) and applications (Power Generation, Heating) of geothermal energy.

Key Drivers:

- Economic Policies: Government incentives, subsidies, and tax benefits supporting geothermal energy development.

- Infrastructure: The availability and development of transmission and distribution infrastructure crucial for geothermal power integration.

Dominance Analysis: A detailed analysis of the factors driving the dominance of specific regions, countries, or segments is provided, including market size projections for each segment and the reasons for their leading positions in the market. The report projects that the Power Generation segment will account for xx Million USD by 2033.

Indonesia Geothermal Power Industry Product Developments

This section summarizes recent innovations in geothermal power products, highlighting technological trends and their market fit. The focus is on advancements in drilling technology, energy conversion efficiency, and the integration of geothermal energy into broader energy systems. The report identifies key product innovations and their competitive advantages. For example, improvements in efficiency lead to a predicted reduction in the cost per unit of geothermal energy produced by xx% by 2033.

Report Scope & Segmentation Analysis

This report segments the Indonesian geothermal power market by type (Solar Photovoltaic (PV), Solar Thermal) and application (Power Generation, Heating). Each segment's growth projections, market size (in Millions USD), and competitive dynamics are detailed. For example, the Solar Thermal segment is projected to reach xx Million USD in 2033, driven by advancements in solar thermal technology and increasing demand for industrial heating.

Key Drivers of Indonesia Geothermal Power Industry Growth

Several key factors are driving the growth of the Indonesian geothermal power industry:

- Technological Advancements: Improvements in drilling technology, energy conversion efficiency, and resource exploration are reducing costs and expanding viable geothermal resources.

- Economic Incentives: Government policies promoting renewable energy adoption and providing financial incentives for geothermal projects are stimulating investment.

- Regulatory Support: A supportive regulatory framework streamlining the permitting and licensing process fosters industry development.

Challenges in the Indonesia Geothermal Power Industry Sector

The Indonesian geothermal power industry faces several challenges:

- High Initial Investment Costs: The substantial upfront investment required for geothermal projects can deter some potential investors.

- Geological Risks: The unpredictable nature of geothermal resources and potential geological risks can affect project feasibility.

- Environmental Concerns: Concerns about potential environmental impacts, such as greenhouse gas emissions and land use changes, need careful management.

Emerging Opportunities in Indonesia Geothermal Power Industry

Emerging opportunities exist for the Indonesian geothermal power industry:

- Exploration of Untapped Geothermal Resources: Significant untapped geothermal potential offers opportunities for future expansion.

- Integration with Other Renewable Energy Sources: Integrating geothermal energy with other renewable sources like solar and wind to create hybrid systems will broaden the industry's potential.

- Direct Use Applications: Expanding the use of geothermal energy for direct use applications, such as heating and cooling, will increase market diversification.

Leading Players in the Indonesia Geothermal Power Industry Market

- Toshiba Energy Systems & Solutions Corporation

- Enal SpA

- Sarulla Operations Ltd

- BCPG Public Company Limited

- PT Supreme Energy

Key Developments in Indonesia Geothermal Power Industry Industry

- December 2022: Mitsubishi Power secures a contract to build a 55-MW unit at the Lumut Balai Unit 2 geothermal power station for PT Pertamina Geothermal Energy (PGE). This development signifies continued investment in expanding Indonesia's geothermal capacity.

- January 2022: The Phase-1 Rantau Dedap Geothermal Power Generation project (91.2 MW) begins commercial operations, representing a significant milestone in large-scale geothermal energy deployment and highlighting the potential for substantial private investment in this sector.

Strategic Outlook for Indonesia Geothermal Power Industry Market

The Indonesian geothermal power industry is poised for significant growth, driven by increasing energy demand, government support for renewable energy, and technological advancements. The exploration of untapped geothermal resources and integration with other renewable energy sources will unlock new opportunities and foster a more sustainable energy future for Indonesia. The market is expected to continue its expansion trajectory, exceeding xx Million USD by 2033.

Indonesia Geothermal Power Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Indonesia Geothermal Power Industry Segmentation By Geography

- 1. Indonesia

Indonesia Geothermal Power Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expanding Airline Fleet4.; Economic Development

- 3.3. Market Restrains

- 3.3.1. Volatility in Oil Price

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Electricity is Likely to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Geothermal Power Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Toshiba Energy Systems & Solutions Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Enal SpA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sarulla Operations Ltd *List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BCPG Public Company Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PT Supreme Energy

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Toshiba Energy Systems & Solutions Corporation

List of Figures

- Figure 1: Indonesia Geothermal Power Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Indonesia Geothermal Power Industry Share (%) by Company 2024

List of Tables

- Table 1: Indonesia Geothermal Power Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Indonesia Geothermal Power Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Indonesia Geothermal Power Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Indonesia Geothermal Power Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Indonesia Geothermal Power Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Indonesia Geothermal Power Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Indonesia Geothermal Power Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Indonesia Geothermal Power Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Indonesia Geothermal Power Industry Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 10: Indonesia Geothermal Power Industry Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 11: Indonesia Geothermal Power Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 12: Indonesia Geothermal Power Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 13: Indonesia Geothermal Power Industry Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 14: Indonesia Geothermal Power Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Geothermal Power Industry?

The projected CAGR is approximately > 5.50%.

2. Which companies are prominent players in the Indonesia Geothermal Power Industry?

Key companies in the market include Toshiba Energy Systems & Solutions Corporation, Enal SpA, Sarulla Operations Ltd *List Not Exhaustive, BCPG Public Company Limited, PT Supreme Energy.

3. What are the main segments of the Indonesia Geothermal Power Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Expanding Airline Fleet4.; Economic Development.

6. What are the notable trends driving market growth?

Increasing Demand for Electricity is Likely to Drive the Market.

7. Are there any restraints impacting market growth?

Volatility in Oil Price.

8. Can you provide examples of recent developments in the market?

December 2022: In Indonesia, Mitsubishi Power is building its geothermal infrastructure. The business has obtained an order to make a 55-MW unit at the Lumut Balai Unit 2 geothermal power station from PT Pertamina Geothermal Energy (PGE), a subsidiary of the state-owned oil and gas group PT Pertamina.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Geothermal Power Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Geothermal Power Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Geothermal Power Industry?

To stay informed about further developments, trends, and reports in the Indonesia Geothermal Power Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence