Key Insights

The global industrial protective footwear market is poised for significant expansion, projected to reach $8.27 billion by 2025, with a robust compound annual growth rate (CAGR) of 8.4% from 2025 to 2033. This growth is propelled by the expanding construction, manufacturing, and oil & gas industries, where stringent safety requirements necessitate advanced protective footwear. Increasing regulatory mandates for hazard mitigation further underpin market demand. Innovations in materials and the integration of smart technologies are enhancing product efficacy and appeal. The market is segmented by material, including leather, rubber, and plastics, and by end-user industries such as construction, manufacturing, and mining. Leather dominates due to its durability, while lighter composite materials are gaining traction. North America and Europe currently lead market share, with the Asia-Pacific region expected to experience substantial growth driven by industrialization in India and China.

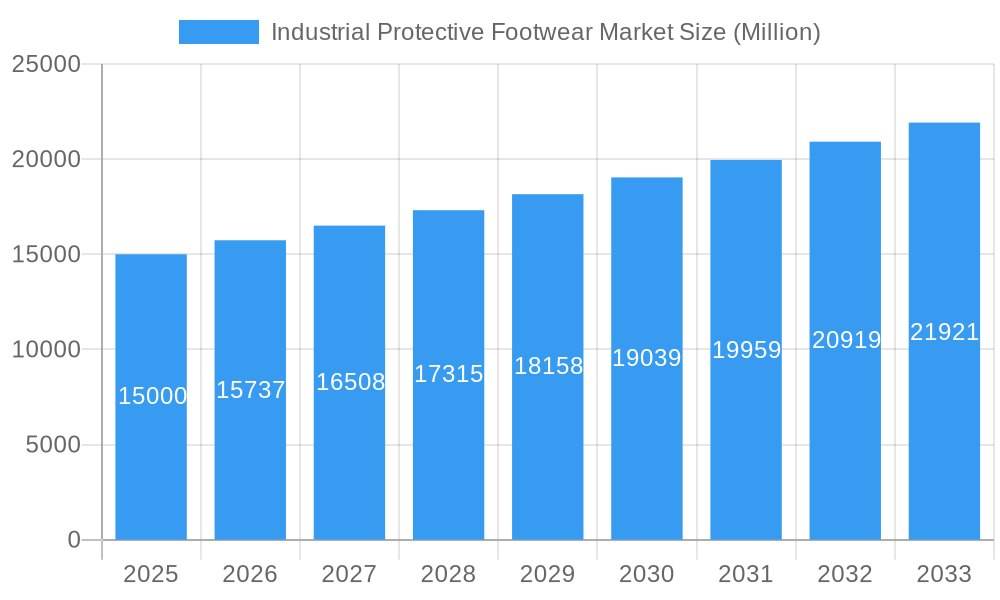

Industrial Protective Footwear Market Market Size (In Billion)

The competitive landscape features established global entities and specialized regional manufacturers. While leading brands leverage brand recognition and distribution, niche players focus on specialized offerings. Market growth is subject to fluctuations in raw material prices and economic conditions. Companies are mitigating these challenges through supply chain optimization, R&D investment in product enhancement, and a commitment to sustainable practices. Future market trends indicate a rise in demand for specialized, technologically integrated footwear, with an increasing emphasis on worker comfort and ergonomic design to boost safety and productivity.

Industrial Protective Footwear Market Company Market Share

Industrial Protective Footwear Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Industrial Protective Footwear market, covering market size, segmentation, growth drivers, challenges, and key players. The report utilizes data from the historical period (2019-2024), base year (2025), and estimated year (2025) to project the market's trajectory through the forecast period (2025-2033). The total market value is projected to reach xx Million by 2033.

Industrial Protective Footwear Market Concentration & Innovation

This section analyzes the competitive landscape, innovation trends, and regulatory factors impacting the industrial protective footwear market. The market exhibits a moderately concentrated structure, with key players such as Honeywell International Inc, VF Corporation, Bata Corporation, U-power Group Spa, Cofra SRL, and Uvex Group holding significant market share. However, numerous smaller regional players and niche specialists also contribute to the overall market dynamics. Market share data for 2024 indicates that the top five players collectively hold approximately xx% of the market.

Innovation Drivers:

- Technological advancements in materials science (e.g., lighter, more durable composites)

- Focus on enhanced ergonomics and comfort features

- Integration of smart technologies (e.g., sensors for monitoring worker safety)

- Growing demand for sustainable and eco-friendly materials

Regulatory Frameworks:

- Stringent safety regulations in various industries drive demand for compliant footwear.

- Variations in standards across different geographies create complexities for manufacturers.

- Increased emphasis on worker safety and well-being fuels market growth.

Product Substitutes:

- While limited, some substitutes exist, primarily focusing on cost reduction, but often compromising on safety features.

End-User Trends:

- Growing awareness of workplace safety among both employers and employees.

- Demand for specialized footwear for specific industries (e.g., steel-toe boots for construction).

- Increased preference for comfortable and lightweight footwear.

M&A Activities:

- The past five years have witnessed a moderate level of M&A activity. While precise deal values are not publicly available for all transactions, significant deals have involved consolidation of regional players and expansion into new markets. The total value of these M&A activities is estimated at xx Million between 2019 and 2024.

Industrial Protective Footwear Market Industry Trends & Insights

The global industrial protective footwear market is experiencing robust growth, driven by several factors. The compound annual growth rate (CAGR) from 2019 to 2024 was xx%, and a similar CAGR of xx% is projected for the forecast period (2025-2033). Market penetration is relatively high in developed economies, but significant growth potential remains in emerging markets due to increasing industrialization and rising awareness of workplace safety.

Technological advancements, including the use of advanced materials and smart technologies, are disrupting the market. Consumer preferences are shifting towards more comfortable, lightweight, and stylish footwear without compromising safety. Competitive dynamics are intense, with both established players and new entrants vying for market share through product innovation, strategic partnerships, and mergers and acquisitions.

Dominant Markets & Segments in Industrial Protective Footwear Market

The construction sector represents the largest end-user segment, driven by the high prevalence of occupational hazards and stringent safety regulations. The market in North America is currently dominant, fueled by robust industrial activity and a strong emphasis on worker safety. However, Asia-Pacific is projected to experience the fastest growth over the forecast period, driven by rapid industrialization and infrastructural development.

Key Drivers by Segment:

Material:

- Leather: Traditional choice, offering good durability and protection, but facing competition from lighter alternatives.

- Rubber: Cost-effective option for basic protection, suitable for specific applications.

- Plastic: Increasing popularity due to lightweight properties, durability, and resistance to chemicals.

- Other Materials: Innovative materials like composites and advanced polymers are gaining traction due to their superior properties.

End-User:

- Construction: High demand for steel-toe boots and other protective footwear.

- Manufacturing: Diverse needs depending on specific industry sub-sectors.

- Mining: Stringent safety standards mandate specialized, heavy-duty footwear.

- Oil and Gas: High demand for chemical-resistant and fire-retardant footwear.

- Chemical: Critical need for specialized footwear to protect against hazardous chemicals.

- Pharmaceutical: Strict hygiene standards and specialized protection needs.

- Transportation: Emphasis on durable and comfortable footwear for drivers and logistics personnel.

Dominance Analysis: North America currently leads in market share, followed by Europe. However, Asia-Pacific is experiencing the most significant growth, driven by increasing industrialization and a growing focus on worker safety. This rapid expansion is fueled by strong economic policies, substantial infrastructure development, and a rising middle class with increasing disposable income.

Industrial Protective Footwear Market Product Developments

Recent product innovations highlight a trend toward lighter, more comfortable, and technologically advanced footwear. Cat Footwear's Invader Mid Vent (September 2023) showcases this trend with its focus on recycled materials, comfort features, and robust protection. Xena Workwear's Valence SD shoe (October 2022) demonstrates the incorporation of sustainable materials and stylish design. Mallcom India's FREDDIE range (August 2022) exemplifies a focus on aesthetics combined with safety, showing a movement toward more appealing safety footwear. These developments demonstrate a successful adaptation to market demands for both functionality and aesthetics.

Report Scope & Segmentation Analysis

This report segments the market by material (Leather, Rubber, Plastic, Other Materials) and end-user (Construction, Manufacturing, Mining, Oil and Gas, Chemical, Pharmaceutical, Transportation, Other End Users). Each segment's growth projection, market size, and competitive dynamics are thoroughly analyzed. The report projects significant growth across all segments, with the fastest growth expected in the segments leveraging innovative materials and targeting the expanding industrial sectors in emerging economies.

Key Drivers of Industrial Protective Footwear Market Growth

Several factors drive the market's growth, including stringent safety regulations mandating protective footwear in various industries, rising awareness of workplace safety among employers and employees, technological advancements leading to more comfortable and durable footwear, and increasing industrialization and infrastructure development, particularly in emerging economies. Furthermore, the growing demand for sustainable and eco-friendly materials is also creating new growth opportunities.

Challenges in the Industrial Protective Footwear Market Sector

The market faces challenges such as fluctuating raw material prices impacting production costs, stringent regulatory compliance requirements across different regions, intense competition among established players and new entrants, and maintaining a balance between safety, comfort, and affordability. Supply chain disruptions, particularly prevalent in recent years, also pose a significant challenge. These factors can impact overall profitability and lead to price volatility.

Emerging Opportunities in Industrial Protective Footwear Market

Emerging opportunities include the increasing demand for specialized footwear catering to niche industries, the growing adoption of smart technologies for enhanced safety and monitoring, the rising popularity of sustainable and eco-friendly materials, and the expansion into new and untapped markets in developing economies. Furthermore, customization and personalization options are expected to become increasingly popular.

Leading Players in the Industrial Protective Footwear Market Market

- Honeywell International Inc

- VF Corporation

- Bata Corporation

- U-power Group Spa

- Cofra SRL

- Uvex Group

- Dunlop Protective Footwear

- Rock Fall (UK) LTD

- Wolverine World Wide Inc

- Hilson Footwear Pvt Ltd

Key Developments in Industrial Protective Footwear Market Industry

- September 2023: Cat Footwear launched the Invader Mid Vent, featuring recycled materials and advanced comfort technology. This launch showcases a trend towards sustainable and high-performance footwear.

- October 2022: Xena Workwear introduced the Valence SD shoe, a stylish and functional Chelsea boot demonstrating an emphasis on design and sustainable materials in safety footwear.

- August 2022: Mallcom India expanded its product line with the aesthetically designed FREDDIE safety shoes, highlighting the growing importance of appealing design in the safety footwear market.

Strategic Outlook for Industrial Protective Footwear Market Market

The industrial protective footwear market is poised for continued growth, driven by increasing industrial activity globally, a heightened focus on worker safety, and ongoing innovation in materials and technology. Companies focused on sustainability, advanced comfort features, and niche market specialization are best positioned for success. The market's future hinges on adapting to evolving regulations, addressing supply chain complexities, and continually innovating to meet the diverse needs of a growing and increasingly safety-conscious workforce.

Industrial Protective Footwear Market Segmentation

-

1. Material

- 1.1. Leather

- 1.2. Rubber

- 1.3. Plastic

- 1.4. Other Materials

-

2. End-User

- 2.1. Construction

- 2.2. Manufacturing

- 2.3. Mining

- 2.4. Oil and Gas

- 2.5. Chemical

- 2.6. Pharmaceutical

- 2.7. Transportation

- 2.8. Other End Users

Industrial Protective Footwear Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Italy

- 2.6. Spain

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Industrial Protective Footwear Market Regional Market Share

Geographic Coverage of Industrial Protective Footwear Market

Industrial Protective Footwear Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Stringent Government Regulations Regarding Worker's Safety; Importance Of Occupational Safety

- 3.3. Market Restrains

- 3.3.1. Impact of Counterfeit Products Coupled With Large Unorganized Labor Population Across Various Industries

- 3.4. Market Trends

- 3.4.1. Strict Government Regulations Regarding Workers' Safety

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Industrial Protective Footwear Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Leather

- 5.1.2. Rubber

- 5.1.3. Plastic

- 5.1.4. Other Materials

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Construction

- 5.2.2. Manufacturing

- 5.2.3. Mining

- 5.2.4. Oil and Gas

- 5.2.5. Chemical

- 5.2.6. Pharmaceutical

- 5.2.7. Transportation

- 5.2.8. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. North America Industrial Protective Footwear Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material

- 6.1.1. Leather

- 6.1.2. Rubber

- 6.1.3. Plastic

- 6.1.4. Other Materials

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. Construction

- 6.2.2. Manufacturing

- 6.2.3. Mining

- 6.2.4. Oil and Gas

- 6.2.5. Chemical

- 6.2.6. Pharmaceutical

- 6.2.7. Transportation

- 6.2.8. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Material

- 7. Europe Industrial Protective Footwear Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material

- 7.1.1. Leather

- 7.1.2. Rubber

- 7.1.3. Plastic

- 7.1.4. Other Materials

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. Construction

- 7.2.2. Manufacturing

- 7.2.3. Mining

- 7.2.4. Oil and Gas

- 7.2.5. Chemical

- 7.2.6. Pharmaceutical

- 7.2.7. Transportation

- 7.2.8. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Material

- 8. Asia Pacific Industrial Protective Footwear Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material

- 8.1.1. Leather

- 8.1.2. Rubber

- 8.1.3. Plastic

- 8.1.4. Other Materials

- 8.2. Market Analysis, Insights and Forecast - by End-User

- 8.2.1. Construction

- 8.2.2. Manufacturing

- 8.2.3. Mining

- 8.2.4. Oil and Gas

- 8.2.5. Chemical

- 8.2.6. Pharmaceutical

- 8.2.7. Transportation

- 8.2.8. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Material

- 9. South America Industrial Protective Footwear Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material

- 9.1.1. Leather

- 9.1.2. Rubber

- 9.1.3. Plastic

- 9.1.4. Other Materials

- 9.2. Market Analysis, Insights and Forecast - by End-User

- 9.2.1. Construction

- 9.2.2. Manufacturing

- 9.2.3. Mining

- 9.2.4. Oil and Gas

- 9.2.5. Chemical

- 9.2.6. Pharmaceutical

- 9.2.7. Transportation

- 9.2.8. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Material

- 10. Middle East and Africa Industrial Protective Footwear Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material

- 10.1.1. Leather

- 10.1.2. Rubber

- 10.1.3. Plastic

- 10.1.4. Other Materials

- 10.2. Market Analysis, Insights and Forecast - by End-User

- 10.2.1. Construction

- 10.2.2. Manufacturing

- 10.2.3. Mining

- 10.2.4. Oil and Gas

- 10.2.5. Chemical

- 10.2.6. Pharmaceutical

- 10.2.7. Transportation

- 10.2.8. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Material

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Honeywell International Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 VF Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bata Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 U-power Group Spa

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Cofra SRL

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Uvex Group*List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Dunlop Protective Footwear

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Rock Fall (UK) LTD

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Wolverine World Wide Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Hilson Footwear Pvt Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Industrial Protective Footwear Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Industrial Protective Footwear Market Revenue (billion), by Material 2025 & 2033

- Figure 3: North America Industrial Protective Footwear Market Revenue Share (%), by Material 2025 & 2033

- Figure 4: North America Industrial Protective Footwear Market Revenue (billion), by End-User 2025 & 2033

- Figure 5: North America Industrial Protective Footwear Market Revenue Share (%), by End-User 2025 & 2033

- Figure 6: North America Industrial Protective Footwear Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Industrial Protective Footwear Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Industrial Protective Footwear Market Revenue (billion), by Material 2025 & 2033

- Figure 9: Europe Industrial Protective Footwear Market Revenue Share (%), by Material 2025 & 2033

- Figure 10: Europe Industrial Protective Footwear Market Revenue (billion), by End-User 2025 & 2033

- Figure 11: Europe Industrial Protective Footwear Market Revenue Share (%), by End-User 2025 & 2033

- Figure 12: Europe Industrial Protective Footwear Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Industrial Protective Footwear Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Industrial Protective Footwear Market Revenue (billion), by Material 2025 & 2033

- Figure 15: Asia Pacific Industrial Protective Footwear Market Revenue Share (%), by Material 2025 & 2033

- Figure 16: Asia Pacific Industrial Protective Footwear Market Revenue (billion), by End-User 2025 & 2033

- Figure 17: Asia Pacific Industrial Protective Footwear Market Revenue Share (%), by End-User 2025 & 2033

- Figure 18: Asia Pacific Industrial Protective Footwear Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Industrial Protective Footwear Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Industrial Protective Footwear Market Revenue (billion), by Material 2025 & 2033

- Figure 21: South America Industrial Protective Footwear Market Revenue Share (%), by Material 2025 & 2033

- Figure 22: South America Industrial Protective Footwear Market Revenue (billion), by End-User 2025 & 2033

- Figure 23: South America Industrial Protective Footwear Market Revenue Share (%), by End-User 2025 & 2033

- Figure 24: South America Industrial Protective Footwear Market Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Industrial Protective Footwear Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Industrial Protective Footwear Market Revenue (billion), by Material 2025 & 2033

- Figure 27: Middle East and Africa Industrial Protective Footwear Market Revenue Share (%), by Material 2025 & 2033

- Figure 28: Middle East and Africa Industrial Protective Footwear Market Revenue (billion), by End-User 2025 & 2033

- Figure 29: Middle East and Africa Industrial Protective Footwear Market Revenue Share (%), by End-User 2025 & 2033

- Figure 30: Middle East and Africa Industrial Protective Footwear Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Industrial Protective Footwear Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Industrial Protective Footwear Market Revenue billion Forecast, by Material 2020 & 2033

- Table 2: Global Industrial Protective Footwear Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 3: Global Industrial Protective Footwear Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Industrial Protective Footwear Market Revenue billion Forecast, by Material 2020 & 2033

- Table 5: Global Industrial Protective Footwear Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 6: Global Industrial Protective Footwear Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Industrial Protective Footwear Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Industrial Protective Footwear Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Industrial Protective Footwear Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Industrial Protective Footwear Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Global Industrial Protective Footwear Market Revenue billion Forecast, by Material 2020 & 2033

- Table 12: Global Industrial Protective Footwear Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 13: Global Industrial Protective Footwear Market Revenue billion Forecast, by Country 2020 & 2033

- Table 14: Germany Industrial Protective Footwear Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: United Kingdom Industrial Protective Footwear Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: France Industrial Protective Footwear Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Russia Industrial Protective Footwear Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Italy Industrial Protective Footwear Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Spain Industrial Protective Footwear Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Industrial Protective Footwear Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Global Industrial Protective Footwear Market Revenue billion Forecast, by Material 2020 & 2033

- Table 22: Global Industrial Protective Footwear Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 23: Global Industrial Protective Footwear Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: India Industrial Protective Footwear Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: China Industrial Protective Footwear Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Japan Industrial Protective Footwear Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Australia Industrial Protective Footwear Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Industrial Protective Footwear Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Global Industrial Protective Footwear Market Revenue billion Forecast, by Material 2020 & 2033

- Table 30: Global Industrial Protective Footwear Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 31: Global Industrial Protective Footwear Market Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Brazil Industrial Protective Footwear Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Argentina Industrial Protective Footwear Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Industrial Protective Footwear Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Global Industrial Protective Footwear Market Revenue billion Forecast, by Material 2020 & 2033

- Table 36: Global Industrial Protective Footwear Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 37: Global Industrial Protective Footwear Market Revenue billion Forecast, by Country 2020 & 2033

- Table 38: South Africa Industrial Protective Footwear Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Saudi Arabia Industrial Protective Footwear Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East and Africa Industrial Protective Footwear Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Industrial Protective Footwear Market?

The projected CAGR is approximately 8.4%.

2. Which companies are prominent players in the Industrial Protective Footwear Market?

Key companies in the market include Honeywell International Inc, VF Corporation, Bata Corporation, U-power Group Spa, Cofra SRL, Uvex Group*List Not Exhaustive, Dunlop Protective Footwear, Rock Fall (UK) LTD, Wolverine World Wide Inc, Hilson Footwear Pvt Ltd.

3. What are the main segments of the Industrial Protective Footwear Market?

The market segments include Material, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.27 billion as of 2022.

5. What are some drivers contributing to market growth?

Stringent Government Regulations Regarding Worker's Safety; Importance Of Occupational Safety.

6. What are the notable trends driving market growth?

Strict Government Regulations Regarding Workers' Safety.

7. Are there any restraints impacting market growth?

Impact of Counterfeit Products Coupled With Large Unorganized Labor Population Across Various Industries.

8. Can you provide examples of recent developments in the market?

September 2023: Cat Footwear introduced the Invader Mid Vent, showcasing a range of innovative features. The Invader Mid Vent is equipped with a ReViveTech Engineered Comfort footbed, a 100% Post Industrial Recycled Lining featuring an NXT footbed cover, a durable EVA midsole, a robust nylon shank, a composite toe for added protection, and a rugged industrial-grade rubber outsole.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Industrial Protective Footwear Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Industrial Protective Footwear Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Industrial Protective Footwear Market?

To stay informed about further developments, trends, and reports in the Industrial Protective Footwear Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence