Key Insights

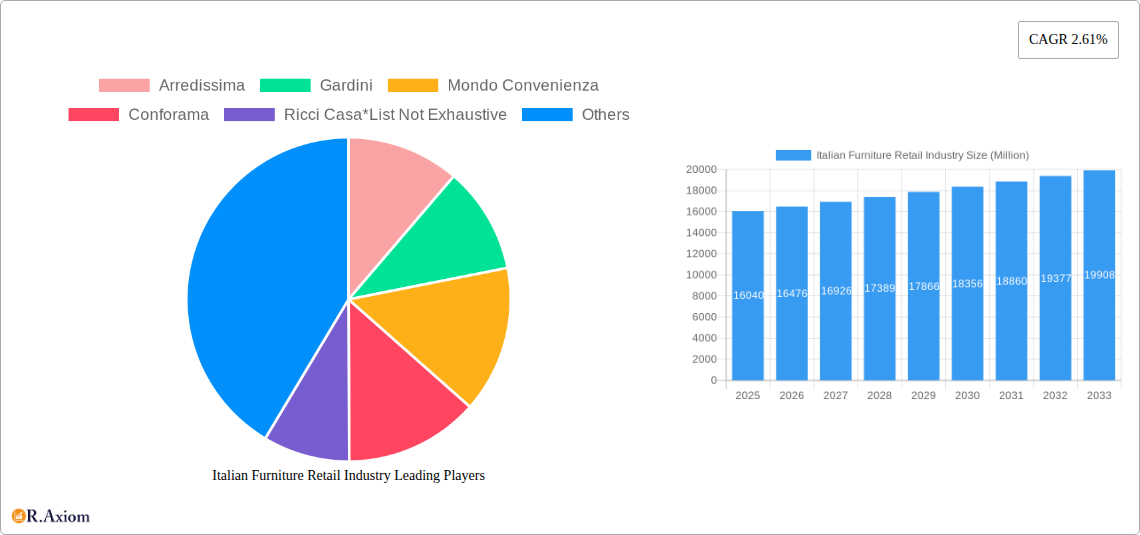

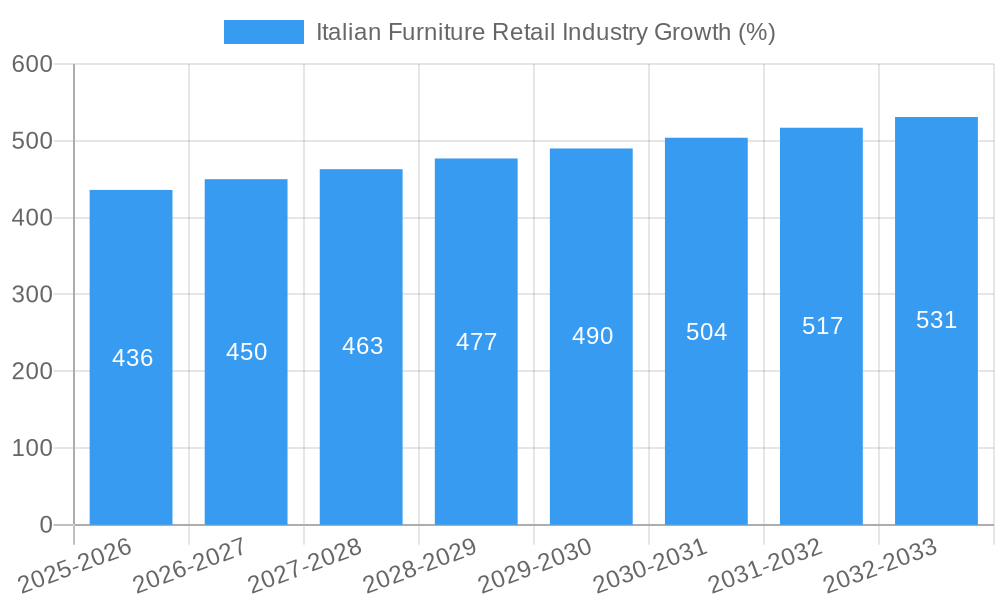

The Italian furniture retail industry, valued at €16.04 billion in 2025, exhibits a steady growth trajectory, projected to expand at a Compound Annual Growth Rate (CAGR) of 2.61% from 2025 to 2033. This growth is fueled by several key factors. Firstly, a rising middle class with increased disposable income is driving demand for higher-quality, stylish furniture, particularly within the bedroom, kitchen, and living room segments. The increasing popularity of minimalist and modern design aesthetics also contributes to this demand. Secondly, the growing e-commerce sector offers convenient access to a wider range of furniture options, boosting sales through online channels. This trend is complemented by the continued presence of established brick-and-mortar stores offering personalized service and the opportunity for customers to experience the quality of the furniture firsthand. However, challenges exist, including increased competition from international brands and fluctuating raw material prices, which can impact production costs and profitability. The industry also faces the need to adapt to evolving consumer preferences and sustainability concerns, with a growing demand for eco-friendly and ethically sourced materials. The segmentation of the market reveals a blend of organized and unorganized players, with established brands like IKEA, Mondo Convenienza, and Poltronesofa competing alongside smaller, specialized retailers. This dynamic landscape requires a blend of innovative marketing strategies, competitive pricing, and a strong focus on customer experience to thrive.

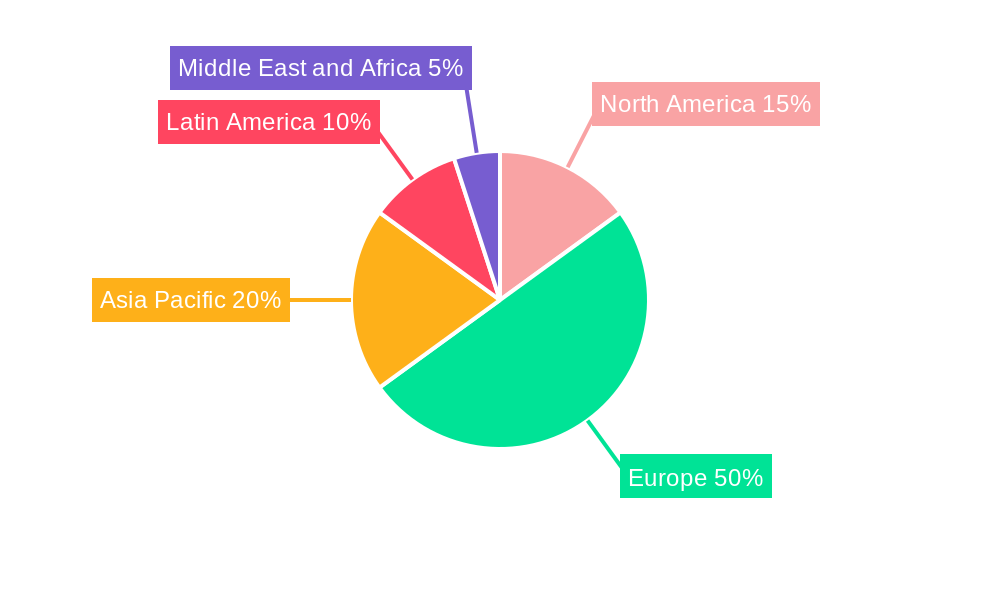

The forecast period (2025-2033) anticipates continued growth, albeit at a moderate pace, reflecting market saturation and economic factors. Regional performance is expected to vary, with mature markets like Europe possibly experiencing slower growth compared to emerging markets in Asia Pacific and Latin America. The industry's success will hinge on its ability to leverage technological advancements, embrace sustainable practices, and cater to the shifting demands of increasingly discerning consumers. This includes offering diverse product lines encompassing various styles and price points to appeal to a broad customer base. The continued expansion of online sales channels, coupled with effective omnichannel strategies that seamlessly integrate online and offline experiences, will be crucial for sustained growth in the coming years. The competitive landscape requires brands to differentiate themselves through exceptional customer service, unique product offerings, and a strong brand identity.

This detailed report provides a comprehensive analysis of the Italian furniture retail industry, covering market size, segmentation, key players, growth drivers, challenges, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period extends from 2025 to 2033, encompassing historical data from 2019 to 2024. This report is an essential resource for industry stakeholders, investors, and businesses seeking to understand and capitalize on opportunities within this dynamic market. The total market value in 2025 is estimated at €XX Billion.

Italian Furniture Retail Industry Market Concentration & Innovation

This section analyzes the competitive landscape of the Italian furniture retail market, focusing on market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and mergers & acquisitions (M&A) activities. The market is characterized by a mix of large multinational players and smaller, specialized retailers.

Market Concentration: The market exhibits moderate concentration, with a few dominant players like IKEA and Mondo Convenienza holding significant market share. However, numerous smaller companies cater to niche segments. The top 5 players account for approximately XX% of the market share in 2025.

Innovation Drivers: Technological advancements, particularly in design software and manufacturing techniques, drive innovation. The growing demand for sustainable and eco-friendly furniture also fuels innovation in materials and production processes.

Regulatory Framework: Italian regulations concerning product safety, environmental standards, and consumer protection significantly influence the industry. Compliance costs can vary and impact profitability, especially for smaller players.

Product Substitutes: The industry faces competition from second-hand furniture markets and online marketplaces offering alternative, often more affordable options. This pressure impacts the pricing strategies of traditional retailers.

End-User Trends: Consumer preferences are shifting towards personalized and customizable furniture, along with greater emphasis on sustainability and durability. This creates opportunities for retailers offering tailored solutions and eco-conscious products.

M&A Activities: The Italian furniture retail sector has witnessed several M&A activities in recent years, driven by consolidation and expansion strategies. For example, the deal value for XX M&A deals between 2019 and 2024 is estimated at €XX Billion. These transactions have led to increased market concentration and integration of various operational capabilities.

Italian Furniture Retail Industry Industry Trends & Insights

The Italian furniture retail industry is experiencing dynamic shifts influenced by evolving consumer preferences, technological disruptions, and competitive dynamics. The industry demonstrates a Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025-2033). Market penetration of online sales is projected to reach XX% by 2033, driven by increased e-commerce adoption and improved digital infrastructure.

Growing disposable incomes and rising urbanization fuel market growth, while the rising popularity of minimalist and sustainable designs influences product development. The increasing use of e-commerce platforms and omnichannel strategies has intensified competition. The integration of technology in the supply chain, such as AI-powered inventory management systems, has enhanced efficiency. However, fluctuating raw material prices, labor costs, and global economic uncertainties present ongoing challenges for the industry. Consumer preferences are shifting towards personalized experiences and online customization.

Dominant Markets & Segments in Italian Furniture Retail Industry

The Italian furniture retail market is geographically concentrated, with major cities and densely populated regions dominating sales. Online channels are experiencing significant growth, surpassing offline sales in the XX major cities by 2033. The organized sector is the dominant market segment, accounting for a larger percentage of total revenue, compared to the unorganized sector.

Dominant Segments:

Room Furniture Type: Living room and bedroom furniture are the largest segments, driven by strong demand from residential customers. Kitchen furniture shows steady growth, propelled by home renovation trends. Outdoor furniture experiences seasonal fluctuations but exhibits strong growth potential.

Distribution Channel: Offline channels still dominate, yet online sales are rapidly gaining traction, offering consumers greater convenience and choice. The integration of offline and online channels is crucial for achieving significant market share gains.

Type of Market: The organized sector exhibits higher growth potential due to better infrastructure, product quality, and service delivery compared to the unorganized sector. The increasing preference for premium and branded products further enhances the organized sector's dominance.

Key Drivers:

- Strong domestic consumption and rising disposable incomes.

- Government initiatives supporting the furniture industry.

- Developed logistics and infrastructure supporting timely product delivery.

Italian Furniture Retail Industry Product Developments

Recent innovations include the integration of smart home technologies into furniture, personalized customization options via online platforms, and the use of sustainable and eco-friendly materials. This reflects consumer preferences for enhanced functionality and environmentally responsible products. Companies are leveraging digital design tools and virtual reality to enhance the customer experience and streamline the buying process.

Report Scope & Segmentation Analysis

This report comprehensively segments the Italian furniture retail industry based on furniture type (bedroom, kitchen, living room/dining room, outdoor, other), distribution channel (online, offline), and market type (organized, unorganized). Each segment's growth projections, market sizes, and competitive dynamics are analyzed. For instance, the online segment is expected to achieve a CAGR of XX% during the forecast period, driven by increasing internet penetration and e-commerce adoption.

Key Drivers of Italian Furniture Retail Industry Growth

Key growth drivers include rising disposable incomes, increasing urbanization, home renovation projects, and technological advancements in design and manufacturing. Government initiatives promoting sustainable practices and supporting the furniture industry also play a role. The increasing adoption of smart home technologies creates opportunities for innovative product development.

Challenges in the Italian Furniture Retail Industry Sector

Challenges include intense competition, fluctuating raw material prices, supply chain disruptions, and economic uncertainties. Compliance with stringent environmental regulations presents costs and complexity. The rise of e-commerce also poses challenges to traditional brick-and-mortar retailers, demanding strategic adjustments.

Emerging Opportunities in Italian Furniture Retail Industry

Emerging opportunities arise from the growing demand for sustainable and eco-friendly furniture, smart home integration, personalized design services, and expanding online marketplaces. The increasing popularity of modular and customizable furniture presents opportunities to cater to evolving consumer tastes. Expansion into niche market segments and international markets offers further growth potential.

Leading Players in the Italian Furniture Retail Industry Market

- Arredissima

- Gardini

- Mondo Convenienza

- Conforama

- Ricci Casa

- IKEA

- Canfalone

- Dotolo Mobili

- Poltronesofa

- JYSK

Key Developments in Italian Furniture Retail Industry Industry

- April 2021: PayGlobe and Ingenico partnered to enhance payment solutions for Mondo Convenienza, improving the customer experience and operational efficiency.

- September 2021: IKEA and Sonos launched an updated version of their SYMFONISK table lamp speaker, showcasing technological innovation and collaboration within the industry.

Strategic Outlook for Italian Furniture Retail Industry Market

The Italian furniture retail industry is poised for continued growth, driven by a combination of strong domestic demand, technological innovation, and evolving consumer preferences. Focusing on sustainable practices, personalized experiences, and omnichannel strategies will be key to success. Companies that effectively leverage technology to streamline operations and enhance the customer experience will gain a competitive advantage.

Italian Furniture Retail Industry Segmentation

-

1. Room Furniture Type

- 1.1. Bedroom Furniture

- 1.2. Kitchen Furniture

- 1.3. Living Room and Dining Room Furniture

- 1.4. Outdoor Furniture and Other Furniture

-

2. Distribution Channel

- 2.1. Online

- 2.2. Offline

-

3. Type of Market

- 3.1. Organized

- 3.2. Unorganized

Italian Furniture Retail Industry Segmentation By Geography

- 1. Italia

Italian Furniture Retail Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.61% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Urbanization and Housing Sector; Home Improvement and Renovation Project

- 3.3. Market Restrains

- 3.3.1. High Competitive Market; Fluctuating Raw Material Cost

- 3.4. Market Trends

- 3.4.1. Growing E-commerce Penetration is Driving the Market.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italian Furniture Retail Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Room Furniture Type

- 5.1.1. Bedroom Furniture

- 5.1.2. Kitchen Furniture

- 5.1.3. Living Room and Dining Room Furniture

- 5.1.4. Outdoor Furniture and Other Furniture

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Online

- 5.2.2. Offline

- 5.3. Market Analysis, Insights and Forecast - by Type of Market

- 5.3.1. Organized

- 5.3.2. Unorganized

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Italia

- 5.1. Market Analysis, Insights and Forecast - by Room Furniture Type

- 6. North America Italian Furniture Retail Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Europe Italian Furniture Retail Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Asia Pacific Italian Furniture Retail Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Latin America Italian Furniture Retail Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Middle East and Africa Italian Furniture Retail Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Arredissima

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Gardini

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Mondo Convenienza

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Conforama

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ricci Casa*List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 IKEA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Canfalone

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Dotolo Mobili

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Poltronesofa

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 JYSK

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Arredissima

List of Figures

- Figure 1: Italian Furniture Retail Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Italian Furniture Retail Industry Share (%) by Company 2024

List of Tables

- Table 1: Italian Furniture Retail Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Italian Furniture Retail Industry Revenue Million Forecast, by Room Furniture Type 2019 & 2032

- Table 3: Italian Furniture Retail Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Italian Furniture Retail Industry Revenue Million Forecast, by Type of Market 2019 & 2032

- Table 5: Italian Furniture Retail Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Italian Furniture Retail Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Italian Furniture Retail Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italian Furniture Retail Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Italian Furniture Retail Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Italian Furniture Retail Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Italian Furniture Retail Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Italian Furniture Retail Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Italian Furniture Retail Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Italian Furniture Retail Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Italian Furniture Retail Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Italian Furniture Retail Industry Revenue Million Forecast, by Room Furniture Type 2019 & 2032

- Table 17: Italian Furniture Retail Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 18: Italian Furniture Retail Industry Revenue Million Forecast, by Type of Market 2019 & 2032

- Table 19: Italian Furniture Retail Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italian Furniture Retail Industry?

The projected CAGR is approximately 2.61%.

2. Which companies are prominent players in the Italian Furniture Retail Industry?

Key companies in the market include Arredissima, Gardini, Mondo Convenienza, Conforama, Ricci Casa*List Not Exhaustive, IKEA, Canfalone, Dotolo Mobili, Poltronesofa, JYSK.

3. What are the main segments of the Italian Furniture Retail Industry?

The market segments include Room Furniture Type, Distribution Channel, Type of Market.

4. Can you provide details about the market size?

The market size is estimated to be USD 16.04 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Urbanization and Housing Sector; Home Improvement and Renovation Project.

6. What are the notable trends driving market growth?

Growing E-commerce Penetration is Driving the Market..

7. Are there any restraints impacting market growth?

High Competitive Market; Fluctuating Raw Material Cost.

8. Can you provide examples of recent developments in the market?

September 2021- IKEA and Sonos are launching a new version of the SYMFONISK table lamp speaker, with a better sound experience and updated, customizable designs. The original SYMFONISK table lamp speaker debuted in 2019, marking the first product developed by IKEA and Sonos.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italian Furniture Retail Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italian Furniture Retail Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italian Furniture Retail Industry?

To stay informed about further developments, trends, and reports in the Italian Furniture Retail Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence