Key Insights

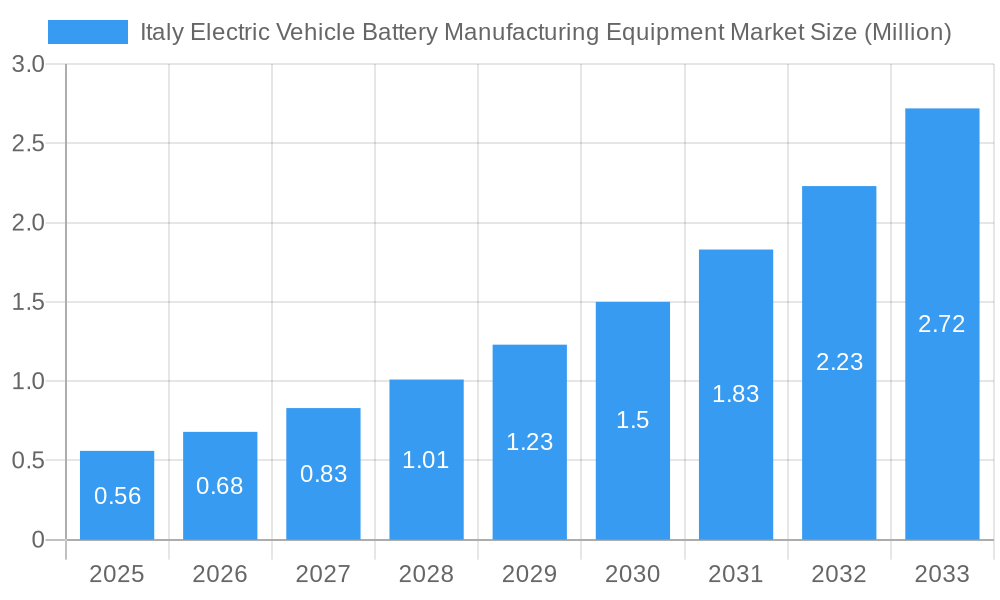

The Italian electric vehicle (EV) battery manufacturing equipment market is poised for significant expansion, demonstrating robust growth potential driven by the accelerating adoption of electric mobility and supportive government initiatives. The market size is estimated at 0.56 million units, projected to surge at a compelling Compound Annual Growth Rate (CAGR) of 21.96% during the forecast period of 2025-2033. This impressive growth is fueled by several key drivers, including increasing demand for EVs, advancements in battery technology leading to higher performance and lower costs, and substantial investments from both domestic and international players in expanding battery production capacity. Furthermore, the EU's Green Deal and Italy's national strategies to decarbonize transportation are creating a favorable ecosystem for localized battery manufacturing. The demand for sophisticated manufacturing equipment, particularly for lithium-ion battery production, is expected to be a primary growth catalyst.

Italy Electric Vehicle Battery Manufacturing Equipment Market Market Size (In Million)

The market is segmented across various processes, with Electrode Making, Mixing, and Coating anticipated to witness the highest demand as these are critical stages in battery cell production. The focus on Lithium-Ion Batteries as the dominant battery type will further underscore the need for advanced manufacturing solutions in this segment. While strong growth is evident, the market may face certain restraints, such as high initial capital investment for advanced manufacturing facilities and the ongoing global supply chain complexities for raw materials. However, the overarching trend towards electrification and the strategic importance of domestic battery production in Europe are expected to outweigh these challenges. Prominent companies like Manz AG, Sovema Group S.p.A., and Durr AG are key players shaping this dynamic landscape, alongside other significant contributors like Hitachi Ltd. and Xiamen Tmax Battery Equipments Limited, indicating a competitive yet opportunity-rich environment. Italy, as a region, is expected to play a crucial role in this European battery manufacturing ecosystem.

Italy Electric Vehicle Battery Manufacturing Equipment Market Company Market Share

This in-depth report provides a detailed examination of the Italy Electric Vehicle Battery Manufacturing Equipment Market, offering critical insights into market dynamics, growth drivers, and future opportunities. With a study period spanning from 2019 to 2033, a base and estimated year of 2025, and a forecast period from 2025 to 2033, this analysis is crucial for understanding the evolving landscape of electric vehicle battery production in Italy. We cover key segments, leading players, technological advancements, and strategic outlooks, ensuring a holistic view of this rapidly expanding sector.

Italy Electric Vehicle Battery Manufacturing Equipment Market Market Concentration & Innovation

The Italy Electric Vehicle Battery Manufacturing Equipment Market exhibits a dynamic interplay between established global players and emerging domestic contenders, reflecting a moderate to high level of market concentration. Innovation is primarily driven by the increasing demand for higher energy density, faster charging capabilities, and improved safety features in electric vehicle (EV) batteries. This necessitates continuous advancements in manufacturing equipment, including sophisticated electrode coating machines, advanced cell assembly lines, and precision testing apparatus. Regulatory frameworks, such as the European Union's Green Deal and national initiatives promoting sustainable mobility, are significant catalysts, mandating higher EV adoption rates and, consequently, boosting the demand for domestic battery production capabilities. Product substitutes, while currently limited in the context of specialized EV battery manufacturing, include advancements in battery chemistries that might influence equipment requirements over time. End-user trends are heavily influenced by automotive manufacturers' commitments to electrification, pushing for localized battery supply chains to mitigate geopolitical risks and reduce logistics costs. Merger and acquisition (M&A) activities, while not extensively detailed in public records for this specific niche, are anticipated to play a crucial role in consolidating market share and acquiring critical technologies. For instance, a hypothetical M&A deal aiming to integrate a leading battery materials supplier with an equipment manufacturer could be valued in the range of $50 Million to $150 Million, signifying strategic consolidation. Key market players like Manz AG and Durr AG are actively investing in R&D to enhance their equipment portfolios.

Italy Electric Vehicle Battery Manufacturing Equipment Market Industry Trends & Insights

The Italy Electric Vehicle Battery Manufacturing Equipment Market is experiencing robust growth, propelled by a confluence of compelling industry trends and insights. A primary growth driver is the escalating global demand for electric vehicles, fueled by growing environmental consciousness, stringent emission regulations, and government incentives aimed at promoting EV adoption. Italy, as a significant automotive manufacturing hub in Europe, is strategically positioned to benefit from this transition. The market is witnessing a substantial Compound Annual Growth Rate (CAGR) estimated at XX%, indicative of a rapid expansion trajectory. Technological disruptions are at the forefront, with continuous innovations in battery chemistries like solid-state batteries demanding novel manufacturing equipment. Equipment manufacturers are responding by developing advanced solutions for processes such as high-precision coating, advanced electrode making, and automated assembly, crucial for the efficient production of next-generation batteries. Consumer preferences are shifting towards longer-range EVs with faster charging capabilities, placing immense pressure on battery manufacturers to optimize production processes. This translates into a heightened demand for sophisticated manufacturing equipment that can ensure quality, consistency, and scalability. Competitive dynamics are intensifying as both established players and new entrants vie for market share. The push for European battery independence from Asian manufacturers is a significant strategic trend, leading to increased investments in local battery gigafactories and, by extension, the manufacturing equipment required to equip them. Market penetration of advanced manufacturing equipment is projected to reach XX% by 2033, signifying a strong adoption rate of modern technologies. Supply chain resilience is another critical factor, with a growing emphasis on localized production of batteries and their constituent components, thereby driving the demand for Italian-made or installed manufacturing equipment. The intricate process of battery production, from material mixing to final assembly, requires specialized machinery that can handle complex chemical processes and intricate mechanical operations with utmost precision. The investment in research and development by key industry players is substantial, aiming to create more efficient, cost-effective, and sustainable manufacturing solutions.

Dominant Markets & Segments in Italy Electric Vehicle Battery Manufacturing Equipment Market

The Lithium-Ion Batteries segment is unequivocally the dominant force within the Italy Electric Vehicle Battery Manufacturing Equipment Market. This dominance stems from the widespread adoption of lithium-ion technology across the burgeoning electric vehicle sector, which constitutes the primary end-user for this equipment. The Italian automotive industry's strategic pivot towards electrification has created an immense and sustained demand for the sophisticated manufacturing equipment required for producing high-performance lithium-ion batteries.

Key drivers underpinning the dominance of the Lithium-Ion Batteries segment include:

- Automotive Sector Electrification: Italy's significant automotive manufacturing base is undergoing a profound transformation, with a substantial commitment to producing electric vehicles. This directly translates into a massive demand for lithium-ion battery production capacity, and consequently, the manufacturing equipment needed to achieve it. Government incentives and stringent EU emission standards further accelerate this trend.

- Technological Advancements in Li-Ion: Continuous improvements in lithium-ion battery energy density, lifespan, and charging speeds make them the preferred choice for current EV applications. Equipment manufacturers are constantly innovating to support these advancements, leading to specialized machinery for cathode and anode material processing, cell assembly, and formation testing.

- Gigafactory Investments: The establishment of gigafactories within Italy and the broader European region, aimed at reducing reliance on Asian battery producers, directly fuels the demand for large-scale, automated manufacturing equipment for lithium-ion cells and battery packs.

- Energy Storage Systems: Beyond automotive applications, lithium-ion batteries are increasingly utilized in stationary energy storage systems, further broadening the demand base for their manufacturing equipment.

Within the Process segmentation, Coating and Electrode Making are pivotal and highly dominant segments. These processes are fundamental to the creation of battery cells, directly impacting their performance, safety, and cost.

- Coating: The precise and uniform application of active materials onto current collectors is a critical step in electrode manufacturing. Advanced coating equipment, such as slot-die coaters and comma coaters, are essential for achieving the high energy densities and performance characteristics demanded by modern EV batteries. The precision and speed of these machines directly influence the efficiency and quality of the final battery.

- Electrode Making (Slitting and Calendering): Following coating, electrodes must be precisely slit to the required dimensions and calendared (compressed) to achieve optimal density and thickness. This requires highly accurate and robust machinery to ensure consistent electrode quality, which is paramount for battery performance and safety. The development of high-speed, high-precision slitting and calendering equipment is a key focus for manufacturers.

While Lead-Acid Batteries and Nickel-Metal Hydride Batteries still hold niche applications, their market share and the corresponding demand for their manufacturing equipment are significantly smaller compared to Lithium-Ion Batteries in the context of the electric vehicle revolution. The "Other Batteries" segment, encompassing emerging technologies, is expected to grow but currently represents a nascent stage of demand for specialized manufacturing equipment. The economic policies supporting green energy and sustainable transportation within Italy and the EU are foundational to the growth of the EV battery manufacturing equipment market, particularly for lithium-ion battery production. Infrastructure development, including the establishment of battery production facilities and associated supply chains, is crucial for supporting the operationalization of this equipment.

Italy Electric Vehicle Battery Manufacturing Equipment Market Product Developments

Product developments in the Italy Electric Vehicle Battery Manufacturing Equipment Market are characterized by a strong emphasis on enhancing precision, speed, and automation. Manufacturers are introducing advanced coating technologies for improved electrode uniformity, enabling higher energy density. Innovations in laser slitting and precision calendering equipment ensure tighter tolerances for electrode dimensions. Furthermore, there is a growing focus on modular and scalable equipment solutions to support the rapid expansion of gigafactories. The integration of AI and machine learning for process optimization and quality control in assembly and testing equipment is also a significant trend, offering competitive advantages by improving efficiency and reducing defects.

Report Scope & Segmentation Analysis

This report meticulously analyzes the Italy Electric Vehicle Battery Manufacturing Equipment Market, segmenting it across key operational processes and battery types.

Process Segmentation:

- Mixing: This segment encompasses equipment for homogenizing active materials, conductive additives, and binders for electrode slurries. Growth projections indicate a steady demand driven by increasing battery production volumes.

- Coating: Focuses on advanced machinery for uniformly applying electrode slurries onto current collectors. This segment is expected to witness significant growth due to the critical role of coating quality in battery performance.

- Calendering: Equipment for compressing and densifying coated electrodes. Demand is driven by the need for precise electrode thickness and density control.

- Slitting and Electrode Making: This segment includes machinery for precisely cutting coated electrodes into desired widths and preparing them for cell assembly. Growth is tied directly to the overall increase in battery manufacturing.

- Other Process: This includes assembly, formation, testing, and recycling equipment, a diverse category expected to grow as battery manufacturing ecosystems mature.

Battery Type Segmentation:

- Lithium-Ion Batteries: This is the largest and fastest-growing segment, driven by the electric vehicle revolution. Market size is substantial, with robust growth projections.

- Lead-Acid Batteries: While a mature technology, this segment retains a smaller, stable demand for its manufacturing equipment, primarily for automotive and industrial backup power.

- Nickel-Metal Hydride Batteries: This segment has a declining market share in EVs but finds applications in hybrid vehicles and other specialized uses, resulting in a modest demand for its manufacturing equipment.

- Other Batteries: This category includes emerging battery technologies like solid-state and sodium-ion batteries, representing a nascent but rapidly evolving market for specialized manufacturing equipment.

Key Drivers of Italy Electric Vehicle Battery Manufacturing Equipment Market Growth

The growth of the Italy Electric Vehicle Battery Manufacturing Equipment Market is propelled by several synergistic factors. The escalating global demand for electric vehicles, supported by favorable government policies and environmental regulations across Europe, forms the bedrock of this expansion. Significant investments in domestic battery production facilities, including gigafactories, are crucial, driven by the strategic imperative to reduce reliance on foreign supply chains and build a resilient European battery ecosystem. Technological advancements in battery chemistry, such as increased energy density and faster charging capabilities, necessitate the adoption of sophisticated manufacturing equipment. Furthermore, Italy's strong automotive manufacturing heritage provides a fertile ground for the localization of battery production and the associated equipment supply chain.

Challenges in the Italy Electric Vehicle Battery Manufacturing Equipment Market Sector

Despite the promising outlook, the Italy Electric Vehicle Battery Manufacturing Equipment Market faces several challenges. The high capital expenditure required for advanced manufacturing equipment can be a significant barrier, particularly for smaller or emerging players. Supply chain disruptions, both for raw materials used in battery production and for components of the manufacturing equipment itself, can lead to production delays and increased costs. Intense global competition, especially from Asian manufacturers with established production scales and cost advantages, poses a considerable challenge. Navigating complex regulatory landscapes, including evolving safety standards and environmental compliance requirements, adds another layer of complexity for equipment manufacturers and users.

Emerging Opportunities in Italy Electric Vehicle Battery Manufacturing Equipment Market

The Italy Electric Vehicle Battery Manufacturing Equipment Market is ripe with emerging opportunities. The ongoing push for battery recycling and second-life applications presents a significant opportunity for specialized equipment manufacturers focused on these areas. The development and scaling up of next-generation battery technologies, such as solid-state batteries, will create demand for entirely new categories of advanced manufacturing equipment. Furthermore, the increasing trend towards customization and modularity in EV battery packs opens avenues for flexible and adaptable manufacturing solutions. The growth of industrial energy storage solutions, beyond automotive applications, also contributes to market expansion.

Leading Players in the Italy Electric Vehicle Battery Manufacturing Equipment Market Market

- Manz AG

- Sovema Group S p A

- Durr AG

- Hitachi Ltd

- Xiamen Tmax Battery Equipments Limited

- Rosendahl Nextrom GmbH

Key Developments in Italy Electric Vehicle Battery Manufacturing Equipment Market Industry

- June 2024: Automotive Cells (ACC), a European vehicle battery venture, has announced a halt to the construction of its factories in Italy. This decision comes as ACC considers a transition to a more cost-effective battery technology. These new ACC sites join a growing list of battery projects in Europe, which is actively working to lessen its dependence on Chinese producers that currently dominate the market.

- September 2023: Intertek, a global leader in total quality assurance, has inaugurated its latest Battery Xcellence Centre in Mestre, Italy. This state-of-the-art facility, spanning 500 sqm, is outfitted with cutting-edge battery cyclers, climatic and salt spray chambers, vibration platforms, and mechanical testing tools. Additionally, it boasts two ATEX-certified anti-fire containers. With its advanced technologies and unmatched industry expertise, the centre is poised to address the growing demand for swift and dependable testing services in the battery sector.

Strategic Outlook for Italy Electric Vehicle Battery Manufacturing Equipment Market Market

The strategic outlook for the Italy Electric Vehicle Battery Manufacturing Equipment Market is exceptionally positive, driven by sustained growth in EV adoption and strong governmental support for domestic battery production. Key growth catalysts include continued investment in gigafactory expansions, fostering localized supply chains for critical components and equipment. The focus on R&D for next-generation battery technologies will spur innovation in manufacturing equipment, creating significant market opportunities. Collaborative efforts between automotive manufacturers, battery producers, and equipment suppliers will be vital for accelerating technological advancements and ensuring market competitiveness. The increasing emphasis on sustainability and circular economy principles will also drive demand for advanced equipment related to battery recycling and repurposing.

Italy Electric Vehicle Battery Manufacturing Equipment Market Segmentation

-

1. Process

- 1.1. Mixing

- 1.2. Coating

- 1.3. Calendering

- 1.4. Slitting and Electrode Making

- 1.5. Other Process

-

2. Battery

- 2.1. Lithium-Ion Batteries

- 2.2. Lead-Acid Batteries

- 2.3. Nickel-Metal Hydride Batteries

- 2.4. Other Batteries

Italy Electric Vehicle Battery Manufacturing Equipment Market Segmentation By Geography

- 1. Italy

Italy Electric Vehicle Battery Manufacturing Equipment Market Regional Market Share

Geographic Coverage of Italy Electric Vehicle Battery Manufacturing Equipment Market

Italy Electric Vehicle Battery Manufacturing Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 21.96% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Adoption of Electric Vehicles4.; Favorable Government Policies

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Electric Vehicles4.; Favorable Government Policies

- 3.4. Market Trends

- 3.4.1. Lithium-Ion batteries Segment is expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Italy Electric Vehicle Battery Manufacturing Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Process

- 5.1.1. Mixing

- 5.1.2. Coating

- 5.1.3. Calendering

- 5.1.4. Slitting and Electrode Making

- 5.1.5. Other Process

- 5.2. Market Analysis, Insights and Forecast - by Battery

- 5.2.1. Lithium-Ion Batteries

- 5.2.2. Lead-Acid Batteries

- 5.2.3. Nickel-Metal Hydride Batteries

- 5.2.4. Other Batteries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Italy

- 5.1. Market Analysis, Insights and Forecast - by Process

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Manz AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sovema Group S p A

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Durr AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hitachi Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Xiamen Tmax Battery Equipments Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Rosendahl Nextrom GmbH*List Not Exhaustive 6 4 Market Ranking/Share (%) Analysis6 5 List of Other Prominent Companie

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Manz AG

List of Figures

- Figure 1: Italy Electric Vehicle Battery Manufacturing Equipment Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Italy Electric Vehicle Battery Manufacturing Equipment Market Share (%) by Company 2025

List of Tables

- Table 1: Italy Electric Vehicle Battery Manufacturing Equipment Market Revenue Million Forecast, by Process 2020 & 2033

- Table 2: Italy Electric Vehicle Battery Manufacturing Equipment Market Volume Million Forecast, by Process 2020 & 2033

- Table 3: Italy Electric Vehicle Battery Manufacturing Equipment Market Revenue Million Forecast, by Battery 2020 & 2033

- Table 4: Italy Electric Vehicle Battery Manufacturing Equipment Market Volume Million Forecast, by Battery 2020 & 2033

- Table 5: Italy Electric Vehicle Battery Manufacturing Equipment Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Italy Electric Vehicle Battery Manufacturing Equipment Market Volume Million Forecast, by Region 2020 & 2033

- Table 7: Italy Electric Vehicle Battery Manufacturing Equipment Market Revenue Million Forecast, by Process 2020 & 2033

- Table 8: Italy Electric Vehicle Battery Manufacturing Equipment Market Volume Million Forecast, by Process 2020 & 2033

- Table 9: Italy Electric Vehicle Battery Manufacturing Equipment Market Revenue Million Forecast, by Battery 2020 & 2033

- Table 10: Italy Electric Vehicle Battery Manufacturing Equipment Market Volume Million Forecast, by Battery 2020 & 2033

- Table 11: Italy Electric Vehicle Battery Manufacturing Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Italy Electric Vehicle Battery Manufacturing Equipment Market Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Italy Electric Vehicle Battery Manufacturing Equipment Market?

The projected CAGR is approximately 21.96%.

2. Which companies are prominent players in the Italy Electric Vehicle Battery Manufacturing Equipment Market?

Key companies in the market include Manz AG, Sovema Group S p A, Durr AG, Hitachi Ltd, Xiamen Tmax Battery Equipments Limited, Rosendahl Nextrom GmbH*List Not Exhaustive 6 4 Market Ranking/Share (%) Analysis6 5 List of Other Prominent Companie.

3. What are the main segments of the Italy Electric Vehicle Battery Manufacturing Equipment Market?

The market segments include Process, Battery.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.56 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Adoption of Electric Vehicles4.; Favorable Government Policies.

6. What are the notable trends driving market growth?

Lithium-Ion batteries Segment is expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Electric Vehicles4.; Favorable Government Policies.

8. Can you provide examples of recent developments in the market?

June 2024: Automotive Cells (ACC), a European vehicle battery venture, has announced a halt to the construction of its factories in Italy. This decision comes as ACC considers a transition to a more cost-effective battery technology. These new ACC sites join a growing list of battery projects in Europe, which is actively working to lessen its dependence on Chinese producers that currently dominate the market..September 2023: Intertek, a global leader in total quality assurance, has inaugurated its latest Battery Xcellence Centre in Mestre, Italy. This state-of-the-art facility, spanning 500 sqm, is outfitted with cutting-edge battery cyclers, climatic and salt spray chambers, vibration platforms, and mechanical testing tools. Additionally, it boasts two ATEX-certified anti-fire containers. With its advanced technologies and unmatched industry expertise, the centre is poised to address the growing demand for swift and dependable testing services in the battery sector.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Italy Electric Vehicle Battery Manufacturing Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Italy Electric Vehicle Battery Manufacturing Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Italy Electric Vehicle Battery Manufacturing Equipment Market?

To stay informed about further developments, trends, and reports in the Italy Electric Vehicle Battery Manufacturing Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence