Key Insights

The Kuwait home appliances market is projected to reach $91.5 million by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 6.5% through 2033. This growth is fueled by rising disposable incomes, a growing expatriate population, and increasing demand for modern, energy-efficient, and smart home solutions. Government initiatives promoting sustainability and technological advancements enhancing user convenience further support market expansion. Key growth segments include major appliances (refrigerators, washing machines, air conditioners) driven by new household formations and replacement demand, alongside small appliances experiencing a surge due to evolving lifestyles and demand for compact, multi-functional devices.

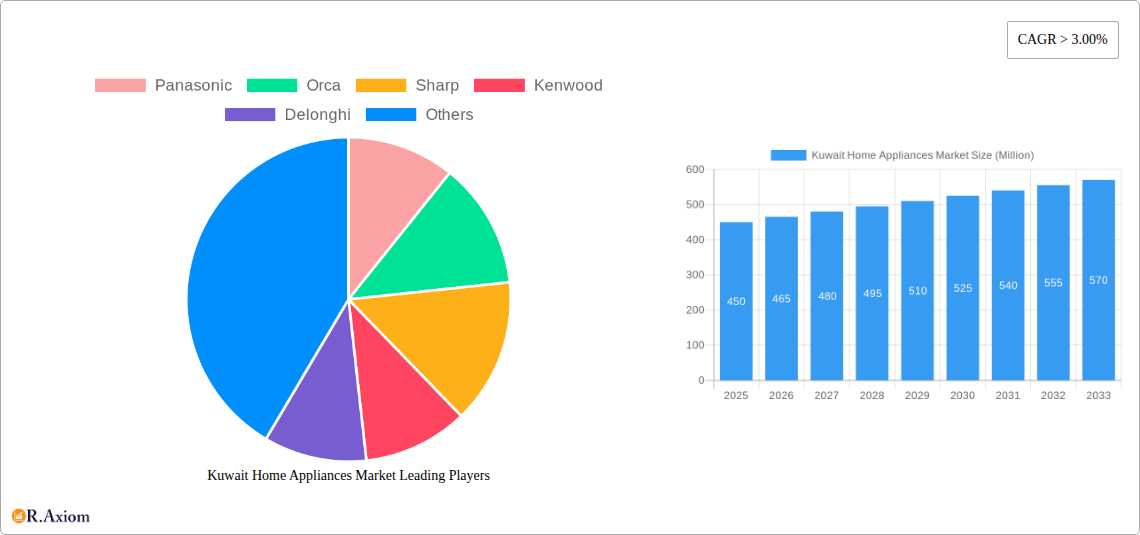

Kuwait Home Appliances Market Market Size (In Million)

Kuwait's distribution landscape features a robust mix of multi-branded stores, specialty electronics retailers, and a rapidly expanding online sales channel. E-commerce platforms are increasingly significant, offering wider product selections, competitive pricing, and convenient delivery, appealing to tech-savvy consumers. Market restraints include intense competition from international and local brands, potential supply chain disruptions, and evolving consumer preferences necessitating continuous product innovation. Leading companies are focusing on product differentiation, smart technology integration, and targeted marketing to gain market share.

Kuwait Home Appliances Market Company Market Share

Kuwait Home Appliances Market: Analysis and Outlook (2025-2033)

This comprehensive report analyzes the Kuwait Home Appliances Market from 2025 to 2033. It covers major appliances, small appliances, and distribution channels including multi-branded stores, specialty stores, and online sales. Key industry players such as Panasonic, Orca, Sharp, Kenwood, Delonghi, Moulinex, Whirlpool, Braun, Bosch, Midea, and TCL are examined. This report is crucial for understanding market trends, competitive strategies, and emerging opportunities in Kuwait's consumer electronics sector.

Kuwait Home Appliances Market Market Concentration & Innovation

The Kuwait Home Appliances Market exhibits a moderate level of market concentration, with several established international brands holding significant market share. The dominance of a few key players, including Panasonic, Sharp, and Midea, indicates a competitive yet somewhat consolidated landscape. Innovation is a critical driver, with companies continually investing in R&D to introduce energy-efficient models, smart appliances, and user-friendly designs. The regulatory framework, while evolving, generally supports market growth through consumer protection laws and standards for appliance safety and energy consumption. Product substitutes, such as the increasing popularity of multi-functional appliances and DIY solutions, present a growing challenge. End-user trends are heavily influenced by rising disposable incomes, a growing expatriate population, and an increasing awareness of sustainable and technologically advanced home solutions. Merger and acquisition activities are relatively low but are expected to increase as larger players seek to consolidate their market position and expand their product portfolios. For instance, recent partnerships, like TCL's collaboration with Jashanmal for AC launches, highlight strategic moves to enhance market reach. While specific M&A deal values are not readily available for this niche market, the overall investment in brand partnerships and distribution networks signifies a strategic approach to market expansion.

Kuwait Home Appliances Market Industry Trends & Insights

The Kuwait Home Appliances Market is poised for robust growth, driven by a confluence of economic, demographic, and technological factors. A projected Compound Annual Growth Rate (CAGR) of approximately 5.8% is anticipated during the forecast period. The increasing disposable incomes of Kuwaiti households, coupled with a growing expatriate population, are primary catalysts for increased demand for both essential and premium home appliances. Furthermore, the government's focus on urban development and infrastructure projects, leading to new housing construction and renovations, directly fuels the demand for a wide range of home appliances.

Technological disruptions are reshaping consumer preferences. The integration of smart technology and the Internet of Things (IoT) into home appliances is a significant trend. Consumers are increasingly seeking connected devices that offer convenience, energy efficiency, and enhanced control through mobile applications. This shift is evident in the growing popularity of smart refrigerators, automated washing machines, and voice-activated kitchen appliances.

Consumer preferences are also evolving to emphasize energy efficiency and sustainability. With rising energy costs and environmental consciousness, consumers are actively looking for appliances with high energy ratings, such as those with inverter technology in air conditioners and refrigerators. Brands that can effectively communicate the long-term cost savings and environmental benefits of their products are likely to gain a competitive edge.

The competitive dynamics within the Kuwait Home Appliances Market are characterized by intense rivalry among global and regional brands. Established players are leveraging their brand reputation and extensive distribution networks, while new entrants are focusing on innovation and competitive pricing. The market penetration of small appliances, in particular, is high and continues to grow as consumers invest in products that enhance their lifestyle and convenience. The e-commerce segment is also witnessing significant growth, offering consumers wider choices and competitive pricing, thus forcing traditional retail channels to adapt and enhance their customer experience. The overall market is expected to reach an estimated value of $2,200 Million by 2025, with significant expansion projected through 2033.

Dominant Markets & Segments in Kuwait Home Appliances Market

The Kuwait Home Appliances Market is characterized by the dominance of specific product categories and distribution channels, driven by economic factors, consumer preferences, and infrastructural developments.

Product Segment Dominance:

Major Appliances: This segment holds the largest market share, estimated to be over 75% of the total market value.

- Air Conditioners: Due to Kuwait's hot climate, air conditioners represent the single largest product category within major appliances. Demand is consistently high, driven by both new installations and replacements. The market is further fueled by the prevalence of residential and commercial properties requiring cooling solutions. Growth drivers include technological advancements in energy efficiency (e.g., inverter technology) and smart features allowing remote control.

- Refrigerators & Freezers: Essential household items, refrigerators and freezers are a consistent revenue driver. The increasing demand for larger capacity units and advanced features like multi-door designs and better food preservation technologies contributes to their sustained market performance.

- Washing Machines & Dishwashing Machines: As living standards rise and consumers seek greater convenience, the adoption rates for these appliances continue to increase. The availability of advanced models with diverse wash cycles and energy-saving features further boosts their appeal.

Small Appliances: While smaller in individual value, the small appliances segment collectively represents a significant and growing portion of the market, estimated at around 25%.

- Coffee/Tea Makers: The increasing preference for home-brewed coffee and the social aspect of tea consumption make these appliances highly popular. The market sees a demand for both basic and advanced espresso machines and smart kettles.

- Food Processors & Grills/Roasters: These cater to a growing interest in home cooking and healthy eating. The convenience and versatility offered by these products appeal to modern households.

- Vacuum Cleaners: With an increasing focus on hygiene and home cleanliness, especially in multi-cultural households, vacuum cleaners, including robotic variants, are gaining traction.

Distribution Channel Dominance:

- Multi-Branded Stores: These remain the leading distribution channel, accounting for approximately 50% of sales.

- Key Drivers: They offer a wide variety of brands and product models under one roof, allowing consumers to compare and make informed decisions. The in-store customer service and the ability to physically inspect products are critical advantages. Established retailers have strong brand recognition and loyalty.

- Online Channels: This segment is experiencing the fastest growth, projected to capture over 30% of the market by 2025 and further expand.

- Key Drivers: The convenience of online shopping, competitive pricing, and the availability of a vast product selection are major attractors. E-commerce platforms are investing heavily in logistics and customer experience to cater to the growing online consumer base. The ease of comparing prices and reading reviews also plays a crucial role.

- Specialty Stores: These cater to specific product categories or premium brands and hold an estimated 15% market share.

- Key Drivers: They offer specialized expertise and a curated selection of high-end or niche products, attracting consumers seeking specific features or brands.

- Other Distribution Channels: This includes direct sales from manufacturers and smaller independent retailers, collectively holding a minor market share.

Kuwait Home Appliances Market Product Developments

Product development in the Kuwait Home Appliances Market is heavily influenced by technological advancements and evolving consumer demands for convenience and efficiency. Innovations in smart home integration are prominent, with appliances featuring IoT capabilities for remote control and automation via smartphone apps. Energy efficiency remains a key focus, leading to the widespread adoption of inverter technologies in cooling and refrigeration systems to reduce power consumption. Advanced features such as improved food preservation in refrigerators, diverse washing programs in washing machines, and multi-functional capabilities in small appliances are continuously being introduced. These developments aim to enhance user experience, offer greater versatility, and align with the growing consumer preference for sustainable and technologically sophisticated home solutions.

Report Scope & Segmentation Analysis

This report offers a comprehensive analysis of the Kuwait Home Appliances Market, segmented across key product categories and distribution channels. The Product segmentation includes Major Appliances such as Refrigerators, Freezers, Dishwashing Machines, Washing Machines, Ovens, and Air Conditioners, alongside Small Appliances like Coffee/Tea Makers, Food Processors, Grills and Roasters, and Vacuum Cleaners. The Distribution Channel segmentation covers Multi-Branded Stores, Specialty Stores, Online, and Other Distribution Channels. The market is projected to witness steady growth across all segments, with the online channel expected to exhibit the highest growth rate. Major appliances will continue to dominate in terms of market value, while small appliances will see significant penetration growth.

Key Drivers of Kuwait Home Appliances Market Growth

Several factors are propelling the growth of the Kuwait Home Appliances Market. The sustained economic growth and rising disposable incomes of Kuwaiti households are fundamental drivers, enabling increased consumer spending on both essential and aspirational home appliances. A growing expatriate population further contributes to demand, as this demographic often invests in outfitting new residences. Technological innovation, particularly the integration of smart home features and IoT connectivity, is creating new demand as consumers seek convenience and advanced functionality. Furthermore, government initiatives promoting energy efficiency and sustainability encourage the adoption of eco-friendly appliances, creating a niche for advanced products. The expansion of e-commerce platforms is also democratizing access to a wider range of products and competitive pricing, stimulating overall market demand.

Challenges in the Kuwait Home Appliances Market Sector

Despite its growth potential, the Kuwait Home Appliances Market faces several challenges. Intense competition among numerous global and regional brands leads to price pressures and necessitates significant marketing investments to maintain brand visibility and market share. Fluctuations in global supply chains and the reliance on imports for many components can lead to potential disruptions and increased costs, impacting product availability and pricing. Evolving regulatory frameworks related to energy efficiency standards and import duties, while beneficial in the long run, can present short-term adaptation challenges for manufacturers and distributors. Moreover, the increasing trend of consumers delaying replacements in favor of repairing older appliances, driven by economic considerations, can temper the demand for new units.

Emerging Opportunities in Kuwait Home Appliances Market

The Kuwait Home Appliances Market presents numerous emerging opportunities for growth and innovation. The rising demand for smart home devices and integrated IoT solutions offers a significant avenue for manufacturers to introduce connected appliances that enhance convenience and user experience. The growing consumer awareness regarding energy efficiency and environmental sustainability is creating a market for green appliances, presenting an opportunity for brands that prioritize eco-friendly designs and technologies. The expansion of e-commerce and online retail continues to offer a fertile ground for brands to reach a wider customer base through digital platforms. Furthermore, the increasing trend of urbanization and the development of new residential projects in Kuwait present a steady demand for a broad spectrum of home appliances.

Leading Players in the Kuwait Home Appliances Market Market

- Panasonic

- Orca

- Sharp

- Kenwood

- Delonghi

- Moulinex

- Whirlpool

- Braun

- Bosch

- Midea

- TCL

Key Developments in Kuwait Home Appliances Market Industry

- June 2022: TCL partners with Jashanmal to launch its new range of ACs. The partnership will enable TCL to reach a wider customer base with its top-of-the-line home appliances and air conditioners (AC).

- August 2021: GE Appliances has signed a multi-year partnership deal with Google Cloud to build the next generation of smart home technologies. The partners will combine their expertise GE Appliances in hardware and Google Cloud in data, artificial intelligence, analytics, and machine learning to deliver new smart home technologies and improved experiences.

Strategic Outlook for Kuwait Home Appliances Market Market

The strategic outlook for the Kuwait Home Appliances Market remains highly positive, driven by sustained economic growth, evolving consumer lifestyles, and technological advancements. The increasing demand for smart and energy-efficient appliances presents a significant opportunity for manufacturers and brands that can innovate and cater to these preferences. The continued expansion of e-commerce channels will be crucial for market penetration and customer acquisition. Companies focusing on building strong brand equity, offering differentiated product portfolios, and ensuring robust after-sales service are well-positioned for success. Strategic partnerships and collaborations, similar to recent developments, will be key to expanding market reach and enhancing competitive positioning. The market is expected to see continued investment in product development and marketing efforts to capture a larger share of the growing consumer base.

Kuwait Home Appliances Market Segmentation

-

1. Product

-

1.1. Major Appliances

- 1.1.1. Refrigerators

- 1.1.2. Freezers

- 1.1.3. Dishwashing Machines

- 1.1.4. Washing Machines

- 1.1.5. Ovens

- 1.1.6. Air Conditioners

- 1.1.7. Other Major Appliances

-

1.2. Small Appliances

- 1.2.1. Coffee/Tea Makers

- 1.2.2. Food Processors

- 1.2.3. Grills and Roasters

- 1.2.4. Vacuum Cleaners

- 1.2.5. Other Small Appliances

-

1.1. Major Appliances

-

2. Distribution Channel

- 2.1. Multi-Branded Stores

- 2.2. Specialty Stores

- 2.3. Online

- 2.4. Other Distribution Channels

Kuwait Home Appliances Market Segmentation By Geography

- 1. Kuwait

Kuwait Home Appliances Market Regional Market Share

Geographic Coverage of Kuwait Home Appliances Market

Kuwait Home Appliances Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Home Improvement Projects are Driving the Growth of the Market; A Positive Trend in Real-Estate Industry also Helps in Boosting the Growth

- 3.3. Market Restrains

- 3.3.1. Changing Consumer Preferences and Lifestyle Trends Influencing Demand for Certain Appliances

- 3.4. Market Trends

- 3.4.1. Urban Areas Account for Majority of Sales in Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Kuwait Home Appliances Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Major Appliances

- 5.1.1.1. Refrigerators

- 5.1.1.2. Freezers

- 5.1.1.3. Dishwashing Machines

- 5.1.1.4. Washing Machines

- 5.1.1.5. Ovens

- 5.1.1.6. Air Conditioners

- 5.1.1.7. Other Major Appliances

- 5.1.2. Small Appliances

- 5.1.2.1. Coffee/Tea Makers

- 5.1.2.2. Food Processors

- 5.1.2.3. Grills and Roasters

- 5.1.2.4. Vacuum Cleaners

- 5.1.2.5. Other Small Appliances

- 5.1.1. Major Appliances

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Multi-Branded Stores

- 5.2.2. Specialty Stores

- 5.2.3. Online

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Kuwait

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Panasonic

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Orca

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sharp

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Kenwood

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Delonghi

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Moulinex

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Whirlpool

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Braun

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bosch

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Midea

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Panasonic

List of Figures

- Figure 1: Kuwait Home Appliances Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Kuwait Home Appliances Market Share (%) by Company 2025

List of Tables

- Table 1: Kuwait Home Appliances Market Revenue million Forecast, by Product 2020 & 2033

- Table 2: Kuwait Home Appliances Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 3: Kuwait Home Appliances Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Kuwait Home Appliances Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 5: Kuwait Home Appliances Market Revenue million Forecast, by Region 2020 & 2033

- Table 6: Kuwait Home Appliances Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Kuwait Home Appliances Market Revenue million Forecast, by Product 2020 & 2033

- Table 8: Kuwait Home Appliances Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 9: Kuwait Home Appliances Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 10: Kuwait Home Appliances Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 11: Kuwait Home Appliances Market Revenue million Forecast, by Country 2020 & 2033

- Table 12: Kuwait Home Appliances Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Kuwait Home Appliances Market?

The projected CAGR is approximately 6.5%.

2. Which companies are prominent players in the Kuwait Home Appliances Market?

Key companies in the market include Panasonic, Orca, Sharp, Kenwood, Delonghi, Moulinex, Whirlpool, Braun, Bosch, Midea.

3. What are the main segments of the Kuwait Home Appliances Market?

The market segments include Product, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 91.5 million as of 2022.

5. What are some drivers contributing to market growth?

Home Improvement Projects are Driving the Growth of the Market; A Positive Trend in Real-Estate Industry also Helps in Boosting the Growth.

6. What are the notable trends driving market growth?

Urban Areas Account for Majority of Sales in Market.

7. Are there any restraints impacting market growth?

Changing Consumer Preferences and Lifestyle Trends Influencing Demand for Certain Appliances.

8. Can you provide examples of recent developments in the market?

June 2022: TCL partners with Jashanmal to launch it's new range of AC's. The partnership will enable TCL to reach a wider customer base with its top-of-the-line home appliances and air conditioners (AC).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Kuwait Home Appliances Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Kuwait Home Appliances Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Kuwait Home Appliances Market?

To stay informed about further developments, trends, and reports in the Kuwait Home Appliances Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence