Key Insights

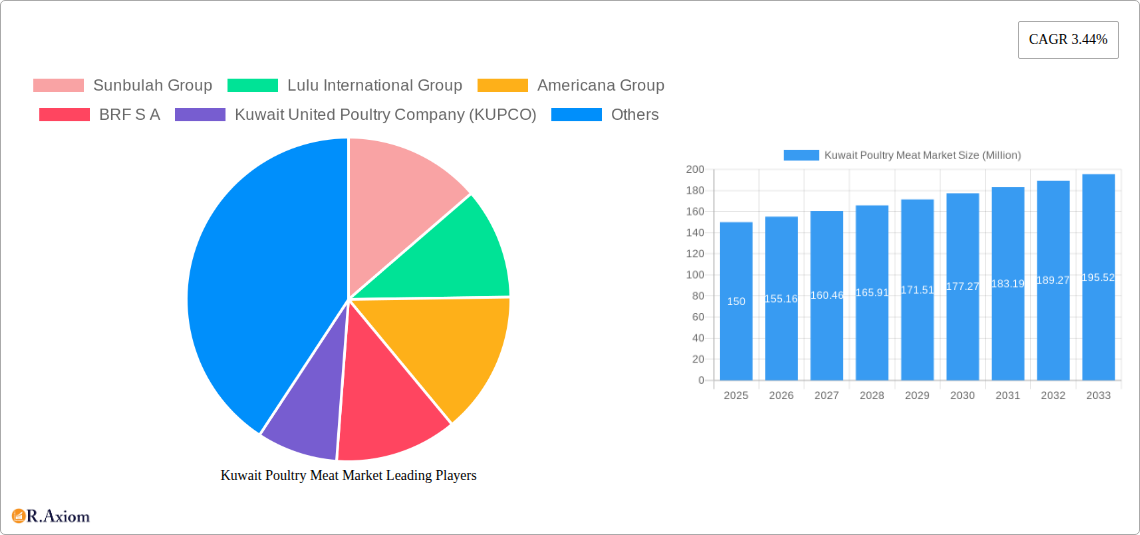

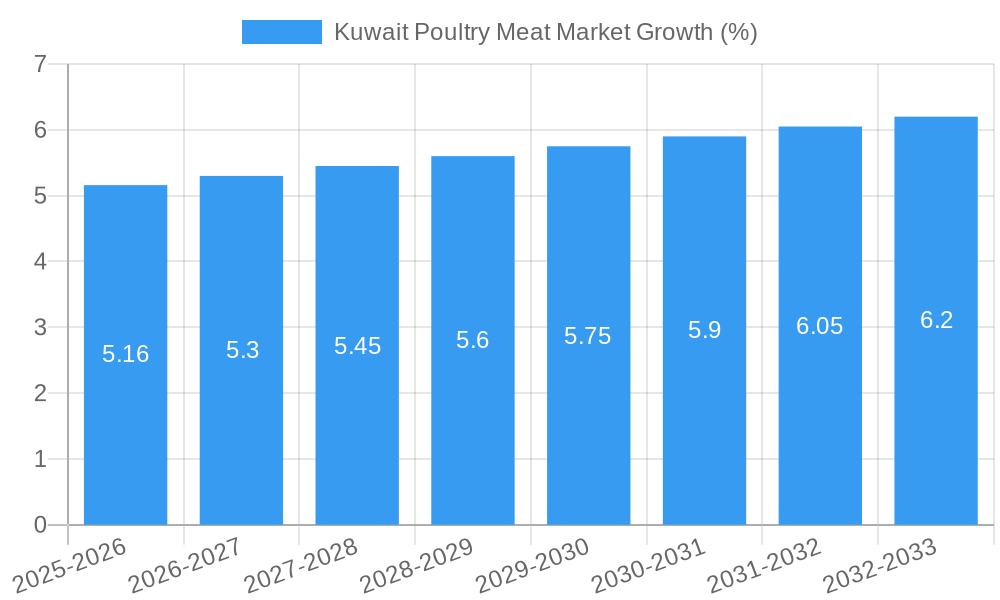

The Kuwait poultry meat market, valued at approximately $X million in 2025 (assuming a logical estimation based on the provided CAGR of 3.44% and the unspecified market size "XX"), is projected to witness steady growth throughout the forecast period (2025-2033). This growth is primarily driven by factors such as rising disposable incomes, increasing urbanization leading to changing dietary habits, and a preference for convenient and protein-rich food sources. The market is segmented by form (canned, fresh/chilled, frozen, processed), distribution channel (off-trade and on-trade), and major players such as Sunbulah Group, Lulu International Group, Americana Group, BRF S.A., Kuwait United Poultry Company (KUPCO), The Savola Group, JBS S.A., and Almarai Food Company are key competitors vying for market share. The increasing demand for processed poultry products, catering to the busy lifestyles of Kuwaiti consumers, is a significant trend shaping market growth. While the market faces constraints such as potential fluctuations in feed prices and government regulations, the overall outlook remains positive, indicating sustained market expansion in the coming years. The dominance of specific distribution channels and product forms will be an area of ongoing analysis as the market evolves.

The historical period (2019-2024) likely showed a growth trajectory consistent with the projected CAGR, although specific figures are unavailable. Analyzing the market share of key players reveals competitive dynamics and potential strategies employed. Further investigation could focus on consumer preferences and the impact of potential economic shifts on purchasing patterns. Considering the market's steady growth trajectory, strategic investments in supply chain efficiency and product diversification are expected to be important for companies aiming to capture a larger market share in the competitive landscape.

Kuwait Poultry Meat Market: A Comprehensive Report (2019-2033)

This meticulously researched report provides a detailed analysis of the Kuwait poultry meat market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The report covers the period from 2019 to 2033, with a focus on the base year 2025 and a forecast period extending to 2033. The historical period analyzed is 2019-2024. The market is segmented by form (Canned, Fresh/Chilled, Frozen, Processed), distribution channel (Off-Trade, On-Trade), and key players including Sunbulah Group, Lulu International Group, Americana Group, BRF S.A., Kuwait United Poultry Company (KUPCO), The Savola Group, JBS S.A., and Almarai Food Company. The report projects a market size of xx Million in 2025, with a xx% CAGR expected during the forecast period (2025-2033).

Kuwait Poultry Meat Market Concentration & Innovation

The Kuwait poultry meat market exhibits a moderately concentrated structure, with a few major players commanding significant market share. Sunbulah Group, Americana Group, and Lulu International Group are among the dominant players, collectively accounting for an estimated xx% of the market in 2025. Market concentration is influenced by factors such as economies of scale, brand recognition, and access to distribution networks.

Innovation in the sector is driven by consumer demand for healthier and more convenient options. This has led to the introduction of organic, gluten-free, and value-added products like marinated chicken. Regulatory frameworks, particularly concerning food safety and labeling, also play a crucial role in shaping market dynamics. The presence of substitute protein sources, such as beef and fish, presents competitive pressure. However, poultry remains a cost-effective and widely consumed protein source in Kuwait.

Mergers and acquisitions (M&A) activity has been moderate in recent years, with deal values estimated at xx Million in the past five years. These activities often aim to expand market reach, enhance product portfolios, and improve supply chain efficiency. End-user trends towards convenience and health consciousness are further driving innovation and shaping the competitive landscape.

Kuwait Poultry Meat Market Industry Trends & Insights

The Kuwait poultry meat market is characterized by consistent growth, fueled by a growing population, rising disposable incomes, and changing dietary habits. The market experienced a CAGR of xx% during the historical period (2019-2024). Technological disruptions, such as advancements in poultry farming and processing techniques, are contributing to increased efficiency and improved product quality. Consumer preferences are shifting towards healthier, ready-to-eat options, driving the demand for processed and marinated poultry products. Competitive dynamics are shaped by price competition, product differentiation, and brand loyalty. The market penetration of frozen poultry is expected to increase significantly in the forecast period due to its extended shelf life and convenience. Market growth is also driven by the increasing popularity of quick-service restaurants and food delivery services, which rely heavily on poultry meat. The market is expected to witness significant growth driven by factors including increasing urbanization, rising disposable incomes, and increasing preference for convenient food options.

Dominant Markets & Segments in Kuwait Poultry Meat Market

- Dominant Segment: The fresh/chilled segment holds the largest market share, driven by consumer preference for freshness and quality.

- Dominant Distribution Channel: The off-trade channel (supermarkets, hypermarkets, and retail stores) dominates the market due to its widespread accessibility and established distribution networks.

- Key Drivers:

- Economic Policies: Government support for the agricultural sector and stable economic conditions contribute to market growth.

- Infrastructure: Well-developed transportation and logistics networks facilitate efficient distribution of poultry products across the country.

- Consumer Preferences: A growing preference for convenient and readily available poultry products is driving market expansion.

The dominance of fresh/chilled poultry is attributed to consumer preference for taste and quality, while the off-trade channel benefits from widespread accessibility and established distribution infrastructure. The strong economic conditions and supportive government policies further contribute to the market’s robust growth.

Kuwait Poultry Meat Market Product Developments

Recent product innovations have focused on enhancing convenience, improving health attributes, and catering to diverse culinary preferences. The introduction of marinated and ready-to-cook poultry products reflects a growing demand for time-saving meal solutions. Technological advancements in processing and packaging are improving product shelf life and minimizing waste. The market has also seen the emergence of organic and gluten-free poultry options, responding to increasing health consciousness among consumers. These innovations demonstrate a focus on meeting evolving consumer demands and leveraging technological advancements to enhance product offerings.

Report Scope & Segmentation Analysis

This report segments the Kuwait poultry meat market based on form (canned, fresh/chilled, frozen, processed) and distribution channel (off-trade, on-trade).

Form: The fresh/chilled segment is projected to experience the highest growth, driven by consumer preference. The frozen segment is expected to show substantial growth due to its convenience and extended shelf life. Canned poultry holds a smaller market share but is expected to experience steady growth. The processed segment, encompassing marinated and value-added products, demonstrates high growth potential due to consumer preference for convenience.

Distribution Channel: The off-trade channel (supermarkets, hypermarkets, etc.) dominates the market, while the on-trade channel (restaurants, hotels, etc.) is expected to show moderate growth. Competitive dynamics vary across segments and channels, with competition being most intense in the fresh/chilled segment.

Key Drivers of Kuwait Poultry Meat Market Growth

Several factors fuel the growth of the Kuwait poultry meat market. Firstly, a steadily growing population increases demand for protein sources. Secondly, rising disposable incomes allow consumers to spend more on readily available and convenient food options, including poultry. Thirdly, government initiatives to support the agricultural sector and improve food security contribute to the market's expansion. Finally, increasing urbanization and changing lifestyles favor convenient and ready-to-eat poultry products.

Challenges in the Kuwait Poultry Meat Market Sector

The Kuwait poultry meat market faces several challenges. Fluctuations in global feed prices impact production costs and profitability. Stringent food safety regulations require significant investments in infrastructure and quality control. Intense competition among established players and the emergence of new entrants create price pressure. Furthermore, potential supply chain disruptions due to geopolitical factors or logistical bottlenecks can affect market stability. These factors can negatively impact overall market growth.

Emerging Opportunities in Kuwait Poultry Meat Market

The Kuwait poultry meat market presents several promising opportunities. The growing demand for healthy and organic products creates space for specialized poultry offerings. Expanding e-commerce and online food delivery platforms present new avenues for distribution and reaching a wider consumer base. Further innovation in processing techniques and product diversification can tap into untapped market segments. Finally, exploring niche markets such as specialized poultry cuts and value-added products could yield significant growth potential.

Leading Players in the Kuwait Poultry Meat Market Market

- Sunbulah Group

- Lulu International Group

- Americana Group

- BRF S.A.

- Kuwait United Poultry Company (KUPCO)

- The Savola Group

- JBS S.A.

- Almarai Food Company

Key Developments in Kuwait Poultry Meat Market Industry

- July 2020: Almarai Food Company introduced new marinated chicken products (tandoori, smoked barbecue, kabsa), expanding its product portfolio and targeting new consumer segments.

- January 2021: Sunbulah Group launched a range of organic and gluten-free products, responding to growing consumer demand for healthier options.

Strategic Outlook for Kuwait Poultry Meat Market Market

The Kuwait poultry meat market is poised for sustained growth driven by a combination of factors including population growth, rising disposable incomes, and a preference for convenient food options. Opportunities exist for companies to innovate with healthier, value-added products and leverage technological advancements to enhance efficiency and sustainability. Strategic partnerships and investments in modernizing processing and distribution infrastructure will be key to capturing market share and ensuring long-term success. The market’s future growth potential is promising, particularly for companies that can adapt to changing consumer preferences and technological advancements.

Kuwait Poultry Meat Market Segmentation

-

1. Form

- 1.1. Canned

- 1.2. Fresh / Chilled

- 1.3. Frozen

-

1.4. Processed

-

1.4.1. By Processed Types

- 1.4.1.1. Deli Meats

- 1.4.1.2. Marinated/ Tenders

- 1.4.1.3. Meatballs

- 1.4.1.4. Nuggets

- 1.4.1.5. Sausages

- 1.4.1.6. Other Processed Poultry

-

1.4.1. By Processed Types

-

2. Distribution Channel

-

2.1. Off-Trade

- 2.1.1. Convenience Stores

- 2.1.2. Online Channel

- 2.1.3. Supermarkets and Hypermarkets

- 2.1.4. Others

- 2.2. On-Trade

-

2.1. Off-Trade

Kuwait Poultry Meat Market Segmentation By Geography

- 1. Kuwait

Kuwait Poultry Meat Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.44% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Clean Label Food & Beverage Products; Rising Demand for Dairy Products

- 3.3. Market Restrains

- 3.3.1. Presence of Preservatives in Ready Meals may Hamper the Market Growth

- 3.4. Market Trends

- 3.4.1 The demand for poultry meat surges as separate counters captivate consumers

- 3.4.2 thus driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Kuwait Poultry Meat Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Canned

- 5.1.2. Fresh / Chilled

- 5.1.3. Frozen

- 5.1.4. Processed

- 5.1.4.1. By Processed Types

- 5.1.4.1.1. Deli Meats

- 5.1.4.1.2. Marinated/ Tenders

- 5.1.4.1.3. Meatballs

- 5.1.4.1.4. Nuggets

- 5.1.4.1.5. Sausages

- 5.1.4.1.6. Other Processed Poultry

- 5.1.4.1. By Processed Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Off-Trade

- 5.2.1.1. Convenience Stores

- 5.2.1.2. Online Channel

- 5.2.1.3. Supermarkets and Hypermarkets

- 5.2.1.4. Others

- 5.2.2. On-Trade

- 5.2.1. Off-Trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Kuwait

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Sunbulah Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Lulu International Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Americana Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BRF S A

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kuwait United Poultry Company (KUPCO)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 The Savola Grou

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 JBS SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Almarai Food Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Sunbulah Group

List of Figures

- Figure 1: Kuwait Poultry Meat Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Kuwait Poultry Meat Market Share (%) by Company 2024

List of Tables

- Table 1: Kuwait Poultry Meat Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Kuwait Poultry Meat Market Revenue Million Forecast, by Form 2019 & 2032

- Table 3: Kuwait Poultry Meat Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Kuwait Poultry Meat Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Kuwait Poultry Meat Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Kuwait Poultry Meat Market Revenue Million Forecast, by Form 2019 & 2032

- Table 7: Kuwait Poultry Meat Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 8: Kuwait Poultry Meat Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Kuwait Poultry Meat Market?

The projected CAGR is approximately 3.44%.

2. Which companies are prominent players in the Kuwait Poultry Meat Market?

Key companies in the market include Sunbulah Group, Lulu International Group, Americana Group, BRF S A, Kuwait United Poultry Company (KUPCO), The Savola Grou, JBS SA, Almarai Food Company.

3. What are the main segments of the Kuwait Poultry Meat Market?

The market segments include Form, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Clean Label Food & Beverage Products; Rising Demand for Dairy Products.

6. What are the notable trends driving market growth?

The demand for poultry meat surges as separate counters captivate consumers. thus driving the market.

7. Are there any restraints impacting market growth?

Presence of Preservatives in Ready Meals may Hamper the Market Growth.

8. Can you provide examples of recent developments in the market?

January 2021: Sunbulah Group announced the launch of range of products and SKUs that will be completely organic and gluten-free, due to the increasing demand.July 2020: Almarai Food Company introduced new products in the market, including marinated whole chicken tandoori, marinated whole chicken smoked barbecue, marinated whole chicken smoked barbecue, and marinated half chicken kabsa, thus penetrating new customer segments and increasing market share.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Kuwait Poultry Meat Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Kuwait Poultry Meat Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Kuwait Poultry Meat Market?

To stay informed about further developments, trends, and reports in the Kuwait Poultry Meat Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence