Key Insights

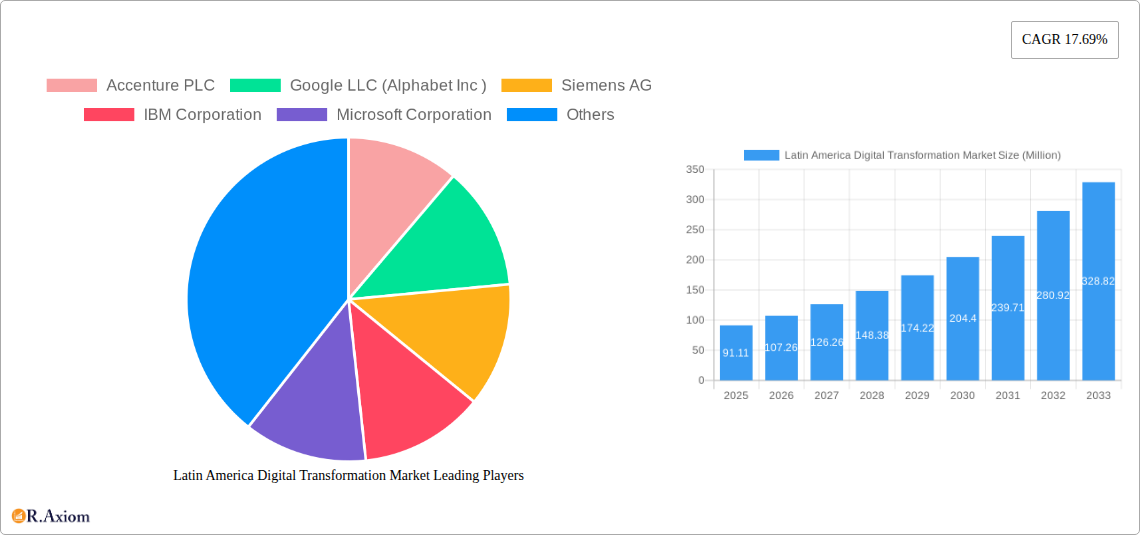

The Latin American Digital Transformation market is experiencing robust growth, projected to reach \$91.11 million in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 17.69% from 2025 to 2033. This expansion is driven by several key factors. Firstly, increasing government initiatives promoting digitalization across various sectors, including healthcare, finance, and education, are creating a fertile ground for technological adoption. Secondly, the burgeoning e-commerce sector and the rising penetration of smartphones and internet access are fueling demand for digital solutions. Furthermore, the region's large and increasingly young population presents a significant opportunity for businesses to leverage digital platforms to reach new customers and improve operational efficiency. Companies are investing heavily in cloud computing, artificial intelligence, and data analytics to improve customer experiences, streamline processes, and gain a competitive edge. While challenges such as digital literacy gaps and infrastructure limitations remain, the overall trajectory points towards sustained growth, particularly in Brazil, Mexico, and Colombia, which are leading the digital transformation efforts within the region.

Latin America Digital Transformation Market Market Size (In Million)

The competitive landscape is marked by a mix of global technology giants and regional players. Major multinational corporations like Accenture, Google, IBM, Microsoft, and Amazon Web Services are actively investing in the region, offering a wide range of digital solutions. These companies are leveraging their extensive expertise and global reach to cater to the specific needs of Latin American businesses. However, smaller, regionally focused companies are also contributing significantly, particularly in niche markets. Their deep understanding of local market dynamics and regulatory landscapes gives them a competitive advantage. The success of these companies hinges on their ability to provide tailored solutions that address the unique challenges and opportunities presented by the diverse Latin American markets. Looking ahead, the market will likely see further consolidation, with larger players acquiring smaller companies to expand their reach and capabilities.

Latin America Digital Transformation Market Company Market Share

This comprehensive report provides an in-depth analysis of the Latin America Digital Transformation Market, covering the period from 2019 to 2033. It offers invaluable insights into market dynamics, growth drivers, challenges, and opportunities, empowering businesses to make informed strategic decisions. The report leverages extensive data analysis, incorporating both historical and projected market values (in Millions) to provide a holistic view of this rapidly evolving landscape. Key segments, leading players, and recent industry developments are meticulously examined. The Base Year is 2025, with an Estimated Year of 2025 and a Forecast Period of 2025-2033. The Historical Period covered is 2019-2024.

Latin America Digital Transformation Market Concentration & Innovation

This section analyzes the competitive landscape of the Latin American digital transformation market, exploring market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and M&A activities. The market is characterized by a mix of global tech giants and regional players, resulting in a moderately concentrated market structure. While precise market share data for each player is proprietary to the full report, we can observe significant presence by companies like Accenture PLC, Google LLC (Alphabet Inc), Siemens AG, IBM Corporation, Microsoft Corporation, and others.

- Innovation Drivers: The market is driven by increasing adoption of cloud computing, AI, IoT, and big data analytics, alongside government initiatives promoting digitalization.

- Regulatory Frameworks: Varying regulatory landscapes across Latin American countries influence market growth and investment decisions, creating both opportunities and challenges.

- Product Substitutes: The emergence of open-source solutions and alternative technologies presents some competitive pressure, though the overall market remains robust.

- End-User Trends: Businesses across various sectors are increasingly adopting digital transformation strategies to improve efficiency, enhance customer experience, and gain a competitive edge.

- M&A Activities: The report details several significant mergers and acquisitions within the period, including deals valued at xx Million (exact figures available in the full report). These activities reflect the consolidation efforts and strategic expansion strategies of key players.

Latin America Digital Transformation Market Industry Trends & Insights

This section delves into the key trends shaping the Latin American digital transformation market. The market is experiencing significant growth, driven by factors like increasing internet and smartphone penetration, rising digital literacy, and government support for digital initiatives. The Compound Annual Growth Rate (CAGR) during the forecast period is estimated at xx%. Market penetration for key technologies like cloud computing and AI is also steadily increasing, contributing significantly to market expansion. The competitive dynamics are characterized by intense competition among global technology giants and regional players vying for market share. Consumer preferences are shifting towards user-friendly, cost-effective, and secure digital solutions. Technological disruptions, such as the rapid advancement of AI and blockchain, are reshaping market landscape, creating new opportunities and challenges.

Dominant Markets & Segments in Latin America Digital Transformation Market

Brazil and Mexico currently dominate the Latin American digital transformation market, accounting for the largest market share due to their larger economies and advanced digital infrastructure. Other countries such as Colombia, Argentina, and Chile are showing strong growth potential.

- Key Drivers for Brazil and Mexico:

- Robust digital infrastructure investments.

- Large and growing middle class with increasing internet penetration.

- Supportive government policies fostering digital adoption.

- Strong presence of major tech players.

Detailed analysis of regional differences, including market size projections and segment performance across key countries, are available in the complete report.

Latin America Digital Transformation Market Product Developments

Recent product developments highlight the continuous innovation in the market. Companies are focusing on developing tailored solutions to address the specific needs of Latin American businesses and consumers. These developments range from cloud-based enterprise resource planning (ERP) systems to AI-powered customer relationship management (CRM) tools and specialized cybersecurity solutions addressing the unique regional challenges. The focus is on improving user experience, enhancing integration capabilities, and ensuring data security and compliance with local regulations.

Report Scope & Segmentation Analysis

This report segments the Latin America Digital Transformation Market based on various factors including technology (Cloud Computing, Big Data & Analytics, Artificial Intelligence, Internet of Things (IoT), Cybersecurity), service (Consulting, System Integration, Application Development & Maintenance, Infrastructure Management), industry vertical (BFSI, Healthcare, Government, Retail, Manufacturing, Telecom, Energy), and country. Each segment’s market size, growth rate, and competitive landscape are extensively analyzed. The detailed segmentation provides granular insights into market opportunities within each area.

Key Drivers of Latin America Digital Transformation Market Growth

The market's growth is propelled by several key factors, including:

- Technological advancements: The continuous development and adoption of new technologies like AI, cloud computing, and IoT are fundamentally changing business operations and consumer behavior.

- Government initiatives: Many Latin American governments are actively promoting digitalization through investment in infrastructure and the implementation of favorable regulatory frameworks.

- Economic growth: The overall economic growth in the region is driving increased investment in digital transformation initiatives, particularly amongst larger businesses.

- Rising digital literacy: Growing digital literacy is leading to higher adoption rates of digital technologies across different sectors.

Challenges in the Latin America Digital Transformation Market Sector

Despite considerable opportunities, challenges remain:

- Digital divide: Unequal access to technology and internet connectivity across the region remains a significant barrier, limiting the full potential of digital transformation.

- Cybersecurity concerns: The increasing reliance on digital technologies has heightened cybersecurity risks, posing a challenge for businesses and individuals alike.

- Lack of skilled workforce: A shortage of skilled professionals hinders the successful implementation of digital transformation projects.

- High implementation costs: The initial investment required for digital transformation can be prohibitive for some businesses, particularly small and medium-sized enterprises (SMEs).

Emerging Opportunities in Latin America Digital Transformation Market

Significant opportunities exist in:

- Fintech: The rapid growth of the fintech sector presents numerous opportunities for digital transformation solutions.

- E-commerce: The increasing adoption of e-commerce is driving the need for advanced logistics and supply chain management solutions.

- Digital government services: Governments are increasingly adopting digital platforms to improve citizen services and enhance efficiency.

- Healthcare IT: The healthcare sector is undergoing significant digital transformation, creating opportunities for solutions in areas such as telemedicine and electronic health records (EHRs).

Leading Players in the Latin America Digital Transformation Market Market

- Accenture PLC

- Google LLC (Alphabet Inc)

- Siemens AG

- IBM Corporation

- Microsoft Corporation

- Cognex Corporation

- Hewlett Packard Enterprise

- SAP SE

- EMC Corporation (Dell EMC)

- Oracle Corporation

- Adobe Inc

- Amazon Web Services Inc

- Apple Inc

- Salesforce com Inc

- Cisco Systems Inc

Key Developments in Latin America Digital Transformation Market Industry

- May 2024: Meltio launched its Meltio M600 Additive Manufacturing solution in Latin America, partnering with MAS Metrology & Solutions and Molinari in Brazil and Argentina.

- April 2024: ArcomedLab completed over 700 successful craniomaxillofacial implant cases across Latin America, highlighting the growing adoption of 3D printing in healthcare.

Strategic Outlook for Latin America Digital Transformation Market Market

The Latin America Digital Transformation Market is poised for sustained growth in the coming years. Continued investment in digital infrastructure, supportive government policies, and the increasing adoption of innovative technologies will drive market expansion. The focus will shift towards more specialized and tailored solutions that cater to the unique needs of specific industries and regions. Companies that can effectively address cybersecurity concerns, bridge the digital divide, and develop solutions that are both affordable and user-friendly will be best positioned to succeed in this dynamic market.

Latin America Digital Transformation Market Segmentation

-

1. Type

-

1.1. Analytic

- 1.1.1. Current

- 1.1.2. Key Grow

- 1.1.3. Use Case Analysis

- 1.1.4. Market Outlook

- 1.2. Extended Reality (XR)

- 1.3. IoT

- 1.4. Industrial Robotics

- 1.5. Blockchain

- 1.6. Additive Manufacturing/3D Printing

- 1.7. Cybersecurity

- 1.8. Cloud and Edge Computing

-

1.9. Others (digital twin, mobility and connectivity)

- 1.9.1. Market B

-

1.1. Analytic

-

2. End-User Industry

- 2.1. Manufacturing

- 2.2. Oil, Gas and Utilities

- 2.3. Retail & E-commerce

- 2.4. Transportation and Logistics

- 2.5. Healthcare

- 2.6. BFSI

- 2.7. Telecom and IT

- 2.8. Government and Public Sector

- 2.9. Others (

Latin America Digital Transformation Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Digital Transformation Market Regional Market Share

Geographic Coverage of Latin America Digital Transformation Market

Latin America Digital Transformation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 17.69% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in the adoption of big data analytics and other technologies in Latin America; The rapid proliferation of mobile devices and apps

- 3.3. Market Restrains

- 3.3.1. Increase in the adoption of big data analytics and other technologies in Latin America; The rapid proliferation of mobile devices and apps

- 3.4. Market Trends

- 3.4.1. The IoT Segment is Expected to Occupy the Largest Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Digital Transformation Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Analytic

- 5.1.1.1. Current

- 5.1.1.2. Key Grow

- 5.1.1.3. Use Case Analysis

- 5.1.1.4. Market Outlook

- 5.1.2. Extended Reality (XR)

- 5.1.3. IoT

- 5.1.4. Industrial Robotics

- 5.1.5. Blockchain

- 5.1.6. Additive Manufacturing/3D Printing

- 5.1.7. Cybersecurity

- 5.1.8. Cloud and Edge Computing

- 5.1.9. Others (digital twin, mobility and connectivity)

- 5.1.9.1. Market B

- 5.1.1. Analytic

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Manufacturing

- 5.2.2. Oil, Gas and Utilities

- 5.2.3. Retail & E-commerce

- 5.2.4. Transportation and Logistics

- 5.2.5. Healthcare

- 5.2.6. BFSI

- 5.2.7. Telecom and IT

- 5.2.8. Government and Public Sector

- 5.2.9. Others (

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Accenture PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Google LLC (Alphabet Inc )

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Siemens AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 IBM Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Microsoft Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cognex Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hewlett Packard Enterprise

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SAP SE

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 EMC Corporation (Dell EMC)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Oracle Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Adobe Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Amazon Web Services Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Apple Inc

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Salesforce com Inc

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Cisco Systems Inc

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Accenture PLC

List of Figures

- Figure 1: Latin America Digital Transformation Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Latin America Digital Transformation Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Digital Transformation Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Latin America Digital Transformation Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Latin America Digital Transformation Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 4: Latin America Digital Transformation Market Volume Billion Forecast, by End-User Industry 2020 & 2033

- Table 5: Latin America Digital Transformation Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Latin America Digital Transformation Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Latin America Digital Transformation Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Latin America Digital Transformation Market Volume Billion Forecast, by Type 2020 & 2033

- Table 9: Latin America Digital Transformation Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 10: Latin America Digital Transformation Market Volume Billion Forecast, by End-User Industry 2020 & 2033

- Table 11: Latin America Digital Transformation Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Latin America Digital Transformation Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: Brazil Latin America Digital Transformation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Brazil Latin America Digital Transformation Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Argentina Latin America Digital Transformation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Argentina Latin America Digital Transformation Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: Chile Latin America Digital Transformation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Chile Latin America Digital Transformation Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Colombia Latin America Digital Transformation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Colombia Latin America Digital Transformation Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Mexico Latin America Digital Transformation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Mexico Latin America Digital Transformation Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Peru Latin America Digital Transformation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Peru Latin America Digital Transformation Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Venezuela Latin America Digital Transformation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Venezuela Latin America Digital Transformation Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Ecuador Latin America Digital Transformation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Ecuador Latin America Digital Transformation Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Bolivia Latin America Digital Transformation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Bolivia Latin America Digital Transformation Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Paraguay Latin America Digital Transformation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Paraguay Latin America Digital Transformation Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Digital Transformation Market?

The projected CAGR is approximately 17.69%.

2. Which companies are prominent players in the Latin America Digital Transformation Market?

Key companies in the market include Accenture PLC, Google LLC (Alphabet Inc ), Siemens AG, IBM Corporation, Microsoft Corporation, Cognex Corporation, Hewlett Packard Enterprise, SAP SE, EMC Corporation (Dell EMC), Oracle Corporation, Adobe Inc, Amazon Web Services Inc, Apple Inc, Salesforce com Inc, Cisco Systems Inc.

3. What are the main segments of the Latin America Digital Transformation Market?

The market segments include Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 91.11 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in the adoption of big data analytics and other technologies in Latin America; The rapid proliferation of mobile devices and apps.

6. What are the notable trends driving market growth?

The IoT Segment is Expected to Occupy the Largest Market Share.

7. Are there any restraints impacting market growth?

Increase in the adoption of big data analytics and other technologies in Latin America; The rapid proliferation of mobile devices and apps.

8. Can you provide examples of recent developments in the market?

May 2024: Meltio, introduced its new Meltio M600 for the first time in Latin America in collaboration with its new sales partners MAS Metrology & Solutions and Molinari in Brazil and Argentina. This group, which had a strong commercial presence in Brazil and Argentina, became Meltio’s official sales partner. Their goal was to promote sales of Meltio’s patented wire laser metal Additive Manufacturing solutions in Latin America.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Digital Transformation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Digital Transformation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Digital Transformation Market?

To stay informed about further developments, trends, and reports in the Latin America Digital Transformation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence