Key Insights

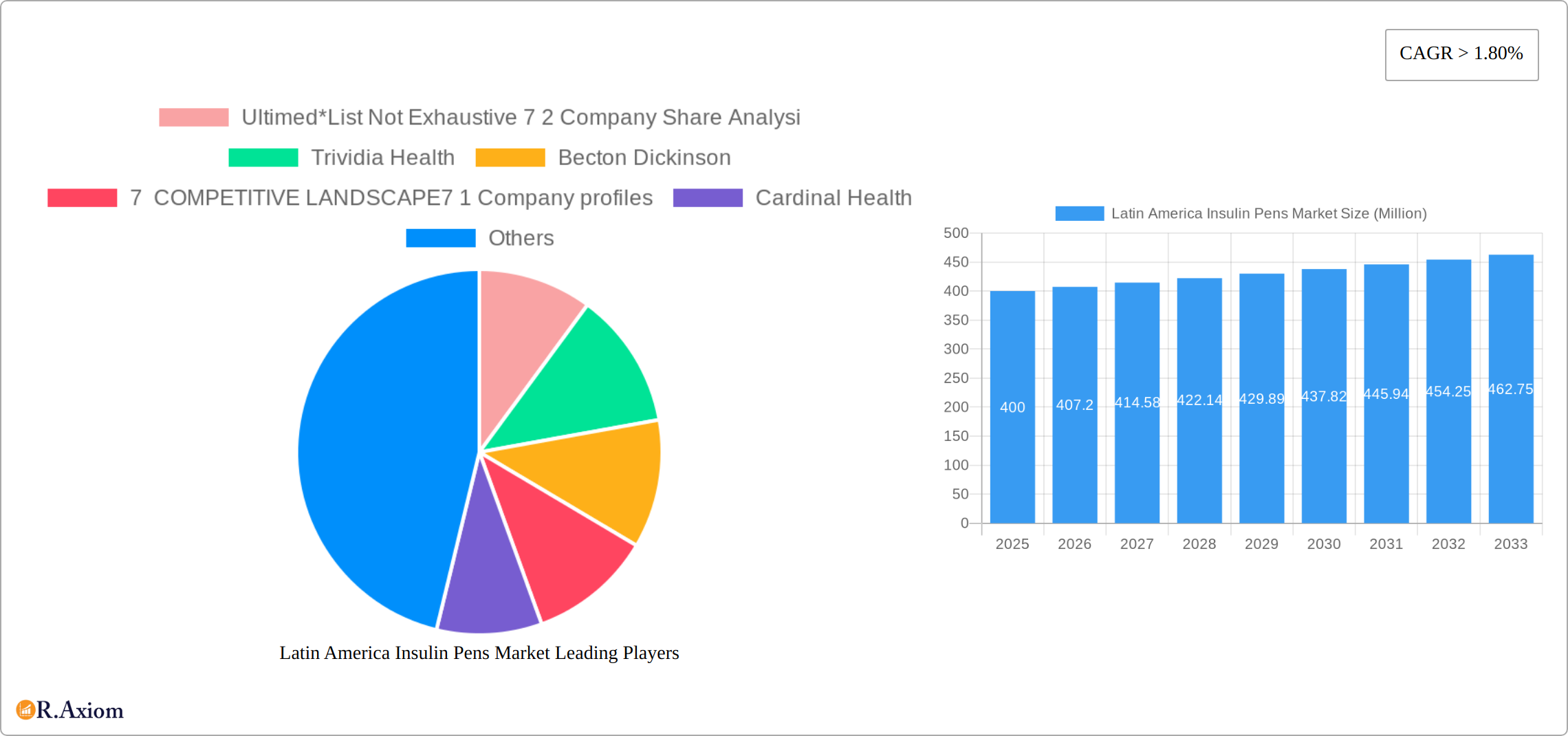

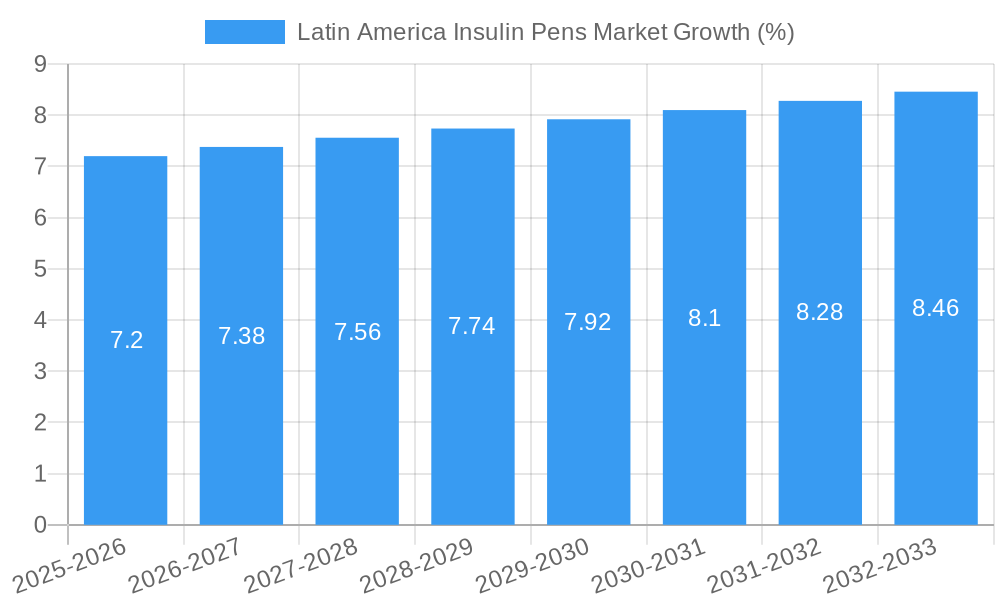

The Latin American insulin pens market, valued at $400 million in 2025, is projected to experience robust growth, driven by rising diabetes prevalence, increasing disposable incomes, and improved healthcare infrastructure across the region. This growth is particularly significant in countries like Brazil, Argentina, and Mexico, which constitute a substantial portion of the regional market. The market's Compound Annual Growth Rate (CAGR) exceeding 1.80% indicates a steady expansion over the forecast period (2025-2033). The market segmentation reveals a preference for both disposable insulin pens and cartridges used in reusable pens, catering to diverse patient needs and preferences. Key players such as Ultimed, Trividia Health, Becton Dickinson, Cardinal Health, and Arkray are actively shaping the competitive landscape through product innovation, strategic partnerships, and market penetration efforts. The increasing adoption of advanced insulin delivery systems and the growing awareness of diabetes management contribute to the market's positive outlook. While potential restraints such as high medication costs and limited access to healthcare in certain regions exist, the overall market trajectory remains optimistic, with substantial growth opportunities anticipated throughout the forecast period.

The continued rise in diabetes prevalence, particularly type 2 diabetes linked to lifestyle changes, fuels the demand for insulin pens. Government initiatives aimed at improving diabetes care and access to affordable medications further support market expansion. The increasing availability of innovative insulin pen designs, incorporating features like dose accuracy and ease of use, also contributes to market growth. Furthermore, the growing presence of pharmaceutical companies and medical device manufacturers in Latin America enhances market competitiveness and product accessibility. The market is expected to see significant investment in research and development to improve insulin pen technology and address specific needs of the Latin American population. This combination of factors positions the Latin American insulin pens market for consistent and substantial growth in the coming years.

Latin America Insulin Pens Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Latin America insulin pens market, covering the period from 2019 to 2033. The study meticulously examines market dynamics, competitive landscapes, and future growth prospects, offering actionable insights for industry stakeholders. With a base year of 2025 and an estimated year of 2025, the report forecasts market trends until 2033, incorporating historical data from 2019-2024. The report segments the market by device type: Disposable Insulin Pens and Cartridges in Reusable Pens. The market size is expressed in Millions.

Latin America Insulin Pens Market Concentration & Innovation

This section analyzes the market concentration, innovation drivers, regulatory landscape, product substitutes, end-user trends, and mergers & acquisitions (M&A) activities within the Latin America insulin pens market. The report assesses market share distribution among key players and explores the impact of M&A activities on market dynamics, providing insights into deal values (where available).

Market Concentration: The report quantifies market concentration using metrics like the Herfindahl-Hirschman Index (HHI) or similar indicators to reveal the level of competition. xx% of the market is held by the top 7 players. Ultimed, Trividia Health, Becton Dickinson, Cardinal Health, and Arkray are key players analyzed within the competitive landscape. The analysis assesses the implications of this concentration on pricing, innovation, and market access.

Innovation: The report identifies key innovation drivers, such as the development of smart insulin pens and improved delivery systems. It examines the role of technological advancements in shaping market trends and enhancing patient outcomes. The report also assesses the impact of regulatory frameworks on innovation and the adoption of new technologies.

Regulatory Frameworks: The report examines the influence of regulatory bodies and their impact on market access, pricing, and product approvals. This includes an assessment of variations in regulatory requirements across different Latin American countries.

Product Substitutes: The report explores potential substitutes for insulin pens and analyzes their impact on market competition and growth.

End-User Trends: The report analyzes changing patient demographics, treatment patterns, and preferences that are impacting demand for insulin pens in Latin America.

M&A Activities: The report documents significant M&A deals within the Latin American insulin pens market during the study period, providing insights into deal values and their influence on market consolidation and competitive dynamics. For example, xx Million was the total value of M&A deals in 2024.

Latin America Insulin Pens Market Industry Trends & Insights

This section delves into the key industry trends and insights shaping the Latin America insulin pens market. It explores market growth drivers, technological disruptions, consumer preferences, and competitive dynamics. The report provides a detailed analysis of the market's Compound Annual Growth Rate (CAGR) and market penetration rates.

The market is expected to witness significant growth driven by rising diabetes prevalence, increasing healthcare expenditure, and growing awareness of diabetes management techniques. Technological disruptions, such as the development of smart insulin pens with connectivity features, are further influencing market trends. The changing consumer preferences toward convenience and improved treatment outcomes are shaping demand. The competitive dynamics are characterized by intense competition among established players and the emergence of new entrants. The report examines these factors, analyzing their individual and collective impact on market growth. The CAGR for the forecast period (2025-2033) is estimated at xx%. Market penetration is expected to increase from xx% in 2025 to xx% by 2033.

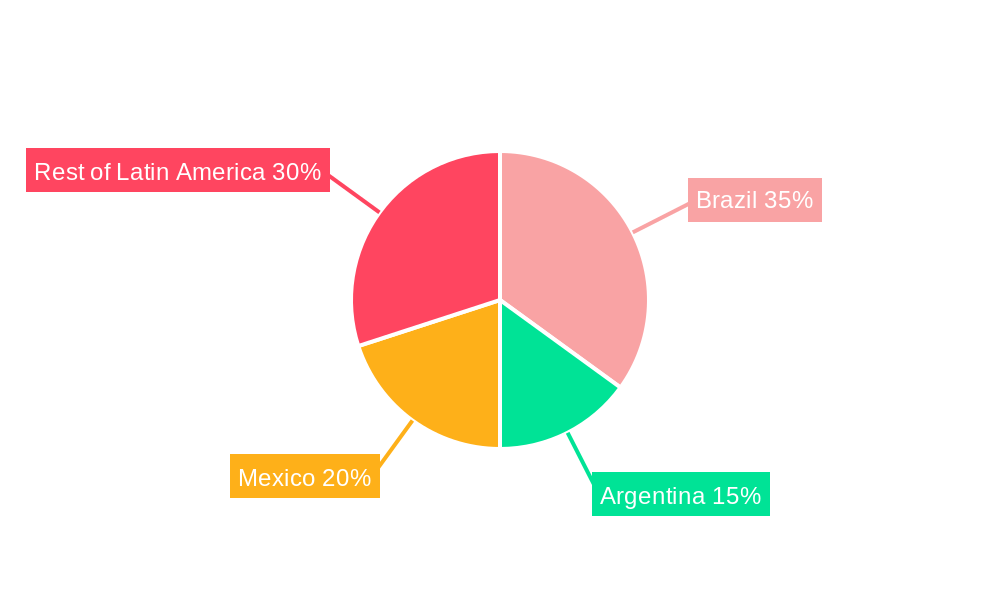

Dominant Markets & Segments in Latin America Insulin Pens Market

This section identifies the leading regions, countries, and segments within the Latin America insulin pens market. It analyzes the factors contributing to the dominance of specific markets or segments.

Leading Region/Country: [Specify the leading region/country and justify the dominance using specific metrics and analysis of factors such as economic growth, healthcare infrastructure, and diabetes prevalence]. For example, Brazil is a significant market due to its large diabetic population and improving healthcare infrastructure.

Leading Segment: [Specify the leading segment - whether Disposable Insulin Pens or Cartridges in Reusable Pens - and explain its dominance based on factors such as pricing, convenience, and technological advancements]. Disposable insulin pens are currently the dominant segment, but the market share of reusable pens is projected to increase over the forecast period due to cost-effectiveness.

Key Drivers of Dominance:

- Economic Policies: Government initiatives to improve healthcare access play a significant role in market growth.

- Healthcare Infrastructure: The availability of hospitals, clinics, and trained healthcare professionals influences market penetration.

- Diabetes Prevalence: The high incidence of diabetes within a particular region or country is a key driver of demand for insulin pens.

The report also examines the impact of these factors on the relative growth of different segments within the chosen leading market.

Latin America Insulin Pens Market Product Developments

This section summarizes recent product innovations, applications, and competitive advantages in the Latin America insulin pens market. The focus is on technological trends and how products address market needs.

Recent technological advancements have led to the development of smart insulin pens with features like dose tracking, connectivity, and data logging. These innovations improve patient adherence to treatment and provide valuable data for healthcare providers. The market is witnessing a shift towards more user-friendly and convenient devices, catering to the evolving needs of patients with diabetes. The increased emphasis on personalized medicine further drives product innovation.

Report Scope & Segmentation Analysis

This section provides a detailed segmentation analysis of the Latin America insulin pens market, offering insights into growth projections, market sizes, and competitive landscapes within each segment. The analysis considers various factors influencing market dynamics, including technological advancements, regulatory changes, and evolving healthcare infrastructure.

Device Type:

Disposable Insulin Pens: This segment holds a substantial market share, driven by factors such as ease of use, portability, and reduced risk of contamination. Growth is expected to remain steady, fueled by increasing diabetes prevalence and a preference for convenient self-administration. The competitive landscape is highly dynamic, with manufacturers focusing on product differentiation through features like improved injection comfort, dose accuracy, and user-friendly design. Pricing strategies also play a significant role in market share.

Cartridges in Reusable Pens: This segment exhibits rising adoption rates, primarily due to its cost-effectiveness compared to disposable pens and its contribution to reduced medical waste. The report offers a comprehensive analysis of market size, growth trajectories, and competitive dynamics, including strategies employed by manufacturers to optimize cartridge design, improve compatibility, and enhance overall user experience.

The report provides a granular overview of market size, growth forecasts, and competitive dynamics within each segment, incorporating current market trends and projecting future market behavior based on established models and expert insights. This analysis considers regional variations within Latin America, acknowledging the diverse healthcare systems and economic conditions prevalent across the region.

Key Drivers of Latin America Insulin Pens Market Growth

The Latin America insulin pens market is experiencing strong growth due to several key factors. The rising prevalence of diabetes, particularly type 2 diabetes, is a major driver. Improvements in healthcare infrastructure and increased access to healthcare are also contributing to market expansion. Furthermore, growing government initiatives to promote diabetes awareness and management, along with technological advancements leading to the development of more user-friendly and effective insulin delivery systems, are driving market growth.

Challenges in the Latin America Insulin Pens Market Sector

Despite the significant growth potential, several challenges hinder the Latin America insulin pens market. High cost of insulin and related supplies creates a significant barrier to access, particularly for patients in lower-income segments. Inadequate healthcare infrastructure in some regions limits access to proper diabetes management and insulin delivery. Stringent regulatory hurdles for new product approvals further pose a challenge. Finally, counterfeit products and inconsistent supply chains represent additional significant challenges.

Emerging Opportunities in Latin America Insulin Pens Market

The Latin America insulin pens market presents substantial emerging opportunities driven by several key factors. The increasing prevalence of diabetes across the region is a major driver, along with the rising adoption of telemedicine and remote patient monitoring systems. These digital health solutions facilitate better diabetes management and expand access to care, particularly in remote areas. Simultaneously, the growth of the middle class and increased health awareness are creating a larger market of informed consumers actively seeking better diabetes control. Finally, the increasing availability of affordable, innovative insulin pens with advanced features is fostering wider adoption and market expansion. This includes pens with improved accuracy, comfort features, and integrated technological capabilities.

Leading Players in the Latin America Insulin Pens Market

- Ultimed

- Trividia Health

- Becton Dickinson

- Cardinal Health

- Arkray

- Novo Nordisk (with growing influence)

- Gan & Lee (expanding presence)

Key Developments in Latin America Insulin Pens Market Industry

July 2023: Gan & Lee's significant contract to supply insulin cartridges and reusable pens to Brazil marks a substantial market entry, indicating increased competition and potential for market disruption. This highlights the growing demand and potential for new players to gain a foothold in the region.

March 2022: Novo Nordisk's launch of advanced insulin pens in the United Kingdom, while outside Latin America, signals a global trend towards technologically sophisticated insulin delivery systems. This development suggests that similar innovations are likely to be introduced to the Latin American market in the near future, shaping market competition and influencing consumer preferences.

[Add other relevant recent developments here, with dates and brief descriptions. Include mergers, acquisitions, new product launches specifically in Latin America, regulatory approvals, etc.]

Strategic Outlook for Latin America Insulin Pens Market

The Latin America insulin pens market is poised for continued growth driven by increasing diabetes prevalence, expanding healthcare infrastructure, and technological advancements. The focus on improving affordability and accessibility through innovative products and government initiatives will further stimulate market expansion. Companies focusing on product innovation, strategic partnerships, and effective market penetration strategies are well-positioned to capitalize on the significant growth potential of this market.

Latin America Insulin Pens Market Segmentation

-

1. Device

- 1.1. Disposable Insulin Pens

- 1.2. Cartridges in Reusable Pens

-

2. Geography

- 2.1. Brazil

- 2.2. Mexico

- 2.3. Rest of Latin America

Latin America Insulin Pens Market Segmentation By Geography

- 1. Brazil

- 2. Mexico

- 3. Rest of Latin America

Latin America Insulin Pens Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 1.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Early Diagnosis of Chronic Conditions; Increasing Incidence of Trauma and Accidents; Surge in the Number of Surgical Procedures Carried Out Worldwide

- 3.3. Market Restrains

- 3.3.1. Blood Contaminations and Other Complications; Injury Caused During Blood Collection

- 3.4. Market Trends

- 3.4.1. Rising diabetes prevalence in Latin America is driving the market in the forecast period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Insulin Pens Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Device

- 5.1.1. Disposable Insulin Pens

- 5.1.2. Cartridges in Reusable Pens

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Brazil

- 5.2.2. Mexico

- 5.2.3. Rest of Latin America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.3.2. Mexico

- 5.3.3. Rest of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Device

- 6. Brazil Latin America Insulin Pens Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Device

- 6.1.1. Disposable Insulin Pens

- 6.1.2. Cartridges in Reusable Pens

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Brazil

- 6.2.2. Mexico

- 6.2.3. Rest of Latin America

- 6.1. Market Analysis, Insights and Forecast - by Device

- 7. Mexico Latin America Insulin Pens Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Device

- 7.1.1. Disposable Insulin Pens

- 7.1.2. Cartridges in Reusable Pens

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Brazil

- 7.2.2. Mexico

- 7.2.3. Rest of Latin America

- 7.1. Market Analysis, Insights and Forecast - by Device

- 8. Rest of Latin America Latin America Insulin Pens Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Device

- 8.1.1. Disposable Insulin Pens

- 8.1.2. Cartridges in Reusable Pens

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Brazil

- 8.2.2. Mexico

- 8.2.3. Rest of Latin America

- 8.1. Market Analysis, Insights and Forecast - by Device

- 9. Brazil Latin America Insulin Pens Market Analysis, Insights and Forecast, 2019-2031

- 10. Argentina Latin America Insulin Pens Market Analysis, Insights and Forecast, 2019-2031

- 11. Mexico Latin America Insulin Pens Market Analysis, Insights and Forecast, 2019-2031

- 12. Peru Latin America Insulin Pens Market Analysis, Insights and Forecast, 2019-2031

- 13. Chile Latin America Insulin Pens Market Analysis, Insights and Forecast, 2019-2031

- 14. Rest of Latin America Latin America Insulin Pens Market Analysis, Insights and Forecast, 2019-2031

- 15. Competitive Analysis

- 15.1. Market Share Analysis 2024

- 15.2. Company Profiles

- 15.2.1 Ultimed*List Not Exhaustive 7 2 Company Share Analysi

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 Trividia Health

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 Becton Dickinson

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 7 COMPETITIVE LANDSCAPE7 1 Company profiles

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 Cardinal Health

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 Arkray

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.1 Ultimed*List Not Exhaustive 7 2 Company Share Analysi

List of Figures

- Figure 1: Latin America Insulin Pens Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Latin America Insulin Pens Market Share (%) by Company 2024

List of Tables

- Table 1: Latin America Insulin Pens Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Latin America Insulin Pens Market Revenue Million Forecast, by Device 2019 & 2032

- Table 3: Latin America Insulin Pens Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: Latin America Insulin Pens Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Latin America Insulin Pens Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Brazil Latin America Insulin Pens Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Argentina Latin America Insulin Pens Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Latin America Insulin Pens Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Peru Latin America Insulin Pens Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Chile Latin America Insulin Pens Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Latin America Latin America Insulin Pens Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Latin America Insulin Pens Market Revenue Million Forecast, by Device 2019 & 2032

- Table 13: Latin America Insulin Pens Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 14: Latin America Insulin Pens Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Latin America Insulin Pens Market Revenue Million Forecast, by Device 2019 & 2032

- Table 16: Latin America Insulin Pens Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: Latin America Insulin Pens Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Latin America Insulin Pens Market Revenue Million Forecast, by Device 2019 & 2032

- Table 19: Latin America Insulin Pens Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 20: Latin America Insulin Pens Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Insulin Pens Market?

The projected CAGR is approximately > 1.80%.

2. Which companies are prominent players in the Latin America Insulin Pens Market?

Key companies in the market include Ultimed*List Not Exhaustive 7 2 Company Share Analysi, Trividia Health, Becton Dickinson, 7 COMPETITIVE LANDSCAPE7 1 Company profiles, Cardinal Health, Arkray.

3. What are the main segments of the Latin America Insulin Pens Market?

The market segments include Device, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.4 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Early Diagnosis of Chronic Conditions; Increasing Incidence of Trauma and Accidents; Surge in the Number of Surgical Procedures Carried Out Worldwide.

6. What are the notable trends driving market growth?

Rising diabetes prevalence in Latin America is driving the market in the forecast period.

7. Are there any restraints impacting market growth?

Blood Contaminations and Other Complications; Injury Caused During Blood Collection.

8. Can you provide examples of recent developments in the market?

July 2023: Gan & Lee emerged as the successful bidder for the insulin aspart injections and reusable insulin pen products developed by the company to Brazil. The initial consignment of these products has already been dispatched to brazil, signifying the fulfillment of the initial round of deliveries. The shipment encompasses a total of 1.34 million cartridges of 3 mL insulin aspart injections and 67,000 reusable insulin pens.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Insulin Pens Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Insulin Pens Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Insulin Pens Market?

To stay informed about further developments, trends, and reports in the Latin America Insulin Pens Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence