Key Insights

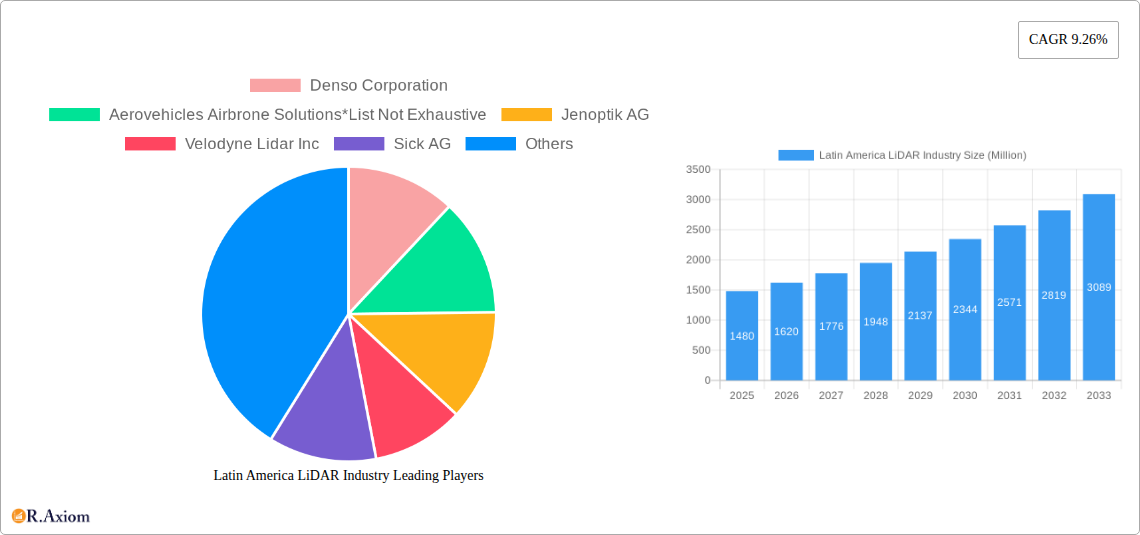

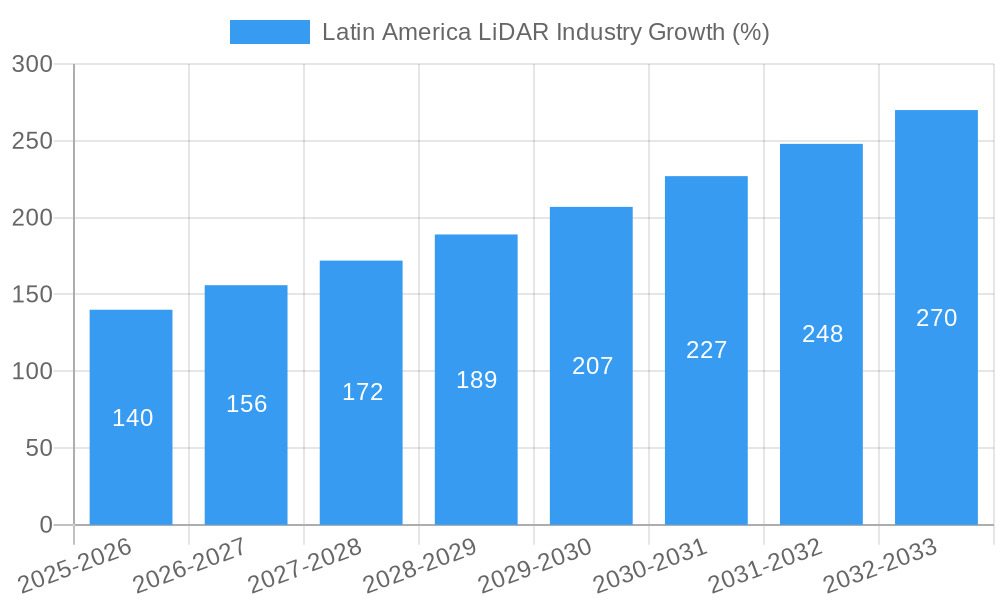

The Latin American LiDAR market, valued at $1.48 billion in 2025, is projected to experience robust growth, driven by increasing infrastructure development, the burgeoning automotive sector's demand for advanced driver-assistance systems (ADAS), and a rising focus on precision agriculture. Brazil, Mexico, and Argentina constitute the major market contributors, benefiting from government investments in smart city initiatives and the expanding adoption of autonomous vehicles. The market segmentation reveals a strong demand for aerial LiDAR solutions in surveying and mapping applications, while ground-based LiDAR systems find traction in engineering and industrial sectors. The key components driving market expansion include GPS, laser scanners, and inertial measurement units. While data privacy concerns and the relatively high initial investment costs pose challenges, the long-term return on investment and the increasing availability of cost-effective LiDAR solutions are expected to mitigate these restraints. Furthermore, technological advancements focusing on miniaturization, improved accuracy, and enhanced data processing capabilities are further propelling market growth. The forecast period (2025-2033) promises significant expansion, fueled by continuous technological innovation and expanding applications across various sectors.

The competitive landscape is characterized by a mix of established international players like Denso Corporation, Velodyne Lidar Inc., and Trimble Inc., alongside regional companies catering to specific market needs. These companies are engaged in strategic partnerships, mergers, and acquisitions to consolidate their market presence and expand their product portfolios. Future market growth will likely depend on successful collaborations between technology providers and end-users to effectively integrate LiDAR solutions across diverse applications. The continued focus on enhancing data processing and analysis capabilities, coupled with the development of user-friendly software solutions, will be crucial in driving wider adoption of LiDAR technology across Latin America. The sustained growth in infrastructure projects, particularly in smart cities and transportation, will further contribute to the expansion of the LiDAR market in the region.

Latin America LiDAR Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Latin America LiDAR industry, offering invaluable insights for stakeholders seeking to navigate this rapidly evolving market. The study period covers 2019-2033, with 2025 serving as the base and estimated year. The forecast period spans 2025-2033, while the historical period encompasses 2019-2024. This report utilizes high-impact keywords to maximize search visibility and offers actionable insights to drive informed business decisions.

Latin America LiDAR Industry Market Concentration & Innovation

The Latin American LiDAR market exhibits a moderately concentrated landscape, with key players such as Denso Corporation, Velodyne Lidar Inc, Sick AG, Trimble Inc, Jenoptik AG, Leica Geosystems AG, and Neptec Technologies Corp holding significant market share. However, the market is witnessing an influx of smaller, innovative companies, particularly in the areas of specialized LiDAR solutions and data processing. Market share distribution amongst these key players in 2025 is estimated as follows: Denso Corporation (15%), Velodyne Lidar Inc (12%), Sick AG (10%), Trimble Inc(8%), Jenoptik AG(7%), others (48%). Innovation is driven by increasing demand for higher accuracy, longer range, and cost-effective LiDAR systems. Regulatory frameworks, while still developing in some Latin American countries, are increasingly supportive of LiDAR technology adoption in infrastructure development and autonomous vehicle testing. Significant M&A activity is anticipated in the coming years, with deal values projected to reach approximately $xx Million by 2033. This will primarily be driven by established players seeking to expand their product portfolios and geographic reach. Product substitutes, such as radar and computer vision, exist but LiDAR's unique capabilities in providing highly accurate 3D point cloud data make it a preferred choice for many applications. End-user trends show a growing preference for integrated LiDAR solutions, combining hardware and data processing capabilities.

Latin America LiDAR Industry Industry Trends & Insights

The Latin American LiDAR market is experiencing robust growth, driven by increasing infrastructure development, expanding adoption in the automotive sector, and the growing demand for precise mapping and surveying services. The market is projected to achieve a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological disruptions such as the development of solid-state LiDAR and advancements in AI-powered data processing are further accelerating market expansion. Market penetration remains relatively low compared to developed regions, presenting a significant opportunity for growth. Consumer preferences are shifting towards higher accuracy and reliability, coupled with a demand for user-friendly data processing tools. Competitive dynamics are characterized by a mix of established international players and emerging local companies specializing in specific niches. This dynamic landscape fuels innovation and drives price competition. The increasing adoption of autonomous vehicles in major Latin American cities is a primary driver and this sector is predicted to contribute to approximately xx% of the total market value by 2033.

Dominant Markets & Segments in Latin America LiDAR Industry

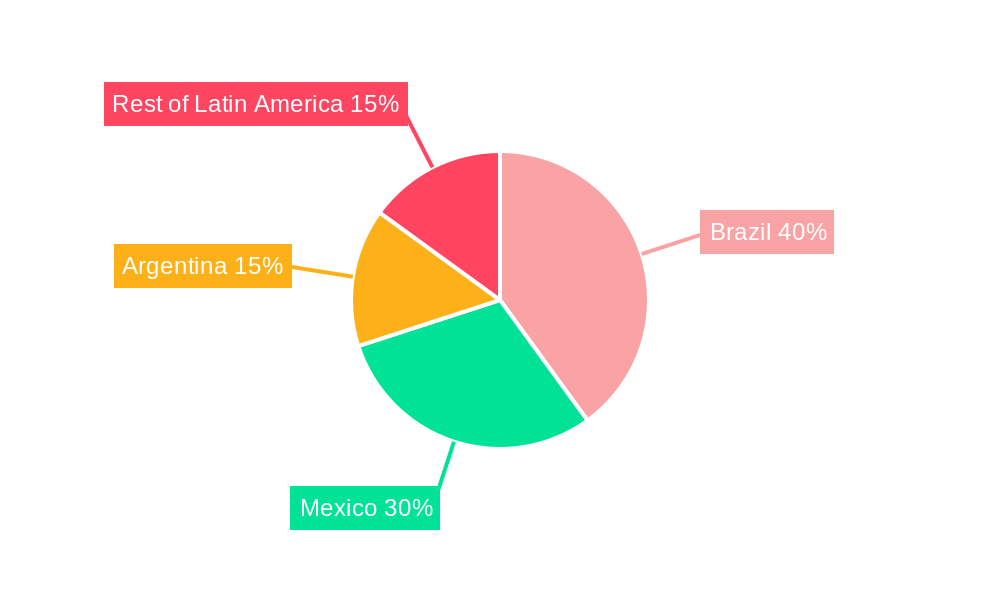

Brazil and Mexico represent the dominant markets in Latin America for LiDAR technology. The large scale of infrastructure projects in both countries are key drivers. Argentina also shows significant potential.

- Leading Country: Brazil, due to its robust construction and agricultural sectors.

- Leading Segment (Product): Aerial LiDAR, driven by the need for large-scale mapping and surveying projects.

- Leading Segment (Component): Laser Scanners, essential for accurate data acquisition.

- Leading Segment (End-User): Engineering, due to significant investment in infrastructure development.

Key Drivers:

- Brazil: Government initiatives focused on infrastructure development (e.g., road expansion, urban development projects) have spurred the demand for high-precision surveying and mapping solutions.

- Mexico: Growing automotive industry and increasing investments in smart city projects are driving LiDAR adoption.

- Argentina: Expanding agricultural sector along with government focus on infrastructure modernization creates a rising demand.

The dominance of these markets and segments is anticipated to continue through 2033, although the Rest of Latin America segment shows substantial potential for growth as infrastructure investments expand.

Latin America LiDAR Industry Product Developments

Recent product innovations include the introduction of compact, lightweight LiDAR sensors suitable for drone integration, enhancing accessibility for various applications. Advancements in solid-state LiDAR technology promise higher reliability and affordability. These developments are creating new market opportunities in areas like precision agriculture, urban planning, and autonomous vehicle navigation. The focus is on improving accuracy, reducing costs, and expanding functionality to cater to the specific needs of diverse end-users across various sectors.

Report Scope & Segmentation Analysis

This report segments the Latin America LiDAR market by product (Aerial LiDAR, Ground-based LiDAR), components (GPS, Laser Scanners, Inertial Measurement Unit, Other Components), end-user (Engineering, Automotive, Industrial, Aerospace & Defense), and country (Brazil, Mexico, Argentina, Rest of Latin America). Each segment's analysis includes market size estimations, growth projections, and competitive dynamics. For instance, the Aerial LiDAR segment is projected to show higher growth due to increasing demand for high-resolution mapping, while the Automotive segment shows the highest potential for future growth. The Engineering end-user sector accounts for the largest market share, followed by the Automotive and Industrial sectors.

Key Drivers of Latin America LiDAR Industry Growth

Several factors are fueling the growth of the Latin American LiDAR industry:

- Infrastructure Development: Extensive investments in infrastructure projects across the region drive demand for precise surveying and mapping.

- Technological Advancements: The development of smaller, lighter, and more cost-effective LiDAR systems is expanding the market’s accessibility.

- Government Support: Supportive policies and regulatory frameworks are encouraging the adoption of LiDAR technology in various sectors.

- Rise of Autonomous Vehicles: The automotive industry’s growing interest in autonomous vehicle technologies fuels the demand for advanced LiDAR systems.

Challenges in the Latin America LiDAR Industry Sector

The Latin American LiDAR industry faces certain challenges:

- High Initial Investment Costs: The initial investment in LiDAR technology can be substantial, limiting adoption for smaller companies.

- Data Processing Complexity: Analyzing and processing LiDAR data can be complex, requiring specialized skills and software.

- Lack of Skilled Workforce: A shortage of skilled professionals with expertise in LiDAR technologies can hinder market expansion.

- Import Dependence: The dependence on imports for certain LiDAR components can lead to supply chain disruptions and price fluctuations.

Emerging Opportunities in Latin America LiDAR Industry

The Latin American LiDAR industry presents several promising opportunities:

- Smart City Initiatives: The increasing adoption of smart city technologies is driving demand for precise urban mapping and monitoring solutions.

- Precision Agriculture: LiDAR technology is finding increasing applications in optimizing agricultural practices, improving yield and efficiency.

- 3D City Modeling: The creation of detailed 3D models of cities is creating new opportunities for urban planning and development.

- Disaster Management: LiDAR is valuable in post-disaster assessment, aiding in effective response and recovery.

Leading Players in the Latin America LiDAR Industry Market

- Denso Corporation

- Aerovehicles Airborne Solutions

- Jenoptik AG

- Velodyne Lidar Inc

- Sick AG

- Trimble Inc

- Neptec Technologies Corp

- Leica Geosystems AG

Key Developments in Latin America LiDAR Industry Industry

- Jan 2023: Trimble Inc. launched a new series of high-accuracy LiDAR sensors for infrastructure monitoring.

- March 2022: A major Brazilian construction firm partnered with a LiDAR provider to map a new highway project.

- June 2021: Velodyne Lidar Inc. expanded its operations in Mexico to cater to the growing automotive sector. (Note: Further detailed development information would be included in the full report.)

Strategic Outlook for Latin America LiDAR Industry Market

The Latin American LiDAR market is poised for substantial growth over the next decade. Continued infrastructure development, advancements in LiDAR technology, and supportive government policies will create a positive environment for market expansion. The increasing adoption of LiDAR across various sectors such as automotive, agriculture, and urban planning will propel market growth. Opportunities exist for both established players and new entrants to capitalize on the market's potential. Strategic partnerships and investments in research and development will be crucial for success in this dynamic market.

Latin America LiDAR Industry Segmentation

-

1. Product

- 1.1. Aerial LiDAR

- 1.2. Ground-based LiDAR

-

2. Components

- 2.1. GPS

- 2.2. Laser Scanners

- 2.3. Inertial Measurement Unit

- 2.4. Other Components

-

3. End-User

- 3.1. Engineering

- 3.2. Automotive

- 3.3. Industrial

- 3.4. Aerospace & Defense

Latin America LiDAR Industry Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America LiDAR Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.26% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Fast Paced Developments And Increasing Applications Of Drones; Growing Applications In Government Sector; Increasing Adoption In Automotive Industry

- 3.3. Market Restrains

- 3.3.1. ; High Cost of The LiDAR Systems

- 3.4. Market Trends

- 3.4.1. The Growing demand of Laser Scanner will Drive the Growth of this Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America LiDAR Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Aerial LiDAR

- 5.1.2. Ground-based LiDAR

- 5.2. Market Analysis, Insights and Forecast - by Components

- 5.2.1. GPS

- 5.2.2. Laser Scanners

- 5.2.3. Inertial Measurement Unit

- 5.2.4. Other Components

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Engineering

- 5.3.2. Automotive

- 5.3.3. Industrial

- 5.3.4. Aerospace & Defense

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Brazil Latin America LiDAR Industry Analysis, Insights and Forecast, 2019-2031

- 7. Argentina Latin America LiDAR Industry Analysis, Insights and Forecast, 2019-2031

- 8. Mexico Latin America LiDAR Industry Analysis, Insights and Forecast, 2019-2031

- 9. Peru Latin America LiDAR Industry Analysis, Insights and Forecast, 2019-2031

- 10. Chile Latin America LiDAR Industry Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Latin America Latin America LiDAR Industry Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Denso Corporation

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Aerovehicles Airbrone Solutions*List Not Exhaustive

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Jenoptik AG

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Velodyne Lidar Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Sick AG

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Trimble Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Neptec Technologies Corp

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Leica Geosystems Ag

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.1 Denso Corporation

List of Figures

- Figure 1: Latin America LiDAR Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Latin America LiDAR Industry Share (%) by Company 2024

List of Tables

- Table 1: Latin America LiDAR Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Latin America LiDAR Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 3: Latin America LiDAR Industry Revenue Million Forecast, by Components 2019 & 2032

- Table 4: Latin America LiDAR Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 5: Latin America LiDAR Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Latin America LiDAR Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Brazil Latin America LiDAR Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Argentina Latin America LiDAR Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Latin America LiDAR Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Peru Latin America LiDAR Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Chile Latin America LiDAR Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Latin America Latin America LiDAR Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Latin America LiDAR Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 14: Latin America LiDAR Industry Revenue Million Forecast, by Components 2019 & 2032

- Table 15: Latin America LiDAR Industry Revenue Million Forecast, by End-User 2019 & 2032

- Table 16: Latin America LiDAR Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Brazil Latin America LiDAR Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Argentina Latin America LiDAR Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Chile Latin America LiDAR Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Colombia Latin America LiDAR Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Mexico Latin America LiDAR Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Peru Latin America LiDAR Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Venezuela Latin America LiDAR Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Ecuador Latin America LiDAR Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Bolivia Latin America LiDAR Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Paraguay Latin America LiDAR Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America LiDAR Industry?

The projected CAGR is approximately 9.26%.

2. Which companies are prominent players in the Latin America LiDAR Industry?

Key companies in the market include Denso Corporation, Aerovehicles Airbrone Solutions*List Not Exhaustive, Jenoptik AG, Velodyne Lidar Inc, Sick AG, Trimble Inc, Neptec Technologies Corp, Leica Geosystems Ag.

3. What are the main segments of the Latin America LiDAR Industry?

The market segments include Product, Components, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.48 Million as of 2022.

5. What are some drivers contributing to market growth?

; Fast Paced Developments And Increasing Applications Of Drones; Growing Applications In Government Sector; Increasing Adoption In Automotive Industry.

6. What are the notable trends driving market growth?

The Growing demand of Laser Scanner will Drive the Growth of this Market.

7. Are there any restraints impacting market growth?

; High Cost of The LiDAR Systems.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America LiDAR Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America LiDAR Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America LiDAR Industry?

To stay informed about further developments, trends, and reports in the Latin America LiDAR Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence