Key Insights

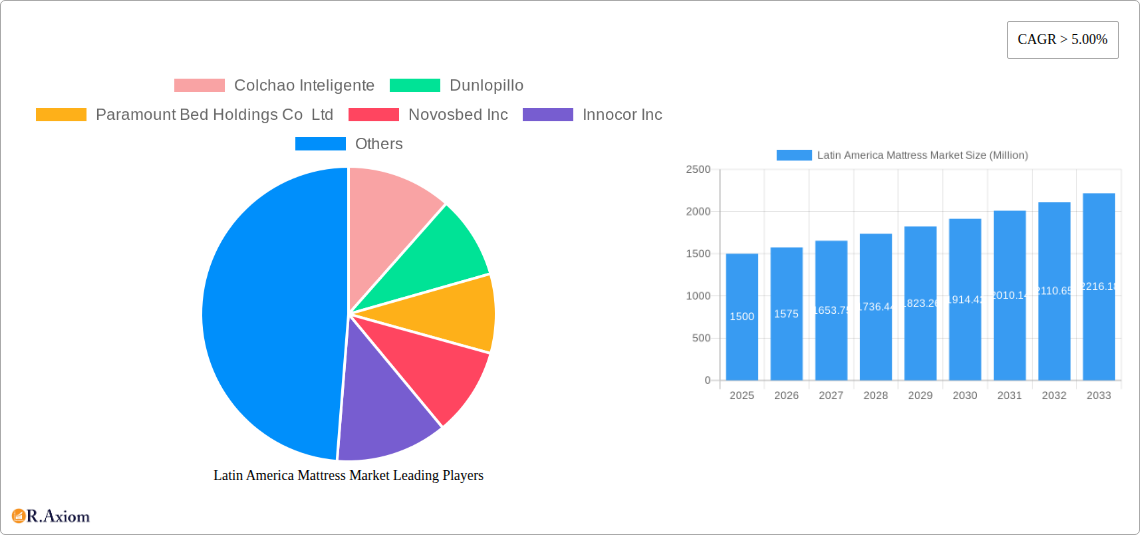

The Latin American mattress market, currently valued at an estimated $XX million in 2025, is experiencing robust growth, projected to exceed a CAGR of 5% from 2025 to 2033. This expansion is fueled by several key drivers. Rising disposable incomes across major economies like Brazil, Mexico, and Argentina are increasing consumer spending on home furnishings, including higher-quality mattresses. Furthermore, a growing awareness of the importance of sleep health and its impact on overall well-being is driving demand for premium mattresses, such as memory foam and latex options, which offer superior comfort and support. The shift towards online purchasing is also contributing to market growth, providing consumers with greater access to a wider variety of products and brands. However, the market faces challenges such as economic volatility in certain regions and the presence of counterfeit products. Segmentation within the market reveals strong growth in the residential sector driven by the increasing urbanization and nuclear family structure. The online distribution channel continues to show significant potential for growth, capitalizing on the rising e-commerce penetration in the region. Leading players like Tempur Sealy International Inc and Casper Sleep Inc are strategically targeting this market by focusing on premium product offerings and tailored marketing campaigns.

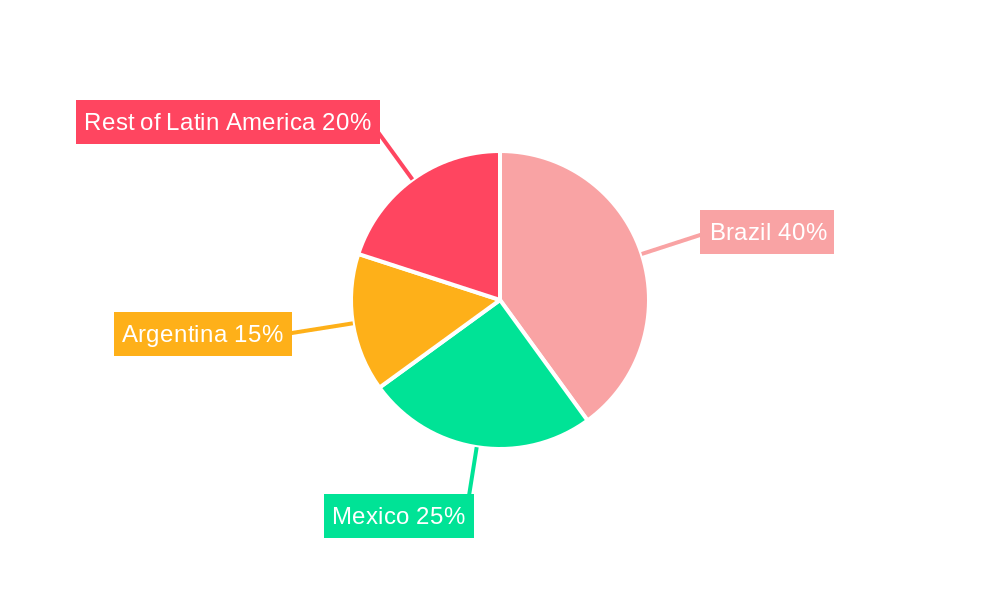

The competitive landscape is dynamic, with both established international players and local manufacturers vying for market share. While innerspring mattresses remain dominant, the segment is experiencing notable growth in memory foam and latex varieties, indicating a premiumization trend within the market. To maintain their competitive edge, manufacturers are focusing on innovations such as smart mattresses and incorporating advanced technologies to enhance comfort and sleep quality. Geographic variations exist within Latin America; Brazil and Mexico represent the largest markets, driven by their significant populations and comparatively higher disposable incomes. However, other countries like Argentina, Peru, and Chile are also demonstrating promising growth potential as their economies continue to evolve. Future growth will depend on maintaining economic stability, adapting to evolving consumer preferences, and effectively navigating the challenges posed by economic fluctuations and competition.

Latin America Mattress Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Latin America mattress market, offering valuable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic sector. The report covers the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033. The market is segmented by application (residential, commercial), distribution channel (online, offline), and type (innerspring, memory foam, latex, other types). Key players like Colchao Inteligente, Dunlopillo, Paramount Bed Holdings Co Ltd, Novosbed Inc, Innocor Inc, Casper Sleep Inc, Simba Sleep Limited, Silent Night Group, Kingsdown Inc, and Tempur Sealy International Inc are analyzed, although the list is not exhaustive. The report projects a market size of xx Million for 2025 and identifies key growth drivers and challenges.

Latin America Mattress Market Concentration & Innovation

The Latin America mattress market exhibits a moderately concentrated structure, with a few large players holding significant market share. However, the presence of numerous smaller regional and local brands creates a competitive landscape. Market share data for 2024 suggests that Tempur Sealy International Inc. and Kingsdown Inc hold approximately xx% and xx%, respectively, while the remaining share is distributed among other players. Innovation in the mattress industry is driven by advancements in materials science (e.g., advanced foams, natural latex), technological integration (e.g., sleep tracking, smart mattresses), and a focus on improving sleep quality and ergonomics. Regulatory frameworks vary across Latin American countries, impacting manufacturing processes and labeling requirements. Product substitutes such as air mattresses and futons exert limited pressure on the market. End-user trends favor increased comfort, personalization, and health-focused features. M&A activities have been moderate, with recent deals totaling approximately xx Million in value, primarily focused on consolidating market share and expanding distribution networks.

- Market Concentration: Moderately concentrated, with larger players holding significant shares.

- Innovation Drivers: Advanced materials, technology integration, focus on sleep health.

- Regulatory Framework: Varied across countries, influencing manufacturing and labeling.

- Product Substitutes: Limited impact from alternatives like air mattresses.

- End-User Trends: Preference for enhanced comfort, personalization, and health benefits.

- M&A Activity: Moderate activity, with deal values totaling approximately xx Million.

Latin America Mattress Market Industry Trends & Insights

The Latin American mattress market is experiencing robust growth, driven by rising disposable incomes, increasing urbanization, and changing consumer preferences toward improved sleep quality. The market registered a CAGR of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033), reaching a market size of xx Million by 2033. Technological disruptions, such as the introduction of smart mattresses and sleep-tracking technologies, are gaining traction, albeit slowly due to affordability concerns. Consumer preferences lean towards higher-quality mattresses with enhanced comfort features, reflecting an increasing emphasis on health and well-being. The competitive dynamics are intense, with established players facing pressure from both local and international competitors. Market penetration of premium mattress types like memory foam and latex is gradually increasing, though innerspring remains dominant.

Dominant Markets & Segments in Latin America Mattress Market

Mexico and Brazil are the leading markets in Latin America, accounting for approximately xx% of the total market share. Their dominance stems from large populations, higher disposable incomes, and a growing middle class. The residential segment dominates the application-based market, reflecting high demand for mattresses in private households. Offline distribution channels still hold the largest market share, but online sales are showing significant growth potential. Innerspring mattresses remain the most prevalent type due to their affordability and wide availability.

- Key Drivers for Mexico and Brazil: Large populations, rising disposable incomes, expanding middle class.

- Residential Segment Dominance: High demand for mattresses in private households drives this segment.

- Offline Distribution Channel Dominance: Traditional retail channels continue to lead, while online sales are growing rapidly.

- Innerspring Mattress Prevalence: Affordability and widespread availability make it the dominant type.

Latin America Mattress Market Product Developments

Recent product innovations include the introduction of mattresses incorporating advanced materials like graphene-infused foams for enhanced temperature regulation and pressure relief. Smart mattresses with integrated sleep-tracking capabilities are also emerging, though adoption is still limited. These developments cater to the growing demand for personalized comfort and health-conscious consumers. Competitive advantages are achieved through superior product quality, innovative designs, strong brand reputation, and efficient distribution networks.

Report Scope & Segmentation Analysis

This report segments the Latin America mattress market based on application (residential and commercial), distribution channel (online and offline), and mattress type (innerspring, memory foam, latex, and other types). Each segment's growth projections, market sizes, and competitive dynamics are thoroughly analyzed. The residential segment is expected to continue its dominance, showing robust growth due to population increase and improving living standards. Online sales are expected to grow faster than offline channels, reflecting the increasing popularity of e-commerce. Memory foam and latex mattresses are expected to show higher growth rates than innerspring, driven by increasing consumer preference for premium products.

Key Drivers of Latin America Mattress Market Growth

Several factors are driving growth in the Latin American mattress market. Rising disposable incomes across several countries are enabling consumers to invest in higher-quality mattresses. The expanding middle class fuels this demand further. Urbanization is also a significant factor, as increased population density in urban areas leads to higher mattress demand. Lastly, government initiatives promoting affordable housing and improving living standards indirectly support the market.

Challenges in the Latin America Mattress Market Sector

The Latin America mattress market faces challenges including fluctuating raw material prices impacting production costs, inconsistent supply chains causing production delays and increasing logistics costs, and intense competition from both domestic and international brands putting pressure on margins. Furthermore, varying regulatory frameworks and import tariffs across countries pose additional complexities. These factors can significantly impede market growth if not managed effectively.

Emerging Opportunities in Latin America Mattress Market

Emerging opportunities lie in expanding into less-penetrated markets within Latin America, focusing on developing innovative products tailored to specific consumer needs and preferences, and leveraging online channels to reach wider audiences. Collaborations with local manufacturers and distributors can also unlock new market segments. The increasing awareness of sleep health is also creating opportunities for premium, technologically advanced products.

Leading Players in the Latin America Mattress Market Market

- Colchao Inteligente

- Dunlopillo

- Paramount Bed Holdings Co Ltd

- Novosbed Inc

- Innocor Inc

- Casper Sleep Inc

- Simba Sleep Limited

- Silent Night Group

- Kingsdown Inc

- Tempur Sealy International Inc

Key Developments in Latin America Mattress Market Industry

- August 2023: Restonic Mattress Corp. expands into the Dominican Republic via a partnership with Advance Foam.

- May 2023: Double Dragon's hotel business partners with Emma, The Sleep Company, to supply mattresses for global projects, including in Mexico.

Strategic Outlook for Latin America Mattress Market Market

The Latin America mattress market is poised for continued growth, driven by several long-term factors such as increasing urbanization, rising disposable incomes, and changing consumer preferences. Focusing on innovative product development, strategic partnerships, and efficient distribution networks will be crucial for success in this dynamic and competitive market. Companies that can adapt to evolving consumer needs and technological advancements will be well-positioned to capitalize on the considerable growth potential.

Latin America Mattress Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Latin America Mattress Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Mattress Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Technological Innovations are Driving the Market

- 3.3. Market Restrains

- 3.3.1. Supply Chain Disruptions are Restraining the Market

- 3.4. Market Trends

- 3.4.1. Brazil is Dominating the Mattress Market of Latin America

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Mattress Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Brazil Latin America Mattress Market Analysis, Insights and Forecast, 2019-2031

- 7. Argentina Latin America Mattress Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico Latin America Mattress Market Analysis, Insights and Forecast, 2019-2031

- 9. Peru Latin America Mattress Market Analysis, Insights and Forecast, 2019-2031

- 10. Chile Latin America Mattress Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Latin America Latin America Mattress Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Colchao Inteligente

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Dunlopillo

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Paramount Bed Holdings Co Ltd

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Novosbed Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Innocor Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Casper Sleep Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Simba Sleep Limited**List Not Exhaustive

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Silent Night Group

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Kingsdown Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Tempur Sealy International Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Colchao Inteligente

List of Figures

- Figure 1: Latin America Mattress Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Latin America Mattress Market Share (%) by Company 2024

List of Tables

- Table 1: Latin America Mattress Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Latin America Mattress Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 3: Latin America Mattress Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 4: Latin America Mattress Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 5: Latin America Mattress Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 6: Latin America Mattress Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 7: Latin America Mattress Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Latin America Mattress Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Brazil Latin America Mattress Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Argentina Latin America Mattress Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Mexico Latin America Mattress Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Peru Latin America Mattress Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Chile Latin America Mattress Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Latin America Latin America Mattress Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Latin America Mattress Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 16: Latin America Mattress Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 17: Latin America Mattress Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 18: Latin America Mattress Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 19: Latin America Mattress Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 20: Latin America Mattress Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Brazil Latin America Mattress Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Argentina Latin America Mattress Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Chile Latin America Mattress Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Colombia Latin America Mattress Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Mexico Latin America Mattress Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Peru Latin America Mattress Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Venezuela Latin America Mattress Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Ecuador Latin America Mattress Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Bolivia Latin America Mattress Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Paraguay Latin America Mattress Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Mattress Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Latin America Mattress Market?

Key companies in the market include Colchao Inteligente, Dunlopillo, Paramount Bed Holdings Co Ltd, Novosbed Inc, Innocor Inc, Casper Sleep Inc, Simba Sleep Limited**List Not Exhaustive, Silent Night Group, Kingsdown Inc, Tempur Sealy International Inc.

3. What are the main segments of the Latin America Mattress Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Technological Innovations are Driving the Market.

6. What are the notable trends driving market growth?

Brazil is Dominating the Mattress Market of Latin America.

7. Are there any restraints impacting market growth?

Supply Chain Disruptions are Restraining the Market.

8. Can you provide examples of recent developments in the market?

August 2023: Restonic Mattress Corp. and its Caribbean licensee have agreed to expand the company's reach into the Dominican Republic. The company's partnership with Advance Foam is strategically moving towards a shared future of delivering sleep solutions to the people of several Caribbean countries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Mattress Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Mattress Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Mattress Market?

To stay informed about further developments, trends, and reports in the Latin America Mattress Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence