Key Insights

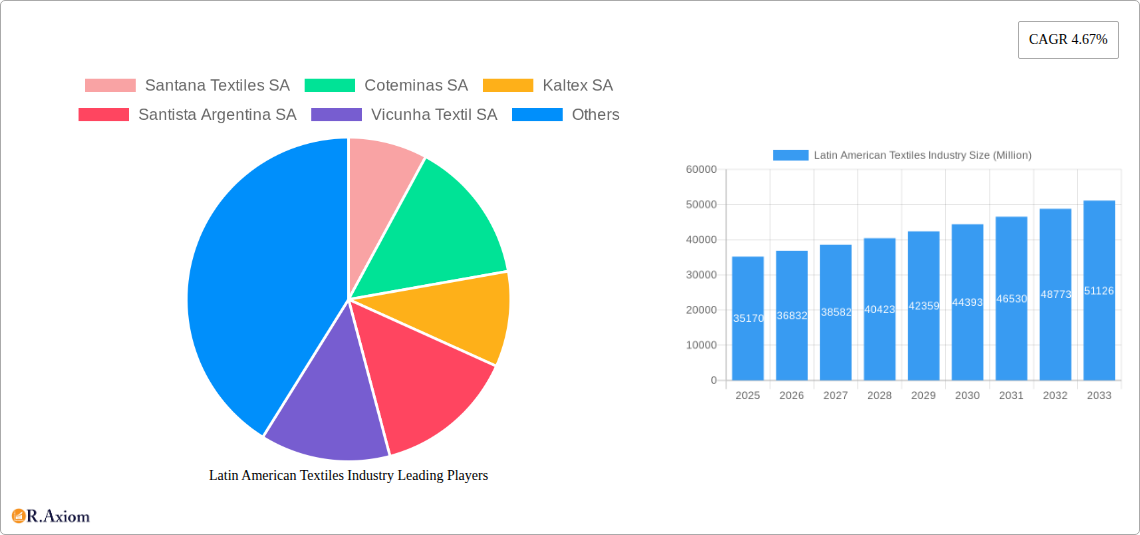

The Latin American textiles industry, valued at $35.17 billion in 2025, is projected to experience steady growth, with a Compound Annual Growth Rate (CAGR) of 4.67% from 2025 to 2033. This growth is driven by several factors. Increasing consumer spending, particularly in the burgeoning middle class across key markets like Brazil, Mexico, and Argentina, fuels demand for clothing and household textiles. Furthermore, the region's robust agricultural sector provides a reliable supply of raw materials such as cotton and jute, supporting domestic production. Growth in the industrial and technical applications segment, driven by infrastructure development and manufacturing expansion, further contributes to overall market expansion. However, challenges exist. Fluctuations in raw material prices, intense competition from imports (particularly from Asia), and the need for technological upgrades in production processes represent potential restraints. The industry is segmented by application (clothing, industrial/technical, household), material (cotton, jute, silk, synthetics, wool), and process (woven, non-woven), offering diverse opportunities for players. Key players such as Santana Textiles SA, Coteminas SA, and Kaltex SA are positioned to capitalize on these trends, while facing the need for innovation and adaptation to maintain competitiveness in a globalized market.

The forecast period (2025-2033) anticipates a significant expansion of the Latin American textiles market, particularly within the clothing segment, driven by rising fashion consciousness and a growing preference for locally sourced and sustainably produced garments. The increasing adoption of innovative textile technologies, like advanced fiber blends and eco-friendly dyeing processes, is also expected to stimulate growth. Regional differences will be evident, with Brazil and Mexico likely to maintain their leading positions due to their larger economies and more developed textile industries. However, other countries like Peru and Chile, with strong export capabilities and a focus on niche segments (like alpaca wool), are poised for considerable growth. Strategic partnerships, mergers and acquisitions, and investments in research and development will play a crucial role in shaping the competitive landscape and fostering long-term sustainability within the industry.

This comprehensive report provides an in-depth analysis of the Latin American textiles industry, covering market size, growth drivers, competitive landscape, and future outlook from 2019 to 2033. The study includes detailed segmentation by application (clothing, industrial/technical, household), material (cotton, jute, silk, synthetics, wool), and process (woven, non-woven). Key players such as Santana Textiles SA, Coteminas SA, and others are profiled, offering valuable insights for investors, industry professionals, and strategic decision-makers. The report utilizes data from the historical period (2019-2024), the base year (2025), and forecasts up to 2033.

Latin American Textiles Industry Market Concentration & Innovation

This section analyzes the market concentration within the Latin American textile industry, examining the market share held by key players and exploring factors driving innovation. The report assesses the impact of regulatory frameworks, the availability of product substitutes, evolving end-user trends, and the role of mergers and acquisitions (M&A) on market dynamics. We delve into the M&A landscape, considering the value of deals and their influence on market consolidation. While precise market share figures for each company require further data collection, initial estimates suggest a moderately fragmented market. Major players, however, are increasingly consolidating their market positions through strategic acquisitions. We project that xx Million USD in M&A activity will be observed in the forecast period.

- Market Concentration: Moderately fragmented with potential for consolidation.

- Innovation Drivers: Technological advancements in fiber production, sustainable manufacturing practices, and increasing demand for specialized textiles.

- Regulatory Frameworks: Varying regulations across Latin American countries impacting production costs and trade.

- Product Substitutes: Growth of synthetic fibers and alternative materials presents competitive pressures.

- End-User Trends: Shifting consumer preferences towards sustainable and ethically sourced products are influencing the industry.

- M&A Activity: A moderate level of consolidation is expected through mergers and acquisitions.

Latin American Textiles Industry Industry Trends & Insights

This section explores the key trends and insights shaping the Latin American textiles industry. We analyze market growth drivers, including economic expansion in certain regions, and the impact of technological disruptions on production processes and consumer preferences. The competitive dynamics are examined, focusing on pricing strategies, product differentiation, and the rise of new market entrants. We project a CAGR of xx% for the industry during the forecast period (2025-2033), with market penetration of xx% in key segments.

The Latin American textile sector is experiencing a transformation driven by factors such as evolving consumer preferences, technological innovation, and fluctuating global economic conditions. The increasing adoption of sustainable and eco-friendly practices is reshaping the industry, influencing supply chains and production methods. Technological advancements are improving efficiency and product quality. The rise of e-commerce is further impacting distribution channels and consumer behaviour. Competitive intensity is high, with established players facing challenges from both domestic and international competitors. This dynamic environment calls for companies to adapt to new technologies and shifts in consumer demand.

Dominant Markets & Segments in Latin American Textiles Industry

This section identifies the leading regions, countries, and segments within the Latin American textiles industry. Key drivers of dominance, such as supportive economic policies, robust infrastructure, and access to skilled labor, are analyzed for each leading segment.

Dominant Region: Brazil, due to its significant manufacturing capacity and market size.

Dominant Country: Brazil, given its large domestic market and robust textile production capabilities.

Dominant Application Segment: Clothing, driven by strong consumer demand and a large apparel manufacturing sector.

Dominant Material Segment: Cotton, due to its widespread availability and usage in various textile applications.

Dominant Process Segment: Woven fabrics, which still dominate the market share in the Latin American textile industry despite a slow increase in the demand for Non-woven fabrics.

Key Drivers of Dominance:

- Brazil: Strong domestic market, established infrastructure, and a relatively large and skilled workforce. Government incentives and investments in the manufacturing sector also contribute.

- Clothing: Large and diverse consumer base with growing demand for apparel, particularly in urban centers.

- Cotton: Widespread cultivation, relatively lower cost compared to other natural fibers, and its suitability for various textile applications.

- Woven fabrics: Long-standing tradition and established manufacturing capabilities for woven fabrics compared to non-woven.

Latin American Textiles Industry Product Developments

Recent product innovations focus on technical textiles for industrial applications, sustainable materials (organic cotton, recycled fibers), and high-performance fabrics with enhanced durability and functionality. These developments target various market segments, driven by advancements in material science and manufacturing technologies, aligning with the increasing demand for eco-friendly and specialized textiles. Technological innovations in textile finishing, such as antimicrobial treatments and water-repellent coatings, are further enhancing the value proposition of these new products.

Report Scope & Segmentation Analysis

This report segments the Latin American textiles market by application (Clothing, Industrial/Technical Applications, Household Applications), material (Cotton, Jute, Silk, Synthetics, Wool), and process (Woven, Non-woven). Each segment's market size, growth projections, and competitive landscape are analyzed. The Clothing segment is projected to experience the highest growth, driven by increasing consumer spending. The Synthetics material segment is expected to witness strong growth due to cost-effectiveness and performance advantages. The Woven process segment continues to hold the largest market share.

Key Drivers of Latin American Textiles Industry Growth

Growth is propelled by factors such as rising disposable incomes, expanding domestic consumption, and government initiatives supporting the manufacturing sector. Technological advancements in production processes and the increasing adoption of sustainable practices also contribute. The February 2021 investment by Paraguay's Ministry of Industry and Commerce reflects a broader trend of government support for the sector.

Challenges in the Latin American Textiles Industry Sector

The industry faces challenges such as fluctuating raw material prices, competition from Asian textile producers, and inconsistencies in regulatory environments across the region. Supply chain disruptions and infrastructural limitations in some areas further constrain growth. These factors can lead to increased production costs and price volatility.

Emerging Opportunities in Latin American Textiles Industry

Growth opportunities exist in the production of niche textiles, eco-friendly and sustainable materials, and technical textiles for specialized applications. The burgeoning e-commerce sector presents opportunities for expanding market reach and improving distribution efficiency. Furthermore, increasing regional trade agreements could facilitate export growth.

Leading Players in the Latin American Textiles Industry Market

- Santana Textiles SA

- Coteminas SA

- Kaltex SA

- Santista Argentina SA

- Vicunha Textil SA

- Evora SA

- Pettenati SA Textile Industry

- Australtex SA

- Fabricato SA

- Alpargatas SAIC

Key Developments in Latin American Textiles Industry Industry

- February 2021: Paraguay's Ministry of Industry and Commerce announces USD 1.1 Million investment in the manufacturing sector, benefiting clothing, textiles, and footwear industries.

Strategic Outlook for Latin American Textiles Industry Market

The Latin American textile industry is poised for continued growth, driven by rising consumer demand, technological advancements, and government support. Focusing on innovation, sustainability, and efficient supply chains will be crucial for companies to maintain competitiveness and capitalize on emerging opportunities. The market's future potential lies in specialized textiles, eco-friendly products, and enhanced regional integration.

Latin American Textiles Industry Segmentation

-

1. Application

- 1.1. Clothing

- 1.2. Industrial/Technical Applications

- 1.3. Household Applications

-

2. Material

- 2.1. Cotton

- 2.2. Jute

- 2.3. Silk

- 2.4. Synthetics

- 2.5. Wool

-

3. Process

- 3.1. Woven

- 3.2. Non-woven

Latin American Textiles Industry Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin American Textiles Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.67% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Technological Innovations In Electric Fireplace driving the market; Rising awareness toward using eco-friendly products

- 3.3. Market Restrains

- 3.3.1. Supply chain disruptions affecting the sales of Electric Fireplace; Increasing Inflation reducing demand of luxury items globally

- 3.4. Market Trends

- 3.4.1. Changing Dynamics of the Latin American Fashion Retail is Helping the Market Grow

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin American Textiles Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Clothing

- 5.1.2. Industrial/Technical Applications

- 5.1.3. Household Applications

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Cotton

- 5.2.2. Jute

- 5.2.3. Silk

- 5.2.4. Synthetics

- 5.2.5. Wool

- 5.3. Market Analysis, Insights and Forecast - by Process

- 5.3.1. Woven

- 5.3.2. Non-woven

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Brazil Latin American Textiles Industry Analysis, Insights and Forecast, 2019-2031

- 7. Argentina Latin American Textiles Industry Analysis, Insights and Forecast, 2019-2031

- 8. Mexico Latin American Textiles Industry Analysis, Insights and Forecast, 2019-2031

- 9. Peru Latin American Textiles Industry Analysis, Insights and Forecast, 2019-2031

- 10. Chile Latin American Textiles Industry Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Latin America Latin American Textiles Industry Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Santana Textiles SA

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Coteminas SA

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Kaltex SA

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Santista Argentina SA

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Vicunha Textil SA

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Evora SA

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Pettenati SA Textile Industry

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Australtex SA

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Fabricato SA

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Alpargatas SAIC

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Santana Textiles SA

List of Figures

- Figure 1: Latin American Textiles Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Latin American Textiles Industry Share (%) by Company 2024

List of Tables

- Table 1: Latin American Textiles Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Latin American Textiles Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Latin American Textiles Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Latin American Textiles Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 5: Latin American Textiles Industry Revenue Million Forecast, by Material 2019 & 2032

- Table 6: Latin American Textiles Industry Volume K Unit Forecast, by Material 2019 & 2032

- Table 7: Latin American Textiles Industry Revenue Million Forecast, by Process 2019 & 2032

- Table 8: Latin American Textiles Industry Volume K Unit Forecast, by Process 2019 & 2032

- Table 9: Latin American Textiles Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Latin American Textiles Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: Latin American Textiles Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Latin American Textiles Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: Brazil Latin American Textiles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Brazil Latin American Textiles Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Argentina Latin American Textiles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Argentina Latin American Textiles Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Mexico Latin American Textiles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Mexico Latin American Textiles Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Peru Latin American Textiles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Peru Latin American Textiles Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: Chile Latin American Textiles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Chile Latin American Textiles Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: Rest of Latin America Latin American Textiles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Latin America Latin American Textiles Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 25: Latin American Textiles Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 26: Latin American Textiles Industry Volume K Unit Forecast, by Application 2019 & 2032

- Table 27: Latin American Textiles Industry Revenue Million Forecast, by Material 2019 & 2032

- Table 28: Latin American Textiles Industry Volume K Unit Forecast, by Material 2019 & 2032

- Table 29: Latin American Textiles Industry Revenue Million Forecast, by Process 2019 & 2032

- Table 30: Latin American Textiles Industry Volume K Unit Forecast, by Process 2019 & 2032

- Table 31: Latin American Textiles Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Latin American Textiles Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 33: Brazil Latin American Textiles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Brazil Latin American Textiles Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 35: Argentina Latin American Textiles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Argentina Latin American Textiles Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 37: Chile Latin American Textiles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Chile Latin American Textiles Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 39: Colombia Latin American Textiles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Colombia Latin American Textiles Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 41: Mexico Latin American Textiles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Mexico Latin American Textiles Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 43: Peru Latin American Textiles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Peru Latin American Textiles Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 45: Venezuela Latin American Textiles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Venezuela Latin American Textiles Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 47: Ecuador Latin American Textiles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Ecuador Latin American Textiles Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 49: Bolivia Latin American Textiles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Bolivia Latin American Textiles Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 51: Paraguay Latin American Textiles Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Paraguay Latin American Textiles Industry Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin American Textiles Industry?

The projected CAGR is approximately 4.67%.

2. Which companies are prominent players in the Latin American Textiles Industry?

Key companies in the market include Santana Textiles SA, Coteminas SA, Kaltex SA, Santista Argentina SA, Vicunha Textil SA, Evora SA, Pettenati SA Textile Industry, Australtex SA, Fabricato SA, Alpargatas SAIC.

3. What are the main segments of the Latin American Textiles Industry?

The market segments include Application, Material, Process.

4. Can you provide details about the market size?

The market size is estimated to be USD 35.17 Million as of 2022.

5. What are some drivers contributing to market growth?

Technological Innovations In Electric Fireplace driving the market; Rising awareness toward using eco-friendly products.

6. What are the notable trends driving market growth?

Changing Dynamics of the Latin American Fashion Retail is Helping the Market Grow.

7. Are there any restraints impacting market growth?

Supply chain disruptions affecting the sales of Electric Fireplace; Increasing Inflation reducing demand of luxury items globally.

8. Can you provide examples of recent developments in the market?

In February 2021, Paraguay's Ministry of Industry and Commerce announced that it will be investing USD 1.1 million in the manufacturing sector, mainly benefiting the clothing, textiles, and footwear industries, among other areas related to assembly operations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin American Textiles Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin American Textiles Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin American Textiles Industry?

To stay informed about further developments, trends, and reports in the Latin American Textiles Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence