Key Insights

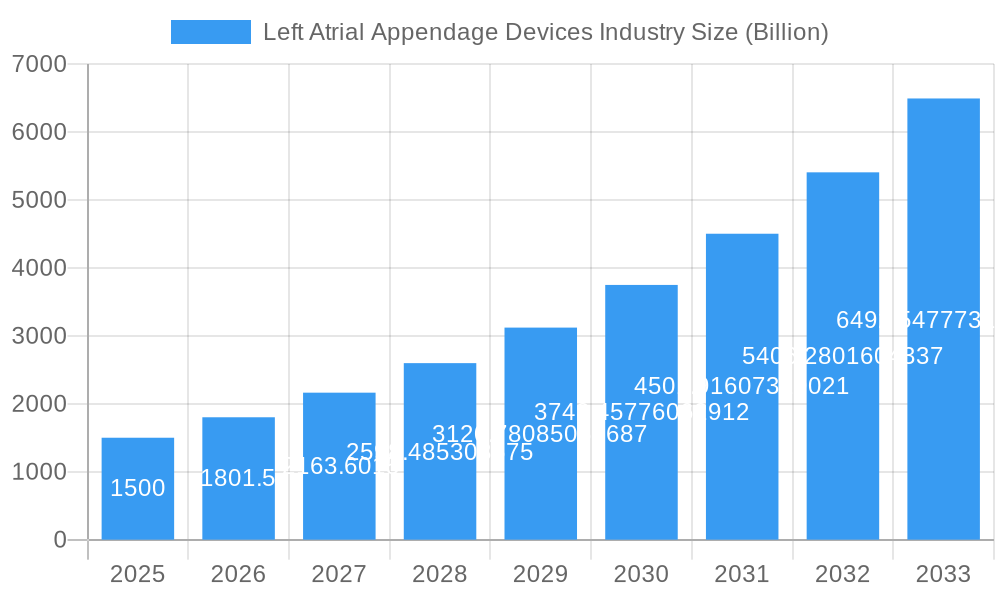

The global Left Atrial Appendage (LAA) Devices market is poised for significant expansion, projected to reach a substantial valuation in the billions by 2033. Fueled by a remarkable Compound Annual Growth Rate (CAGR) of 20.10%, this robust growth trajectory is primarily driven by the increasing prevalence of atrial fibrillation (AFib) worldwide. As AFib significantly elevates the risk of stroke, the demand for effective LAA occlusion devices, which aim to prevent clot formation and embolization, is escalating. Key drivers include advancements in device technology, leading to safer and more effective implantation procedures, as well as growing physician adoption and patient awareness regarding stroke prevention strategies for AFib patients. The market is witnessing a dynamic interplay of technological innovation and expanding clinical applications, paving the way for substantial market penetration.

Left Atrial Appendage Devices Industry Market Size (In Billion)

Further propelling market growth are the ongoing advancements in minimally invasive surgical techniques and the development of novel LAA closure devices designed for enhanced patient outcomes and reduced procedural complications. The market segmentation reveals a strong emphasis on both endocardial and epicardial approaches, catering to diverse clinical needs and preferences. Hospitals and ambulatory surgical centers are the primary end-users, reflecting the procedural nature of LAA device implantation. Geographically, North America and Europe are expected to maintain their dominant positions due to well-established healthcare infrastructure, high adoption rates of advanced medical technologies, and a concentrated patient population with AFib. However, the Asia Pacific region is anticipated to witness the fastest growth, driven by increasing healthcare expenditure, a rising AFib burden, and improving access to sophisticated medical treatments. Restraints, such as the cost of devices and the need for specialized training, are being addressed through technological innovations and expanding reimbursement policies, ensuring sustained market momentum.

Left Atrial Appendage Devices Industry Company Market Share

Left Atrial Appendage Devices Industry Market Concentration & Innovation

The Left Atrial Appendage (LAA) Devices Industry is characterized by a moderate to high market concentration, with a few key players dominating the global landscape. Innovation remains a primary driver, fueled by the urgent need for effective stroke prevention in patients with non-valvular atrial fibrillation (NVAF). Regulatory frameworks, particularly stringent FDA and EMA approvals, shape the pace of innovation and market entry. Product substitutes, primarily oral anticoagulants (OACs), continue to pose a competitive challenge, though LAA closure devices offer distinct advantages for select patient populations, particularly those with bleeding risks or contraindications to OACs. End-user adoption is steadily increasing, driven by physician familiarity and improved patient outcomes. Mergers and acquisitions (M&A) activity, while not consistently high in recent years, remains a potential avenue for market consolidation and technology integration. Deal values are projected to increase as innovative technologies mature and market penetration expands.

- Market Share Dynamics: The top 5 companies are estimated to hold over 70% of the global market share.

- M&A Activity: Anticipated M&A deal values in the forecast period are expected to reach several billion dollars, driven by strategic acquisitions of promising technologies and market expansion.

- Innovation Focus: Key innovation areas include device miniaturization, enhanced deployability, improved imaging integration, and patient-specific sizing solutions.

Left Atrial Appendage Devices Industry Industry Trends & Insights

The global Left Atrial Appendage (LAA) Devices Industry is poised for significant growth, driven by an increasing prevalence of atrial fibrillation (AF) worldwide, coupled with a growing preference for minimally invasive procedures over long-term oral anticoagulation therapy. The estimated Compound Annual Growth Rate (CAGR) for the LAA Devices Market is projected to be robust, reaching xx% during the forecast period of 2025–2033. This expansion is underpinned by several critical trends. Firstly, the rising global burden of cardiovascular diseases, including AF, directly translates to a larger patient pool eligible for LAA closure. Aging populations in developed and developing economies are particularly susceptible to AF, further amplifying the demand for effective stroke prevention solutions. Secondly, technological advancements in LAA closure devices are making these procedures safer, more efficient, and accessible. Innovations in device design, material science, and delivery systems are enabling physicians to achieve higher success rates with reduced procedural complications. This includes the development of steerable sheaths for improved navigation and deployable devices that adapt to varied LAA anatomies. The market penetration of LAA closure devices, while still lower than traditional OACs, is steadily increasing as clinical evidence supporting their efficacy and safety continues to accumulate. Patient preferences are also shifting towards LAA closure, especially for individuals who experience adverse effects from OACs, have a high bleeding risk, or require frequent monitoring. This trend is further supported by favorable reimbursement policies in key markets, which are recognizing the long-term cost-effectiveness of LAA closure in preventing costly stroke events. Competitive dynamics within the industry are characterized by intense R&D efforts, strategic partnerships, and an ongoing pursuit of market leadership through product differentiation and clinical validation. The development of novel imaging guidance techniques and improved procedural protocols are also contributing to the increasing adoption and effectiveness of LAA closure devices.

Dominant Markets & Segments in Left Atrial Appendage Devices Industry

The Left Atrial Appendage (LAA) Devices Industry exhibits distinct regional dominance and segment preferences. North America, led by the United States, is currently the largest market due to a combination of factors including a high prevalence of AF, advanced healthcare infrastructure, early adoption of innovative medical technologies, and robust reimbursement policies for LAA closure procedures. The economic policies in the US strongly support the adoption of novel medical devices, and the healthcare system's focus on preventive cardiology contributes to market expansion.

Product Segmentation Dominance:

- Endocardial Devices: This segment currently holds the dominant market share and is expected to continue its lead throughout the forecast period. The ease of access via transseptal puncture and the established track record of transcatheter procedures contribute to its widespread use. Key drivers include technological refinements for better sealing and compatibility with diverse LAA anatomies, along with increasing physician comfort and expertise.

- Epicardial Devices: While a smaller segment, epicardial devices are gaining traction due to their potential for treating complex LAA anatomies not amenable to endocardial approaches. Growth in this segment is driven by advancements in minimally invasive surgical techniques and the development of specialized epicardial closure devices.

End User Dominance:

- Hospitals: Hospitals are the primary end-users of LAA devices, accounting for the largest market share. This is attributed to the complex nature of AF patients, the availability of specialized cardiac catheterization labs and surgical suites, and the comprehensive care provided in hospital settings. Economic policies that favor inpatient procedures and the availability of multidisciplinary cardiac teams contribute to this dominance.

- Ambulatory Surgical Centres: As minimally invasive procedures become more routine, ambulatory surgical centres are emerging as significant players. Their ability to offer cost-effective and efficient procedures for select patient groups is driving growth in this segment. The increasing trend towards outpatient cardiac interventions further bolsters their role.

Regional and Country-Level Dominance:

- North America (United States): As mentioned, the US leads due to high AF incidence, advanced healthcare, and favorable reimbursement.

- Europe: With a significant aging population and a strong emphasis on cardiovascular health, Europe represents another major market, with countries like Germany, the UK, and France showing substantial adoption. Economic policies in these regions are increasingly aligning with the value-based care models that favor LAA closure.

- Asia Pacific: This region is poised for substantial growth, driven by rising AF prevalence, improving healthcare infrastructure, increasing disposable incomes, and growing awareness of LAA closure as a stroke prevention strategy. Government initiatives to enhance healthcare access and the expanding medical tourism sector are key drivers.

Left Atrial Appendage Devices Industry Product Developments

Recent product developments in the Left Atrial Appendage (LAA) Devices Industry focus on enhancing device efficacy, safety, and ease of use. Innovations include the development of more conformable and adaptable devices that can effectively seal a wider range of LAA anatomies, reducing the risk of leak. Advancements in delivery systems aim to improve maneuverability and precision during implantation, minimizing procedural time and potential complications. Furthermore, research is exploring novel biomaterials and designs that promote rapid endothelialization, leading to more permanent and secure closure. These developments are crucial for expanding the patient population eligible for LAA closure and solidifying its position as a preferred stroke prevention strategy.

Report Scope & Segmentation Analysis

This report offers a comprehensive analysis of the Left Atrial Appendage (LAA) Devices Industry, encompassing a detailed segmentation to provide granular market insights. The study covers the historical period from 2019 to 2024, with 2025 as the base and estimated year, and projects market trends and growth through 2033.

- Product Segmentation: The report meticulously analyzes the market for Endocardial Devices and Epicardial Devices. Endocardial devices, accessed via transseptal puncture, are expected to dominate the market due to their established track record and technological advancements. Epicardial devices, though a smaller segment, are projected to experience robust growth driven by their utility in complex anatomies and advancements in minimally invasive surgical techniques.

- End User Segmentation: The analysis is further segmented by Hospitals, Ambulatory Surgical Centres, and Other End Users. Hospitals are anticipated to remain the largest end-user segment, leveraging their comprehensive infrastructure and specialized cardiac teams. Ambulatory Surgical Centres are expected to witness significant growth as LAA closure procedures become more routine and cost-effective, aligning with the trend towards outpatient care.

Key Drivers of Left Atrial Appendage Devices Industry Growth

Several key factors are propelling the growth of the Left Atrial Appendage (LAA) Devices Industry. The increasing global prevalence of atrial fibrillation (AF), particularly in aging populations, creates a larger addressable market. Growing awareness among healthcare professionals and patients about the risks of stroke associated with AF, and the limitations of long-term oral anticoagulation therapy, particularly for those with bleeding predispositions, are driving demand for alternative solutions. Technological advancements in LAA closure devices, leading to improved safety profiles, efficacy, and ease of implantation, are crucial. Favorable reimbursement policies in key markets and the increasing focus on value-based healthcare, which recognizes the cost-effectiveness of preventing strokes, are also significant growth catalysts.

Challenges in the Left Atrial Appendage Devices Industry Sector

Despite the promising growth trajectory, the Left Atrial Appendage (LAA) Devices Industry faces several challenges. The high cost of LAA closure procedures compared to oral anticoagulants can be a barrier to widespread adoption, especially in healthcare systems with limited budgets. Stringent regulatory approval processes for novel devices, although essential for patient safety, can prolong time-to-market and increase development costs. The learning curve associated with LAA closure procedures for physicians, requiring specialized training and expertise, can also limit market penetration. Furthermore, competition from established and emerging oral anticoagulants, which offer simpler administration, remains a significant factor. Ensuring consistent access to these complex devices and their associated delivery systems across diverse geographical regions presents logistical hurdles.

Emerging Opportunities in Left Atrial Appendage Devices Industry

Emerging opportunities in the Left Atrial Appendage (LAA) Devices Industry are abundant, driven by ongoing innovation and evolving patient care paradigms. The development of next-generation LAA closure devices with enhanced sealing capabilities and adaptability to complex anatomies presents significant potential. Expanding the use of LAA closure in younger patient populations with specific risk factors for stroke, beyond the traditional elderly demographic, offers a new avenue for market growth. The integration of artificial intelligence (AI) and advanced imaging techniques for better procedural guidance and patient selection is another promising area. Furthermore, the expansion into emerging markets with increasing AF prevalence and improving healthcare infrastructure represents a substantial opportunity for market players. Strategic partnerships and collaborations aimed at enhancing clinical evidence and improving patient access will also be key to capitalizing on these opportunities.

Leading Players in the Left Atrial Appendage Devices Industry Market

- Articure

- Lifetech Scientific

- Acutus Medical Inc

- Aegis Medical Group

- Cardia Inc

- Boston Scientific

- Abbott

- Johnson & Johnson (Biosense Webster)

- Occlutech

- ŌNŌCOR Llc

Key Developments in Left Atrial Appendage Devices Industry Industry

- September 2022: Boston Scientific Corporation received U.S. Food and Drug Administration (FDA) approval to expand the instructions for use labeling for the current-generation WATCHMAN FLX™ Left Atrial Appendage Closure (LAAC) Device to include a 45-day dual anti-platelet therapy (DAPT) option as an alternative to 45-day oral anticoagulation (OAC) plus aspirin for post-procedural treatment of patients with non-valvular atrial fibrillation (NVAF). This development expands treatment options and potentially improves patient compliance.

- April 2022: Abbott launched the Amplatzer Steerable Delivery sheath in the United States which is used with the company's Amplatzer Amulet Left Atrial appendage occluder to treat people with atrial fibrillation who are at risk of ischemic stroke. This launch enhances the procedural efficiency and maneuverability of a leading LAA closure device.

Strategic Outlook for Left Atrial Appendage Devices Industry Market

The strategic outlook for the Left Atrial Appendage (LAA) Devices Industry is overwhelmingly positive, driven by a convergence of increasing disease burden, technological advancements, and a growing preference for minimally invasive interventions. Future growth catalysts will likely stem from the continuous refinement of device technology to address challenging anatomies and further improve safety and efficacy. Strategic expansions into underserved geographical markets, coupled with robust clinical data dissemination to support wider adoption and favorable reimbursement, will be crucial. Furthermore, increased collaboration between device manufacturers, healthcare providers, and regulatory bodies will accelerate innovation and market access. The industry is also expected to witness strategic alliances and potential consolidations as companies aim to broaden their product portfolios and global reach. The ultimate strategic goal is to establish LAA closure as a cornerstone therapy for stroke prevention in appropriately selected atrial fibrillation patients.

Left Atrial Appendage Devices Industry Segmentation

-

1. Product

- 1.1. Endocardial

- 1.2. Epicardial

-

2. End User

- 2.1. Hospitals

- 2.2. Ambulatory Surgical Centres

- 2.3. Other End Users

Left Atrial Appendage Devices Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

- 4. Rest of the World

Left Atrial Appendage Devices Industry Regional Market Share

Geographic Coverage of Left Atrial Appendage Devices Industry

Left Atrial Appendage Devices Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 20.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Burden of Atrial Fibrillation; Technological Advancements in the Devices

- 3.3. Market Restrains

- 3.3.1. High Cost of Devices

- 3.4. Market Trends

- 3.4.1. Hospital Segment is Expected to Hold a Significant Share in the Left Atrial Appendage Devices Market Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Left Atrial Appendage Devices Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Endocardial

- 5.1.2. Epicardial

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Hospitals

- 5.2.2. Ambulatory Surgical Centres

- 5.2.3. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Left Atrial Appendage Devices Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Endocardial

- 6.1.2. Epicardial

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Hospitals

- 6.2.2. Ambulatory Surgical Centres

- 6.2.3. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Left Atrial Appendage Devices Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Endocardial

- 7.1.2. Epicardial

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Hospitals

- 7.2.2. Ambulatory Surgical Centres

- 7.2.3. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Left Atrial Appendage Devices Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Endocardial

- 8.1.2. Epicardial

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Hospitals

- 8.2.2. Ambulatory Surgical Centres

- 8.2.3. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Rest of the World Left Atrial Appendage Devices Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Endocardial

- 9.1.2. Epicardial

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Hospitals

- 9.2.2. Ambulatory Surgical Centres

- 9.2.3. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Articure

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Lifetech Scientific

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Acutus Medical Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Aegis Medical Group

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Cardia Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Boston Scientific

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Abbott

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Johnson & Johnson (Biosense Webster)

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Occlutech

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 ŌNŌCOR Llc*List Not Exhaustive

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Articure

List of Figures

- Figure 1: Global Left Atrial Appendage Devices Industry Revenue Breakdown (Billion, %) by Region 2025 & 2033

- Figure 2: North America Left Atrial Appendage Devices Industry Revenue (Billion), by Product 2025 & 2033

- Figure 3: North America Left Atrial Appendage Devices Industry Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America Left Atrial Appendage Devices Industry Revenue (Billion), by End User 2025 & 2033

- Figure 5: North America Left Atrial Appendage Devices Industry Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Left Atrial Appendage Devices Industry Revenue (Billion), by Country 2025 & 2033

- Figure 7: North America Left Atrial Appendage Devices Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Left Atrial Appendage Devices Industry Revenue (Billion), by Product 2025 & 2033

- Figure 9: Europe Left Atrial Appendage Devices Industry Revenue Share (%), by Product 2025 & 2033

- Figure 10: Europe Left Atrial Appendage Devices Industry Revenue (Billion), by End User 2025 & 2033

- Figure 11: Europe Left Atrial Appendage Devices Industry Revenue Share (%), by End User 2025 & 2033

- Figure 12: Europe Left Atrial Appendage Devices Industry Revenue (Billion), by Country 2025 & 2033

- Figure 13: Europe Left Atrial Appendage Devices Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Left Atrial Appendage Devices Industry Revenue (Billion), by Product 2025 & 2033

- Figure 15: Asia Pacific Left Atrial Appendage Devices Industry Revenue Share (%), by Product 2025 & 2033

- Figure 16: Asia Pacific Left Atrial Appendage Devices Industry Revenue (Billion), by End User 2025 & 2033

- Figure 17: Asia Pacific Left Atrial Appendage Devices Industry Revenue Share (%), by End User 2025 & 2033

- Figure 18: Asia Pacific Left Atrial Appendage Devices Industry Revenue (Billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Left Atrial Appendage Devices Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Left Atrial Appendage Devices Industry Revenue (Billion), by Product 2025 & 2033

- Figure 21: Rest of the World Left Atrial Appendage Devices Industry Revenue Share (%), by Product 2025 & 2033

- Figure 22: Rest of the World Left Atrial Appendage Devices Industry Revenue (Billion), by End User 2025 & 2033

- Figure 23: Rest of the World Left Atrial Appendage Devices Industry Revenue Share (%), by End User 2025 & 2033

- Figure 24: Rest of the World Left Atrial Appendage Devices Industry Revenue (Billion), by Country 2025 & 2033

- Figure 25: Rest of the World Left Atrial Appendage Devices Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Left Atrial Appendage Devices Industry Revenue Billion Forecast, by Product 2020 & 2033

- Table 2: Global Left Atrial Appendage Devices Industry Revenue Billion Forecast, by End User 2020 & 2033

- Table 3: Global Left Atrial Appendage Devices Industry Revenue Billion Forecast, by Region 2020 & 2033

- Table 4: Global Left Atrial Appendage Devices Industry Revenue Billion Forecast, by Product 2020 & 2033

- Table 5: Global Left Atrial Appendage Devices Industry Revenue Billion Forecast, by End User 2020 & 2033

- Table 6: Global Left Atrial Appendage Devices Industry Revenue Billion Forecast, by Country 2020 & 2033

- Table 7: United States Left Atrial Appendage Devices Industry Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Left Atrial Appendage Devices Industry Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Left Atrial Appendage Devices Industry Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 10: Global Left Atrial Appendage Devices Industry Revenue Billion Forecast, by Product 2020 & 2033

- Table 11: Global Left Atrial Appendage Devices Industry Revenue Billion Forecast, by End User 2020 & 2033

- Table 12: Global Left Atrial Appendage Devices Industry Revenue Billion Forecast, by Country 2020 & 2033

- Table 13: Germany Left Atrial Appendage Devices Industry Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Left Atrial Appendage Devices Industry Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 15: France Left Atrial Appendage Devices Industry Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 16: Italy Left Atrial Appendage Devices Industry Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 17: Spain Left Atrial Appendage Devices Industry Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Left Atrial Appendage Devices Industry Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 19: Global Left Atrial Appendage Devices Industry Revenue Billion Forecast, by Product 2020 & 2033

- Table 20: Global Left Atrial Appendage Devices Industry Revenue Billion Forecast, by End User 2020 & 2033

- Table 21: Global Left Atrial Appendage Devices Industry Revenue Billion Forecast, by Country 2020 & 2033

- Table 22: China Left Atrial Appendage Devices Industry Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 23: Japan Left Atrial Appendage Devices Industry Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 24: India Left Atrial Appendage Devices Industry Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 25: Australia Left Atrial Appendage Devices Industry Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 26: South Korea Left Atrial Appendage Devices Industry Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Left Atrial Appendage Devices Industry Revenue (Billion) Forecast, by Application 2020 & 2033

- Table 28: Global Left Atrial Appendage Devices Industry Revenue Billion Forecast, by Product 2020 & 2033

- Table 29: Global Left Atrial Appendage Devices Industry Revenue Billion Forecast, by End User 2020 & 2033

- Table 30: Global Left Atrial Appendage Devices Industry Revenue Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Left Atrial Appendage Devices Industry?

The projected CAGR is approximately 20.10%.

2. Which companies are prominent players in the Left Atrial Appendage Devices Industry?

Key companies in the market include Articure, Lifetech Scientific, Acutus Medical Inc, Aegis Medical Group, Cardia Inc, Boston Scientific, Abbott, Johnson & Johnson (Biosense Webster), Occlutech, ŌNŌCOR Llc*List Not Exhaustive.

3. What are the main segments of the Left Atrial Appendage Devices Industry?

The market segments include Product, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Burden of Atrial Fibrillation; Technological Advancements in the Devices.

6. What are the notable trends driving market growth?

Hospital Segment is Expected to Hold a Significant Share in the Left Atrial Appendage Devices Market Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Devices.

8. Can you provide examples of recent developments in the market?

September 2022: Boston Scientific Corporation received U.S. Food and Drug Administration (FDA) approval to expand the instructions for use labeling for the current-generation WATCHMAN FLX™ Left Atrial Appendage Closure (LAAC) Device to include a 45-day dual anti-platelet therapy (DAPT) option as an alternative to 45-day oral anticoagulation (OAC) plus aspirin for post-procedural treatment of patients with non-valvular atrial fibrillation (NVAF).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Left Atrial Appendage Devices Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Left Atrial Appendage Devices Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Left Atrial Appendage Devices Industry?

To stay informed about further developments, trends, and reports in the Left Atrial Appendage Devices Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence