Key Insights

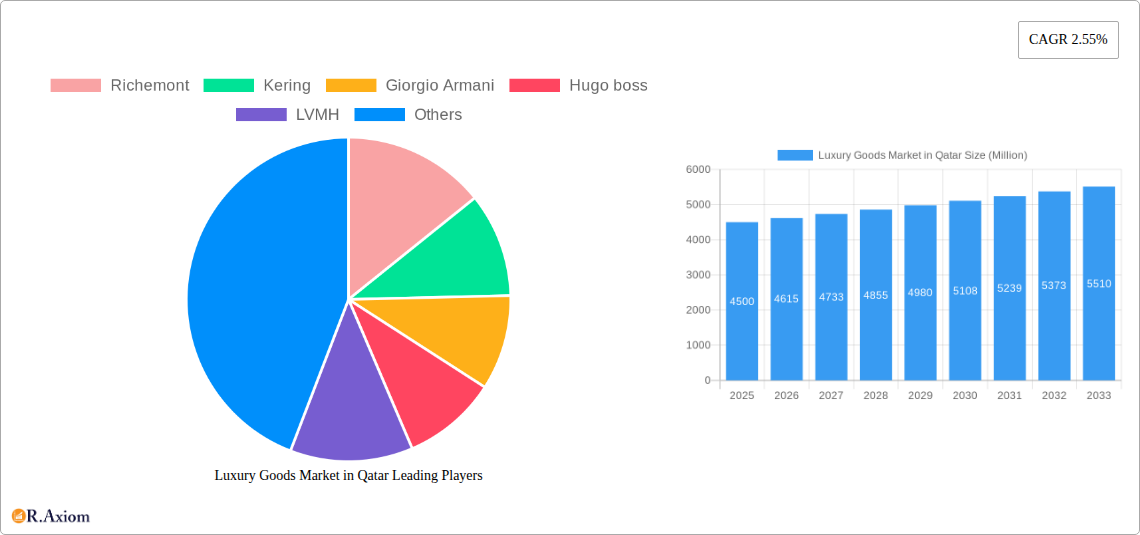

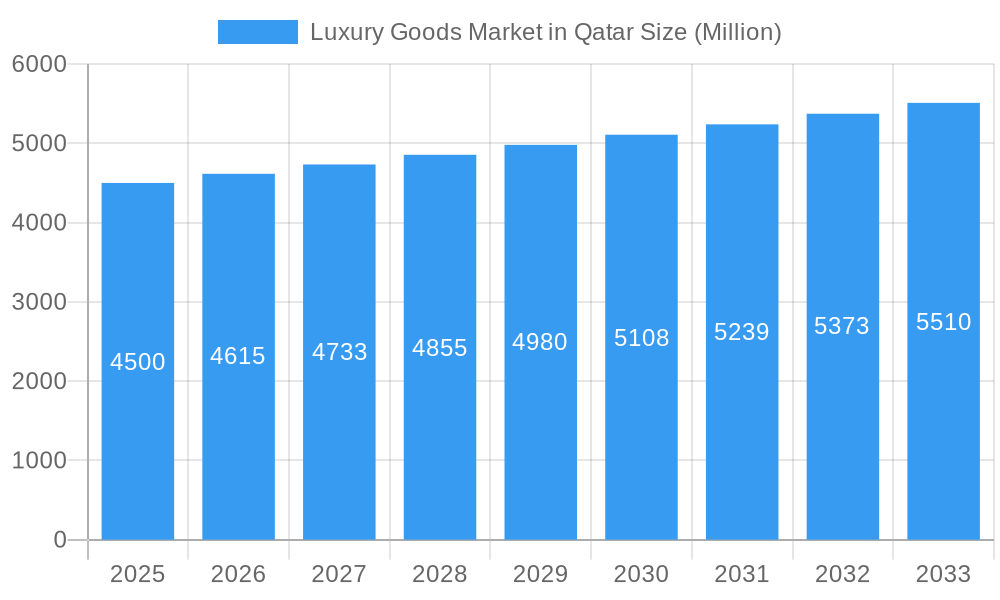

Qatar's luxury goods market is projected for robust expansion, anticipating a market size of 563.28 million by 2033. This growth is driven by a Compound Annual Growth Rate (CAGR) of 5.38% between the base year 2025 and 2033. Key growth factors include Qatar's strong economy, increasing disposable income among affluent consumers, and a high demand for premium brands, appreciation for craftsmanship, and exclusivity. Extensive infrastructure development and major events hosted by Qatar further attract a global elite, increasing demand for luxury items. Market segmentation highlights Clothing & Apparel, Footwear, and Bags as leading categories, followed by Jewellery & Watches. The increasing adoption of online retail complements traditional single-brand and multi-brand stores, indicating a move towards omnichannel engagement.

Luxury Goods Market in Qatar Market Size (In Million)

Future market trends in Qatar's luxury sector will be shaped by the growing influence of e-commerce and digital platforms, enhancing access and personalization. Sustainability and ethical sourcing are also becoming crucial for Qatari consumers, favoring brands with demonstrated corporate social responsibility. Challenges include global economic uncertainties, inflation's impact on consumer spending, and intense competition. However, the luxury sector's inherent resilience, Qatar's economic stability, and a discerning consumer base point to a promising market future, with a focus on evolving male and female luxury consumer preferences.

Luxury Goods Market in Qatar Company Market Share

This comprehensive report provides an exhaustive analysis of Qatar's luxury goods market, projecting a strong CAGR and offering critical insights for stakeholders. Covering 2019-2033, with a 2025 base year, this study examines market dynamics, key players, and future trends in Qatar's high-end consumer sector. We explore market concentration, innovation drivers, regulatory environments, and evolving consumer preferences, delivering actionable intelligence for strategic decision-making.

Luxury Goods Market in Qatar Market Concentration & Innovation

The Luxury Goods Market in Qatar exhibits a moderately concentrated structure, with a few dominant global players vying for market share against a growing landscape of local and regional entrants. Innovation is a primary catalyst for growth, driven by continuous product development, exclusive collections, and the integration of cutting-edge technology in both product design and customer experience. Regulatory frameworks, while generally supportive of foreign investment, require careful navigation by international brands entering the market. Product substitutes are limited in the high-luxury segment, as exclusivity and brand heritage are paramount. End-user trends showcase a discerning consumer base increasingly valuing personalization, sustainable luxury, and experiential retail. Mergers and acquisitions (M&A) activities are anticipated to rise as larger conglomerates seek to expand their footprint and portfolio within this lucrative market. While specific M&A deal values are still developing, the strategic importance of the Qatari market suggests potential for significant transactions aimed at consolidating market presence or acquiring niche luxury brands. Market share is dynamic, with established players holding substantial portions, but emerging brands are gaining traction through digital channels and targeted marketing.

Luxury Goods Market in Qatar Industry Trends & Insights

The Luxury Goods Market in Qatar is experiencing significant growth, propelled by a confluence of factors including a rapidly expanding affluent population, robust economic policies, and a strategic focus on diversifying the economy beyond oil and gas. The forecast period of 2025–2033 is expected to witness sustained expansion, with the market penetration of luxury goods reaching new heights. Technological disruptions are reshaping the industry, with e-commerce platforms and digital marketing strategies playing an increasingly vital role in reaching sophisticated consumers. Online luxury retail, in particular, is witnessing an upward trend, offering convenience and a wider selection of brands and products. Consumer preferences are evolving; while traditional luxury items like haute couture and fine jewelry remain popular, there is a growing demand for experiential luxury, including bespoke services, exclusive events, and personalized product offerings. Sustainability and ethical sourcing are also becoming critical considerations for Qatari luxury consumers, influencing purchasing decisions and brand choices. The competitive dynamics within the market are intensifying, with both global luxury powerhouses and emerging niche brands actively competing for consumer attention and loyalty. This competitive landscape necessitates continuous innovation and a deep understanding of local consumer nuances to maintain a competitive edge. The market is projected to grow at a healthy CAGR, reflecting the underlying economic strength and the evolving consumption patterns of Qatar's high-net-worth individuals.

Dominant Markets & Segments in Luxury Goods Market in Qatar

The Luxury Goods Market in Qatar is characterized by strong demand across several key segments, with Jewellery and Watches emerging as particularly dominant categories, reflecting a deep-seated appreciation for craftsmanship and investment value among Qatari consumers. The Clothing and Apparel segment also holds significant sway, driven by the demand for high-fashion brands and bespoke tailoring.

- Jewellery: This segment benefits from cultural significance, with traditional and contemporary designs both finding favour. The presence of established international luxury jewellers alongside renowned regional artisans contributes to its dominance.

- Watches: The Qatari market displays a strong affinity for high-end timepieces, with collectors and enthusiasts actively seeking rare and limited-edition models. The robust economic standing of the population supports substantial spending in this segment.

- Clothing and Apparel: This segment is fueled by the influx of global fashion brands and the growing interest in avant-garde and designer wear. The demand extends to both haute couture and luxury ready-to-wear collections.

- Bags: Luxury handbags are a significant status symbol and a key component of a high-end wardrobe, driving substantial sales within this category.

- Footwear: High-end footwear, from designer sneakers to elegant heels, contributes significantly to the overall luxury apparel market.

- Other Accessories: This broad category, encompassing luxury scarves, belts, eyewear, and small leather goods, caters to a diverse range of consumer preferences and impulse purchases.

The Single Brand Stores dominate the distribution channel landscape, offering an immersive brand experience and exclusive product assortments. However, Online Stores are rapidly gaining traction, offering convenience and access to a broader selection, particularly for younger demographics. Multi-Brand Stores also play a crucial role in curating a diverse range of luxury offerings under one roof.

- Male Gender Segment: While historically leaning towards female consumers, the male luxury goods market in Qatar is experiencing significant growth, driven by an increasing focus on personal style and a strong demand for luxury watches, formal wear, and accessories.

- Female Gender Segment: This remains the largest segment, with a strong demand for haute couture, fine jewellery, luxury handbags, and high-end cosmetics.

Key drivers for the dominance of these segments include:

- Economic Prosperity: Qatar's high per capita income and wealth accumulation create a fertile ground for luxury spending.

- Cultural Appreciation: A deep-seated cultural value placed on ornate jewellery and fine craftsmanship.

- Global Brand Presence: The strategic establishment of flagship stores by leading international luxury brands.

- Tourism and Events: Major international events hosted in Qatar draw affluent visitors who contribute to luxury retail sales.

Luxury Goods Market in Qatar Product Developments

Product developments in the Qatari luxury goods market are characterized by an increasing emphasis on exclusivity, personalization, and sustainable innovation. Brands are responding to consumer demand for unique items through limited-edition collections and bespoke customization services, particularly in jewellery and watches. Technological integration is evident in smart luxury wearables and enhanced online shopping experiences. Competitive advantages are being forged through superior craftsmanship, ethically sourced materials, and brand storytelling that resonates with the discerning Qatari consumer, driving both desirability and long-term value.

Report Scope & Segmentation Analysis

This report meticulously segments the Luxury Goods Market in Qatar by product type, distribution channel, and gender. The Type segmentation includes Clothing and Apparel, Footwear, Bags, Jewellery, Watches, and Other Accessories, each offering distinct growth projections and market sizes. The Distribution Channel segmentation covers Single Brand Stores, Multi Brand Stores, Online Stores, and Other Distribution Channels, analyzing their evolving market shares and competitive dynamics. The Gender segmentation further divides the market into Male and Female segments, providing detailed insights into purchasing power and preferences within each demographic.

Key Drivers of Luxury Goods Market in Qatar Growth

The Luxury Goods Market in Qatar is propelled by several key drivers.

- Economic Growth and High Disposable Income: A robust economy and a high per capita income among the Qatari population fuels substantial discretionary spending on luxury goods.

- Growing Expatriate Population: The significant influx of expatriates with affluent backgrounds contributes to the demand for international luxury brands.

- Government Initiatives and Investment: Strategic government investments in tourism and retail infrastructure create a conducive environment for luxury brands.

- Digital Transformation: The rapid adoption of e-commerce and digital marketing strategies enhances accessibility and customer engagement for luxury brands.

- Cultural Affinity for Luxury: A strong cultural inclination towards premium products, craftsmanship, and brand prestige.

Challenges in the Luxury Goods Market in Qatar Sector

Despite its growth potential, the Luxury Goods Market in Qatar faces certain challenges.

- Intense Competition: The presence of numerous global and regional luxury brands leads to a highly competitive landscape.

- Evolving Consumer Preferences: Rapidly changing consumer tastes necessitate continuous adaptation and innovation from brands.

- Supply Chain Complexities: Navigating international supply chains and ensuring timely product availability can be challenging.

- Economic Volatility: While currently robust, potential global economic fluctuations could impact consumer spending on discretionary luxury items.

- Talent Acquisition: Securing skilled personnel for specialized roles within the luxury retail sector can be a constraint.

Emerging Opportunities in Luxury Goods Market in Qatar

Emerging opportunities in the Luxury Goods Market in Qatar lie in several key areas.

- Sustainable Luxury: Growing consumer consciousness towards environmental and social responsibility presents a significant opportunity for brands focusing on ethical sourcing and sustainable practices.

- Experiential Retail: The demand for unique experiences, such as personalized styling sessions, exclusive brand events, and immersive in-store environments, offers avenues for differentiation.

- Digital Innovation: Further leveraging e-commerce, augmented reality (AR) for virtual try-ons, and personalized digital marketing can enhance customer reach and engagement.

- Niche Luxury Segments: Exploring and catering to growing demands in specific niche markets like luxury home décor, bespoke travel experiences, and high-end wellness products.

- Collaborations and Partnerships: Strategic alliances with local designers, cultural institutions, or complementary luxury service providers can unlock new customer segments.

Leading Players in the Luxury Goods Market in Qatar Market

- Richemont

- Kering

- Giorgio Armani

- Hugo boss

- LVMH

- Chanel

- Puig

- Joyalukkas

- PVH

- Prada SpA

- Rolex

Key Developments in Luxury Goods Market in Qatar Industry

- November 2022: A luxury e-commerce website, Ounass, was launched in Qatar, where consumers can shop for luxury brands, including Gucci, Saint Laurent, Balenciaga, etc. Consumers can shop for men's, women's, and children's ready-to-wear clothing, handbags, footwear, cosmetics, fine jewelry, and home goods.

- April 2022: Louis Vuitton, a leading global French luxury fashion house, announced the launch of its first store at Qatar Duty-Free in Hamad International Airport, Doha. This space will offer consumers leather goods, ready-to-wear, textiles, watches, jewelry, accessories, fragrances, and shoes for both men and women.

Strategic Outlook for Luxury Goods Market in Qatar Market

The strategic outlook for the Luxury Goods Market in Qatar is exceptionally positive, driven by sustained economic growth, a young and affluent demographic, and a government actively promoting the nation as a global hub for luxury and retail. Future growth catalysts will include continued investment in world-class retail infrastructure, the expansion of e-commerce capabilities, and an increasing focus on experiential luxury offerings that cater to the sophisticated tastes of Qatari consumers. Brands that prioritize personalization, sustainability, and authentic storytelling will be best positioned to capture market share and foster long-term customer loyalty. The market is set to evolve into an even more dynamic and diverse landscape, presenting lucrative opportunities for both established global players and innovative emerging brands.

Luxury Goods Market in Qatar Segmentation

-

1. Type

- 1.1. Clothing and Apparel

- 1.2. Footwear

- 1.3. Bags

- 1.4. Jewellery

- 1.5. Watches

- 1.6. Other Accessories

-

2. Distribution Channel

- 2.1. Single Brand Stores

- 2.2. Multi Brand Stores

- 2.3. Online Stores

- 2.4. Other Distribution Channels

-

3. Gender

- 3.1. Male

- 3.2. Female

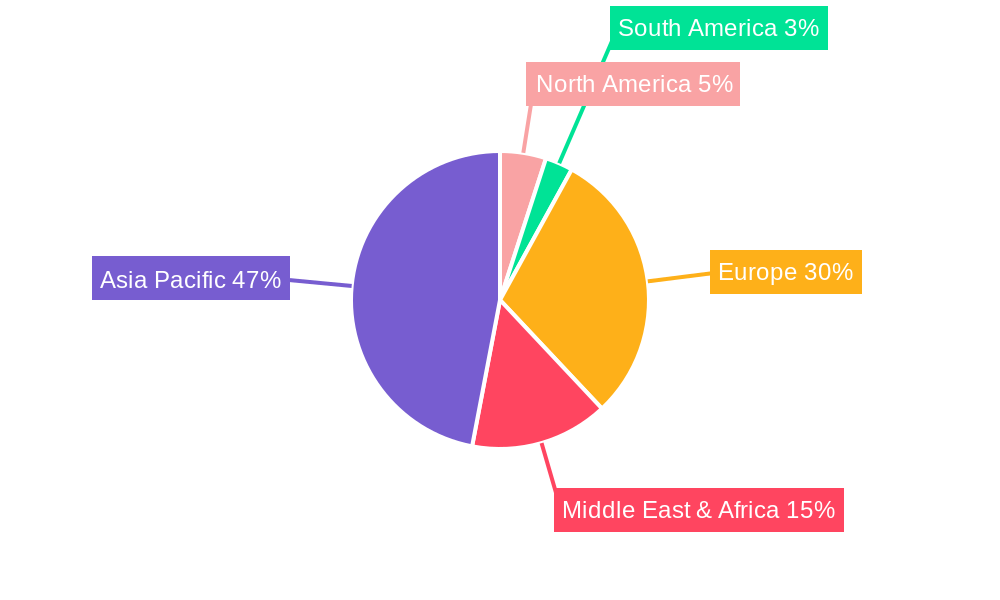

Luxury Goods Market in Qatar Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Luxury Goods Market in Qatar Regional Market Share

Geographic Coverage of Luxury Goods Market in Qatar

Luxury Goods Market in Qatar REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.38% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Fast Fashion Trend; Inflating Income Level of Individuals

- 3.3. Market Restrains

- 3.3.1. The Presence Of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Qatar becoming the Luxury Fashion Hub to Support Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Luxury Goods Market in Qatar Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Clothing and Apparel

- 5.1.2. Footwear

- 5.1.3. Bags

- 5.1.4. Jewellery

- 5.1.5. Watches

- 5.1.6. Other Accessories

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Single Brand Stores

- 5.2.2. Multi Brand Stores

- 5.2.3. Online Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Gender

- 5.3.1. Male

- 5.3.2. Female

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Luxury Goods Market in Qatar Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Clothing and Apparel

- 6.1.2. Footwear

- 6.1.3. Bags

- 6.1.4. Jewellery

- 6.1.5. Watches

- 6.1.6. Other Accessories

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Single Brand Stores

- 6.2.2. Multi Brand Stores

- 6.2.3. Online Stores

- 6.2.4. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Gender

- 6.3.1. Male

- 6.3.2. Female

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Luxury Goods Market in Qatar Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Clothing and Apparel

- 7.1.2. Footwear

- 7.1.3. Bags

- 7.1.4. Jewellery

- 7.1.5. Watches

- 7.1.6. Other Accessories

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Single Brand Stores

- 7.2.2. Multi Brand Stores

- 7.2.3. Online Stores

- 7.2.4. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Gender

- 7.3.1. Male

- 7.3.2. Female

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Luxury Goods Market in Qatar Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Clothing and Apparel

- 8.1.2. Footwear

- 8.1.3. Bags

- 8.1.4. Jewellery

- 8.1.5. Watches

- 8.1.6. Other Accessories

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Single Brand Stores

- 8.2.2. Multi Brand Stores

- 8.2.3. Online Stores

- 8.2.4. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Gender

- 8.3.1. Male

- 8.3.2. Female

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Luxury Goods Market in Qatar Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Clothing and Apparel

- 9.1.2. Footwear

- 9.1.3. Bags

- 9.1.4. Jewellery

- 9.1.5. Watches

- 9.1.6. Other Accessories

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Single Brand Stores

- 9.2.2. Multi Brand Stores

- 9.2.3. Online Stores

- 9.2.4. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by Gender

- 9.3.1. Male

- 9.3.2. Female

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Luxury Goods Market in Qatar Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Clothing and Apparel

- 10.1.2. Footwear

- 10.1.3. Bags

- 10.1.4. Jewellery

- 10.1.5. Watches

- 10.1.6. Other Accessories

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Single Brand Stores

- 10.2.2. Multi Brand Stores

- 10.2.3. Online Stores

- 10.2.4. Other Distribution Channels

- 10.3. Market Analysis, Insights and Forecast - by Gender

- 10.3.1. Male

- 10.3.2. Female

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Richemont

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Kering

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Giorgio Armani

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Hugo boss

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 LVMH

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Chanel

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Puig

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Joyalukkas

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 PVH

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Prada SpA*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Rolex

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Richemont

List of Figures

- Figure 1: Global Luxury Goods Market in Qatar Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Luxury Goods Market in Qatar Revenue (million), by Type 2025 & 2033

- Figure 3: North America Luxury Goods Market in Qatar Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Luxury Goods Market in Qatar Revenue (million), by Distribution Channel 2025 & 2033

- Figure 5: North America Luxury Goods Market in Qatar Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Luxury Goods Market in Qatar Revenue (million), by Gender 2025 & 2033

- Figure 7: North America Luxury Goods Market in Qatar Revenue Share (%), by Gender 2025 & 2033

- Figure 8: North America Luxury Goods Market in Qatar Revenue (million), by Country 2025 & 2033

- Figure 9: North America Luxury Goods Market in Qatar Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Luxury Goods Market in Qatar Revenue (million), by Type 2025 & 2033

- Figure 11: South America Luxury Goods Market in Qatar Revenue Share (%), by Type 2025 & 2033

- Figure 12: South America Luxury Goods Market in Qatar Revenue (million), by Distribution Channel 2025 & 2033

- Figure 13: South America Luxury Goods Market in Qatar Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 14: South America Luxury Goods Market in Qatar Revenue (million), by Gender 2025 & 2033

- Figure 15: South America Luxury Goods Market in Qatar Revenue Share (%), by Gender 2025 & 2033

- Figure 16: South America Luxury Goods Market in Qatar Revenue (million), by Country 2025 & 2033

- Figure 17: South America Luxury Goods Market in Qatar Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Luxury Goods Market in Qatar Revenue (million), by Type 2025 & 2033

- Figure 19: Europe Luxury Goods Market in Qatar Revenue Share (%), by Type 2025 & 2033

- Figure 20: Europe Luxury Goods Market in Qatar Revenue (million), by Distribution Channel 2025 & 2033

- Figure 21: Europe Luxury Goods Market in Qatar Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 22: Europe Luxury Goods Market in Qatar Revenue (million), by Gender 2025 & 2033

- Figure 23: Europe Luxury Goods Market in Qatar Revenue Share (%), by Gender 2025 & 2033

- Figure 24: Europe Luxury Goods Market in Qatar Revenue (million), by Country 2025 & 2033

- Figure 25: Europe Luxury Goods Market in Qatar Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Luxury Goods Market in Qatar Revenue (million), by Type 2025 & 2033

- Figure 27: Middle East & Africa Luxury Goods Market in Qatar Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East & Africa Luxury Goods Market in Qatar Revenue (million), by Distribution Channel 2025 & 2033

- Figure 29: Middle East & Africa Luxury Goods Market in Qatar Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Middle East & Africa Luxury Goods Market in Qatar Revenue (million), by Gender 2025 & 2033

- Figure 31: Middle East & Africa Luxury Goods Market in Qatar Revenue Share (%), by Gender 2025 & 2033

- Figure 32: Middle East & Africa Luxury Goods Market in Qatar Revenue (million), by Country 2025 & 2033

- Figure 33: Middle East & Africa Luxury Goods Market in Qatar Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Luxury Goods Market in Qatar Revenue (million), by Type 2025 & 2033

- Figure 35: Asia Pacific Luxury Goods Market in Qatar Revenue Share (%), by Type 2025 & 2033

- Figure 36: Asia Pacific Luxury Goods Market in Qatar Revenue (million), by Distribution Channel 2025 & 2033

- Figure 37: Asia Pacific Luxury Goods Market in Qatar Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 38: Asia Pacific Luxury Goods Market in Qatar Revenue (million), by Gender 2025 & 2033

- Figure 39: Asia Pacific Luxury Goods Market in Qatar Revenue Share (%), by Gender 2025 & 2033

- Figure 40: Asia Pacific Luxury Goods Market in Qatar Revenue (million), by Country 2025 & 2033

- Figure 41: Asia Pacific Luxury Goods Market in Qatar Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Luxury Goods Market in Qatar Revenue million Forecast, by Type 2020 & 2033

- Table 2: Global Luxury Goods Market in Qatar Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Luxury Goods Market in Qatar Revenue million Forecast, by Gender 2020 & 2033

- Table 4: Global Luxury Goods Market in Qatar Revenue million Forecast, by Region 2020 & 2033

- Table 5: Global Luxury Goods Market in Qatar Revenue million Forecast, by Type 2020 & 2033

- Table 6: Global Luxury Goods Market in Qatar Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 7: Global Luxury Goods Market in Qatar Revenue million Forecast, by Gender 2020 & 2033

- Table 8: Global Luxury Goods Market in Qatar Revenue million Forecast, by Country 2020 & 2033

- Table 9: United States Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Canada Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Global Luxury Goods Market in Qatar Revenue million Forecast, by Type 2020 & 2033

- Table 13: Global Luxury Goods Market in Qatar Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 14: Global Luxury Goods Market in Qatar Revenue million Forecast, by Gender 2020 & 2033

- Table 15: Global Luxury Goods Market in Qatar Revenue million Forecast, by Country 2020 & 2033

- Table 16: Brazil Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Argentina Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Global Luxury Goods Market in Qatar Revenue million Forecast, by Type 2020 & 2033

- Table 20: Global Luxury Goods Market in Qatar Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 21: Global Luxury Goods Market in Qatar Revenue million Forecast, by Gender 2020 & 2033

- Table 22: Global Luxury Goods Market in Qatar Revenue million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Germany Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: France Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Italy Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Spain Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Russia Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 29: Benelux Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: Nordics Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Global Luxury Goods Market in Qatar Revenue million Forecast, by Type 2020 & 2033

- Table 33: Global Luxury Goods Market in Qatar Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 34: Global Luxury Goods Market in Qatar Revenue million Forecast, by Gender 2020 & 2033

- Table 35: Global Luxury Goods Market in Qatar Revenue million Forecast, by Country 2020 & 2033

- Table 36: Turkey Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Israel Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 38: GCC Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 39: North Africa Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 40: South Africa Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: Global Luxury Goods Market in Qatar Revenue million Forecast, by Type 2020 & 2033

- Table 43: Global Luxury Goods Market in Qatar Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 44: Global Luxury Goods Market in Qatar Revenue million Forecast, by Gender 2020 & 2033

- Table 45: Global Luxury Goods Market in Qatar Revenue million Forecast, by Country 2020 & 2033

- Table 46: China Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 47: India Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 48: Japan Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 49: South Korea Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 51: Oceania Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Luxury Goods Market in Qatar Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Luxury Goods Market in Qatar?

The projected CAGR is approximately 5.38%.

2. Which companies are prominent players in the Luxury Goods Market in Qatar?

Key companies in the market include Richemont, Kering, Giorgio Armani, Hugo boss, LVMH, Chanel, Puig, Joyalukkas, PVH, Prada SpA*List Not Exhaustive, Rolex.

3. What are the main segments of the Luxury Goods Market in Qatar?

The market segments include Type, Distribution Channel, Gender.

4. Can you provide details about the market size?

The market size is estimated to be USD 563.28 million as of 2022.

5. What are some drivers contributing to market growth?

Fast Fashion Trend; Inflating Income Level of Individuals.

6. What are the notable trends driving market growth?

Qatar becoming the Luxury Fashion Hub to Support Market Growth.

7. Are there any restraints impacting market growth?

The Presence Of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

November 2022: A luxury e-commerce website, Ounass, was launched in Qatar, where consumers can shop for luxury brands, including Gucci, Saint Laurent, Balenciaga, etc. Consumers can shop for men's, women's, and children's ready-to-wear clothing, handbags, footwear, cosmetics, fine jewelry, and home goods.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Luxury Goods Market in Qatar," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Luxury Goods Market in Qatar report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Luxury Goods Market in Qatar?

To stay informed about further developments, trends, and reports in the Luxury Goods Market in Qatar, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence