Key Insights

The Thai luxury goods market, a dynamic sector encompassing apparel, footwear, accessories, jewelry, and timepieces, presents a significant growth opportunity. Fueled by an expanding high-net-worth individual (HNWI) demographic, rising disposable incomes, and a pronounced consumer preference for aspirational brands, the market is projected for sustained expansion. The robust tourism industry further bolsters demand, particularly in segments renowned for Thailand's superior craftsmanship, such as jewelry and watches. Key distribution channels are evolving, with a notable increase in online retail alongside established single- and multi-brand stores, catering to the digitally proficient luxury consumer. While economic volatility may pose a challenge, the overall positive growth trajectory is expected to persist, supported by the strong presence of global luxury leaders. Strategic adaptation to evolving consumer preferences, embracing integrated online and offline approaches, and demographic-specific segmentation will be paramount for future success.

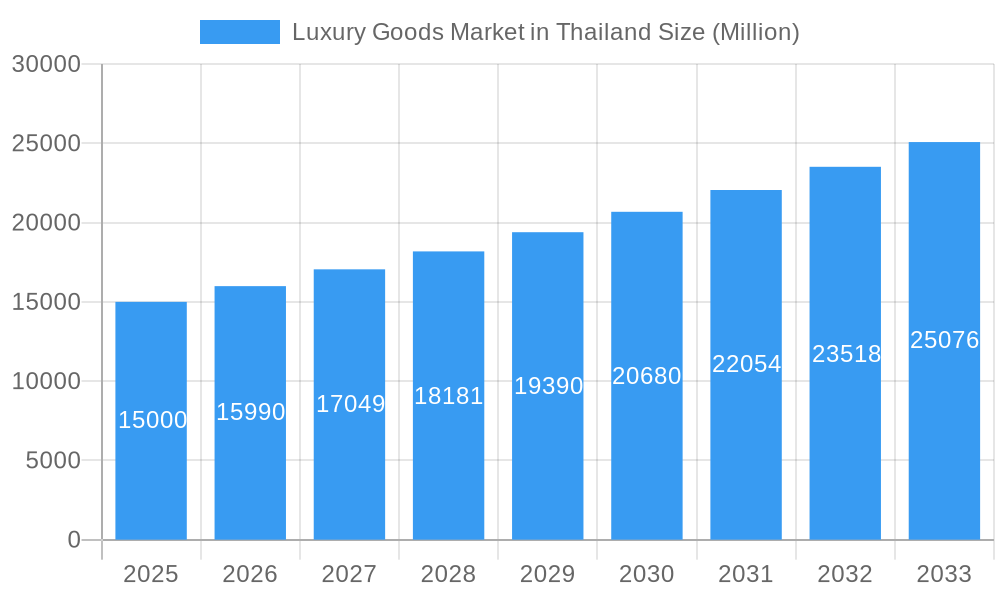

Luxury Goods Market in Thailand Market Size (In Billion)

Strategic brand positioning is central to the market's continued expansion. International luxury brands recognize Thailand as a pivotal Southeast Asian hub, evidenced by investments in flagship retail spaces and tailored marketing initiatives. Concurrently, domestic brands are successfully establishing themselves by leveraging distinctive Thai design elements and artisanal expertise. Future growth will depend on balancing these forces, with product innovation and personalized customer experiences serving as key drivers. Brands must adeptly manage the competitive landscape, navigating the interplay between established global players and emerging local contenders. The burgeoning online retail channel offers both considerable advantages and unique hurdles, necessitating secure, personalized, and seamless digital shopping experiences that uphold brand exclusivity and high-touch service standards through advanced technology and sophisticated digital marketing strategies.

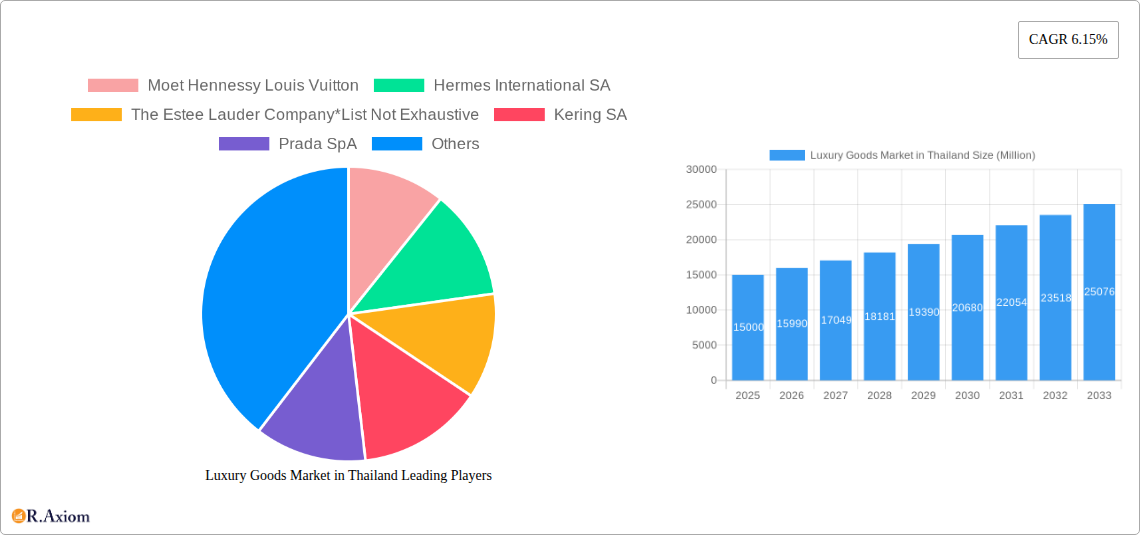

Luxury Goods Market in Thailand Company Market Share

The Thai luxury goods market is projected to reach $3.2 billion by 2024, expanding at a compound annual growth rate (CAGR) of 9.8% from a base year of 2024.

Luxury Goods Market in Thailand: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the thriving luxury goods market in Thailand, covering the period from 2019 to 2033. It offers invaluable insights for industry stakeholders, investors, and businesses seeking to understand the market dynamics, growth drivers, and future opportunities within this lucrative sector. The report utilizes a robust methodology incorporating historical data (2019-2024), a base year of 2025, and forecasts extending to 2033. The market is segmented by product type (Clothing and Apparel, Footwear, Bags, Jewellery, Watches, Other Types) and distribution channel (Single-branded Stores, Multi-brand Stores, Online Retail Stores, Other Distribution Channels). Key players like Moet Hennessy Louis Vuitton, Hermes International SA, The Estee Lauder Company, Kering SA, Prada SpA, The Swatch Group Ltd, Chanel SA, Rolex SA, PVH Corp, and Ralph Lauren Corporation are analyzed for their market positioning and strategies. The report's total market value prediction for 2025 is estimated at xx Million.

Luxury Goods Market in Thailand Market Concentration & Innovation

The Thai luxury goods market exhibits a moderately concentrated landscape, dominated by a few key international players and a growing number of local luxury brands. Market share data from 2024 shows that the top 5 players account for approximately 60% of the total market value (xx Million). Innovation is a key driver, with brands focusing on limited-edition products, personalized experiences, and sustainable practices to cater to the discerning Thai consumer. Regulatory frameworks, while generally supportive of foreign investment, are evolving to address issues related to intellectual property protection and counterfeit goods. Consumers are increasingly seeking unique experiences and personalized service, which drives innovation in retail formats and customer engagement strategies. The market experiences consistent M&A activities, though deal values vary greatly depending on the size and scope of the acquisition. Over the period 2019-2024, the total value of M&A deals in the Thai luxury goods sector is estimated to be around xx Million. Several factors contribute to this trend, including the desire for market expansion, access to new technologies, and diversification of brand portfolios.

- Key Market Concentration Metrics: Top 5 players holding 60% market share in 2024; xx Million total M&A deal value (2019-2024).

- Innovation Drivers: Limited-edition products, personalized experiences, sustainable practices.

- Regulatory Landscape: Evolving to address intellectual property rights and counterfeit goods.

- End-user Trends: Demand for unique experiences and personalized service.

Luxury Goods Market in Thailand Industry Trends & Insights

The Thai luxury goods market demonstrates robust growth, fueled by a rising affluent population with a strong appetite for luxury brands. The market experienced a CAGR of xx% during the historical period (2019-2024) and is projected to maintain a healthy CAGR of xx% during the forecast period (2025-2033). Several factors drive this growth: a burgeoning middle class with increasing disposable income, a strong tourism sector, and a preference for premium brands. However, the market is not immune to external shocks, such as economic downturns or global health crises. Technological disruptions, primarily e-commerce and personalized marketing strategies, have profoundly impacted the market, leading to increased online sales and heightened brand engagement. Furthermore, consumer preferences are shifting toward experiences, sustainability, and local craftsmanship, prompting brands to adapt their offerings and messaging. Competition is intense, with both established luxury houses and emerging brands vying for market share. The market penetration of online luxury retail channels continues to grow, with projections of reaching xx% by 2033.

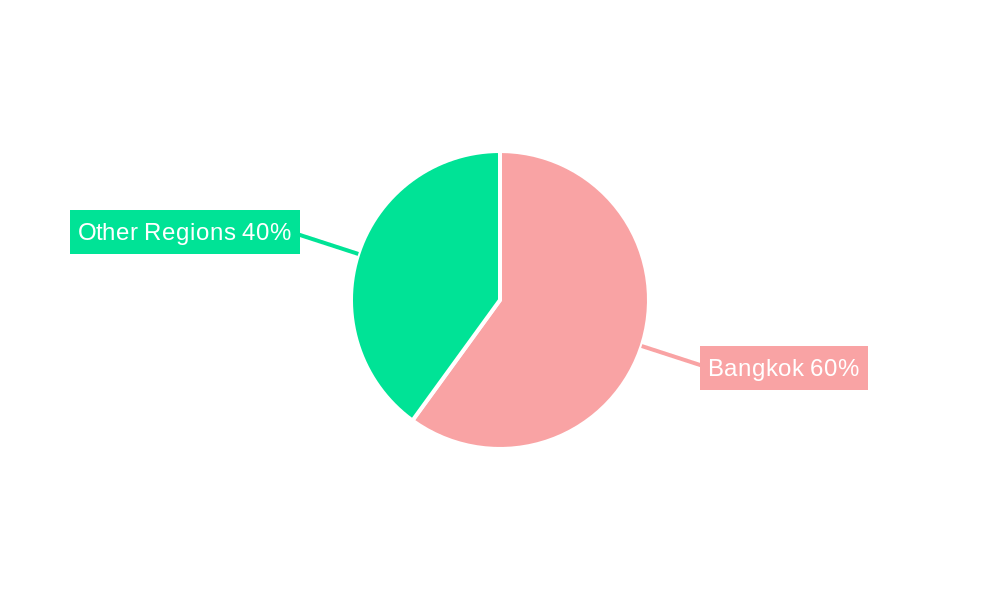

Dominant Markets & Segments in Luxury Goods Market in Thailand

Bangkok remains the dominant market for luxury goods in Thailand, accounting for approximately 70% of total sales, driven by its concentration of high-net-worth individuals, luxury retail outlets, and tourist attractions. Within the product segments, watches and jewellery maintain the leading positions due to their high perceived value and cultural significance.

- Key Drivers for Bangkok's Dominance: High concentration of HNWIs, luxury retail outlets, and tourism.

- Leading Product Segments: Watches and jewellery due to high perceived value and cultural significance.

- Distribution Channel Dominance: Single-branded stores currently hold the largest market share, but online retail is experiencing rapid growth.

Dominant Segments by Type:

- Watches: Strong demand driven by both domestic and international tourists.

- Jewellery: Significant cultural importance and high price points contribute to strong sales.

- Bags: A popular segment with a diverse range of offerings across price points.

Dominant Segments by Distribution Channel:

- Single-branded Stores: High-end brands favour this channel to maintain brand image and control the customer experience.

- Multi-brand Stores: Offer a wider selection of products catering to different preferences.

- Online Retail Stores: Shows rapid growth, driven by increased internet penetration and convenience.

Luxury Goods Market in Thailand Product Developments

Recent product innovations in the Thai luxury goods market highlight a focus on personalization, sustainability, and technological integration. Brands are incorporating smart technology into their products, such as wearable tech integrated into watches and clothing, and using augmented reality (AR) and virtual reality (VR) for enhanced customer experiences. Furthermore, there's a growing emphasis on sustainable materials and ethical sourcing, appealing to environmentally conscious consumers. This focus on innovation allows brands to maintain their competitive edge and appeal to the evolving preferences of the Thai luxury consumer.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Thai luxury goods market, segmented by product type (Clothing and Apparel, Footwear, Bags, Jewellery, Watches, Other Types) and distribution channel (Single-branded Stores, Multi-brand Stores, Online Retail Stores, Other Distribution Channels). Each segment is analyzed for its market size, growth projections, and competitive dynamics. The forecast period (2025-2033) projects significant growth across all segments, driven by rising disposable income and increased tourism. The competitive landscape is dynamic, with both established and emerging players competing for market share, leading to innovation in product offerings and marketing strategies.

Key Drivers of Luxury Goods Market in Thailand Growth

The growth of the Thai luxury goods market is fueled by a confluence of factors. Rising disposable incomes among the affluent population, a burgeoning middle class striving for upward mobility, and a strong tourism sector contribute significantly. Furthermore, the increasing popularity of e-commerce and social media marketing provides brands with new avenues for reaching consumers. Government policies that support foreign investment and tourism also play a crucial role.

Challenges in the Luxury Goods Market in Thailand Sector

The Thai luxury goods market faces challenges, including economic volatility which can impact consumer spending, and the prevalence of counterfeit goods. Supply chain disruptions can also affect the availability of products, especially luxury items. Intense competition necessitates constant innovation and adaptation by brands.

Emerging Opportunities in Luxury Goods Market in Thailand

The Thai luxury goods market presents significant opportunities for growth. The increasing demand for personalized experiences and sustainable products presents a ripe area for innovation. Furthermore, tapping into the expanding e-commerce market and catering to the needs of the young, digitally savvy luxury consumer can yield significant returns. Moreover, the growing interest in locally produced luxury goods offers an avenue for Thai artisans and brands to showcase their heritage and craftsmanship.

Leading Players in the Luxury Goods Market in Thailand Market

Key Developments in Luxury Goods Market in Thailand Industry

- July 2022: Cortina Watch Thailand launched a new luxury watch boutique at The Mandarin Oriental Hotel, featuring Patek Philippe, Franck Muller, and Breguet brands. This signals a shift towards creating unique and high-end shopping experiences.

- July 2022: Ulysse Nardin launched a limited-edition Diver Chrono Great White watch, showcasing innovation and appealing to collectors. This highlights the trend of limited-edition luxury items.

- June 2022: Estée Lauder Travel Retail launched a luxury fragrance collection in Thailand via King Power Duty-Free, expanding its reach through strategic partnerships. This expands the reach of luxury brands to a broader audience and utilizes travel retail channels effectively.

Strategic Outlook for Luxury Goods Market in Thailand Market

The future of the Thai luxury goods market is bright, with strong growth potential driven by continued economic expansion, rising affluence, and evolving consumer preferences. Brands that successfully adapt to these changing trends, focus on personalized experiences, prioritize sustainability, and leverage technological innovations will be best positioned for success. The market's potential for expansion in e-commerce and the increasing demand for unique, high-quality products will continue to shape the industry in the coming years.

Luxury Goods Market in Thailand Segmentation

-

1. Type

- 1.1. Clothing and Apparel

- 1.2. Footwear

- 1.3. Bags

- 1.4. Jewellery

- 1.5. Watches

- 1.6. Other Types

-

2. Distibution Channel

- 2.1. Single-branded Stores

- 2.2. Multi-brand Stores

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

Luxury Goods Market in Thailand Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Luxury Goods Market in Thailand Regional Market Share

Geographic Coverage of Luxury Goods Market in Thailand

Luxury Goods Market in Thailand REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Appeal for Multi-functional and Damage Control Hair Care Products; Prevalence of Different Hair Concerns Remains the Major Driving Force

- 3.3. Market Restrains

- 3.3.1. Growing Availability of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Growing Influence of Social Media on Buying Decisions

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Luxury Goods Market in Thailand Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Clothing and Apparel

- 5.1.2. Footwear

- 5.1.3. Bags

- 5.1.4. Jewellery

- 5.1.5. Watches

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 5.2.1. Single-branded Stores

- 5.2.2. Multi-brand Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Luxury Goods Market in Thailand Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Clothing and Apparel

- 6.1.2. Footwear

- 6.1.3. Bags

- 6.1.4. Jewellery

- 6.1.5. Watches

- 6.1.6. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 6.2.1. Single-branded Stores

- 6.2.2. Multi-brand Stores

- 6.2.3. Online Retail Stores

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Luxury Goods Market in Thailand Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Clothing and Apparel

- 7.1.2. Footwear

- 7.1.3. Bags

- 7.1.4. Jewellery

- 7.1.5. Watches

- 7.1.6. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 7.2.1. Single-branded Stores

- 7.2.2. Multi-brand Stores

- 7.2.3. Online Retail Stores

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Luxury Goods Market in Thailand Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Clothing and Apparel

- 8.1.2. Footwear

- 8.1.3. Bags

- 8.1.4. Jewellery

- 8.1.5. Watches

- 8.1.6. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 8.2.1. Single-branded Stores

- 8.2.2. Multi-brand Stores

- 8.2.3. Online Retail Stores

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Luxury Goods Market in Thailand Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Clothing and Apparel

- 9.1.2. Footwear

- 9.1.3. Bags

- 9.1.4. Jewellery

- 9.1.5. Watches

- 9.1.6. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 9.2.1. Single-branded Stores

- 9.2.2. Multi-brand Stores

- 9.2.3. Online Retail Stores

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Luxury Goods Market in Thailand Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Clothing and Apparel

- 10.1.2. Footwear

- 10.1.3. Bags

- 10.1.4. Jewellery

- 10.1.5. Watches

- 10.1.6. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 10.2.1. Single-branded Stores

- 10.2.2. Multi-brand Stores

- 10.2.3. Online Retail Stores

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Moet Hennessy Louis Vuitton

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hermes International SA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 The Estee Lauder Company*List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Kering SA

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Prada SpA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 The Swatch Group Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Chanel SA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Rolex SA

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 PVH Corp

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Ralph Lauren Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Moet Hennessy Louis Vuitton

List of Figures

- Figure 1: Global Luxury Goods Market in Thailand Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Luxury Goods Market in Thailand Volume Breakdown (K Units, %) by Region 2025 & 2033

- Figure 3: North America Luxury Goods Market in Thailand Revenue (billion), by Type 2025 & 2033

- Figure 4: North America Luxury Goods Market in Thailand Volume (K Units), by Type 2025 & 2033

- Figure 5: North America Luxury Goods Market in Thailand Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Luxury Goods Market in Thailand Volume Share (%), by Type 2025 & 2033

- Figure 7: North America Luxury Goods Market in Thailand Revenue (billion), by Distibution Channel 2025 & 2033

- Figure 8: North America Luxury Goods Market in Thailand Volume (K Units), by Distibution Channel 2025 & 2033

- Figure 9: North America Luxury Goods Market in Thailand Revenue Share (%), by Distibution Channel 2025 & 2033

- Figure 10: North America Luxury Goods Market in Thailand Volume Share (%), by Distibution Channel 2025 & 2033

- Figure 11: North America Luxury Goods Market in Thailand Revenue (billion), by Country 2025 & 2033

- Figure 12: North America Luxury Goods Market in Thailand Volume (K Units), by Country 2025 & 2033

- Figure 13: North America Luxury Goods Market in Thailand Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Luxury Goods Market in Thailand Volume Share (%), by Country 2025 & 2033

- Figure 15: South America Luxury Goods Market in Thailand Revenue (billion), by Type 2025 & 2033

- Figure 16: South America Luxury Goods Market in Thailand Volume (K Units), by Type 2025 & 2033

- Figure 17: South America Luxury Goods Market in Thailand Revenue Share (%), by Type 2025 & 2033

- Figure 18: South America Luxury Goods Market in Thailand Volume Share (%), by Type 2025 & 2033

- Figure 19: South America Luxury Goods Market in Thailand Revenue (billion), by Distibution Channel 2025 & 2033

- Figure 20: South America Luxury Goods Market in Thailand Volume (K Units), by Distibution Channel 2025 & 2033

- Figure 21: South America Luxury Goods Market in Thailand Revenue Share (%), by Distibution Channel 2025 & 2033

- Figure 22: South America Luxury Goods Market in Thailand Volume Share (%), by Distibution Channel 2025 & 2033

- Figure 23: South America Luxury Goods Market in Thailand Revenue (billion), by Country 2025 & 2033

- Figure 24: South America Luxury Goods Market in Thailand Volume (K Units), by Country 2025 & 2033

- Figure 25: South America Luxury Goods Market in Thailand Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Luxury Goods Market in Thailand Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe Luxury Goods Market in Thailand Revenue (billion), by Type 2025 & 2033

- Figure 28: Europe Luxury Goods Market in Thailand Volume (K Units), by Type 2025 & 2033

- Figure 29: Europe Luxury Goods Market in Thailand Revenue Share (%), by Type 2025 & 2033

- Figure 30: Europe Luxury Goods Market in Thailand Volume Share (%), by Type 2025 & 2033

- Figure 31: Europe Luxury Goods Market in Thailand Revenue (billion), by Distibution Channel 2025 & 2033

- Figure 32: Europe Luxury Goods Market in Thailand Volume (K Units), by Distibution Channel 2025 & 2033

- Figure 33: Europe Luxury Goods Market in Thailand Revenue Share (%), by Distibution Channel 2025 & 2033

- Figure 34: Europe Luxury Goods Market in Thailand Volume Share (%), by Distibution Channel 2025 & 2033

- Figure 35: Europe Luxury Goods Market in Thailand Revenue (billion), by Country 2025 & 2033

- Figure 36: Europe Luxury Goods Market in Thailand Volume (K Units), by Country 2025 & 2033

- Figure 37: Europe Luxury Goods Market in Thailand Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe Luxury Goods Market in Thailand Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East & Africa Luxury Goods Market in Thailand Revenue (billion), by Type 2025 & 2033

- Figure 40: Middle East & Africa Luxury Goods Market in Thailand Volume (K Units), by Type 2025 & 2033

- Figure 41: Middle East & Africa Luxury Goods Market in Thailand Revenue Share (%), by Type 2025 & 2033

- Figure 42: Middle East & Africa Luxury Goods Market in Thailand Volume Share (%), by Type 2025 & 2033

- Figure 43: Middle East & Africa Luxury Goods Market in Thailand Revenue (billion), by Distibution Channel 2025 & 2033

- Figure 44: Middle East & Africa Luxury Goods Market in Thailand Volume (K Units), by Distibution Channel 2025 & 2033

- Figure 45: Middle East & Africa Luxury Goods Market in Thailand Revenue Share (%), by Distibution Channel 2025 & 2033

- Figure 46: Middle East & Africa Luxury Goods Market in Thailand Volume Share (%), by Distibution Channel 2025 & 2033

- Figure 47: Middle East & Africa Luxury Goods Market in Thailand Revenue (billion), by Country 2025 & 2033

- Figure 48: Middle East & Africa Luxury Goods Market in Thailand Volume (K Units), by Country 2025 & 2033

- Figure 49: Middle East & Africa Luxury Goods Market in Thailand Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East & Africa Luxury Goods Market in Thailand Volume Share (%), by Country 2025 & 2033

- Figure 51: Asia Pacific Luxury Goods Market in Thailand Revenue (billion), by Type 2025 & 2033

- Figure 52: Asia Pacific Luxury Goods Market in Thailand Volume (K Units), by Type 2025 & 2033

- Figure 53: Asia Pacific Luxury Goods Market in Thailand Revenue Share (%), by Type 2025 & 2033

- Figure 54: Asia Pacific Luxury Goods Market in Thailand Volume Share (%), by Type 2025 & 2033

- Figure 55: Asia Pacific Luxury Goods Market in Thailand Revenue (billion), by Distibution Channel 2025 & 2033

- Figure 56: Asia Pacific Luxury Goods Market in Thailand Volume (K Units), by Distibution Channel 2025 & 2033

- Figure 57: Asia Pacific Luxury Goods Market in Thailand Revenue Share (%), by Distibution Channel 2025 & 2033

- Figure 58: Asia Pacific Luxury Goods Market in Thailand Volume Share (%), by Distibution Channel 2025 & 2033

- Figure 59: Asia Pacific Luxury Goods Market in Thailand Revenue (billion), by Country 2025 & 2033

- Figure 60: Asia Pacific Luxury Goods Market in Thailand Volume (K Units), by Country 2025 & 2033

- Figure 61: Asia Pacific Luxury Goods Market in Thailand Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Pacific Luxury Goods Market in Thailand Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Luxury Goods Market in Thailand Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Luxury Goods Market in Thailand Volume K Units Forecast, by Type 2020 & 2033

- Table 3: Global Luxury Goods Market in Thailand Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 4: Global Luxury Goods Market in Thailand Volume K Units Forecast, by Distibution Channel 2020 & 2033

- Table 5: Global Luxury Goods Market in Thailand Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Luxury Goods Market in Thailand Volume K Units Forecast, by Region 2020 & 2033

- Table 7: Global Luxury Goods Market in Thailand Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Global Luxury Goods Market in Thailand Volume K Units Forecast, by Type 2020 & 2033

- Table 9: Global Luxury Goods Market in Thailand Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 10: Global Luxury Goods Market in Thailand Volume K Units Forecast, by Distibution Channel 2020 & 2033

- Table 11: Global Luxury Goods Market in Thailand Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Global Luxury Goods Market in Thailand Volume K Units Forecast, by Country 2020 & 2033

- Table 13: United States Luxury Goods Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United States Luxury Goods Market in Thailand Volume (K Units) Forecast, by Application 2020 & 2033

- Table 15: Canada Luxury Goods Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Canada Luxury Goods Market in Thailand Volume (K Units) Forecast, by Application 2020 & 2033

- Table 17: Mexico Luxury Goods Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Mexico Luxury Goods Market in Thailand Volume (K Units) Forecast, by Application 2020 & 2033

- Table 19: Global Luxury Goods Market in Thailand Revenue billion Forecast, by Type 2020 & 2033

- Table 20: Global Luxury Goods Market in Thailand Volume K Units Forecast, by Type 2020 & 2033

- Table 21: Global Luxury Goods Market in Thailand Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 22: Global Luxury Goods Market in Thailand Volume K Units Forecast, by Distibution Channel 2020 & 2033

- Table 23: Global Luxury Goods Market in Thailand Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Global Luxury Goods Market in Thailand Volume K Units Forecast, by Country 2020 & 2033

- Table 25: Brazil Luxury Goods Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Brazil Luxury Goods Market in Thailand Volume (K Units) Forecast, by Application 2020 & 2033

- Table 27: Argentina Luxury Goods Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Argentina Luxury Goods Market in Thailand Volume (K Units) Forecast, by Application 2020 & 2033

- Table 29: Rest of South America Luxury Goods Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Rest of South America Luxury Goods Market in Thailand Volume (K Units) Forecast, by Application 2020 & 2033

- Table 31: Global Luxury Goods Market in Thailand Revenue billion Forecast, by Type 2020 & 2033

- Table 32: Global Luxury Goods Market in Thailand Volume K Units Forecast, by Type 2020 & 2033

- Table 33: Global Luxury Goods Market in Thailand Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 34: Global Luxury Goods Market in Thailand Volume K Units Forecast, by Distibution Channel 2020 & 2033

- Table 35: Global Luxury Goods Market in Thailand Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Global Luxury Goods Market in Thailand Volume K Units Forecast, by Country 2020 & 2033

- Table 37: United Kingdom Luxury Goods Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: United Kingdom Luxury Goods Market in Thailand Volume (K Units) Forecast, by Application 2020 & 2033

- Table 39: Germany Luxury Goods Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Germany Luxury Goods Market in Thailand Volume (K Units) Forecast, by Application 2020 & 2033

- Table 41: France Luxury Goods Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: France Luxury Goods Market in Thailand Volume (K Units) Forecast, by Application 2020 & 2033

- Table 43: Italy Luxury Goods Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: Italy Luxury Goods Market in Thailand Volume (K Units) Forecast, by Application 2020 & 2033

- Table 45: Spain Luxury Goods Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Spain Luxury Goods Market in Thailand Volume (K Units) Forecast, by Application 2020 & 2033

- Table 47: Russia Luxury Goods Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Russia Luxury Goods Market in Thailand Volume (K Units) Forecast, by Application 2020 & 2033

- Table 49: Benelux Luxury Goods Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: Benelux Luxury Goods Market in Thailand Volume (K Units) Forecast, by Application 2020 & 2033

- Table 51: Nordics Luxury Goods Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Nordics Luxury Goods Market in Thailand Volume (K Units) Forecast, by Application 2020 & 2033

- Table 53: Rest of Europe Luxury Goods Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Rest of Europe Luxury Goods Market in Thailand Volume (K Units) Forecast, by Application 2020 & 2033

- Table 55: Global Luxury Goods Market in Thailand Revenue billion Forecast, by Type 2020 & 2033

- Table 56: Global Luxury Goods Market in Thailand Volume K Units Forecast, by Type 2020 & 2033

- Table 57: Global Luxury Goods Market in Thailand Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 58: Global Luxury Goods Market in Thailand Volume K Units Forecast, by Distibution Channel 2020 & 2033

- Table 59: Global Luxury Goods Market in Thailand Revenue billion Forecast, by Country 2020 & 2033

- Table 60: Global Luxury Goods Market in Thailand Volume K Units Forecast, by Country 2020 & 2033

- Table 61: Turkey Luxury Goods Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 62: Turkey Luxury Goods Market in Thailand Volume (K Units) Forecast, by Application 2020 & 2033

- Table 63: Israel Luxury Goods Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 64: Israel Luxury Goods Market in Thailand Volume (K Units) Forecast, by Application 2020 & 2033

- Table 65: GCC Luxury Goods Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 66: GCC Luxury Goods Market in Thailand Volume (K Units) Forecast, by Application 2020 & 2033

- Table 67: North Africa Luxury Goods Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 68: North Africa Luxury Goods Market in Thailand Volume (K Units) Forecast, by Application 2020 & 2033

- Table 69: South Africa Luxury Goods Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 70: South Africa Luxury Goods Market in Thailand Volume (K Units) Forecast, by Application 2020 & 2033

- Table 71: Rest of Middle East & Africa Luxury Goods Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 72: Rest of Middle East & Africa Luxury Goods Market in Thailand Volume (K Units) Forecast, by Application 2020 & 2033

- Table 73: Global Luxury Goods Market in Thailand Revenue billion Forecast, by Type 2020 & 2033

- Table 74: Global Luxury Goods Market in Thailand Volume K Units Forecast, by Type 2020 & 2033

- Table 75: Global Luxury Goods Market in Thailand Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 76: Global Luxury Goods Market in Thailand Volume K Units Forecast, by Distibution Channel 2020 & 2033

- Table 77: Global Luxury Goods Market in Thailand Revenue billion Forecast, by Country 2020 & 2033

- Table 78: Global Luxury Goods Market in Thailand Volume K Units Forecast, by Country 2020 & 2033

- Table 79: China Luxury Goods Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 80: China Luxury Goods Market in Thailand Volume (K Units) Forecast, by Application 2020 & 2033

- Table 81: India Luxury Goods Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 82: India Luxury Goods Market in Thailand Volume (K Units) Forecast, by Application 2020 & 2033

- Table 83: Japan Luxury Goods Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 84: Japan Luxury Goods Market in Thailand Volume (K Units) Forecast, by Application 2020 & 2033

- Table 85: South Korea Luxury Goods Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 86: South Korea Luxury Goods Market in Thailand Volume (K Units) Forecast, by Application 2020 & 2033

- Table 87: ASEAN Luxury Goods Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 88: ASEAN Luxury Goods Market in Thailand Volume (K Units) Forecast, by Application 2020 & 2033

- Table 89: Oceania Luxury Goods Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 90: Oceania Luxury Goods Market in Thailand Volume (K Units) Forecast, by Application 2020 & 2033

- Table 91: Rest of Asia Pacific Luxury Goods Market in Thailand Revenue (billion) Forecast, by Application 2020 & 2033

- Table 92: Rest of Asia Pacific Luxury Goods Market in Thailand Volume (K Units) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Luxury Goods Market in Thailand?

The projected CAGR is approximately 9.8%.

2. Which companies are prominent players in the Luxury Goods Market in Thailand?

Key companies in the market include Moet Hennessy Louis Vuitton, Hermes International SA, The Estee Lauder Company*List Not Exhaustive, Kering SA, Prada SpA, The Swatch Group Ltd, Chanel SA, Rolex SA, PVH Corp, Ralph Lauren Corporation.

3. What are the main segments of the Luxury Goods Market in Thailand?

The market segments include Type, Distibution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.2 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Appeal for Multi-functional and Damage Control Hair Care Products; Prevalence of Different Hair Concerns Remains the Major Driving Force.

6. What are the notable trends driving market growth?

Growing Influence of Social Media on Buying Decisions.

7. Are there any restraints impacting market growth?

Growing Availability of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

In July 2022, Cortina Watch Thailand launched the new luxury watch boutique at The Mandarin Oriental Hotel. Providing customers the unique shopping experience. The new boutique combined 3 watches brand within area of 156 sqm., including Patek Philippe, Franck Muller, and Breguet.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Luxury Goods Market in Thailand," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Luxury Goods Market in Thailand report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Luxury Goods Market in Thailand?

To stay informed about further developments, trends, and reports in the Luxury Goods Market in Thailand, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence