Key Insights

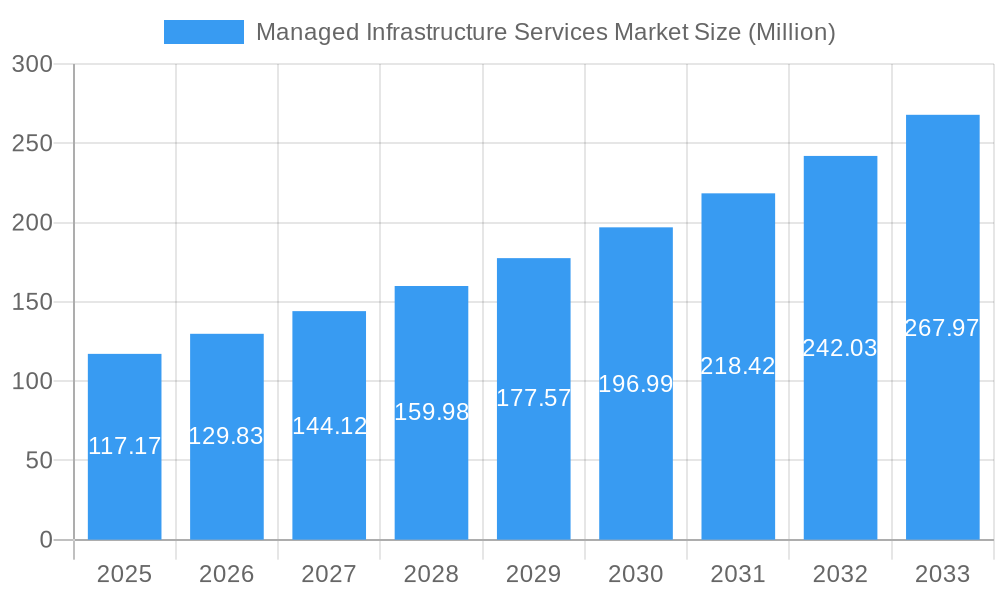

The Managed Infrastructure Services Market is poised for robust expansion, projected to reach a substantial USD 117.17 million by 2025, with a compelling Compound Annual Growth Rate (CAGR) of 10.22% anticipated through 2033. This significant growth is fueled by a confluence of transformative factors. The escalating complexity of IT infrastructure, coupled with the increasing adoption of cloud technologies and the growing demand for specialized IT expertise, are primary drivers propelling the market forward. Businesses across all sectors are increasingly recognizing the strategic advantage of outsourcing their IT infrastructure management to specialized providers, allowing them to focus on core competencies and innovation. The shift towards remote work models and the proliferation of hybrid cloud environments further accentuate the need for sophisticated managed services to ensure seamless operations, enhanced security, and cost optimization. The market's trajectory also reflects a growing emphasis on proactive IT management, predictive analytics, and automation to mitigate risks and improve service delivery efficiency.

Managed Infrastructure Services Market Market Size (In Million)

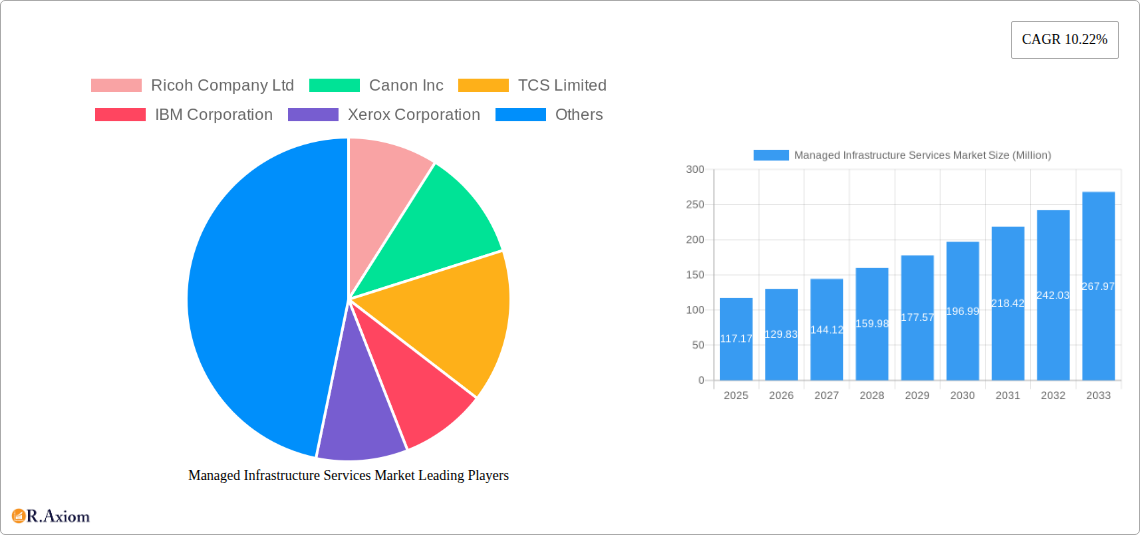

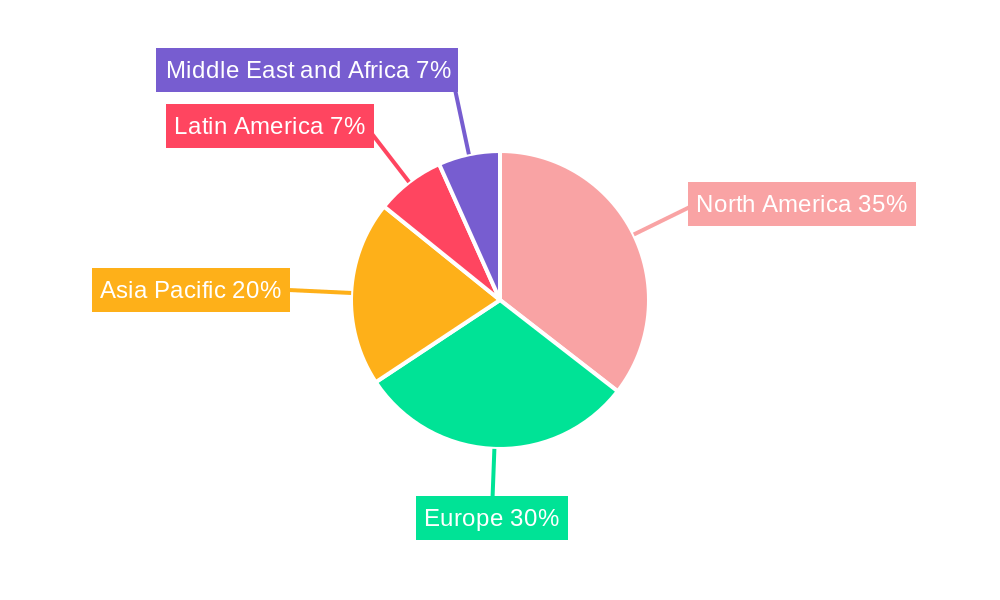

The market segmentation reveals a dynamic landscape with distinct growth opportunities. The Cloud deployment segment is expected to witness the most substantial growth, reflecting the widespread migration of businesses to cloud-based solutions for scalability and flexibility. Among service types, Desktop and Print Services, along with Servers, are projected to remain key revenue generators, underpinned by the continuous need for reliable end-user support and core server management. The BFSI and IT and Telecom sectors are anticipated to be the leading end-users, driven by stringent regulatory requirements, the critical nature of their operations, and the rapid pace of technological evolution in these industries. Geographically, North America and Europe are expected to continue their dominance, owing to the mature IT markets and high adoption rates of managed services. However, the Asia Pacific region is poised for significant growth, fueled by increasing digital transformation initiatives and a burgeoning IT ecosystem. Key players such as Ricoh Company Ltd, Canon Inc, TCS Limited, and IBM Corporation are actively shaping the market through strategic acquisitions, technological advancements, and expanded service offerings.

Managed Infrastructure Services Market Company Market Share

This detailed report provides an in-depth analysis of the global Managed Infrastructure Services Market, offering critical insights for industry stakeholders. Covering the historical period of 2019–2024 and projecting growth through 2033, with a base year of 2025, this study delves into market dynamics, key players, emerging trends, and segmentation analysis. The Managed Infrastructure Services Market Size is projected to reach $XXX Million by 2033, exhibiting a robust CAGR of XX% during the forecast period. This comprehensive overview is designed to equip businesses with actionable intelligence for strategic decision-making in the rapidly evolving IT landscape.

Managed Infrastructure Services Market Market Concentration & Innovation

The Managed Infrastructure Services Market is characterized by a moderate level of market concentration, with a mix of large, established global players and a growing number of specialized providers. Innovation is a key differentiator, driven by the constant evolution of cloud technologies, cybersecurity demands, and the increasing need for agile IT operations. Regulatory frameworks, particularly around data privacy and compliance, also significantly influence service offerings and operational strategies. Product substitutes are emerging, primarily in the form of fully automated IT management tools and in-house IT capabilities, though the complexity and scale of enterprise needs often favor managed services. End-user trends, such as the widespread adoption of hybrid and multi-cloud environments and the demand for greater digital transformation, are pushing service providers to enhance their service portfolios. Mergers and acquisitions (M&A) remain a significant strategy for market expansion and capability enhancement. Recent M&A activities in the broader IT services sector, with deal values often in the hundreds of millions, signal a consolidation trend aimed at acquiring specialized expertise and expanding market reach. Key players like IBM Corporation, Ricoh Company Ltd, and TCS Limited are actively involved in shaping the market through strategic partnerships and service innovation.

Managed Infrastructure Services Market Industry Trends & Insights

The Managed Infrastructure Services Market is experiencing substantial growth, fueled by the increasing complexity of IT environments and the growing need for businesses to focus on core competencies rather than IT management. The pervasive adoption of cloud computing, including public, private, and hybrid models, is a primary growth driver, as organizations seek expertise in managing these dynamic infrastructures. Cybersecurity threats are escalating, compelling businesses to outsource their security management to specialized providers who can offer advanced protection and rapid response capabilities. The rise of remote work and the digital transformation initiatives across all industries further amplify the demand for reliable, scalable, and secure IT infrastructure.

Technological disruptions, such as the advent of AI and Machine Learning in IT operations (AIOps), are revolutionizing how infrastructure is managed, enabling predictive maintenance, automated troubleshooting, and enhanced efficiency. The Internet of Things (IoT) is creating new avenues for managed services, particularly in monitoring and managing vast networks of connected devices. Consumer preferences are shifting towards outcome-based service models, where businesses pay for performance and results rather than just the provision of services. This demands a more proactive and strategic approach from managed service providers.

The competitive landscape is intense, with established IT giants vying for market share against agile, niche players. Differentiation is increasingly achieved through specialized expertise in specific cloud platforms, industry-specific solutions, and advanced analytics capabilities. The CAGR for the Managed Infrastructure Services Market is projected to be around XX% over the forecast period, reflecting its strong upward trajectory. Market penetration continues to deepen across various sectors, as businesses of all sizes recognize the strategic advantages of leveraging external expertise for their critical IT infrastructure. This trend is further accelerated by the increasing cost-efficiency and scalability offered by managed services compared to maintaining in-house IT departments.

Dominant Markets & Segments in Managed Infrastructure Services Market

The Managed Infrastructure Services Market is experiencing significant growth and dominance across various segments, driven by distinct factors.

Deployment Type: Cloud Dominance and On-Premise Niche

- Cloud: The Cloud deployment type is unequivocally leading the market. This dominance is propelled by the inherent scalability, flexibility, and cost-effectiveness of cloud solutions. The shift towards hybrid and multi-cloud strategies by enterprises further solidifies cloud's position. The ease of access to advanced technologies and the reduced burden of capital expenditure are major economic policies favoring cloud adoption.

- On-premise: While still significant, On-premise deployment is gradually seeing a slower growth rate compared to cloud. However, specific industries with stringent data residency requirements or highly sensitive data, such as some government entities or legacy financial institutions, continue to opt for on-premise solutions for enhanced control and security.

Services Type: Desktop and Print Services Evolving, Servers and Inventory Growing Steadily

- Servers: The Servers segment is a robust contributor, driven by the continuous need for reliable and scalable server infrastructure, whether physical or virtual. The growing demand for high-performance computing and data processing power fuels this segment.

- Desktop and Print Services: This segment, while mature, is undergoing transformation. With the rise of remote work, there's an increased demand for managed endpoint security, device management, and optimized printing solutions to support distributed workforces.

- Inventory: While not a standalone service, efficient IT inventory management is crucial for optimizing infrastructure. This segment's growth is tied to the overall expansion of IT assets managed by service providers.

- Other Types: This broad category includes emerging services such as network management, cybersecurity services, disaster recovery, and IT consulting, which are experiencing rapid expansion due to evolving technological landscapes and business needs.

End User: IT and Telecom Leading, BFSI and Healthcare Showing Strong Growth

- IT and Telecom: This sector is the largest consumer of managed infrastructure services, given its inherently complex and technology-intensive nature. The continuous need for network optimization, data center management, and cybersecurity solutions makes this segment a powerhouse.

- BFSI (Banking, Financial Services, and Insurance): The BFSI sector is a significant and growing market. Stringent regulatory compliance, the need for robust security to protect sensitive financial data, and the drive for digital transformation (e.g., online banking, fintech solutions) are key drivers. Economic policies promoting financial inclusion and digital banking further boost this segment.

- Healthcare: This sector is experiencing rapid adoption of managed infrastructure services to manage patient data, electronic health records (EHRs), and healthcare IoT devices. Compliance with regulations like HIPAA, coupled with the need for data integrity and accessibility, fuels this growth.

- Manufacturing: The manufacturing industry is increasingly leveraging managed services for Industry 4.0 initiatives, including smart factories, IoT deployment, and supply chain optimization. The focus on operational efficiency and automation is a primary driver.

- Retail: Retailers are adopting managed infrastructure services to support e-commerce platforms, inventory management systems, point-of-sale (POS) systems, and customer relationship management (CRM) solutions. The need for seamless customer experiences and efficient operations is paramount.

- Other End Users: This includes government, education, and media & entertainment sectors, all of which are increasingly relying on managed services for various IT needs, from data management to cloud migration.

Managed Infrastructure Services Market Product Developments

The Managed Infrastructure Services Market is witnessing a surge in product developments focused on enhancing automation, security, and cloud integration. Innovations include AI-powered IT operations management (AIOps) tools for predictive maintenance and proactive issue resolution, advanced cybersecurity solutions that leverage machine learning to detect and mitigate threats in real-time, and integrated platforms that simplify the management of multi-cloud environments. Service providers are also developing specialized solutions for emerging technologies like IoT and edge computing, offering enhanced capabilities for data ingestion, processing, and analytics. These developments aim to provide clients with greater efficiency, reduced downtime, improved security posture, and a more agile IT infrastructure, thereby offering a significant competitive advantage in their respective industries.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the Managed Infrastructure Services Market across key segmentation dimensions.

Deployment Type:

- On-premise: This segment focuses on the management of IT infrastructure residing within an organization's physical premises. It caters to businesses with specific security, regulatory, or control requirements. Projections indicate steady but slower growth compared to cloud.

- Cloud: This segment encompasses the management of infrastructure hosted on public, private, or hybrid cloud platforms. It is expected to exhibit the highest growth rate due to its scalability and flexibility.

Services Type:

- Desktop and Print Services: This segment covers the management of end-user computing devices and printing solutions. Growth is driven by evolving remote work needs and device lifecycle management.

- Servers: This segment includes the management of physical and virtual server environments, crucial for core business operations. It shows consistent demand and growth.

- Inventory: This segment focuses on the tracking and management of IT assets, essential for cost optimization and resource allocation. Its growth is intrinsically linked to overall IT infrastructure expansion.

- Other Types: This broad category includes a spectrum of specialized services like network management, cybersecurity, disaster recovery, and data center management, all experiencing significant expansion.

End User:

- BFSI: This segment, comprising banking, financial services, and insurance, exhibits strong growth due to stringent compliance and digital transformation needs.

- IT and Telecom: The largest segment, driven by the inherent technological complexity and continuous evolution of these industries.

- Healthcare: Rapidly growing due to data management, security, and regulatory compliance needs.

- Manufacturing: Driven by Industry 4.0, IoT, and operational efficiency demands.

- Retail: Fueled by e-commerce, inventory management, and customer experience enhancement.

- Other End Users: This includes a diverse range of sectors like government, education, and media, all contributing to the market's overall expansion.

Key Drivers of Managed Infrastructure Services Market Growth

Several factors are propelling the Managed Infrastructure Services Market forward:

- Increasing IT Complexity: As businesses adopt advanced technologies like cloud, IoT, and AI, managing these intricate environments becomes challenging, leading to outsourcing.

- Focus on Core Business Competencies: Organizations are offloading IT management to concentrate on strategic initiatives and innovation.

- Cybersecurity Demands: The escalating threat landscape necessitates specialized expertise in security management, which managed service providers offer.

- Cost Optimization: Managed services can offer economies of scale and predictable operational expenses, reducing the burden of capital expenditure.

- Digital Transformation Initiatives: The widespread push for digital transformation requires robust, scalable, and agile IT infrastructure, often best managed by experts.

- Skill Gap: The shortage of skilled IT professionals in specialized areas encourages businesses to leverage external managed services.

Challenges in the Managed Infrastructure Services Market Sector

Despite its robust growth, the Managed Infrastructure Services Market faces several challenges:

- Security Concerns and Data Breaches: Despite outsourcing, the ultimate responsibility for data security often remains with the client, and breaches can severely damage trust and reputation.

- Vendor Lock-in: Organizations may become heavily reliant on a single provider, making it difficult and costly to switch vendors.

- Integration Complexity: Integrating managed services with existing legacy systems can be challenging and time-consuming.

- Service Level Agreement (SLA) Mismatches: Ensuring that SLAs accurately reflect business needs and are consistently met can be a point of contention.

- Evolving Regulatory Landscape: Keeping pace with ever-changing data privacy and compliance regulations across different geographies adds complexity.

- Talent Shortage in Specialized Areas: Even managed service providers can face challenges in recruiting and retaining highly skilled professionals for niche technologies.

Emerging Opportunities in Managed Infrastructure Services Market

The Managed Infrastructure Services Market is ripe with emerging opportunities:

- Hybrid and Multi-Cloud Management: As organizations increasingly adopt complex cloud strategies, there's a significant demand for specialized services to manage these environments seamlessly.

- Edge Computing Services: The proliferation of IoT devices and the need for real-time data processing at the edge present a growing opportunity for managed edge infrastructure.

- AI-driven IT Operations (AIOps): The integration of AI and machine learning for predictive maintenance, automation, and enhanced IT service delivery is a rapidly expanding field.

- Industry-Specific Managed Services: Developing tailored solutions for specific verticals like healthcare, manufacturing, and BFSI, addressing their unique regulatory and operational needs, offers a competitive edge.

- Managed Cybersecurity Services: With cyber threats constantly evolving, the demand for advanced, proactive, and comprehensive managed security solutions will continue to surge.

- Sustainability in IT Infrastructure: Offering services that focus on optimizing energy consumption and reducing the environmental footprint of IT infrastructure is an emerging trend.

Leading Players in the Managed Infrastructure Services Market Market

- Ricoh Company Ltd

- Canon Inc

- TCS Limited

- IBM Corporation

- Xerox Corporation

- Toshiba Corporation

- Fujitsu Ltd

- Alcatel-Lucent SA (Nokia Corporation)

- Hewlett Packard Enterprise

- Lexmark International Inc

- Cisco Systems Inc

- Verizon Communications Inc

- Microsoft Corporation

- Deutsche Telekom AG

- Dell Technologies Inc

- Konica Minolta Inc

- Citrix Systems Inc

Key Developments in Managed Infrastructure Services Market Industry

- September 2023: Cloud4C achieved the APAC region's Google Cloud Specialization for Infrastructure Services, showcasing its extensive technical proficiency in offering fully managed infrastructure modernization and digital transformation solutions driven by Google Cloud.

- May 2023: Kyndryl Holdings, Inc. and Cloudflare, Inc. partnered to help businesses modernize and scale their corporate networks with managed WAN-as-a-Service and Cloudflare Zero Trust, enabling more efficient multi-cloud connectivity.

- October 2022: Gulf Bridge International (GBI) and Alliance International Management (AIM) signed a partnership to provide digital infrastructure services in the Middle East, leveraging GBI's Smart Network.

- June 2022: Cisco Systems and Kyndryl formed a technology partnership, integrating Cisco's products with Kyndryl's managed services capabilities to co-develop new private cloud services, network, and edge computing solutions.

Strategic Outlook for Managed Infrastructure Services Market Market

The future of the Managed Infrastructure Services Market is exceptionally promising, driven by the relentless pace of technological advancement and the increasing reliance of businesses on robust IT infrastructure. Key growth catalysts include the continued migration to cloud environments, the adoption of sophisticated cybersecurity measures, and the demand for specialized managed services tailored to emerging technologies like AI and edge computing. Organizations will increasingly seek partners who can not only manage their infrastructure but also provide strategic guidance and drive digital transformation initiatives. The market is poised for significant expansion as businesses of all sizes recognize the value of leveraging external expertise to enhance efficiency, reduce costs, and maintain a competitive edge in the global digital economy. The ongoing evolution of services towards outcome-based models and specialized industry solutions will further shape the market landscape, creating ample opportunities for innovation and growth.

Managed Infrastructure Services Market Segmentation

-

1. Deployment Type

- 1.1. On-premise

- 1.2. Cloud

-

2. Services Type

- 2.1. Desktop and Print Services

- 2.2. Servers

- 2.3. Inventory

- 2.4. Other Types

-

3. End User

- 3.1. BFSI

- 3.2. IT and Telecom

- 3.3. Healthcare

- 3.4. Manufacturing

- 3.5. Retail

- 3.6. Other End Users

Managed Infrastructure Services Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. UK

- 2.3. France

- 2.4. Spain

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Argentina

- 4.4. Rest of Latin America

-

5. Middle East and Africa

- 5.1. UAE

- 5.2. Saudi Arabia

- 5.3. South Africa

- 5.4. Rest of Middle East and Africa

Managed Infrastructure Services Market Regional Market Share

Geographic Coverage of Managed Infrastructure Services Market

Managed Infrastructure Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.22% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing use of Cloud Managed Infrastructure Services; Technological Proliferation and Advancement of Cloud Based Technology Boosting the Demand; Improved cost and Operational Efficiency and Update of Outdated Hardware

- 3.3. Market Restrains

- 3.3.1. Declining Profit Margins and Integration and Reliability Concerns

- 3.4. Market Trends

- 3.4.1. The Cloud Segment is Expected to Exhibit the Highest Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Managed Infrastructure Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Deployment Type

- 5.1.1. On-premise

- 5.1.2. Cloud

- 5.2. Market Analysis, Insights and Forecast - by Services Type

- 5.2.1. Desktop and Print Services

- 5.2.2. Servers

- 5.2.3. Inventory

- 5.2.4. Other Types

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. BFSI

- 5.3.2. IT and Telecom

- 5.3.3. Healthcare

- 5.3.4. Manufacturing

- 5.3.5. Retail

- 5.3.6. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Deployment Type

- 6. North America Managed Infrastructure Services Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Deployment Type

- 6.1.1. On-premise

- 6.1.2. Cloud

- 6.2. Market Analysis, Insights and Forecast - by Services Type

- 6.2.1. Desktop and Print Services

- 6.2.2. Servers

- 6.2.3. Inventory

- 6.2.4. Other Types

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. BFSI

- 6.3.2. IT and Telecom

- 6.3.3. Healthcare

- 6.3.4. Manufacturing

- 6.3.5. Retail

- 6.3.6. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Deployment Type

- 7. Europe Managed Infrastructure Services Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Deployment Type

- 7.1.1. On-premise

- 7.1.2. Cloud

- 7.2. Market Analysis, Insights and Forecast - by Services Type

- 7.2.1. Desktop and Print Services

- 7.2.2. Servers

- 7.2.3. Inventory

- 7.2.4. Other Types

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. BFSI

- 7.3.2. IT and Telecom

- 7.3.3. Healthcare

- 7.3.4. Manufacturing

- 7.3.5. Retail

- 7.3.6. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Deployment Type

- 8. Asia Pacific Managed Infrastructure Services Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Deployment Type

- 8.1.1. On-premise

- 8.1.2. Cloud

- 8.2. Market Analysis, Insights and Forecast - by Services Type

- 8.2.1. Desktop and Print Services

- 8.2.2. Servers

- 8.2.3. Inventory

- 8.2.4. Other Types

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. BFSI

- 8.3.2. IT and Telecom

- 8.3.3. Healthcare

- 8.3.4. Manufacturing

- 8.3.5. Retail

- 8.3.6. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Deployment Type

- 9. Latin America Managed Infrastructure Services Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Deployment Type

- 9.1.1. On-premise

- 9.1.2. Cloud

- 9.2. Market Analysis, Insights and Forecast - by Services Type

- 9.2.1. Desktop and Print Services

- 9.2.2. Servers

- 9.2.3. Inventory

- 9.2.4. Other Types

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. BFSI

- 9.3.2. IT and Telecom

- 9.3.3. Healthcare

- 9.3.4. Manufacturing

- 9.3.5. Retail

- 9.3.6. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Deployment Type

- 10. Middle East and Africa Managed Infrastructure Services Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Deployment Type

- 10.1.1. On-premise

- 10.1.2. Cloud

- 10.2. Market Analysis, Insights and Forecast - by Services Type

- 10.2.1. Desktop and Print Services

- 10.2.2. Servers

- 10.2.3. Inventory

- 10.2.4. Other Types

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. BFSI

- 10.3.2. IT and Telecom

- 10.3.3. Healthcare

- 10.3.4. Manufacturing

- 10.3.5. Retail

- 10.3.6. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Deployment Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Ricoh Company Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Canon Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 TCS Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 IBM Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Xerox Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Toshiba Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Fujitsu Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Alcatel-Lucent SA (Nokia Corporation)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Hewlett Packard Enterprise

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Lexmark International Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Cisco Systems Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Verizon Communications Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Microsoft Corporation

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Deutsche Telekom AG

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Dell Technologies Inc

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Konica Minolta Inc

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Citrix Systems Inc

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 Ricoh Company Ltd

List of Figures

- Figure 1: Global Managed Infrastructure Services Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Managed Infrastructure Services Market Revenue (Million), by Deployment Type 2025 & 2033

- Figure 3: North America Managed Infrastructure Services Market Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 4: North America Managed Infrastructure Services Market Revenue (Million), by Services Type 2025 & 2033

- Figure 5: North America Managed Infrastructure Services Market Revenue Share (%), by Services Type 2025 & 2033

- Figure 6: North America Managed Infrastructure Services Market Revenue (Million), by End User 2025 & 2033

- Figure 7: North America Managed Infrastructure Services Market Revenue Share (%), by End User 2025 & 2033

- Figure 8: North America Managed Infrastructure Services Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Managed Infrastructure Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Managed Infrastructure Services Market Revenue (Million), by Deployment Type 2025 & 2033

- Figure 11: Europe Managed Infrastructure Services Market Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 12: Europe Managed Infrastructure Services Market Revenue (Million), by Services Type 2025 & 2033

- Figure 13: Europe Managed Infrastructure Services Market Revenue Share (%), by Services Type 2025 & 2033

- Figure 14: Europe Managed Infrastructure Services Market Revenue (Million), by End User 2025 & 2033

- Figure 15: Europe Managed Infrastructure Services Market Revenue Share (%), by End User 2025 & 2033

- Figure 16: Europe Managed Infrastructure Services Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Managed Infrastructure Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Managed Infrastructure Services Market Revenue (Million), by Deployment Type 2025 & 2033

- Figure 19: Asia Pacific Managed Infrastructure Services Market Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 20: Asia Pacific Managed Infrastructure Services Market Revenue (Million), by Services Type 2025 & 2033

- Figure 21: Asia Pacific Managed Infrastructure Services Market Revenue Share (%), by Services Type 2025 & 2033

- Figure 22: Asia Pacific Managed Infrastructure Services Market Revenue (Million), by End User 2025 & 2033

- Figure 23: Asia Pacific Managed Infrastructure Services Market Revenue Share (%), by End User 2025 & 2033

- Figure 24: Asia Pacific Managed Infrastructure Services Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Managed Infrastructure Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Managed Infrastructure Services Market Revenue (Million), by Deployment Type 2025 & 2033

- Figure 27: Latin America Managed Infrastructure Services Market Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 28: Latin America Managed Infrastructure Services Market Revenue (Million), by Services Type 2025 & 2033

- Figure 29: Latin America Managed Infrastructure Services Market Revenue Share (%), by Services Type 2025 & 2033

- Figure 30: Latin America Managed Infrastructure Services Market Revenue (Million), by End User 2025 & 2033

- Figure 31: Latin America Managed Infrastructure Services Market Revenue Share (%), by End User 2025 & 2033

- Figure 32: Latin America Managed Infrastructure Services Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Latin America Managed Infrastructure Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Managed Infrastructure Services Market Revenue (Million), by Deployment Type 2025 & 2033

- Figure 35: Middle East and Africa Managed Infrastructure Services Market Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 36: Middle East and Africa Managed Infrastructure Services Market Revenue (Million), by Services Type 2025 & 2033

- Figure 37: Middle East and Africa Managed Infrastructure Services Market Revenue Share (%), by Services Type 2025 & 2033

- Figure 38: Middle East and Africa Managed Infrastructure Services Market Revenue (Million), by End User 2025 & 2033

- Figure 39: Middle East and Africa Managed Infrastructure Services Market Revenue Share (%), by End User 2025 & 2033

- Figure 40: Middle East and Africa Managed Infrastructure Services Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Managed Infrastructure Services Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Managed Infrastructure Services Market Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 2: Global Managed Infrastructure Services Market Revenue Million Forecast, by Services Type 2020 & 2033

- Table 3: Global Managed Infrastructure Services Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Global Managed Infrastructure Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Managed Infrastructure Services Market Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 6: Global Managed Infrastructure Services Market Revenue Million Forecast, by Services Type 2020 & 2033

- Table 7: Global Managed Infrastructure Services Market Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Global Managed Infrastructure Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Managed Infrastructure Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Managed Infrastructure Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Managed Infrastructure Services Market Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 12: Global Managed Infrastructure Services Market Revenue Million Forecast, by Services Type 2020 & 2033

- Table 13: Global Managed Infrastructure Services Market Revenue Million Forecast, by End User 2020 & 2033

- Table 14: Global Managed Infrastructure Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: Germany Managed Infrastructure Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: UK Managed Infrastructure Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Managed Infrastructure Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Spain Managed Infrastructure Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Rest of Europe Managed Infrastructure Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Global Managed Infrastructure Services Market Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 21: Global Managed Infrastructure Services Market Revenue Million Forecast, by Services Type 2020 & 2033

- Table 22: Global Managed Infrastructure Services Market Revenue Million Forecast, by End User 2020 & 2033

- Table 23: Global Managed Infrastructure Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: China Managed Infrastructure Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Japan Managed Infrastructure Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: India Managed Infrastructure Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Australia Managed Infrastructure Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Managed Infrastructure Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global Managed Infrastructure Services Market Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 30: Global Managed Infrastructure Services Market Revenue Million Forecast, by Services Type 2020 & 2033

- Table 31: Global Managed Infrastructure Services Market Revenue Million Forecast, by End User 2020 & 2033

- Table 32: Global Managed Infrastructure Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 33: Brazil Managed Infrastructure Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Mexico Managed Infrastructure Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Argentina Managed Infrastructure Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Latin America Managed Infrastructure Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Managed Infrastructure Services Market Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 38: Global Managed Infrastructure Services Market Revenue Million Forecast, by Services Type 2020 & 2033

- Table 39: Global Managed Infrastructure Services Market Revenue Million Forecast, by End User 2020 & 2033

- Table 40: Global Managed Infrastructure Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 41: UAE Managed Infrastructure Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Saudi Arabia Managed Infrastructure Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Africa Managed Infrastructure Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Rest of Middle East and Africa Managed Infrastructure Services Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Managed Infrastructure Services Market?

The projected CAGR is approximately 10.22%.

2. Which companies are prominent players in the Managed Infrastructure Services Market?

Key companies in the market include Ricoh Company Ltd, Canon Inc, TCS Limited, IBM Corporation, Xerox Corporation, Toshiba Corporation, Fujitsu Ltd, Alcatel-Lucent SA (Nokia Corporation), Hewlett Packard Enterprise, Lexmark International Inc, Cisco Systems Inc, Verizon Communications Inc, Microsoft Corporation, Deutsche Telekom AG, Dell Technologies Inc, Konica Minolta Inc , Citrix Systems Inc.

3. What are the main segments of the Managed Infrastructure Services Market?

The market segments include Deployment Type, Services Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 117.17 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing use of Cloud Managed Infrastructure Services; Technological Proliferation and Advancement of Cloud Based Technology Boosting the Demand; Improved cost and Operational Efficiency and Update of Outdated Hardware.

6. What are the notable trends driving market growth?

The Cloud Segment is Expected to Exhibit the Highest Growth.

7. Are there any restraints impacting market growth?

Declining Profit Margins and Integration and Reliability Concerns.

8. Can you provide examples of recent developments in the market?

September 2023: Cloud4C, a global application-focused cloud-managed services provider, achieved the APAC region's Google Cloud Specialization for Infrastructure Services. As a result, the business gained significant experience in various Google Cloud products, solutions, and industries and became a Specialized Partner for the firm. This demonstrates Cloud4C's extensive technical proficiency in offering fully managed infrastructure modernization and wider digital transformation solutions driven by Google Cloud to APAC enterprises.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Managed Infrastructure Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Managed Infrastructure Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Managed Infrastructure Services Market?

To stay informed about further developments, trends, and reports in the Managed Infrastructure Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence