Key Insights

The MEA e-commerce footwear market is experiencing robust growth, projected to reach a significant market size in the coming years. Driven by increasing internet and smartphone penetration, coupled with a rising young population embracing online shopping, the region showcases considerable potential. The convenience of online purchasing, wider selection compared to brick-and-mortar stores, and competitive pricing are key factors fueling market expansion. The athletic footwear segment commands a substantial share, propelled by the growing fitness and sports culture in the MEA region. This segment is further segmented by product type (running shoes, training shoes, etc.) and caters to various end-users (men, women, children). Non-athletic footwear, including casual, formal, and sandals, also contributes significantly. While third-party retailers currently dominate the platform type segment, a rise in company-owned websites reflects brands' strategies to enhance direct-to-consumer engagement and improve brand loyalty. The presence of major international players like Adidas, Nike, and Puma, alongside local and regional brands, creates a competitive landscape characterized by innovative marketing, product diversification, and strategic partnerships. Challenges remain, including inconsistent internet infrastructure in certain areas, concerns about online payment security, and logistics limitations impacting delivery timelines and costs. Overcoming these hurdles will be crucial for sustained market expansion.

MEA E-Commerce Footwear Market Market Size (In Billion)

The forecast period (2025-2033) anticipates continued growth, albeit at a slightly moderated pace compared to the historical period (2019-2024). This moderation may reflect market saturation in some segments and the need for further infrastructure development. However, innovative marketing campaigns leveraging social media and influencer collaborations, along with a focus on providing personalized customer experiences, will continue to be key growth drivers. The expansion of e-commerce logistics networks within the MEA region and the increasing adoption of mobile payment solutions will also play a significant role in shaping market dynamics. A deeper understanding of consumer preferences across different age groups and geographic locations within the MEA region will be critical for brand success and market share capture. The market will likely see more focused strategies addressing specific niche markets and increased customization options for consumers, further fostering growth.

MEA E-Commerce Footwear Market Company Market Share

MEA E-Commerce Footwear Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Middle East and Africa (MEA) e-commerce footwear market, covering the period 2019-2033. It offers invaluable insights for industry stakeholders, including manufacturers, retailers, investors, and market analysts seeking to understand the market dynamics, growth potential, and competitive landscape. The report leverages robust data analysis and forecasts to deliver actionable intelligence. Key players like Adidas AG, ALDO Group, Lululemon Athletica Inc, Skechers USA Inc, Steven Madden Ltd, Puma SE, LVMH Moët Hennessy Louis Vuitton, Under Armour Inc, Nike Inc, New Balance Athletics Inc, and ASICS Corporation are profiled, along with an examination of key market segments. The base year for this report is 2025, with estimations provided for 2025 and forecasts extending to 2033.

MEA E-Commerce Footwear Market Concentration & Innovation

This section analyzes the MEA e-commerce footwear market's concentration, innovation drivers, regulatory environment, product substitutes, end-user trends, and mergers and acquisitions (M&A) activity. The market exhibits a moderately concentrated structure, with a few major players holding significant market share. Nike Inc and Adidas AG, for instance, collectively command an estimated xx% market share in 2025. However, the emergence of smaller, specialized brands and the increasing popularity of direct-to-consumer (DTC) models is fostering competition.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) for the MEA e-commerce footwear market is estimated at xx in 2025.

- Innovation Drivers: Technological advancements in manufacturing, design, and e-commerce platforms are driving innovation. The adoption of 3D printing, sustainable materials, and personalized product offerings is influencing market trends.

- Regulatory Frameworks: Varying regulations across MEA countries regarding online sales, import/export, and consumer protection influence market dynamics. Compliance with these regulations is crucial for market success.

- Product Substitutes: The market faces competition from alternative footwear types and related products. The increasing preference for comfortable and sustainable footwear presents both challenges and opportunities.

- End-User Trends: Changing consumer preferences, particularly among younger demographics, towards trendy styles and personalized products, drive innovation in product design and marketing strategies.

- M&A Activity: The MEA e-commerce footwear market has witnessed a moderate level of M&A activity in recent years, with deal values totaling approximately xx Million between 2019 and 2024. These activities primarily focused on expanding market reach and product portfolios.

MEA E-Commerce Footwear Market Industry Trends & Insights

The MEA e-commerce footwear market is experiencing robust growth, driven by factors such as rising disposable incomes, increasing internet and smartphone penetration, and a growing preference for online shopping. The market's Compound Annual Growth Rate (CAGR) is projected at xx% during the forecast period (2025-2033). Technological disruptions, such as the rise of mobile commerce and the use of augmented reality (AR) in online shopping, are significantly shaping consumer behavior. Evolving consumer preferences, including a demand for sustainable and ethically sourced footwear, also influence market dynamics. Competitive dynamics are characterized by intense competition among established brands and emerging players, leading to strategic investments in marketing, technology, and product innovation. Market penetration of e-commerce footwear is estimated at xx% in 2025 and projected to reach xx% by 2033.

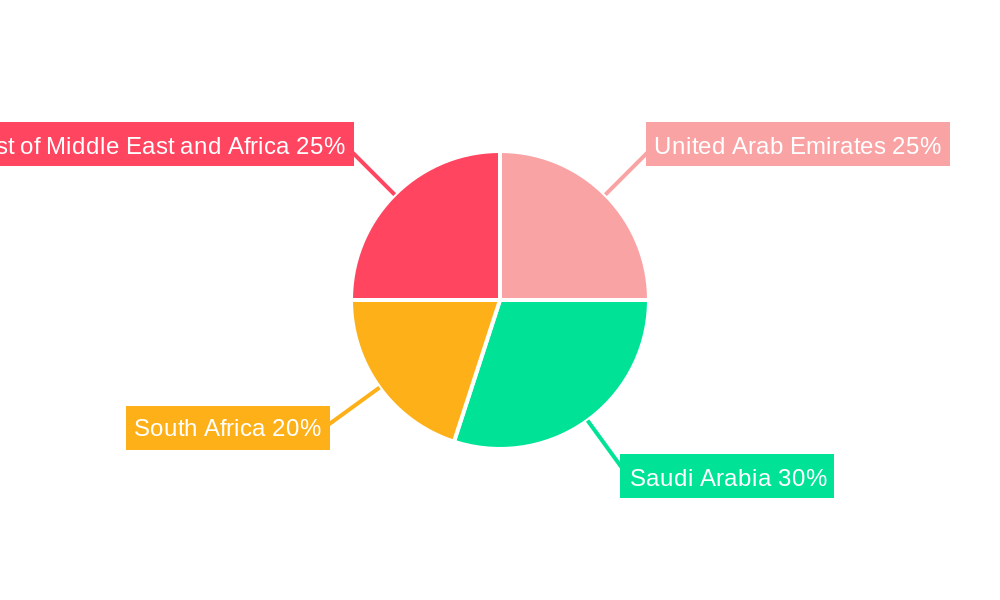

Dominant Markets & Segments in MEA E-Commerce Footwear Market

The UAE and Saudi Arabia are currently the dominant markets within the MEA e-commerce footwear sector, driven by high levels of internet penetration, strong consumer spending, and developed e-commerce infrastructure. Nigeria and South Africa are also emerging as significant markets.

- Leading Region: Middle East (specifically UAE and Saudi Arabia)

- Leading Country: UAE

- Dominant Product Type: Athletic footwear, due to the increasing popularity of fitness and sports activities.

- Dominant End-User: Men, owing to relatively higher disposable incomes and greater engagement in sports and fitness activities.

- Dominant Platform Type: Third-party retailers, due to their extensive reach and established customer base.

Key Drivers:

- Economic Growth: Rising disposable incomes and a growing middle class in several MEA countries fuel demand.

- E-commerce Infrastructure: Improved logistics and payment gateway infrastructure facilitate online transactions.

- Favorable Government Policies: Supportive government initiatives promoting e-commerce in some regions.

MEA E-Commerce Footwear Market Product Developments

Recent product innovations focus on incorporating advanced materials for enhanced comfort, durability, and sustainability, as well as integrating technology features such as smart sensors and personalized fitting options. Brands are increasingly leveraging collaborations with designers and influencers to cater to specific consumer preferences and enhance product appeal. The focus is shifting towards sustainable and ethically sourced materials, reflecting growing consumer concern for environmental and social responsibility.

Report Scope & Segmentation Analysis

This comprehensive report meticulously segments the MEA e-commerce footwear market, offering granular insights into its various facets. The analysis is categorized by product type (Athletic Footwear, Non-Athletic Footwear), end-user (Men, Women, Kids/Children), and platform type (Third-Party Retailer, Company's Own Website). Each segment is examined for its unique growth trajectories and competitive dynamics. The athletic footwear segment is poised for substantial expansion, fueled by a burgeoning health and wellness culture and a surge in fitness-related activities across the region. The men's segment is anticipated to maintain its dominance, largely attributed to higher average spending power and a strong demand for a diverse range of footwear options. In terms of platforms, third-party retailers currently command a larger market share due to their extensive reach, established customer bases, and broader product assortments, often surpassing the individual capabilities of company-owned websites.

Key Drivers of MEA E-Commerce Footwear Market Growth

The robust expansion of the MEA e-commerce footwear market is propelled by a confluence of powerful factors. A significant contributor is the steady rise in disposable incomes across key economies, empowering consumers to spend more on fashion and lifestyle products. Concurrently, the escalating penetration of internet and smartphone access is bringing a vast new demographic online, creating a fertile ground for e-commerce. The rapid development and maturation of e-commerce infrastructure, including sophisticated logistics networks and secure payment gateways, further lubricate the wheels of online retail. Consumers are increasingly embracing the convenience, extensive product selection, and competitive pricing that online platforms offer, leading to a palpable shift in purchasing habits. Furthermore, supportive government initiatives focused on digital transformation and the promotion of e-commerce are creating a more conducive business environment, accelerating market growth.

Challenges in the MEA E-Commerce Footwear Market Sector

Challenges include inconsistent internet connectivity in some regions, concerns regarding online payment security, high import duties and taxes in certain countries, and the prevalence of counterfeit products. Supply chain disruptions and logistical challenges can also impact market growth. Competition from established international brands and local players can pressure profit margins.

Emerging Opportunities in MEA E-Commerce Footwear Market

Opportunities exist in tapping into the growing demand for sustainable and ethically produced footwear, expanding into less-penetrated markets within the MEA region, leveraging mobile commerce, and incorporating personalized product recommendations and AR/VR technologies to enhance online shopping experiences. Focus on local partnerships and collaborations can facilitate market penetration.

Leading Players in the MEA E-Commerce Footwear Market Market

Key Developments in MEA E-Commerce Footwear Market Industry

- November 2022: Steve Madden launched its first African collaboration with Bonang Matheba, signifying market expansion.

- October 2022: Nike's Jordan Brand partnered with Shelflife, expanding its presence in the African market.

- April 2021: Adidas Originals collaborated with Arwa Al Banawi, highlighting the growing importance of localized collaborations.

Strategic Outlook for MEA E-Commerce Footwear Market Market

The MEA e-commerce footwear market is a dynamic landscape brimming with significant growth opportunities, underpinned by favorable demographics, rising consumer purchasing power, and an accelerating adoption of digital channels. To thrive in this evolving market, brands are advised to prioritize strategies that resonate with modern consumers. This includes a strong focus on personalization, offering tailored product recommendations and customized shopping experiences. Embracing sustainability in sourcing, production, and packaging will also appeal to an increasingly conscious consumer base. Furthermore, leveraging cutting-edge technological advancements, such as augmented reality for virtual try-ons or AI-driven customer service, will be crucial for gaining a competitive edge. Successful players will need to demonstrate agility in adapting to the diverse cultural nuances and rapidly changing consumer preferences prevalent across the distinct markets within the MEA region. Continued strategic investments in enhancing e-commerce infrastructure, optimizing supply chain logistics, and fostering strong relationships with local partners will be paramount for achieving sustained and profitable growth.

MEA E-Commerce Footwear Market Segmentation

-

1. Product Type

- 1.1. Athletic Footwear

- 1.2. Non-Athletic Footwear

-

2. End User

- 2.1. Men

- 2.2. Women

- 2.3. Kids/Children

-

3. Platform Type

- 3.1. Third Party Retailer

- 3.2. Company's Own Website

-

4. Geography

- 4.1. South Africa

- 4.2. United Arab Emirates

- 4.3. Rest of Middle East and Africa

MEA E-Commerce Footwear Market Segmentation By Geography

- 1. South Africa

- 2. United Arab Emirates

- 3. Rest of Middle East and Africa

MEA E-Commerce Footwear Market Regional Market Share

Geographic Coverage of MEA E-Commerce Footwear Market

MEA E-Commerce Footwear Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.35% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Social Media Influence and Aggressive Marketing Fueling Market Demand; Augmented Expenditure on Advertisement and Promotional Activities by Key players

- 3.3. Market Restrains

- 3.3.1. Availability of Counterfiet Products

- 3.4. Market Trends

- 3.4.1. Social Media Influence and Aggressive Marketing Fueling Market Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. MEA E-Commerce Footwear Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Athletic Footwear

- 5.1.2. Non-Athletic Footwear

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Men

- 5.2.2. Women

- 5.2.3. Kids/Children

- 5.3. Market Analysis, Insights and Forecast - by Platform Type

- 5.3.1. Third Party Retailer

- 5.3.2. Company's Own Website

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. South Africa

- 5.4.2. United Arab Emirates

- 5.4.3. Rest of Middle East and Africa

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. South Africa

- 5.5.2. United Arab Emirates

- 5.5.3. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. South Africa MEA E-Commerce Footwear Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Athletic Footwear

- 6.1.2. Non-Athletic Footwear

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Men

- 6.2.2. Women

- 6.2.3. Kids/Children

- 6.3. Market Analysis, Insights and Forecast - by Platform Type

- 6.3.1. Third Party Retailer

- 6.3.2. Company's Own Website

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. South Africa

- 6.4.2. United Arab Emirates

- 6.4.3. Rest of Middle East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. United Arab Emirates MEA E-Commerce Footwear Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Athletic Footwear

- 7.1.2. Non-Athletic Footwear

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Men

- 7.2.2. Women

- 7.2.3. Kids/Children

- 7.3. Market Analysis, Insights and Forecast - by Platform Type

- 7.3.1. Third Party Retailer

- 7.3.2. Company's Own Website

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. South Africa

- 7.4.2. United Arab Emirates

- 7.4.3. Rest of Middle East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Rest of Middle East and Africa MEA E-Commerce Footwear Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Athletic Footwear

- 8.1.2. Non-Athletic Footwear

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Men

- 8.2.2. Women

- 8.2.3. Kids/Children

- 8.3. Market Analysis, Insights and Forecast - by Platform Type

- 8.3.1. Third Party Retailer

- 8.3.2. Company's Own Website

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. South Africa

- 8.4.2. United Arab Emirates

- 8.4.3. Rest of Middle East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Adidas AG

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 ALDO Group

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Lululemon Athletica Inc

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Skechers USA Inc

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Steven Madden Ltd*List Not Exhaustive

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Puma SE

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 LVMH Moët Hennessy Louis Vuitton

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Under Armour Inc

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Nike Inc

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 New Balance Athletics Inc

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 ASICS Corporation

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.1 Adidas AG

List of Figures

- Figure 1: MEA E-Commerce Footwear Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: MEA E-Commerce Footwear Market Share (%) by Company 2025

List of Tables

- Table 1: MEA E-Commerce Footwear Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: MEA E-Commerce Footwear Market Revenue Million Forecast, by End User 2020 & 2033

- Table 3: MEA E-Commerce Footwear Market Revenue Million Forecast, by Platform Type 2020 & 2033

- Table 4: MEA E-Commerce Footwear Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 5: MEA E-Commerce Footwear Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: MEA E-Commerce Footwear Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 7: MEA E-Commerce Footwear Market Revenue Million Forecast, by End User 2020 & 2033

- Table 8: MEA E-Commerce Footwear Market Revenue Million Forecast, by Platform Type 2020 & 2033

- Table 9: MEA E-Commerce Footwear Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: MEA E-Commerce Footwear Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: MEA E-Commerce Footwear Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 12: MEA E-Commerce Footwear Market Revenue Million Forecast, by End User 2020 & 2033

- Table 13: MEA E-Commerce Footwear Market Revenue Million Forecast, by Platform Type 2020 & 2033

- Table 14: MEA E-Commerce Footwear Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: MEA E-Commerce Footwear Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: MEA E-Commerce Footwear Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 17: MEA E-Commerce Footwear Market Revenue Million Forecast, by End User 2020 & 2033

- Table 18: MEA E-Commerce Footwear Market Revenue Million Forecast, by Platform Type 2020 & 2033

- Table 19: MEA E-Commerce Footwear Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: MEA E-Commerce Footwear Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MEA E-Commerce Footwear Market?

The projected CAGR is approximately 8.35%.

2. Which companies are prominent players in the MEA E-Commerce Footwear Market?

Key companies in the market include Adidas AG, ALDO Group, Lululemon Athletica Inc, Skechers USA Inc, Steven Madden Ltd*List Not Exhaustive, Puma SE, LVMH Moët Hennessy Louis Vuitton, Under Armour Inc, Nike Inc, New Balance Athletics Inc, ASICS Corporation.

3. What are the main segments of the MEA E-Commerce Footwear Market?

The market segments include Product Type, End User, Platform Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Social Media Influence and Aggressive Marketing Fueling Market Demand; Augmented Expenditure on Advertisement and Promotional Activities by Key players.

6. What are the notable trends driving market growth?

Social Media Influence and Aggressive Marketing Fueling Market Demand.

7. Are there any restraints impacting market growth?

Availability of Counterfiet Products.

8. Can you provide examples of recent developments in the market?

November 2022: Steve Madden announced its first-ever African collaboration with South African media personality Bonang Matheba. The apparel, footwear, and accessory brand stated that this collaboration is part of their 10-year celebration in Africa. The company launched six pieces of footwear and two handbags as a part of this collaboration in Africa.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MEA E-Commerce Footwear Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MEA E-Commerce Footwear Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MEA E-Commerce Footwear Market?

To stay informed about further developments, trends, and reports in the MEA E-Commerce Footwear Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence