Key Insights

The Middle East and Africa (MEA) luxury goods market, valued at $14.05 billion in 2025, is projected to experience robust growth, with a Compound Annual Growth Rate (CAGR) of 6.23% from 2025 to 2033. This expansion is fueled by several key factors. The rising disposable incomes of the burgeoning middle class across the region, particularly in countries like Saudi Arabia and the UAE, are significantly driving demand for luxury goods. Furthermore, a young and increasingly affluent population, coupled with a growing preference for aspirational lifestyles and brand prestige, is bolstering market expansion. Tourism, especially luxury tourism, also contributes substantially to the market's growth, with international visitors contributing significantly to sales. The increasing adoption of e-commerce platforms and omnichannel strategies by luxury brands further enhances accessibility and convenience, boosting sales across diverse product categories like clothing and apparel, footwear, and jewelry. However, geopolitical instability in certain regions and fluctuating currency exchange rates present challenges to consistent growth.

MEA Luxury Goods Industry Market Size (In Billion)

Despite these challenges, the MEA luxury goods market presents significant opportunities for established and emerging players. The market’s segmentation across product types (clothing, footwear, accessories) and distribution channels (single-brand stores, online retail) provides opportunities for tailored marketing strategies. Brands are capitalizing on this by investing in sophisticated digital marketing, personalized experiences, and strategic partnerships to reach their target audiences. The continued expansion of luxury tourism and the sustained rise in disposable incomes will continue to propel growth in the coming years. The diversification of luxury offerings to cater to local preferences and cultural nuances will also play a vital role in driving future market success. Competition remains intense, with established international brands vying for market share alongside local and regional players, necessitating consistent innovation and brand differentiation.

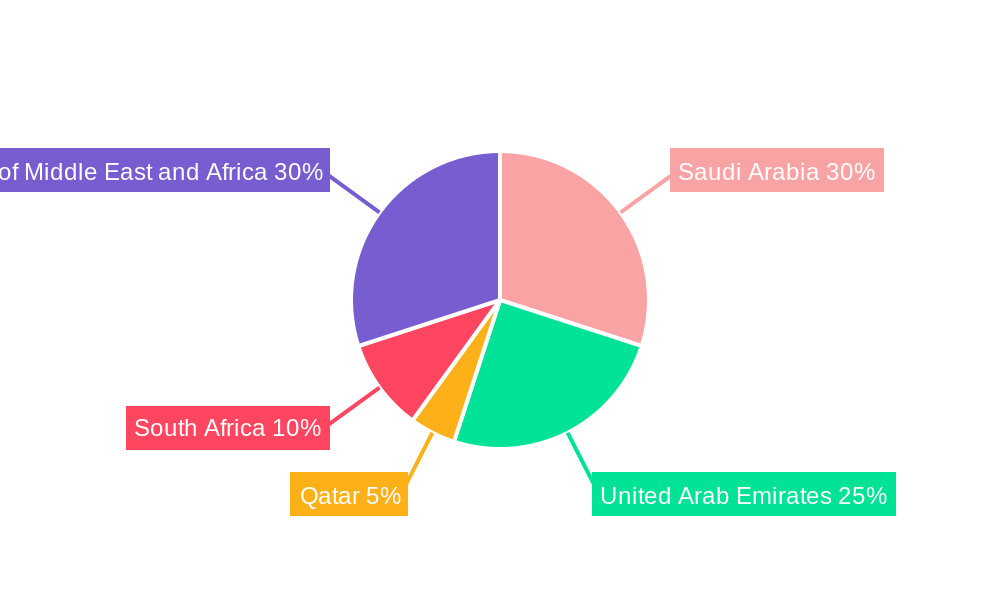

MEA Luxury Goods Industry Company Market Share

MEA Luxury Goods Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Middle East and Africa (MEA) luxury goods industry, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. The report covers the period from 2019 to 2033, with a focus on the base year 2025 and a forecast period from 2025 to 2033. The analysis incorporates key market segments, prominent players, and significant industry developments, delivering actionable intelligence for navigating this dynamic market. The report’s total market value in 2025 is estimated at xx Million, expected to reach xx Million by 2033.

MEA Luxury Goods Industry Market Concentration & Innovation

The MEA luxury goods market exhibits a concentrated landscape, dominated by a few global players and regional powerhouses. Key players such as LVMH Moët Hennessy Louis Vuitton, Kering S A, Compagnie Financière Richemont S A, and others control a significant market share, estimated at approximately xx% collectively in 2025. This concentration is driven by strong brand recognition, established distribution networks, and substantial marketing budgets. However, the market is not static; several factors influence its evolution:

- Innovation Drivers: The industry is characterized by continuous innovation in product design, materials, technology, and customer experience. Brands are leveraging technological advancements, such as personalized online shopping experiences and augmented reality (AR) to enhance engagement and sales.

- Regulatory Frameworks: Varying customs duties, import regulations, and taxation policies across MEA countries significantly influence market dynamics. Understanding these nuances is crucial for effective market entry and expansion strategies.

- Product Substitutes: The rise of affordable luxury brands and counterfeit products presents a challenge to established luxury houses. Brands are countering this through enhanced authenticity verification and a focus on craftsmanship and exclusivity.

- End-User Trends: The MEA region has witnessed a shift in consumer preferences, with increased demand for personalized experiences, sustainable products, and locally relevant designs. Younger consumers are also driving changes in brand loyalty.

- M&A Activities: The luxury sector has witnessed numerous mergers and acquisitions in recent years, with deal values reaching xx Million in 2024. These activities reflect consolidation efforts, expansion into new markets, and the acquisition of smaller niche brands. Examples include (specific M&A deals with values would be included here if data were available).

MEA Luxury Goods Industry Industry Trends & Insights

The MEA luxury goods market is experiencing robust growth, driven by a confluence of factors. The Compound Annual Growth Rate (CAGR) is projected at xx% during the forecast period (2025-2033). Key drivers include:

- Rising Disposable Incomes: The increasing disposable incomes of the affluent population across the MEA region fuels demand for luxury goods and experiences.

- E-commerce Expansion: The rapid growth of e-commerce platforms is broadening access to luxury brands and facilitating convenient purchasing. Market penetration of online luxury retail is estimated to reach xx% by 2033.

- Tourism and Travel: The MEA region's popularity as a tourist destination drives sales of luxury products to both local and international clientele.

- Social Media Influence: Social media platforms significantly impact consumer purchasing decisions, driving brand awareness and creating desire.

- Technological Disruptions: The use of technology, such as personalized recommendations and virtual try-on features, is enhancing the shopping experience and driving sales.

- Competitive Dynamics: The market is highly competitive, with established international brands vying for market share alongside emerging local players. This competitive landscape fosters product innovation and drives efficiency.

Dominant Markets & Segments in MEA Luxury Goods Industry

The UAE and Saudi Arabia are the leading markets for luxury goods within the MEA region. However, other markets, such as Qatar, Kuwait, and Egypt, are also showing significant growth potential.

Key Drivers for Market Dominance:

- Strong Economic Growth: High GDP growth and economic diversification contribute to increased purchasing power.

- Developed Infrastructure: Sophisticated retail infrastructure and logistics networks facilitate efficient distribution and sales.

- Favorable Government Policies: Government initiatives promoting tourism and luxury retail positively impact market expansion.

Segment Analysis:

- Product Type: Watches and jewelry currently represent the largest segments, driven by high demand for luxury timepieces and precious stones. Clothing and apparel also holds a substantial market share, with considerable growth anticipated in footwear and bags.

- Distribution Channel: Single-branded stores remain the dominant distribution channel. However, online retail is rapidly expanding, offering consumers greater convenience and accessibility. Multi-brand stores continue to play a pivotal role, catering to diverse customer preferences.

Detailed analysis of market size and competitive dynamics for each segment would be included in this section.

MEA Luxury Goods Industry Product Developments

Recent product innovations emphasize sustainability, personalization, and technological integration. Brands are increasingly incorporating ethical sourcing and eco-friendly materials into their collections. Personalization is another key trend, with brands offering bespoke products and customized services to cater to individual preferences. Moreover, the integration of technology in the form of smartwatches and augmented reality experiences is enhancing the customer journey and driving engagement.

Report Scope & Segmentation Analysis

This report segments the MEA luxury goods market based on product type (Clothing and Apparel, Footwear, Bags, Jewelry, Watches, Other Accessories) and distribution channel (Single-branded Stores, Multi-brand Stores, Online Retail Stores, Other Distribution Channels). Growth projections, market size estimations, and competitive analyses are provided for each segment, offering granular insights into market dynamics. For example, the online retail segment is projected to witness rapid growth, driven by rising internet penetration and mobile commerce.

Key Drivers of MEA Luxury Goods Industry Growth

Several factors contribute to the growth trajectory of the MEA luxury goods industry:

- Economic Expansion: The region's economic growth, especially in countries like the UAE and Saudi Arabia, is a key driver of increased consumer spending.

- Young and Affluent Population: A growing young, affluent population fuels demand for luxury products.

- Tourism Growth: The growing tourism sector drives substantial sales of luxury items to both local and international visitors.

- Government Support: Government initiatives aimed at fostering economic diversification and boosting tourism create a favorable environment.

Challenges in the MEA Luxury Goods Industry Sector

Despite the positive outlook, the MEA luxury goods industry faces certain challenges:

- Economic Volatility: Global and regional economic fluctuations can impact consumer spending and market stability.

- Counterfeit Goods: The proliferation of counterfeit products damages brand reputation and affects sales.

- Supply Chain Disruptions: Global supply chain disruptions can impact product availability and increase costs.

- Competition: The intense competition among established brands and emerging players requires a dynamic strategy.

Emerging Opportunities in MEA Luxury Goods Industry

Several opportunities exist for growth in the MEA luxury goods market:

- Expansion into Underserved Markets: Untapped potential exists in developing markets within the MEA region.

- Focus on Sustainability: Growing consumer preference for eco-friendly products presents an opportunity for differentiation.

- Personalization and Customization: Offering tailored products and services enhances customer loyalty and increases sales.

- Leveraging Digital Platforms: Optimizing the use of digital platforms for marketing and sales increases market reach.

Leading Players in the MEA Luxury Goods Industry Market

- Giorgio Armani S p A

- The Estée Lauder Companies Inc

- Kering S A

- Burberry Group PLC

- Compagnie Financière Richemont S A

- Alshaya franchise group (Tribe of 6 Aerie)

- Dolce & Gabbana Luxembourg S À R L

- Rolex SA

- Prada S P A

- Roberto Cavalli S P A

- Chanel S A

- LVMH Moët Hennessy Louis Vuitton

- Chopard Group

Key Developments in MEA Luxury Goods Industry Industry

- May 2021: A new Rolex Boutique opened at the Galleria Al Maryah Island in Abu Dhabi, UAE, showcasing a "watchbar" and VIP room, highlighting the brand's commitment to the region.

- May 2022: PRADA Tropico launched an exclusive pop-up boutique in Dubai's Mall of Emirates, demonstrating the brand's innovative retail approach and targeting the younger luxury consumer.

- November 2022: Cartier launched its new Santos de Cartier jewelry collection, featuring rings, bracelets, and necklaces with diamond-studded coffee bean designs, emphasizing luxury and craftsmanship.

Strategic Outlook for MEA Luxury Goods Industry Market

The MEA luxury goods market is poised for continued growth, driven by strong economic fundamentals, rising disposable incomes, and evolving consumer preferences. Brands that successfully adapt to changing consumer demands, embrace innovation, and effectively leverage digital platforms are best positioned to capitalize on the region's significant growth potential. The focus on personalized experiences, sustainable practices, and the strategic use of technology will be key for future success.

MEA Luxury Goods Industry Segmentation

-

1. Product Type

- 1.1. Clothing and Apparel

- 1.2. Footwear

- 1.3. Bags

- 1.4. Jewelry

- 1.5. Watches

- 1.6. Other Accessories

-

2. Distribution Channel

- 2.1. Single-branded Stores

- 2.2. Multi-brand Stores

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

-

3. Geography

- 3.1. Saudi Arabia

- 3.2. United Arab Emirates

- 3.3. Qatar

- 3.4. South Africa

- 3.5. Rest of Middle East and Africa

MEA Luxury Goods Industry Segmentation By Geography

- 1. Saudi Arabia

- 2. United Arab Emirates

- 3. Qatar

- 4. South Africa

- 5. Rest of Middle East and Africa

MEA Luxury Goods Industry Regional Market Share

Geographic Coverage of MEA Luxury Goods Industry

MEA Luxury Goods Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.23% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Tourism Expected to Drive the Market; Robust Luxury Market Infrastructure

- 3.3. Market Restrains

- 3.3.1. Counterfeit Goods Restricting the Market Growth

- 3.4. Market Trends

- 3.4.1. Rise in Tourism Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. MEA Luxury Goods Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Clothing and Apparel

- 5.1.2. Footwear

- 5.1.3. Bags

- 5.1.4. Jewelry

- 5.1.5. Watches

- 5.1.6. Other Accessories

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Single-branded Stores

- 5.2.2. Multi-brand Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Saudi Arabia

- 5.3.2. United Arab Emirates

- 5.3.3. Qatar

- 5.3.4. South Africa

- 5.3.5. Rest of Middle East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.4.2. United Arab Emirates

- 5.4.3. Qatar

- 5.4.4. South Africa

- 5.4.5. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Saudi Arabia MEA Luxury Goods Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Clothing and Apparel

- 6.1.2. Footwear

- 6.1.3. Bags

- 6.1.4. Jewelry

- 6.1.5. Watches

- 6.1.6. Other Accessories

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Single-branded Stores

- 6.2.2. Multi-brand Stores

- 6.2.3. Online Retail Stores

- 6.2.4. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Saudi Arabia

- 6.3.2. United Arab Emirates

- 6.3.3. Qatar

- 6.3.4. South Africa

- 6.3.5. Rest of Middle East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. United Arab Emirates MEA Luxury Goods Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Clothing and Apparel

- 7.1.2. Footwear

- 7.1.3. Bags

- 7.1.4. Jewelry

- 7.1.5. Watches

- 7.1.6. Other Accessories

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Single-branded Stores

- 7.2.2. Multi-brand Stores

- 7.2.3. Online Retail Stores

- 7.2.4. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Saudi Arabia

- 7.3.2. United Arab Emirates

- 7.3.3. Qatar

- 7.3.4. South Africa

- 7.3.5. Rest of Middle East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Qatar MEA Luxury Goods Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Clothing and Apparel

- 8.1.2. Footwear

- 8.1.3. Bags

- 8.1.4. Jewelry

- 8.1.5. Watches

- 8.1.6. Other Accessories

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Single-branded Stores

- 8.2.2. Multi-brand Stores

- 8.2.3. Online Retail Stores

- 8.2.4. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Saudi Arabia

- 8.3.2. United Arab Emirates

- 8.3.3. Qatar

- 8.3.4. South Africa

- 8.3.5. Rest of Middle East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South Africa MEA Luxury Goods Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Clothing and Apparel

- 9.1.2. Footwear

- 9.1.3. Bags

- 9.1.4. Jewelry

- 9.1.5. Watches

- 9.1.6. Other Accessories

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Single-branded Stores

- 9.2.2. Multi-brand Stores

- 9.2.3. Online Retail Stores

- 9.2.4. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Saudi Arabia

- 9.3.2. United Arab Emirates

- 9.3.3. Qatar

- 9.3.4. South Africa

- 9.3.5. Rest of Middle East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Rest of Middle East and Africa MEA Luxury Goods Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Clothing and Apparel

- 10.1.2. Footwear

- 10.1.3. Bags

- 10.1.4. Jewelry

- 10.1.5. Watches

- 10.1.6. Other Accessories

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Single-branded Stores

- 10.2.2. Multi-brand Stores

- 10.2.3. Online Retail Stores

- 10.2.4. Other Distribution Channels

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Saudi Arabia

- 10.3.2. United Arab Emirates

- 10.3.3. Qatar

- 10.3.4. South Africa

- 10.3.5. Rest of Middle East and Africa

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Giorgio Armani S p A

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 The Estée Lauder Companies Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Kering S A

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Burberry Group PLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Compagnie Financière Richemont S A *List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Alshaya franchise group (Tribe of 6 Aerie)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Dolce & Gabbana Luxembourg S À R L

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Rolex SA

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Prada S P A

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Roberto Cavalli S P A

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Chanel S A

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 LVMH Moët Hennessy Louis Vuitton

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Chopard Group

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Giorgio Armani S p A

List of Figures

- Figure 1: MEA Luxury Goods Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: MEA Luxury Goods Industry Share (%) by Company 2025

List of Tables

- Table 1: MEA Luxury Goods Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: MEA Luxury Goods Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: MEA Luxury Goods Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: MEA Luxury Goods Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: MEA Luxury Goods Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: MEA Luxury Goods Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 7: MEA Luxury Goods Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: MEA Luxury Goods Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: MEA Luxury Goods Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 10: MEA Luxury Goods Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 11: MEA Luxury Goods Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: MEA Luxury Goods Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: MEA Luxury Goods Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: MEA Luxury Goods Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 15: MEA Luxury Goods Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: MEA Luxury Goods Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: MEA Luxury Goods Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 18: MEA Luxury Goods Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 19: MEA Luxury Goods Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: MEA Luxury Goods Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: MEA Luxury Goods Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 22: MEA Luxury Goods Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 23: MEA Luxury Goods Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 24: MEA Luxury Goods Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MEA Luxury Goods Industry?

The projected CAGR is approximately 6.23%.

2. Which companies are prominent players in the MEA Luxury Goods Industry?

Key companies in the market include Giorgio Armani S p A, The Estée Lauder Companies Inc, Kering S A, Burberry Group PLC, Compagnie Financière Richemont S A *List Not Exhaustive, Alshaya franchise group (Tribe of 6 Aerie), Dolce & Gabbana Luxembourg S À R L, Rolex SA, Prada S P A, Roberto Cavalli S P A, Chanel S A, LVMH Moët Hennessy Louis Vuitton, Chopard Group.

3. What are the main segments of the MEA Luxury Goods Industry?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.05 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Tourism Expected to Drive the Market; Robust Luxury Market Infrastructure.

6. What are the notable trends driving market growth?

Rise in Tourism Expected to Drive the Market.

7. Are there any restraints impacting market growth?

Counterfeit Goods Restricting the Market Growth.

8. Can you provide examples of recent developments in the market?

November 2022: Santos de Cartier launched new series of jewelry collections that consists of rings, bracelets, and necklaces. The collection consists of a gold chain in two colors, mounted with a single or double row of coffee beans decorated with diamonds of various sizes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MEA Luxury Goods Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MEA Luxury Goods Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MEA Luxury Goods Industry?

To stay informed about further developments, trends, and reports in the MEA Luxury Goods Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence