Key Insights

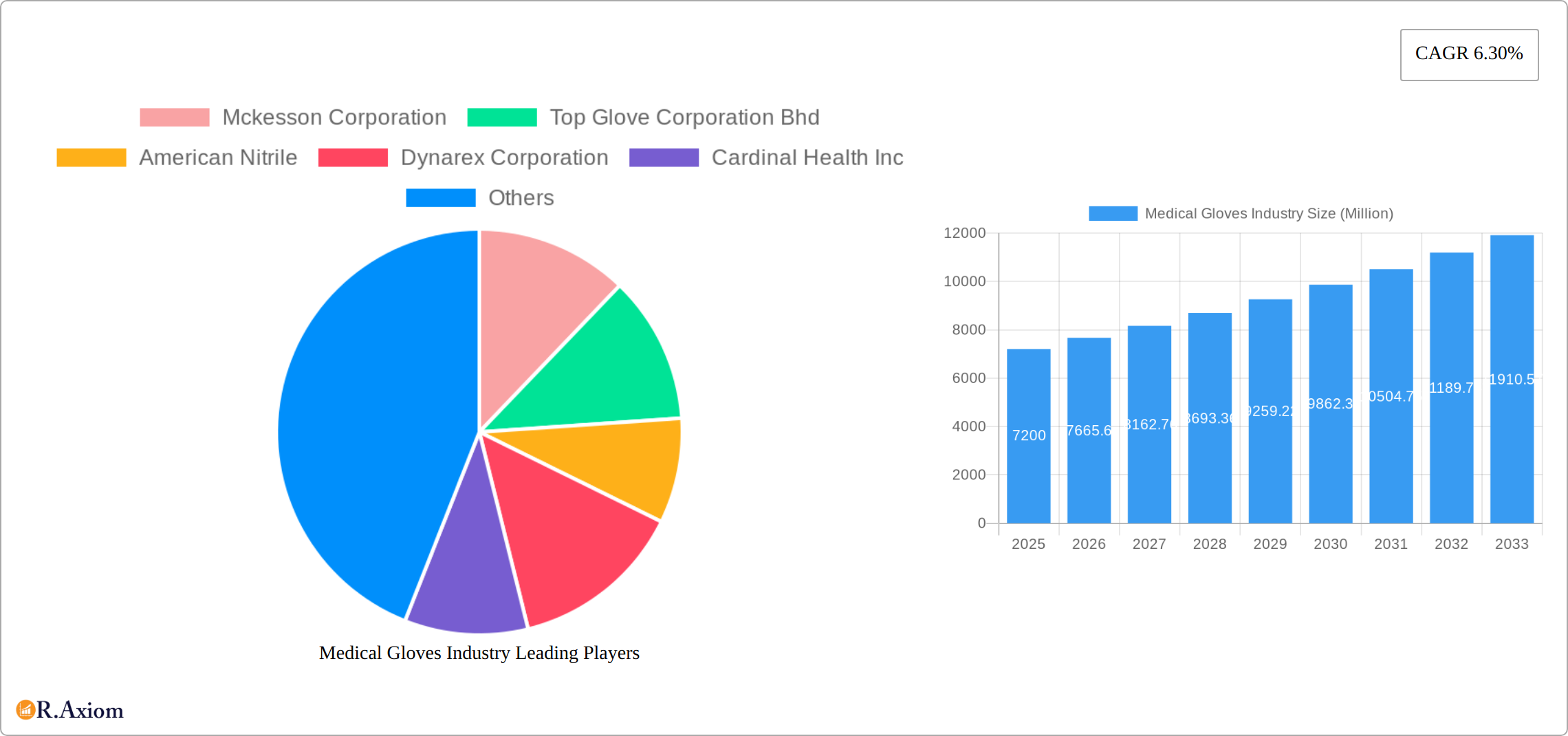

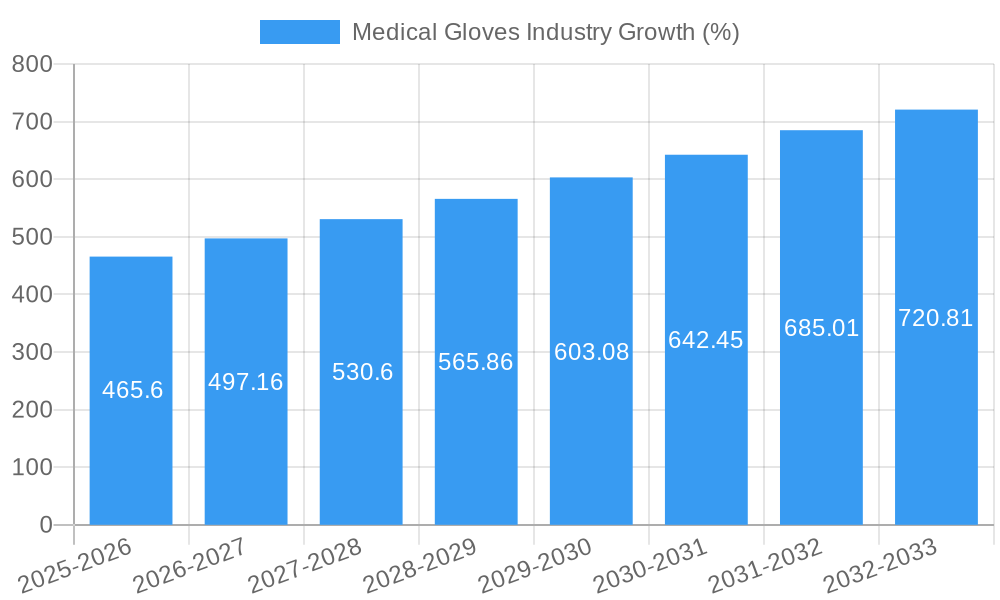

The global medical gloves market, valued at $7.2 billion in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 6.30% from 2025 to 2033. This expansion is fueled by several key factors. The rising prevalence of infectious diseases, coupled with stringent infection control protocols in healthcare settings, significantly boosts demand for medical gloves. Technological advancements leading to the development of more durable, comfortable, and specialized gloves (e.g., chemotherapy gloves) further stimulate market growth. The increasing number of surgical procedures and diagnostic examinations worldwide also contributes significantly. Furthermore, the growing awareness of healthcare worker safety and the implementation of stricter regulatory guidelines regarding personal protective equipment (PPE) are pivotal drivers. Geographic expansion into emerging markets with growing healthcare infrastructure also presents lucrative opportunities for market players.

However, the market is not without its challenges. Fluctuations in raw material prices, particularly natural rubber latex, can impact profitability. Competition from lower-cost manufacturers in developing countries necessitates strategic pricing and product differentiation for established players. Moreover, concerns surrounding environmental sustainability and the disposal of medical waste, particularly non-biodegradable gloves, are emerging constraints that companies must address. Segmentation analysis reveals strong demand across various glove types, including nitrile and powdered varieties, catering to diverse application needs in medical examinations, surgeries, and chemotherapy treatments. Key players, such as McKesson Corporation, Top Glove Corporation Bhd, and Cardinal Health Inc., are actively engaged in strategic initiatives such as mergers and acquisitions, product innovation, and geographical expansion to maintain their competitive edge within this dynamic market.

This comprehensive report provides an in-depth analysis of the global medical gloves industry, covering market size, segmentation, growth drivers, challenges, and key players. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The forecast period is 2025-2033, and the historical period is 2019-2024. The report utilizes a robust methodology to provide actionable insights for industry stakeholders, including manufacturers, distributors, healthcare providers, and investors. The market is valued in Millions of USD throughout this report.

Medical Gloves Industry Market Concentration & Innovation

The medical gloves industry's competitive landscape is a dynamic blend of established giants and agile newcomers. Market concentration is moderate, with a few key players commanding significant shares, yet a multitude of smaller companies contribute to the market's vibrancy and responsiveness to evolving needs. This analysis delves into market concentration, innovation drivers, regulatory frameworks, substitute products, end-user trends, and mergers & acquisitions (M&A) activity.

Market Share: In 2025, the top five players—McKesson Corporation, Top Glove Corporation Bhd, Cardinal Health Inc, 3M Company, and Ansell Limited—held an estimated [Insert precise percentage if available, otherwise use a range estimate like "60-65%"] of the global market share. Smaller players, including Dynarex Corporation and Medline Industries Inc., compete for the remaining share. Precise figures are highly variable depending on the specific glove segment (e.g., nitrile vs. latex) and geographic region.

Innovation Drivers: Demand for enhanced features is a potent driver of innovation. This includes improvements in dexterity, tactile sensitivity, and minimizing the risk of allergic reactions. The development of superior materials, such as advanced nitrile formulations with enhanced barrier protection and durability, and the increased adoption of automation in manufacturing to improve efficiency and consistency, are critical aspects of this progress.

Regulatory Landscape: The industry operates under stringent regulatory oversight, particularly concerning material safety and manufacturing processes, largely dictated by bodies such as the FDA (in the US) and equivalent agencies globally. Maintaining compliance with these constantly evolving regulations is crucial for industry players.

Product Substitutes: Reusable gloves represent the primary substitute for disposable medical gloves. However, their usage is significantly limited due to stringent hygiene requirements, sterilization complexities, and the regulatory environment favoring single-use disposables for infection control.

M&A Activity: Recent years have seen considerable M&A activity in the industry, with deal values reaching the [Insert precise value range if available, otherwise use a range estimate like "hundreds of millions to billions of dollars"] range. These transactions are mainly driven by the need to expand product portfolios, enhance market reach, consolidate market positions, and gain access to new technologies or manufacturing capabilities.

Medical Gloves Industry Industry Trends & Insights

The global medical gloves market is experiencing robust growth, driven by a confluence of factors including the rising prevalence of infectious diseases, increasing demand in healthcare settings, and technological advancements. The market exhibited a CAGR of xx% during the historical period (2019-2024) and is projected to grow at a CAGR of xx% during the forecast period (2025-2033).

Market penetration of nitrile gloves is rapidly increasing due to their superior barrier properties compared to natural rubber latex, resulting in higher adoption. Consumer preferences are shifting towards non-powdered gloves to minimize the risk of allergies and improve hygiene. The competitive dynamics are characterized by ongoing innovation, strategic alliances, and price competition. Technological disruptions, such as advanced manufacturing technologies and the development of innovative materials, are transforming the industry. The increasing adoption of e-commerce platforms by distributors and healthcare facilities enhances the distribution chain and improves availability.

Dominant Markets & Segments in Medical Gloves Industry

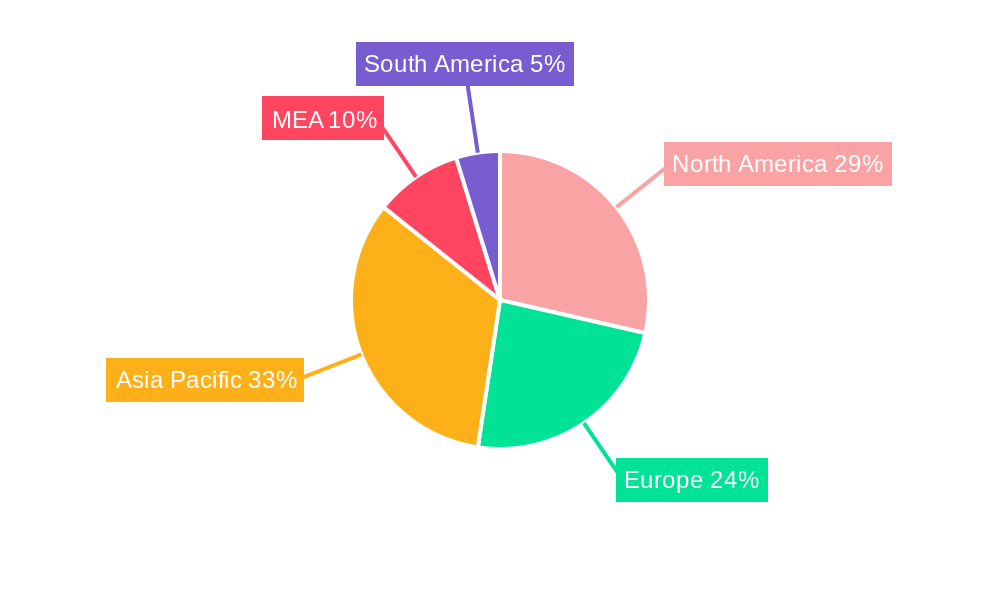

The North American and European markets represent significant portions of the global medical gloves market, driven by high healthcare expenditure, a well-established healthcare infrastructure, and stringent regulations. However, growth in the Asia-Pacific region is expected to outpace other regions due to rising disposable incomes and increasing healthcare spending.

Dominant Segments:

Type: Non-powdered gloves dominate the market due to safety and hygiene concerns, representing an estimated xx Million market share in 2025.

Material: Nitrile gloves hold the largest market share among materials, driven by their superior barrier properties and allergy-free nature, with an estimated value of xx Million in 2025.

Application: Medical examination gloves account for the largest application segment, due to their widespread use in healthcare settings.

Key Drivers:

- North America: High healthcare spending, advanced healthcare infrastructure, and stringent regulatory frameworks.

- Europe: Similar to North America, high healthcare expenditure, robust healthcare systems, and regulatory compliance demands.

- Asia-Pacific: Rising disposable incomes, growing healthcare awareness, and increased government investments in healthcare infrastructure.

Medical Gloves Industry Product Developments

Recent product innovations focus on enhancing comfort, improving tactile sensitivity, and providing superior barrier protection. The development of thinner, more flexible nitrile gloves, incorporation of antimicrobial properties, and introduction of specialized gloves for chemotherapy applications are key trends. These developments cater to evolving end-user preferences and provide competitive advantages. The integration of smart technologies, while still nascent, is an area of future innovation.

Report Scope & Segmentation Analysis

This report segments the medical gloves market based on type (powdered, non-powdered), material (natural rubber, nitrile, vinyl, other), and application (medical examination, surgery, chemotherapy, other). Each segment is analyzed in terms of market size, growth projections, and competitive dynamics. The non-powdered segment is expected to experience higher growth due to its increased safety and hygiene benefits. Nitrile gloves exhibit the fastest growth due to their superior properties. Medical examination and surgical applications constitute the largest share of the market.

Key Drivers of Medical Gloves Industry Growth

The medical gloves market is propelled by several factors:

- Rising prevalence of infectious diseases: Increased incidence of healthcare-associated infections drives the demand for single-use gloves.

- Stringent healthcare regulations: Mandatory use of gloves in healthcare settings boosts consumption.

- Technological advancements: Development of more comfortable, durable, and high-performance gloves.

- Growing awareness of hygiene and infection control: Enhanced awareness amongst healthcare professionals fuels demand.

Challenges in the Medical Gloves Industry Sector

The medical gloves industry faces certain challenges:

- Fluctuations in raw material prices: Price volatility in natural rubber and nitrile butadiene rubber impacts profitability.

- Stringent regulatory compliance: Meeting international safety and quality standards requires significant investment.

- Intense competition: The presence of numerous players leads to price competition and margins compression.

- Supply chain disruptions: Geopolitical events and pandemics can cause significant disruptions in the supply chain.

Emerging Opportunities in Medical Gloves Industry

Emerging opportunities include:

- Expansion into new markets: Developing economies present significant growth potential.

- Development of specialized gloves: Growing demand for gloves for specific applications, such as chemotherapy.

- Adoption of sustainable and eco-friendly materials: Increased focus on environmental concerns creates opportunities for biodegradable materials.

- Integration of smart technologies: Opportunities exist for developing gloves with embedded sensors for monitoring parameters.

Leading Players in the Medical Gloves Industry Market

- Mckesson Corporation

- Top Glove Corporation Bhd

- American Nitrile

- Dynarex Corporation

- Cardinal Health Inc

- 3M Company

- Semperit AG Holding

- Hartalega Holdings Berhad

- B Braun Melsungen AG

- Medline Industries Inc

- Honeywell International Inc

- Ansell Limited

Key Developments in Medical Gloves Industry Industry

- November 2022: Vizient Inc. entered an agreement with SafeSource Direct for the manufacture of chemo-rated nitrile gloves, aiming to enhance supply chain security.

- January 2023: The Medicom group announced plans to construct a new nitrile glove factory, ManiKHeir, through its subsidiary Kolmi-Hopen, signaling expansion in manufacturing capacity.

Strategic Outlook for Medical Gloves Industry Market

The medical gloves market is poised for continued growth, driven by increasing healthcare spending, technological advancements, and a heightened focus on infection control. The shift towards non-powdered and nitrile gloves, coupled with expansion into emerging markets, presents significant opportunities for industry players. Strategic investments in R&D, supply chain optimization, and sustainable practices will be critical for success in this dynamic market.

Medical Gloves Industry Segmentation

-

1. Type

- 1.1. Powdered

- 1.2. Non-powdered

-

2. Material

- 2.1. Natural Rubber Gloves

- 2.2. Nitrile Gloves

- 2.3. Vinyl Gloves

- 2.4. Other Materials

-

3. Application

- 3.1. Medical Examination

- 3.2. Surgery

- 3.3. Chemotherapy

- 3.4. Other Applications

Medical Gloves Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

- 4. Middle East

-

5. GCC

- 5.1. South Africa

- 5.2. Rest of Middle East

-

6. South America

- 6.1. Brazil

- 6.2. Argentina

- 6.3. Rest of South America

Medical Gloves Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Growing awareness about hygiene standards and infection control in healthcare settings has increased the demand for medical gloves. Healthcare professionals rely on gloves for protection against infectious diseases and contaminants during examinations

- 3.2.2 surgeries

- 3.2.3 and patient care

- 3.3. Market Restrains

- 3.3.1 The cost of raw materials

- 3.3.2 particularly latex and nitrile

- 3.3.3 fluctuates based on market demand and supply. This can impact the production cost and pricing of medical gloves

- 3.4. Market Trends

- 3.4.1 Automation in glove production will improve manufacturing efficiency

- 3.4.2 reduce costs

- 3.4.3 and ensure consistent product quality. This trend is likely to grow as demand continues to increase globally

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Medical Gloves Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Powdered

- 5.1.2. Non-powdered

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Natural Rubber Gloves

- 5.2.2. Nitrile Gloves

- 5.2.3. Vinyl Gloves

- 5.2.4. Other Materials

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Medical Examination

- 5.3.2. Surgery

- 5.3.3. Chemotherapy

- 5.3.4. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East

- 5.4.5. GCC

- 5.4.6. South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Medical Gloves Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Powdered

- 6.1.2. Non-powdered

- 6.2. Market Analysis, Insights and Forecast - by Material

- 6.2.1. Natural Rubber Gloves

- 6.2.2. Nitrile Gloves

- 6.2.3. Vinyl Gloves

- 6.2.4. Other Materials

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Medical Examination

- 6.3.2. Surgery

- 6.3.3. Chemotherapy

- 6.3.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Medical Gloves Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Powdered

- 7.1.2. Non-powdered

- 7.2. Market Analysis, Insights and Forecast - by Material

- 7.2.1. Natural Rubber Gloves

- 7.2.2. Nitrile Gloves

- 7.2.3. Vinyl Gloves

- 7.2.4. Other Materials

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Medical Examination

- 7.3.2. Surgery

- 7.3.3. Chemotherapy

- 7.3.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Medical Gloves Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Powdered

- 8.1.2. Non-powdered

- 8.2. Market Analysis, Insights and Forecast - by Material

- 8.2.1. Natural Rubber Gloves

- 8.2.2. Nitrile Gloves

- 8.2.3. Vinyl Gloves

- 8.2.4. Other Materials

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Medical Examination

- 8.3.2. Surgery

- 8.3.3. Chemotherapy

- 8.3.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East Medical Gloves Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Powdered

- 9.1.2. Non-powdered

- 9.2. Market Analysis, Insights and Forecast - by Material

- 9.2.1. Natural Rubber Gloves

- 9.2.2. Nitrile Gloves

- 9.2.3. Vinyl Gloves

- 9.2.4. Other Materials

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Medical Examination

- 9.3.2. Surgery

- 9.3.3. Chemotherapy

- 9.3.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. GCC Medical Gloves Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Powdered

- 10.1.2. Non-powdered

- 10.2. Market Analysis, Insights and Forecast - by Material

- 10.2.1. Natural Rubber Gloves

- 10.2.2. Nitrile Gloves

- 10.2.3. Vinyl Gloves

- 10.2.4. Other Materials

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Medical Examination

- 10.3.2. Surgery

- 10.3.3. Chemotherapy

- 10.3.4. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. South America Medical Gloves Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Powdered

- 11.1.2. Non-powdered

- 11.2. Market Analysis, Insights and Forecast - by Material

- 11.2.1. Natural Rubber Gloves

- 11.2.2. Nitrile Gloves

- 11.2.3. Vinyl Gloves

- 11.2.4. Other Materials

- 11.3. Market Analysis, Insights and Forecast - by Application

- 11.3.1. Medical Examination

- 11.3.2. Surgery

- 11.3.3. Chemotherapy

- 11.3.4. Other Applications

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. North America Medical Gloves Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United States

- 12.1.2 Canada

- 12.1.3 Mexico

- 13. South America Medical Gloves Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 Brazil

- 13.1.2 Mexico

- 13.1.3 Rest of South America

- 14. Europe Medical Gloves Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 United Kingdom

- 14.1.2 Germany

- 14.1.3 France

- 14.1.4 Italy

- 14.1.5 Spain

- 14.1.6 Russia

- 14.1.7 Rest of Europe

- 15. Asia Pacific Medical Gloves Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 China

- 15.1.2 Japan

- 15.1.3 India

- 15.1.4 South Korea

- 15.1.5 Taiwan

- 15.1.6 Australia

- 15.1.7 Rest of Asia-Pacific

- 16. MEA Medical Gloves Industry Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1 Middle East

- 16.1.2 Africa

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Mckesson Corporation

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Top Glove Corporation Bhd

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 American Nitrile

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Dynarex Corporation

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Cardinal Health Inc

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 3M Company

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Semperit AG Holding

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Hartalega Holdings Berhad

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 B Braun Melsungen AG

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 Medline Industries Inc

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.11 Honeywell International Inc

- 17.2.11.1. Overview

- 17.2.11.2. Products

- 17.2.11.3. SWOT Analysis

- 17.2.11.4. Recent Developments

- 17.2.11.5. Financials (Based on Availability)

- 17.2.12 Ansell Limited

- 17.2.12.1. Overview

- 17.2.12.2. Products

- 17.2.12.3. SWOT Analysis

- 17.2.12.4. Recent Developments

- 17.2.12.5. Financials (Based on Availability)

- 17.2.1 Mckesson Corporation

List of Figures

- Figure 1: Global Medical Gloves Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global Medical Gloves Industry Volume Breakdown (K Units, %) by Region 2024 & 2032

- Figure 3: North America Medical Gloves Industry Revenue (Million), by Country 2024 & 2032

- Figure 4: North America Medical Gloves Industry Volume (K Units), by Country 2024 & 2032

- Figure 5: North America Medical Gloves Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: North America Medical Gloves Industry Volume Share (%), by Country 2024 & 2032

- Figure 7: South America Medical Gloves Industry Revenue (Million), by Country 2024 & 2032

- Figure 8: South America Medical Gloves Industry Volume (K Units), by Country 2024 & 2032

- Figure 9: South America Medical Gloves Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Medical Gloves Industry Volume Share (%), by Country 2024 & 2032

- Figure 11: Europe Medical Gloves Industry Revenue (Million), by Country 2024 & 2032

- Figure 12: Europe Medical Gloves Industry Volume (K Units), by Country 2024 & 2032

- Figure 13: Europe Medical Gloves Industry Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Medical Gloves Industry Volume Share (%), by Country 2024 & 2032

- Figure 15: Asia Pacific Medical Gloves Industry Revenue (Million), by Country 2024 & 2032

- Figure 16: Asia Pacific Medical Gloves Industry Volume (K Units), by Country 2024 & 2032

- Figure 17: Asia Pacific Medical Gloves Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Asia Pacific Medical Gloves Industry Volume Share (%), by Country 2024 & 2032

- Figure 19: MEA Medical Gloves Industry Revenue (Million), by Country 2024 & 2032

- Figure 20: MEA Medical Gloves Industry Volume (K Units), by Country 2024 & 2032

- Figure 21: MEA Medical Gloves Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: MEA Medical Gloves Industry Volume Share (%), by Country 2024 & 2032

- Figure 23: North America Medical Gloves Industry Revenue (Million), by Type 2024 & 2032

- Figure 24: North America Medical Gloves Industry Volume (K Units), by Type 2024 & 2032

- Figure 25: North America Medical Gloves Industry Revenue Share (%), by Type 2024 & 2032

- Figure 26: North America Medical Gloves Industry Volume Share (%), by Type 2024 & 2032

- Figure 27: North America Medical Gloves Industry Revenue (Million), by Material 2024 & 2032

- Figure 28: North America Medical Gloves Industry Volume (K Units), by Material 2024 & 2032

- Figure 29: North America Medical Gloves Industry Revenue Share (%), by Material 2024 & 2032

- Figure 30: North America Medical Gloves Industry Volume Share (%), by Material 2024 & 2032

- Figure 31: North America Medical Gloves Industry Revenue (Million), by Application 2024 & 2032

- Figure 32: North America Medical Gloves Industry Volume (K Units), by Application 2024 & 2032

- Figure 33: North America Medical Gloves Industry Revenue Share (%), by Application 2024 & 2032

- Figure 34: North America Medical Gloves Industry Volume Share (%), by Application 2024 & 2032

- Figure 35: North America Medical Gloves Industry Revenue (Million), by Country 2024 & 2032

- Figure 36: North America Medical Gloves Industry Volume (K Units), by Country 2024 & 2032

- Figure 37: North America Medical Gloves Industry Revenue Share (%), by Country 2024 & 2032

- Figure 38: North America Medical Gloves Industry Volume Share (%), by Country 2024 & 2032

- Figure 39: Europe Medical Gloves Industry Revenue (Million), by Type 2024 & 2032

- Figure 40: Europe Medical Gloves Industry Volume (K Units), by Type 2024 & 2032

- Figure 41: Europe Medical Gloves Industry Revenue Share (%), by Type 2024 & 2032

- Figure 42: Europe Medical Gloves Industry Volume Share (%), by Type 2024 & 2032

- Figure 43: Europe Medical Gloves Industry Revenue (Million), by Material 2024 & 2032

- Figure 44: Europe Medical Gloves Industry Volume (K Units), by Material 2024 & 2032

- Figure 45: Europe Medical Gloves Industry Revenue Share (%), by Material 2024 & 2032

- Figure 46: Europe Medical Gloves Industry Volume Share (%), by Material 2024 & 2032

- Figure 47: Europe Medical Gloves Industry Revenue (Million), by Application 2024 & 2032

- Figure 48: Europe Medical Gloves Industry Volume (K Units), by Application 2024 & 2032

- Figure 49: Europe Medical Gloves Industry Revenue Share (%), by Application 2024 & 2032

- Figure 50: Europe Medical Gloves Industry Volume Share (%), by Application 2024 & 2032

- Figure 51: Europe Medical Gloves Industry Revenue (Million), by Country 2024 & 2032

- Figure 52: Europe Medical Gloves Industry Volume (K Units), by Country 2024 & 2032

- Figure 53: Europe Medical Gloves Industry Revenue Share (%), by Country 2024 & 2032

- Figure 54: Europe Medical Gloves Industry Volume Share (%), by Country 2024 & 2032

- Figure 55: Asia Pacific Medical Gloves Industry Revenue (Million), by Type 2024 & 2032

- Figure 56: Asia Pacific Medical Gloves Industry Volume (K Units), by Type 2024 & 2032

- Figure 57: Asia Pacific Medical Gloves Industry Revenue Share (%), by Type 2024 & 2032

- Figure 58: Asia Pacific Medical Gloves Industry Volume Share (%), by Type 2024 & 2032

- Figure 59: Asia Pacific Medical Gloves Industry Revenue (Million), by Material 2024 & 2032

- Figure 60: Asia Pacific Medical Gloves Industry Volume (K Units), by Material 2024 & 2032

- Figure 61: Asia Pacific Medical Gloves Industry Revenue Share (%), by Material 2024 & 2032

- Figure 62: Asia Pacific Medical Gloves Industry Volume Share (%), by Material 2024 & 2032

- Figure 63: Asia Pacific Medical Gloves Industry Revenue (Million), by Application 2024 & 2032

- Figure 64: Asia Pacific Medical Gloves Industry Volume (K Units), by Application 2024 & 2032

- Figure 65: Asia Pacific Medical Gloves Industry Revenue Share (%), by Application 2024 & 2032

- Figure 66: Asia Pacific Medical Gloves Industry Volume Share (%), by Application 2024 & 2032

- Figure 67: Asia Pacific Medical Gloves Industry Revenue (Million), by Country 2024 & 2032

- Figure 68: Asia Pacific Medical Gloves Industry Volume (K Units), by Country 2024 & 2032

- Figure 69: Asia Pacific Medical Gloves Industry Revenue Share (%), by Country 2024 & 2032

- Figure 70: Asia Pacific Medical Gloves Industry Volume Share (%), by Country 2024 & 2032

- Figure 71: Middle East Medical Gloves Industry Revenue (Million), by Type 2024 & 2032

- Figure 72: Middle East Medical Gloves Industry Volume (K Units), by Type 2024 & 2032

- Figure 73: Middle East Medical Gloves Industry Revenue Share (%), by Type 2024 & 2032

- Figure 74: Middle East Medical Gloves Industry Volume Share (%), by Type 2024 & 2032

- Figure 75: Middle East Medical Gloves Industry Revenue (Million), by Material 2024 & 2032

- Figure 76: Middle East Medical Gloves Industry Volume (K Units), by Material 2024 & 2032

- Figure 77: Middle East Medical Gloves Industry Revenue Share (%), by Material 2024 & 2032

- Figure 78: Middle East Medical Gloves Industry Volume Share (%), by Material 2024 & 2032

- Figure 79: Middle East Medical Gloves Industry Revenue (Million), by Application 2024 & 2032

- Figure 80: Middle East Medical Gloves Industry Volume (K Units), by Application 2024 & 2032

- Figure 81: Middle East Medical Gloves Industry Revenue Share (%), by Application 2024 & 2032

- Figure 82: Middle East Medical Gloves Industry Volume Share (%), by Application 2024 & 2032

- Figure 83: Middle East Medical Gloves Industry Revenue (Million), by Country 2024 & 2032

- Figure 84: Middle East Medical Gloves Industry Volume (K Units), by Country 2024 & 2032

- Figure 85: Middle East Medical Gloves Industry Revenue Share (%), by Country 2024 & 2032

- Figure 86: Middle East Medical Gloves Industry Volume Share (%), by Country 2024 & 2032

- Figure 87: GCC Medical Gloves Industry Revenue (Million), by Type 2024 & 2032

- Figure 88: GCC Medical Gloves Industry Volume (K Units), by Type 2024 & 2032

- Figure 89: GCC Medical Gloves Industry Revenue Share (%), by Type 2024 & 2032

- Figure 90: GCC Medical Gloves Industry Volume Share (%), by Type 2024 & 2032

- Figure 91: GCC Medical Gloves Industry Revenue (Million), by Material 2024 & 2032

- Figure 92: GCC Medical Gloves Industry Volume (K Units), by Material 2024 & 2032

- Figure 93: GCC Medical Gloves Industry Revenue Share (%), by Material 2024 & 2032

- Figure 94: GCC Medical Gloves Industry Volume Share (%), by Material 2024 & 2032

- Figure 95: GCC Medical Gloves Industry Revenue (Million), by Application 2024 & 2032

- Figure 96: GCC Medical Gloves Industry Volume (K Units), by Application 2024 & 2032

- Figure 97: GCC Medical Gloves Industry Revenue Share (%), by Application 2024 & 2032

- Figure 98: GCC Medical Gloves Industry Volume Share (%), by Application 2024 & 2032

- Figure 99: GCC Medical Gloves Industry Revenue (Million), by Country 2024 & 2032

- Figure 100: GCC Medical Gloves Industry Volume (K Units), by Country 2024 & 2032

- Figure 101: GCC Medical Gloves Industry Revenue Share (%), by Country 2024 & 2032

- Figure 102: GCC Medical Gloves Industry Volume Share (%), by Country 2024 & 2032

- Figure 103: South America Medical Gloves Industry Revenue (Million), by Type 2024 & 2032

- Figure 104: South America Medical Gloves Industry Volume (K Units), by Type 2024 & 2032

- Figure 105: South America Medical Gloves Industry Revenue Share (%), by Type 2024 & 2032

- Figure 106: South America Medical Gloves Industry Volume Share (%), by Type 2024 & 2032

- Figure 107: South America Medical Gloves Industry Revenue (Million), by Material 2024 & 2032

- Figure 108: South America Medical Gloves Industry Volume (K Units), by Material 2024 & 2032

- Figure 109: South America Medical Gloves Industry Revenue Share (%), by Material 2024 & 2032

- Figure 110: South America Medical Gloves Industry Volume Share (%), by Material 2024 & 2032

- Figure 111: South America Medical Gloves Industry Revenue (Million), by Application 2024 & 2032

- Figure 112: South America Medical Gloves Industry Volume (K Units), by Application 2024 & 2032

- Figure 113: South America Medical Gloves Industry Revenue Share (%), by Application 2024 & 2032

- Figure 114: South America Medical Gloves Industry Volume Share (%), by Application 2024 & 2032

- Figure 115: South America Medical Gloves Industry Revenue (Million), by Country 2024 & 2032

- Figure 116: South America Medical Gloves Industry Volume (K Units), by Country 2024 & 2032

- Figure 117: South America Medical Gloves Industry Revenue Share (%), by Country 2024 & 2032

- Figure 118: South America Medical Gloves Industry Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Medical Gloves Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Medical Gloves Industry Volume K Units Forecast, by Region 2019 & 2032

- Table 3: Global Medical Gloves Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Global Medical Gloves Industry Volume K Units Forecast, by Type 2019 & 2032

- Table 5: Global Medical Gloves Industry Revenue Million Forecast, by Material 2019 & 2032

- Table 6: Global Medical Gloves Industry Volume K Units Forecast, by Material 2019 & 2032

- Table 7: Global Medical Gloves Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 8: Global Medical Gloves Industry Volume K Units Forecast, by Application 2019 & 2032

- Table 9: Global Medical Gloves Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Global Medical Gloves Industry Volume K Units Forecast, by Region 2019 & 2032

- Table 11: Global Medical Gloves Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Global Medical Gloves Industry Volume K Units Forecast, by Country 2019 & 2032

- Table 13: United States Medical Gloves Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United States Medical Gloves Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 15: Canada Medical Gloves Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada Medical Gloves Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 17: Mexico Medical Gloves Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Mexico Medical Gloves Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 19: Global Medical Gloves Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global Medical Gloves Industry Volume K Units Forecast, by Country 2019 & 2032

- Table 21: Brazil Medical Gloves Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Brazil Medical Gloves Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 23: Mexico Medical Gloves Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Mexico Medical Gloves Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 25: Rest of South America Medical Gloves Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of South America Medical Gloves Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 27: Global Medical Gloves Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Global Medical Gloves Industry Volume K Units Forecast, by Country 2019 & 2032

- Table 29: United Kingdom Medical Gloves Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: United Kingdom Medical Gloves Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 31: Germany Medical Gloves Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Germany Medical Gloves Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 33: France Medical Gloves Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: France Medical Gloves Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 35: Italy Medical Gloves Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Italy Medical Gloves Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 37: Spain Medical Gloves Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Spain Medical Gloves Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 39: Russia Medical Gloves Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Russia Medical Gloves Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 41: Rest of Europe Medical Gloves Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of Europe Medical Gloves Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 43: Global Medical Gloves Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 44: Global Medical Gloves Industry Volume K Units Forecast, by Country 2019 & 2032

- Table 45: China Medical Gloves Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: China Medical Gloves Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 47: Japan Medical Gloves Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Japan Medical Gloves Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 49: India Medical Gloves Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: India Medical Gloves Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 51: South Korea Medical Gloves Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: South Korea Medical Gloves Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 53: Taiwan Medical Gloves Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Taiwan Medical Gloves Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 55: Australia Medical Gloves Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Australia Medical Gloves Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 57: Rest of Asia-Pacific Medical Gloves Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Rest of Asia-Pacific Medical Gloves Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 59: Global Medical Gloves Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 60: Global Medical Gloves Industry Volume K Units Forecast, by Country 2019 & 2032

- Table 61: Middle East Medical Gloves Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Middle East Medical Gloves Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 63: Africa Medical Gloves Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: Africa Medical Gloves Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 65: Global Medical Gloves Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 66: Global Medical Gloves Industry Volume K Units Forecast, by Type 2019 & 2032

- Table 67: Global Medical Gloves Industry Revenue Million Forecast, by Material 2019 & 2032

- Table 68: Global Medical Gloves Industry Volume K Units Forecast, by Material 2019 & 2032

- Table 69: Global Medical Gloves Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 70: Global Medical Gloves Industry Volume K Units Forecast, by Application 2019 & 2032

- Table 71: Global Medical Gloves Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 72: Global Medical Gloves Industry Volume K Units Forecast, by Country 2019 & 2032

- Table 73: United States Medical Gloves Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 74: United States Medical Gloves Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 75: Canada Medical Gloves Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 76: Canada Medical Gloves Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 77: Mexico Medical Gloves Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 78: Mexico Medical Gloves Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 79: Global Medical Gloves Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 80: Global Medical Gloves Industry Volume K Units Forecast, by Type 2019 & 2032

- Table 81: Global Medical Gloves Industry Revenue Million Forecast, by Material 2019 & 2032

- Table 82: Global Medical Gloves Industry Volume K Units Forecast, by Material 2019 & 2032

- Table 83: Global Medical Gloves Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 84: Global Medical Gloves Industry Volume K Units Forecast, by Application 2019 & 2032

- Table 85: Global Medical Gloves Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 86: Global Medical Gloves Industry Volume K Units Forecast, by Country 2019 & 2032

- Table 87: Germany Medical Gloves Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 88: Germany Medical Gloves Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 89: United Kingdom Medical Gloves Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 90: United Kingdom Medical Gloves Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 91: France Medical Gloves Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 92: France Medical Gloves Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 93: Italy Medical Gloves Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 94: Italy Medical Gloves Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 95: Spain Medical Gloves Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 96: Spain Medical Gloves Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 97: Rest of Europe Medical Gloves Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 98: Rest of Europe Medical Gloves Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 99: Global Medical Gloves Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 100: Global Medical Gloves Industry Volume K Units Forecast, by Type 2019 & 2032

- Table 101: Global Medical Gloves Industry Revenue Million Forecast, by Material 2019 & 2032

- Table 102: Global Medical Gloves Industry Volume K Units Forecast, by Material 2019 & 2032

- Table 103: Global Medical Gloves Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 104: Global Medical Gloves Industry Volume K Units Forecast, by Application 2019 & 2032

- Table 105: Global Medical Gloves Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 106: Global Medical Gloves Industry Volume K Units Forecast, by Country 2019 & 2032

- Table 107: China Medical Gloves Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 108: China Medical Gloves Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 109: Japan Medical Gloves Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 110: Japan Medical Gloves Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 111: India Medical Gloves Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 112: India Medical Gloves Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 113: Australia Medical Gloves Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 114: Australia Medical Gloves Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 115: South Korea Medical Gloves Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 116: South Korea Medical Gloves Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 117: Rest of Asia Pacific Medical Gloves Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 118: Rest of Asia Pacific Medical Gloves Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 119: Global Medical Gloves Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 120: Global Medical Gloves Industry Volume K Units Forecast, by Type 2019 & 2032

- Table 121: Global Medical Gloves Industry Revenue Million Forecast, by Material 2019 & 2032

- Table 122: Global Medical Gloves Industry Volume K Units Forecast, by Material 2019 & 2032

- Table 123: Global Medical Gloves Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 124: Global Medical Gloves Industry Volume K Units Forecast, by Application 2019 & 2032

- Table 125: Global Medical Gloves Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 126: Global Medical Gloves Industry Volume K Units Forecast, by Country 2019 & 2032

- Table 127: Global Medical Gloves Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 128: Global Medical Gloves Industry Volume K Units Forecast, by Type 2019 & 2032

- Table 129: Global Medical Gloves Industry Revenue Million Forecast, by Material 2019 & 2032

- Table 130: Global Medical Gloves Industry Volume K Units Forecast, by Material 2019 & 2032

- Table 131: Global Medical Gloves Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 132: Global Medical Gloves Industry Volume K Units Forecast, by Application 2019 & 2032

- Table 133: Global Medical Gloves Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 134: Global Medical Gloves Industry Volume K Units Forecast, by Country 2019 & 2032

- Table 135: South Africa Medical Gloves Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 136: South Africa Medical Gloves Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 137: Rest of Middle East Medical Gloves Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 138: Rest of Middle East Medical Gloves Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 139: Global Medical Gloves Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 140: Global Medical Gloves Industry Volume K Units Forecast, by Type 2019 & 2032

- Table 141: Global Medical Gloves Industry Revenue Million Forecast, by Material 2019 & 2032

- Table 142: Global Medical Gloves Industry Volume K Units Forecast, by Material 2019 & 2032

- Table 143: Global Medical Gloves Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 144: Global Medical Gloves Industry Volume K Units Forecast, by Application 2019 & 2032

- Table 145: Global Medical Gloves Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 146: Global Medical Gloves Industry Volume K Units Forecast, by Country 2019 & 2032

- Table 147: Brazil Medical Gloves Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 148: Brazil Medical Gloves Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 149: Argentina Medical Gloves Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 150: Argentina Medical Gloves Industry Volume (K Units) Forecast, by Application 2019 & 2032

- Table 151: Rest of South America Medical Gloves Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 152: Rest of South America Medical Gloves Industry Volume (K Units) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Medical Gloves Industry?

The projected CAGR is approximately 6.30%.

2. Which companies are prominent players in the Medical Gloves Industry?

Key companies in the market include Mckesson Corporation, Top Glove Corporation Bhd, American Nitrile, Dynarex Corporation, Cardinal Health Inc, 3M Company, Semperit AG Holding, Hartalega Holdings Berhad, B Braun Melsungen AG, Medline Industries Inc, Honeywell International Inc , Ansell Limited.

3. What are the main segments of the Medical Gloves Industry?

The market segments include Type, Material, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.2 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing awareness about hygiene standards and infection control in healthcare settings has increased the demand for medical gloves. Healthcare professionals rely on gloves for protection against infectious diseases and contaminants during examinations. surgeries. and patient care.

6. What are the notable trends driving market growth?

Automation in glove production will improve manufacturing efficiency. reduce costs. and ensure consistent product quality. This trend is likely to grow as demand continues to increase globally.

7. Are there any restraints impacting market growth?

The cost of raw materials. particularly latex and nitrile. fluctuates based on market demand and supply. This can impact the production cost and pricing of medical gloves.

8. Can you provide examples of recent developments in the market?

January 2023: The Medicom group announced that it had planned to build a nitrile glove factory called ManiKHeir, via its subsidiary Kolmi-Hopen which specializes in the manufacture of single-use medical devices

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Medical Gloves Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Medical Gloves Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Medical Gloves Industry?

To stay informed about further developments, trends, and reports in the Medical Gloves Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence