Key Insights

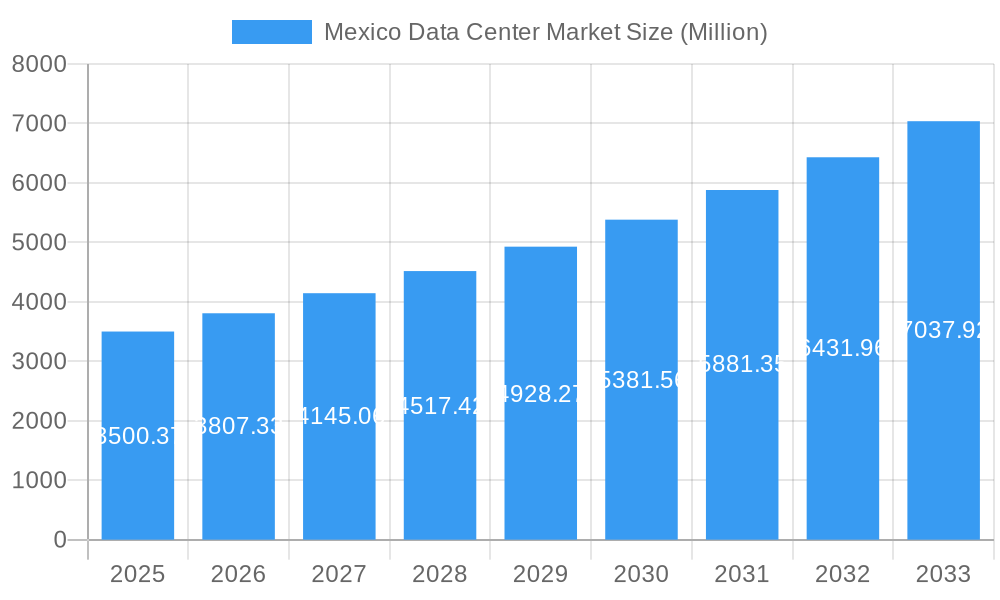

The Mexico Data Center Market is poised for significant expansion, with an estimated market size of $3500.37 million in 2025 and projected to grow at a robust Compound Annual Growth Rate (CAGR) of 8.88% through 2033. This upward trajectory is primarily fueled by escalating demand for digital infrastructure driven by the rapid adoption of cloud computing, the burgeoning e-commerce sector, and the continuous expansion of telecommunications networks. Key growth drivers include increasing digitalization across industries, the need for localized data processing to reduce latency, and government initiatives promoting digital transformation. The market's strong performance is further bolstered by substantial investments from both domestic and international players, leading to the development of hyperscale and wholesale colocation facilities across major hubs.

Mexico Data Center Market Market Size (In Billion)

The market segmentation reveals a dynamic landscape with a strong focus on large and massive data center sizes, indicating a trend towards consolidated, high-capacity infrastructure. Tier 3 and Tier 4 facilities are dominant, reflecting the critical need for reliability and uptime for enterprise-grade operations. Guadalajara and Querétaro stand out as prime hotspots for data center development, attracting significant investment due to their strategic locations, robust connectivity, and supportive business environments. The end-user segment is diverse, with BFSI, Cloud, E-Commerce, and Telecom sectors leading the demand, underscoring the foundational role data centers play in supporting Mexico's digital economy. Restraints such as high initial capital expenditure and the need for skilled labor are being addressed through strategic partnerships and technological advancements, ensuring sustained market growth.

Mexico Data Center Market Company Market Share

This in-depth report provides a comprehensive analysis of the Mexico data center market, covering its current state, historical trends, and future projections from 2019 to 2033. With a base year of 2025 and a forecast period of 2025–2033, this study offers critical insights into market dynamics, competitive landscapes, and emerging opportunities for industry stakeholders. Leveraging high-traffic keywords such as "Mexico data center," "cloud computing Mexico," "colocation services Mexico," "hyperscale data centers Mexico," and "digital transformation Mexico," this report aims to capture the attention of investors, IT professionals, and business leaders seeking to understand and capitalize on the rapid growth of Mexico's digital infrastructure.

Mexico Data Center Market Market Concentration & Innovation

The Mexico data center market is characterized by a moderate level of market concentration, with a few dominant players holding significant market share, alongside a growing number of specialized providers and new entrants. Innovation is primarily driven by the escalating demand for advanced cloud services, the expansion of hyperscale facilities, and the need for robust digital infrastructure to support digital transformation initiatives across various industries. Regulatory frameworks are evolving to support data localization and enhance cybersecurity, although complexities can still present challenges. Product substitutes, such as on-premises IT solutions, are gradually being overshadowed by the cost-effectiveness, scalability, and reliability offered by colocation and cloud services. End-user trends highlight a strong preference for cloud adoption, e-commerce growth, and the increasing reliance on data analytics and AI. Merger and acquisition (M&A) activities are anticipated to intensify as larger players seek to consolidate their presence and expand their geographical reach. For instance, M&A deal values are expected to reach USD 500 million by 2028, reflecting the strategic importance of the Mexican market.

- Market Share Distribution: The top 5 players are projected to hold approximately 65% of the market by 2030.

- Key Innovation Drivers:

- 5G network deployment driving edge computing demand.

- AI and Machine Learning adoption requiring high-density compute.

- Increased cybersecurity threats demanding resilient infrastructure.

- Regulatory Focus: Data privacy laws (e.g., LGPD-like regulations), cybersecurity mandates.

- End-User Dominance: Cloud, BFSI, and E-Commerce segments are leading adoption.

- M&A Trends: Acquisitions of smaller providers for market entry and expansion.

Mexico Data Center Market Industry Trends & Insights

The Mexico data center market is experiencing robust growth, fueled by a confluence of technological advancements, burgeoning digital adoption, and a strategic geographical position. The compound annual growth rate (CAGR) for the market is estimated at 12.5% over the forecast period, driven by increasing investments in digital infrastructure from both domestic and international companies. Technological disruptions, including the widespread adoption of 5G, the proliferation of IoT devices, and the advancements in artificial intelligence, are creating an insatiable demand for data processing, storage, and connectivity. Consumer preferences are shifting towards seamless digital experiences, necessitating low-latency, high-availability data center solutions. This trend is particularly evident in the e-commerce and media & entertainment sectors, which are witnessing exponential growth. Competitive dynamics are becoming more intense, with established global players vying for market share alongside agile local providers. The market penetration of advanced data center solutions is projected to reach 40% by 2030.

The increasing need for digital transformation across all sectors of the Mexican economy is a primary growth catalyst. Businesses are recognizing the imperative to migrate their IT operations to modern, scalable, and secure data center environments to enhance efficiency, agility, and competitiveness. The Mexican government's initiatives to promote digital inclusion and smart city development further bolster this trend. Furthermore, Mexico's strategic location as a gateway to North and South American markets makes it an attractive hub for nearshoring and regional data center operations. The rise of hybrid and multi-cloud strategies among enterprises is also a significant driver, demanding flexible and interconnected data center solutions.

The development of advanced cooling technologies, power efficiency measures, and the integration of renewable energy sources are becoming critical differentiators for data center operators. Companies are increasingly focused on sustainability and reducing their carbon footprint, which aligns with global environmental goals and regulatory pressures. The demand for edge data centers is also on the rise, driven by latency-sensitive applications like autonomous vehicles, real-time analytics, and advanced gaming. This necessitates a distributed data center infrastructure that brings compute power closer to the end-users.

The evolving landscape of cybersecurity threats necessitates robust security measures within data centers. Investments in physical security, network security, and data encryption are paramount to building trust among clients. The increasing volume of data generated globally, coupled with Mexico's growing digital economy, ensures a sustained demand for data center capacity. The report highlights that the total available data center capacity is expected to surpass 3,000 MW by 2030, reflecting the immense growth potential.

Dominant Markets & Segments in Mexico Data Center Market

The Mexico data center market exhibits distinct dominance across various geographical locations, data center sizes, tier types, colocation models, and end-user industries.

Hotspots:

- Querétaro: This region has emerged as a prime hub for data center development due to its favorable business environment, skilled workforce, robust infrastructure, and strategic location. Its growth is propelled by significant investments from hyperscalers and colocation providers.

- Guadalajara: As a major technology and innovation center, Guadalajara benefits from a strong ecosystem of tech companies and universities, driving demand for data center services, particularly for cloud and e-commerce operations.

- Rest of Mexico: While major cities lead, the "Rest of Mexico" is witnessing nascent growth as businesses in secondary cities recognize the need for digital infrastructure, often served by a mix of retail and wholesale colocation providers.

Data Center Size:

- Large & Massive: These segments are experiencing the most significant expansion, driven by the requirements of hyperscale cloud providers and large enterprises demanding extensive capacity for their digital operations. Investments in these categories are projected to account for over 70% of new capacity by 2028.

- Medium: Continues to be a strong segment, catering to mid-sized businesses and specific enterprise workloads.

Tier Type:

- Tier 3: This tier dominates the market, offering a balance of reliability, availability, and cost-effectiveness for a wide range of applications. The increasing demand for mission-critical operations solidifies its position.

- Tier 4: While currently a smaller segment, Tier 4 facilities are gaining traction for highly regulated industries and mission-critical applications requiring maximum uptime and redundancy.

Absorption:

- Non-Utilized: A significant portion of available capacity remains non-utilized, indicating a healthy supply-demand balance and opportunity for new market entrants or expansion. However, as demand accelerates, this is expected to decrease.

Colocation Type:

- Hyperscale: This segment is experiencing the most rapid growth, driven by global cloud providers expanding their presence in Mexico to serve the Latin American market. These facilities are characterized by massive scale and high power density.

- Wholesale: Continues to be a strong driver, catering to enterprises requiring dedicated space and power solutions within a shared data center environment.

- Retail: Serves a diverse range of smaller businesses and organizations requiring flexible, modular colocation solutions.

End User:

- Cloud: This segment is the primary driver of demand, with cloud service providers requiring vast amounts of space and power.

- BFSI (Banking, Financial Services, and Insurance): These organizations are increasingly migrating to data centers for enhanced security, compliance, and scalability of their digital services.

- E-Commerce: The burgeoning e-commerce sector demands high availability and low latency to support online transactions and customer experiences.

- Telecom: Telecom operators are key customers, utilizing data centers for network infrastructure and cloud services to support their expanding mobile and broadband offerings.

- Manufacturing: Increasingly adopting digital technologies for smart manufacturing and supply chain optimization, driving demand for localized data processing.

Mexico Data Center Market Product Developments

Product developments in the Mexico data center market are increasingly focused on enhanced energy efficiency, advanced cooling solutions, and modular designs to support flexible deployments. Innovations in power distribution systems and uninterruptible power supplies (UPS) are crucial for meeting the demands of high-density computing. Edge computing solutions, optimized for smaller footprints and distributed deployments, are also gaining traction. Furthermore, the integration of AI-powered management systems for predictive maintenance and operational optimization is a key trend. These advancements provide competitive advantages by lowering operational costs, improving reliability, and enabling faster deployment of IT infrastructure.

Report Scope & Segmentation Analysis

This report provides a granular analysis of the Mexico data center market segmented across several key dimensions. The Hotspot segmentation includes Guadalajara, Querétaro, and the Rest of Mexico, detailing their unique growth drivers and market penetrations. Data Center Size is analyzed across Small, Medium, Large, Massive, and Mega categories, reflecting the diverse needs of the market. Tier Type segmentation covers Tier 1 & 2, Tier 3, and Tier 4 facilities, highlighting their respective market shares and adoption rates. Absorption is assessed based on Non-Utilized capacity, indicating market maturity and opportunity. Colocation Type segmentation includes Hyperscale, Retail, and Wholesale, each catering to distinct customer segments. Finally, End User segmentation examines the demand from BFSI, Cloud, E-Commerce, Government, Manufacturing, Media & Entertainment, Telecom, and Other End User segments, providing insights into industry-specific adoption patterns and growth projections.

Key Drivers of Mexico Data Center Market Growth

The growth of the Mexico data center market is propelled by several key factors. Firstly, the accelerating digital transformation across all industries in Mexico is a primary driver, increasing the demand for robust IT infrastructure. Secondly, the increasing adoption of cloud computing services, both public and private, necessitates significant data center capacity. Thirdly, the expansion of hyperscale cloud providers into the region, driven by proximity to the US market and growing local demand, is a major growth catalyst. Fourthly, the development of 5G networks and the proliferation of IoT devices are creating a demand for edge computing and increased data processing capabilities. Lastly, favorable government initiatives promoting technological development and digital economy growth, alongside increasing foreign direct investment in the tech sector, contribute significantly.

Challenges in the Mexico Data Center Market Sector

Despite the robust growth, the Mexico data center market faces several challenges. Regulatory complexities and evolving data privacy laws can create compliance hurdles for operators and their clients. Ensuring a stable and affordable supply of electricity, especially for large-scale facilities, remains a significant concern, with power outages and rising energy costs posing risks. The availability of skilled IT talent for managing and operating sophisticated data centers can be a constraint in certain regions. Furthermore, cybersecurity threats are ever-present, requiring continuous investment in advanced security measures. Supply chain disruptions for critical hardware and equipment can also impact project timelines and costs.

Emerging Opportunities in Mexico Data Center Market

Emerging opportunities within the Mexico data center market are abundant. The burgeoning demand for edge computing solutions, driven by the growth of IoT and low-latency applications, presents a significant avenue for growth. The increasing adoption of Artificial Intelligence (AI) and Machine Learning (ML) will require high-performance computing infrastructure, creating opportunities for specialized data centers. The expansion of digital infrastructure into secondary cities and more remote regions of Mexico can unlock new markets. Furthermore, the growing emphasis on sustainability is creating opportunities for data centers powered by renewable energy and employing eco-friendly cooling technologies. The increasing trend of nearshoring manufacturing and IT services to Mexico also presents a significant opportunity for data center providers.

Leading Players in the Mexico Data Center Market Market

- Nabiax

- Equinix Inc

- KIO Networks

- MetroCarrier (Megacable Holdings SAB de CV)

- Lumen Technologies Inc

- Telmex (American Movil)

- HostDime Global Corp

- CloudHQ

- EdgeUno Inc

- OData (Patria Investments Ltd)

- Ascenty (Digital Realty Trust Inc)

- Servidores y Sistemas SA de CV

Key Developments in Mexico Data Center Market Industry

- November 2022: Kio Networks acquired a new data center campus, KIO MEX6, in the greater Mexico City Metro area. This campus features a 50,000-square-meter building with a 20 MW energy capacity, designed to house essential communications and IT services.

- September 2022: América Móvil's subsidiary, TELMEX-Triara, partnered to jointly provide Oracle Cloud Infrastructure (OCI) services across Mexico. TELMEX-Triara, with five locations and 74,000 square meters of space, is hosting the second Oracle Cloud Region in Mexico.

- August 2022: Ascenty launched operations in Mexico with the inauguration of its first two data centers in Querétaro, representing a BRL 1 billion investment. Mexico 1 offers 20,000 m² and 21 MW, while Mexico 2 provides 24,000 m² and 31 MW, with initial occupancy rates of 20% and 25% respectively.

Strategic Outlook for Mexico Data Center Market Market

The strategic outlook for the Mexico data center market is exceptionally promising, driven by sustained demand for digital infrastructure and the nation's growing role as a digital hub in Latin America. The continued expansion of hyperscale cloud providers, coupled with the increasing adoption of advanced technologies like AI, IoT, and 5G, will fuel demand for capacity and advanced services. Investments in renewable energy and sustainable data center practices will become increasingly crucial for market leadership. Furthermore, the growth of retail and wholesale colocation services will cater to a broadening base of businesses seeking flexible and reliable IT solutions. Strategic partnerships and M&A activities are expected to consolidate the market and drive innovation. Mexico's strategic geographical position and its supportive regulatory environment for digital transformation position it for significant and sustained growth in the data center sector.

Mexico Data Center Market Segmentation

-

1. Hotspot

- 1.1. Guadalajara

- 1.2. Querétaro

- 1.3. Rest of Mexico

-

2. Data Center Size

- 2.1. Large

- 2.2. Massive

- 2.3. Medium

- 2.4. Mega

- 2.5. Small

-

3. Tier Type

- 3.1. Tier 1 and 2

- 3.2. Tier 3

- 3.3. Tier 4

-

4. Absorption

- 4.1. Non-Utilized

-

5. Colocation Type

- 5.1. Hyperscale

- 5.2. Retail

- 5.3. Wholesale

-

6. End User

- 6.1. BFSI

- 6.2. Cloud

- 6.3. E-Commerce

- 6.4. Government

- 6.5. Manufacturing

- 6.6. Media & Entertainment

- 6.7. Telecom

- 6.8. Other End User

Mexico Data Center Market Segmentation By Geography

- 1. Mexico

Mexico Data Center Market Regional Market Share

Geographic Coverage of Mexico Data Center Market

Mexico Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.88% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 ; High Mobile penetration

- 3.2.2 Low Tariff

- 3.2.3 and Mature Regulatory Authority; Successful Privatization and Liberalization Initiatives

- 3.3. Market Restrains

- 3.3.1. ; Difficulties in Customization According to Business Needs

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Data Center Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 5.1.1. Guadalajara

- 5.1.2. Querétaro

- 5.1.3. Rest of Mexico

- 5.2. Market Analysis, Insights and Forecast - by Data Center Size

- 5.2.1. Large

- 5.2.2. Massive

- 5.2.3. Medium

- 5.2.4. Mega

- 5.2.5. Small

- 5.3. Market Analysis, Insights and Forecast - by Tier Type

- 5.3.1. Tier 1 and 2

- 5.3.2. Tier 3

- 5.3.3. Tier 4

- 5.4. Market Analysis, Insights and Forecast - by Absorption

- 5.4.1. Non-Utilized

- 5.5. Market Analysis, Insights and Forecast - by Colocation Type

- 5.5.1. Hyperscale

- 5.5.2. Retail

- 5.5.3. Wholesale

- 5.6. Market Analysis, Insights and Forecast - by End User

- 5.6.1. BFSI

- 5.6.2. Cloud

- 5.6.3. E-Commerce

- 5.6.4. Government

- 5.6.5. Manufacturing

- 5.6.6. Media & Entertainment

- 5.6.7. Telecom

- 5.6.8. Other End User

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Nabiax

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Equinix Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 KIO Networks

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 MetroCarrier (Megacable Holdings SAB de CV)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Lumen Technologies Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Telmex (American Movil)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 HostDime Global Corp

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 CloudHQ

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 EdgeUno Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 OData (Patria Investments Ltd)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Ascenty (Digital Realty Trust Inc )

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Servidores y Sistemas SA de CV

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Nabiax

List of Figures

- Figure 1: Mexico Data Center Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Mexico Data Center Market Share (%) by Company 2025

List of Tables

- Table 1: Mexico Data Center Market Revenue undefined Forecast, by Hotspot 2020 & 2033

- Table 2: Mexico Data Center Market Volume K Unit Forecast, by Hotspot 2020 & 2033

- Table 3: Mexico Data Center Market Revenue undefined Forecast, by Data Center Size 2020 & 2033

- Table 4: Mexico Data Center Market Volume K Unit Forecast, by Data Center Size 2020 & 2033

- Table 5: Mexico Data Center Market Revenue undefined Forecast, by Tier Type 2020 & 2033

- Table 6: Mexico Data Center Market Volume K Unit Forecast, by Tier Type 2020 & 2033

- Table 7: Mexico Data Center Market Revenue undefined Forecast, by Absorption 2020 & 2033

- Table 8: Mexico Data Center Market Volume K Unit Forecast, by Absorption 2020 & 2033

- Table 9: Mexico Data Center Market Revenue undefined Forecast, by Colocation Type 2020 & 2033

- Table 10: Mexico Data Center Market Volume K Unit Forecast, by Colocation Type 2020 & 2033

- Table 11: Mexico Data Center Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 12: Mexico Data Center Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 13: Mexico Data Center Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 14: Mexico Data Center Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 15: Mexico Data Center Market Revenue undefined Forecast, by Hotspot 2020 & 2033

- Table 16: Mexico Data Center Market Volume K Unit Forecast, by Hotspot 2020 & 2033

- Table 17: Mexico Data Center Market Revenue undefined Forecast, by Data Center Size 2020 & 2033

- Table 18: Mexico Data Center Market Volume K Unit Forecast, by Data Center Size 2020 & 2033

- Table 19: Mexico Data Center Market Revenue undefined Forecast, by Tier Type 2020 & 2033

- Table 20: Mexico Data Center Market Volume K Unit Forecast, by Tier Type 2020 & 2033

- Table 21: Mexico Data Center Market Revenue undefined Forecast, by Absorption 2020 & 2033

- Table 22: Mexico Data Center Market Volume K Unit Forecast, by Absorption 2020 & 2033

- Table 23: Mexico Data Center Market Revenue undefined Forecast, by Colocation Type 2020 & 2033

- Table 24: Mexico Data Center Market Volume K Unit Forecast, by Colocation Type 2020 & 2033

- Table 25: Mexico Data Center Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 26: Mexico Data Center Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 27: Mexico Data Center Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 28: Mexico Data Center Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Data Center Market?

The projected CAGR is approximately 8.88%.

2. Which companies are prominent players in the Mexico Data Center Market?

Key companies in the market include Nabiax, Equinix Inc, KIO Networks, MetroCarrier (Megacable Holdings SAB de CV), Lumen Technologies Inc, Telmex (American Movil), HostDime Global Corp, CloudHQ, EdgeUno Inc, OData (Patria Investments Ltd), Ascenty (Digital Realty Trust Inc ), Servidores y Sistemas SA de CV.

3. What are the main segments of the Mexico Data Center Market?

The market segments include Hotspot, Data Center Size, Tier Type, Absorption, Colocation Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; High Mobile penetration. Low Tariff. and Mature Regulatory Authority; Successful Privatization and Liberalization Initiatives.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

; Difficulties in Customization According to Business Needs.

8. Can you provide examples of recent developments in the market?

November 2022: Kio Networks have purchased a new campus of data centers in the greater Mexico City Metro area. The campus, known as KIO MEX6, has a 50,000-square-meter building with a 20 MW energy capacity and the ability to house operations and essential communications and IT services.September 2022: The company, owned by América Móvil, signed a deal to jointly provide Oracle Cloud Infrastructure (OCI) services to clients throughout Mexico. As part of the collaboration, TELMEX-Triara was the host organization for the second Oracle Cloud Region planned for Mexico. Telmex's data center division, Triara, has five locations in Queretaro, Monterey, Mexico City, Guadalajara, and Cancun, offering 74,000 square meters (796,500 square feet) of space.August 2022: Ascenty has begun operating in Mexico with the announcement of the inauguration of its first two locations. The two new data centers in the city of Querétaro required BRL 1 billion in total investment for their installation. Mexico 1 has a 20,000 m2 area with a total power of 21 MW, while Mexico 2 has a 24,000 m2 area and a capacity of 31 MW. The buildings were put into use on July 1st, and as of now, Mexico 1 and Mexico 2 each have 20% and 25% of the total capacity of the data processing centers occupied by customers, respectively.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Data Center Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Data Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Data Center Market?

To stay informed about further developments, trends, and reports in the Mexico Data Center Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence