Key Insights

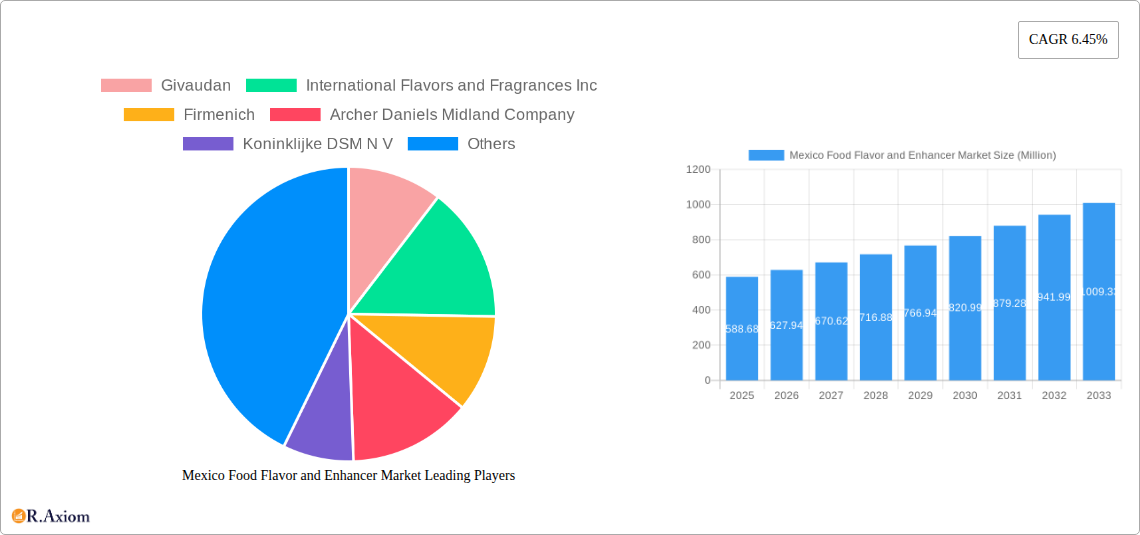

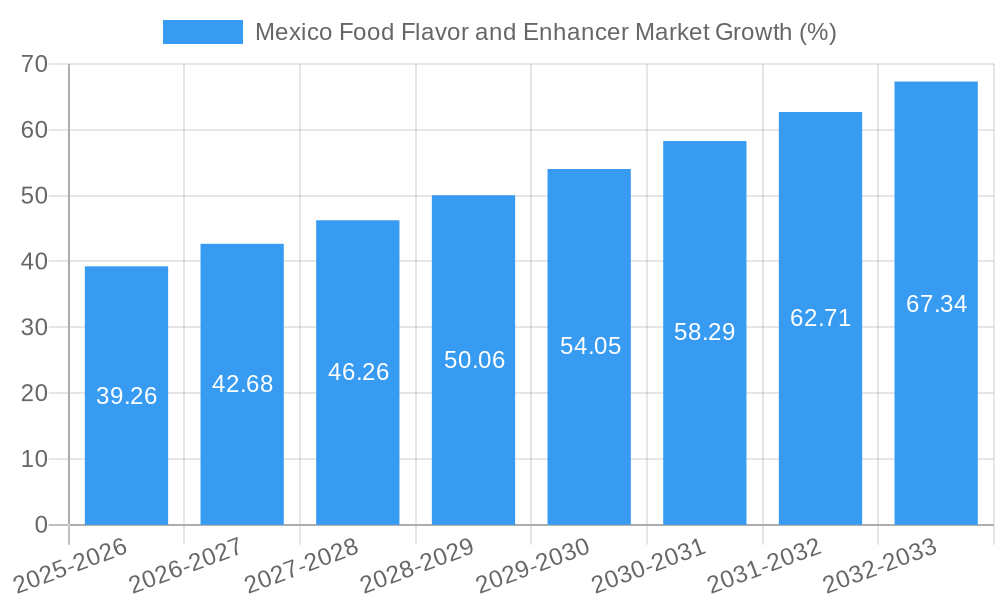

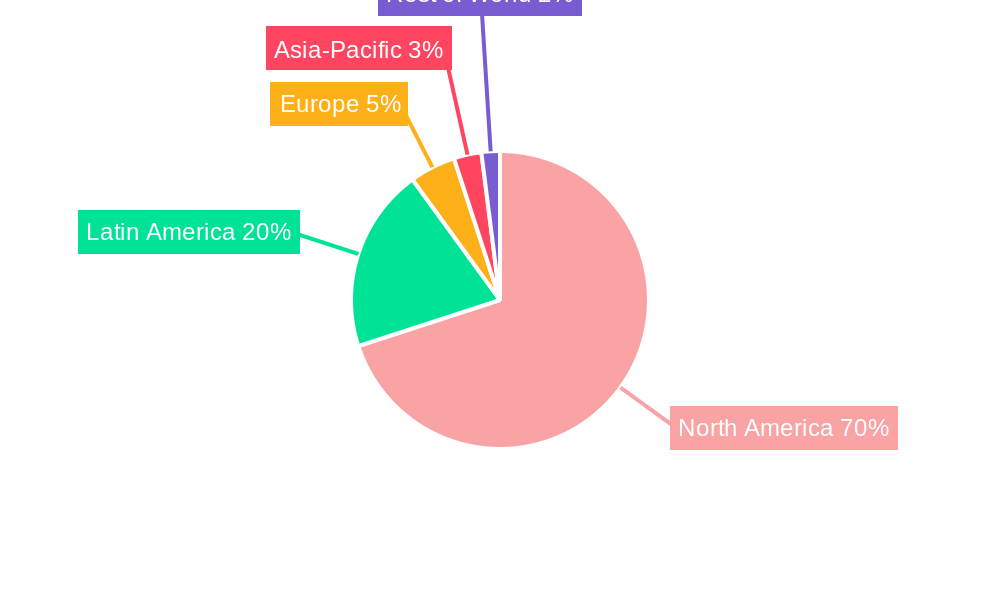

The Mexico food flavor and enhancer market, valued at $588.68 million in 2025, is projected to experience robust growth, driven by increasing demand for processed foods, convenient ready-to-eat meals, and diverse culinary experiences. The rising popularity of bakery and confectionery products, coupled with the expanding beverage industry, significantly fuels market expansion. Consumer preference for enhanced taste and flavor profiles in processed foods contributes substantially to this growth. While precise segmentation data for Mexico is unavailable, leveraging the global trend, we can infer that natural and nature-identical flavors are likely to dominate, reflecting the growing consumer preference for clean-label products. This segment is expected to outpace the growth of artificial flavor enhancers. The market's growth is further propelled by the increasing presence of multinational food companies in Mexico, driving innovation and product diversification.

However, potential restraints include fluctuating raw material prices, stringent food safety regulations, and economic volatility. The market's success hinges on manufacturers' ability to adapt to evolving consumer preferences, including a shift towards healthier options and increasing demand for unique, localized flavor profiles. This necessitates continuous research and development in flavor creation, aligning with health and wellness trends, and catering to the diverse tastes of Mexican consumers. Key players like Givaudan, Firmenich, and IFF, with their established presence and expertise in flavor technology, are well-positioned to capture significant market share. The forecast period (2025-2033) promises continued expansion, largely driven by the nation's growing food processing sector and a burgeoning middle class with higher disposable incomes.

This comprehensive report provides an in-depth analysis of the Mexico food flavor and enhancer market, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market dynamics, growth drivers, challenges, and opportunities. The market is segmented by type (Flavors, Nature Identical Flavors, Flavor Enhancers) and application (Bakery, Confectionery, Dairy, Beverages, Processed Food, Others). Key players, including Givaudan, International Flavors and Fragrances Inc, Firmenich, Archer Daniels Midland Company, Koninklijke DSM N V, Kerry Group, Corbion NV, and Takasago International Corporation (list not exhaustive), are profiled to understand their market strategies and competitive landscape. The report projects a market size of xx Million by 2033.

Mexico Food Flavor and Enhancer Market Concentration & Innovation

The Mexico food flavor and enhancer market exhibits a moderately concentrated structure, with the top five players holding approximately xx% of the market share in 2024. Givaudan, International Flavors and Fragrances Inc., and Firmenich are leading players known for their extensive product portfolios and global presence. Market concentration is influenced by factors such as brand recognition, R&D capabilities, and established distribution networks. Innovation is a key driver, with companies investing heavily in developing novel flavors catering to evolving consumer preferences, including natural and clean-label options. Regulatory frameworks, particularly those related to food safety and labeling, significantly influence market dynamics. The increasing demand for healthier and functional foods fuels the demand for natural and nature-identical flavors, while stringent regulations push companies towards sustainable and ethically sourced ingredients. Product substitutes, such as natural spices and extracts, pose a competitive challenge. End-user trends, such as the growing popularity of ethnic cuisines and customized food experiences, are shaping flavor preferences. M&A activities in the market have been moderate in recent years, with deal values averaging xx Million per transaction.

- Market Share: Top 5 players: xx% (2024)

- M&A Deal Value (Avg.): xx Million (2019-2024)

- Key Innovation Drivers: Clean label, natural ingredients, ethnic flavors, personalized nutrition.

- Regulatory Impact: Food safety regulations, labeling requirements, sustainability standards.

Mexico Food Flavor and Enhancer Market Industry Trends & Insights

The Mexico food flavor and enhancer market is experiencing robust growth, driven by factors such as rising disposable incomes, changing consumer preferences, and increasing demand for processed and convenience foods. The market is projected to register a CAGR of xx% during the forecast period (2025-2033). Technological advancements, particularly in flavor extraction and delivery systems, have enhanced product quality and expanded application possibilities. Consumer preferences are shifting towards natural, clean-label products, creating opportunities for manufacturers who emphasize transparency and sustainability. The competitive landscape is marked by intense rivalry, with companies focusing on product differentiation, innovation, and strategic partnerships to maintain market share. Market penetration of natural and organic flavors is gradually increasing, representing approximately xx% of the total market in 2024. The growing demand for ethnic flavors and customized taste experiences presents further growth avenues.

Dominant Markets & Segments in Mexico Food Flavor and Enhancer Market

The Beverages segment dominates the Mexico food flavor and enhancer market, accounting for xx% of the total market revenue in 2024. This is primarily driven by the burgeoning popularity of carbonated soft drinks, ready-to-drink beverages, and functional drinks. The Confectionery segment is another significant contributor.

Beverages Segment Drivers:

- High consumption of soft drinks and juices

- Increasing demand for ready-to-drink beverages

- Growing preference for flavored water and functional drinks

Confectionery Segment Drivers:

- High per capita consumption of sweets and chocolates

- Expanding middle class increasing purchasing power

- Innovative flavor combinations and product launches

Within the type segment, Flavors holds the largest market share, driven by the demand for a wide range of flavor profiles across various food applications. The processed food segment is expected to exhibit strong growth potential during the forecast period, driven by increasing urbanization and changing lifestyles.

Mexico Food Flavor and Enhancer Market Product Developments

Recent product innovations focus on developing clean-label, natural, and sustainable flavor solutions. Companies are investing in technologies that allow for the extraction and enhancement of natural flavors without the use of artificial ingredients. There is a strong emphasis on creating unique flavor profiles that meet the demand for personalized and diverse culinary experiences. This trend aligns with consumer preference shifts towards health-conscious choices and transparent labeling.

Report Scope & Segmentation Analysis

This report provides a detailed segmentation of the Mexico food flavor and enhancer market based on type (Flavors, Nature Identical Flavors, Flavor Enhancers) and application (Bakery, Confectionery, Dairy, Beverages, Processed Food, Others). Each segment's growth projections, market size, and competitive dynamics are analyzed. The Flavors segment, for instance, is anticipated to grow at a CAGR of xx% during the forecast period. The market size for each application segment is projected in detail, showing the current revenue for each as well as future market size projections.

Key Drivers of Mexico Food Flavor and Enhancer Market Growth

The growth of the Mexico food flavor and enhancer market is primarily driven by increasing consumer demand for processed food, the rise in disposable incomes, and a preference for customized taste profiles. Technological advancements enabling the creation of cleaner labels and more natural flavors are contributing factors, alongside government initiatives promoting food processing and manufacturing in the country.

Challenges in the Mexico Food Flavor and Enhancer Market Sector

The market faces challenges such as fluctuating raw material prices, intense competition among established players, and stringent food safety regulations. Supply chain disruptions can also impact production costs and timelines. Furthermore, the increasing preference for natural and clean-label products necessitates adaptation from manufacturers.

Emerging Opportunities in Mexico Food Flavor and Enhancer Market

Emerging opportunities exist in the growing demand for functional foods, ethnic flavors, and clean-label products. This creates potential for innovation in flavor technology, sustainability, and niche product development. Furthermore, the growth in the food processing industry offers expanding market potential.

Leading Players in the Mexico Food Flavor and Enhancer Market Market

- Givaudan

- International Flavors and Fragrances Inc

- Firmenich

- Archer Daniels Midland Company

- Koninklijke DSM N V

- Kerry Group

- Corbion NV

- Takasago International Corporation *List Not Exhaustive

Key Developments in Mexico Food Flavor and Enhancer Market Industry

- 2022 Q4: Givaudan launched a new range of natural flavors for the beverage industry.

- 2023 Q1: Firmenich acquired a smaller flavor company specializing in ethnic flavors.

- 2024 Q2: ADM announced a new facility expansion focusing on flavor production for the Mexican market. (Further developments to be added based on available data)

Strategic Outlook for Mexico Food Flavor and Enhancer Market Market

The Mexico food flavor and enhancer market is poised for continued growth, driven by the factors mentioned above. Opportunities exist for companies to capitalize on the increasing demand for natural, clean-label, and functional flavors. A strategic focus on innovation, sustainability, and catering to evolving consumer preferences will be crucial for success in this dynamic market.

Mexico Food Flavor and Enhancer Market Segmentation

-

1. Type

-

1.1. Flavors

- 1.1.1. Natural Flavors

- 1.1.2. Synthetic Flavors

- 1.1.3. Nature Identical Flavors

- 1.2. Flavor Enhancers

-

1.1. Flavors

-

2. Application

- 2.1. Bakery

- 2.2. Confectionery

- 2.3. Dairy

- 2.4. Beverages

- 2.5. Processed Food

- 2.6. Others

Mexico Food Flavor and Enhancer Market Segmentation By Geography

- 1. Mexico

Mexico Food Flavor and Enhancer Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.45% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for Convenient Ready-to-Eat Food Products; Growing Affinity Toward Ethnic and Organic Frozen Ready Meals

- 3.3. Market Restrains

- 3.3.1. Rising Concerns Over Food Safety and Quality

- 3.4. Market Trends

- 3.4.1. Increase in Demand for Clean Label Ingredients

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Food Flavor and Enhancer Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Flavors

- 5.1.1.1. Natural Flavors

- 5.1.1.2. Synthetic Flavors

- 5.1.1.3. Nature Identical Flavors

- 5.1.2. Flavor Enhancers

- 5.1.1. Flavors

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Bakery

- 5.2.2. Confectionery

- 5.2.3. Dairy

- 5.2.4. Beverages

- 5.2.5. Processed Food

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States Mexico Food Flavor and Enhancer Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada Mexico Food Flavor and Enhancer Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico Mexico Food Flavor and Enhancer Market Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Givaudan

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 International Flavors and Fragrances Inc

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Firmenich

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Archer Daniels Midland Company

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Koninklijke DSM N V

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Kerry Group

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Corbion NV

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Takasago International Corporation*List Not Exhaustive

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.1 Givaudan

List of Figures

- Figure 1: Mexico Food Flavor and Enhancer Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Mexico Food Flavor and Enhancer Market Share (%) by Company 2024

List of Tables

- Table 1: Mexico Food Flavor and Enhancer Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Mexico Food Flavor and Enhancer Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Mexico Food Flavor and Enhancer Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Mexico Food Flavor and Enhancer Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Mexico Food Flavor and Enhancer Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Mexico Food Flavor and Enhancer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Mexico Food Flavor and Enhancer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Mexico Food Flavor and Enhancer Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Food Flavor and Enhancer Market Revenue Million Forecast, by Type 2019 & 2032

- Table 10: Mexico Food Flavor and Enhancer Market Revenue Million Forecast, by Application 2019 & 2032

- Table 11: Mexico Food Flavor and Enhancer Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Food Flavor and Enhancer Market?

The projected CAGR is approximately 6.45%.

2. Which companies are prominent players in the Mexico Food Flavor and Enhancer Market?

Key companies in the market include Givaudan, International Flavors and Fragrances Inc, Firmenich, Archer Daniels Midland Company, Koninklijke DSM N V, Kerry Group, Corbion NV, Takasago International Corporation*List Not Exhaustive.

3. What are the main segments of the Mexico Food Flavor and Enhancer Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 588.68 Million as of 2022.

5. What are some drivers contributing to market growth?

Demand for Convenient Ready-to-Eat Food Products; Growing Affinity Toward Ethnic and Organic Frozen Ready Meals.

6. What are the notable trends driving market growth?

Increase in Demand for Clean Label Ingredients.

7. Are there any restraints impacting market growth?

Rising Concerns Over Food Safety and Quality.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Food Flavor and Enhancer Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Food Flavor and Enhancer Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Food Flavor and Enhancer Market?

To stay informed about further developments, trends, and reports in the Mexico Food Flavor and Enhancer Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence