Key Insights

The Mexican kitchen appliance market is projected for substantial growth, driven by escalating consumer demand for advanced, energy-efficient home solutions. The market is estimated to reach 13.16 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 3.6% through 2033. Key growth catalysts include rising disposable incomes, an expanding middle class, and a notable trend towards kitchen modernization, particularly in urban areas. Consumers are increasingly prioritizing appliances with superior functionality, smart capabilities, and modern aesthetics, aligning with global smart home trends. Demand for both small cooking appliances (e.g., air fryers, blenders) and large kitchen appliances (e.g., refrigerators, ovens) is anticipated to rise as households invest in upgrading their culinary spaces. Additionally, growing awareness of energy efficiency and sustainability is influencing purchasing decisions, favoring appliances with lower energy consumption.

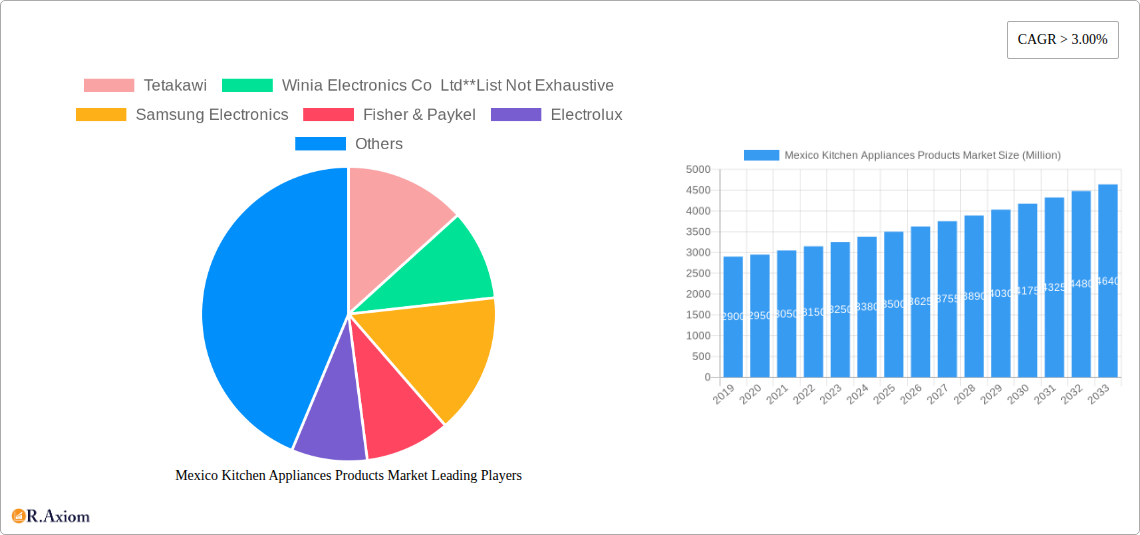

Mexico Kitchen Appliances Products Market Market Size (In Billion)

Evolving lifestyles, emphasizing convenience and time-saving solutions, further fuel market expansion. This translates into a strong preference for innovative kitchen appliances that streamline food preparation and cooking. While traditional offline retail channels remain significant, the online segment is rapidly gaining traction, offering consumers wider selections, competitive pricing, and convenient home delivery. Leading companies such as Samsung Electronics, Whirlpool, LG Electronics, and Mabe are actively launching new product lines and investing in marketing to secure market share. The competitive landscape is dynamic, featuring both established global players and emerging domestic brands. Addressing potential restraints, including economic volatility and supply chain disruptions, will be critical for sustained market performance. However, positive consumer sentiment and continuous technological advancements signal a promising future for the Mexican kitchen appliance market.

Mexico Kitchen Appliances Products Market Company Market Share

This comprehensive report offers an exhaustive analysis of the Mexico Kitchen Appliances Products Market, providing critical insights and actionable intelligence for industry stakeholders. Covering the historical period from 2019 to 2024, with 2025 as the base year, and an extensive forecast period through 2033, this study delves into market dynamics, trends, and future potential. With an estimated market size projected to reach 13.16 billion by 2025, this report is an indispensable resource for manufacturers, suppliers, distributors, and investors seeking to capitalize on the burgeoning Mexican appliance sector. Our analysis incorporates high-traffic keywords such as "Mexico kitchen appliances," "appliance market Mexico," "household appliances Mexico," "nearshoring appliance manufacturing," "smart kitchen appliances Mexico," and "consumer electronics Mexico" to ensure maximum search visibility.

Mexico Kitchen Appliances Products Market Market Concentration & Innovation

The Mexico Kitchen Appliances Products Market exhibits a XX% market concentration, with leading players like Whirlpool, LG Electronics, and Mabe holding significant market share. Innovation is a key differentiator, driven by the increasing demand for energy-efficient appliances, smart home integration, and aesthetically pleasing designs. Regulatory frameworks, such as those promoting energy conservation and safety standards, also influence product development. Product substitutes, including countertop alternatives and specialized cooking gadgets, present a dynamic competitive landscape. End-user trends are shifting towards connected kitchens, premium features, and sustainable options. Mergers and acquisitions (M&A) activities are expected to play a crucial role in market consolidation, with an estimated US $XX Million in M&A deal values anticipated over the forecast period.

- Market Share Dominance: Key players like Whirlpool and LG Electronics command a substantial portion of the market.

- Innovation Drivers:

- Smart home connectivity and IoT integration.

- Energy efficiency and sustainability certifications.

- Advanced cooking technologies and user-friendly interfaces.

- Aesthetic appeal and customizable designs.

- Regulatory Impact: Government initiatives promoting energy efficiency and product safety standards are shaping product innovation.

- End-User Preferences: Growing demand for convenience, automation, and personalized kitchen experiences.

- M&A Outlook: Potential for consolidation among smaller players and strategic acquisitions by larger entities.

Mexico Kitchen Appliances Products Market Industry Trends & Insights

The Mexico Kitchen Appliances Products Market is poised for significant expansion, driven by robust economic growth, increasing disposable incomes, and a growing middle class. The CAGR for the market is projected at XX% over the forecast period. The surge in nearshoring initiatives is a pivotal trend, attracting substantial foreign investment into Mexico's manufacturing sector. This has led to increased local production of a wide range of appliances, from refrigerators and washing machines to stoves and air conditioners, boosting both domestic supply and export potential. Technological disruptions, such as the integration of Artificial Intelligence (AI) and the Internet of Things (IoT) into kitchen appliances, are transforming consumer experiences, offering enhanced convenience, efficiency, and connectivity. Samsung's opening of its first Latin American Bespoke Home flagship store in Mexico City underscores the growing importance of premium and customizable product offerings. Consumer preferences are increasingly leaning towards smart, energy-efficient, and aesthetically pleasing appliances that align with modern living trends. Competitive dynamics are intensifying, with both global giants and local manufacturers vying for market share through product differentiation, aggressive marketing campaigns, and strategic partnerships. The market penetration of advanced kitchen technologies is expected to rise steadily as consumer awareness and adoption rates increase.

Dominant Markets & Segments in Mexico Kitchen Appliances Products Market

The Mexico Kitchen Appliances Products Market is characterized by the dominance of Large Kitchen Appliances, which consistently hold the largest market share due to their essential nature in every household. Within this segment, refrigerators and ovens are particularly strong performers. Food Preparation Appliances and Small Cooking Appliances are also experiencing robust growth, fueled by evolving consumer lifestyles and a growing interest in home cooking and culinary exploration. The Online sales channel is rapidly gaining traction, mirroring global e-commerce trends, though Offline - Traditional channels, such as large retail chains and specialized appliance stores, still command a significant portion of sales, especially for high-value items. Mexico's economic policies and infrastructure development play a crucial role in the market's expansion.

Dominant Product Type Segment:

- Large Kitchen Appliances: Driven by essential household needs, sustained demand for refrigerators, freezers, washing machines, and dryers.

- Key Drivers: Urbanization, rising household formation, replacement demand.

- Food Preparation Appliances: Growth propelled by convenience-seeking consumers and a rising interest in healthier eating.

- Key Drivers: Busy lifestyles, increasing popularity of home cooking, product innovation.

- Small Cooking Appliances: Experiencing a surge in popularity due to affordability, versatility, and space-saving designs.

- Key Drivers: Smaller living spaces, growing culinary trends, ease of use.

- Other Kitchen Appliances: Including water dispensers, small coolers, and other niche products, contributing to market diversity.

- Key Drivers: Specialization, emerging consumer needs.

- Large Kitchen Appliances: Driven by essential household needs, sustained demand for refrigerators, freezers, washing machines, and dryers.

Dominant Channel:

- Offline - Traditional: Still a strong contender, offering in-person product experience and immediate purchase options.

- Key Drivers: Established retail networks, brand trust, larger appliance purchases.

- Online: Rapidly expanding its reach, driven by convenience, wider selection, and competitive pricing.

- Key Drivers: E-commerce penetration, digital marketing efforts, flexible payment options.

- Offline - Traditional: Still a strong contender, offering in-person product experience and immediate purchase options.

Mexico Kitchen Appliances Products Market Product Developments

Product developments in the Mexico Kitchen Appliances Products Market are heavily influenced by technological advancements and evolving consumer needs. Innovations are focused on enhancing user experience through smart features, connectivity, and intuitive controls. Energy efficiency remains a paramount concern, with manufacturers introducing appliances that consume less power, aligning with both environmental consciousness and cost savings. The integration of AI and machine learning is enabling appliances to learn user preferences and optimize performance. For instance, smart refrigerators can now track inventory and suggest recipes, while ovens offer pre-programmed cooking cycles. These developments provide significant competitive advantages by catering to a sophisticated consumer base that values convenience, sustainability, and cutting-edge technology.

Report Scope & Segmentation Analysis

This report meticulously analyzes the Mexico Kitchen Appliances Products Market, segmented by Product Type and Channel. The Product Type segmentation includes: Food Preparation Appliances, Small Cooking Appliances, Large Kitchen Appliances, and Other Kitchen Appliances. Each segment is further analyzed for its market size, growth projections, and competitive dynamics. The Channel segmentation encompasses Offline - Traditional and Online sales channels, providing insights into their respective market shares, growth trends, and strategic importance. The analysis provides granular detail on the projected market size and compound annual growth rate (CAGR) for each segment throughout the forecast period.

- Food Preparation Appliances: Projected market size of US $XXX Million by 2025 with a CAGR of XX%.

- Small Cooking Appliances: Projected market size of US $XXX Million by 2025 with a CAGR of XX%.

- Large Kitchen Appliances: Projected market size of US $XXX Million by 2025 with a CAGR of XX%.

- Other Kitchen Appliances: Projected market size of US $XXX Million by 2025 with a CAGR of XX%.

- Offline - Traditional Channel: Projected market size of US $XXX Million by 2025 with a CAGR of XX%.

- Online Channel: Projected market size of US $XXX Million by 2025 with a CAGR of XX%.

Key Drivers of Mexico Kitchen Appliances Products Market Growth

Several key factors are propelling the growth of the Mexico Kitchen Appliances Products Market. The increasing disposable income and the expanding middle class are driving demand for modern and feature-rich kitchen appliances. The ongoing nearshoring trend is a significant economic catalyst, attracting substantial foreign investment into manufacturing, leading to job creation and increased economic activity. Technological advancements, particularly the integration of smart home capabilities and energy-efficient technologies, are appealing to consumers seeking convenience and sustainability. Government initiatives promoting home ownership and infrastructure development further contribute to market expansion.

- Rising Disposable Income: Increased purchasing power fuels demand for premium kitchen appliances.

- Nearshoring Momentum: Manufacturing investments and job creation boost economic confidence.

- Technological Advancements: Smart features and energy efficiency are key consumer attractions.

- Government Support: Policies promoting housing and infrastructure development indirectly benefit appliance sales.

Challenges in the Mexico Kitchen Appliances Products Market Sector

Despite the positive outlook, the Mexico Kitchen Appliances Products Market faces several challenges. Fluctuations in currency exchange rates can impact the cost of imported components and finished goods, affecting pricing strategies. Intense competition from both domestic and international players can lead to price wars and pressure on profit margins. Supply chain disruptions, while improving due to nearshoring, can still pose risks, impacting production schedules and product availability. Evolving consumer preferences require continuous product innovation and adaptation, demanding significant R&D investments. Regulatory complexities and potential changes in trade policies can also create uncertainties for businesses operating in the market.

- Currency Volatility: Impacts import costs and profitability.

- Intense Competition: Leads to price pressures and market saturation.

- Supply Chain Vulnerabilities: Potential for disruptions affecting production and delivery.

- Rapidly Evolving Consumer Demands: Requires constant innovation and investment.

Emerging Opportunities in Mexico Kitchen Appliances Products Market

The Mexico Kitchen Appliances Products Market presents numerous emerging opportunities for growth. The increasing adoption of smart home technologies offers significant potential for connected kitchen appliances, creating new revenue streams through software and service offerings. The growing demand for sustainable and eco-friendly products opens avenues for manufacturers focusing on energy-efficient and durable appliances. The expansion of e-commerce platforms provides an excellent opportunity to reach a wider customer base across the country. Furthermore, the development of affordable yet feature-rich appliances can cater to a larger segment of the population, driving market penetration. The rise of customisation and personalization in product design is another area for growth.

- Smart Home Integration: Demand for connected and automated kitchen solutions.

- Sustainability Focus: Growing market for eco-friendly and energy-efficient appliances.

- E-commerce Expansion: Untapped potential in reaching diverse customer segments online.

- Affordable Premium Appliances: Catering to the rising middle class with feature-rich yet accessible products.

Leading Players in the Mexico Kitchen Appliances Products Market Market

- Tetakawi

- Winia Electronics Co Ltd

- Samsung Electronics

- Fisher & Paykel

- Electrolux

- Mabe

- Haier

- Whirlpool

- Panasonic Corporation

- LG Electronics

Key Developments in Mexico Kitchen Appliances Products Market Industry

- January 2023: Nearshoring boosts appliance manufacturing in Mexico. Mexico is taking advantage of its position within the nearshoring phenomenon, so in terms of production and investment, there will be a growth of 8%. The appliances produced in Mexico include washing machines, air conditioners, stoves, electric water heaters, and vacuum cleaners.

- January 2023: In 2022, refrigerators, washing machines, and other household appliance manufacturers invested more than US $1.15 billion in Mexico.

- January 2023: Samsung has announced that it has opened its first Latin American Bespoke Home flagship store in Mexico City. The new flagship store is located at the Centro Comercial Perisur, among the city's biggest shopping malls, visited by an average of 2 million people a month.

Strategic Outlook for Mexico Kitchen Appliances Products Market Market

The strategic outlook for the Mexico Kitchen Appliances Products Market is highly promising, driven by sustained economic growth and evolving consumer preferences. The continued momentum of nearshoring will bolster local manufacturing capabilities and attract further investment, creating a more robust domestic supply chain. Manufacturers should focus on innovating with smart technologies, energy efficiency, and aesthetically pleasing designs to capture the growing demand for premium products. Expanding online sales channels will be crucial for reaching a wider consumer base and enhancing convenience. Furthermore, developing product portfolios that cater to diverse income segments, including affordable yet feature-rich options, will be key to maximizing market penetration and driving overall growth in this dynamic and expanding market.

Mexico Kitchen Appliances Products Market Segmentation

-

1. BY Product type

- 1.1. Food Preparation Appliances

- 1.2. Small Cooking Appliances

- 1.3. Large Kitchen Appliances

- 1.4. Other Kitchen Appliances

-

2. Channel

- 2.1. Offline - Traditional

- 2.2. Online

Mexico Kitchen Appliances Products Market Segmentation By Geography

- 1. Mexico

Mexico Kitchen Appliances Products Market Regional Market Share

Geographic Coverage of Mexico Kitchen Appliances Products Market

Mexico Kitchen Appliances Products Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expanding Construction and Real Estate Sector

- 3.3. Market Restrains

- 3.3.1. Rising competition among the players

- 3.4. Market Trends

- 3.4.1. Increasing Gross Production of Small Kitchen Appliances

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Kitchen Appliances Products Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by BY Product type

- 5.1.1. Food Preparation Appliances

- 5.1.2. Small Cooking Appliances

- 5.1.3. Large Kitchen Appliances

- 5.1.4. Other Kitchen Appliances

- 5.2. Market Analysis, Insights and Forecast - by Channel

- 5.2.1. Offline - Traditional

- 5.2.2. Online

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by BY Product type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Tetakawi

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Winia Electronics Co Ltd**List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Samsung Electronics

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Fisher & Paykel

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Electrolux

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mabe

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Haier

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Whirlpool

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Panasonic Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 LG Electronics

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Tetakawi

List of Figures

- Figure 1: Mexico Kitchen Appliances Products Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Mexico Kitchen Appliances Products Market Share (%) by Company 2025

List of Tables

- Table 1: Mexico Kitchen Appliances Products Market Revenue billion Forecast, by BY Product type 2020 & 2033

- Table 2: Mexico Kitchen Appliances Products Market Revenue billion Forecast, by Channel 2020 & 2033

- Table 3: Mexico Kitchen Appliances Products Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Mexico Kitchen Appliances Products Market Revenue billion Forecast, by BY Product type 2020 & 2033

- Table 5: Mexico Kitchen Appliances Products Market Revenue billion Forecast, by Channel 2020 & 2033

- Table 6: Mexico Kitchen Appliances Products Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Kitchen Appliances Products Market?

The projected CAGR is approximately 3.6%.

2. Which companies are prominent players in the Mexico Kitchen Appliances Products Market?

Key companies in the market include Tetakawi, Winia Electronics Co Ltd**List Not Exhaustive, Samsung Electronics, Fisher & Paykel, Electrolux, Mabe, Haier, Whirlpool, Panasonic Corporation, LG Electronics.

3. What are the main segments of the Mexico Kitchen Appliances Products Market?

The market segments include BY Product type, Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.16 billion as of 2022.

5. What are some drivers contributing to market growth?

Expanding Construction and Real Estate Sector.

6. What are the notable trends driving market growth?

Increasing Gross Production of Small Kitchen Appliances.

7. Are there any restraints impacting market growth?

Rising competition among the players.

8. Can you provide examples of recent developments in the market?

January 2023: Nearshoring boosts appliance manufacturing in Mexico. Mexico is taking advantage of its position within the nearshoring phenomenon, so in terms of production and investment, there will be a growth of 8%. The appliances produced in Mexico include washing machines, air conditioners, stoves, electric water heaters, and vacuum cleaners. In 2022, refrigerators, washing machines, and other household appliance manufacturers invested more than US $1.15 billion in Mexico.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Kitchen Appliances Products Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Kitchen Appliances Products Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Kitchen Appliances Products Market?

To stay informed about further developments, trends, and reports in the Mexico Kitchen Appliances Products Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence