Key Insights

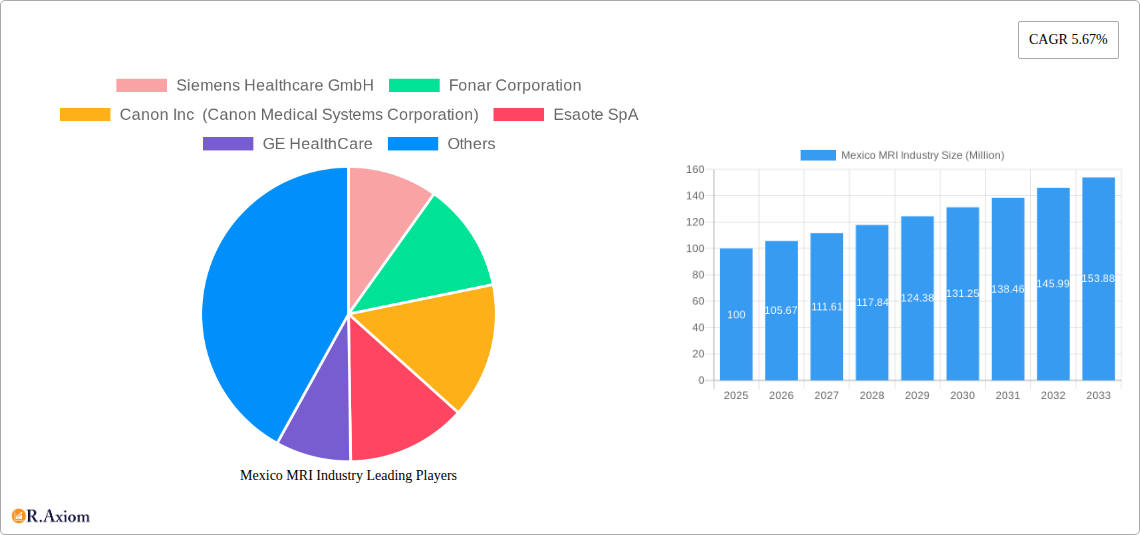

The Mexico MRI market, valued at approximately $100 million in 2025 (estimated based on typical market sizes for comparable economies and the provided CAGR), is projected to experience robust growth, driven primarily by increasing prevalence of chronic diseases like cancer and neurological disorders, coupled with rising healthcare expenditure and improving medical infrastructure in the country. The market's expansion is further fueled by technological advancements leading to more sophisticated MRI systems—higher field strength magnets offering improved image quality and faster scan times—and the growing adoption of minimally invasive procedures, increasing the need for precise pre-operative and post-operative imaging. The segment of high-field MRI systems is expected to dominate the market share, owing to their superior diagnostic capabilities, though open MRI systems are anticipated to witness notable growth driven by patient comfort and reduced claustrophobia. Major players like Siemens Healthcare, GE Healthcare, and Philips are actively investing in expanding their presence and product portfolios within the Mexican market.

Despite the promising growth outlook, challenges persist. High equipment costs, particularly for advanced MRI systems, may limit adoption in smaller clinics and hospitals. Additionally, the market faces constraints from a relatively small number of specialized radiologists, potentially impacting the throughput of MRI scans. However, government initiatives aimed at improving healthcare infrastructure and access to advanced medical technologies, coupled with private sector investments in diagnostic imaging facilities, are likely to mitigate these challenges and further stimulate market growth in the coming years. The forecast period of 2025-2033 suggests a continued expansion, with a potential market value exceeding $180 million by 2033, driven by consistent adoption of advanced technologies.

This comprehensive report provides a detailed analysis of the Mexico MRI industry, covering market size, segmentation, key players, growth drivers, challenges, and future opportunities. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. This report is invaluable for industry stakeholders, investors, and researchers seeking insights into this dynamic market.

Mexico MRI Industry Market Concentration & Innovation

The Mexico MRI market exhibits a moderately concentrated landscape, with a handful of multinational corporations holding significant market share. Key players like Siemens Healthcare GmbH, GE HealthCare, Koninklijke Philips NV, Fujifilm Holdings Corporation, Canon Inc (Canon Medical Systems Corporation), Esaote SpA, and Fonar Corporation dominate the market, competing primarily on technological advancements, service offerings, and pricing strategies. The combined market share of these companies is estimated to be around 75% in 2025.

Market concentration is further influenced by:

- High capital expenditure: The substantial investment required for purchasing and maintaining MRI systems limits the entry of new players.

- Regulatory approvals: Stringent regulatory approvals for medical devices pose a barrier to market entry and expansion.

- Technological advancements: Continuous innovations in MRI technology, such as higher field strength systems and advanced imaging techniques, create a competitive landscape favoring established players with strong R&D capabilities.

Mergers and acquisitions (M&A) activity within the Mexican MRI market has been moderate in recent years. While major global deals have indirectly impacted the Mexican market through the presence of these large players, few significant M&A activities have been directly within the country. The value of M&A deals within Mexico related to MRI technology in the past five years is estimated at xx Million. This relatively low activity may be due to a combination of factors, including the relatively smaller size of the Mexican market compared to larger global markets and the regulatory hurdles involved in such transactions.

Mexico MRI Industry Industry Trends & Insights

The Mexican MRI market is witnessing robust growth, driven by several factors. The increasing prevalence of chronic diseases like cardiovascular diseases, neurological disorders, and cancer is fueling demand for advanced diagnostic imaging solutions. Government initiatives to improve healthcare infrastructure and expand access to quality healthcare are further stimulating market growth. The market is also witnessing the adoption of high-field MRI systems and advanced imaging techniques. Technological disruptions in areas such as AI-powered image analysis and improved software are driving market advancements.

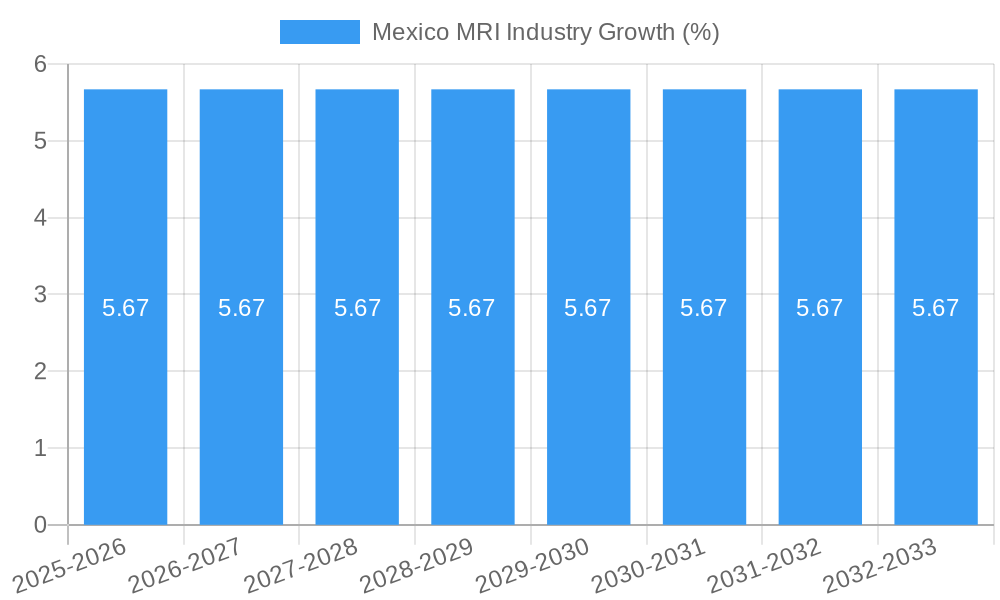

The compound annual growth rate (CAGR) of the Mexican MRI market during the historical period (2019-2024) was approximately 5%, with a projected CAGR of 6% during the forecast period (2025-2033). This growth can be attributed to the following:

- Increasing healthcare expenditure and investments in hospital infrastructure.

- Rising prevalence of chronic diseases necessitating advanced diagnostic tools.

- Growing adoption of high-field and advanced MRI systems offering superior image quality and diagnostic capabilities.

- Government initiatives promoting the expansion of healthcare facilities, especially in underserved areas.

Market penetration remains relatively low compared to developed nations, offering significant scope for future growth. Increasing affordability and improved insurance coverage are expected to further drive market penetration.

Dominant Markets & Segments in Mexico MRI Industry

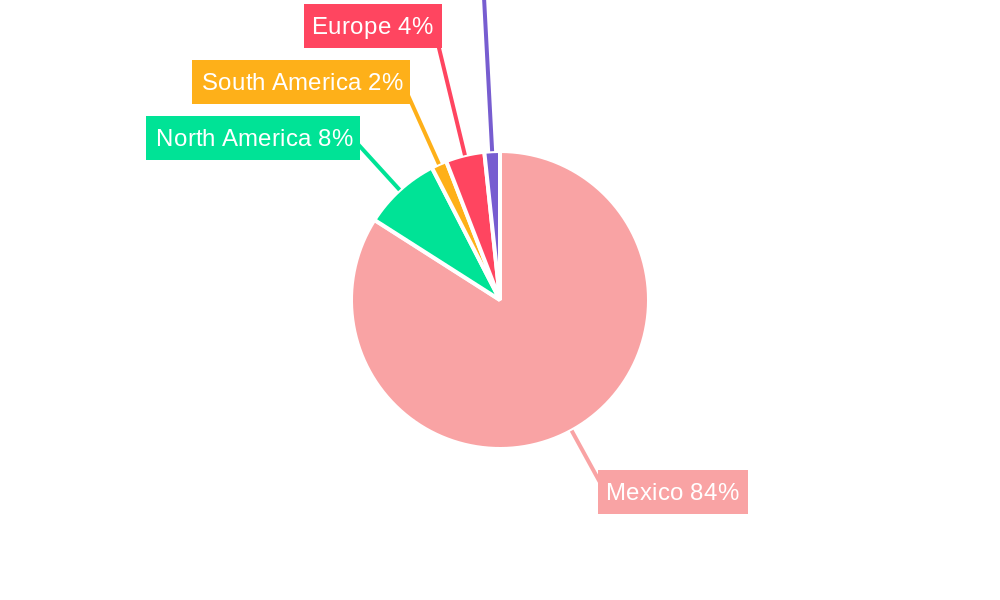

While nationwide demand is increasing, the dominant market for MRI systems in Mexico is concentrated in major urban centers, particularly Mexico City and Guadalajara. These areas house the most significant number of hospitals, specialized clinics, and research facilities equipped with MRI technology. The economic activity and higher concentration of medical professionals in these regions explain this geographic dominance. Key drivers include:

- High concentration of healthcare facilities: The majority of large hospitals and specialized clinics are concentrated in urban areas.

- Higher disposable income: Urban centers typically have a higher per capita income, leading to greater affordability of advanced medical treatments.

- Better infrastructure: Major cities boast superior infrastructure, facilitating the installation and maintenance of MRI systems.

Segment Dominance:

- Architecture: Closed MRI systems currently hold a larger market share due to their superior image quality and widespread acceptance. However, open MRI systems are witnessing increasing adoption due to their patient-friendliness and suitability for claustrophobic individuals.

- Field Strength: High-field MRI systems (1.5T and 3.0T) are gaining popularity because of their improved image resolution and diagnostic capabilities. The adoption of ultra-high field systems (7.0T and above) is still relatively limited due to their high cost and specialized applications.

- Application: Oncology, neurology, and musculoskeletal imaging are the leading applications for MRI systems in Mexico, reflecting the high prevalence of related diseases.

Mexico MRI Industry Product Developments

Recent product innovations have focused on improving image quality, reducing scan time, and enhancing patient comfort. Manufacturers are incorporating advanced technologies like AI-powered image analysis, parallel imaging, and compressed sensing to optimize the MRI process. These developments are geared toward addressing the needs of clinicians and improving the overall patient experience. The market trend clearly indicates a strong inclination towards improved speed and higher resolution, coupled with enhanced patient comfort features.

Report Scope & Segmentation Analysis

This report comprehensively segments the Mexican MRI market based on architecture (closed vs. open systems), field strength (low, high, very high, ultra-high), and application (oncology, neurology, cardiology, gastroenterology, musculoskeletal, other). Each segment is analyzed based on market size, growth rate, and competitive dynamics, providing a detailed overview of current and projected market conditions. Growth projections vary across segments, with high-field and ultra-high-field MRI systems exhibiting the highest growth potential due to their advanced capabilities. The competitive landscape varies across segments with differing levels of market share held by the major players.

Key Drivers of Mexico MRI Industry Growth

The growth of the Mexican MRI industry is driven by several factors, including:

- Technological advancements: The introduction of advanced MRI systems with superior image quality, faster scan times, and improved patient comfort is driving market growth.

- Economic growth: Increasing disposable incomes and healthcare expenditure are bolstering market demand.

- Government initiatives: Government policies aimed at improving healthcare infrastructure and expanding access to advanced medical technologies are creating favorable market conditions.

- Increasing prevalence of chronic diseases: The rise in chronic diseases, particularly cancers and neurological conditions, requires advanced diagnostic tools like MRI, fostering market growth.

Challenges in the Mexico MRI Industry Sector

Several challenges hinder the growth of the Mexican MRI industry:

- High cost of MRI systems: The high cost of acquisition, installation, and maintenance represents a significant barrier to market entry and widespread adoption.

- Limited healthcare infrastructure: Uneven distribution of healthcare infrastructure, particularly in rural areas, limits access to MRI technology.

- Regulatory hurdles: Stringent regulatory approvals for medical devices can delay market entry and limit competition.

- Skilled personnel shortage: A shortage of trained radiologists and technicians can constrain the effective utilization of MRI systems. This shortage impacts the speed and quality of diagnoses and analysis performed using MRI.

Emerging Opportunities in Mexico MRI Industry

Emerging opportunities in the Mexican MRI market include:

- Expansion into underserved areas: Growing demand in underserved areas presents significant market opportunities.

- Tele-radiology services: The expansion of tele-radiology services can improve access to MRI expertise, particularly in rural areas.

- AI-powered image analysis: The integration of AI-powered image analysis tools can enhance diagnostic accuracy and efficiency.

- Development of specialized MRI applications: The development of specialized MRI applications for specific clinical needs, such as cardiac and functional MRI, holds immense potential.

Leading Players in the Mexico MRI Industry Market

- Siemens Healthcare GmbH

- Fonar Corporation

- Canon Inc (Canon Medical Systems Corporation)

- Esaote SpA

- GE HealthCare

- Koninklijke Philips NV

- Fujifilm Holdings Corporation

Key Developments in Mexico MRI Industry Industry

- December 2022: Universidad Nacional Autonoma de Mexico launched a clinical trial exploring the impact of rs-fMRI on stroke patients undergoing occupational therapy. This highlights the growing research interest in advanced MRI applications.

- August 2022: Simon Hegele Healthcare Solutions launched a cryo farm in Mexico City, signifying investments in specialized MRI equipment storage and maintenance.

Strategic Outlook for Mexico MRI Industry Market

The Mexican MRI market is poised for continued growth, driven by technological advancements, increased healthcare expenditure, and government initiatives. The expanding applications of MRI in various medical fields, along with improving affordability and access, will further stimulate market expansion. Opportunities exist for companies to develop tailored solutions for the specific needs of the Mexican healthcare system, focusing on affordability, accessibility, and advanced technological capabilities. The strategic focus should be on partnerships with local healthcare providers and investments in training and infrastructure to address the challenges mentioned earlier and maximize growth potential.

Mexico MRI Industry Segmentation

-

1. Architecture

- 1.1. Closed MRI Systems

- 1.2. Open MRI Systems

-

2. Field Strength

- 2.1. Low Field MRI Systems

- 2.2. High Field MRI Systems

- 2.3. Very Hig

-

3. Application

- 3.1. Oncology

- 3.2. Neurology

- 3.3. Cardiology

- 3.4. Gastroenterology

- 3.5. Musculoskeletal

- 3.6. Other Applications

Mexico MRI Industry Segmentation By Geography

- 1. Mexico

Mexico MRI Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.67% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Advancements in MRI Systems; Growing Number of Chronic Diseases

- 3.3. Market Restrains

- 3.3.1. High Cost of MRI Systems

- 3.4. Market Trends

- 3.4.1. Neurology Segment is Expected to Witness a Significant Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico MRI Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Architecture

- 5.1.1. Closed MRI Systems

- 5.1.2. Open MRI Systems

- 5.2. Market Analysis, Insights and Forecast - by Field Strength

- 5.2.1. Low Field MRI Systems

- 5.2.2. High Field MRI Systems

- 5.2.3. Very Hig

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Oncology

- 5.3.2. Neurology

- 5.3.3. Cardiology

- 5.3.4. Gastroenterology

- 5.3.5. Musculoskeletal

- 5.3.6. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Architecture

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Siemens Healthcare GmbH

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Fonar Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Canon Inc (Canon Medical Systems Corporation)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Esaote SpA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 GE HealthCare

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Koninklijke Philips NV

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Fujifilm Holdings Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Siemens Healthcare GmbH

List of Figures

- Figure 1: Mexico MRI Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Mexico MRI Industry Share (%) by Company 2024

List of Tables

- Table 1: Mexico MRI Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Mexico MRI Industry Revenue Million Forecast, by Architecture 2019 & 2032

- Table 3: Mexico MRI Industry Revenue Million Forecast, by Field Strength 2019 & 2032

- Table 4: Mexico MRI Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Mexico MRI Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Mexico MRI Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Mexico MRI Industry Revenue Million Forecast, by Architecture 2019 & 2032

- Table 8: Mexico MRI Industry Revenue Million Forecast, by Field Strength 2019 & 2032

- Table 9: Mexico MRI Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 10: Mexico MRI Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico MRI Industry?

The projected CAGR is approximately 5.67%.

2. Which companies are prominent players in the Mexico MRI Industry?

Key companies in the market include Siemens Healthcare GmbH, Fonar Corporation, Canon Inc (Canon Medical Systems Corporation), Esaote SpA, GE HealthCare, Koninklijke Philips NV, Fujifilm Holdings Corporation.

3. What are the main segments of the Mexico MRI Industry?

The market segments include Architecture, Field Strength, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Advancements in MRI Systems; Growing Number of Chronic Diseases.

6. What are the notable trends driving market growth?

Neurology Segment is Expected to Witness a Significant Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of MRI Systems.

8. Can you provide examples of recent developments in the market?

December 2022: Universidad Nacional Autonoma de Mexico sponsored a clinical trial to understand the possible changes in motor function and the brain's functional connectivity through resting-state functional Magnetic Resonance Imaging (rs-fMRI) for subacute ischemic stroke outpatients associated with occupational therapy using interactive applications as a therapeutic complement, comparing with patients on conventional therapy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico MRI Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico MRI Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico MRI Industry?

To stay informed about further developments, trends, and reports in the Mexico MRI Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence