Key Insights

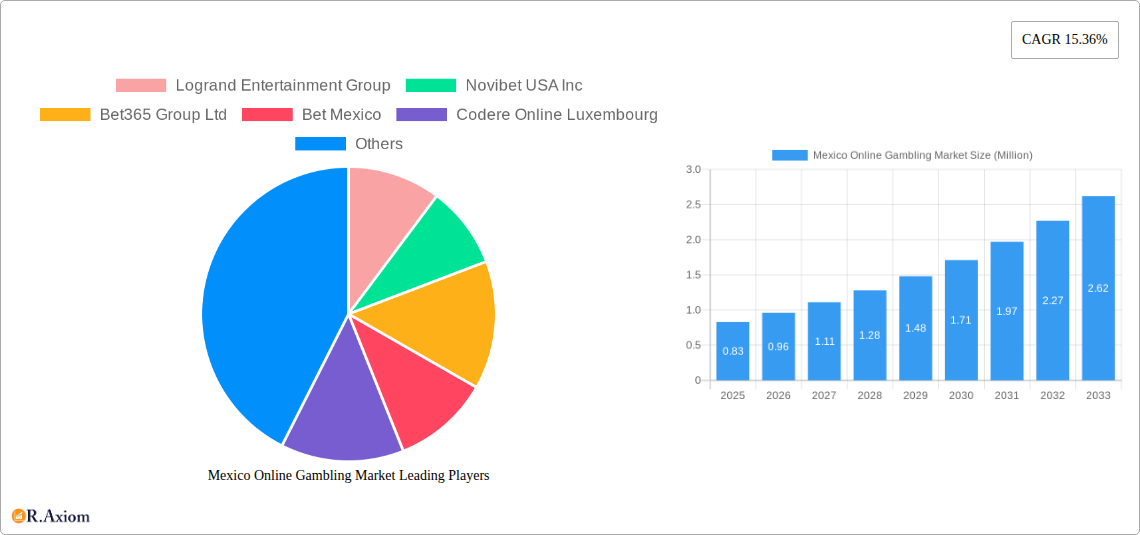

The Mexico Online Gambling Market is poised for exceptional growth, demonstrating a robust Compound Annual Growth Rate (CAGR) of 15.36% from 2025 to 2033. This surge is driven by a confluence of factors, including the increasing penetration of smartphones and internet access across Mexico, a growing youthful demographic with a predisposition towards digital entertainment, and evolving regulatory frameworks that are gradually legitimizing and formalizing the online gambling sector. The current market size, valued at $0.83 million in 2025, is expected to experience a significant expansion. Key drivers for this growth include the widespread adoption of mobile platforms, which offer unparalleled convenience and accessibility to a broad consumer base. Furthermore, the burgeoning popularity of sports betting, fueled by a passionate sports culture and the availability of live betting options, is a significant contributor. The online casino segment also plays a crucial role, with a diverse range of games catering to varied player preferences, from classic slots to live dealer experiences.

Mexico Online Gambling Market Market Size (In Million)

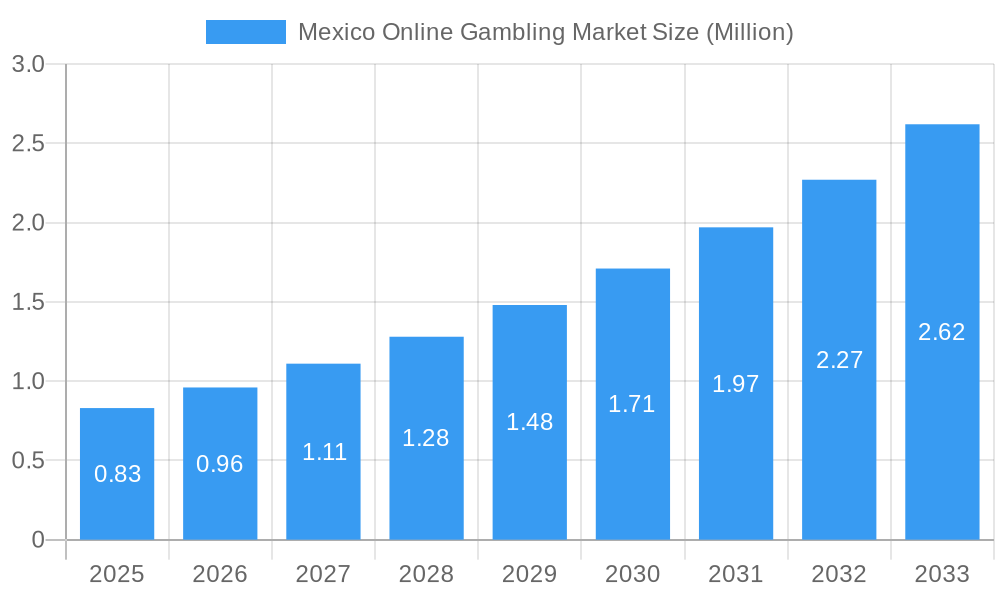

The competitive landscape is characterized by both established international operators and emerging local players, all vying for a significant share of this expanding market. Companies like Logrand Entertainment Group, Novibet USA Inc., Bet365 Group Ltd., and Codere Online Luxembourg are actively investing in their Mexican operations, launching innovative products and aggressive marketing campaigns. The shift towards mobile gaming is a paramount trend, with a substantial portion of wagers now being placed through smartphones and tablets, necessitating a mobile-first approach from all market participants. While the market is brimming with opportunities, potential restraints include the ongoing need for clearer and more consistent regulatory policies, as well as concerns surrounding responsible gambling and consumer protection. Addressing these challenges proactively will be vital for sustained and ethical market development. The projected growth trajectory indicates a highly dynamic and lucrative market for online gambling in Mexico over the coming decade.

Mexico Online Gambling Market Company Market Share

Mexico Online Gambling Market Report: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides an unparalleled analysis of the burgeoning Mexico online gambling market. Covering the historical period from 2019 to 2024, the base year of 2025, and projecting growth through 2033, this study offers crucial insights into market dynamics, competitive landscapes, and future opportunities for stakeholders. With an estimated market size of over XX Million by the forecast period, the Mexican iGaming sector is experiencing rapid expansion driven by increasing internet penetration, a growing younger demographic, and evolving regulatory frameworks. This report is essential for online casino operators, sports betting providers, iGaming software developers, and investors seeking to capitalize on the significant potential of the Mexican gambling industry.

Mexico Online Gambling Market Market Concentration & Innovation

The Mexico online gambling market exhibits a moderate level of market concentration, with a few key players holding significant market share, estimated to be around XX% of the total market value. However, the entry of new operators and the continuous innovation by existing ones are fostering a dynamic and competitive environment. Innovation drivers are primarily fueled by technological advancements, particularly in mobile gaming and live dealer experiences, as well as the introduction of new game types like iLottery and jackpot games. Regulatory frameworks are evolving, with efforts to create a more structured and transparent market, which in turn encourages responsible gambling and player protection. While direct product substitutes are limited within the online gambling sphere, competition from traditional land-based casinos and alternative entertainment options presents a peripheral challenge. End-user trends indicate a strong preference for mobile accessibility and diverse game portfolios, pushing operators to enhance user experience and engagement. Mergers and acquisitions (M&A) activity is anticipated to increase as larger international entities seek to consolidate their presence and smaller players aim for strategic partnerships to enhance their offerings and reach. Estimated M&A deal values are projected to reach XX Million within the forecast period.

Mexico Online Gambling Market Industry Trends & Insights

The Mexico online gambling market is poised for substantial growth, driven by a confluence of favorable industry trends and evolving consumer behaviors. The market is projected to witness a Compound Annual Growth Rate (CAGR) of XX% between 2025 and 2033, a testament to its robust expansion trajectory. Factors such as increasing disposable incomes, a burgeoning digitally-connected population, and a younger demographic's growing familiarity and acceptance of online entertainment are significantly contributing to market penetration. The Mexican iGaming sector benefits from a growing demand for convenient and accessible entertainment options, with online sports betting and online casino games leading the charge. Technological disruptions play a pivotal role, with advancements in mobile technology, high-speed internet infrastructure, and innovative payment gateways making online gambling more seamless and engaging for consumers. Artificial intelligence (AI) and virtual reality (VR) are emerging as potential game-changers, promising more immersive and personalized gaming experiences. Consumer preferences are increasingly leaning towards a diverse range of games, live dealer options, and secure, user-friendly platforms. Competitive dynamics are intensifying, with both established international operators and burgeoning local players vying for market share. This competitive pressure fosters innovation in game development, marketing strategies, and customer retention programs. The demand for responsible gambling features and transparent operations is also rising, pushing operators to adopt stricter protocols and offer enhanced player protection tools. The market penetration of online gambling in Mexico is still relatively nascent compared to more mature markets, presenting a significant untapped potential for further growth. The widespread adoption of smartphones and the increasing affordability of mobile data plans are key enablers, facilitating a shift from desktop to mobile-first gaming experiences. Furthermore, the growing popularity of social media platforms has created new avenues for marketing and customer engagement, allowing operators to reach a wider audience and build brand loyalty. The market's resilience and adaptability to changing consumer demands, coupled with ongoing technological advancements, will be crucial in shaping its future trajectory.

Dominant Markets & Segments in Mexico Online Gambling Market

Within the dynamic Mexico online gambling market, certain segments and platforms demonstrate significant dominance, reflecting current consumer preferences and industry advancements.

Game Type Dominance:

- Sports Betting: This segment holds a commanding position, driven by the passionate sports culture in Mexico, particularly for football (soccer). The accessibility of online sports betting platforms allows enthusiasts to engage with their favorite teams and leagues conveniently.

- Key Drivers:

- High passion for international and domestic football leagues.

- Introduction of live betting and in-play wagering options.

- Availability of diverse betting markets beyond traditional outcomes.

- Strong marketing presence of sports betting brands through sponsorships.

- Key Drivers:

- Casino: The online casino segment is experiencing robust growth, attracting players with a wide array of games such as slots, table games (blackjack, roulette), and poker. The demand for live casino experiences, mimicking the thrill of land-based establishments, is a significant contributor.

- Key Drivers:

- Growing preference for diverse entertainment options.

- Increasing availability of high-quality online slot games and table game variations.

- Introduction of live dealer games with interactive dealers.

- The appeal of jackpot games offering substantial winnings.

- Promotional offers and bonuses to attract and retain players.

- Key Drivers:

- Other Game Types: This encompasses a growing category including iLottery, bingo, and skill-based games. The iLottery segment, in particular, is showing promising growth as more players embrace digital alternatives to traditional lottery purchasing.

- Key Drivers:

- Novelty and unique gameplay of emerging game categories.

- Government initiatives and partnerships for iLottery expansion.

- Appealing prize structures and accessibility.

- Key Drivers:

Platform Dominance:

- Mobile: The mobile platform unequivocally dominates the Mexico online gambling market. The widespread adoption of smartphones and the increasing availability of affordable mobile data have made on-the-go gambling the preferred method for a vast majority of players.

- Key Drivers:

- Ubiquitous smartphone ownership in Mexico.

- Development of sophisticated and user-friendly mobile applications.

- Faster internet speeds enabling seamless streaming of live games.

- Convenience and accessibility for players at any time and from any location.

- Key Drivers:

- Desktop: While still relevant, the desktop platform has a declining share compared to mobile. It primarily caters to players who prefer larger screens for extended gaming sessions or for accessing more complex functionalities.

- Key Drivers:

- Preference for larger screen real estate for certain game types.

- Enhanced functionality for advanced players or those involved in professional betting.

- Historical user base accustomed to desktop access.

- Key Drivers:

The dominance of sports betting and online casino games, particularly on mobile platforms, underscores the market's trajectory towards accessible, engaging, and diverse digital gambling experiences. The ongoing development of iLottery and innovative casino games further signifies the market's evolving landscape and its potential for continued expansion across all segments.

Mexico Online Gambling Market Product Developments

The Mexico online gambling market is experiencing a surge in product developments aimed at enhancing player engagement and expanding market reach. Innovations focus on creating more interactive and immersive gaming experiences. Recent developments include the introduction of bespoke live game shows with multi-tier payout systems, designed to captivate players with novel gameplay and significant multiplier potential. The integration of cutting-edge iGaming casino games onto popular platforms, extending their availability across regions including North America, signifies a strategic push for broader market penetration. Furthermore, the continuous refinement of online slot games with diverse themes and enhanced bonus features, alongside the development of sophisticated live casino interfaces, are key to maintaining a competitive edge. These product advancements are crucial for operators looking to attract and retain a discerning player base.

Report Scope & Segmentation Analysis

This report meticulously segments the Mexico online gambling market across key categories to provide granular insights. The analysis covers:

- Game Type: This segmentation delves into the market share and growth projections for Sports Betting, Casino (including slots, table games, live dealer), and Other Game Types such as iLottery and bingo. Each sub-segment is analyzed for its current market size and future potential, considering evolving player preferences and regulatory impacts.

- Platform: The report examines the market dynamics and growth trends for both Desktop and Mobile platforms. Particular emphasis is placed on the continued dominance and projected growth of mobile gaming, given the increasing smartphone penetration and mobile internet usage in Mexico.

Key Drivers of Mexico Online Gambling Market Growth

The Mexico online gambling market is propelled by several key drivers. The increasing internet penetration and widespread adoption of smartphones provide the essential infrastructure for digital gambling. A growing younger demographic with greater digital literacy and a predisposition towards online entertainment is a significant consumer base. Evolving regulatory frameworks are gradually creating a more structured and trustworthy environment for operators and players alike. The convenience and accessibility of online platforms, offering 24/7 access to a diverse range of games, are major attractors. Furthermore, the rise of mobile gaming and the introduction of innovative live casino experiences are significantly boosting engagement and market growth.

Challenges in the Mexico Online Gambling Market Sector

Despite its robust growth, the Mexico online gambling market faces several challenges. Regulatory uncertainty and evolving legal frameworks can create operational hurdles and compliance costs for operators. Payment processing complexities and concerns around secure and efficient transactions persist. Intense competition among a growing number of operators necessitates significant investment in marketing and player acquisition. Furthermore, responsible gambling initiatives and the need to combat problem gambling require continuous attention and resources. Ensuring data security and player privacy in an increasingly digital landscape remains a paramount concern.

Emerging Opportunities in Mexico Online Gambling Market

The Mexico online gambling market presents numerous emerging opportunities for growth and innovation. The continued expansion of mobile gaming offers immense potential, with a focus on developing tailored mobile-first experiences. The burgeoning iLottery segment, driven by government initiatives and increasing player interest, represents a significant untapped market. The integration of emerging technologies like AI and VR promises to create more immersive and personalized gaming experiences, attracting new player segments. Furthermore, the potential for partnerships with local businesses and the development of unique Mexican-themed casino games can cater to specific cultural preferences and enhance market differentiation.

Leading Players in the Mexico Online Gambling Market Market

- Logrand Entertainment Group

- Novibet USA Inc

- Bet365 Group Ltd

- Bet Mexico

- Codere Online Luxembourg

- Playdoit (Atracciones America SA de CV)

- Playuzu

- Rush Street Interactive Inc

- Winnermx

- TV Global Enterprises Limited

Key Developments in Mexico Online Gambling Market Industry

- October 2024: Novibet, in collaboration with OBBSworks, introduced its iGaming casino games on the Novibet platform, extending its reach across North America, including Mexico.

- July 2024: Novibet Partnered with 7777gaming company to feature its casino games across Mexico, Canada, Brazil, Chile, Ecuador, and Ireland. iLottery, Jackpot, and other casinos were among the major types of casinos available in the market.

- April 2024: In a collaboration with its long-time operator partner bet365, Playtech unveiled a bespoke live game show named Super Mega Ultra. This new live game show is accessible to bet365 players in various regions, such as the UK, Mexico, and Ontario. The game boasts an innovative three-tier base system across two wheels, presenting three payout levels: Super, Mega, and Ultra. Each round is designed with maximum multipliers: ×300 for Super, ×500 for Mega, and an impressive ×2500 for Ultra.

Strategic Outlook for Mexico Online Gambling Market Market

The strategic outlook for the Mexico online gambling market is exceptionally positive, driven by increasing digital adoption and a favorable demographic profile. The continuous expansion of mobile betting and online casino offerings, coupled with the innovation in live dealer games, will remain central to market growth. Investments in user experience, secure payment solutions, and localized content are crucial for sustained success. The potential for regulatory clarity will further unlock new avenues for responsible growth and investment. Embracing technological advancements and focusing on player engagement and retention strategies will be key to capitalizing on the vast untapped potential of this dynamic market.

Mexico Online Gambling Market Segmentation

-

1. Game Type

- 1.1. Sports Betting

- 1.2. Casino

- 1.3. Other Game Types

-

2. Platform

- 2.1. Desktop

- 2.2. Mobile

Mexico Online Gambling Market Segmentation By Geography

- 1. Mexico

Mexico Online Gambling Market Regional Market Share

Geographic Coverage of Mexico Online Gambling Market

Mexico Online Gambling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.36% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Consumer Interest in Sports and Betting; Increased Internet Penetration and Smartphones

- 3.3. Market Restrains

- 3.3.1. Rising Consumer Interest in Sports and Betting; Increased Internet Penetration and Smartphones

- 3.4. Market Trends

- 3.4.1. Sports Betting Is The Preferred Game Type Amongst The Majority

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Online Gambling Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Game Type

- 5.1.1. Sports Betting

- 5.1.2. Casino

- 5.1.3. Other Game Types

- 5.2. Market Analysis, Insights and Forecast - by Platform

- 5.2.1. Desktop

- 5.2.2. Mobile

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Game Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Logrand Entertainment Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Novibet USA Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bet365 Group Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bet Mexico

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Codere Online Luxembourg

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Playdoit (Atracciones America SA de CV)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Playuzu

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Rush Street Interactive Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Winnermx

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 TV Global Enterprises Limited*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Logrand Entertainment Group

List of Figures

- Figure 1: Mexico Online Gambling Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Mexico Online Gambling Market Share (%) by Company 2025

List of Tables

- Table 1: Mexico Online Gambling Market Revenue Million Forecast, by Game Type 2020 & 2033

- Table 2: Mexico Online Gambling Market Volume Billion Forecast, by Game Type 2020 & 2033

- Table 3: Mexico Online Gambling Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 4: Mexico Online Gambling Market Volume Billion Forecast, by Platform 2020 & 2033

- Table 5: Mexico Online Gambling Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Mexico Online Gambling Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Mexico Online Gambling Market Revenue Million Forecast, by Game Type 2020 & 2033

- Table 8: Mexico Online Gambling Market Volume Billion Forecast, by Game Type 2020 & 2033

- Table 9: Mexico Online Gambling Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 10: Mexico Online Gambling Market Volume Billion Forecast, by Platform 2020 & 2033

- Table 11: Mexico Online Gambling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Mexico Online Gambling Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Online Gambling Market?

The projected CAGR is approximately 15.36%.

2. Which companies are prominent players in the Mexico Online Gambling Market?

Key companies in the market include Logrand Entertainment Group, Novibet USA Inc, Bet365 Group Ltd, Bet Mexico, Codere Online Luxembourg, Playdoit (Atracciones America SA de CV), Playuzu, Rush Street Interactive Inc, Winnermx, TV Global Enterprises Limited*List Not Exhaustive.

3. What are the main segments of the Mexico Online Gambling Market?

The market segments include Game Type, Platform.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.83 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Consumer Interest in Sports and Betting; Increased Internet Penetration and Smartphones.

6. What are the notable trends driving market growth?

Sports Betting Is The Preferred Game Type Amongst The Majority.

7. Are there any restraints impacting market growth?

Rising Consumer Interest in Sports and Betting; Increased Internet Penetration and Smartphones.

8. Can you provide examples of recent developments in the market?

October 2024: Novibet, in collaboration with OBBSworks, introduced its iGaming casino games on the Novibet platform, extending its reach across North America, including Mexico.July 2024: Novibet Partnered with 7777gaming company to feature its casino games across Mexico, Canada, Brazil, Chile, Ecuador, and Ireland. iLottery, Jackpot, and other casinos were among the major types of casinos available in the market.April 2024: In a collaboration with its long-time operator partner bet365, Playtech unveiled a bespoke live game show named Super Mega Ultra. This new live game show is accessible to bet365 players in various regions, such as the UK, Mexico, and Ontario. The game boasts an innovative three-tier base system across two wheels, presenting three payout levels: Super, Mega, and Ultra. Each round is designed with maximum multipliers: ×300 for Super, ×500 for Mega, and an impressive ×2500 for Ultra.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Online Gambling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Online Gambling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Online Gambling Market?

To stay informed about further developments, trends, and reports in the Mexico Online Gambling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence