Key Insights

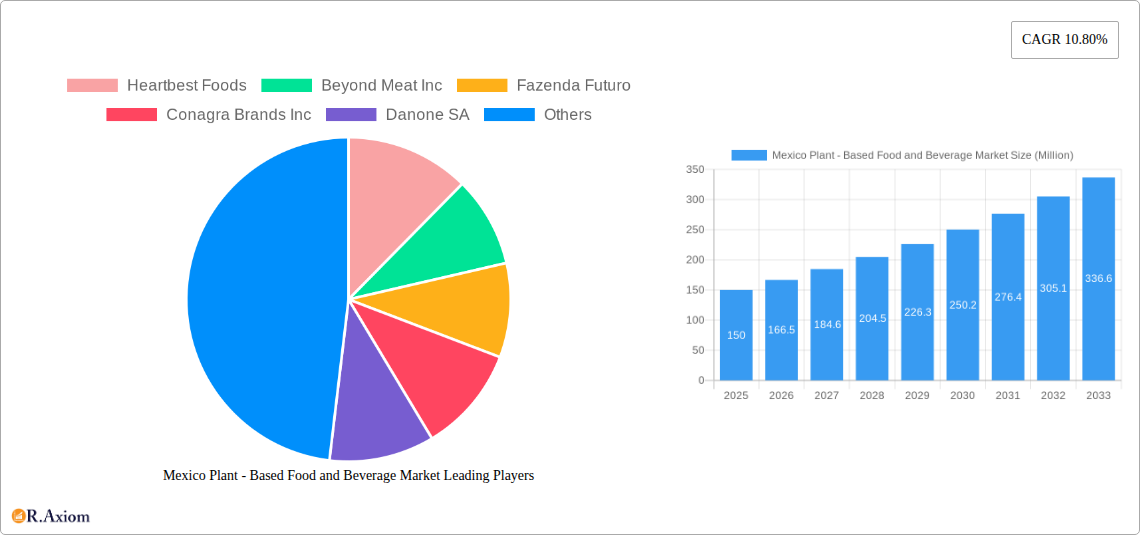

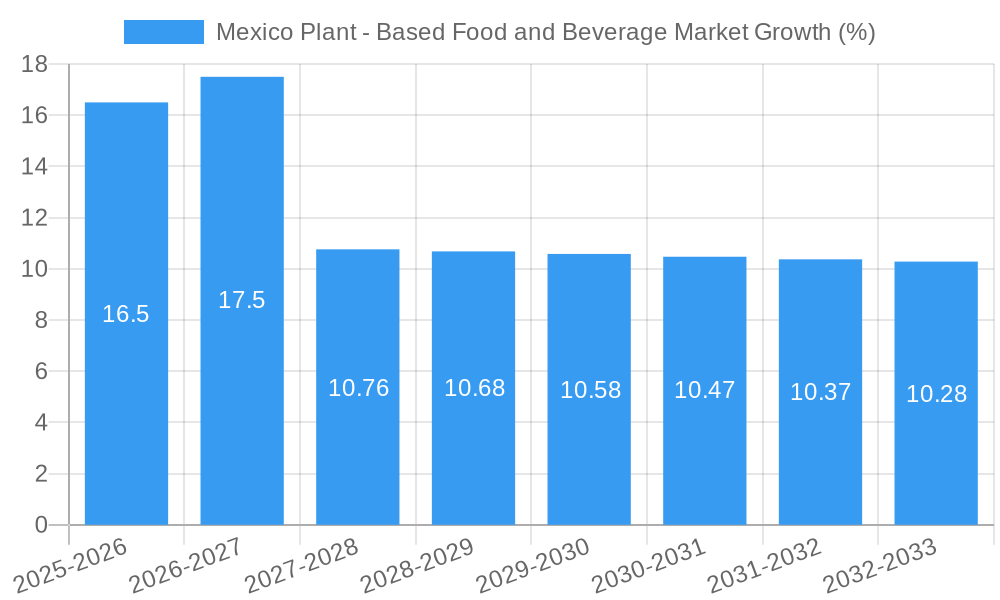

The Mexico plant-based food and beverage market is experiencing robust growth, fueled by increasing consumer awareness of health and environmental benefits, coupled with a rising vegan and vegetarian population. The market, valued at approximately $XX million in 2025 (assuming a logical extrapolation from the provided CAGR and study period), is projected to witness a Compound Annual Growth Rate (CAGR) of 10.80% from 2025 to 2033. Key drivers include the growing popularity of meat substitutes (including burgers, sausages, and other protein sources), dairy alternatives (milk, yogurt, cheese, ice cream), and other plant-based products. The rising demand for convenient and readily available options is significantly impacting the distribution channels, with supermarket/hypermarkets and online retail stores experiencing substantial growth. However, the market faces certain restraints, potentially including price sensitivity among consumers, limited product availability in certain regions, and potential challenges in replicating the taste and texture of traditional animal-based products. The market segmentation reveals that meat substitutes and dairy alternative beverages currently hold significant market share, but other segments like plant-based ice creams and yogurts are also exhibiting strong growth potential. Leading companies like Beyond Meat, Danone, and Nestle are actively investing in the Mexican market, further driving innovation and market expansion.

This dynamic market presents lucrative opportunities for both established players and emerging brands. Success will depend on effectively addressing consumer preferences regarding taste, price, and convenience. Further growth is anticipated through product diversification, expansion into new distribution channels, and increased marketing efforts focusing on the health and sustainability aspects of plant-based food and beverages. The strong CAGR suggests a significant market expansion over the forecast period (2025-2033), highlighting the long-term viability and profitability potential for investments within the Mexican plant-based food and beverage sector. Strategic partnerships with local distributors and focusing on culturally relevant products are expected to be key success factors in the future.

Mexico Plant-Based Food and Beverage Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Mexico plant-based food and beverage market, offering invaluable insights for industry stakeholders. The study covers the period from 2019 to 2033, with 2025 as the base and estimated year. The report leverages extensive research, encompassing market sizing, segmentation, competitive landscape, and future projections. Key players such as Heartbest Foods, Beyond Meat Inc, Fazenda Futuro, Conagra Brands Inc, Danone SA, Unilever Plc, Nestle SA, NotCo, Heura, and JBS Foods - Planterra Foods are analyzed within the context of market trends and opportunities.

Mexico Plant-Based Food and Beverage Market Market Concentration & Innovation

The Mexican plant-based food and beverage market exhibits a moderately concentrated structure, with a few major international players holding significant market share. However, the market is experiencing rapid growth and diversification, driven by increasing consumer demand for sustainable and healthy food options. Innovation is a key factor, with companies constantly developing new products and technologies to meet evolving consumer preferences. This includes the introduction of novel ingredients, improved textures, and more appealing flavors. The regulatory landscape is also evolving, with increasing attention being paid to labeling and food safety standards. Several key product substitutes exist, including meat alternatives, dairy-free alternatives, and other plant-based foods that cater to various dietary restrictions and preferences. End-user trends heavily favor products mimicking traditional animal-based products but with added benefits in terms of health and environmental sustainability. Mergers and acquisitions (M&A) activity in the sector is on the rise, indicating the strategic importance of the Mexican market. While precise M&A deal values are not publicly available for all transactions, recent deals suggest a strong investment appetite in this segment, likely in the range of xx Million annually. This consolidates market power and accelerates innovation.

- Market Share: The top 5 players account for approximately xx% of the market share.

- M&A Activity: Several acquisitions and partnerships have occurred in the past few years (values not publicly disclosed for all).

Mexico Plant-Based Food and Beverage Market Industry Trends & Insights

The Mexican plant-based food and beverage market is experiencing robust growth, driven by a confluence of factors. Rising awareness of health and environmental concerns is fueling demand for plant-based alternatives to traditional meat and dairy products. Growing disposable incomes, particularly among the middle class, also contribute to market expansion, enabling consumers to afford premium plant-based products. Technological advancements in food processing are leading to improvements in texture and taste, making plant-based options more appealing to a wider audience. This progress has been instrumental in addressing previous shortcomings of plant-based options. The market exhibits a notable CAGR of xx% during the forecast period (2025-2033). Market penetration is growing, with plant-based products increasingly available in diverse distribution channels. Competitive dynamics are intense, marked by both established players and emerging startups vying for market share. This leads to aggressive innovation and the development of new product categories. Consumer preferences are shifting towards convenience, flavor variety, and products that align with health and sustainability ideals, driving innovation in product development.

Dominant Markets & Segments in Mexico Plant-Based Food and Beverage Market

Leading Region: The most populous metropolitan areas (Mexico City, Guadalajara, Monterrey) are expected to showcase the highest demand and market size, considering factors like consumer awareness, income levels, and accessibility to diverse product offerings.

Dominant Segments:

- Type: Meat substitutes are currently the largest segment, driven by strong consumer interest in reducing meat consumption. Dairy alternative beverages also hold a significant share.

- Distribution Channel: Supermarket/hypermarkets are the primary distribution channel, due to their wide reach and established supply chains. Online retail stores are a rapidly growing segment, reflecting the increasing preference for online grocery shopping.

Key Drivers:

- Economic Policies: Government initiatives promoting sustainable agriculture and food security indirectly support the plant-based food market.

- Infrastructure: Improved cold chain logistics enhances the accessibility and quality of perishable plant-based products.

The dominance of specific segments is influenced by several factors. High population density in urban centers drives the demand for convenient and accessible plant-based options. The increasing affordability of these products, aided by supply chain improvements and technological advancements, fuels growth.

Mexico Plant-Based Food and Beverage Market Product Developments

Recent product innovations showcase advancements in replicating the texture and taste of traditional animal products. Companies are focused on developing plant-based products that are not only nutritious and sustainable but also offer superior culinary experience. This involves using novel ingredients, optimizing processing techniques, and focusing on delivering high-quality products that closely mimic the sensory attributes of traditional counterparts. The market is seeing significant growth in more diverse product lines beyond core segments such as meat substitutes. This includes innovative ready-to-eat plant-based meals that cater to busy lifestyles and preferences for greater convenience.

Report Scope & Segmentation Analysis

This report segments the Mexican plant-based food and beverage market based on product type (Meat Substitute, Dairy Alternative Beverages, Non-Dairy Ice Creams, Non-Dairy Cheese, Non-Dairy Yogurt, Non-Dairy Spreads, Other Plant-based Products) and distribution channel (Supermarket/Hypermarket, Convenience Stores, Online Retail Stores, Other Distribution Channels). Each segment’s growth projection, market size, and competitive dynamics are analyzed, highlighting the specific market opportunities and challenges within each category. For instance, meat substitutes are expected to demonstrate high growth rates, driven by rising consumer preference for environmentally conscious dietary options. Conversely, the online retail channel’s expansion signifies a shift in consumer purchasing behavior.

Key Drivers of Mexico Plant-Based Food and Beverage Market Growth

The growth of the Mexican plant-based market is fueled by several key drivers. Health-conscious consumers are seeking nutritious alternatives to traditional products. Increasing awareness of the environmental impact of animal agriculture is also a critical driver. Government initiatives supporting sustainable agriculture and food security are indirectly supporting this market segment. Technological advancements lead to the creation of products with improved taste, texture, and nutritional profiles, making them more appealing to a wider range of consumers.

Challenges in the Mexico Plant-Based Food and Beverage Market Sector

Despite substantial growth potential, challenges exist. The relatively high cost of some plant-based products compared to conventional options can hinder widespread adoption, especially among price-sensitive consumers. Supply chain complexities, particularly for specialized ingredients, can impact production efficiency and cost. Limited consumer awareness regarding the health and environmental benefits of plant-based products necessitates significant educational campaigns. Furthermore, the need for regulatory clarity on labeling and food safety standards remains a challenge.

Emerging Opportunities in Mexico Plant-Based Food and Beverage Market

Significant opportunities exist for businesses to capitalize on this expanding market. This includes expansion into underserved regions, broadening product lines to cater to diverse consumer preferences (e.g., regional tastes and cultural dietary norms), and incorporating technological advancements to enhance manufacturing efficiency. Developing targeted marketing campaigns emphasizing health, environmental, and ethical benefits can enhance consumer engagement. Furthermore, collaboration among food manufacturers, retailers, and government agencies can foster growth through improved infrastructure and consumer education.

Leading Players in the Mexico Plant-Based Food and Beverage Market Market

- Heartbest Foods

- Beyond Meat Inc

- Fazenda Futuro

- Conagra Brands Inc

- Danone SA

- Unilever Plc

- Nestle SA

- NotCo

- Heura

- JBS Foods- Planterra Foods

Key Developments in Mexico Plant-Based Food and Beverage Market Industry

- August 2022: NotCo and Starbucks Mexico partnered, introducing new plant-based menu options. This significantly expands the reach and visibility of plant-based products.

- October 2021: Heura expanded its presence in Mexico, selling its products through major retailers like Walmart. This significantly increased the market availability of Heura's plant-based meat products.

- June 2021: JBS Foods' Planterra Foods expanded into Mexico, partnering with UNFI to distribute its plant-based products. This marks a major entry by a large player into the Mexican plant-based market, significantly expanding the product availability and market competition.

Strategic Outlook for Mexico Plant-Based Food and Beverage Market Market

The Mexican plant-based food and beverage market presents a compelling growth story. Continued innovation in product development, coupled with rising consumer awareness and increasing availability through diverse distribution channels, will drive further market expansion. The strategic focus for companies should be on enhancing product quality, expanding distribution networks, and investing in effective marketing campaigns highlighting the health, environmental, and ethical benefits of plant-based alternatives. The market's potential is enormous, promising significant returns for businesses that can successfully navigate the market's dynamics and leverage emerging opportunities.

Mexico Plant - Based Food and Beverage Market Segmentation

-

1. Type

- 1.1. Meat Substitute

- 1.2. Dairy Alternative Beverages

- 1.3. Non Dairy Ice creams

- 1.4. Non Dairy Cheese

- 1.5. Non Dairy Yogurt

- 1.6. Non Dairy Spreads

- 1.7. Other Plant-based Products

-

2. Distibution Channel

- 2.1. Supermarket/ Hypermarket

- 2.2. Convenience Stores

- 2.3. Online Retail stores

- 2.4. Other Distribution Channels

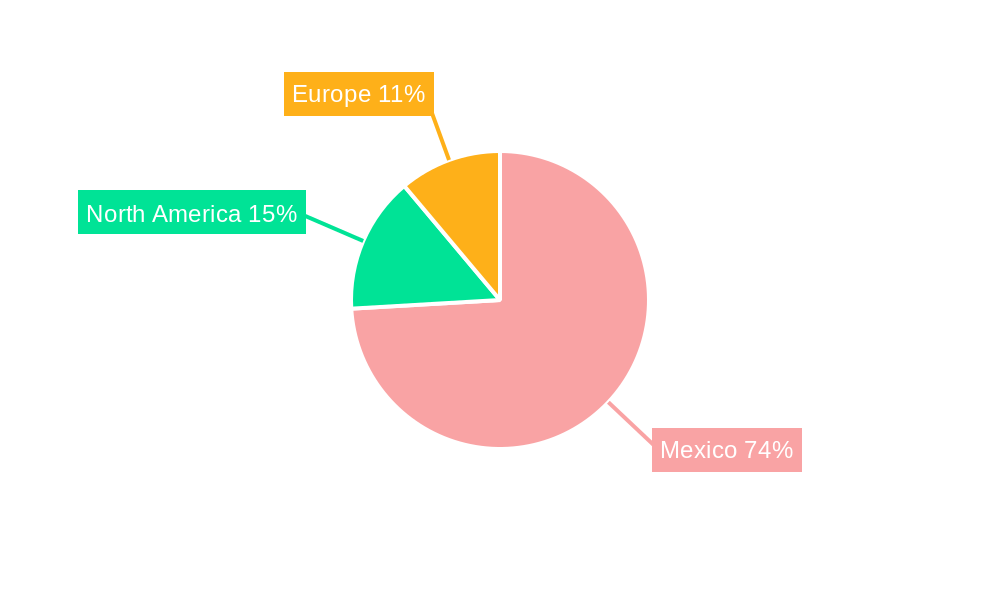

Mexico Plant - Based Food and Beverage Market Segmentation By Geography

- 1. Mexico

Mexico Plant - Based Food and Beverage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased visibility of vegan and vegetarian lifestyles is influencing consumer choices and expanding market options

- 3.3. Market Restrains

- 3.3.1 Plant-based products can be more expensive than their animal-based counterparts

- 3.3.2 which may limit their appeal in price-sensitive segments of the market.

- 3.4. Market Trends

- 3.4.1. Rapid Expansion of Vegan Culture

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Plant - Based Food and Beverage Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Meat Substitute

- 5.1.2. Dairy Alternative Beverages

- 5.1.3. Non Dairy Ice creams

- 5.1.4. Non Dairy Cheese

- 5.1.5. Non Dairy Yogurt

- 5.1.6. Non Dairy Spreads

- 5.1.7. Other Plant-based Products

- 5.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 5.2.1. Supermarket/ Hypermarket

- 5.2.2. Convenience Stores

- 5.2.3. Online Retail stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Heartbest Foods

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Beyond Meat Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Fazenda Futuro

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Conagra Brands Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Danone SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Unilever Plc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nestle SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 NotCo

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Heura

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 JBS Foods- Planterra Foods

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Heartbest Foods

List of Figures

- Figure 1: Mexico Plant - Based Food and Beverage Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Mexico Plant - Based Food and Beverage Market Share (%) by Company 2024

List of Tables

- Table 1: Mexico Plant - Based Food and Beverage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Mexico Plant - Based Food and Beverage Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Mexico Plant - Based Food and Beverage Market Revenue Million Forecast, by Distibution Channel 2019 & 2032

- Table 4: Mexico Plant - Based Food and Beverage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Mexico Plant - Based Food and Beverage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Mexico Plant - Based Food and Beverage Market Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Mexico Plant - Based Food and Beverage Market Revenue Million Forecast, by Distibution Channel 2019 & 2032

- Table 8: Mexico Plant - Based Food and Beverage Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Plant - Based Food and Beverage Market?

The projected CAGR is approximately 10.80%.

2. Which companies are prominent players in the Mexico Plant - Based Food and Beverage Market?

Key companies in the market include Heartbest Foods, Beyond Meat Inc, Fazenda Futuro, Conagra Brands Inc, Danone SA, Unilever Plc, Nestle SA, NotCo, Heura, JBS Foods- Planterra Foods.

3. What are the main segments of the Mexico Plant - Based Food and Beverage Market?

The market segments include Type, Distibution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increased visibility of vegan and vegetarian lifestyles is influencing consumer choices and expanding market options.

6. What are the notable trends driving market growth?

Rapid Expansion of Vegan Culture.

7. Are there any restraints impacting market growth?

Plant-based products can be more expensive than their animal-based counterparts. which may limit their appeal in price-sensitive segments of the market..

8. Can you provide examples of recent developments in the market?

In August 2022, NotCo and Starbucks Mexico announced the partnership. Starbucks Mexico Introduces New Plant-based Menu options Made with NotCo Plant-based Products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Plant - Based Food and Beverage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Plant - Based Food and Beverage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Plant - Based Food and Beverage Market?

To stay informed about further developments, trends, and reports in the Mexico Plant - Based Food and Beverage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence