Key Insights

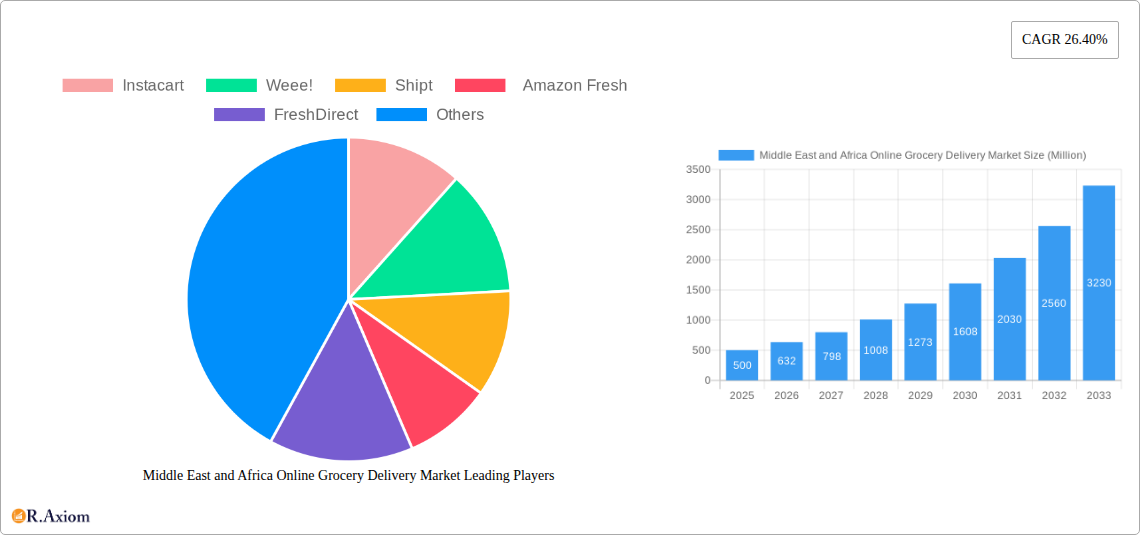

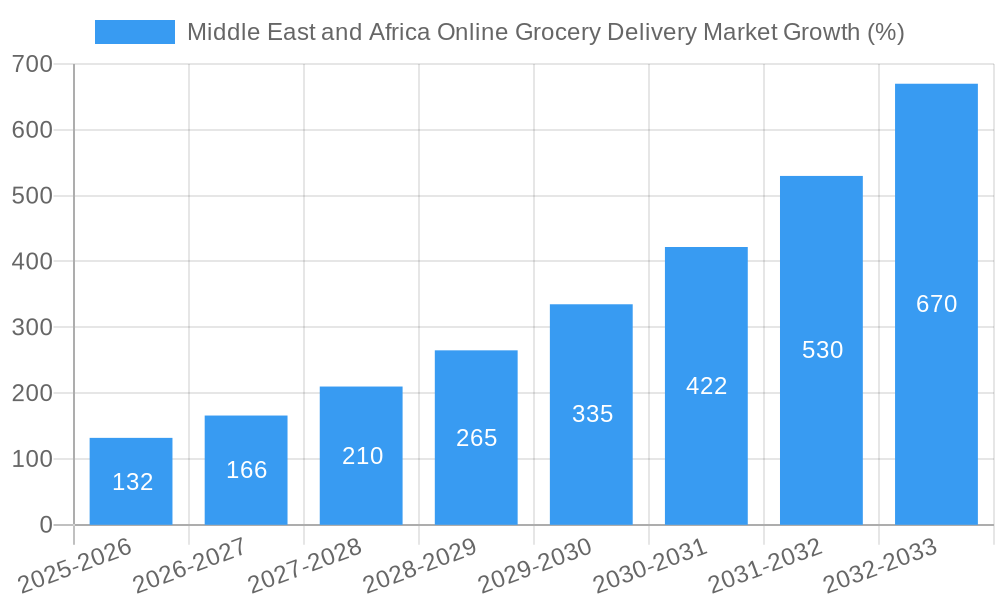

The Middle East and Africa (MEA) online grocery delivery market is experiencing robust growth, fueled by increasing internet and smartphone penetration, a burgeoning young population comfortable with e-commerce, and a rising preference for convenience. The market, valued at approximately $X million in 2025 (assuming a logical estimation based on global market trends and the provided CAGR of 26.40%), is projected to expand significantly over the forecast period (2025-2033). Key drivers include the rapid urbanization in major MEA cities like Dubai, Johannesburg, and Riyadh, leading to increased time constraints and a demand for efficient delivery services. The convenience of home delivery, particularly for busy professionals and families, is a major catalyst. Furthermore, the expansion of e-commerce infrastructure, including improved logistics and payment gateways, is facilitating market growth. While challenges exist, such as maintaining cold chain integrity in hot climates and addressing concerns about food safety, innovative solutions are emerging to overcome these hurdles. The segment breakdown reveals a growing demand for quick commerce and meal kit deliveries, reflecting changing consumer lifestyles and preferences for speed and convenience. Competitive intensity is high, with both international players like Amazon Fresh and Instacart, and regional players vying for market share.

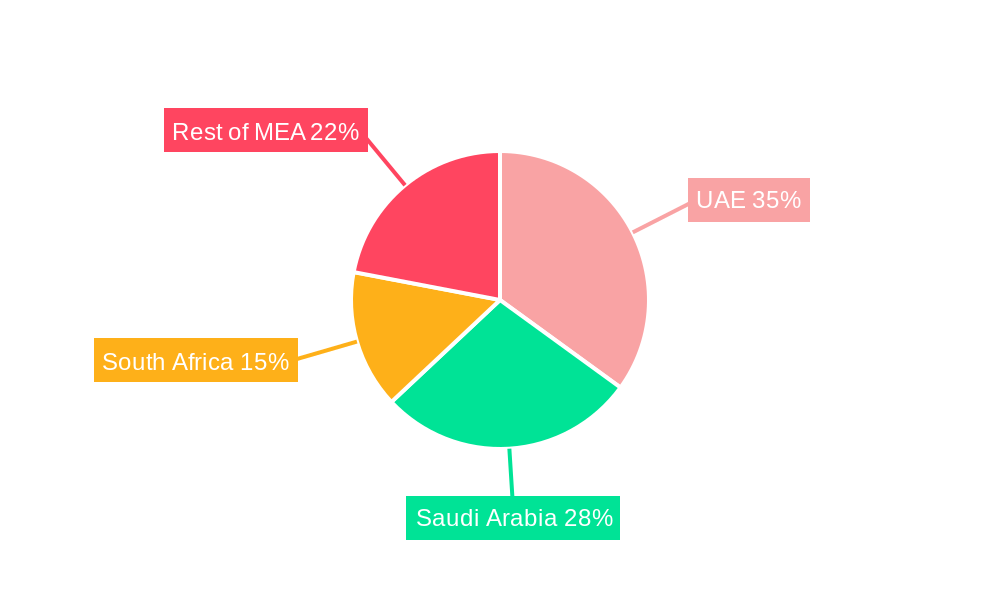

The projected CAGR of 26.40% indicates substantial growth potential for the MEA online grocery delivery market. However, this growth is not uniform across the region. The UAE and Saudi Arabia are currently leading the market due to higher disposable incomes and advanced digital infrastructure. South Africa and other parts of MEA are also experiencing growth, but at a potentially slower pace due to varying levels of internet access and economic development. The continued expansion of reliable payment systems, investment in efficient logistics networks, and the development of localized platforms catering to specific cultural preferences will be crucial factors influencing future market expansion. Moreover, addressing consumer concerns regarding food quality and security will be vital for maintaining consumer trust and driving sustainable growth.

Middle East & Africa Online Grocery Delivery Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Middle East and Africa online grocery delivery market, covering the period 2019-2033. It offers actionable insights into market trends, competitive dynamics, growth drivers, and emerging opportunities for industry stakeholders, investors, and businesses operating or planning to enter this rapidly expanding sector. The report leverages extensive data analysis and incorporates recent industry developments to provide a realistic forecast for the future. The base year for this report is 2025, with estimates for 2025 and a forecast period spanning 2025-2033. The historical period covered is 2019-2024.

Middle East and Africa Online Grocery Delivery Market Concentration & Innovation

The Middle East and Africa online grocery delivery market exhibits a dynamic competitive landscape with varying levels of concentration across different regions and segments. Market share data reveals a fragmented market, with a few dominant players alongside numerous smaller, regional operators. Innovation is a key driver, with companies continuously introducing new technologies to enhance efficiency, personalize customer experiences, and expand their service offerings. Regulatory frameworks, while still evolving in certain areas, are gradually shaping the market through policies related to data privacy, food safety, and logistics. The emergence of quick commerce and the growing adoption of mobile payment systems are significant factors influencing market growth. Product substitutes, such as traditional brick-and-mortar grocery stores and local markets, continue to pose competition. However, the convenience and speed offered by online grocery delivery services are driving significant consumer adoption. Mergers and acquisitions (M&A) are also shaping the market's consolidation. In 2024, the total value of M&A deals in the online grocery delivery sector across the Middle East and Africa was estimated at xx Million. Key M&A activities include strategic partnerships and acquisitions aimed at expanding geographical reach, enhancing technological capabilities, and diversifying product offerings.

Middle East and Africa Online Grocery Delivery Market Industry Trends & Insights

The Middle East and Africa online grocery delivery market is experiencing substantial growth, driven by several factors. Rising internet and smartphone penetration, particularly among younger demographics, is fueling the adoption of online grocery shopping. The convenience factor, coupled with increasingly busy lifestyles, is a key driver for market expansion. The market is witnessing significant technological disruption, with innovations such as AI-powered recommendation systems, automated warehouses, and drone delivery systems continuously improving efficiency and customer experience. Consumer preferences are shifting towards personalized shopping experiences, seamless checkout processes, and a wider selection of products, including locally sourced and organic options. The competitive landscape is highly dynamic, with established players expanding their reach and new entrants constantly emerging. The compound annual growth rate (CAGR) for the market during the forecast period (2025-2033) is projected to be xx%, driven by the factors mentioned above and a rising middle class with increased disposable income. Market penetration currently stands at xx%, with significant potential for further growth in underserved regions.

Dominant Markets & Segments in Middle East and Africa Online Grocery Delivery Market

While the overall market shows strong growth across the region, several countries and segments stand out. The UAE, Saudi Arabia, and South Africa are among the leading markets in terms of online grocery adoption and revenue generation. The quick commerce segment is experiencing particularly rapid growth, driven by consumers' desire for immediate delivery.

Key Drivers of Dominance:

- UAE: Strong government support for digital commerce, well-developed logistics infrastructure, and high internet penetration.

- Saudi Arabia: Growing middle class, increasing adoption of e-commerce, and government initiatives promoting digital transformation.

- South Africa: Large population base, rising urbanisation, and increasing demand for convenient shopping options.

Segment Dominance:

Quick Commerce: This segment benefits from rapid growth fueled by consumer preference for speed and convenience. Several dedicated quick-commerce platforms are experiencing significant traction, attracting both customers and investors. The demand is largely driven by busy lifestyles and the desire for immediate gratification.

Retail Delivery: This segment still holds significant market share, benefiting from the wider availability of products and lower price points compared to quick commerce. However, it faces pressure from the rapid growth of quick commerce services.

Meal Kit Delivery: Though smaller than other segments, this niche sector exhibits steady growth, driven by health-conscious consumers seeking convenient and pre-portioned meal solutions.

Middle East and Africa Online Grocery Delivery Market Product Developments

Product innovation is crucial in the online grocery delivery market. We see a focus on enhancing user experience through personalized recommendations, improved search functionalities, and seamless checkout options. Technological trends, such as AI-powered inventory management and predictive analytics, are improving operational efficiency and reducing delivery times. Companies are also expanding their product offerings to include locally sourced produce, organic items, and specialized dietary options, catering to the evolving needs of consumers. The successful integration of these innovations enhances customer loyalty and provides a competitive edge.

Report Scope & Segmentation Analysis

This report segments the Middle East and Africa online grocery delivery market by service type:

Retail Delivery: This segment encompasses traditional online grocery delivery services, offering a wide range of products with varying delivery times (typically one to two days). The market size for Retail Delivery in 2025 is estimated at xx Million, projected to grow to xx Million by 2033. The segment is characterized by intense competition among established players and new entrants.

Quick Commerce: This fast-growing segment focuses on delivering groceries within minutes or hours, targeting customers seeking immediate fulfillment. The 2025 market size is predicted at xx Million, expected to reach xx Million by 2033. Quick commerce companies typically operate within a limited geographical radius and prioritize speed over a wide product range.

Meal Kit Delivery: This niche segment provides pre-portioned ingredients and recipes, catering to consumers seeking convenient and healthy meal options. The 2025 market size is estimated at xx Million, with projected growth to xx Million by 2033. Meal kit services often face challenges in managing perishable goods and ensuring consistent quality.

Key Drivers of Middle East and Africa Online Grocery Delivery Market Growth

Several factors fuel the growth of the online grocery delivery market in the Middle East and Africa. These include the rapid expansion of internet and smartphone penetration, particularly among younger generations. The increasing adoption of digital payment methods and the growth of a middle class with higher disposable incomes are significant contributors. Government initiatives supporting e-commerce and digital infrastructure development further accelerate market growth. The convenience offered by online grocery shopping appeals to busy lifestyles, and the ability to access a wider range of products beyond what is locally available is another key driver.

Challenges in the Middle East and Africa Online Grocery Delivery Market Sector

The Middle East and Africa online grocery delivery market faces significant challenges. Maintaining a stable and efficient cold chain for perishable goods is a primary concern, especially in regions with less developed infrastructure. High logistics costs, coupled with traffic congestion in urban areas, can impact delivery times and profitability. Regulatory hurdles, such as licensing and compliance requirements, can pose barriers to entry for new players. Intense competition among established players and new entrants also presents a challenge, necessitating continuous innovation and efficiency improvements to maintain a competitive edge. The fluctuation in fuel prices significantly affects the profitability of delivery businesses.

Emerging Opportunities in Middle East and Africa Online Grocery Delivery Market

The Middle East and Africa online grocery delivery market presents numerous emerging opportunities. Expanding into underserved markets across the region, leveraging innovative technologies like drone delivery and autonomous vehicles, and catering to specific dietary needs and preferences are key opportunities. Partnerships with local farmers and producers to offer fresh and locally sourced products enhance the value proposition. The development of tailored marketing strategies targeting specific demographic segments can further enhance market penetration.

Leading Players in the Middle East and Africa Online Grocery Delivery Market Market

Key Developments in Middle East and Africa Online Grocery Delivery Market Industry

July 2022: Veppy.com, a UAE-based grocery delivery and quick commerce application, started allowing retailers to register their products before its commercial launch, aiming for immediate business operation post-launch. The platform uses personalized product recommendations based on past customer purchases.

July 2022: Deliveroo UAE launched "Hop," a rapid grocery delivery service in partnership with Choithrams, promising 15-minute deliveries within a defined radius. This is expected to significantly boost Deliveroo's growth.

Strategic Outlook for Middle East and Africa Online Grocery Delivery Market Market

The future of the Middle East and Africa online grocery delivery market appears bright, driven by continued technological advancements, increasing smartphone penetration, and evolving consumer preferences. The market is poised for substantial growth, with opportunities for both established players and new entrants. Strategic focus on enhancing customer experience, optimizing logistics, and adapting to changing market dynamics will be key to success. Further market consolidation through mergers and acquisitions is anticipated as companies strive to gain scale and market share. The development of robust cold chain infrastructure and the exploration of sustainable delivery solutions will also play a significant role in the sector's future trajectory.

Middle East and Africa Online Grocery Delivery Market Segmentation

-

1. Service Type

- 1.1. Retail Delivery

- 1.2. Quick Commerce

- 1.3. Meal Kit Delivery

-

2. Geography

- 2.1. UAE

- 2.2. Saudi Arabia

- 2.3. South Africa

- 2.4. Rest of Middle East and Africa

Middle East and Africa Online Grocery Delivery Market Segmentation By Geography

- 1. UAE

- 2. Saudi Arabia

- 3. South Africa

- 4. Rest of Middle East and Africa

Middle East and Africa Online Grocery Delivery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 26.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Urbanization; Growing Disposable Income

- 3.3. Market Restrains

- 3.3.1. High-price and additional delivery charges

- 3.4. Market Trends

- 3.4.1. Mobile apps segment is anticipated to grow at a noticeable pace during the forecast period.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Online Grocery Delivery Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Retail Delivery

- 5.1.2. Quick Commerce

- 5.1.3. Meal Kit Delivery

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. UAE

- 5.2.2. Saudi Arabia

- 5.2.3. South Africa

- 5.2.4. Rest of Middle East and Africa

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. UAE

- 5.3.2. Saudi Arabia

- 5.3.3. South Africa

- 5.3.4. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. UAE Middle East and Africa Online Grocery Delivery Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Retail Delivery

- 6.1.2. Quick Commerce

- 6.1.3. Meal Kit Delivery

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. UAE

- 6.2.2. Saudi Arabia

- 6.2.3. South Africa

- 6.2.4. Rest of Middle East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Saudi Arabia Middle East and Africa Online Grocery Delivery Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Retail Delivery

- 7.1.2. Quick Commerce

- 7.1.3. Meal Kit Delivery

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. UAE

- 7.2.2. Saudi Arabia

- 7.2.3. South Africa

- 7.2.4. Rest of Middle East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. South Africa Middle East and Africa Online Grocery Delivery Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Retail Delivery

- 8.1.2. Quick Commerce

- 8.1.3. Meal Kit Delivery

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. UAE

- 8.2.2. Saudi Arabia

- 8.2.3. South Africa

- 8.2.4. Rest of Middle East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Rest of Middle East and Africa Middle East and Africa Online Grocery Delivery Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Retail Delivery

- 9.1.2. Quick Commerce

- 9.1.3. Meal Kit Delivery

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. UAE

- 9.2.2. Saudi Arabia

- 9.2.3. South Africa

- 9.2.4. Rest of Middle East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. UAE Middle East and Africa Online Grocery Delivery Market Analysis, Insights and Forecast, 2019-2031

- 11. South Africa Middle East and Africa Online Grocery Delivery Market Analysis, Insights and Forecast, 2019-2031

- 12. Saudi Arabia Middle East and Africa Online Grocery Delivery Market Analysis, Insights and Forecast, 2019-2031

- 13. Rest of MEA Middle East and Africa Online Grocery Delivery Market Analysis, Insights and Forecast, 2019-2031

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Instacart

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Weee!

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Shipt

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Amazon Fresh

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 FreshDirect

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Boxed

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 DoorDash

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Peapod

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Uber Eats

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Grubhub

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Instacart

List of Figures

- Figure 1: Middle East and Africa Online Grocery Delivery Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle East and Africa Online Grocery Delivery Market Share (%) by Company 2024

List of Tables

- Table 1: Middle East and Africa Online Grocery Delivery Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle East and Africa Online Grocery Delivery Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 3: Middle East and Africa Online Grocery Delivery Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: Middle East and Africa Online Grocery Delivery Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Middle East and Africa Online Grocery Delivery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: UAE Middle East and Africa Online Grocery Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South Africa Middle East and Africa Online Grocery Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Saudi Arabia Middle East and Africa Online Grocery Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of MEA Middle East and Africa Online Grocery Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Middle East and Africa Online Grocery Delivery Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 11: Middle East and Africa Online Grocery Delivery Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 12: Middle East and Africa Online Grocery Delivery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Middle East and Africa Online Grocery Delivery Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 14: Middle East and Africa Online Grocery Delivery Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 15: Middle East and Africa Online Grocery Delivery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Middle East and Africa Online Grocery Delivery Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 17: Middle East and Africa Online Grocery Delivery Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: Middle East and Africa Online Grocery Delivery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Middle East and Africa Online Grocery Delivery Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 20: Middle East and Africa Online Grocery Delivery Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: Middle East and Africa Online Grocery Delivery Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Online Grocery Delivery Market?

The projected CAGR is approximately 26.40%.

2. Which companies are prominent players in the Middle East and Africa Online Grocery Delivery Market?

Key companies in the market include Instacart , Weee! , Shipt , Amazon Fresh , FreshDirect , Boxed, DoorDash , Peapod, Uber Eats , Grubhub .

3. What are the main segments of the Middle East and Africa Online Grocery Delivery Market?

The market segments include Service Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Urbanization; Growing Disposable Income.

6. What are the notable trends driving market growth?

Mobile apps segment is anticipated to grow at a noticeable pace during the forecast period..

7. Are there any restraints impacting market growth?

High-price and additional delivery charges.

8. Can you provide examples of recent developments in the market?

July 2022: Considering the high level of competition in the market, the UAE's grocery delivery and quick commerce application 'Veppy.com' is allowing retailers to register their products on its website before its commercial launch at the end of August 2022. This was done in anticipation that the site could be in business right after its launch. Veppy.com makes shopping very personalized by recommending products based on what customers have bought on the site before and what the app has learned from that.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Online Grocery Delivery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Online Grocery Delivery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Online Grocery Delivery Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa Online Grocery Delivery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence