Key Insights

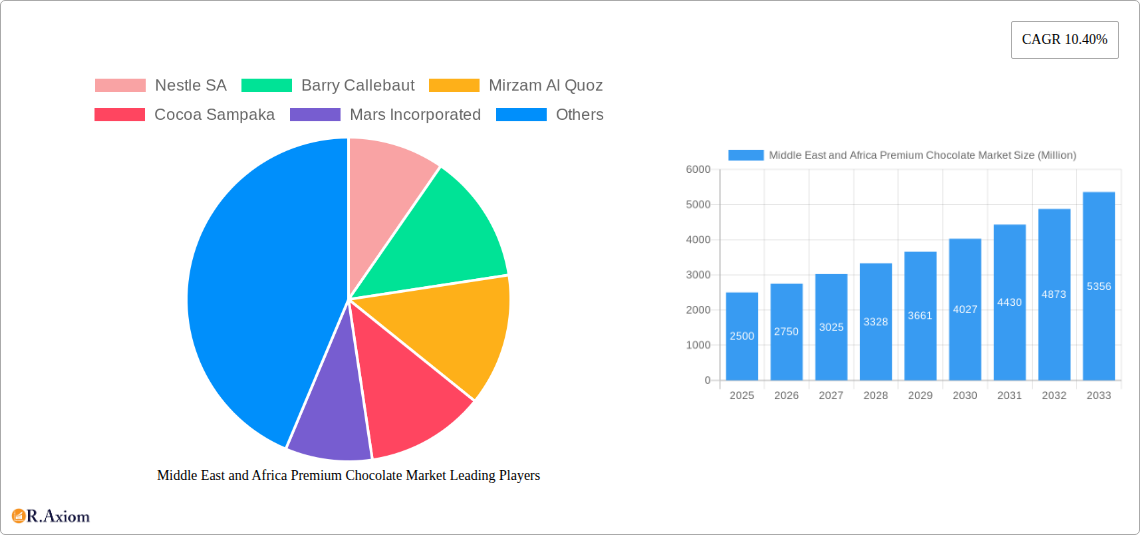

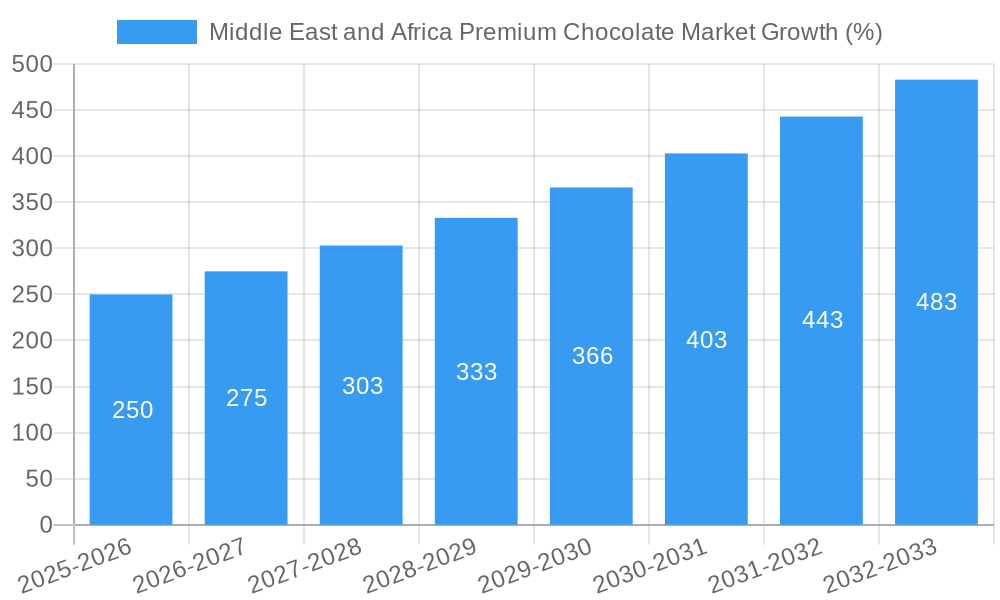

The Middle East and Africa Premium Chocolate Market exhibits robust growth potential, driven by rising disposable incomes, increasing urbanization, and a growing preference for premium confectionery products. The market's CAGR of 10.40% from 2019-2024 suggests a significant expansion, indicating a considerable appetite for high-quality chocolate experiences. Key segments fueling this growth include Dark Premium Chocolate, favored for its health benefits and intense flavor profile, and White and Milk Premium Chocolate, which appeal to broader consumer preferences. Supermarkets and hypermarkets remain dominant distribution channels, but online retail channels are experiencing rapid expansion, reflecting the increasing adoption of e-commerce in the region. Leading players such as Nestlé, Barry Callebaut, Mondelez International, and Lindt & Sprüngli are capitalizing on this growth, focusing on product innovation, strategic partnerships, and premium branding to cater to discerning consumers. However, challenges remain, such as fluctuating cocoa prices, economic instability in certain regions, and competition from local and international brands. Despite these restraints, the market's long-term outlook remains positive, with the forecast period (2025-2033) projected to witness continued expansion driven by evolving consumer tastes, increased tourism, and expanding middle classes across key markets within Africa. The focus on premiumization within the chocolate sector suggests sustained growth even against economic headwinds.

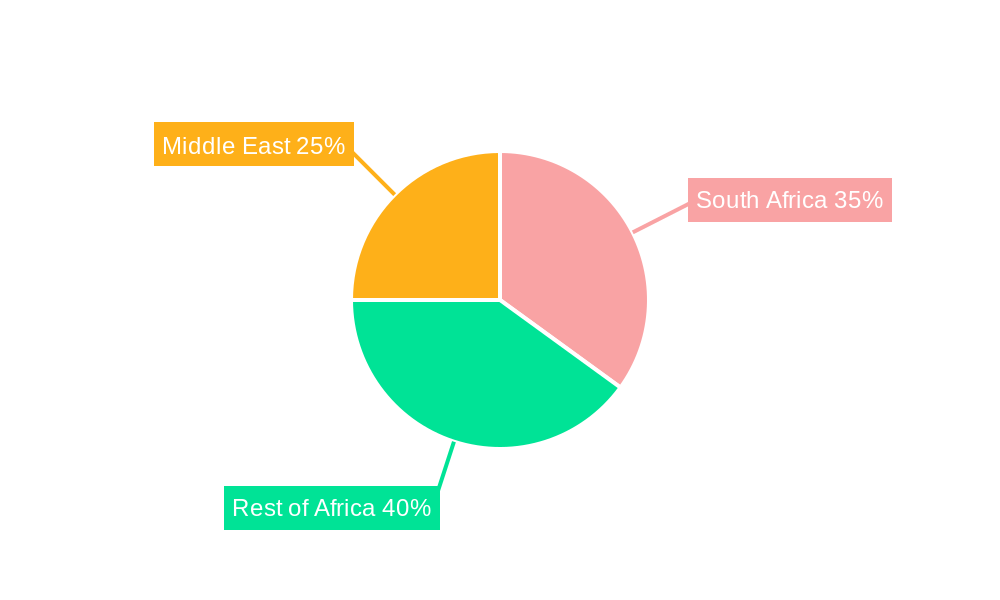

The market's segmentation also reveals important regional nuances. South Africa, with its relatively developed economy and strong retail infrastructure, likely accounts for a significant portion of the African market share. Other countries, such as Kenya and Uganda, show promising growth potential due to increasing middle-class populations and changing consumer preferences. Successfully navigating the diverse market conditions within Africa requires tailored strategies focusing on cultural sensitivities, distribution networks, and product adaptations to suit local tastes and affordability. The continued investment in marketing and branding, particularly emphasizing the premium aspects of the product, will be crucial for sustained market penetration across the diverse regions of the Middle East and Africa.

Middle East and Africa Premium Chocolate Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Middle East and Africa premium chocolate market, offering valuable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic sector. Covering the period from 2019 to 2033, with a focus on 2025, this report leverages robust data and expert analysis to illuminate current trends and future growth opportunities.

Middle East and Africa Premium Chocolate Market Concentration & Innovation

This section analyzes the competitive landscape, innovation drivers, and regulatory factors shaping the Middle East and Africa premium chocolate market. The market exhibits a moderately concentrated structure, with key players such as Nestlé SA, Barry Callebaut, and Mondelez International Inc. holding significant market share. However, smaller, artisanal brands like Mirzam Al Quoz and Al Nassma Chocolate LLC are also gaining traction, catering to the growing demand for unique and locally-sourced premium chocolates.

Market Concentration Metrics:

- Market Leader Share (2024 Estimate): Nestlé SA holds an estimated xx% market share.

- Top 3 Players Combined Share (2024 Estimate): Approximately xx%

- Herfindahl-Hirschman Index (HHI) (2024 Estimate): xx (indicating a moderately concentrated market).

Innovation Drivers:

- Consumer Demand: A rising preference for premium, ethically sourced, and unique chocolate flavors drives innovation in product development.

- Technological Advancements: New processing techniques and packaging solutions are enhancing product quality and shelf life.

- Health and Wellness Trends: Growing interest in dark chocolate's health benefits fuels the development of functional premium chocolate products.

Regulatory Framework & M&A Activities:

- The regulatory environment varies across countries in the region, impacting ingredient sourcing and labeling requirements. Further research is required to determine a specific HHI value.

- M&A activity in the premium chocolate sector is moderate. Deal values are xx Million in 2023, representing a decrease from xx Million in 2022. (Note: Precise M&A data requires further investigation.)

- Product substitutes, such as premium confectionery and artisanal sweets, pose a competitive challenge.

Middle East and Africa Premium Chocolate Market Industry Trends & Insights

The Middle East and Africa premium chocolate market is experiencing robust growth, driven by factors like rising disposable incomes, increasing urbanization, and changing consumer preferences towards premium and specialized food products. The market's Compound Annual Growth Rate (CAGR) during the historical period (2019-2024) was approximately xx%, and it is projected to grow at a CAGR of xx% during the forecast period (2025-2033).

Market penetration of premium chocolate is increasing, particularly in urban centers. This growth is fueled by several key factors:

- Rising Disposable Incomes: Increased affluence allows consumers to indulge in premium goods, including chocolate.

- Westernization of Diets: Exposure to global trends and increasing adoption of Western-style consumption patterns drive demand for premium chocolate.

- Tourism and Travel Retail: The thriving tourism sector and associated duty-free sales significantly contribute to market expansion.

- E-commerce Growth: Online retail channels are becoming increasingly important for premium chocolate sales, extending market reach and convenience.

Competitive dynamics are intense, with both global giants and regional players vying for market share. Successful strategies focus on product differentiation, innovative marketing campaigns, and strong distribution networks.

Dominant Markets & Segments in Middle East and Africa Premium Chocolate Market

The UAE and Saudi Arabia are the leading markets for premium chocolate in the Middle East and Africa region, driven by high disposable incomes and a preference for luxury goods. Within product types, milk and white premium chocolate hold a larger market share than dark premium chocolate, driven by broader consumer appeal.

Leading Regions & Countries:

- United Arab Emirates (UAE): High disposable incomes, a strong tourism sector, and the presence of major international brands contribute to the UAE's dominance.

- Saudi Arabia: Rapid economic growth and increasing consumer spending are driving premium chocolate market expansion.

Leading Segments:

- Product Type: Milk and white premium chocolate segments dominate due to their wider consumer appeal.

- Distribution Channel: Supermarkets and hypermarkets represent the largest distribution channel, offering convenience and wide reach. However, online retail channels are experiencing significant growth, driven by increasing internet penetration and the popularity of e-commerce.

Key Drivers:

- Economic Policies: Favorable economic policies and government initiatives promoting tourism and retail growth significantly benefit the premium chocolate market.

- Infrastructure: Well-developed retail infrastructure and robust logistics networks facilitate efficient product distribution.

Middle East and Africa Premium Chocolate Market Product Developments

Recent product innovations reflect a focus on unique flavors, ethical sourcing, and health-conscious offerings. Manufacturers are increasingly incorporating regional ingredients and flavors to cater to local preferences. Technological advancements in chocolate production and packaging ensure improved product quality, shelf life, and enhanced consumer experiences. These developments are shaping competitive advantages, allowing companies to better address consumer demand for premium, sustainable, and health-conscious chocolate options.

Report Scope & Segmentation Analysis

This report segments the Middle East and Africa premium chocolate market based on:

Product Type:

- Dark Premium Chocolate: This segment exhibits steady growth driven by health-conscious consumers. Market size is projected to reach xx Million by 2033.

- White and Milk Premium Chocolate: This segment holds the largest market share, fueled by broader consumer appeal. Market size is projected to reach xx Million by 2033.

Distribution Channel:

- Supermarkets and Hypermarkets: This remains the dominant channel, offering high visibility and accessibility. Market size is projected to reach xx Million by 2033.

- Convenience Stores: A smaller but growing segment benefiting from convenience and impulse purchases. Market size is projected to reach xx Million by 2033.

- Online Retail Channels: Rapidly expanding due to increased internet penetration and e-commerce adoption. Market size is projected to reach xx Million by 2033.

- Other Distribution Channels: Includes specialty stores, direct sales, and other niche channels. Market size is projected to reach xx Million by 2033.

Key Drivers of Middle East and Africa Premium Chocolate Market Growth

Several factors fuel the market's growth:

- Rising Disposable Incomes: Increased purchasing power allows consumers to spend more on premium products.

- Growing Urbanization: Urban populations concentrate demand and create better retail opportunities.

- Changing Consumer Preferences: A shift towards premium and indulgent food experiences drives growth.

Challenges in the Middle East and Africa Premium Chocolate Market Sector

The market faces challenges like:

- Fluctuating Cocoa Prices: Cocoa price volatility impacts profitability and pricing strategies.

- Stringent Regulatory Requirements: Compliance with food safety and labeling regulations can be complex.

- Intense Competition: The market is competitive, with both local and international brands vying for market share.

Emerging Opportunities in Middle East and Africa Premium Chocolate Market

Opportunities exist in:

- Expanding into Tier 2 and Tier 3 Cities: Untapped potential in less saturated markets.

- Developing Unique Flavors and Products: Catering to local tastes with innovative products.

- Leveraging E-commerce Channels: Optimizing online sales to reach broader customer base.

Leading Players in the Middle East and Africa Premium Chocolate Market Market

- Nestle SA

- Barry Callebaut

- Mirzam Al Quoz

- Cocoa Sampaka

- Mars Incorporated

- Al Nassma Chocolate LLC

- Mondelez International Inc

- Godiva

- Kees Beyers Chocolate CC

- Chocoladefabriken Lindt & Sprngli AG

Key Developments in Middle East and Africa Premium Chocolate Market Industry

- December 2022: Läderach, a Swiss chocolatier, opened a new store in Dubai Mall, highlighting the growing demand for high-end chocolate experiences.

- July 2022: Nestlé launched a travel retail exclusive Mackintosh's Quality Street Oriental Selection with regionally-inspired flavors, showcasing adaptation to local preferences.

- October 2021: Barry Callebaut opened a Chocolate Academy in Dubai, emphasizing innovation and talent development in the premium chocolate sector.

Strategic Outlook for Middle East and Africa Premium Chocolate Market Market

The Middle East and Africa premium chocolate market is poised for continued growth, driven by increasing consumer affluence, evolving tastes, and the expansion of retail channels. Companies that successfully adapt to evolving consumer preferences, invest in innovation, and develop robust distribution networks are best positioned to capitalize on future market opportunities. The focus on sustainability, ethical sourcing, and unique flavor profiles will further shape market dynamics and growth prospects.

Middle East and Africa Premium Chocolate Market Segmentation

-

1. Product Type

- 1.1. Dark Premium Chocolate

- 1.2. White and Milk Premium Chocolate

-

2. Distribution Channel

- 2.1. Supermarkets and Hypermarkets

- 2.2. Convenience Stores

- 2.3. Online Retail Channels

- 2.4. Other Distribution Channels

-

3. Geography

- 3.1. South Africa

- 3.2. Saudi Arabia

- 3.3. United Arab Emirates

- 3.4. Rest of Middle East and Africa

Middle East and Africa Premium Chocolate Market Segmentation By Geography

- 1. South Africa

- 2. Saudi Arabia

- 3. United Arab Emirates

- 4. Rest of Middle East and Africa

Middle East and Africa Premium Chocolate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Consumer inclination toward functional food and beverages; Increasing Number of Applications and Growing Industrial Use

- 3.3. Market Restrains

- 3.3.1. Increasing Shift Toward Plant-Based Protein

- 3.4. Market Trends

- 3.4.1. Health Benefits of High Quality Premium Chocolates Drives the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Premium Chocolate Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Dark Premium Chocolate

- 5.1.2. White and Milk Premium Chocolate

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets and Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Online Retail Channels

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. South Africa

- 5.3.2. Saudi Arabia

- 5.3.3. United Arab Emirates

- 5.3.4. Rest of Middle East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South Africa

- 5.4.2. Saudi Arabia

- 5.4.3. United Arab Emirates

- 5.4.4. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. South Africa Middle East and Africa Premium Chocolate Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Dark Premium Chocolate

- 6.1.2. White and Milk Premium Chocolate

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets and Hypermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Online Retail Channels

- 6.2.4. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. South Africa

- 6.3.2. Saudi Arabia

- 6.3.3. United Arab Emirates

- 6.3.4. Rest of Middle East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Saudi Arabia Middle East and Africa Premium Chocolate Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Dark Premium Chocolate

- 7.1.2. White and Milk Premium Chocolate

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets and Hypermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Online Retail Channels

- 7.2.4. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. South Africa

- 7.3.2. Saudi Arabia

- 7.3.3. United Arab Emirates

- 7.3.4. Rest of Middle East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. United Arab Emirates Middle East and Africa Premium Chocolate Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Dark Premium Chocolate

- 8.1.2. White and Milk Premium Chocolate

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets and Hypermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Online Retail Channels

- 8.2.4. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. South Africa

- 8.3.2. Saudi Arabia

- 8.3.3. United Arab Emirates

- 8.3.4. Rest of Middle East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of Middle East and Africa Middle East and Africa Premium Chocolate Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Dark Premium Chocolate

- 9.1.2. White and Milk Premium Chocolate

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets and Hypermarkets

- 9.2.2. Convenience Stores

- 9.2.3. Online Retail Channels

- 9.2.4. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. South Africa

- 9.3.2. Saudi Arabia

- 9.3.3. United Arab Emirates

- 9.3.4. Rest of Middle East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. South Africa Middle East and Africa Premium Chocolate Market Analysis, Insights and Forecast, 2019-2031

- 11. Sudan Middle East and Africa Premium Chocolate Market Analysis, Insights and Forecast, 2019-2031

- 12. Uganda Middle East and Africa Premium Chocolate Market Analysis, Insights and Forecast, 2019-2031

- 13. Tanzania Middle East and Africa Premium Chocolate Market Analysis, Insights and Forecast, 2019-2031

- 14. Kenya Middle East and Africa Premium Chocolate Market Analysis, Insights and Forecast, 2019-2031

- 15. Rest of Africa Middle East and Africa Premium Chocolate Market Analysis, Insights and Forecast, 2019-2031

- 16. Competitive Analysis

- 16.1. Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Nestle SA

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Barry Callebaut

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Mirzam Al Quoz

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Cocoa Sampaka

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Mars Incorporated

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Al Nassma Chocolate LLC

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Mondelez International Inc

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Godiva

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Kees Beyers Chocolate CC*List Not Exhaustive

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Chocoladefabriken Lindt & Sprngli AG

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Nestle SA

List of Figures

- Figure 1: Middle East and Africa Premium Chocolate Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle East and Africa Premium Chocolate Market Share (%) by Company 2024

List of Tables

- Table 1: Middle East and Africa Premium Chocolate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle East and Africa Premium Chocolate Market Volume Thousand Tons Forecast, by Region 2019 & 2032

- Table 3: Middle East and Africa Premium Chocolate Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: Middle East and Africa Premium Chocolate Market Volume Thousand Tons Forecast, by Product Type 2019 & 2032

- Table 5: Middle East and Africa Premium Chocolate Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 6: Middle East and Africa Premium Chocolate Market Volume Thousand Tons Forecast, by Distribution Channel 2019 & 2032

- Table 7: Middle East and Africa Premium Chocolate Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 8: Middle East and Africa Premium Chocolate Market Volume Thousand Tons Forecast, by Geography 2019 & 2032

- Table 9: Middle East and Africa Premium Chocolate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Middle East and Africa Premium Chocolate Market Volume Thousand Tons Forecast, by Region 2019 & 2032

- Table 11: Middle East and Africa Premium Chocolate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Middle East and Africa Premium Chocolate Market Volume Thousand Tons Forecast, by Country 2019 & 2032

- Table 13: South Africa Middle East and Africa Premium Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: South Africa Middle East and Africa Premium Chocolate Market Volume (Thousand Tons) Forecast, by Application 2019 & 2032

- Table 15: Sudan Middle East and Africa Premium Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Sudan Middle East and Africa Premium Chocolate Market Volume (Thousand Tons) Forecast, by Application 2019 & 2032

- Table 17: Uganda Middle East and Africa Premium Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Uganda Middle East and Africa Premium Chocolate Market Volume (Thousand Tons) Forecast, by Application 2019 & 2032

- Table 19: Tanzania Middle East and Africa Premium Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Tanzania Middle East and Africa Premium Chocolate Market Volume (Thousand Tons) Forecast, by Application 2019 & 2032

- Table 21: Kenya Middle East and Africa Premium Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Kenya Middle East and Africa Premium Chocolate Market Volume (Thousand Tons) Forecast, by Application 2019 & 2032

- Table 23: Rest of Africa Middle East and Africa Premium Chocolate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Africa Middle East and Africa Premium Chocolate Market Volume (Thousand Tons) Forecast, by Application 2019 & 2032

- Table 25: Middle East and Africa Premium Chocolate Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 26: Middle East and Africa Premium Chocolate Market Volume Thousand Tons Forecast, by Product Type 2019 & 2032

- Table 27: Middle East and Africa Premium Chocolate Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 28: Middle East and Africa Premium Chocolate Market Volume Thousand Tons Forecast, by Distribution Channel 2019 & 2032

- Table 29: Middle East and Africa Premium Chocolate Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 30: Middle East and Africa Premium Chocolate Market Volume Thousand Tons Forecast, by Geography 2019 & 2032

- Table 31: Middle East and Africa Premium Chocolate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Middle East and Africa Premium Chocolate Market Volume Thousand Tons Forecast, by Country 2019 & 2032

- Table 33: Middle East and Africa Premium Chocolate Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 34: Middle East and Africa Premium Chocolate Market Volume Thousand Tons Forecast, by Product Type 2019 & 2032

- Table 35: Middle East and Africa Premium Chocolate Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 36: Middle East and Africa Premium Chocolate Market Volume Thousand Tons Forecast, by Distribution Channel 2019 & 2032

- Table 37: Middle East and Africa Premium Chocolate Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 38: Middle East and Africa Premium Chocolate Market Volume Thousand Tons Forecast, by Geography 2019 & 2032

- Table 39: Middle East and Africa Premium Chocolate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 40: Middle East and Africa Premium Chocolate Market Volume Thousand Tons Forecast, by Country 2019 & 2032

- Table 41: Middle East and Africa Premium Chocolate Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 42: Middle East and Africa Premium Chocolate Market Volume Thousand Tons Forecast, by Product Type 2019 & 2032

- Table 43: Middle East and Africa Premium Chocolate Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 44: Middle East and Africa Premium Chocolate Market Volume Thousand Tons Forecast, by Distribution Channel 2019 & 2032

- Table 45: Middle East and Africa Premium Chocolate Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 46: Middle East and Africa Premium Chocolate Market Volume Thousand Tons Forecast, by Geography 2019 & 2032

- Table 47: Middle East and Africa Premium Chocolate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 48: Middle East and Africa Premium Chocolate Market Volume Thousand Tons Forecast, by Country 2019 & 2032

- Table 49: Middle East and Africa Premium Chocolate Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 50: Middle East and Africa Premium Chocolate Market Volume Thousand Tons Forecast, by Product Type 2019 & 2032

- Table 51: Middle East and Africa Premium Chocolate Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 52: Middle East and Africa Premium Chocolate Market Volume Thousand Tons Forecast, by Distribution Channel 2019 & 2032

- Table 53: Middle East and Africa Premium Chocolate Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 54: Middle East and Africa Premium Chocolate Market Volume Thousand Tons Forecast, by Geography 2019 & 2032

- Table 55: Middle East and Africa Premium Chocolate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 56: Middle East and Africa Premium Chocolate Market Volume Thousand Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Premium Chocolate Market?

The projected CAGR is approximately 10.40%.

2. Which companies are prominent players in the Middle East and Africa Premium Chocolate Market?

Key companies in the market include Nestle SA, Barry Callebaut, Mirzam Al Quoz, Cocoa Sampaka, Mars Incorporated, Al Nassma Chocolate LLC, Mondelez International Inc, Godiva, Kees Beyers Chocolate CC*List Not Exhaustive, Chocoladefabriken Lindt & Sprngli AG.

3. What are the main segments of the Middle East and Africa Premium Chocolate Market?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Consumer inclination toward functional food and beverages; Increasing Number of Applications and Growing Industrial Use.

6. What are the notable trends driving market growth?

Health Benefits of High Quality Premium Chocolates Drives the Market Growth.

7. Are there any restraints impacting market growth?

Increasing Shift Toward Plant-Based Protein.

8. Can you provide examples of recent developments in the market?

December 2022: The inauguration of a new store in Dubai was announced by Mohammed Rasool Khoory and Sons and Läderach, one of the largest artisanal chocolatiers in Switzerland, producing its own chocolate since 2012. The new Läderach store is situated in Dubai Mall, on the lower ground floor of the complex.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Thousand Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Premium Chocolate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Premium Chocolate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Premium Chocolate Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa Premium Chocolate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence