Key Insights

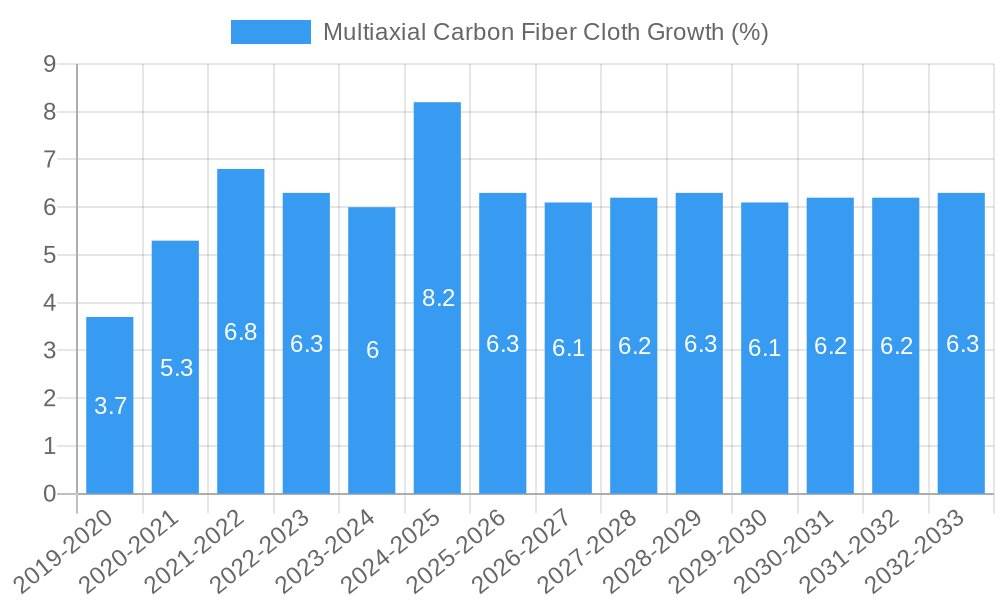

The Multiaxial Carbon Fiber Cloth market is poised for substantial growth, projected to reach an estimated value of USD 384 million by 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of 5.7% throughout the forecast period extending to 2033. This expansion is largely fueled by the increasing demand across key industries such as Aerospace, Sporting Goods, and Automotive, where the exceptional strength-to-weight ratio and superior mechanical properties of multiaxial carbon fiber composites are highly valued. The Aerospace sector, in particular, is a significant driver, leveraging these materials for lighter and more fuel-efficient aircraft structures. The Sporting Goods industry benefits from enhanced performance and durability in high-end equipment. The Automotive sector is increasingly adopting these advanced materials for lightweighting vehicles, thereby improving fuel efficiency and electric vehicle range. While triaxial and quadriaxial fabrics represent the dominant types, ongoing innovation in material science is also paving the way for new and specialized "Other" types to cater to niche applications.

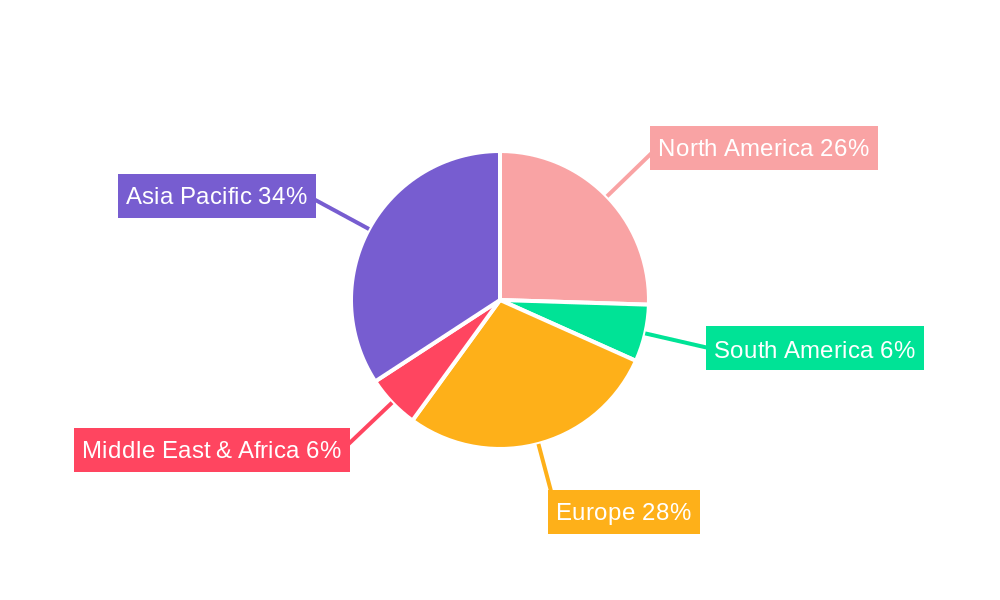

The market's trajectory is further bolstered by a series of beneficial trends, including advancements in manufacturing processes that are making multiaxial carbon fiber more accessible and cost-effective. The growing emphasis on sustainability and the drive towards reducing carbon footprints in various industries also present a strong tailwind, as lightweight composite materials contribute to lower energy consumption. However, the market does face certain restraints, primarily revolving around the relatively high initial cost of raw materials and manufacturing equipment compared to traditional materials. Stringent regulatory frameworks, particularly in the aerospace industry, and the need for specialized handling and processing expertise also pose challenges. Nevertheless, the continued investment in research and development by leading companies such as Toray, Hexcel, and SGL Carbon, alongside strategic collaborations and expanding applications, are expected to overcome these hurdles, solidifying the positive growth outlook for the multiaxial carbon fiber cloth market globally. The Asia Pacific region, with China at its forefront, is anticipated to be a dominant force in terms of both production and consumption.

Multiaxial Carbon Fiber Cloth Market Concentration & Innovation

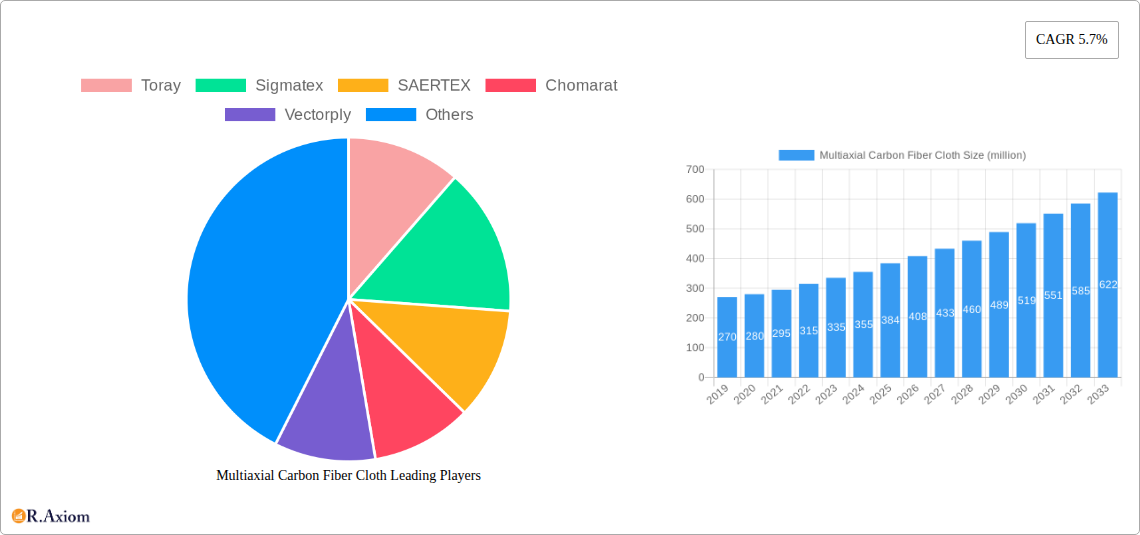

The global multiaxial carbon fiber cloth market exhibits a moderate concentration, with key players like Toray, Sigmatex, SAERTEX, Chomarat, Vectorply, SGL Carbon, Hexcel, Selcom, Gernitex, Formosa Taffeta, and Hyundai Fiber strategically positioned. Innovation is a primary driver, fueled by ongoing research and development in advanced composite materials, leading to enhanced mechanical properties and application-specific solutions. Regulatory frameworks, particularly concerning safety and environmental standards in aerospace and automotive sectors, indirectly influence product development and adoption. The threat of product substitutes, while present in some lower-performance applications from traditional materials, is mitigated by the unique strength-to-weight ratio and superior performance of carbon fiber. End-user trends reveal a strong preference for lightweight, high-strength materials across diverse industries, pushing demand for multiaxial carbon fiber cloth. Mergers and acquisition (M&A) activities, though not pervasive, have occurred to consolidate market share and acquire specialized technological capabilities. M&A deal values are estimated to be in the hundreds of million range. Market share is fragmented, with the top five companies holding approximately 60% of the market. Innovation investment by leading firms is projected to exceed one million dollars annually.

Multiaxial Carbon Fiber Cloth Industry Trends & Insights

The multiaxial carbon fiber cloth market is poised for robust growth, driven by increasing demand for high-performance, lightweight materials across a spectrum of industries. The compound annual growth rate (CAGR) is estimated to be around 8.5% during the forecast period of 2025–2033. Market penetration is steadily increasing, particularly in sectors demanding superior strength and reduced weight. Technological disruptions, such as advancements in weaving techniques and resin infusion processes, are enhancing the manufacturing efficiency and performance characteristics of multiaxial carbon fiber fabrics, leading to their wider adoption. Consumer preferences are shifting towards sustainable and durable products, where carbon fiber composites offer longevity and reduced lifecycle environmental impact compared to some traditional materials. Competitive dynamics are characterized by a blend of established global players and emerging regional manufacturers, each vying for market dominance through product differentiation, strategic partnerships, and cost optimization. The ongoing evolution of manufacturing processes, including the integration of automation and digital technologies, is further shaping the competitive landscape. The automotive industry's pursuit of fuel efficiency through vehicle lightweighting remains a significant growth catalyst, while the aerospace sector's continuous need for advanced materials for aircraft components further propels market expansion. The sporting goods industry, driven by consumer demand for high-performance equipment, also contributes substantially to market growth. Innovations in material science, leading to tailored fiber orientations and resin compatibility, are opening new application avenues. The market size is projected to reach over ten million dollars by 2033.

Dominant Markets & Segments in Multiaxial Carbon Fiber Cloth

The multiaxial carbon fiber cloth market is dominated by several key regions and segments, driven by distinct economic policies, infrastructure development, and technological adoption rates.

Leading Region: North America and Europe

- Economic Policies: Favorable government incentives for advanced manufacturing, R&D tax credits for composite materials, and stringent fuel efficiency standards in the automotive sector contribute significantly to market dominance in North America and Europe.

- Infrastructure Development: Investment in aerospace and defense programs, coupled with the continuous upgrade of transportation infrastructure, necessitates the use of high-performance composites.

- Technological Adoption: These regions have a high propensity to adopt cutting-edge technologies, making them early adopters of multiaxial carbon fiber cloth in new applications.

- Dominance Analysis: North America, with its substantial aerospace and automotive manufacturing base, and Europe, driven by advanced engineering and stringent environmental regulations, collectively account for over sixty percent of the global market share. The focus on lightweighting in these regions for both fuel efficiency and enhanced performance is a primary driver.

Dominant Application: Aerospace

- Key Drivers: The aerospace industry's unyielding demand for materials with exceptional strength-to-weight ratios, high fatigue resistance, and superior performance under extreme conditions makes multiaxial carbon fiber cloth indispensable. Strict safety regulations and the need for fuel efficiency further solidify its position.

- Dominance Analysis: Aerospace applications, including aircraft structural components, interiors, and satellite structures, represent a significant portion of the market. The continuous innovation in aircraft design and the drive to reduce operational costs by minimizing weight directly translate into sustained demand. The market size for aerospace applications is estimated to be in the hundreds of million dollars.

Dominant Type: Quadriaxial Fabrics

- Key Drivers: Quadriaxial fabrics, with their ability to provide multidirectional strength and stiffness, are crucial for complex structural components that experience loads from multiple axes.

- Dominance Analysis: The versatility and enhanced mechanical properties of quadriaxial carbon fiber cloth make them the preferred choice for demanding applications in aerospace, automotive, and high-performance sporting goods. Their ability to optimize material usage and improve structural integrity contributes to their market dominance.

Emerging Segment: Automotive

- Key Drivers: The automotive sector's increasing focus on lightweighting for improved fuel economy and reduced emissions is a major growth catalyst for multiaxial carbon fiber cloth. Advances in manufacturing techniques are making these materials more cost-effective for automotive applications.

- Dominance Analysis: While historically a smaller segment compared to aerospace, the automotive industry is rapidly expanding its use of carbon fiber composites for chassis, body panels, and interior components. The drive towards electric vehicles (EVs) and autonomous driving further amplifies the need for lightweight materials to offset battery weight and enhance performance.

Multiaxial Carbon Fiber Cloth Product Developments

Recent product developments in multiaxial carbon fiber cloth focus on enhancing performance characteristics and expanding application versatility. Innovations include the development of specialized weaving patterns for improved drapability and resin compatibility, as well as the integration of advanced fiber technologies to achieve higher tensile strength and stiffness. These advancements enable the creation of lighter, stronger, and more durable composite parts, offering significant competitive advantages in demanding sectors like aerospace, automotive, and high-performance sporting goods. The market is also seeing a rise in custom-engineered fabrics tailored to specific end-user requirements, further solidifying their market fit and driving innovation.

Report Scope & Segmentation Analysis

This report segments the multiaxial carbon fiber cloth market based on key parameters to provide a comprehensive understanding of its dynamics.

Application:

- Aerospace: This segment, projected to be the largest in terms of market size (estimated at over one hundred million dollars), is driven by the demand for lightweight and high-strength materials in aircraft and space exploration.

- Sporting Goods: This segment, with an estimated market size in the tens of millions, benefits from the consumer's preference for high-performance equipment like bicycles, tennis rackets, and golf clubs.

- Automotive: The automotive segment, experiencing rapid growth (estimated market size in the tens of millions), is fueled by the trend towards vehicle lightweighting for improved fuel efficiency and reduced emissions.

- Others: This segment, encompassing wind energy, marine, and industrial applications, shows steady growth (estimated market size in the tens of millions) due to increasing adoption of composite materials.

Types:

- Triaxial: This type offers balanced strength in three directions and is widely used in applications requiring multi-directional reinforcement.

- Quadriaxial: Offering enhanced strength and stiffness across four directions, this type is crucial for complex structural components in high-stress applications.

- Others: This category includes specialized weaves and orientations designed for niche applications, contributing to market diversification.

Key Drivers of Multiaxial Carbon Fiber Cloth Growth

The multiaxial carbon fiber cloth market is propelled by several significant growth drivers. Technologically, advancements in fiber manufacturing and weaving techniques are leading to improved material properties and reduced production costs, making carbon fiber composites more accessible. Economically, the global push for sustainability and fuel efficiency across industries like automotive and aerospace directly translates into increased demand for lightweight materials. Regulatory frameworks, particularly in transportation, mandating stricter emissions standards, further incentivize the adoption of carbon fiber to reduce vehicle weight. The inherent superior strength-to-weight ratio of carbon fiber, coupled with its excellent fatigue resistance and corrosion properties, makes it an attractive alternative to traditional materials in high-performance applications, including renewable energy (wind turbines) and sporting goods.

Challenges in the Multiaxial Carbon Fiber Cloth Sector

Despite its promising growth trajectory, the multiaxial carbon fiber cloth sector faces several challenges. High raw material costs, particularly for virgin carbon fiber, can impact the overall affordability of composite parts, especially for cost-sensitive applications. Regulatory hurdles in certain sectors, such as stringent certification processes for aerospace and automotive components, can lead to extended development and adoption timelines. Supply chain complexities and the need for specialized manufacturing expertise can also pose challenges for new entrants and market expansion. Furthermore, the competitive pressure from other advanced materials and the ongoing price volatility of precursor materials can create market uncertainties. The energy-intensive nature of carbon fiber production also presents an environmental consideration that the industry is actively addressing through sustainable manufacturing practices.

Emerging Opportunities in Multiaxial Carbon Fiber Cloth

Emerging opportunities in the multiaxial carbon fiber cloth market are abundant, driven by technological innovation and evolving industry demands. The burgeoning electric vehicle (EV) market presents a significant avenue for growth, as lightweighting is critical to maximizing EV range and performance. Advances in additive manufacturing and 3D printing of composite structures are opening new design possibilities and enabling the production of complex geometries with multiaxial carbon fiber. The growing renewable energy sector, particularly in wind turbine blade manufacturing, offers substantial demand for durable and lightweight composite materials. Furthermore, the increasing focus on circular economy principles is driving research into recyclable carbon fiber composites and more sustainable production methods. The expansion of high-speed rail networks globally also presents an opportunity for the adoption of lightweight and durable materials in rolling stock.

Leading Players in the Multiaxial Carbon Fiber Cloth Market

- Toray

- Sigmatex

- SAERTEX

- Chomarat

- Vectorply

- SGL Carbon

- Hexcel

- Selcom

- Gernitex

- Formosa Taffeta

- Hyundai Fiber

Key Developments in Multiaxial Carbon Fiber Cloth Industry

- 2023 March: Toray launches a new range of high-strength multiaxial carbon fiber fabrics with enhanced resin compatibility for automotive applications.

- 2023 June: Hexcel announces expansion of its advanced composites manufacturing facility to meet increasing demand from the aerospace sector.

- 2023 September: Sigmatex introduces innovative unidirectional carbon fiber reinforcements for improved structural performance in wind turbine blades.

- 2024 January: SAERTEX showcases advancements in fire-retardant multiaxial fabrics for specialized industrial applications.

- 2024 April: Vectorply develops a new series of lightweight carbon fiber reinforcements for performance sporting goods.

Strategic Outlook for Multiaxial Carbon Fiber Cloth Market

The strategic outlook for the multiaxial carbon fiber cloth market is exceptionally positive, driven by an unwavering demand for high-performance, lightweight materials across diverse and rapidly growing industries. The continuous pursuit of fuel efficiency, emission reduction, and enhanced performance in aerospace and automotive sectors will remain a primary growth catalyst. Innovations in manufacturing technologies, leading to cost reductions and improved material properties, will further broaden the adoption base. Emerging applications in renewable energy, electric vehicles, and advanced sporting goods represent significant untapped potential. Strategic collaborations between material suppliers, manufacturers, and end-users will be crucial for accelerating product development and market penetration, ensuring sustained growth and innovation in the coming years.

Multiaxial Carbon Fiber Cloth Segmentation

-

1. Application

- 1.1. Aerospace

- 1.2. Sporting Goods

- 1.3. Automotive

- 1.4. Others

-

2. Types

- 2.1. Triaxial

- 2.2. Quadriaxial

- 2.3. Others

Multiaxial Carbon Fiber Cloth Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Multiaxial Carbon Fiber Cloth REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.7% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Multiaxial Carbon Fiber Cloth Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Aerospace

- 5.1.2. Sporting Goods

- 5.1.3. Automotive

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Triaxial

- 5.2.2. Quadriaxial

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Multiaxial Carbon Fiber Cloth Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Aerospace

- 6.1.2. Sporting Goods

- 6.1.3. Automotive

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Triaxial

- 6.2.2. Quadriaxial

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Multiaxial Carbon Fiber Cloth Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Aerospace

- 7.1.2. Sporting Goods

- 7.1.3. Automotive

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Triaxial

- 7.2.2. Quadriaxial

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Multiaxial Carbon Fiber Cloth Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Aerospace

- 8.1.2. Sporting Goods

- 8.1.3. Automotive

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Triaxial

- 8.2.2. Quadriaxial

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Multiaxial Carbon Fiber Cloth Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Aerospace

- 9.1.2. Sporting Goods

- 9.1.3. Automotive

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Triaxial

- 9.2.2. Quadriaxial

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Multiaxial Carbon Fiber Cloth Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Aerospace

- 10.1.2. Sporting Goods

- 10.1.3. Automotive

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Triaxial

- 10.2.2. Quadriaxial

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Toray

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Sigmatex

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 SAERTEX

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Chomarat

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Vectorply

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 SGL Carbon

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Hexcel

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Selcom

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Gernitex

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Formosa Taffeta

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Hyundai Fiber

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Toray

List of Figures

- Figure 1: Global Multiaxial Carbon Fiber Cloth Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Multiaxial Carbon Fiber Cloth Revenue (million), by Application 2024 & 2032

- Figure 3: North America Multiaxial Carbon Fiber Cloth Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Multiaxial Carbon Fiber Cloth Revenue (million), by Types 2024 & 2032

- Figure 5: North America Multiaxial Carbon Fiber Cloth Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Multiaxial Carbon Fiber Cloth Revenue (million), by Country 2024 & 2032

- Figure 7: North America Multiaxial Carbon Fiber Cloth Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Multiaxial Carbon Fiber Cloth Revenue (million), by Application 2024 & 2032

- Figure 9: South America Multiaxial Carbon Fiber Cloth Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Multiaxial Carbon Fiber Cloth Revenue (million), by Types 2024 & 2032

- Figure 11: South America Multiaxial Carbon Fiber Cloth Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Multiaxial Carbon Fiber Cloth Revenue (million), by Country 2024 & 2032

- Figure 13: South America Multiaxial Carbon Fiber Cloth Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Multiaxial Carbon Fiber Cloth Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Multiaxial Carbon Fiber Cloth Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Multiaxial Carbon Fiber Cloth Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Multiaxial Carbon Fiber Cloth Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Multiaxial Carbon Fiber Cloth Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Multiaxial Carbon Fiber Cloth Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Multiaxial Carbon Fiber Cloth Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Multiaxial Carbon Fiber Cloth Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Multiaxial Carbon Fiber Cloth Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Multiaxial Carbon Fiber Cloth Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Multiaxial Carbon Fiber Cloth Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Multiaxial Carbon Fiber Cloth Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Multiaxial Carbon Fiber Cloth Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Multiaxial Carbon Fiber Cloth Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Multiaxial Carbon Fiber Cloth Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Multiaxial Carbon Fiber Cloth Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Multiaxial Carbon Fiber Cloth Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Multiaxial Carbon Fiber Cloth Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Multiaxial Carbon Fiber Cloth Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Multiaxial Carbon Fiber Cloth Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Multiaxial Carbon Fiber Cloth Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Multiaxial Carbon Fiber Cloth Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Multiaxial Carbon Fiber Cloth Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Multiaxial Carbon Fiber Cloth Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Multiaxial Carbon Fiber Cloth Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Multiaxial Carbon Fiber Cloth Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Multiaxial Carbon Fiber Cloth Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Multiaxial Carbon Fiber Cloth Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Multiaxial Carbon Fiber Cloth Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Multiaxial Carbon Fiber Cloth Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Multiaxial Carbon Fiber Cloth Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Multiaxial Carbon Fiber Cloth Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Multiaxial Carbon Fiber Cloth Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Multiaxial Carbon Fiber Cloth Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Multiaxial Carbon Fiber Cloth Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Multiaxial Carbon Fiber Cloth Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Multiaxial Carbon Fiber Cloth Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Multiaxial Carbon Fiber Cloth Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Multiaxial Carbon Fiber Cloth Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Multiaxial Carbon Fiber Cloth Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Multiaxial Carbon Fiber Cloth Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Multiaxial Carbon Fiber Cloth Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Multiaxial Carbon Fiber Cloth Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Multiaxial Carbon Fiber Cloth Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Multiaxial Carbon Fiber Cloth Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Multiaxial Carbon Fiber Cloth Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Multiaxial Carbon Fiber Cloth Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Multiaxial Carbon Fiber Cloth Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Multiaxial Carbon Fiber Cloth Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Multiaxial Carbon Fiber Cloth Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Multiaxial Carbon Fiber Cloth Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Multiaxial Carbon Fiber Cloth Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Multiaxial Carbon Fiber Cloth Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Multiaxial Carbon Fiber Cloth Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Multiaxial Carbon Fiber Cloth Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Multiaxial Carbon Fiber Cloth Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Multiaxial Carbon Fiber Cloth Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Multiaxial Carbon Fiber Cloth Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Multiaxial Carbon Fiber Cloth Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Multiaxial Carbon Fiber Cloth Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Multiaxial Carbon Fiber Cloth Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Multiaxial Carbon Fiber Cloth Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Multiaxial Carbon Fiber Cloth Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Multiaxial Carbon Fiber Cloth Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Multiaxial Carbon Fiber Cloth Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Multiaxial Carbon Fiber Cloth?

The projected CAGR is approximately 5.7%.

2. Which companies are prominent players in the Multiaxial Carbon Fiber Cloth?

Key companies in the market include Toray, Sigmatex, SAERTEX, Chomarat, Vectorply, SGL Carbon, Hexcel, Selcom, Gernitex, Formosa Taffeta, Hyundai Fiber.

3. What are the main segments of the Multiaxial Carbon Fiber Cloth?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 384 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Multiaxial Carbon Fiber Cloth," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Multiaxial Carbon Fiber Cloth report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Multiaxial Carbon Fiber Cloth?

To stay informed about further developments, trends, and reports in the Multiaxial Carbon Fiber Cloth, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence