Key Insights

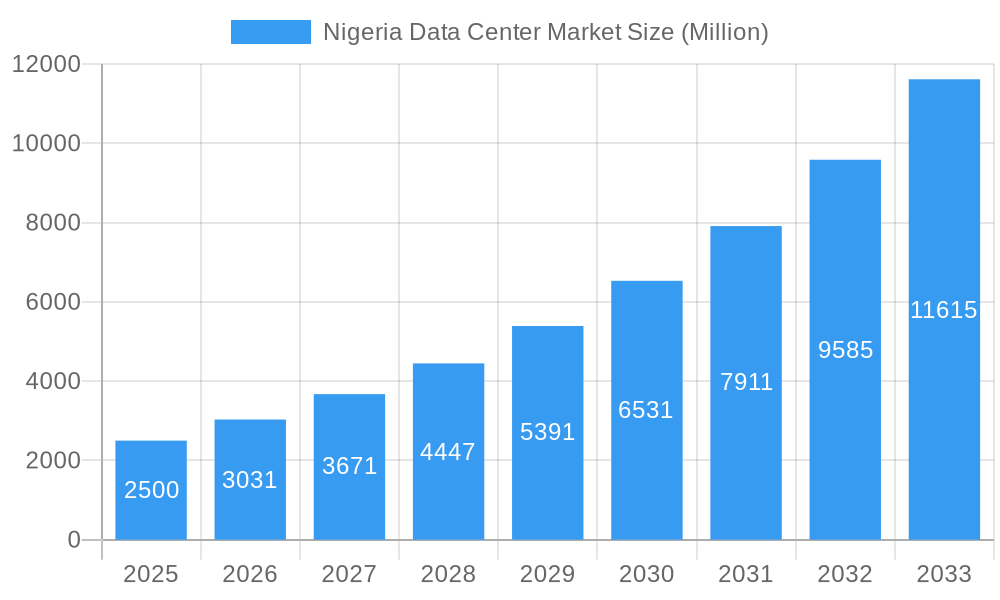

The Nigerian Data Center Market is poised for significant expansion, forecasted to achieve a market size of $288 million by 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of 24.99%. This growth is driven by increasing cloud service adoption, a burgeoning digital economy fueled by e-commerce, and the demand for localized data processing. Government digital transformation initiatives and the telecommunications sector's expansion also contribute. Key trends include the development of hyperscale data centers, a focus on Tier 3 and Tier 4 facilities for reliability, and a growing preference for colocation services. The rollout of 5G networks further necessitates distributed and edge data center solutions.

Nigeria Data Center Market Market Size (In Million)

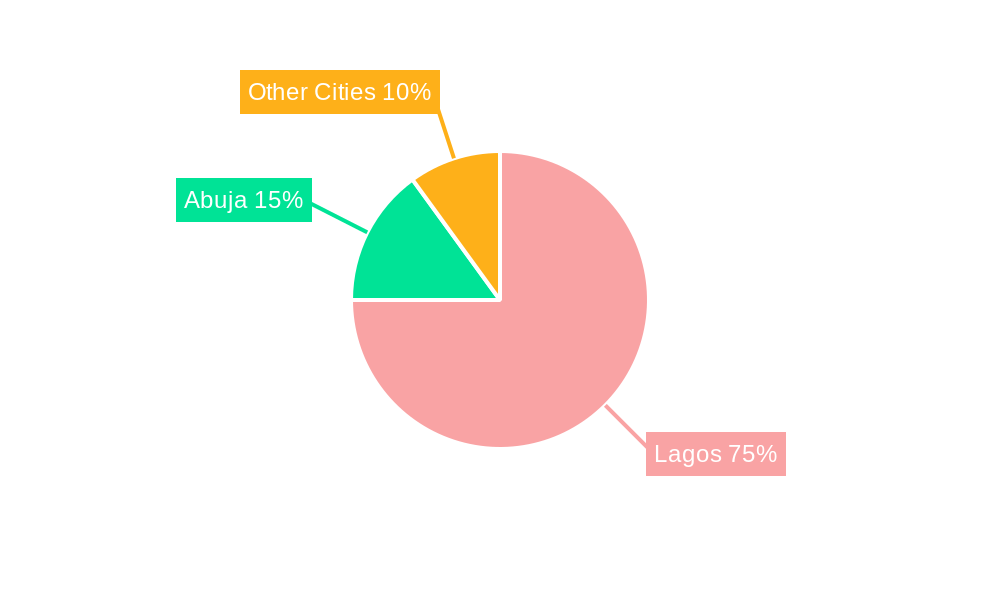

Market restraints include power infrastructure challenges, substantial capital investment requirements, and regulatory complexities. Opportunities lie in optimizing underutilized capacity. The market is segmented by data center size and tier, with a preference for Tier 3 and Tier 4 facilities. Lagos is a key investment hub. Dominant end-user segments are BFSI, Cloud, E-Commerce, Telecom, and Government. Key players include Africa Data Centers, WIOCC, MDXi, Rack Centre Limited, MTN Nigeria Communications Ltd, and Digital Realty.

Nigeria Data Center Market Company Market Share

Nigeria Data Center Market: Comprehensive Analysis and Future Outlook (2019–2033)

This in-depth report provides a granular analysis of the Nigeria Data Center Market, a pivotal and rapidly expanding sector within Africa's digital infrastructure landscape. Covering the historical period of 2019–2024, the base and estimated year of 2025, and a comprehensive forecast period extending to 2033, this study delves into market dynamics, key players, technological advancements, and future growth trajectories. With a focus on high-traffic keywords such as "Nigeria data center," "African data center market," "hyperscale data centers Nigeria," "data center colocation Nigeria," and "digital infrastructure Africa," this report is engineered to maximize search visibility and provide actionable insights for industry stakeholders, including investors, data center operators, technology providers, and government agencies.

Nigeria Data Center Market Market Concentration & Innovation

The Nigeria Data Center Market is exhibiting a dynamic blend of emerging competition and strategic consolidation, indicating a maturing yet innovative ecosystem. Market concentration, while increasing with key acquisitions, still allows for significant player influence. Innovation is being primarily driven by the escalating demand for cloud services, the proliferation of digital payment systems, and the growing adoption of edge computing solutions to reduce latency for a population increasingly reliant on mobile and internet services. Regulatory frameworks, though evolving, are a crucial aspect of market development, aiming to foster investment while ensuring data security and sovereignty. Product substitutes, such as on-premise server solutions, are diminishing in relevance as the cost-effectiveness and scalability of colocation and hyperscale data centers become more apparent. End-user trends highlight a strong shift towards digital transformation across all sectors, with BFSI, E-Commerce, and Telecom leading the charge. Mergers and acquisitions (M&A) are a significant indicator of market maturation and strategic expansion. The acquisition of MainOne by Equinix for approximately USD 320 million in April 2022 exemplifies this trend, signaling substantial foreign investment and a long-term commitment to carrier-neutral data center services in Nigeria. This M&A activity is reshaping the competitive landscape, consolidating market share, and fueling further innovation as larger entities integrate their operations and expand their service offerings.

Nigeria Data Center Market Industry Trends & Insights

The Nigeria Data Center Market is experiencing exponential growth, fueled by a confluence of technological advancements, a burgeoning digital economy, and increasing investment in critical infrastructure. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 15% over the forecast period, driven by the insatiable demand for digital services, data storage, and processing power. This growth is underpinned by Nigeria's status as Africa's largest economy and its vibrant, youthful population that is rapidly embracing digital technologies. Cloud adoption is a primary catalyst, with businesses of all sizes migrating their operations to the cloud to enhance scalability, flexibility, and cost-efficiency. The rise of e-commerce platforms and digital payment systems further necessitates robust data center infrastructure to handle massive transaction volumes and ensure seamless customer experiences.

Technological disruptions are playing a pivotal role in shaping the market. The increasing deployment of fiber optic networks, coupled with the rollout of 5G services, is significantly improving internet speeds and connectivity, thereby lowering latency and enabling more sophisticated applications such as IoT and AI-driven solutions. This hyper-connectivity is creating a fertile ground for hyperscale data centers, which are essential for supporting the massive data requirements of global cloud providers and large enterprises. Consumer preferences are increasingly leaning towards on-demand digital services, pushing companies to invest in data center capacity to meet these expectations. The competitive dynamics are intensifying, with both local and international players vying for market share. Strategic partnerships and acquisitions, such as Equinix's acquisition of MainOne, are indicative of this aggressive expansion strategy, aimed at capturing a larger portion of this lucrative market. The push for carrier-neutral facilities is also a significant trend, offering businesses greater choice and flexibility in selecting network providers. The development of smart city initiatives and government digitalization programs further bolster the demand for localized data processing and storage capabilities, underscoring the critical role of data centers in Nigeria's digital future. The absorption rate of existing capacity is expected to increase significantly as new enterprises and digital services come online, potentially leading to a need for rapid capacity expansion.

Dominant Markets & Segments in Nigeria Data Center Market

The Nigeria Data Center Market is characterized by distinct dominance across various segments, with Lagos emerging as the undisputed hotspot for data center development and operations. Its status as the nation's commercial and financial hub, coupled with its advanced telecommunications infrastructure and high concentration of businesses, makes it the primary destination for data center investment. Within this vibrant ecosystem, Lagos is the leading region, accounting for over 70% of the current and projected data center capacity.

- Data Center Size: The market is seeing a pronounced demand for Large and Mega data centers, driven by the requirements of hyperscale cloud providers and large enterprises undertaking significant digital transformations. While Medium and Small data centers cater to the needs of SMEs and niche applications, the trend is clearly towards colossally scaled facilities to support the exponential growth in data generated by digital services and the increasing penetration of cloud computing.

- Tier Type: Tier 3 and Tier 4 data centers are becoming the benchmark for new developments, reflecting the critical need for high availability, fault tolerance, and robust uptime guarantees, especially for mission-critical applications in sectors like BFSI and government. While Tier 1 and Tier 2 facilities exist, the market's trajectory is towards higher reliability tiers to meet the stringent demands of modern digital operations and minimize the risk of downtime, which can result in significant financial losses.

- Absorption: Currently, there exists a significant amount of Non-Utilized capacity, representing a key opportunity for market players to attract new clients and expand their footprint. However, with the projected growth in demand, this absorption rate is expected to climb sharply in the coming years. This presents a strategic window for investment and expansion before saturation occurs.

- Colocation Type: Hyperscale colocation is the most significant growth segment, driven by the massive infrastructure needs of global cloud giants like AWS, Azure, and Google Cloud, as well as large local cloud providers. Wholesale colocation also plays a crucial role, catering to large enterprises requiring dedicated capacity. Retail colocation, serving smaller businesses and individual racks, continues to be important but is gradually being overshadowed by the larger-scale demands.

- End User: The Telecom sector remains a foundational pillar, requiring extensive connectivity and data processing capabilities. However, Cloud service providers and E-Commerce businesses are rapidly emerging as dominant end-users, consuming vast amounts of data center resources to power their digital platforms and services. The BFSI sector is another critical segment, demanding high security and uptime for financial transactions and customer data. The Government sector is also increasingly investing in digital infrastructure for e-governance initiatives and data management. While Manufacturing and Media & Entertainment are growing, their current consumption is less significant compared to the aforementioned sectors.

Nigeria Data Center Market Product Developments

Product developments in the Nigeria Data Center Market are increasingly focused on enhancing efficiency, scalability, and sustainability. Innovations in cooling technologies, such as liquid cooling, are gaining traction to manage the heat generated by high-density computing environments within hyperscale facilities. Advanced power management systems, including renewable energy integration and sophisticated backup power solutions, are crucial for achieving higher Tier certifications and ensuring uninterrupted service. Modular data center designs are also emerging, allowing for rapid deployment and scalable expansion to meet fluctuating demand. Furthermore, the development of specialized software for data center infrastructure management (DCIM) is enhancing operational efficiency, providing real-time monitoring, and enabling predictive maintenance, which is vital for maintaining optimal performance and minimizing downtime. These advancements collectively contribute to a more robust, reliable, and cost-effective data center ecosystem in Nigeria, offering competitive advantages to operators and enhanced services to end-users.

Report Scope & Segmentation Analysis

This report meticulously analyzes the Nigeria Data Center Market across several key segmentation criteria to provide a holistic view of its diverse landscape. The market is segmented by Hotspot, with a primary focus on Lagos, recognizing its overwhelming dominance in infrastructure development and market activity. Further segmentation is conducted based on Data Center Size, categorizing the market into Small, Medium, Large, Mega, and Massive facilities, to understand the varying capacity needs and offerings. The Tier Type segmentation includes Tier 1 and 2, Tier 3, and Tier 4 data centers, highlighting the importance of reliability and uptime guarantees for different applications. Absorption levels are analyzed, focusing on Non-Utilized capacity and its implications for future growth. Colocation Type is broken down into Hyperscale, Retail, and Wholesale models, reflecting the diverse strategies of service providers and the needs of various clients. Finally, the report examines End User segments, including BFSI, Cloud, E-Commerce, Government, Manufacturing, Telecom, Media & Entertainment, and Other End User, to pinpoint the key drivers of demand and the evolving consumption patterns across the Nigerian economy. Each segment's growth projections and competitive dynamics are assessed within the study period, offering targeted insights into market potential and strategic positioning.

Key Drivers of Nigeria Data Center Market Growth

The Nigeria Data Center Market's rapid expansion is propelled by a potent combination of factors. A significant driver is the exponential growth in internet penetration and mobile data consumption, fueled by a young, digitally-native population. The increasing adoption of cloud computing services by businesses of all sizes is a monumental catalyst, seeking scalability, cost-efficiency, and enhanced disaster recovery capabilities. Furthermore, the burgeoning e-commerce sector and the widespread adoption of digital payment solutions necessitate robust and secure data storage and processing infrastructure. Government initiatives focused on digital transformation, such as e-governance programs and the development of smart cities, are also stimulating demand for localized data center services. Finally, increasing foreign direct investment in Nigeria's digital infrastructure, attracted by its large market potential and growing technological adoption, plays a crucial role in funding the development of advanced data center facilities.

Challenges in the Nigeria Data Center Market Sector

Despite its promising growth, the Nigeria Data Center Market faces several significant challenges. Inconsistent and unreliable power supply remains a major hurdle, necessitating substantial investment in backup generators and uninterrupted power supply systems, which increases operational costs. The high cost of bandwidth and connectivity, particularly outside major urban centers, can limit the accessibility and affordability of data center services for businesses in remote areas. Navigating the complex and evolving regulatory landscape, including data localization policies and varying tax structures, can pose challenges for investors and operators. Furthermore, the availability of skilled IT professionals for data center operations and maintenance can be a constraint, requiring significant investment in training and development. Supply chain disruptions for critical equipment and the high import duties on technology components also contribute to project delays and increased capital expenditure.

Emerging Opportunities in Nigeria Data Center Market

The Nigeria Data Center Market is ripe with emerging opportunities, particularly in the expansion of edge computing infrastructure to serve the growing demand for low-latency applications like IoT and real-time data analytics. The increasing digitalization of government services and the drive towards smart cities present a substantial opportunity for government cloud and data management solutions. The burgeoning fintech sector and the continued growth of e-commerce will continue to fuel demand for hyperscale and wholesale colocation facilities. Furthermore, the development of renewable energy sources and sustainable data center practices offers an opportunity for operators to differentiate themselves and appeal to environmentally conscious clients, potentially reducing operational costs in the long run. The increasing focus on data sovereignty and security regulations also creates opportunities for specialized, compliant data center offerings.

Leading Players in the Nigeria Data Center Market Market

- Africa Data Centers (Cassava Technologies)

- WIOCC (Open Access Data Centres)

- MDXi (MainOne by Equinix)

- Rack Centre Limited

- MTN Nigeria Communications Ltd

- Digital Realty (Medallion Communications Ltd)

Key Developments in Nigeria Data Center Market Industry

- April 2022: Equinix, Inc. acquired MainOne, the parent company of MDX-I, for about USD 320 million to begin its expansion into the African region. This would allow Equinix to practice its long-term strategy to offer carrier-neutral data center services in Nigeria.

Strategic Outlook for Nigeria Data Center Market Market

The strategic outlook for the Nigeria Data Center Market is overwhelmingly positive, driven by robust demand for digital services and ongoing infrastructure development. The market is poised for significant expansion, particularly in hyperscale and Tier 3/4 facilities, catering to the needs of cloud providers, e-commerce giants, and the financial services sector. Investments in fiber optic networks and the rollout of 5G will further accelerate data center adoption by enhancing connectivity and enabling advanced applications. Strategic partnerships and mergers are expected to continue, consolidating the market and fostering innovation. Opportunities exist in expanding edge computing capabilities and developing sustainable data center solutions. Addressing the challenges of power reliability and connectivity will be crucial for unlocking the full potential of this dynamic market, positioning Nigeria as a key digital hub in Africa.

Nigeria Data Center Market Segmentation

-

1. Hotspot

- 1.1. Lagos

-

2. Data Center Size

- 2.1. Large

- 2.2. Massive

- 2.3. Medium

- 2.4. Mega

- 2.5. Small

-

3. Tier Type

- 3.1. Tier 1 and 2

- 3.2. Tier 3

- 3.3. Tier 4

-

4. Absorption

- 4.1. Non-Utilized

-

5. Colocation Type

- 5.1. Hyperscale

- 5.2. Retail

- 5.3. Wholesale

-

6. End User

- 6.1. BFSI

- 6.2. Cloud

- 6.3. E-Commerce

- 6.4. Government

- 6.5. Manufacturing

- 6.6. Telecom

- 6.7. Media & Entertainment

- 6.8. Other End User

Nigeria Data Center Market Segmentation By Geography

- 1. Niger

Nigeria Data Center Market Regional Market Share

Geographic Coverage of Nigeria Data Center Market

Nigeria Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 24.99% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise of E-Commerce; Flourishing Startup Culture

- 3.3. Market Restrains

- 3.3.1. Slow Penetration Rate in Developing Countries

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Nigeria Data Center Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 5.1.1. Lagos

- 5.2. Market Analysis, Insights and Forecast - by Data Center Size

- 5.2.1. Large

- 5.2.2. Massive

- 5.2.3. Medium

- 5.2.4. Mega

- 5.2.5. Small

- 5.3. Market Analysis, Insights and Forecast - by Tier Type

- 5.3.1. Tier 1 and 2

- 5.3.2. Tier 3

- 5.3.3. Tier 4

- 5.4. Market Analysis, Insights and Forecast - by Absorption

- 5.4.1. Non-Utilized

- 5.5. Market Analysis, Insights and Forecast - by Colocation Type

- 5.5.1. Hyperscale

- 5.5.2. Retail

- 5.5.3. Wholesale

- 5.6. Market Analysis, Insights and Forecast - by End User

- 5.6.1. BFSI

- 5.6.2. Cloud

- 5.6.3. E-Commerce

- 5.6.4. Government

- 5.6.5. Manufacturing

- 5.6.6. Telecom

- 5.6.7. Media & Entertainment

- 5.6.8. Other End User

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. Niger

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Africa Data Centers (Cassava Technologies)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 WIOCC (Open Access Data Centres)5 4 LIST OF COMPANIES STUDIE

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 MDXi (MainOne by Equinix)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Rack Centre Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 MTN Nigeria Communications Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Digital Realty (Medallion Communications Ltd)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Africa Data Centers (Cassava Technologies)

List of Figures

- Figure 1: Nigeria Data Center Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Nigeria Data Center Market Share (%) by Company 2025

List of Tables

- Table 1: Nigeria Data Center Market Revenue million Forecast, by Hotspot 2020 & 2033

- Table 2: Nigeria Data Center Market Volume K Unit Forecast, by Hotspot 2020 & 2033

- Table 3: Nigeria Data Center Market Revenue million Forecast, by Data Center Size 2020 & 2033

- Table 4: Nigeria Data Center Market Volume K Unit Forecast, by Data Center Size 2020 & 2033

- Table 5: Nigeria Data Center Market Revenue million Forecast, by Tier Type 2020 & 2033

- Table 6: Nigeria Data Center Market Volume K Unit Forecast, by Tier Type 2020 & 2033

- Table 7: Nigeria Data Center Market Revenue million Forecast, by Absorption 2020 & 2033

- Table 8: Nigeria Data Center Market Volume K Unit Forecast, by Absorption 2020 & 2033

- Table 9: Nigeria Data Center Market Revenue million Forecast, by Colocation Type 2020 & 2033

- Table 10: Nigeria Data Center Market Volume K Unit Forecast, by Colocation Type 2020 & 2033

- Table 11: Nigeria Data Center Market Revenue million Forecast, by End User 2020 & 2033

- Table 12: Nigeria Data Center Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 13: Nigeria Data Center Market Revenue million Forecast, by Region 2020 & 2033

- Table 14: Nigeria Data Center Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 15: Nigeria Data Center Market Revenue million Forecast, by Hotspot 2020 & 2033

- Table 16: Nigeria Data Center Market Volume K Unit Forecast, by Hotspot 2020 & 2033

- Table 17: Nigeria Data Center Market Revenue million Forecast, by Data Center Size 2020 & 2033

- Table 18: Nigeria Data Center Market Volume K Unit Forecast, by Data Center Size 2020 & 2033

- Table 19: Nigeria Data Center Market Revenue million Forecast, by Tier Type 2020 & 2033

- Table 20: Nigeria Data Center Market Volume K Unit Forecast, by Tier Type 2020 & 2033

- Table 21: Nigeria Data Center Market Revenue million Forecast, by Absorption 2020 & 2033

- Table 22: Nigeria Data Center Market Volume K Unit Forecast, by Absorption 2020 & 2033

- Table 23: Nigeria Data Center Market Revenue million Forecast, by Colocation Type 2020 & 2033

- Table 24: Nigeria Data Center Market Volume K Unit Forecast, by Colocation Type 2020 & 2033

- Table 25: Nigeria Data Center Market Revenue million Forecast, by End User 2020 & 2033

- Table 26: Nigeria Data Center Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 27: Nigeria Data Center Market Revenue million Forecast, by Country 2020 & 2033

- Table 28: Nigeria Data Center Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Nigeria Data Center Market?

The projected CAGR is approximately 24.99%.

2. Which companies are prominent players in the Nigeria Data Center Market?

Key companies in the market include Africa Data Centers (Cassava Technologies), WIOCC (Open Access Data Centres)5 4 LIST OF COMPANIES STUDIE, MDXi (MainOne by Equinix), Rack Centre Limited, MTN Nigeria Communications Ltd, Digital Realty (Medallion Communications Ltd).

3. What are the main segments of the Nigeria Data Center Market?

The market segments include Hotspot, Data Center Size, Tier Type, Absorption, Colocation Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 288 million as of 2022.

5. What are some drivers contributing to market growth?

Rise of E-Commerce; Flourishing Startup Culture.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Slow Penetration Rate in Developing Countries.

8. Can you provide examples of recent developments in the market?

April 2022: Equinix, Inc. acquired MainOne, the parent company of MDX-I, for about USD 320 million to begin its expansion into the African region. This would allow Equinix to practise its long-term strategy to offer carrier-neutral data center services in Nigeria.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Nigeria Data Center Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Nigeria Data Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Nigeria Data Center Market?

To stay informed about further developments, trends, and reports in the Nigeria Data Center Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence