Key Insights

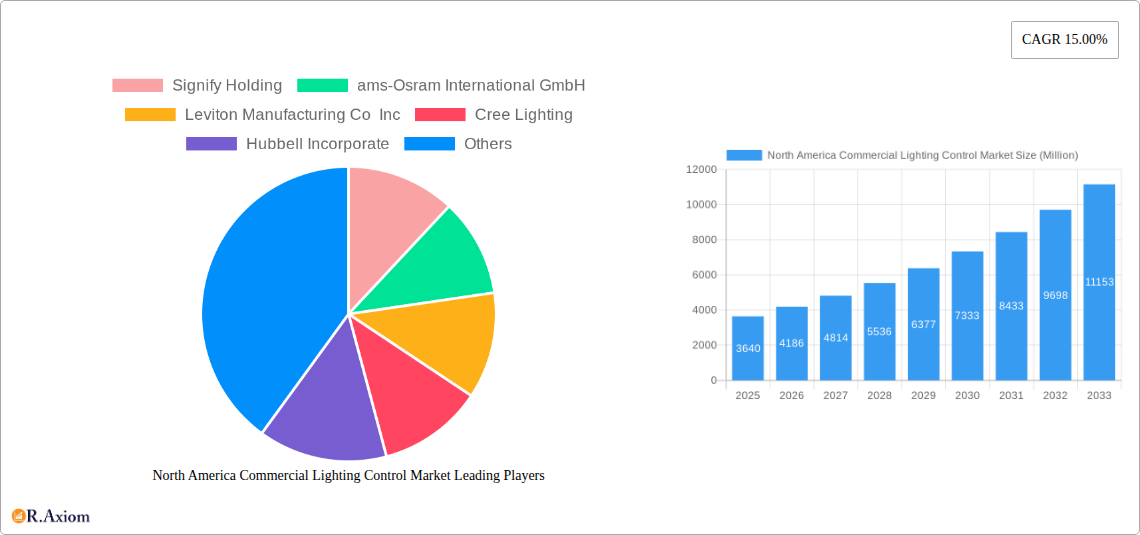

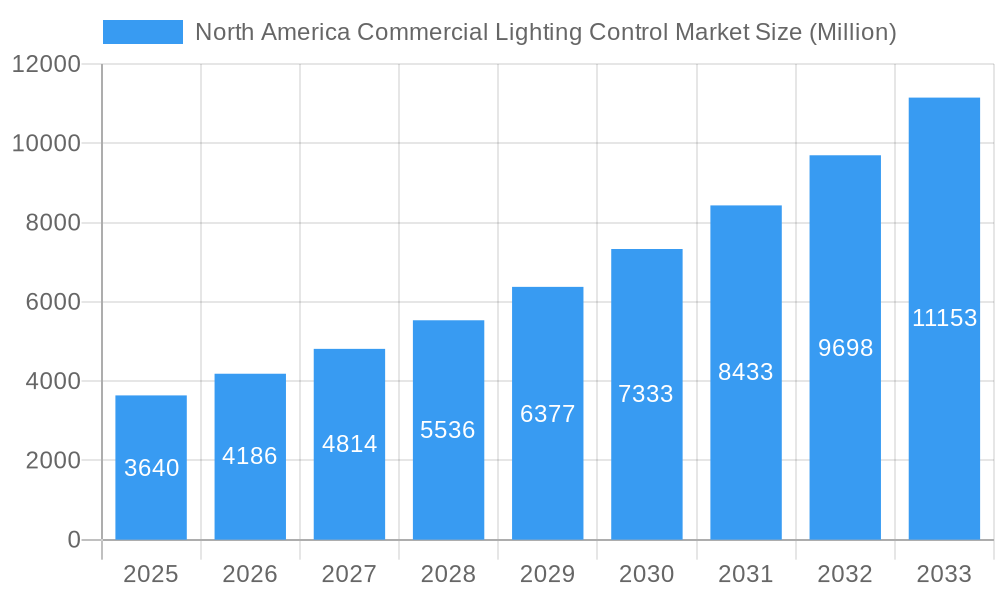

The North American commercial lighting control market is poised for substantial expansion, with a current estimated market size of $3.64 billion and a projected CAGR of 15.00% through 2033. This robust growth is fueled by a confluence of factors, primarily the increasing demand for energy efficiency and sustainability across commercial sectors. Regulations and incentives aimed at reducing carbon footprints and operational costs are compelling businesses to adopt advanced lighting control solutions. Smart building initiatives, driven by the integration of IoT technologies, are further accelerating adoption, enabling sophisticated automation, enhanced occupant comfort, and improved facility management. The "Smart Building" trend is a significant driver, pushing for integrated systems where lighting controls play a central role in overall building intelligence and operational optimization.

North America Commercial Lighting Control Market Market Size (In Billion)

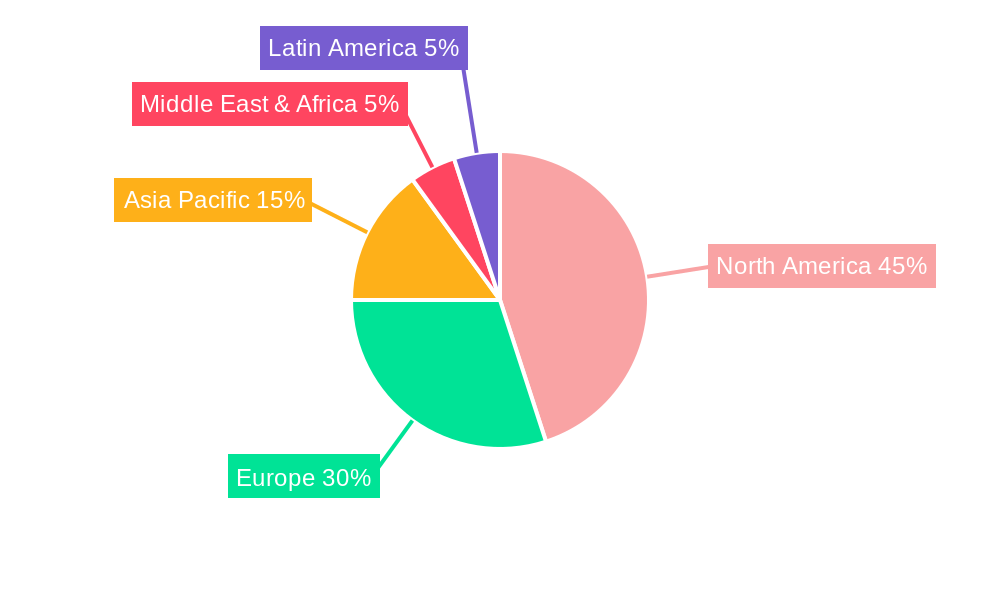

The market is segmented by type into hardware, software, and communication protocols, with hardware components like sensors and controllers forming a substantial portion due to their foundational role. Software solutions are gaining prominence as they enable advanced analytics, remote management, and seamless integration with other building systems. Communication protocols are crucial for interoperability and are evolving to support more complex networks. Key industries driving this growth include office buildings, where energy savings and employee productivity are paramount, followed by retail stores aiming to optimize ambiance and operational expenses, and healthcare facilities seeking to improve patient environments and reduce energy consumption. North America, with its advanced technological infrastructure and strong focus on sustainability, represents a significant portion of the global market, with the United States leading adoption.

North America Commercial Lighting Control Market Company Market Share

North America Commercial Lighting Control Market Market Concentration & Innovation

The North America Commercial Lighting Control Market exhibits a moderately concentrated landscape, characterized by the strong presence of established global players alongside emerging innovators. Key companies like Signify Holding, ams-Osram International GmbH, Leviton Manufacturing Co Inc, Cree Lighting, Hubbell Incorporate, Lutron Electronics Co Inc, Schneider Electric, Acuity Brands Inc, Digital Lumens Incorporated, and Eaton Corporation hold significant market share. Innovation is primarily driven by the increasing demand for energy efficiency, smart building integration, and enhanced occupant comfort. Regulatory frameworks, particularly in the United States and Canada, mandating energy-saving standards, are crucial innovation accelerators. Product substitutes are limited in their direct impact, but advancements in standalone LED fixtures without integrated controls present a mild competitive challenge. End-user trends show a clear shift towards networked and intelligent lighting systems that offer granular control, data analytics, and integration with Building Management Systems (BMS). Mergers and acquisitions (M&A) are strategic moves to consolidate market share, acquire innovative technologies, and expand product portfolios. For instance, reported M&A deal values in the past five years have ranged from tens to hundreds of millions of dollars, indicating significant investment in market consolidation and technological advancement. This dynamic environment fosters continuous product development and strategic partnerships to maintain a competitive edge in the evolving commercial lighting control sector.

North America Commercial Lighting Control Market Industry Trends & Insights

The North America Commercial Lighting Control Market is poised for substantial growth, driven by a confluence of technological advancements, evolving regulatory landscapes, and a heightened awareness of energy conservation and operational efficiency across various commercial sectors. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately XX% between the base year of 2025 and the forecast period ending in 2033. This robust growth is underpinned by several key trends. Firstly, the relentless pursuit of energy savings in commercial buildings remains a primary catalyst. With rising electricity costs and increasing environmental regulations, businesses are actively investing in lighting control solutions that significantly reduce energy consumption. Smart lighting systems, featuring occupancy sensors, daylight harvesting, and scheduling functionalities, are becoming standard. Secondly, the integration of Internet of Things (IoT) technology is transforming traditional lighting into intelligent, connected networks. These networked systems enable remote monitoring, diagnostics, and control, facilitating proactive maintenance and optimized energy usage. The proliferation of wireless communication protocols such as Bluetooth Low Energy (BLE), Zigbee, and Wi-Fi is further simplifying installation and expanding the capabilities of these smart systems.

Thirdly, the demand for enhanced occupant comfort and well-being is increasingly influencing purchasing decisions. Advanced lighting controls allow for dynamic adjustments in light intensity and color temperature, mimicking natural daylight patterns and improving productivity and mood in office environments, retail spaces, and educational institutions. The "health and wellness" trend is directly impacting the adoption of tunable white and circadian rhythm lighting solutions. Fourthly, the growing adoption of Building Information Modeling (BIM) and smart building technologies is creating a synergistic effect, where lighting controls are seamlessly integrated into the broader building management infrastructure. This holistic approach optimizes building performance, reduces operational costs, and enhances the overall user experience. Finally, the competitive landscape is characterized by both consolidation and innovation. Leading manufacturers are focusing on developing integrated solutions that combine hardware, software, and advanced analytics, while also exploring new business models such as Software-as-a-Service (SaaS) for lighting management. The market penetration of advanced lighting control solutions is expected to deepen as the benefits become more widely recognized and the cost of implementation decreases.

Dominant Markets & Segments in North America Commercial Lighting Control Market

The North America Commercial Lighting Control Market is segmented by Type, Communication Protocol, and Industry, with distinct segments demonstrating varying levels of dominance and growth potential.

Dominant Region/Country: The United States currently holds the largest market share within North America, driven by its extensive commercial real estate footprint, stringent energy efficiency mandates (such as ASHRAE standards and state-level energy codes), and a robust economy that supports significant investment in building upgrades and new construction. Canadian markets, while smaller, are also experiencing steady growth fueled by similar energy conservation initiatives and a growing interest in smart building technologies.

Dominant Segments by Type:

- Hardware: This segment consistently leads the market.

- Key Drivers: The foundational nature of hardware components like sensors (occupancy, daylight), controllers, dimmers, and switches makes them essential for any lighting control system. The ongoing replacement cycles of older lighting infrastructure with energy-efficient LEDs, which often integrate control capabilities, further fuels hardware demand. Market penetration of advanced sensor technologies is particularly high in new construction and major retrofits.

- Software: This segment is witnessing the fastest growth.

- Key Drivers: Sophisticated lighting control software, including management platforms and analytics tools, is crucial for maximizing the benefits of networked systems. The increasing adoption of IoT and cloud-based solutions for remote management, energy reporting, and fault detection is driving significant growth. Software enables features like advanced scheduling, scene setting, and integration with other building systems.

- Communication Protocol: This segment plays a vital enabling role.

- Key Drivers: While not a standalone product category in terms of direct sales, the dominance of protocols like BACnet and LonWorks in enterprise-level building management systems, and the rapid rise of wireless protocols like Bluetooth Low Energy (BLE) and Zigbee for ease of installation and scalability, are critical. The choice of protocol dictates system interoperability and functionality, influencing hardware and software adoption.

Dominant Segments by Industry:

- Office Buildings: This segment represents the largest market for commercial lighting controls.

- Key Drivers: High energy consumption, large floor areas, and a strong focus on employee productivity and comfort make office buildings prime candidates for advanced lighting control solutions. The trend towards flexible workspaces and smart building integration further amplifies demand. Strict energy codes and corporate sustainability goals are major adoption catalysts.

- Retail Stores: This segment is a significant and growing market.

- Key Drivers: Retailers are increasingly leveraging lighting controls to enhance customer experience, create dynamic in-store atmospheres, and reduce operational costs. Dynamic lighting that adjusts based on time of day, customer traffic, and product displays is becoming more prevalent. Energy savings are also a key consideration, especially in large format stores.

- Healthcare Facilities: This segment shows strong growth driven by specific needs.

- Key Drivers: Beyond energy savings, healthcare facilities prioritize patient well-being, staff productivity, and operational efficiency. Lighting controls that support circadian rhythms, task lighting in examination rooms, and automated dimming in corridors contribute to these goals. The need for precise control and integration with building management systems for security and HVAC optimization is paramount.

- Education Facilities: This segment is experiencing steady adoption.

- Key Drivers: Schools and universities are increasingly investing in smart technologies to create conducive learning environments and reduce energy expenditures. Lighting controls in classrooms, lecture halls, and administrative areas help manage energy use and improve learning outcomes through optimized lighting conditions. Budgetary constraints can influence adoption rates, but the long-term energy savings are a compelling factor.

North America Commercial Lighting Control Market Product Developments

Product innovation in the North America Commercial Lighting Control Market is centered on enhancing intelligence, connectivity, and user experience. Manufacturers are developing integrated solutions that combine advanced hardware, intuitive software, and seamless wireless communication. Key trends include the proliferation of tunable white and circadian rhythm lighting systems, which mimic natural daylight patterns to improve occupant well-being and productivity. The integration of AI and machine learning into lighting control platforms enables predictive maintenance, optimized energy usage based on real-time occupancy data, and personalized lighting experiences. Furthermore, the development of modular and scalable control systems simplifies installation and allows for easy upgrades, catering to diverse commercial building needs. The focus remains on delivering robust, energy-efficient, and user-friendly solutions that provide measurable ROI for commercial clients.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the North America Commercial Lighting Control Market, meticulously segmented to offer granular insights. The segmentation includes:

- Type: This encompasses Hardware (sensors, controllers, switches, dimmers), Software (management platforms, analytics, cloud-based solutions), and Communication Protocol (DALI, Zigbee, BLE, BACnet, proprietary protocols). Growth projections for hardware are steady, while software is expected to exhibit rapid expansion.

- Industry: The analysis covers key sectors including Office Buildings, Retail Stores, Healthcare Facilities, and Education Facilities. Office Buildings currently dominate, with healthcare and retail demonstrating high growth potential due to specialized application needs.

- Geographic: The report focuses on the North American region, with detailed breakdowns for the United States and Canada.

The market size and competitive dynamics are analyzed for each segment, with a particular focus on identifying areas of high growth and emerging opportunities within these classifications.

Key Drivers of North America Commercial Lighting Control Market Growth

Several key factors are propelling the growth of the North America Commercial Lighting Control Market. Increasing energy costs and a strong regulatory push for energy efficiency are paramount, compelling businesses to adopt sophisticated control systems to reduce consumption. The widespread adoption of LED technology, which is inherently compatible with advanced controls, provides a significant tailwind. Furthermore, the growing integration of smart building technologies and the Internet of Things (IoT) is driving demand for networked lighting solutions that offer data analytics, remote management, and enhanced functionality. The rising awareness of occupant well-being and productivity is also a crucial driver, with demand for dynamic lighting that mimics natural daylight patterns. Finally, government incentives and tax credits for energy-efficient upgrades further stimulate market expansion.

Challenges in the North America Commercial Lighting Control Market Sector

Despite robust growth, the North America Commercial Lighting Control Market faces several challenges. High initial investment costs for advanced systems can be a deterrent for smaller businesses or those with tight budgets. Lack of awareness and understanding regarding the full benefits of sophisticated lighting controls among some end-users can hinder adoption. Interoperability issues between different manufacturers' systems and communication protocols can create complexities during integration. Security concerns related to connected devices and data privacy are also emerging as potential barriers, requiring robust cybersecurity measures. Furthermore, skilled labor shortages for installation and maintenance of complex systems can impact deployment efficiency.

Emerging Opportunities in North America Commercial Lighting Control Market

The North America Commercial Lighting Control Market is ripe with emerging opportunities. The increasing focus on smart city initiatives presents a significant avenue for expanding lighting control solutions into public infrastructure like street lighting and smart buildings. The growing demand for data analytics and insights from lighting systems, beyond just energy savings, opens opportunities for value-added services in building optimization and space utilization. The burgeoning trend of well-being in the workplace and public spaces is driving demand for advanced solutions like tunable white and circadian lighting. Furthermore, the integration of lighting controls with other building systems, such as HVAC and security, to create truly intelligent and automated environments offers significant cross-selling and up-selling potential. The continued evolution of wireless communication technologies is also creating opportunities for more flexible and cost-effective deployments.

Leading Players in the North America Commercial Lighting Control Market Market

- Signify Holding

- ams-Osram International GmbH

- Leviton Manufacturing Co Inc

- Cree Lighting

- Hubbell Incorporate

- Lutron Electronics Co Inc

- Schneider Electric

- Acuity Brands Inc

- Digital Lumens Incorporated

- Eaton Corporation

Key Developments in North America Commercial Lighting Control Market Industry

- 2023/2024: Increased focus on AI-driven analytics for predictive maintenance and energy optimization in lighting systems.

- 2023: Expansion of wireless communication protocols (e.g., Bluetooth Mesh) for enhanced scalability and ease of installation in retrofits.

- 2022/2023: Greater integration of lighting controls with Building Management Systems (BMS) for holistic smart building management.

- 2022: Introduction of advanced tunable white and circadian rhythm lighting solutions to enhance occupant well-being.

- 2021/2022: Strategic acquisitions and partnerships aimed at consolidating market share and expanding product portfolios in IoT-enabled lighting controls.

- 2020/2021: Continued emphasis on energy efficiency mandates driving the adoption of smart lighting controls across commercial sectors.

Strategic Outlook for North America Commercial Lighting Control Market Market

The strategic outlook for the North America Commercial Lighting Control Market remains exceptionally positive, fueled by an unyielding demand for energy efficiency and the accelerating adoption of smart building technologies. The market's growth trajectory is set to be further propelled by advancements in IoT, AI, and wireless connectivity, enabling more sophisticated and integrated lighting solutions. Companies that focus on developing user-friendly, data-driven platforms that offer tangible ROI through energy savings, enhanced occupant comfort, and operational efficiency will be best positioned for success. Strategic partnerships, mergers, and acquisitions will continue to shape the competitive landscape, allowing for innovation and market expansion. The increasing recognition of lighting controls as a critical component of sustainable and intelligent buildings ensures sustained growth and the emergence of new application areas.

North America Commercial Lighting Control Market Segmentation

-

1. Type

- 1.1. Hardware

- 1.2. Software

- 1.3. Communication Protocol

-

2. Industry

- 2.1. Office Buildings

- 2.2. Retail Stores

- 2.3. Healthcare Facilities

- 2.4. Education Facilities

North America Commercial Lighting Control Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Commercial Lighting Control Market Regional Market Share

Geographic Coverage of North America Commercial Lighting Control Market

North America Commercial Lighting Control Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Preferance for Energy-Saving Lighting Options; Several Government Regulations for Adopting Energy Efficient Lighting Options

- 3.3. Market Restrains

- 3.3.1. High Initial Cost of Installations

- 3.4. Market Trends

- 3.4.1. Wireless Communication Protocol Segment is Expected to Grow Significantly

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Commercial Lighting Control Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. Communication Protocol

- 5.2. Market Analysis, Insights and Forecast - by Industry

- 5.2.1. Office Buildings

- 5.2.2. Retail Stores

- 5.2.3. Healthcare Facilities

- 5.2.4. Education Facilities

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Signify Holding

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ams-Osram International GmbH

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Leviton Manufacturing Co Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Cree Lighting

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hubbell Incorporate

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Lutron Electronics Co Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Schneider Electric

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Acuity Brands Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Digital Lumens Incorporated

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Eaton Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Signify Holding

List of Figures

- Figure 1: North America Commercial Lighting Control Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Commercial Lighting Control Market Share (%) by Company 2025

List of Tables

- Table 1: North America Commercial Lighting Control Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: North America Commercial Lighting Control Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: North America Commercial Lighting Control Market Revenue Million Forecast, by Industry 2020 & 2033

- Table 4: North America Commercial Lighting Control Market Volume K Unit Forecast, by Industry 2020 & 2033

- Table 5: North America Commercial Lighting Control Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: North America Commercial Lighting Control Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: North America Commercial Lighting Control Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: North America Commercial Lighting Control Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 9: North America Commercial Lighting Control Market Revenue Million Forecast, by Industry 2020 & 2033

- Table 10: North America Commercial Lighting Control Market Volume K Unit Forecast, by Industry 2020 & 2033

- Table 11: North America Commercial Lighting Control Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: North America Commercial Lighting Control Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: United States North America Commercial Lighting Control Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States North America Commercial Lighting Control Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Canada North America Commercial Lighting Control Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada North America Commercial Lighting Control Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Mexico North America Commercial Lighting Control Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Mexico North America Commercial Lighting Control Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Commercial Lighting Control Market?

The projected CAGR is approximately 15.00%.

2. Which companies are prominent players in the North America Commercial Lighting Control Market?

Key companies in the market include Signify Holding, ams-Osram International GmbH, Leviton Manufacturing Co Inc, Cree Lighting, Hubbell Incorporate, Lutron Electronics Co Inc, Schneider Electric, Acuity Brands Inc, Digital Lumens Incorporated, Eaton Corporation.

3. What are the main segments of the North America Commercial Lighting Control Market?

The market segments include Type, Industry .

4. Can you provide details about the market size?

The market size is estimated to be USD 3.64 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Preferance for Energy-Saving Lighting Options; Several Government Regulations for Adopting Energy Efficient Lighting Options.

6. What are the notable trends driving market growth?

Wireless Communication Protocol Segment is Expected to Grow Significantly.

7. Are there any restraints impacting market growth?

High Initial Cost of Installations.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Commercial Lighting Control Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Commercial Lighting Control Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Commercial Lighting Control Market?

To stay informed about further developments, trends, and reports in the North America Commercial Lighting Control Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence