Key Insights

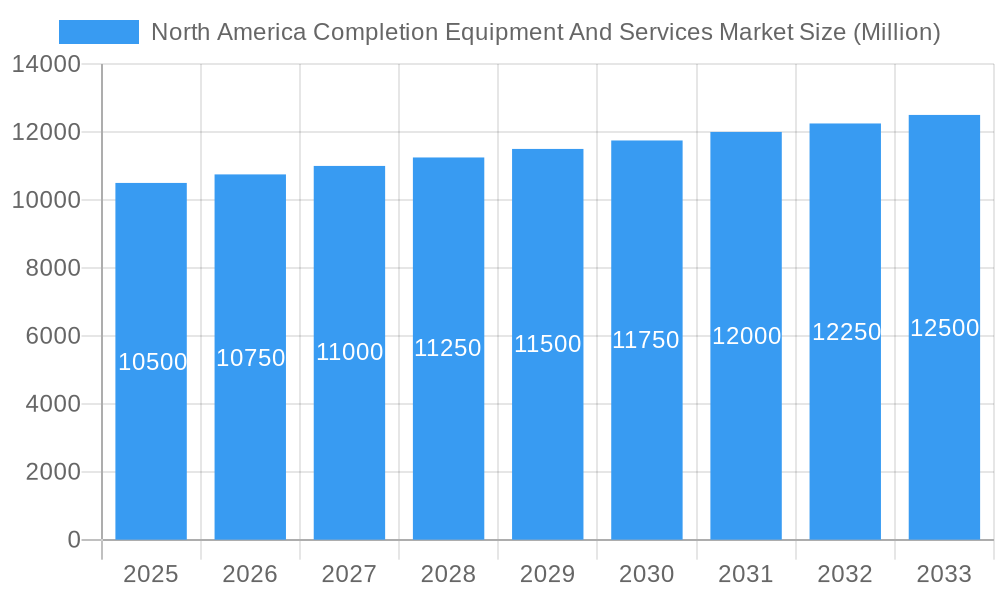

The North America Completion Equipment and Services market is projected for significant growth, anticipating a market size of $2.46 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 2.4% through 2033. This expansion is driven by escalating energy demand from robust economic activity and a growing global population, with the United States and Canada at the forefront. Technological advancements, including intelligent completions and multi-stage fracturing, are boosting well productivity and efficiency, thereby increasing the adoption of advanced equipment and specialized services. The continuous development of unconventional resources, such as shale oil and gas, remains a key driver, requiring sophisticated completion solutions for optimized extraction. Leading companies like Schlumberger, Halliburton, and Baker Hughes are at the forefront of innovation and service delivery, competing through technological expertise and comprehensive service offerings.

North America Completion Equipment And Services Market Market Size (In Billion)

The North American market is segmented by deployment location, encompassing both onshore and offshore operations. Onshore operations, primarily in the United States and Canada, currently lead due to extensive shale resource reserves. Offshore exploration and production, particularly in the Gulf of Mexico and off the Canadian coast, are also gaining momentum, presenting distinct opportunities and challenges for specialized completion equipment and services. Emerging trends include the integration of digital solutions, such as AI and IoT, for real-time monitoring and optimization of completion operations to minimize downtime and enhance safety. However, stringent environmental regulations and volatile oil and gas prices pose notable restraints. The ongoing energy transition and increased focus on renewable energy sources may also impact long-term market dynamics, necessitating strategic adaptations towards sustainable completion practices and technologies.

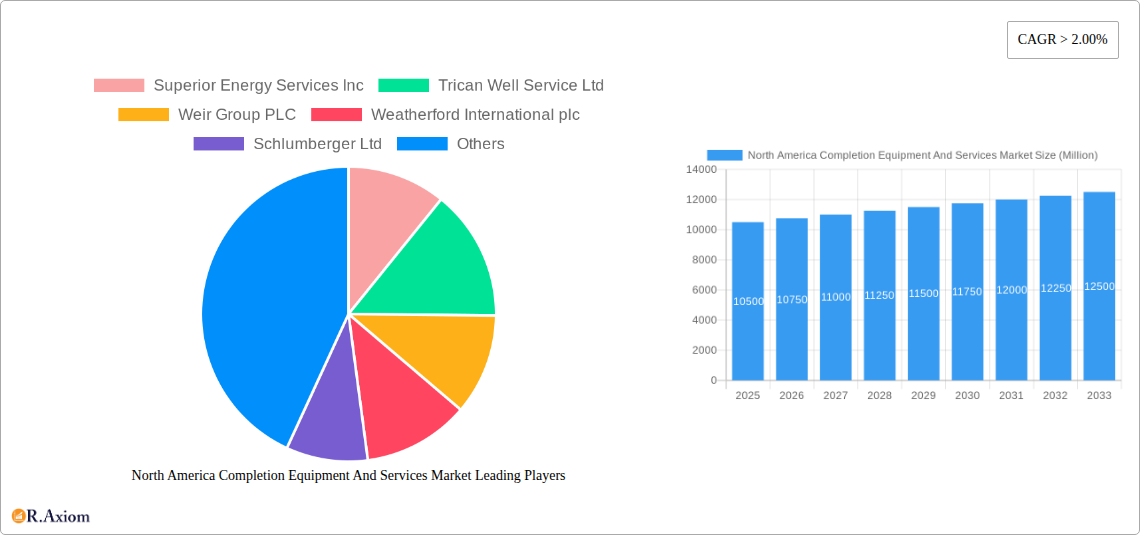

North America Completion Equipment And Services Market Company Market Share

This detailed report offers insights into the North America Completion Equipment and Services Market, covering market size, growth, and forecasts.

North America Completion Equipment And Services Market Market Concentration & Innovation

The North America Completion Equipment and Services Market is characterized by a moderate to high level of market concentration, with a few key global players holding significant market share. Innovation serves as a critical differentiator, driven by the relentless pursuit of enhanced oil and gas recovery, operational efficiency, and reduced environmental impact. Advanced completion technologies, including intelligent completions, multistage fracturing, and expandable sand screens, are at the forefront of innovation. Regulatory frameworks, particularly concerning environmental protection and safety standards, significantly influence product development and service offerings. For instance, stringent emissions regulations encourage the development of greener completion fluids and processes. Product substitutes, while present in the form of alternative energy sources, are not directly substitutable for the immediate needs of upstream oil and gas extraction. End-user trends highlight a demand for integrated solutions, cost-effectiveness, and reliable service delivery. Mergers and acquisitions (M&A) activities are prevalent as companies seek to consolidate their market position, expand their service portfolios, and gain access to new technologies and geographic regions. Notable M&A deals, with values often in the hundreds of millions of dollars, reshape the competitive landscape and market dynamics. The market share of leading players, often exceeding 10% individually, underscores the competitive intensity.

North America Completion Equipment And Services Market Industry Trends & Insights

The North America Completion Equipment and Services Market is projected to witness robust growth throughout the forecast period of 2025–2033. This expansion is fueled by several key market growth drivers. The sustained global demand for energy, particularly for oil and natural gas, necessitates continuous upstream exploration and production activities. The increasing complexity of hydrocarbon reservoirs, including unconventional resources like shale gas and tight oil, requires sophisticated completion techniques and specialized equipment to maximize recovery rates. Technological disruptions are profoundly impacting the market, with advancements in digital oilfield technologies, artificial intelligence (AI), and data analytics enabling real-time monitoring, predictive maintenance, and optimized well performance. The adoption of these technologies is enhancing operational efficiency and reducing downtime, thereby improving the overall economic viability of extraction projects. Consumer preferences are evolving to favor solutions that offer improved safety records, reduced environmental footprints, and greater cost predictability. Companies that can deliver these integrated and sustainable solutions are gaining a competitive edge. The competitive dynamics within the market are intense, with established oilfield service giants competing fiercely with specialized technology providers and regional players. Strategic partnerships and collaborations are becoming increasingly common as companies aim to leverage each other's expertise and market access. The compound annual growth rate (CAGR) for the market is anticipated to be in the range of 4.5% to 6.0%, reflecting a healthy and sustained expansion trajectory. Market penetration of advanced completion technologies is steadily increasing, particularly in mature basins and for complex well designs, further contributing to market growth.

Dominant Markets & Segments in North America Completion Equipment And Services Market

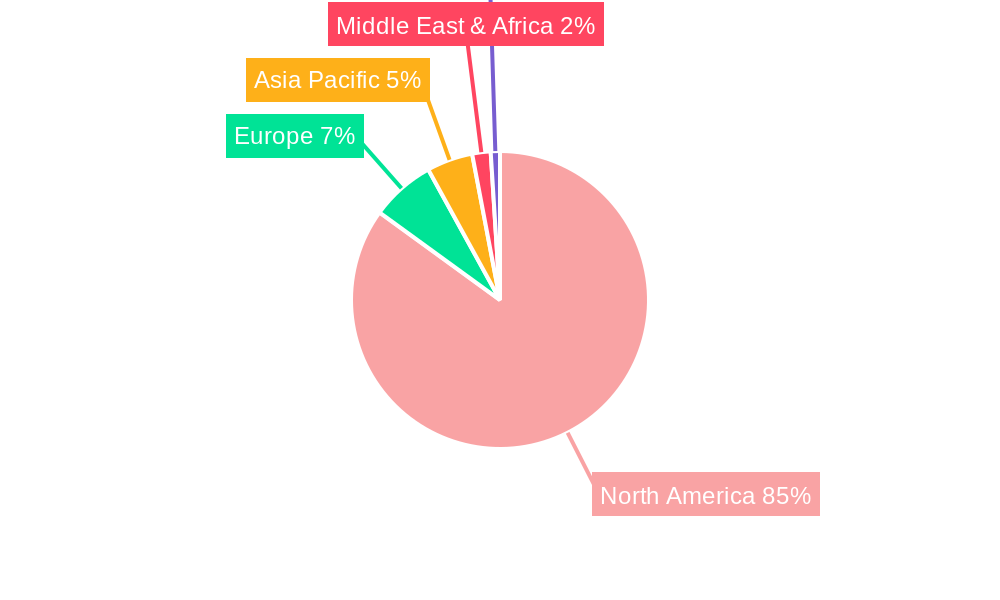

The United States stands as the dominant market within the North America Completion Equipment and Services Market, driven by its vast hydrocarbon reserves and extensive exploration and production activities. The Onshore deployment segment significantly outweighs its Offshore counterpart, reflecting the substantial shale plays and unconventional resource development across the nation.

United States - Onshore Dominance:

- Economic Policies: Supportive government policies and a favorable regulatory environment for oil and gas exploration and production in key regions like the Permian Basin, Eagle Ford Shale, and Bakken Shale have been instrumental in driving demand for completion equipment and services.

- Infrastructure: The presence of robust existing infrastructure, including pipelines, processing facilities, and transportation networks, facilitates efficient development and production of onshore reserves.

- Technological Advancement: The U.S. has been a hotbed for innovation in unconventional resource completion, particularly in hydraulic fracturing and horizontal drilling techniques, which require advanced completion tools and specialized services.

- Shale Revolution: The ongoing shale revolution continues to be a primary demand driver, with companies investing heavily in drilling and completing wells to tap into these vast reserves.

Canada - Significant Contributor:

- Resource Potential: Canada possesses significant oil and gas reserves, particularly in the Western Canadian Sedimentary Basin. While facing unique regulatory and environmental considerations, the country remains a crucial market for completion services.

- Oil Sands Development: The development of oil sands projects, while distinct from conventional drilling, still requires specialized completion techniques and associated services.

- Technological Adoption: Canadian operators are increasingly adopting advanced completion technologies to optimize production and manage complex reservoir conditions.

Rest of North America - Emerging Potential:

- While smaller in scale compared to the U.S. and Canada, the "Rest of North America" segment, which includes Mexico, presents emerging opportunities. Mexico's efforts to liberalize its energy sector and attract foreign investment are expected to boost exploration and production activities, thereby increasing demand for completion equipment and services.

- Exploration in frontier regions and the potential for unconventional resource development in specific areas contribute to the growing, albeit nascent, market.

Offshore Segment - Niche but Critical:

- While onshore dominates, the offshore segment, particularly in the U.S. Gulf of Mexico, remains critical for large-scale, deepwater projects. These projects necessitate highly specialized and technologically advanced completion solutions due to the harsh operating environments and complex geological formations.

- Discoveries like those announced by Talos Energy in January 2023 highlight the continued importance and potential of offshore exploration and production in the region.

North America Completion Equipment And Services Market Product Developments

Product developments in the North America Completion Equipment and Services Market are centered on enhancing efficiency, reliability, and environmental performance. Innovations include intelligent completion systems that allow for remote monitoring and control of downhole operations, maximizing hydrocarbon recovery and minimizing intervention costs. Advanced multi-stage fracturing tools and packers are being developed to optimize stimulation treatments in complex unconventional reservoirs. Furthermore, there's a growing focus on materials science to create more durable and corrosion-resistant equipment for harsh operating environments. The competitive advantage lies in offerings that reduce well lifecycle costs, improve safety, and support sustainable extraction practices, aligning with evolving industry demands and regulatory pressures.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the North America Completion Equipment and Services Market, segmented by Location of Deployment (Onshore, Offshore) and Geography (United States, Canada, Rest of North America).

The Onshore segment is projected to dominate the market due to extensive unconventional resource development, particularly in the United States. Growth here is driven by technological advancements in hydraulic fracturing and horizontal drilling, alongside supportive economic policies.

The Offshore segment, while smaller in volume, represents a high-value market segment. Significant growth is anticipated in deepwater exploration and production, particularly in the U.S. Gulf of Mexico, fueled by new discoveries and the need for advanced, reliable completion solutions.

The United States is the largest and most dynamic geographic market, characterized by widespread activity across both onshore and offshore domains. Its extensive reserves and ongoing technological innovation ensure its continued leadership.

Canada represents a significant market, primarily driven by its vast unconventional resources and the ongoing development of oil sands. Growth in this segment is influenced by commodity prices and regulatory frameworks.

The Rest of North America, primarily Mexico, is an emerging market with significant growth potential as it liberalizes its energy sector and attracts investment for exploration and production activities.

Key Drivers of North America Completion Equipment And Services Market Growth

Several factors are driving the growth of the North America Completion Equipment and Services Market. Technologically, the increasing complexity of reservoirs, particularly unconventional ones, necessitates advanced completion techniques and equipment to maximize hydrocarbon recovery. This includes innovations in hydraulic fracturing, intelligent completions, and downhole monitoring systems. Economically, the persistent global demand for oil and natural gas, coupled with favorable commodity prices at various times, incentivizes upstream investments and the drilling of new wells. Regulatory factors, while sometimes posing challenges, also drive demand for compliance-oriented solutions and technologies that enhance safety and environmental performance, such as stricter emissions control and improved well integrity measures.

Challenges in the North America Completion Equipment And Services Market Sector

Despite robust growth, the North America Completion Equipment and Services Market faces several challenges. Regulatory hurdles, particularly concerning environmental impact and permitting processes, can lead to project delays and increased operational costs. Fluctuations in commodity prices create uncertainty for exploration and production budgets, directly impacting demand for completion services. Supply chain disruptions, as experienced in recent years, can lead to material shortages and increased lead times for critical equipment, affecting project timelines and profitability. Furthermore, intense competition among a large number of service providers can lead to price pressures, squeezing profit margins for some companies. The ongoing energy transition also presents a long-term challenge, as a shift towards renewable energy sources could gradually impact the demand for fossil fuels.

Emerging Opportunities in North America Completion Equipment And Services Market

Emerging opportunities within the North America Completion Equipment and Services Market are abundant. The increasing focus on environmental sustainability is driving demand for lower-emission completion technologies and services, including carbon capture and utilization (CCUS) integration in production sites. Digitalization and AI are creating opportunities for predictive maintenance, optimized production through real-time data analysis, and remote operational management, leading to greater efficiency and cost savings. The development of enhanced oil recovery (EOR) techniques for mature fields presents a significant opportunity to extend the life of existing assets. Furthermore, as exploration pushes into more challenging and deeper offshore environments, there will be a growing need for highly specialized and innovative completion solutions. The integration of completion services with broader production optimization strategies also offers a pathway for service providers to offer more comprehensive and value-added solutions.

Leading Players in the North America Completion Equipment And Services Market Market

- Superior Energy Services Inc

- Trican Well Service Ltd

- Weir Group PLC

- Weatherford International plc

- Schlumberger Ltd

- Packers Plus Energy Services Inc

- Baker Hughes Company

- Halliburton Company

- National-Oilwell Varco Inc

- Schoeller-Bleckmann Oilfield Equipment AG

- Welltec A/S

Key Developments in North America Completion Equipment And Services Market Industry

- January 2023: Talos Energy announced that the company found commercial quantities of oil and natural gas at two deepwater discoveries in the U.S. Gulf of Mexico. The company carried out a drilling campaign at the Lime Rock and Venice prospects in the fourth quarter of 2022. This development underscores the ongoing exploration potential in the offshore U.S. market and the demand for associated completion services.

- March 2023: The Biden administration gave formal approval Monday for the Willow oil drilling project in Alaska, United States. ConocoPhillips is the owner of the project, which is expected to cost USD 8 billion. This significant project approval highlights continued investment in onshore oil production in the U.S. and will spur demand for a wide range of completion equipment and services.

Strategic Outlook for North America Completion Equipment And Services Market Market

The strategic outlook for the North America Completion Equipment and Services Market is one of sustained growth and evolving technological integration. Key growth catalysts include the ongoing demand for oil and natural gas to meet global energy needs, coupled with the exploitation of complex and unconventional reserves that require sophisticated completion solutions. The increasing adoption of digital technologies, AI, and data analytics will be pivotal in enhancing operational efficiency, reducing costs, and improving production outcomes. Companies that can offer integrated service packages, from well planning and execution to production optimization, will be best positioned for success. Furthermore, a strong focus on environmental, social, and governance (ESG) principles and the development of sustainable completion practices will be crucial for long-term market viability and attracting investment. The market will likely see continued consolidation through strategic M&A as companies seek to enhance their technological capabilities and expand their service offerings.

North America Completion Equipment And Services Market Segmentation

-

1. Location of Deployment

- 1.1. Onshore

- 1.2. Offshore

-

2. Geography

- 2.1. United States

- 2.2. Canada

- 2.3. Rest of North America

North America Completion Equipment And Services Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America Completion Equipment And Services Market Regional Market Share

Geographic Coverage of North America Completion Equipment And Services Market

North America Completion Equipment And Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Global Inclination toward Renewable-based Power Generation4.; Increased Power Demand in Line with the Increasing Population

- 3.3. Market Restrains

- 3.3.1. 4.; High Initial Cost

- 3.4. Market Trends

- 3.4.1. Onshore to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Completion Equipment And Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 5.1.1. Onshore

- 5.1.2. Offshore

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. United States

- 5.2.2. Canada

- 5.2.3. Rest of North America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 6. United States North America Completion Equipment And Services Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 6.1.1. Onshore

- 6.1.2. Offshore

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. United States

- 6.2.2. Canada

- 6.2.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 7. Canada North America Completion Equipment And Services Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 7.1.1. Onshore

- 7.1.2. Offshore

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. United States

- 7.2.2. Canada

- 7.2.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 8. Rest of North America North America Completion Equipment And Services Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 8.1.1. Onshore

- 8.1.2. Offshore

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. United States

- 8.2.2. Canada

- 8.2.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Superior Energy Services Inc

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Trican Well Service Ltd

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Weir Group PLC

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Weatherford International plc

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Schlumberger Ltd

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Packers Plus Energy Services Inc

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Baker Hughes Company

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Halliburton Company

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 National-Oilwell Varco Inc

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Schoeller-Bleckmann Oilfield Equipment AG

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 Welltec A/S

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.1 Superior Energy Services Inc

List of Figures

- Figure 1: North America Completion Equipment And Services Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Completion Equipment And Services Market Share (%) by Company 2025

List of Tables

- Table 1: North America Completion Equipment And Services Market Revenue billion Forecast, by Location of Deployment 2020 & 2033

- Table 2: North America Completion Equipment And Services Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 3: North America Completion Equipment And Services Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: North America Completion Equipment And Services Market Revenue billion Forecast, by Location of Deployment 2020 & 2033

- Table 5: North America Completion Equipment And Services Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: North America Completion Equipment And Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: North America Completion Equipment And Services Market Revenue billion Forecast, by Location of Deployment 2020 & 2033

- Table 8: North America Completion Equipment And Services Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 9: North America Completion Equipment And Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: North America Completion Equipment And Services Market Revenue billion Forecast, by Location of Deployment 2020 & 2033

- Table 11: North America Completion Equipment And Services Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: North America Completion Equipment And Services Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Completion Equipment And Services Market?

The projected CAGR is approximately 2.4%.

2. Which companies are prominent players in the North America Completion Equipment And Services Market?

Key companies in the market include Superior Energy Services Inc, Trican Well Service Ltd, Weir Group PLC, Weatherford International plc, Schlumberger Ltd, Packers Plus Energy Services Inc, Baker Hughes Company, Halliburton Company, National-Oilwell Varco Inc, Schoeller-Bleckmann Oilfield Equipment AG, Welltec A/S.

3. What are the main segments of the North America Completion Equipment And Services Market?

The market segments include Location of Deployment, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.46 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Global Inclination toward Renewable-based Power Generation4.; Increased Power Demand in Line with the Increasing Population.

6. What are the notable trends driving market growth?

Onshore to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Initial Cost.

8. Can you provide examples of recent developments in the market?

January 2023: Talos Energy announced that the company found commercial quantities of oil and natural gas at two deepwater discoveries in the U.S. Gulf of Mexico. The company carried out a drilling campaign at the Lime Rock and Venice prospects in the fourth quarter of 2022.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Completion Equipment And Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Completion Equipment And Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Completion Equipment And Services Market?

To stay informed about further developments, trends, and reports in the North America Completion Equipment And Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence