Key Insights

The North American Industrial Centrifuge Market is poised for significant expansion, projected to reach $10.22 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 6.7%. This robust growth is fueled by escalating demand across key sectors, including food and beverage processing, pharmaceuticals, and water and wastewater treatment. Advancements in separation technologies are enhancing operational efficiency and product quality in the food and beverage industry, while the pharmaceutical sector relies on precise purification capabilities. Growing environmental compliance mandates are also driving the adoption of advanced wastewater treatment solutions. The continuous operation mode is anticipated to lead market share due to its superior throughput and cost-effectiveness. Technological innovations in centrifuge design, including specialized horizontal and vertical models, are further contributing to the positive market outlook.

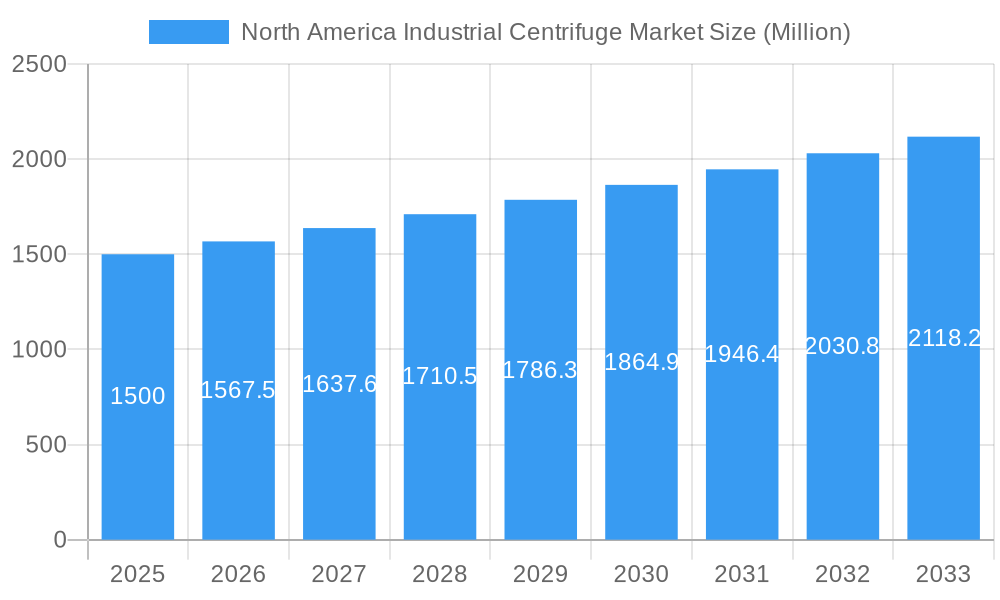

North America Industrial Centrifuge Market Market Size (In Billion)

Despite the promising growth trajectory, the market contends with challenges such as high initial capital expenditure and the requirement for specialized operators, which may impede adoption by smaller enterprises. However, evolving technologies, accessible financing, and heightened environmental awareness are expected to counterbalance these restraints. The competitive environment, marked by both global players and niche manufacturers, fosters continuous innovation and diverse product offerings. The United States is expected to maintain its leadership position, with Mexico showing accelerated growth driven by industrialization and foreign investment.

North America Industrial Centrifuge Market Company Market Share

North America Industrial Centrifuge Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America industrial centrifuge market, covering market size, segmentation, growth drivers, challenges, and key players. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report offers actionable insights for stakeholders across various segments, including manufacturers, end-users, and investors.

North America Industrial Centrifuge Market Market Concentration & Innovation

The North American industrial centrifuge market exhibits a moderately concentrated landscape, with several major players holding significant market share. While precise market share data for each company requires further investigation, key players such as GEA Group AG, Alfa Laval AB, and Flottweg SE are expected to account for a considerable portion of the overall market revenue. The market concentration is influenced by factors such as economies of scale, technological advancements, and brand recognition. However, the market also features several smaller niche players offering specialized solutions.

Innovation plays a crucial role in market growth, driven by increasing demands for higher efficiency, automation, and reduced operational costs. Recent advancements include the development of advanced control systems, improved materials, and the integration of Industry 4.0 technologies. Regulatory frameworks, particularly those concerning environmental protection and safety standards, significantly impact market dynamics. Stricter regulations often necessitate the adoption of more advanced and efficient centrifuge technologies. Product substitutes, while limited, include alternative separation techniques like filtration and decantation. However, centrifuges often maintain a competitive edge due to their superior efficiency and ability to handle high solids content. End-user trends toward automation, sustainability, and process optimization drive demand for technologically advanced centrifuges. M&A activity has been moderate, with deal values averaging xx Million annually during the historical period. The ongoing consolidation is anticipated to continue, driven by the desire for expansion and enhanced technological capabilities.

North America Industrial Centrifuge Market Industry Trends & Insights

The North American industrial centrifuge market exhibits a steady growth trajectory, projected to achieve a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by several factors, including the expansion of key end-use industries like pharmaceuticals, food and beverage processing, and water treatment. Technological disruptions, particularly the adoption of advanced materials and automation technologies, enhance centrifuge efficiency and operational capabilities. Consumer preferences are shifting towards more sustainable and efficient separation processes, pushing manufacturers to develop environmentally friendly solutions. Competitive dynamics are characterized by intense rivalry among major players, each striving to gain market share through technological innovation, strategic partnerships, and acquisitions. Market penetration of advanced centrifuge technologies remains relatively high in developed regions but offers substantial growth potential in less developed regions of North America.

Dominant Markets & Segments in North America Industrial Centrifuge Market

Leading Region/Country: The United States is expected to maintain its dominance within the North American market, driven by substantial industrial activity and technological advancements.

Dominant Operation Mode: Continuous operation centrifuges hold a larger market share than batch operation centrifuges owing to their superior processing capacity and efficiency.

Leading Industry: The pharmaceutical industry is predicted to be a major driver of market growth, given the strict purity requirements and high demand for efficient separation technologies.

Dominant Centrifuge Type: Sedimentation centrifuges are widely used across several industrial segments, contributing significantly to the market share.

Leading Centrifuge Design: Horizontal centrifuges have a more extensive market presence due to their adaptability to various applications and their high throughput capacities.

Key Drivers for Segment Dominance:

- Pharmaceutical Industry: Stringent regulatory requirements and the need for high-purity products drive demand for advanced centrifuge technologies.

- United States: High industrial output, robust infrastructure, and advanced technological capabilities sustain market growth.

- Continuous Operation: Superior efficiency and processing capacity propel the market dominance of this operating mode.

North America Industrial Centrifuge Market Product Developments

Recent product innovations focus on enhancing efficiency, automation, and ease of operation. The introduction of new materials capable of withstanding harsh conditions, along with advanced control systems, improves performance and reliability. The development of systems like GEA's Kytero addresses the need for reduced cleaning and maintenance procedures, boosting cost-effectiveness. These innovations enhance the competitiveness of centrifuges compared to alternative separation methods. The market is witnessing a growing trend toward modular and customizable centrifuge designs, allowing for better adaptation to specific customer needs.

Report Scope & Segmentation Analysis

This report segments the North American industrial centrifuge market based on operation mode (batch, continuous), industry (food and beverage, pharmaceutical, water and wastewater treatment, chemical, metal and mining, power, pulp and paper, other industries), type (sedimentation, filtering), and design (horizontal, vertical). Each segment’s growth projection, market size, and competitive dynamics are meticulously analyzed, offering insights into market trends and opportunities. For instance, the pharmaceutical segment is expected to exhibit significant growth due to stringent purity requirements. Continuous operation centrifuges are forecasted to hold a larger market share due to higher efficiency.

Key Drivers of North America Industrial Centrifuge Market Growth

Several factors propel the market’s expansion, including:

- Technological advancements: Innovations such as automated control systems, advanced materials, and improved designs enhance efficiency and productivity.

- Stringent environmental regulations: Growing concerns about waste management and environmental protection drive the adoption of efficient separation technologies.

- Expanding end-use industries: Growth in sectors like pharmaceuticals, food processing, and water treatment significantly boosts demand for industrial centrifuges.

Challenges in the North America Industrial Centrifuge Market Sector

The market faces several challenges, including:

- High initial investment costs: The purchase and installation of industrial centrifuges can be expensive, deterring some potential customers.

- Complex maintenance requirements: Regular maintenance and repairs are crucial for optimal performance and can be costly.

- Competition from alternative separation technologies: Alternative separation methods like filtration and decantation pose competition.

Emerging Opportunities in North America Industrial Centrifuge Market

Emerging opportunities include:

- Growth in emerging industries: Expansion of sectors like biofuels and renewable energy presents new applications for industrial centrifuges.

- Demand for customized solutions: Tailored centrifuge designs for specific applications offer significant market potential.

- Integration of digital technologies: The incorporation of Industry 4.0 technologies, such as predictive maintenance and remote monitoring, enhances operational efficiency and reduces downtime.

Leading Players in the North America Industrial Centrifuge Market Market

- Hiller Separation & Process GmbH

- Acutronic USA Inc

- Centrifuges Unlimited Inc

- Flottweg SE

- GEA Group AG

- CentraSep Technologies Inc

- Andritz AG

- Centrisys Corporation

- Alfa Laval AB

Key Developments in North America Industrial Centrifuge Market Industry

- August 2022: GEA launched Kytero, a new range of pharmaceutical industrial centrifuge systems for North America, featuring a 75% reduction in filter regions, elimination of intermediate tanks, and simplified cleaning processes.

- February 2022: Beckman Coulter introduced the Allegra V-15R refrigerated centrifuge, offering versatile rotor configurations and programmed runs for diverse applications.

Strategic Outlook for North America Industrial Centrifuge Market Market

The North American industrial centrifuge market is poised for continued growth, driven by technological innovation, expanding end-use industries, and stringent environmental regulations. Focus on sustainability, automation, and customized solutions will be key to success. Companies that invest in R&D and strategic partnerships will be well-positioned to capture market share. The market's future potential rests on meeting the evolving needs of diverse industries while ensuring efficient and environmentally responsible operations.

North America Industrial Centrifuge Market Segmentation

-

1. Type

- 1.1. Sedimentaion

- 1.2. Filtering

-

2. Design

- 2.1. Horizontal Centrifuge

- 2.2. Vertical Centrifuge

-

3. Operation Mode

- 3.1. Batch

- 3.2. Continuous

-

4. Industry

- 4.1. Food and Beverage

- 4.2. Pharmaceutical

- 4.3. Water and Wastewater Treatment

- 4.4. Chemical

- 4.5. Metal and Mining

- 4.6. Power

- 4.7. Pulp and Paper

- 4.8. Other Industries

-

5. Geography

- 5.1. United States

- 5.2. Canada

- 5.3. Rest of North America

North America Industrial Centrifuge Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America Industrial Centrifuge Market Regional Market Share

Geographic Coverage of North America Industrial Centrifuge Market

North America Industrial Centrifuge Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Demand from the Downstream Industry

- 3.3. Market Restrains

- 3.3.1. 4.; Adoption of Renewable and Clean Energy Sources

- 3.4. Market Trends

- 3.4.1. Water and Wastewater Treatment Expected to be the Fastest Growing Market Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Industrial Centrifuge Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Sedimentaion

- 5.1.2. Filtering

- 5.2. Market Analysis, Insights and Forecast - by Design

- 5.2.1. Horizontal Centrifuge

- 5.2.2. Vertical Centrifuge

- 5.3. Market Analysis, Insights and Forecast - by Operation Mode

- 5.3.1. Batch

- 5.3.2. Continuous

- 5.4. Market Analysis, Insights and Forecast - by Industry

- 5.4.1. Food and Beverage

- 5.4.2. Pharmaceutical

- 5.4.3. Water and Wastewater Treatment

- 5.4.4. Chemical

- 5.4.5. Metal and Mining

- 5.4.6. Power

- 5.4.7. Pulp and Paper

- 5.4.8. Other Industries

- 5.5. Market Analysis, Insights and Forecast - by Geography

- 5.5.1. United States

- 5.5.2. Canada

- 5.5.3. Rest of North America

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. United States

- 5.6.2. Canada

- 5.6.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Industrial Centrifuge Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Sedimentaion

- 6.1.2. Filtering

- 6.2. Market Analysis, Insights and Forecast - by Design

- 6.2.1. Horizontal Centrifuge

- 6.2.2. Vertical Centrifuge

- 6.3. Market Analysis, Insights and Forecast - by Operation Mode

- 6.3.1. Batch

- 6.3.2. Continuous

- 6.4. Market Analysis, Insights and Forecast - by Industry

- 6.4.1. Food and Beverage

- 6.4.2. Pharmaceutical

- 6.4.3. Water and Wastewater Treatment

- 6.4.4. Chemical

- 6.4.5. Metal and Mining

- 6.4.6. Power

- 6.4.7. Pulp and Paper

- 6.4.8. Other Industries

- 6.5. Market Analysis, Insights and Forecast - by Geography

- 6.5.1. United States

- 6.5.2. Canada

- 6.5.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada North America Industrial Centrifuge Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Sedimentaion

- 7.1.2. Filtering

- 7.2. Market Analysis, Insights and Forecast - by Design

- 7.2.1. Horizontal Centrifuge

- 7.2.2. Vertical Centrifuge

- 7.3. Market Analysis, Insights and Forecast - by Operation Mode

- 7.3.1. Batch

- 7.3.2. Continuous

- 7.4. Market Analysis, Insights and Forecast - by Industry

- 7.4.1. Food and Beverage

- 7.4.2. Pharmaceutical

- 7.4.3. Water and Wastewater Treatment

- 7.4.4. Chemical

- 7.4.5. Metal and Mining

- 7.4.6. Power

- 7.4.7. Pulp and Paper

- 7.4.8. Other Industries

- 7.5. Market Analysis, Insights and Forecast - by Geography

- 7.5.1. United States

- 7.5.2. Canada

- 7.5.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Rest of North America North America Industrial Centrifuge Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Sedimentaion

- 8.1.2. Filtering

- 8.2. Market Analysis, Insights and Forecast - by Design

- 8.2.1. Horizontal Centrifuge

- 8.2.2. Vertical Centrifuge

- 8.3. Market Analysis, Insights and Forecast - by Operation Mode

- 8.3.1. Batch

- 8.3.2. Continuous

- 8.4. Market Analysis, Insights and Forecast - by Industry

- 8.4.1. Food and Beverage

- 8.4.2. Pharmaceutical

- 8.4.3. Water and Wastewater Treatment

- 8.4.4. Chemical

- 8.4.5. Metal and Mining

- 8.4.6. Power

- 8.4.7. Pulp and Paper

- 8.4.8. Other Industries

- 8.5. Market Analysis, Insights and Forecast - by Geography

- 8.5.1. United States

- 8.5.2. Canada

- 8.5.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Hiller Separation & Process GmbH

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Acutronic USA Inc

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Centrifuges Unlimited Inc

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Flottweg SE

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 GEA Group AG

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 CentraSep Technologies Inc *List Not Exhaustive

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Andritz AG

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Centrisys Corporation

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Alfa Laval AB

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.1 Hiller Separation & Process GmbH

List of Figures

- Figure 1: North America Industrial Centrifuge Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Industrial Centrifuge Market Share (%) by Company 2025

List of Tables

- Table 1: North America Industrial Centrifuge Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: North America Industrial Centrifuge Market Revenue billion Forecast, by Design 2020 & 2033

- Table 3: North America Industrial Centrifuge Market Revenue billion Forecast, by Operation Mode 2020 & 2033

- Table 4: North America Industrial Centrifuge Market Revenue billion Forecast, by Industry 2020 & 2033

- Table 5: North America Industrial Centrifuge Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: North America Industrial Centrifuge Market Revenue billion Forecast, by Region 2020 & 2033

- Table 7: North America Industrial Centrifuge Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: North America Industrial Centrifuge Market Revenue billion Forecast, by Design 2020 & 2033

- Table 9: North America Industrial Centrifuge Market Revenue billion Forecast, by Operation Mode 2020 & 2033

- Table 10: North America Industrial Centrifuge Market Revenue billion Forecast, by Industry 2020 & 2033

- Table 11: North America Industrial Centrifuge Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: North America Industrial Centrifuge Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: North America Industrial Centrifuge Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: North America Industrial Centrifuge Market Revenue billion Forecast, by Design 2020 & 2033

- Table 15: North America Industrial Centrifuge Market Revenue billion Forecast, by Operation Mode 2020 & 2033

- Table 16: North America Industrial Centrifuge Market Revenue billion Forecast, by Industry 2020 & 2033

- Table 17: North America Industrial Centrifuge Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 18: North America Industrial Centrifuge Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: North America Industrial Centrifuge Market Revenue billion Forecast, by Type 2020 & 2033

- Table 20: North America Industrial Centrifuge Market Revenue billion Forecast, by Design 2020 & 2033

- Table 21: North America Industrial Centrifuge Market Revenue billion Forecast, by Operation Mode 2020 & 2033

- Table 22: North America Industrial Centrifuge Market Revenue billion Forecast, by Industry 2020 & 2033

- Table 23: North America Industrial Centrifuge Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 24: North America Industrial Centrifuge Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Industrial Centrifuge Market?

The projected CAGR is approximately 6.7%.

2. Which companies are prominent players in the North America Industrial Centrifuge Market?

Key companies in the market include Hiller Separation & Process GmbH, Acutronic USA Inc, Centrifuges Unlimited Inc, Flottweg SE, GEA Group AG, CentraSep Technologies Inc *List Not Exhaustive, Andritz AG, Centrisys Corporation, Alfa Laval AB.

3. What are the main segments of the North America Industrial Centrifuge Market?

The market segments include Type, Design, Operation Mode, Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.22 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Demand from the Downstream Industry.

6. What are the notable trends driving market growth?

Water and Wastewater Treatment Expected to be the Fastest Growing Market Segment.

7. Are there any restraints impacting market growth?

4.; Adoption of Renewable and Clean Energy Sources.

8. Can you provide examples of recent developments in the market?

August 2022: GEA launched a new range of pharmaceutical industrial centrifuge systems for North America called Kytero. Kytero is ready for manufacturing. Filter regions can be reduced by 75%. The system requires a standard power connection; intermediate tanks are obsolete. The simple exchange eliminates CIP (clean-in-place) and SIP (sterilize-in-place).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Industrial Centrifuge Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Industrial Centrifuge Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Industrial Centrifuge Market?

To stay informed about further developments, trends, and reports in the North America Industrial Centrifuge Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence