Key Insights

The North America Pipeline Maintenance Market is projected for robust growth, expected to reach $26.64 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 6.6% during the 2025-2033 forecast period. This expansion is driven by the critical need to ensure the integrity and operational efficiency of extensive and aging pipeline infrastructure. Key growth factors include stringent regulatory mandates for safety and environmental protection, alongside sustained demand for oil and gas, necessitating reliable transportation networks. Investments in new pipeline construction also contribute, as these require ongoing maintenance.

North America Pipeline Maintenance Market Market Size (In Billion)

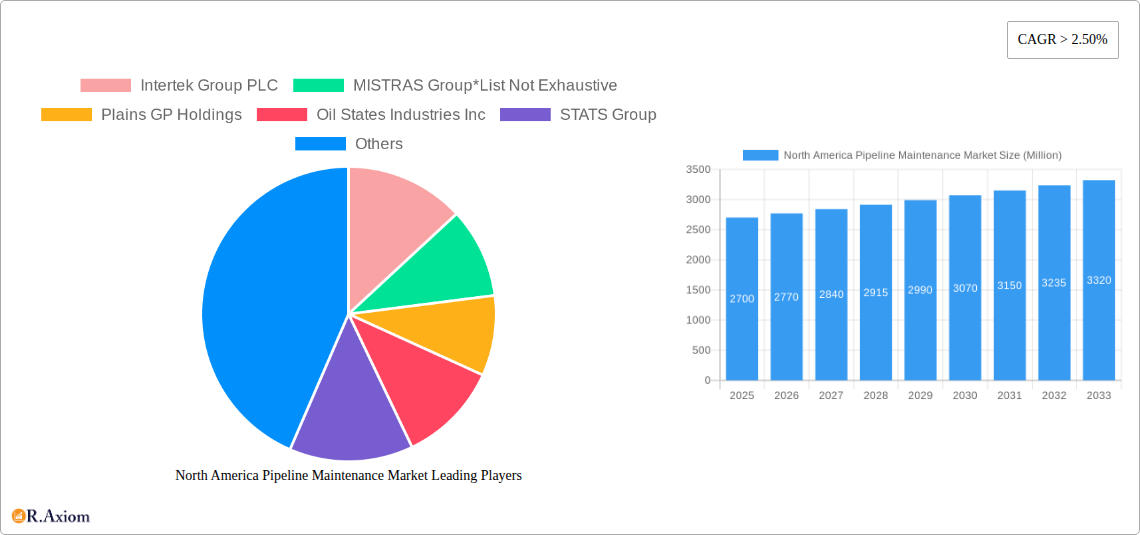

Dominant market segments include Pigging, Flushing & Chemical Cleaning, and Pipeline Repair & Maintenance. Pigging is vital for internal cleaning and inspection, while flushing and chemical treatments address blockages and corrosion. Pipeline repair and maintenance are crucial for wear and tear, structural integrity, and emergency response. Onshore operations lead in service deployment, reflecting extensive land-based pipelines, while the offshore segment offers significant growth opportunities due to challenging environments. The United States holds the largest market share, followed by Canada, with consistent development in the Rest of North America. Leading companies are driving market evolution through innovative services and strategic expansions.

North America Pipeline Maintenance Market Company Market Share

This comprehensive report provides an in-depth analysis of the North America Pipeline Maintenance Market, offering critical insights into market dynamics, trends, and future projections from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033. It is an essential resource for stakeholders understanding pipeline integrity and operational efficiency across the United States, Canada, and the Rest of North America.

The report examines key market segments: Service Types (Pigging, Flushing & Chemical Cleaning, Pipeline Repair & Maintenance, Drying, Others) and Location of Deployment (Onshore, Offshore). It meticulously analyzes the competitive landscape, highlighting dominant players and their strategic initiatives.

North America Pipeline Maintenance Market Market Concentration & Innovation

The North America Pipeline Maintenance Market exhibits moderate to high concentration, with a mix of large, established players and specialized service providers. Innovation is a key driver, fueled by advancements in inspection technologies, robotic systems for internal pipeline assessment, and the development of advanced materials for repairs. Regulatory frameworks, such as those mandated by PHMSA in the U.S. and its Canadian counterparts, continually push for enhanced safety and integrity, necessitating proactive maintenance strategies. Product substitutes, while limited in the core maintenance functions, can emerge in the form of alternative transportation methods or materials that reduce the need for frequent pipeline interventions. End-user trends are increasingly focused on predictive maintenance, digital twins for asset management, and minimizing environmental impact. Mergers and acquisitions (M&A) are significant, with deal values reflecting the strategic importance of acquiring advanced technologies and expanding service portfolios. For instance, significant M&A activities have been observed in the past five years, with an estimated total deal value of over $5,000 Million, aimed at consolidating market share and fostering innovation. Companies like Intertek Group PLC and MISTRAS Group are at the forefront, actively engaging in R&D and strategic partnerships.

North America Pipeline Maintenance Market Industry Trends & Insights

The North America Pipeline Maintenance Market is experiencing robust growth, driven by the aging infrastructure of extensive oil and gas pipeline networks and increasing stringent regulatory compliance demands. The estimated CAGR for the forecast period is approximately 5.2%. Technological disruptions are revolutionizing the sector, with the adoption of AI-powered analytics for anomaly detection, drone-based inspections for remote asset monitoring, and advanced robotic systems for internal cleaning and repair significantly enhancing efficiency and safety. Consumer preferences are shifting towards integrated service solutions that offer end-to-end pipeline integrity management, from initial inspection to long-term maintenance and remediation. This includes a growing demand for non-disruptive inspection techniques and environmentally friendly cleaning solutions. Competitive dynamics are characterized by intense rivalry among established service providers and an influx of technology-focused startups. Companies are investing heavily in digital transformation to offer real-time data analytics and predictive maintenance capabilities. The escalating need to ensure the safe and reliable transportation of hydrocarbons, coupled with increased investments in pipeline expansion and upgrades in regions like the Permian Basin and the Gulf Coast, further fuels market expansion. The market penetration of advanced inspection technologies is projected to reach 70% by 2030. The growing focus on ESG (Environmental, Social, and Governance) factors is also pushing operators to adopt more sustainable maintenance practices, impacting the types of chemicals used in cleaning and the methods employed for leak detection and repair. The forecast period is expected to witness a substantial increase in the utilization of smart sensors and IoT devices for continuous pipeline monitoring, leading to a paradigm shift from reactive to proactive maintenance strategies.

Dominant Markets & Segments in North America Pipeline Maintenance Market

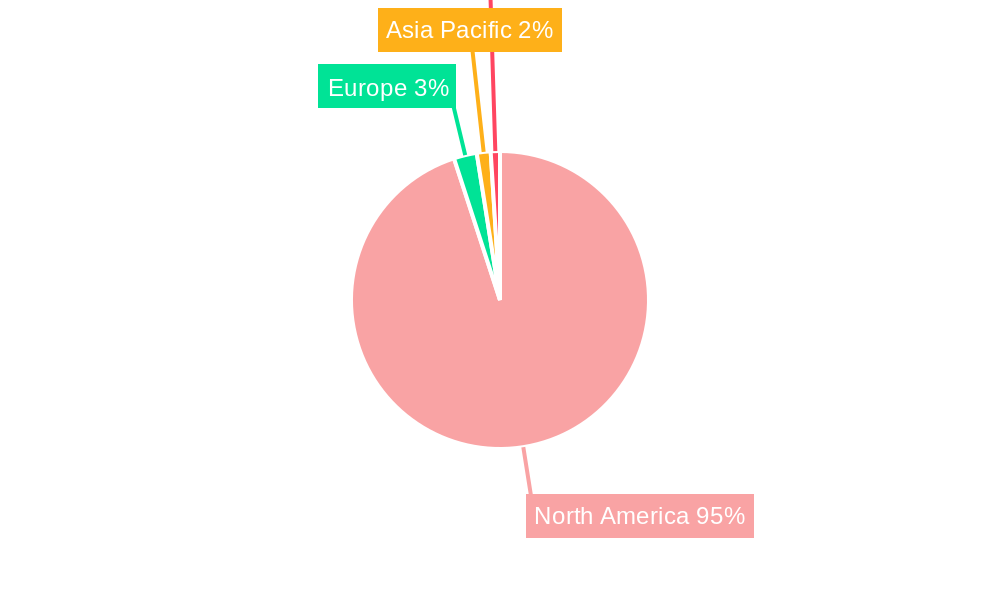

The United States stands as the dominant market within the North America Pipeline Maintenance landscape, accounting for an estimated 75% of the total market value in 2025. This dominance is attributed to its vast network of oil and gas pipelines, significant historical investments in infrastructure, and stringent regulatory oversight that mandates regular and thorough maintenance. Economic policies promoting energy independence and the continued development of shale oil and gas production, particularly in regions like the Permian Basin and the Appalachian Basin, further bolster demand for pipeline maintenance services.

Onshore deployment represents the largest segment in terms of value and volume, driven by the sheer scale of terrestrial pipeline networks used for transporting crude oil, natural gas, and refined products across the continent. The presence of extensive distribution and transmission pipelines in both urban and rural areas necessitates continuous inspection and maintenance.

Within Service Types, Pipeline Repair & Maintenance commands the largest market share. This is a broad category encompassing various activities crucial for extending asset life, ensuring operational safety, and preventing environmental incidents. This includes leak detection, structural repairs, corrosion management, and rehabilitation.

- United States Dominance:

- Extensive pipeline infrastructure spanning over 2.5 million miles.

- Stringent regulatory compliance from PHMSA, driving demand for regular inspections and maintenance.

- Significant ongoing exploration and production activities, requiring new pipeline installations and maintenance of existing ones.

- High investment in upgrades and retrofitting of aging pipelines.

- Onshore Segment Leadership:

- Majority of oil and gas production and consumption occurs onshore.

- Cost-effectiveness and accessibility of onshore pipeline maintenance compared to offshore.

- Expansion of midstream infrastructure to support growing production volumes.

- Pipeline Repair & Maintenance Dominance:

- Critical for ensuring asset integrity, preventing leaks, and complying with safety regulations.

- Includes a wide range of essential services like welding, patching, and coating.

- Continuous need due to wear and tear, environmental factors, and operational stress.

- Technological Adoption:

- Increasing adoption of advanced inspection technologies like in-line inspection (ILI) tools and non-destructive testing (NDT) methods.

- Demand for digital solutions for monitoring, data analysis, and predictive maintenance.

While offshore maintenance is crucial for subsea pipelines, its share is smaller due to the higher complexity and cost associated with these operations. Canada, while a significant market, follows the U.S. due to its extensive but comparatively smaller pipeline network and regulatory environment. The Rest of North America segment, encompassing Mexico and other smaller entities, represents a nascent but growing market with increasing investments in energy infrastructure.

North America Pipeline Maintenance Market Product Developments

Product developments in the North America Pipeline Maintenance Market are largely driven by the pursuit of enhanced efficiency, safety, and environmental sustainability. Innovations include the development of advanced in-line inspection (ILI) tools capable of detecting minute cracks and defects, as well as the deployment of sophisticated robotic systems for automated internal cleaning and inspection, particularly in challenging onshore and offshore environments. Furthermore, research into novel coating materials that offer superior corrosion resistance and extend pipeline lifespan is gaining traction. The integration of AI and IoT into maintenance platforms is enabling predictive analytics, allowing for proactive interventions before failures occur. These advancements provide a competitive edge by reducing downtime, minimizing manual intervention in hazardous areas, and improving the overall reliability and safety of pipeline operations.

Report Scope & Segmentation Analysis

This report provides a comprehensive segmentation of the North America Pipeline Maintenance Market. The Service Type segment includes Pigging, Flushing & Chemical Cleaning, Pipeline Repair & Maintenance, Drying, and Others, each with distinct growth projections and market shares driven by their specific applications and demand drivers. The Location of Deployment is divided into Onshore and Offshore, with onshore operations dominating the market due to the extensive terrestrial pipeline network. Geographically, the market is segmented into the United States, Canada, and the Rest of North America. The United States is projected to hold the largest market share due to its vast infrastructure and stringent regulations, while Canada remains a significant contributor. The Rest of North America segment represents an emerging market with growing potential. Competitive dynamics within each segment are influenced by technological adoption, regulatory compliance, and the need for specialized expertise.

Key Drivers of North America Pipeline Maintenance Market Growth

The North America Pipeline Maintenance Market is propelled by several key factors. Firstly, the vast and aging pipeline infrastructure across the continent necessitates ongoing maintenance and upgrades to ensure operational integrity and prevent potential environmental hazards. Secondly, increasingly stringent regulatory frameworks, such as those mandated by PHMSA in the United States, are driving demand for advanced inspection, testing, and repair services. Technological advancements, including the adoption of AI, robotics, and IoT for predictive maintenance and real-time monitoring, are enhancing efficiency and safety. Furthermore, the continuous expansion of oil and gas exploration and production activities, particularly in shale plays, requires the maintenance and expansion of associated pipeline networks. Lastly, the global push towards decarbonization and the safe transportation of new energy sources, such as hydrogen and carbon capture pipelines, will also contribute to market growth.

Challenges in the North America Pipeline Maintenance Market Sector

Despite its growth prospects, the North America Pipeline Maintenance Market faces several challenges. The sheer age of a significant portion of the pipeline infrastructure presents complex maintenance issues, often requiring costly repairs or replacements. Stringent and evolving regulatory landscapes, while driving demand, also impose significant compliance burdens and associated costs on operators and service providers. Supply chain disruptions, particularly for specialized equipment and materials, can impact project timelines and cost-effectiveness. Furthermore, the availability of skilled labor, especially for advanced inspection and repair techniques, remains a concern. Competitive pressures from numerous established and emerging players can lead to price erosion, challenging profitability. Environmental concerns and public scrutiny regarding pipeline leaks and spills also add pressure to perform maintenance with minimal disruption and utmost environmental responsibility.

Emerging Opportunities in North America Pipeline Maintenance Market

Emerging opportunities in the North America Pipeline Maintenance Market are multifaceted, driven by technological innovation and evolving energy landscapes. The growing emphasis on the safe transportation of new energy carriers, such as hydrogen and carbon dioxide for carbon capture, utilization, and storage (CCUS) projects, presents a significant growth avenue for specialized pipeline maintenance services. The digitalization trend continues to offer opportunities for developing and implementing AI-powered predictive maintenance solutions, digital twins, and advanced data analytics platforms that optimize asset management and reduce operational risks. Furthermore, the increasing focus on sustainability and ESG compliance is creating demand for environmentally friendly cleaning agents and leak detection technologies. The expansion of renewable energy infrastructure, including the potential need for transporting bio-fuels or hydrogen through repurposed or new pipelines, also represents a nascent but promising sector for maintenance providers.

Leading Players in the North America Pipeline Maintenance Market Market

- Intertek Group PLC

- MISTRAS Group

- Plains GP Holdings

- Oil States Industries Inc

- STATS Group

- M&M Pipeline Services LLC

- NiGen International L L C

- T D Williamson Inc

- Chevron Corporation

- Pipeline Operators

- Energy Transfer LP

- EnerMech Ltd

- Kinder Morgan

- Enterprise Products Partners L P

- Baker Hughes A GE Co

- American Pipeline Solutions

- ExxonMobil Corporation

- Pipeline Maintenance Services Providers

Key Developments in North America Pipeline Maintenance Market Industry

- 2023: Multiple companies launched AI-powered predictive maintenance platforms to enhance pipeline integrity monitoring and reduce downtime.

- 2022: Increased M&A activity focused on acquiring innovative robotic inspection and repair technologies.

- 2022: Significant investments made in developing non-destructive testing (NDT) methods for faster and more accurate defect detection.

- 2021: Introduction of advanced composite materials for rapid pipeline repairs, reducing the need for excavation and downtime.

- 2020: Enhanced focus on developing sustainable and environmentally friendly chemical cleaning solutions.

- 2019: Rollout of drone-based inspection services for remote pipeline monitoring in challenging terrains.

Strategic Outlook for North America Pipeline Maintenance Market Market

The strategic outlook for the North America Pipeline Maintenance Market is exceptionally positive, driven by persistent demand for asset integrity and operational safety. The market is poised for sustained growth, fueled by the continuous need to maintain aging infrastructure, comply with evolving regulations, and embrace technological advancements. Key growth catalysts include the ongoing digital transformation of the industry, leading to increased adoption of AI and IoT for predictive analytics, and the expanding role of pipelines in transporting new energy sources. Strategic partnerships and consolidation are expected to continue as companies seek to enhance their service portfolios and market reach. Investments in research and development for innovative inspection and repair solutions will remain critical for maintaining a competitive edge. The sector's ability to adapt to environmental regulations and public expectations will also shape its future trajectory, creating opportunities for companies prioritizing sustainability.

North America Pipeline Maintenance Market Segmentation

-

1. Service Type

- 1.1. Pigging

- 1.2. Flushing & Chemical Cleaning

- 1.3. Pipeline Repair & Maintenance

- 1.4. Drying

- 1.5. Others

-

2. Location of Deployment

- 2.1. Onshore

- 2.2. Offshore

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Rest of North America

North America Pipeline Maintenance Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

North America Pipeline Maintenance Market Regional Market Share

Geographic Coverage of North America Pipeline Maintenance Market

North America Pipeline Maintenance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Gas Production and Infrastructure4.; Increasing Exploration and Production Activities

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Clean Power Sources

- 3.4. Market Trends

- 3.4.1. Pipeline Repair & Maintenance Segment to have a Significant Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Pipeline Maintenance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Pigging

- 5.1.2. Flushing & Chemical Cleaning

- 5.1.3. Pipeline Repair & Maintenance

- 5.1.4. Drying

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 5.2.1. Onshore

- 5.2.2. Offshore

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. United States North America Pipeline Maintenance Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Pigging

- 6.1.2. Flushing & Chemical Cleaning

- 6.1.3. Pipeline Repair & Maintenance

- 6.1.4. Drying

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 6.2.1. Onshore

- 6.2.2. Offshore

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Canada North America Pipeline Maintenance Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Pigging

- 7.1.2. Flushing & Chemical Cleaning

- 7.1.3. Pipeline Repair & Maintenance

- 7.1.4. Drying

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 7.2.1. Onshore

- 7.2.2. Offshore

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Rest of North America North America Pipeline Maintenance Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Pigging

- 8.1.2. Flushing & Chemical Cleaning

- 8.1.3. Pipeline Repair & Maintenance

- 8.1.4. Drying

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Location of Deployment

- 8.2.1. Onshore

- 8.2.2. Offshore

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Intertek Group PLC

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 MISTRAS Group*List Not Exhaustive

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Plains GP Holdings

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Oil States Industries Inc

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 STATS Group

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 M&M Pipeline Services LLC

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 NiGen International L L C

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 T D Williamson Inc

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Chevron Corporation

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Pipeline Operators

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 Energy Transfer LP

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.12 EnerMech Ltd

- 9.2.12.1. Overview

- 9.2.12.2. Products

- 9.2.12.3. SWOT Analysis

- 9.2.12.4. Recent Developments

- 9.2.12.5. Financials (Based on Availability)

- 9.2.13 Kinder Morgan

- 9.2.13.1. Overview

- 9.2.13.2. Products

- 9.2.13.3. SWOT Analysis

- 9.2.13.4. Recent Developments

- 9.2.13.5. Financials (Based on Availability)

- 9.2.14 Enterprise Products Partners L P

- 9.2.14.1. Overview

- 9.2.14.2. Products

- 9.2.14.3. SWOT Analysis

- 9.2.14.4. Recent Developments

- 9.2.14.5. Financials (Based on Availability)

- 9.2.15 Baker Hughes A GE Co

- 9.2.15.1. Overview

- 9.2.15.2. Products

- 9.2.15.3. SWOT Analysis

- 9.2.15.4. Recent Developments

- 9.2.15.5. Financials (Based on Availability)

- 9.2.16 American Pipeline Solutions

- 9.2.16.1. Overview

- 9.2.16.2. Products

- 9.2.16.3. SWOT Analysis

- 9.2.16.4. Recent Developments

- 9.2.16.5. Financials (Based on Availability)

- 9.2.17 ExxonMobil Corporation

- 9.2.17.1. Overview

- 9.2.17.2. Products

- 9.2.17.3. SWOT Analysis

- 9.2.17.4. Recent Developments

- 9.2.17.5. Financials (Based on Availability)

- 9.2.18 Pipeline Maintenance Services Providers

- 9.2.18.1. Overview

- 9.2.18.2. Products

- 9.2.18.3. SWOT Analysis

- 9.2.18.4. Recent Developments

- 9.2.18.5. Financials (Based on Availability)

- 9.2.1 Intertek Group PLC

List of Figures

- Figure 1: North America Pipeline Maintenance Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Pipeline Maintenance Market Share (%) by Company 2025

List of Tables

- Table 1: North America Pipeline Maintenance Market Revenue billion Forecast, by Service Type 2020 & 2033

- Table 2: North America Pipeline Maintenance Market Revenue billion Forecast, by Location of Deployment 2020 & 2033

- Table 3: North America Pipeline Maintenance Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: North America Pipeline Maintenance Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: North America Pipeline Maintenance Market Revenue billion Forecast, by Service Type 2020 & 2033

- Table 6: North America Pipeline Maintenance Market Revenue billion Forecast, by Location of Deployment 2020 & 2033

- Table 7: North America Pipeline Maintenance Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: North America Pipeline Maintenance Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: North America Pipeline Maintenance Market Revenue billion Forecast, by Service Type 2020 & 2033

- Table 10: North America Pipeline Maintenance Market Revenue billion Forecast, by Location of Deployment 2020 & 2033

- Table 11: North America Pipeline Maintenance Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: North America Pipeline Maintenance Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: North America Pipeline Maintenance Market Revenue billion Forecast, by Service Type 2020 & 2033

- Table 14: North America Pipeline Maintenance Market Revenue billion Forecast, by Location of Deployment 2020 & 2033

- Table 15: North America Pipeline Maintenance Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: North America Pipeline Maintenance Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Pipeline Maintenance Market?

The projected CAGR is approximately 6.6%.

2. Which companies are prominent players in the North America Pipeline Maintenance Market?

Key companies in the market include Intertek Group PLC, MISTRAS Group*List Not Exhaustive, Plains GP Holdings, Oil States Industries Inc, STATS Group, M&M Pipeline Services LLC, NiGen International L L C, T D Williamson Inc, Chevron Corporation, Pipeline Operators, Energy Transfer LP, EnerMech Ltd, Kinder Morgan, Enterprise Products Partners L P, Baker Hughes A GE Co, American Pipeline Solutions, ExxonMobil Corporation, Pipeline Maintenance Services Providers.

3. What are the main segments of the North America Pipeline Maintenance Market?

The market segments include Service Type, Location of Deployment, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 26.64 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Gas Production and Infrastructure4.; Increasing Exploration and Production Activities.

6. What are the notable trends driving market growth?

Pipeline Repair & Maintenance Segment to have a Significant Share in the Market.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Clean Power Sources.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Pipeline Maintenance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Pipeline Maintenance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Pipeline Maintenance Market?

To stay informed about further developments, trends, and reports in the North America Pipeline Maintenance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence