Key Insights

The North American satellite manufacturing and launch systems market is experiencing robust growth, driven by increasing demand for satellite-based services across military, government, and commercial sectors. A compound annual growth rate (CAGR) exceeding 3% indicates a consistently expanding market throughout the forecast period (2025-2033). This growth is fueled by several key factors: the burgeoning need for enhanced communication infrastructure, particularly in remote areas; the rising adoption of Earth observation technologies for environmental monitoring, agriculture, and urban planning; and the continued investment in national security and defense applications. Leading companies like SpaceX, Lockheed Martin, and Boeing are major contributors to this growth, leveraging advanced technologies and innovative launch systems. The market segmentation reveals a significant share held by the United States, with Canada contributing considerably, indicating a strong North American dominance. Growth within the commercial segment is particularly noteworthy, signifying a shift towards greater private sector involvement and investment in space-based applications, including satellite internet services.

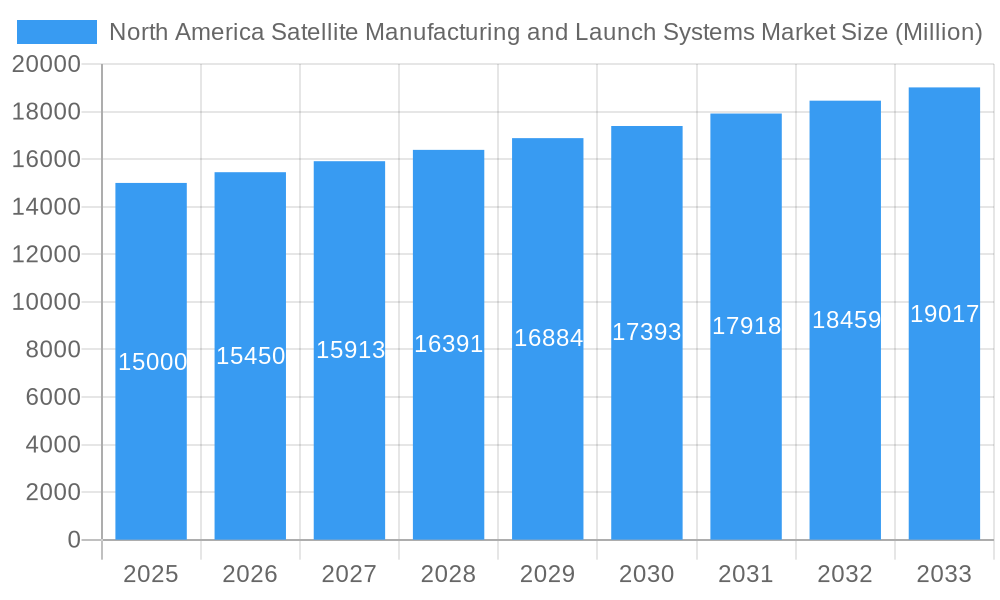

North America Satellite Manufacturing and Launch Systems Market Market Size (In Billion)

The market's restraints primarily involve the high capital expenditures associated with satellite development and launch, coupled with the inherent technological complexities and regulatory hurdles. However, ongoing advancements in reusable launch vehicles and miniaturization technologies are mitigating some of these challenges. The increasing availability of private capital, government funding initiatives, and the emergence of innovative business models focused on offering affordable satellite solutions are further bolstering market expansion. Looking ahead, the integration of Artificial Intelligence (AI) and machine learning into satellite operations, along with advancements in satellite constellations, is expected to accelerate market growth even further in the coming decade. The forecast period suggests significant potential for expansion, particularly in the commercial sector, with the US maintaining its leading position due to its robust aerospace industry and government support.

North America Satellite Manufacturing and Launch Systems Market Company Market Share

North America Satellite Manufacturing and Launch Systems Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the North America satellite manufacturing and launch systems market, offering actionable insights for industry stakeholders. Covering the period from 2019 to 2033, with a focus on 2025, this report examines market trends, competitive dynamics, and growth opportunities across various segments.

North America Satellite Manufacturing and Launch Systems Market Market Concentration & Innovation

The North American satellite manufacturing and launch systems market exhibits a moderately concentrated landscape, dominated by a few key players like SpaceX (Space Exploration Technologies Corp), Lockheed Martin Corporation (Lockheed Martin), and Boeing (The Boeing Company). These companies hold significant market share, owing to their established technological capabilities, extensive experience, and substantial investments in research and development. However, the market is witnessing increased participation from smaller, more agile companies focusing on niche applications and innovative technologies.

Market concentration is further influenced by regulatory frameworks, particularly those governing access to space and launch licenses. The increasing demand for smaller, more cost-effective satellites, fueled by the burgeoning NewSpace movement, presents opportunities for new entrants. Product substitution, primarily driven by advancements in electric propulsion and reusable launch systems, is also reshaping the competitive dynamics. The market witnesses regular mergers and acquisitions (M&A) activity, with deal values fluctuating depending on the target company's technology and market position. For example, in 2024, an estimated xx Million USD was invested in M&A activities within this sector. End-user trends, particularly the growing demand for satellite-based communication and earth observation services from both government and commercial sectors, are major drivers for market growth.

North America Satellite Manufacturing and Launch Systems Market Industry Trends & Insights

The North American satellite manufacturing and launch systems market is experiencing robust growth, driven by a confluence of factors. The increasing demand for high-bandwidth communication, particularly from the commercial sector (e.g., broadband internet services and satellite television), is a primary growth driver. Governments in the US and Canada continue to invest heavily in national security and defense applications, boosting demand for military and government satellites. Technological advancements, including miniaturization of satellites, development of more efficient launch vehicles, and progress in electric propulsion, are significantly reducing launch costs and opening up new possibilities for smaller payloads and constellations. The emergence of reusable launch vehicles has further propelled market growth by decreasing launch costs and increasing launch frequency. Consumer preferences are shifting toward higher-quality satellite-based services, driving innovation in satellite technology and payload capabilities. The competitive landscape is dynamic, with established players constantly innovating and new entrants entering the market, leading to increased competition and pressure to deliver cost-effective and high-performance solutions. The CAGR for the market during the forecast period (2025-2033) is estimated to be xx%, indicating strong growth prospects. Market penetration of advanced satellite technologies is also increasing, with xx% of new satellite launches now incorporating cutting-edge features.

Dominant Markets & Segments in North America Satellite Manufacturing and Launch Systems Market

The United States dominates the North American satellite manufacturing and launch systems market, accounting for the lion’s share of revenue generation and market activities. This dominance stems from the robust presence of major aerospace companies, significant government investment in space exploration and national security, and a well-established space infrastructure.

- Key Drivers for US Dominance:

- Strong government funding for space programs and research.

- Large and established aerospace industry with significant expertise and resources.

- Favorable regulatory environment for space activities.

- High demand from both the military and commercial sectors.

Canada, while a smaller player compared to the US, is also a significant participant. Canada's strong aerospace sector, with expertise in areas like satellite technology and remote sensing, and its government's support for space-related initiatives contribute to its market presence.

Product Type: The launch systems segment is currently the larger market segment in terms of revenue, driven by high demand for satellite launches. The satellite segment demonstrates substantial growth potential, particularly with the rising popularity of smaller, more affordable satellites.

Application: The military and government segment holds a significant share due to the large investments in national security and space-based surveillance systems. However, the commercial segment is rapidly expanding, propelled by increasing demand for commercial communication and earth observation services.

North America Satellite Manufacturing and Launch Systems Market Product Developments

Recent years have witnessed remarkable advancements in satellite technology, particularly in miniaturization, increased payload capacity, and longer operational lifespans. Launch systems have also undergone significant developments, focusing on reusability, improved efficiency, and reduced costs. These advancements are leading to enhanced performance, reduced launch costs, and increased accessibility for various applications. The market is witnessing a shift towards constellations of smaller, interconnected satellites, providing broader coverage and enhanced data transmission capabilities.

Report Scope & Segmentation Analysis

This report comprehensively segments the North America satellite manufacturing and launch systems market across various parameters:

Product Type: The market is divided into Satellite and Launch Systems. The Satellite segment is further categorized by type (e.g., communication, earth observation, navigation), while the Launch Systems segment is segmented by type (e.g., expendable, reusable). Both segments are projected to experience significant growth during the forecast period.

Application: The market is divided into Military & Government and Commercial. The Military & Government segment is driven by government spending on national security, while the Commercial segment is fueled by increasing demand for communication and other commercial services. Both segments are expected to witness substantial growth.

Country: The market is segmented into the United States and Canada. The United States dominates the market, followed by Canada. Both countries exhibit growth potential.

Key Drivers of North America Satellite Manufacturing and Launch Systems Market Growth

Several key factors drive the market’s growth: increased demand for high-bandwidth communication and data transmission; government investment in national security and space exploration; technological advancements in satellite miniaturization and launch vehicle efficiency; and the declining cost of launching satellites. Furthermore, the rise of NewSpace companies and increased private sector investment are fueling innovation and competition.

Challenges in the North America Satellite Manufacturing and Launch Systems Market Sector

The market faces challenges such as high launch costs (despite recent reductions), intense competition from established players and new entrants, regulatory hurdles related to space debris management and spectrum allocation, and supply chain disruptions affecting the availability of crucial components. These factors can impact profitability and market expansion.

Emerging Opportunities in North America Satellite Manufacturing and Launch Systems Market

Emerging opportunities exist in providing satellite-based internet access to underserved areas, development of advanced earth observation technologies for climate monitoring and disaster management, and the growing demand for smallsat constellations for various applications. The market also presents opportunities for companies developing innovative launch technologies and reusable launch vehicles.

Leading Players in the North America Satellite Manufacturing and Launch Systems Market Market

- Space Exploration Technologies Corp

- SpaceQuest Ltd

- Lockheed Martin Corporation

- Sierra Nevada Corporation

- Thales Group

- ArianeGroup

- Dynetics Inc

- Northrop Grumman Corporation

- The Boeing Company

Key Developments in North America Satellite Manufacturing and Launch Systems Market Industry

- Jan 2023: SpaceX successfully launches a large constellation of Starlink satellites.

- June 2024: Lockheed Martin secures a major contract for the development of a new military communication satellite.

- Oct 2024: A significant merger occurs between two smaller satellite manufacturers, leading to increased market consolidation. (Specifics of merger omitted for lack of publicly available data).

Strategic Outlook for North America Satellite Manufacturing and Launch Systems Market Market

The North American satellite manufacturing and launch systems market is poised for continued growth, driven by persistent demand for satellite-based services, technological advancements, and rising private investment. The increasing adoption of smallsats and constellations, along with innovations in reusable launch vehicles, will further propel market expansion. The focus on enhancing satellite performance, reducing costs, and expanding applications will be central to achieving future growth.

North America Satellite Manufacturing and Launch Systems Market Segmentation

-

1. Product Type

- 1.1. Satellite

- 1.2. Launch Systems

-

2. Application

- 2.1. Military and Government

- 2.2. Commercial

North America Satellite Manufacturing and Launch Systems Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Satellite Manufacturing and Launch Systems Market Regional Market Share

Geographic Coverage of North America Satellite Manufacturing and Launch Systems Market

North America Satellite Manufacturing and Launch Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions

- 3.3. Market Restrains

- 3.3.1. Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data

- 3.4. Market Trends

- 3.4.1. The Advent of Reusable Launch Vehicles Driving Down Satellite Launch Costs

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Satellite Manufacturing and Launch Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Satellite

- 5.1.2. Launch Systems

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Military and Government

- 5.2.2. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Space Exploration Technologies Corp

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 SpaceQuest Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Lockheed Martin Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sierra Nevada Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Thales Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ArianeGroup

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Dynetics Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Northrop Grumman Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 The Boeing Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Space Exploration Technologies Corp

List of Figures

- Figure 1: North America Satellite Manufacturing and Launch Systems Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America Satellite Manufacturing and Launch Systems Market Share (%) by Company 2025

List of Tables

- Table 1: North America Satellite Manufacturing and Launch Systems Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: North America Satellite Manufacturing and Launch Systems Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: North America Satellite Manufacturing and Launch Systems Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: North America Satellite Manufacturing and Launch Systems Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 5: North America Satellite Manufacturing and Launch Systems Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: North America Satellite Manufacturing and Launch Systems Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States North America Satellite Manufacturing and Launch Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Satellite Manufacturing and Launch Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Satellite Manufacturing and Launch Systems Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Satellite Manufacturing and Launch Systems Market?

The projected CAGR is approximately 14.4%.

2. Which companies are prominent players in the North America Satellite Manufacturing and Launch Systems Market?

Key companies in the market include Space Exploration Technologies Corp, SpaceQuest Ltd, Lockheed Martin Corporation, Sierra Nevada Corporation, Thales Group, ArianeGroup, Dynetics Inc, Northrop Grumman Corporation, The Boeing Company.

3. What are the main segments of the North America Satellite Manufacturing and Launch Systems Market?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions.

6. What are the notable trends driving market growth?

The Advent of Reusable Launch Vehicles Driving Down Satellite Launch Costs.

7. Are there any restraints impacting market growth?

Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Satellite Manufacturing and Launch Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Satellite Manufacturing and Launch Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Satellite Manufacturing and Launch Systems Market?

To stay informed about further developments, trends, and reports in the North America Satellite Manufacturing and Launch Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence