Key Insights

The North American specialty coffee market, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by several key factors. A rising consumer preference for premium coffee experiences, including single-origin beans, unique brewing methods, and ethically sourced products, fuels market expansion. This trend is particularly strong among millennials and Gen Z, who are willing to pay a premium for high-quality coffee. Furthermore, the increasing popularity of coffee shops and cafes, alongside the convenience of at-home specialty coffee brewing methods like pour-over and espresso machines, contributes to market growth. The diverse product segments, including whole bean, ground, instant, and pods/capsules, cater to a wide range of consumer preferences and lifestyles, driving market diversification. However, fluctuating coffee bean prices and increasing competition from established and emerging players present challenges to sustained growth. The off-trade segment (grocery stores, online retailers) is expected to show significant growth due to increased convenience and online shopping trends, while the on-trade segment (coffee shops, restaurants) continues to be a significant revenue contributor. Leading players like Starbucks, Keurig Dr Pepper, and JAB Holding Company are actively innovating and expanding their product lines to maintain their market share.

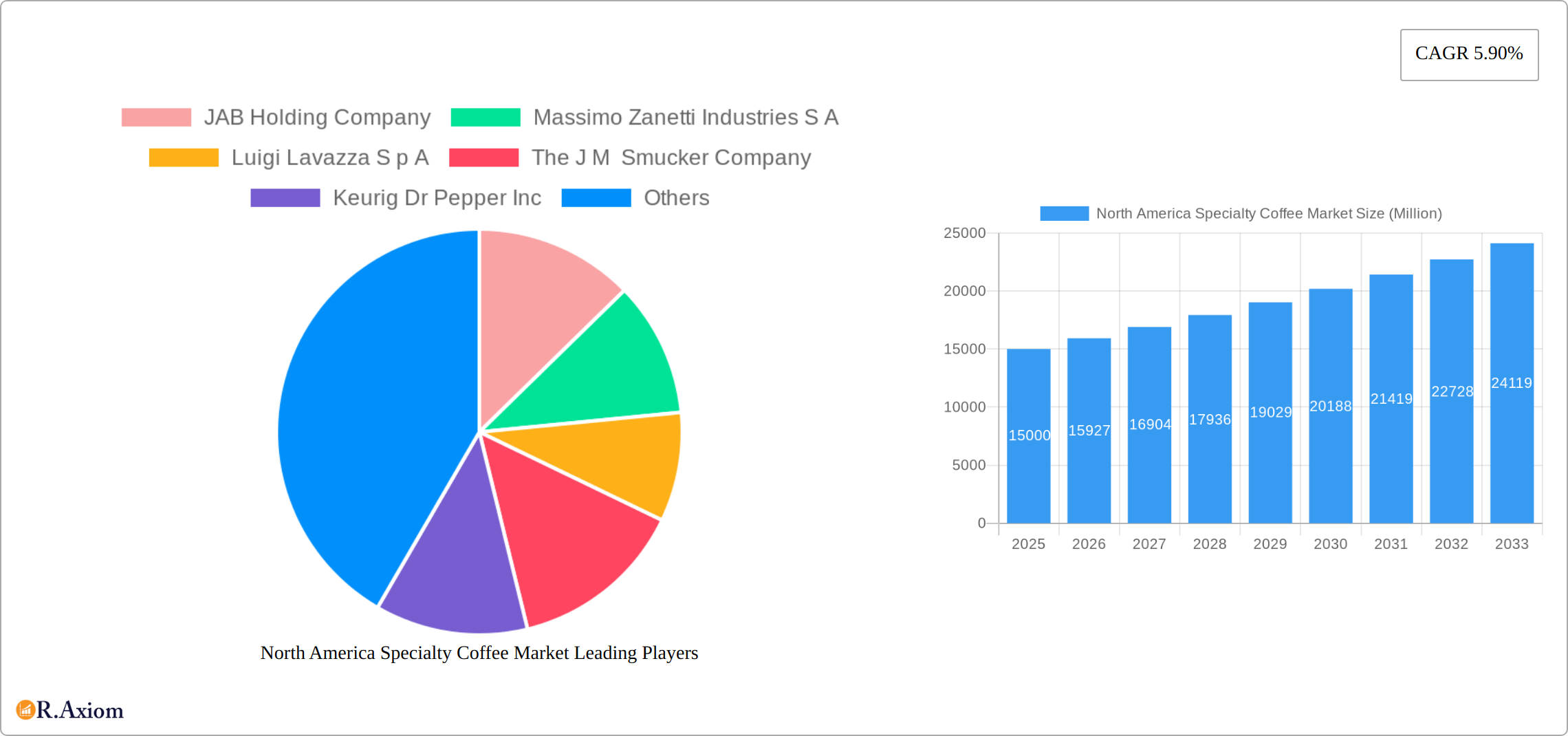

The forecast period of 2025-2033 anticipates a continued upward trajectory for the North American specialty coffee market, with a projected CAGR of 5.90%. The market's growth will be influenced by several factors, including the ongoing expansion of the specialty coffee culture, increasing disposable incomes, and the continuous innovation in coffee brewing technologies and product offerings. While potential economic downturns could impact consumer spending on premium products, the enduring popularity of specialty coffee suggests that the market will remain relatively resilient. Regional variations exist within North America, with the United States likely maintaining the largest market share due to its significant consumer base and established coffee culture. Canada and Mexico are also expected to witness substantial growth, driven by increasing coffee consumption and a growing middle class. Strategic partnerships, mergers and acquisitions, and product diversification will continue to shape the competitive landscape as companies strive to capture a larger market share.

North America Specialty Coffee Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the North America specialty coffee market, covering the period from 2019 to 2033. It offers actionable insights for industry stakeholders, including manufacturers, distributors, and investors, by examining market trends, competitive dynamics, and future growth opportunities. The report utilizes a robust methodology, incorporating historical data (2019-2024), a base year of 2025, and forecasts extending to 2033. The total market value in 2025 is estimated at XX Million, showcasing a significant opportunity for growth.

North America Specialty Coffee Market Market Concentration & Innovation

The North America specialty coffee market exhibits a moderately concentrated structure, with key players such as JAB Holding Company, Starbucks Corporation, Nestlé S.A., and Keurig Dr Pepper Inc. holding significant market share. However, a considerable number of smaller, regional roasters and independent cafes contribute to the market's dynamism. Innovation is a key driver, with companies focusing on product diversification (e.g., unique blends, single-origin coffees, and innovative brewing methods), sustainable sourcing practices, and convenient formats like coffee pods and capsules. Regulatory frameworks, including labeling requirements and fair trade certifications, influence market practices. The market also experiences competitive pressure from product substitutes like tea and other beverages. Mergers and acquisitions (M&A) activities are prevalent, with deal values reaching XX Million annually in recent years, signifying industry consolidation and expansion strategies. Key M&A events include (but aren't limited to) the acquisition of smaller roasters by larger corporations.

North America Specialty Coffee Market Industry Trends & Insights

The North American specialty coffee market is experiencing robust growth, fueled by a confluence of factors. Rising consumer disposable incomes empower premiumization, driving demand for high-quality, ethically sourced beans and unique brewing experiences. The burgeoning popularity of at-home brewing, accelerated by technological innovations like single-serve brewers and smart coffee makers, has significantly broadened the market's reach. Health-conscious consumers are increasingly seeking organic, fair trade, and sustainably produced options, further shaping market demand. The ready-to-drink (RTD) segment is experiencing particularly rapid growth, contributing to a significant compound annual growth rate (CAGR) of [Insert Updated CAGR]% during the forecast period (2025-2033). This growth is further propelled by expanding market penetration, estimated at [Insert Updated Percentage]% in 2025. The competitive landscape remains dynamic, with established industry giants and agile newcomers vying for market share through strategic product innovation, targeted branding campaigns, and efficient distribution networks. Beyond these key drivers, evolving consumer preferences for unique flavor profiles and exceptional coffee experiences are also key to this market's continued expansion.

Dominant Markets & Segments in North America Specialty Coffee Market

Leading Region: The US dominates the North American specialty coffee market, driven by high coffee consumption, strong consumer spending, and the prevalence of specialty coffee shops. Canada follows as the second-largest market.

Leading Product Type: Ground coffee maintains a significant market share, followed closely by whole bean coffee and coffee pods & capsules. Instant coffee represents a smaller but steadily growing segment, driven by convenience factors. Key drivers for the dominance of ground coffee include tradition, accessibility, and versatility. The pods and capsules segment experiences growth from convenient brewing technology and diverse offerings.

Leading Distribution Channel: Off-trade channels (grocery stores, supermarkets, online retailers) are prominent due to widespread accessibility and ease of purchasing. On-trade (coffee shops, cafes, restaurants) caters to a premium segment, offering a distinct coffee experience. The on-trade segment benefits from increased experiential consumption trends among younger demographics.

North America Specialty Coffee Market Product Developments

The specialty coffee market showcases continuous product innovation, encompassing new roasting techniques, unique flavor profiles (e.g., flavored coffees, cold brew concentrates), sustainable packaging, and functional additions. Technological advancements in brewing equipment and single-serve formats continue to drive market growth, with a focus on optimizing convenience and coffee quality. Companies are also emphasizing sustainability in sourcing and packaging to resonate with environmentally conscious consumers. The market fits perfectly the trend towards premiumization and convenience-driven consumption.

Report Scope & Segmentation Analysis

This report offers a comprehensive analysis of the North American specialty coffee market, meticulously segmented by product type (whole bean, ground coffee, instant coffee, coffee pods and capsules) and distribution channel (on-trade, encompassing cafes and restaurants, and off-trade, including grocery stores and online retailers). Each segment undergoes thorough scrutiny, with detailed growth projections, precise market size estimations (in millions), and in-depth competitive landscape assessments spanning the period from 2019 to 2033. Growth trajectories vary across segments, reflecting nuanced consumer preferences and distinct market dynamics. The competitive landscape within each segment is shaped by a complex interplay of factors, including brand recognition, pricing strategies, product differentiation, and the effectiveness of marketing and distribution strategies. The report provides a granular view of market size and growth projections for each segment throughout both historical and projected periods.

Key Drivers of North America Specialty Coffee Market Growth

The robust growth of the North American specialty coffee market is driven by a powerful combination of factors. Increased consumer spending power fuels a trend towards premiumization, with consumers willing to invest in higher-quality coffee experiences. The proliferation of specialty coffee shops and cafes has elevated coffee consumption to a social ritual, further driving demand. The rise of sophisticated at-home brewing methods, coupled with advancements in brewing technology (e.g., single-serve brewers and smart coffee makers), empowers consumers to recreate cafe-quality experiences at home. Moreover, the growing emphasis on ethical and sustainable consumption patterns is boosting the demand for organic, fair trade, and sustainably sourced coffee. This combined effect ensures the continued growth and expansion of the specialty coffee market within North America.

Challenges in the North America Specialty Coffee Market Sector

Despite its strong growth trajectory, the North American specialty coffee market faces significant challenges. Volatility in coffee bean prices poses a considerable risk to profitability, requiring careful cost management and hedging strategies. Intense competition from established brands and the influx of innovative newcomers necessitate continuous product development and strategic adaptation. The rising popularity of alternative beverages, such as tea and energy drinks, presents a constant challenge in capturing and retaining market share. Furthermore, evolving consumer preferences, coupled with regulatory shifts concerning sustainability and labeling, necessitate continuous adaptation and innovation to ensure long-term success within this dynamic market landscape. Addressing these challenges requires a robust strategy focused on agility, innovation, and effective risk management.

Emerging Opportunities in North America Specialty Coffee Market

The market presents various emerging opportunities: the growing demand for ready-to-drink (RTD) specialty coffee, the expansion of niche segments like cold brew and nitro coffee, and the increasing adoption of sustainable and ethically sourced coffee. Further market expansion is expected in emerging consumer segments and through innovative packaging formats. The integration of technology with smart brewing systems and subscription models offers new avenues for growth.

Leading Players in the North America Specialty Coffee Market Market

- JAB Holding Company

- Massimo Zanetti Industries S A

- Luigi Lavazza S p A

- The J M Smucker Company

- Keurig Dr Pepper Inc

- The Kraft Heinz Company

- Starbucks Corporation

- Tata Group (Eight O'Clock Coffee Company)

- Maxingvest AG (Tchibo)

- Nestlé S A

Key Developments in North America Specialty Coffee Market Industry

- April 2021: Nestlé's development of low-carbon coffee varieties, achieving up to a 30% reduction in the CO2e footprint of green coffee beans, underscores the industry's increasing commitment to sustainability and its alignment with growing consumer demand for environmentally conscious products.

- January 2022: Peet's Coffee's transition to water-based decaffeination showcases a response to consumer preferences for chemical-free decaf options, significantly impacting the growth and perception of the decaf coffee segment.

- July 2022: Keurig Dr. Pepper's launch of Intelligentsia K-Cup pods exemplifies the strategic leveraging of the convenient single-serve format to capture a larger share of the specialty coffee market, directly influencing the growth of the coffee pod segment.

- [Add another recent key development with date and brief description]

Strategic Outlook for North America Specialty Coffee Market Market

The North American specialty coffee market is poised for continued growth, driven by evolving consumer preferences and technological advancements. The focus on sustainability, premiumization, and convenient consumption formats will shape the market's trajectory. New product innovation, strategic partnerships, and expansion into emerging channels will be crucial for success. The market's future potential is substantial, with opportunities in both established and emerging segments.

North America Specialty Coffee Market Segmentation

-

1. Product Type

- 1.1. Whole Bean

- 1.2. Ground Coffee

- 1.3. Instant Coffee

- 1.4. Coffee Pods and Capsules

-

2. Distribution Channel

- 2.1. On-Trade

-

2.2. Off-Trade

- 2.2.1. Supermarkets/Hypermarkets

- 2.2.2. Convenience Stores

- 2.2.3. Specialist Retailers

- 2.2.4. Online Retail Stores

- 2.2.5. Other Off-Trade Channels

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of North America

North America Specialty Coffee Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Specialty Coffee Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Incidences of Food Allergies; Favorable Government Initiatives and Regulations for Food Safety

- 3.3. Market Restrains

- 3.3.1. Inconsistencies Involved in Food Allergen Declarations

- 3.4. Market Trends

- 3.4.1. Increase in Coffee Consumption Among Working Population

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Specialty Coffee Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Whole Bean

- 5.1.2. Ground Coffee

- 5.1.3. Instant Coffee

- 5.1.4. Coffee Pods and Capsules

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. On-Trade

- 5.2.2. Off-Trade

- 5.2.2.1. Supermarkets/Hypermarkets

- 5.2.2.2. Convenience Stores

- 5.2.2.3. Specialist Retailers

- 5.2.2.4. Online Retail Stores

- 5.2.2.5. Other Off-Trade Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United States North America Specialty Coffee Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Whole Bean

- 6.1.2. Ground Coffee

- 6.1.3. Instant Coffee

- 6.1.4. Coffee Pods and Capsules

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. On-Trade

- 6.2.2. Off-Trade

- 6.2.2.1. Supermarkets/Hypermarkets

- 6.2.2.2. Convenience Stores

- 6.2.2.3. Specialist Retailers

- 6.2.2.4. Online Retail Stores

- 6.2.2.5. Other Off-Trade Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Canada North America Specialty Coffee Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Whole Bean

- 7.1.2. Ground Coffee

- 7.1.3. Instant Coffee

- 7.1.4. Coffee Pods and Capsules

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. On-Trade

- 7.2.2. Off-Trade

- 7.2.2.1. Supermarkets/Hypermarkets

- 7.2.2.2. Convenience Stores

- 7.2.2.3. Specialist Retailers

- 7.2.2.4. Online Retail Stores

- 7.2.2.5. Other Off-Trade Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Mexico North America Specialty Coffee Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Whole Bean

- 8.1.2. Ground Coffee

- 8.1.3. Instant Coffee

- 8.1.4. Coffee Pods and Capsules

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. On-Trade

- 8.2.2. Off-Trade

- 8.2.2.1. Supermarkets/Hypermarkets

- 8.2.2.2. Convenience Stores

- 8.2.2.3. Specialist Retailers

- 8.2.2.4. Online Retail Stores

- 8.2.2.5. Other Off-Trade Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of North America North America Specialty Coffee Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Whole Bean

- 9.1.2. Ground Coffee

- 9.1.3. Instant Coffee

- 9.1.4. Coffee Pods and Capsules

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. On-Trade

- 9.2.2. Off-Trade

- 9.2.2.1. Supermarkets/Hypermarkets

- 9.2.2.2. Convenience Stores

- 9.2.2.3. Specialist Retailers

- 9.2.2.4. Online Retail Stores

- 9.2.2.5. Other Off-Trade Channels

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. United States North America Specialty Coffee Market Analysis, Insights and Forecast, 2019-2031

- 11. Canada North America Specialty Coffee Market Analysis, Insights and Forecast, 2019-2031

- 12. Mexico North America Specialty Coffee Market Analysis, Insights and Forecast, 2019-2031

- 13. Rest of North America North America Specialty Coffee Market Analysis, Insights and Forecast, 2019-2031

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 JAB Holding Company

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Massimo Zanetti Industries S A

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Luigi Lavazza S p A

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 The J M Smucker Company

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Keurig Dr Pepper Inc

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 The Kraft Heinz Company

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Starbucks Corporation

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Tata Group (Eight O'Clock Coffee Company)*List Not Exhaustive

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Maxingvest AG (Tchibo)

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Nestlé S A

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 JAB Holding Company

List of Figures

- Figure 1: North America Specialty Coffee Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Specialty Coffee Market Share (%) by Company 2024

List of Tables

- Table 1: North America Specialty Coffee Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Specialty Coffee Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: North America Specialty Coffee Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: North America Specialty Coffee Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: North America Specialty Coffee Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Specialty Coffee Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America Specialty Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America Specialty Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America Specialty Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America Specialty Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Specialty Coffee Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 12: North America Specialty Coffee Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 13: North America Specialty Coffee Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 14: North America Specialty Coffee Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: North America Specialty Coffee Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 16: North America Specialty Coffee Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 17: North America Specialty Coffee Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: North America Specialty Coffee Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: North America Specialty Coffee Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 20: North America Specialty Coffee Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 21: North America Specialty Coffee Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 22: North America Specialty Coffee Market Revenue Million Forecast, by Country 2019 & 2032

- Table 23: North America Specialty Coffee Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 24: North America Specialty Coffee Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 25: North America Specialty Coffee Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: North America Specialty Coffee Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Specialty Coffee Market?

The projected CAGR is approximately 5.90%.

2. Which companies are prominent players in the North America Specialty Coffee Market?

Key companies in the market include JAB Holding Company, Massimo Zanetti Industries S A, Luigi Lavazza S p A, The J M Smucker Company, Keurig Dr Pepper Inc, The Kraft Heinz Company, Starbucks Corporation, Tata Group (Eight O'Clock Coffee Company)*List Not Exhaustive, Maxingvest AG (Tchibo), Nestlé S A.

3. What are the main segments of the North America Specialty Coffee Market?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Incidences of Food Allergies; Favorable Government Initiatives and Regulations for Food Safety.

6. What are the notable trends driving market growth?

Increase in Coffee Consumption Among Working Population.

7. Are there any restraints impacting market growth?

Inconsistencies Involved in Food Allergen Declarations.

8. Can you provide examples of recent developments in the market?

July 2022: Keurig Dr. Pepper announced the launch of Intelligentsia K-Cup pods for its Keurig brewing system to capitalize on the growing demand for specialty coffee in the United States. Intelligentsia K-Cups are available in two flavors: House and Organic El Gallo, and can be purchased for 90 cents per pod in a 60-count box from Keurig.com.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Specialty Coffee Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Specialty Coffee Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Specialty Coffee Market?

To stay informed about further developments, trends, and reports in the North America Specialty Coffee Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence