Key Insights

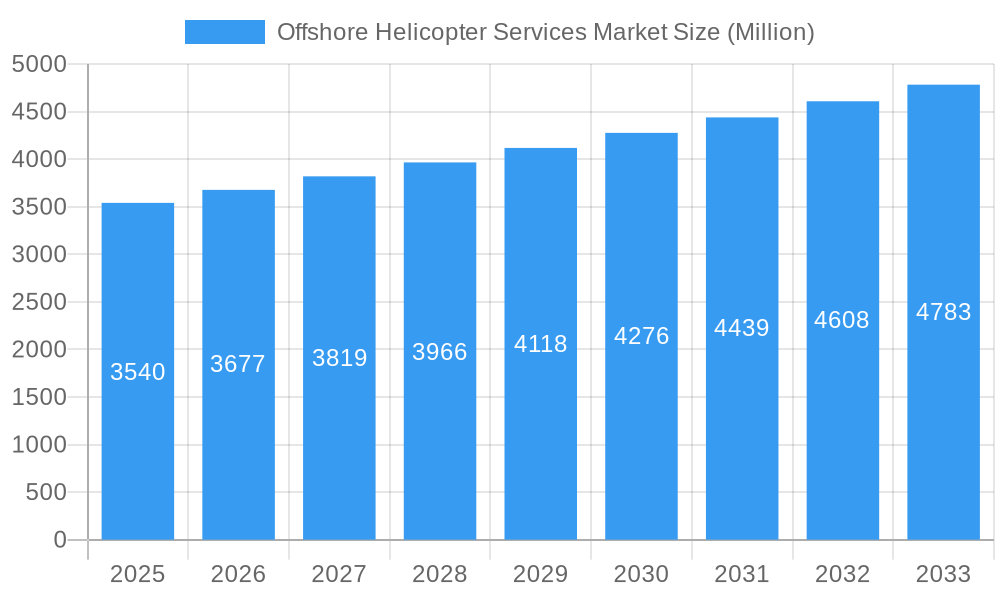

The global Offshore Helicopter Services Market is poised for steady expansion, projected to reach approximately USD 3.54 billion in 2025 and grow at a Compound Annual Growth Rate (CAGR) of 3.90% through 2033. This growth is fundamentally driven by the continuous demand for efficient and reliable transportation of personnel and equipment to offshore oil and gas platforms and, increasingly, to burgeoning offshore wind farms. The industry's vital role in supporting exploration, drilling, production, and maintenance operations in remote and often hazardous offshore environments underpins its sustained relevance. Key enablers for this market include technological advancements in helicopter design, improving safety features, and operational efficiency, alongside an increasing global focus on renewable energy sources, particularly offshore wind, which is creating new avenues for helicopter service providers.

Offshore Helicopter Services Market Market Size (In Billion)

The market dynamics are further shaped by specific growth trends and prevailing restraints. The expansion of offshore wind energy projects worldwide is a significant catalyst, necessitating specialized helicopter services for installation, maintenance, and inspection. Simultaneously, the ongoing exploration and production activities in mature oil and gas regions continue to contribute to market stability. However, the industry faces challenges such as fluctuating oil prices, which can impact exploration budgets and, consequently, demand for helicopter services. Stringent regulatory environments concerning safety and environmental compliance also represent a considerable operational cost. Despite these headwinds, the strategic importance of offshore helicopter services in ensuring operational continuity and safety in challenging offshore sectors ensures a resilient market outlook.

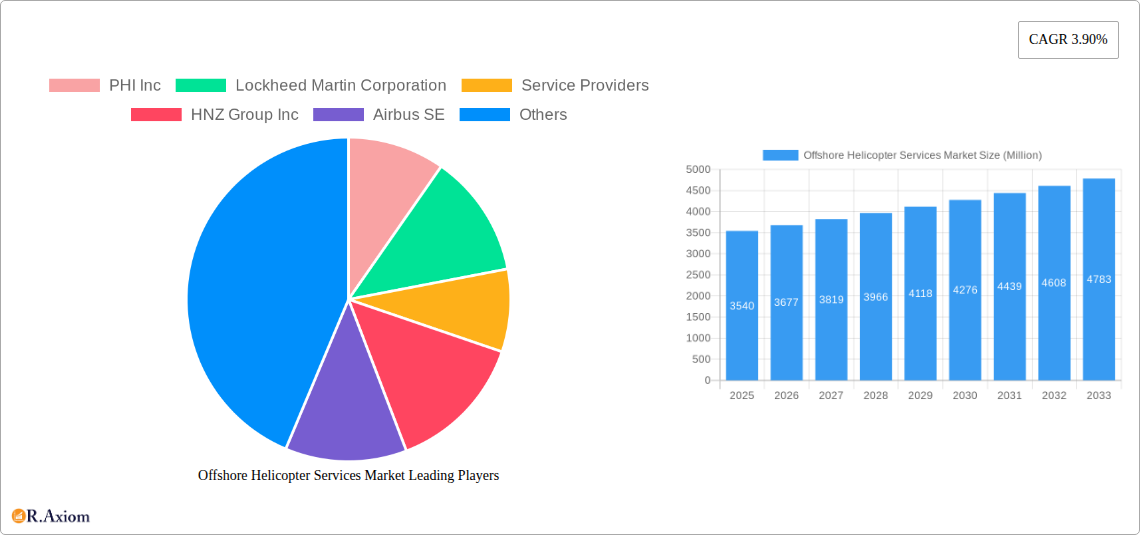

Offshore Helicopter Services Market Company Market Share

Here is the SEO-optimized, detailed report description for the Offshore Helicopter Services Market, designed for high search visibility and stakeholder engagement:

Offshore Helicopter Services Market Market Concentration & Innovation

The Offshore Helicopter Services Market exhibits moderate to high concentration, with a significant share held by a few key players. Leading helicopter manufacturers like Airbus SE, Leonardo S.p.A., and Textron Inc. heavily influence the market through their advanced rotorcraft technology and continuous innovation. Service providers such as Bristow Group Inc., PHI Inc., and CHC Group Ltd. compete fiercely for contracts, driving advancements in operational efficiency and safety protocols. Innovation is primarily fueled by the demand for enhanced safety features, increased payload capacity, improved fuel efficiency, and the integration of advanced avionics and navigation systems. Regulatory frameworks, established by aviation authorities worldwide, play a crucial role in shaping market dynamics, dictating stringent safety standards and operational permits. Product substitutes, while limited in direct offshore operations, might include alternative transport methods for personnel to nearshore facilities or advancements in uncrewed aerial vehicles for specific cargo delivery. End-user trends are increasingly leaning towards sustainable operations and the exploration of remote offshore reserves. Mergers and acquisitions (M&A) activity, such as the April 2023 acquisition of Offshore Helicopter Services by Ultimate Aviation, indicate a trend towards consolidation and expansion of service capabilities. The M&A deal values are substantial, reflecting strategic moves to gain market share and operational synergies.

Offshore Helicopter Services Market Industry Trends & Insights

The Offshore Helicopter Services Market is experiencing robust growth, driven by the escalating global demand for energy resources and the expansion of offshore wind farms. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 4.5% to 5.5% during the forecast period of 2025–2033. Market penetration is deepening across established and emerging offshore exploration regions, particularly in Asia-Pacific and the Middle East. Technological disruptions are at the forefront of industry evolution, with a significant push towards the adoption of advanced helicopter models boasting superior performance, enhanced safety features, and reduced environmental impact. The development of new rotorcraft with greater range and payload capacity directly caters to the needs of the oil and gas industry and the burgeoning offshore wind sector. Consumer preferences are shifting towards service providers offering comprehensive solutions, including maintenance, repair, and overhaul (MRO) services, alongside reliable transportation. Competitive dynamics are intense, characterized by strategic partnerships between helicopter manufacturers and service providers, aimed at developing customized solutions for specific offshore operational requirements. The increasing focus on sustainability is also influencing demand for more fuel-efficient aircraft and environmentally conscious operational practices. Furthermore, the growing complexity of offshore projects, including deep-water exploration and large-scale wind farm installations, necessitates specialized helicopter capabilities, driving demand for medium and heavy helicopters. The integration of digital technologies for real-time monitoring and predictive maintenance is also becoming a critical factor for service providers to enhance operational reliability and cost-effectiveness.

Dominant Markets & Segments in Offshore Helicopter Services Market

The Oil and Gas Industry segment holds dominant market share within the Offshore Helicopter Services Market, largely due to the continuous need for personnel and equipment transport to remote exploration and production sites. This dominance is underpinned by ongoing investments in offshore drilling and the exploitation of mature fields requiring regular logistical support.

- Key Drivers in the Oil and Gas Industry:

- Energy Demand: Persistent global energy requirements fuel offshore exploration and production activities.

- Technological Advancements: Innovations in drilling technology enable access to previously inaccessible offshore reserves.

- Government Policies: Supportive regulatory environments and licensing rounds for offshore blocks stimulate investment.

- Infrastructure Development: Continued investment in offshore platforms and facilities necessitates robust helicopter support.

The Medium and Heavy Helicopters segment is also a dominant force, essential for transporting larger crews, heavier equipment, and for longer-range missions critical to offshore operations. Their versatility makes them indispensable for both oil and gas and the growing offshore wind sectors.

- Key Drivers for Medium and Heavy Helicopters:

- Mission Requirements: Ability to carry more passengers and heavier cargo is crucial for complex offshore tasks.

- Range and Endurance: Extended flight times are required for operations in remote offshore locations.

- Versatility: Adaptability for various roles, including search and rescue, medical evacuation, and specialized transport.

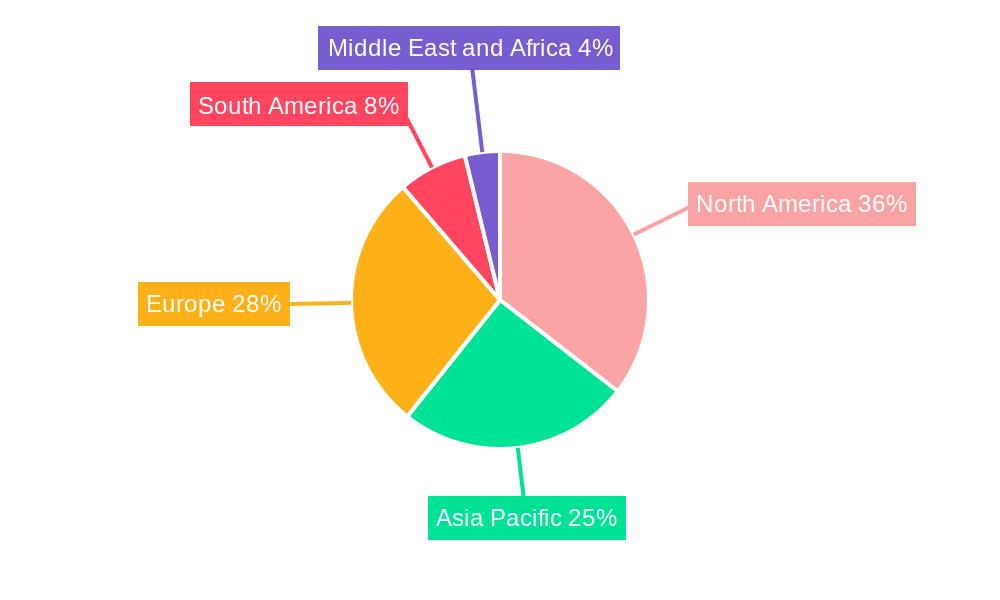

Geographically, Asia-Pacific is emerging as a significant growth region, driven by substantial investments in offshore oil and gas exploration and the rapid expansion of the offshore wind energy sector in countries like China and Vietnam.

- Key Drivers in Asia-Pacific:

- Economic Growth: Rapid industrialization and increasing energy consumption.

- Resource Potential: Vast unexplored offshore reserves in the region.

- Government Initiatives: Strong push for renewable energy development and strategic focus on energy security.

- Infrastructure Investment: Development of new port facilities and offshore energy infrastructure.

Within applications, Production activities represent a substantial segment, requiring continuous helicopter services for crew changes, maintenance, and supply runs to operational platforms.

- Key Drivers for Production Application:

- Operational Continuity: Ensuring uninterrupted production requires reliable personnel and supply chain support.

- Maintenance and Repair: Access to platforms for routine and emergency maintenance.

- Personnel Logistics: Efficient transportation of skilled workers to and from production facilities.

The Offshore Wind Industry is a rapidly growing segment, showcasing strong market penetration. The expansion of offshore wind farms globally necessitates significant helicopter support for construction, maintenance, and inspection.

- Key Drivers for Offshore Wind Industry:

- Renewable Energy Targets: Global commitment to decarbonization and increasing reliance on wind energy.

- Technological Advancements: Larger turbines and more complex installations requiring specialized support.

- Government Subsidies and Incentives: Favorable policies promoting offshore wind development.

Offshore Helicopter Services Market Product Developments

Product developments in the Offshore Helicopter Services Market are characterized by a strong emphasis on safety, efficiency, and sustainability. Manufacturers are innovating with lighter, more fuel-efficient airframes, advanced composite materials, and next-generation avionics systems that enhance situational awareness and reduce pilot workload. The integration of state-of-the-art navigation and communication systems is crucial for operations in challenging offshore environments. Furthermore, there's a growing focus on developing helicopters with enhanced environmental performance, including reduced emissions and noise pollution. These advancements provide competitive advantages by offering operators lower operating costs, improved mission capabilities, and a stronger commitment to environmental stewardship, aligning with evolving industry and regulatory demands.

Report Scope & Segmentation Analysis

The Offshore Helicopter Services Market is segmented by Type, including Light Helicopters, and Medium and Heavy Helicopters. The Medium and Heavy Helicopters segment is projected to lead in market share due to their greater payload capacity and longer range, essential for extensive offshore operations. The End-user Industry is analyzed across the Oil and Gas Industry, Offshore Wind Industry, and Other End-user Industries. The Oil and Gas Industry currently dominates, driven by exploration and production activities, but the Offshore Wind Industry is exhibiting rapid growth. Application segments include Drilling, Production, Relocation and Decommissioning, and Other Applications. Production activities are expected to maintain a significant market share due to continuous operational needs.

Key Drivers of Offshore Helicopter Services Market Growth

Key drivers fueling the Offshore Helicopter Services Market growth include the sustained global demand for energy, necessitating continued exploration and production in offshore regions. The rapid expansion of the offshore wind industry, supported by government initiatives and climate change mitigation goals, presents a substantial growth avenue. Technological advancements in helicopter design, focusing on safety, efficiency, and environmental performance, are critical enablers. Additionally, favorable regulatory frameworks and government incentives for both offshore energy sectors encourage investment and operational expansion.

Challenges in the Offshore Helicopter Services Market Sector

Significant challenges facing the Offshore Helicopter Services Market include the inherent cyclicality of the oil and gas industry, which can impact investment in exploration and thus demand for services. Stringent and evolving regulatory requirements for safety and environmental compliance necessitate continuous investment in training and equipment. High capital costs for acquiring and maintaining advanced helicopter fleets pose a barrier for smaller players. Furthermore, geopolitical instability and fluctuating commodity prices can create market uncertainty and affect demand patterns.

Emerging Opportunities in Offshore Helicopter Services Market

Emerging opportunities lie in the increasing demand for helicopter services supporting the offshore wind energy sector, a rapidly growing market with significant expansion potential. The development of new ultra-deepwater oil and gas fields also presents opportunities for specialized helicopter operations. Advancements in electric and hybrid-electric helicopter technology could offer sustainable and cost-effective solutions for certain offshore missions. Furthermore, the growing need for search and rescue (SAR) capabilities in remote offshore areas represents another burgeoning market segment.

Leading Players in the Offshore Helicopter Services Market Market

- PHI Inc

- Lockheed Martin Corporation

- HNZ Group Inc

- Airbus SE

- CHC Group Ltd

- Textron Inc

- Leonardo SpA

- Bristow Group Inc

- Abu Dhabi Aviation Airways PJSC (Abu Dhabi Aviation)

Key Developments in Offshore Helicopter Services Market Industry

- April 2023: South Africa-based Ultimate Aviation acquired North Sea helicopter services provider Offshore Helicopter Services. The deal has been completed, and the acquisition is expected to present exciting opportunities for OHS, as both companies believe.

- March 2023: At Heli-Expo 2023, Leonardo announced that Abu Dhabi Aviation (ADA) inked a contract to purchase six AW139 intermediate twin-engine helicopters. The aircraft are scheduled to be delivered between 2024 and 2026. They are to be used to execute offshore transport missions, boosting ADA's AW139 fleet, which is expected to assist the energy industry largely.

- July 2022: China's CITIC Offshore Helicopter Corporation purchased four AW139 helicopters for offshore oil and gas production. Four AW139 offshore-configured helicopters are planned to arrive in 2023. The acquisition brings COHC's Leonardo fleet to ten helicopters, including eight AW139s, one AW169, and one AW109 Power.

Strategic Outlook for Offshore Helicopter Services Market Market

The strategic outlook for the Offshore Helicopter Services Market is characterized by significant growth potential, primarily driven by the dual expansion of offshore oil and gas activities and the burgeoning offshore wind sector. Key growth catalysts include the increasing global energy demand, coupled with aggressive renewable energy targets. Innovations in helicopter technology, focusing on enhanced safety, fuel efficiency, and reduced environmental impact, will be pivotal. Companies that can offer integrated service solutions, including maintenance, training, and specialized operational support, are poised for success. Strategic partnerships between manufacturers and service providers, along with targeted M&A activities, will shape the competitive landscape, leading to a market focused on sustainability, efficiency, and technological advancement.

Offshore Helicopter Services Market Segmentation

-

1. Type

- 1.1. Light Helicopters

- 1.2. Medium and Heavy Helicopters

-

2. End-user Industry

- 2.1. Oil and Gas Industry

- 2.2. Offshore Wind Industry

- 2.3. Other End-user Industries

-

3. Application

- 3.1. Drilling

- 3.2. Production

- 3.3. Relocation and Decommissioning

- 3.4. Other Applications

Offshore Helicopter Services Market Segmentation By Geography

-

1. North America

- 1.1. United States of America

- 1.2. Canada

- 1.3. Rest of North America

-

2. Asia Pacific

- 2.1. China

- 2.2. India

- 2.3. Japan

- 2.4. Rest of Asia Pacific

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Rest of the Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of the South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. United Arab Emirates

- 5.3. Rest of the Middle East and Africa

Offshore Helicopter Services Market Regional Market Share

Geographic Coverage of Offshore Helicopter Services Market

Offshore Helicopter Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.90% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rising Deepwater Offshore Exploration and Development Activities

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Competition from Crew Transfer Vessels

- 3.4. Market Trends

- 3.4.1. Offshore Wind Power Industry Expected to Witness Fastest Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Offshore Helicopter Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Light Helicopters

- 5.1.2. Medium and Heavy Helicopters

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Oil and Gas Industry

- 5.2.2. Offshore Wind Industry

- 5.2.3. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Drilling

- 5.3.2. Production

- 5.3.3. Relocation and Decommissioning

- 5.3.4. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Asia Pacific

- 5.4.3. Europe

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Offshore Helicopter Services Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Light Helicopters

- 6.1.2. Medium and Heavy Helicopters

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Oil and Gas Industry

- 6.2.2. Offshore Wind Industry

- 6.2.3. Other End-user Industries

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Drilling

- 6.3.2. Production

- 6.3.3. Relocation and Decommissioning

- 6.3.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Asia Pacific Offshore Helicopter Services Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Light Helicopters

- 7.1.2. Medium and Heavy Helicopters

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Oil and Gas Industry

- 7.2.2. Offshore Wind Industry

- 7.2.3. Other End-user Industries

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Drilling

- 7.3.2. Production

- 7.3.3. Relocation and Decommissioning

- 7.3.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Offshore Helicopter Services Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Light Helicopters

- 8.1.2. Medium and Heavy Helicopters

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Oil and Gas Industry

- 8.2.2. Offshore Wind Industry

- 8.2.3. Other End-user Industries

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Drilling

- 8.3.2. Production

- 8.3.3. Relocation and Decommissioning

- 8.3.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Offshore Helicopter Services Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Light Helicopters

- 9.1.2. Medium and Heavy Helicopters

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Oil and Gas Industry

- 9.2.2. Offshore Wind Industry

- 9.2.3. Other End-user Industries

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Drilling

- 9.3.2. Production

- 9.3.3. Relocation and Decommissioning

- 9.3.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Offshore Helicopter Services Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Light Helicopters

- 10.1.2. Medium and Heavy Helicopters

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Oil and Gas Industry

- 10.2.2. Offshore Wind Industry

- 10.2.3. Other End-user Industries

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Drilling

- 10.3.2. Production

- 10.3.3. Relocation and Decommissioning

- 10.3.4. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 PHI Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Lockheed Martin Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Service Providers

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 HNZ Group Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Airbus SE

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 CHC Group Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Textron Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Leonardo SpA

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bristow Group Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Abu Dhabi Aviation Airways PJSC (Abu Dhabi Aviation)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Helicopter Manufacturers

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 PHI Inc

List of Figures

- Figure 1: Global Offshore Helicopter Services Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Offshore Helicopter Services Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Offshore Helicopter Services Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Offshore Helicopter Services Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 5: North America Offshore Helicopter Services Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America Offshore Helicopter Services Market Revenue (Million), by Application 2025 & 2033

- Figure 7: North America Offshore Helicopter Services Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Offshore Helicopter Services Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Offshore Helicopter Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Offshore Helicopter Services Market Revenue (Million), by Type 2025 & 2033

- Figure 11: Asia Pacific Offshore Helicopter Services Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Asia Pacific Offshore Helicopter Services Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 13: Asia Pacific Offshore Helicopter Services Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 14: Asia Pacific Offshore Helicopter Services Market Revenue (Million), by Application 2025 & 2033

- Figure 15: Asia Pacific Offshore Helicopter Services Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Asia Pacific Offshore Helicopter Services Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Asia Pacific Offshore Helicopter Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Offshore Helicopter Services Market Revenue (Million), by Type 2025 & 2033

- Figure 19: Europe Offshore Helicopter Services Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Europe Offshore Helicopter Services Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 21: Europe Offshore Helicopter Services Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 22: Europe Offshore Helicopter Services Market Revenue (Million), by Application 2025 & 2033

- Figure 23: Europe Offshore Helicopter Services Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Europe Offshore Helicopter Services Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Offshore Helicopter Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Offshore Helicopter Services Market Revenue (Million), by Type 2025 & 2033

- Figure 27: South America Offshore Helicopter Services Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: South America Offshore Helicopter Services Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 29: South America Offshore Helicopter Services Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: South America Offshore Helicopter Services Market Revenue (Million), by Application 2025 & 2033

- Figure 31: South America Offshore Helicopter Services Market Revenue Share (%), by Application 2025 & 2033

- Figure 32: South America Offshore Helicopter Services Market Revenue (Million), by Country 2025 & 2033

- Figure 33: South America Offshore Helicopter Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Offshore Helicopter Services Market Revenue (Million), by Type 2025 & 2033

- Figure 35: Middle East and Africa Offshore Helicopter Services Market Revenue Share (%), by Type 2025 & 2033

- Figure 36: Middle East and Africa Offshore Helicopter Services Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 37: Middle East and Africa Offshore Helicopter Services Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 38: Middle East and Africa Offshore Helicopter Services Market Revenue (Million), by Application 2025 & 2033

- Figure 39: Middle East and Africa Offshore Helicopter Services Market Revenue Share (%), by Application 2025 & 2033

- Figure 40: Middle East and Africa Offshore Helicopter Services Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Offshore Helicopter Services Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Offshore Helicopter Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Offshore Helicopter Services Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Offshore Helicopter Services Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Offshore Helicopter Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Offshore Helicopter Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Offshore Helicopter Services Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 7: Global Offshore Helicopter Services Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Offshore Helicopter Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States of America Offshore Helicopter Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Offshore Helicopter Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Offshore Helicopter Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Offshore Helicopter Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 13: Global Offshore Helicopter Services Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 14: Global Offshore Helicopter Services Market Revenue Million Forecast, by Application 2020 & 2033

- Table 15: Global Offshore Helicopter Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: China Offshore Helicopter Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: India Offshore Helicopter Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Japan Offshore Helicopter Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Rest of Asia Pacific Offshore Helicopter Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Global Offshore Helicopter Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 21: Global Offshore Helicopter Services Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 22: Global Offshore Helicopter Services Market Revenue Million Forecast, by Application 2020 & 2033

- Table 23: Global Offshore Helicopter Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Germany Offshore Helicopter Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: United Kingdom Offshore Helicopter Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: France Offshore Helicopter Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of the Europe Offshore Helicopter Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Offshore Helicopter Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 29: Global Offshore Helicopter Services Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 30: Global Offshore Helicopter Services Market Revenue Million Forecast, by Application 2020 & 2033

- Table 31: Global Offshore Helicopter Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Brazil Offshore Helicopter Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Argentina Offshore Helicopter Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Rest of the South America Offshore Helicopter Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Global Offshore Helicopter Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 36: Global Offshore Helicopter Services Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 37: Global Offshore Helicopter Services Market Revenue Million Forecast, by Application 2020 & 2033

- Table 38: Global Offshore Helicopter Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 39: Saudi Arabia Offshore Helicopter Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: United Arab Emirates Offshore Helicopter Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of the Middle East and Africa Offshore Helicopter Services Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Offshore Helicopter Services Market?

The projected CAGR is approximately 3.90%.

2. Which companies are prominent players in the Offshore Helicopter Services Market?

Key companies in the market include PHI Inc, Lockheed Martin Corporation, Service Providers, HNZ Group Inc, Airbus SE, CHC Group Ltd, Textron Inc, Leonardo SpA, Bristow Group Inc, Abu Dhabi Aviation Airways PJSC (Abu Dhabi Aviation), Helicopter Manufacturers.

3. What are the main segments of the Offshore Helicopter Services Market?

The market segments include Type, End-user Industry, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.54 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rising Deepwater Offshore Exploration and Development Activities.

6. What are the notable trends driving market growth?

Offshore Wind Power Industry Expected to Witness Fastest Growth.

7. Are there any restraints impacting market growth?

4.; Increasing Competition from Crew Transfer Vessels.

8. Can you provide examples of recent developments in the market?

April 2023: South Africa-based Ultimate Aviation acquired North Sea helicopter services provider Offshore Helicopter Services. The deal has been completed, and the acquisition is expected to present exciting opportunities for OHS, as both companies believe.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Offshore Helicopter Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Offshore Helicopter Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Offshore Helicopter Services Market?

To stay informed about further developments, trends, and reports in the Offshore Helicopter Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence