Key Insights

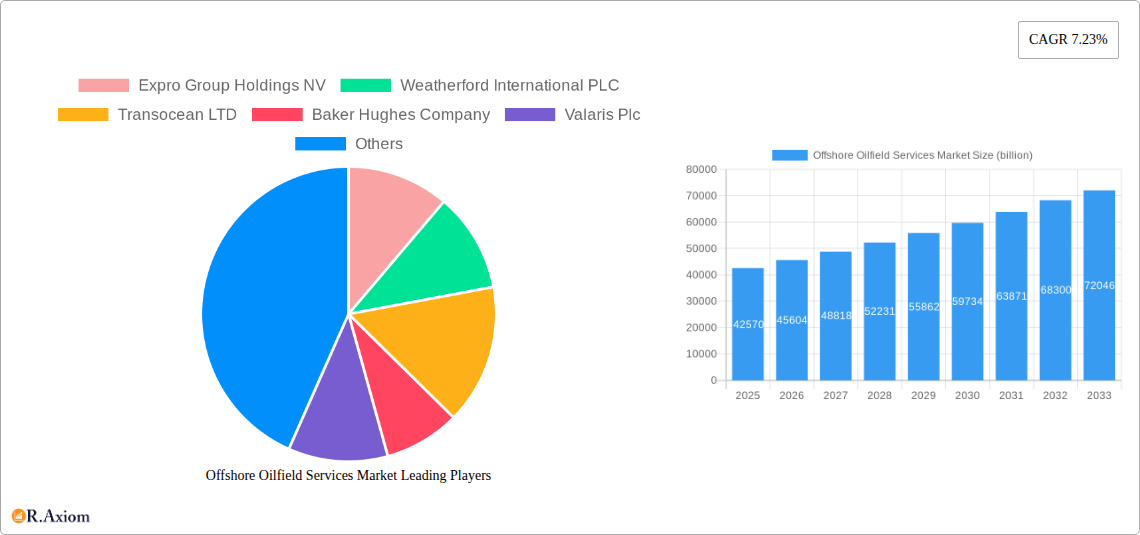

The global Offshore Oilfield Services Market is poised for substantial growth, projected to reach an estimated $42.57 billion in 2025, with a robust Compound Annual Growth Rate (CAGR) of 7.23% through 2033. This expansion is primarily driven by increasing global energy demand, necessitating greater exploration and production activities in offshore environments. As conventional onshore reserves become more depleted, companies are intensifying their focus on offshore frontiers, including deepwater and ultra-deepwater locations, which are rich in untapped hydrocarbon resources. Technological advancements in drilling, completion, and production techniques are crucial enablers, improving efficiency and reducing operational costs, thereby making offshore projects more economically viable. Furthermore, the ongoing energy transition, while emphasizing renewables, still relies on oil and gas for a significant portion of the global energy mix, ensuring sustained investment in offshore exploration and production services.

Offshore Oilfield Services Market Market Size (In Billion)

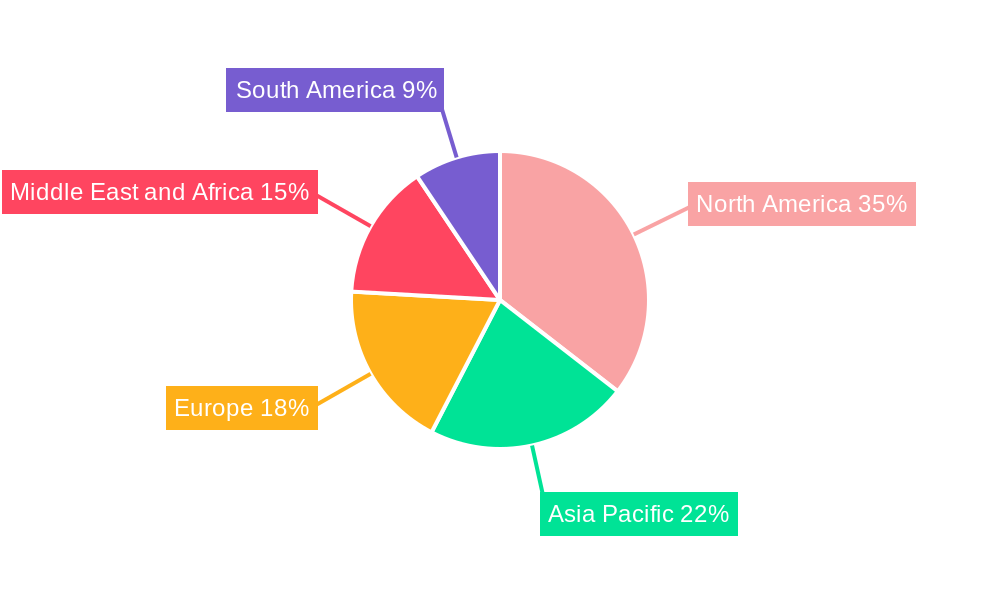

Key market segments contributing to this growth include Drilling Services, Completion Services (further categorized into Cementing, Hydraulic Fracturing, and Other Completion Services), and Production and Intervention Services (encompassing Logging, Production Testing, Well Services, and Other Production and Intervention Services). The demand for specialized drilling technologies and advanced completion techniques to maximize hydrocarbon recovery from complex offshore reservoirs is a significant trend. However, the market faces certain restraints, including the volatility of oil prices, which can impact investment decisions, and stringent environmental regulations that necessitate significant compliance costs. Geographically, North America, driven by the United States and Canada's extensive offshore operations, is expected to maintain a leading position. Asia Pacific, with burgeoning energy needs in countries like China and India, and the Middle East, with its vast offshore reserves, are also significant growth regions. Companies like Schlumberger, Halliburton, Baker Hughes, and TechnipFMC are key players investing heavily in innovation and strategic partnerships to capitalize on these market opportunities.

Offshore Oilfield Services Market Company Market Share

This in-depth market research report provides a panoramic view of the global Offshore Oilfield Services Market, offering critical insights for stakeholders navigating this dynamic sector. With a detailed analysis spanning the historical period of 2019-2024, a base and estimated year of 2025, and a robust forecast period from 2025-2033, this report equips industry players with actionable intelligence to capitalize on emerging opportunities and mitigate potential challenges. The market, projected to reach USD 175.89 billion by 2033, is characterized by significant technological advancements, evolving regulatory landscapes, and increasing demand for energy resources.

Offshore Oilfield Services Market Market Concentration & Innovation

The Offshore Oilfield Services Market exhibits a moderate to high concentration, with a few dominant global players controlling a substantial market share. Key companies like Schlumberger Limited, Halliburton Company, Baker Hughes Company, and TechnipFMC PLC are at the forefront, driving innovation through significant investments in research and development. Market concentration is influenced by the high capital expenditure required for offshore operations and the specialized nature of the services offered. Innovation is primarily driven by the pursuit of efficiency, safety, and environmental sustainability in exploration and production (E&P) activities. The development of advanced drilling technologies, subsea systems, and digital solutions for real-time data analysis are key innovation drivers. Regulatory frameworks play a crucial role, with stringent environmental standards and safety regulations shaping service offerings and operational practices. Product substitutes are limited due to the specialized nature of offshore oilfield services; however, advancements in renewable energy technologies present a long-term indirect substitute. End-user trends indicate a growing preference for integrated service solutions and a demand for services that minimize environmental impact. Mergers and acquisitions (M&A) activities are prevalent as companies seek to expand their service portfolios, geographical reach, and technological capabilities. For instance, significant M&A deals in the historical period are expected to have reshaped market dynamics, with the aggregate M&A deal value in the past few years reaching into the billions.

Offshore Oilfield Services Market Industry Trends & Insights

The Offshore Oilfield Services Market is experiencing robust growth, driven by several key factors. The increasing global demand for crude oil and natural gas, coupled with the declining reserves in conventional onshore fields, is compelling oil and gas companies to explore and develop more challenging offshore reserves. This has led to a surge in exploration and production (E&P) activities in deepwater and ultra-deepwater regions, consequently boosting the demand for specialized offshore oilfield services. Technological disruptions are continuously reshaping the industry. The advent of digitalization, artificial intelligence (AI), and the Internet of Things (IoT) is enabling real-time monitoring, predictive maintenance, and enhanced operational efficiency in offshore platforms and rigs. Companies are investing heavily in these technologies to reduce costs, improve safety, and optimize production. Consumer preferences are evolving, with a growing emphasis on environmental sustainability and responsible energy production. This is driving the demand for services that minimize carbon emissions, reduce waste, and adhere to strict environmental regulations. The competitive dynamics within the market are characterized by intense rivalry among established players, who are constantly innovating and vying for market share through strategic partnerships, acquisitions, and the development of advanced technologies. The market penetration of advanced drilling techniques and subsea technologies is steadily increasing. The Compound Annual Growth Rate (CAGR) for the Offshore Oilfield Services Market is projected to be approximately 5.2% during the forecast period of 2025-2033, indicating sustained expansion. The increasing focus on maximizing recovery from existing offshore fields and exploring new frontier areas in regions like the Arctic and the Mediterranean will further fuel market growth. The sustained high prices of crude oil, barring significant geopolitical disruptions, will continue to incentivize offshore exploration and production investments, thereby supporting the demand for a wide array of oilfield services.

Dominant Markets & Segments in Offshore Oilfield Services Market

The North America region, particularly the United States and Canada, currently dominates the Offshore Oilfield Services Market. This dominance is attributed to the presence of mature offshore basins like the Gulf of Mexico, coupled with significant investments in deepwater exploration and production. Economic policies that favor energy independence and substantial investments in technological advancements further bolster its leading position.

- Key Drivers in North America:

- Abundant deepwater reserves and advanced E&P technologies.

- Favorable regulatory environment for offshore development.

- Strong presence of major oil and gas companies and service providers.

- Robust infrastructure for offshore operations.

Drilling Services represent the largest segment within the Service Type category. This segment includes exploration drilling, development drilling, and workover services, all of which are fundamental to offshore oil and gas extraction. The increasing number of offshore projects globally, especially in deepwater and ultra-deepwater locations, directly translates to a higher demand for drilling rigs, associated equipment, and skilled personnel. The Completion Services segment, encompassing Cementing Services, Hydraulic Fracturing Services, and Other Completion Services, is also a significant contributor. Cementing services are critical for well integrity and zonal isolation, while hydraulic fracturing is increasingly being employed in offshore unconventional reservoirs. The Production and Intervention Services segment, which includes Logging Services, Production Testing, Well Services, and Other Production and Intervention Services, is vital for optimizing production, maintaining well performance, and ensuring the longevity of offshore assets.

- Dominance Analysis of Key Segments:

- Drilling Services: The insatiable demand for new reserves necessitates continuous drilling activities. Technological advancements in drilling techniques, such as managed pressure drilling (MPD) and high-pressure high-temperature (HPHT) drilling, are expanding the scope and complexity of offshore drilling operations, further solidifying this segment's dominance. The market for drilling services is estimated to be USD 65.34 billion in 2025.

- Completion Services: As wells become more complex, so does the need for specialized completion techniques. Innovations in intelligent completions and multi-stage fracturing are driving growth within this segment. The market for completion services is projected to reach USD 38.78 billion by 2033.

- Production and Intervention Services: The mature nature of many offshore fields necessitates continuous intervention and production optimization services. This segment is driven by the need to maximize hydrocarbon recovery and extend the productive life of existing offshore assets. The market for production and intervention services is expected to grow steadily, reaching an estimated USD 55.10 billion by 2033.

- Other Services: This residual category, while smaller, includes crucial support functions and emerging technologies that are essential for the overall efficiency and sustainability of offshore operations.

Offshore Oilfield Services Market Product Developments

Product developments in the Offshore Oilfield Services Market are increasingly focused on enhancing efficiency, safety, and environmental performance. Innovations in autonomous underwater vehicles (AUVs) and remotely operated vehicles (ROVs) for subsea inspection and intervention are gaining traction. Furthermore, advancements in digital twin technology and AI-powered predictive analytics are revolutionizing well monitoring and maintenance, leading to reduced downtime and optimized production. The development of more robust and environmentally friendly drilling fluids and cementing solutions are also key product trends. These innovations offer competitive advantages by reducing operational costs, improving the reliability of offshore assets, and enabling operations in more challenging environments.

Offshore Oilfield Services Market Scope & Segmentation Analysis

The Offshore Oilfield Services Market is segmented by Service Type. The primary segments analyzed include:

Drilling Services: This segment encompasses all activities related to drilling new wells, including exploration and development drilling. It is characterized by high capital expenditure and technological sophistication. The market size for drilling services is projected to be USD 65.34 billion in 2025, with an estimated CAGR of 4.8% during the forecast period.

Completion Services: This segment includes services required to prepare a well for production after drilling. It is further broken down into Cementing Services, crucial for wellbore integrity; Hydraulic Fracturing Services, employed for stimulating production in certain formations; and Other Completion Services, covering a range of specialized activities. The market size for completion services is estimated at USD 28.15 billion in 2025, with a projected CAGR of 5.5%.

Production and Intervention Services: This segment focuses on optimizing production from existing wells and performing maintenance or remedial work. It comprises Logging Services, for reservoir characterization; Production Testing, to assess flow rates; Well Services, for maintenance and repair; and Other Production and Intervention Services. The market size for this segment is estimated at USD 40.88 billion in 2025, with an anticipated CAGR of 5.4%.

Other Services: This segment includes a range of other essential support services not classified in the above categories, contributing to the overall operational efficiency and safety of offshore oil and gas operations. The market size for this segment is estimated at USD 41.52 billion in 2025, with a projected CAGR of 5.1%.

Key Drivers of Offshore Oilfield Services Market Growth

The growth of the Offshore Oilfield Services Market is primarily propelled by the persistent global demand for energy, which necessitates the exploration and development of offshore hydrocarbon reserves. Technological advancements, particularly in deepwater and ultra-deepwater exploration and production, are unlocking new reserves and driving demand for specialized services. Favorable economic policies and government incentives aimed at boosting domestic energy production also play a significant role. Furthermore, the maturation of onshore fields globally is forcing companies to shift their focus to offshore prospects, thereby increasing the overall market potential. The increasing emphasis on enhanced oil recovery (EOR) techniques in aging offshore fields also contributes to sustained demand for intervention and production services.

Challenges in the Offshore Oilfield Services Market Sector

Despite its growth potential, the Offshore Oilfield Services Market faces several challenges. Volatile crude oil prices create uncertainty and can lead to reduced capital expenditure by oil and gas companies, impacting service demand. Stringent environmental regulations and the growing pressure to reduce carbon emissions necessitate significant investments in sustainable technologies and practices, increasing operational costs. Geopolitical instability and complex regulatory frameworks in certain offshore regions can hinder project development and increase operational risks. The high cost of entry and operation, coupled with the need for specialized equipment and skilled labor, also presents a significant barrier for new entrants and can constrain market expansion. Supply chain disruptions, as experienced during recent global events, can also impact project timelines and costs.

Emerging Opportunities in Offshore Oilfield Services Market

Emerging opportunities in the Offshore Oilfield Services Market lie in the increasing focus on deepwater and ultra-deepwater exploration, driven by technological advancements that make these challenging environments more accessible. The growing demand for natural gas as a cleaner fossil fuel is also spurring investments in offshore gas fields. Furthermore, the digitalization of offshore operations, including the adoption of AI, IoT, and big data analytics, presents significant opportunities for service providers offering integrated digital solutions for enhanced efficiency and predictive maintenance. The development of offshore wind farms also presents a potential diversification avenue for some oilfield service companies, leveraging their expertise in offshore construction and engineering. The drive towards decarbonization is also creating opportunities in carbon capture, utilization, and storage (CCUS) solutions for offshore facilities.

Leading Players in the Offshore Oilfield Services Market Market

- Expro Group Holdings NV

- Weatherford International PLC

- Transocean LTD

- Baker Hughes Company

- Valaris Plc

- China Oilfield Services Limited

- Halliburton Company

- OiLSERV

- Schlumberger Limited

- TechnipFMC PLC

- Nabors Industries Ltd

Key Developments in Offshore Oilfield Services Market Industry

March 2022: Saipem was awarded an offshore drilling contract worth USD 325 million by Norway's oil and gas company Aker BP for a campaign offshore Norway. The operations were expected to commence from the end of Q4 2022. The contract involves the use of Saipem's Scarabeo 8, a semi-submersible drilling rig capable of operating in harsh environments, featuring a dual derrick, deepwater capabilities, a dynamic positioning system, and enhanced mooring capabilities.

February 2022: Abu Dhabi National Oil Company (ADNOC) awarded framework agreements to four oilfield services providers valued at USD 1.94 billion. These agreements are designed to support drilling growth in ADNOC's operations within the United Arab Emirates (UAE). The awards are a consequence of ADNOC's recent investments in drilling-related equipment and services, aimed at boosting crude oil production capacity to 5 million barrels per day (mmbpd) by 2030. The framework agreements cover ADNOC's onshore and offshore fields and are set to run for five years with an option for an additional two years.

Strategic Outlook for Offshore Oilfield Services Market Market

The strategic outlook for the Offshore Oilfield Services Market is one of sustained growth and continuous innovation. Companies are expected to focus on expanding their capabilities in deepwater and ultra-deepwater operations, leveraging advanced technologies to reduce costs and improve efficiency. The integration of digital solutions, including AI and IoT, will be crucial for optimizing operations, enhancing safety, and providing predictive maintenance services. Strategic partnerships and acquisitions will likely continue as companies aim to consolidate their market positions and broaden their service offerings. The increasing emphasis on environmental sustainability will drive demand for greener technologies and services, creating opportunities for companies that can demonstrate a commitment to responsible resource development. The market's ability to adapt to fluctuating commodity prices and evolving regulatory landscapes will be key to long-term success.

Offshore Oilfield Services Market Segmentation

-

1. Service Type

- 1.1. Drilling Services

-

1.2. Completion Services

- 1.2.1. Cementing Services

- 1.2.2. Hydraulic Fracturing Services

- 1.2.3. Other Completion Services

-

1.3. Production and Intervention Services

- 1.3.1. Logging Services

- 1.3.2. Production Testing

- 1.3.3. Well Services

- 1.3.4. Other Production and Intervention Services

- 1.4. Other Se

Offshore Oilfield Services Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Asia Pacific

- 2.1. China

- 2.2. India

- 2.3. Indonesia

- 2.4. Malaysia

- 2.5. Rest of Asia Pacific

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Norway

- 3.4. Denmark

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. United Arab Emirates

- 5.3. Nigeria

- 5.4. Rest of Middle East and Africa

Offshore Oilfield Services Market Regional Market Share

Geographic Coverage of Offshore Oilfield Services Market

Offshore Oilfield Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.23% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Automotive Sales in Saudi Arabia4.; Rising Demand from Heavy Automotives

- 3.3. Market Restrains

- 3.3.1. 4.; Rising Emphasis on Electric Vehicles

- 3.4. Market Trends

- 3.4.1. Drilling Services Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Offshore Oilfield Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Drilling Services

- 5.1.2. Completion Services

- 5.1.2.1. Cementing Services

- 5.1.2.2. Hydraulic Fracturing Services

- 5.1.2.3. Other Completion Services

- 5.1.3. Production and Intervention Services

- 5.1.3.1. Logging Services

- 5.1.3.2. Production Testing

- 5.1.3.3. Well Services

- 5.1.3.4. Other Production and Intervention Services

- 5.1.4. Other Se

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Asia Pacific

- 5.2.3. Europe

- 5.2.4. South America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. North America Offshore Oilfield Services Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Drilling Services

- 6.1.2. Completion Services

- 6.1.2.1. Cementing Services

- 6.1.2.2. Hydraulic Fracturing Services

- 6.1.2.3. Other Completion Services

- 6.1.3. Production and Intervention Services

- 6.1.3.1. Logging Services

- 6.1.3.2. Production Testing

- 6.1.3.3. Well Services

- 6.1.3.4. Other Production and Intervention Services

- 6.1.4. Other Se

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Asia Pacific Offshore Oilfield Services Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Drilling Services

- 7.1.2. Completion Services

- 7.1.2.1. Cementing Services

- 7.1.2.2. Hydraulic Fracturing Services

- 7.1.2.3. Other Completion Services

- 7.1.3. Production and Intervention Services

- 7.1.3.1. Logging Services

- 7.1.3.2. Production Testing

- 7.1.3.3. Well Services

- 7.1.3.4. Other Production and Intervention Services

- 7.1.4. Other Se

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Europe Offshore Oilfield Services Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Drilling Services

- 8.1.2. Completion Services

- 8.1.2.1. Cementing Services

- 8.1.2.2. Hydraulic Fracturing Services

- 8.1.2.3. Other Completion Services

- 8.1.3. Production and Intervention Services

- 8.1.3.1. Logging Services

- 8.1.3.2. Production Testing

- 8.1.3.3. Well Services

- 8.1.3.4. Other Production and Intervention Services

- 8.1.4. Other Se

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. South America Offshore Oilfield Services Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Drilling Services

- 9.1.2. Completion Services

- 9.1.2.1. Cementing Services

- 9.1.2.2. Hydraulic Fracturing Services

- 9.1.2.3. Other Completion Services

- 9.1.3. Production and Intervention Services

- 9.1.3.1. Logging Services

- 9.1.3.2. Production Testing

- 9.1.3.3. Well Services

- 9.1.3.4. Other Production and Intervention Services

- 9.1.4. Other Se

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. Middle East and Africa Offshore Oilfield Services Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 10.1.1. Drilling Services

- 10.1.2. Completion Services

- 10.1.2.1. Cementing Services

- 10.1.2.2. Hydraulic Fracturing Services

- 10.1.2.3. Other Completion Services

- 10.1.3. Production and Intervention Services

- 10.1.3.1. Logging Services

- 10.1.3.2. Production Testing

- 10.1.3.3. Well Services

- 10.1.3.4. Other Production and Intervention Services

- 10.1.4. Other Se

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Expro Group Holdings NV

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Weatherford International PLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Transocean LTD

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Baker Hughes Company

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Valaris Plc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 China Oilfield Services Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Halliburton Company

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 OiLSERV

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Schlumberger Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 TechnipFMC PLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Nabors Industries Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Expro Group Holdings NV

List of Figures

- Figure 1: Global Offshore Oilfield Services Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Offshore Oilfield Services Market Revenue (billion), by Service Type 2025 & 2033

- Figure 3: North America Offshore Oilfield Services Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 4: North America Offshore Oilfield Services Market Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Offshore Oilfield Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Asia Pacific Offshore Oilfield Services Market Revenue (billion), by Service Type 2025 & 2033

- Figure 7: Asia Pacific Offshore Oilfield Services Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 8: Asia Pacific Offshore Oilfield Services Market Revenue (billion), by Country 2025 & 2033

- Figure 9: Asia Pacific Offshore Oilfield Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Offshore Oilfield Services Market Revenue (billion), by Service Type 2025 & 2033

- Figure 11: Europe Offshore Oilfield Services Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 12: Europe Offshore Oilfield Services Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Offshore Oilfield Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Offshore Oilfield Services Market Revenue (billion), by Service Type 2025 & 2033

- Figure 15: South America Offshore Oilfield Services Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 16: South America Offshore Oilfield Services Market Revenue (billion), by Country 2025 & 2033

- Figure 17: South America Offshore Oilfield Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Offshore Oilfield Services Market Revenue (billion), by Service Type 2025 & 2033

- Figure 19: Middle East and Africa Offshore Oilfield Services Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 20: Middle East and Africa Offshore Oilfield Services Market Revenue (billion), by Country 2025 & 2033

- Figure 21: Middle East and Africa Offshore Oilfield Services Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Offshore Oilfield Services Market Revenue billion Forecast, by Service Type 2020 & 2033

- Table 2: Global Offshore Oilfield Services Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Offshore Oilfield Services Market Revenue billion Forecast, by Service Type 2020 & 2033

- Table 4: Global Offshore Oilfield Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States Offshore Oilfield Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada Offshore Oilfield Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Mexico Offshore Oilfield Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Global Offshore Oilfield Services Market Revenue billion Forecast, by Service Type 2020 & 2033

- Table 9: Global Offshore Oilfield Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: China Offshore Oilfield Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: India Offshore Oilfield Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Indonesia Offshore Oilfield Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Malaysia Offshore Oilfield Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Rest of Asia Pacific Offshore Oilfield Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Global Offshore Oilfield Services Market Revenue billion Forecast, by Service Type 2020 & 2033

- Table 16: Global Offshore Oilfield Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Germany Offshore Oilfield Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: United Kingdom Offshore Oilfield Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Norway Offshore Oilfield Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Denmark Offshore Oilfield Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Offshore Oilfield Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Global Offshore Oilfield Services Market Revenue billion Forecast, by Service Type 2020 & 2033

- Table 23: Global Offshore Oilfield Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Brazil Offshore Oilfield Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Argentina Offshore Oilfield Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Rest of South America Offshore Oilfield Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Global Offshore Oilfield Services Market Revenue billion Forecast, by Service Type 2020 & 2033

- Table 28: Global Offshore Oilfield Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 29: Saudi Arabia Offshore Oilfield Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: United Arab Emirates Offshore Oilfield Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Nigeria Offshore Oilfield Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Rest of Middle East and Africa Offshore Oilfield Services Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Offshore Oilfield Services Market?

The projected CAGR is approximately 7.23%.

2. Which companies are prominent players in the Offshore Oilfield Services Market?

Key companies in the market include Expro Group Holdings NV, Weatherford International PLC, Transocean LTD, Baker Hughes Company, Valaris Plc, China Oilfield Services Limited, Halliburton Company, OiLSERV, Schlumberger Limited, TechnipFMC PLC, Nabors Industries Ltd.

3. What are the main segments of the Offshore Oilfield Services Market?

The market segments include Service Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 42.57 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Automotive Sales in Saudi Arabia4.; Rising Demand from Heavy Automotives.

6. What are the notable trends driving market growth?

Drilling Services Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Rising Emphasis on Electric Vehicles.

8. Can you provide examples of recent developments in the market?

March 2022: Saipem awarded an offshore drilling contract worth USD 325 million by Norway's oil and gas company Aker BP for a campaign offshore Norway. The operations were expected to start from the end of Q4 2022, upon the termination of the works in which Scarabeo 8 was engaged then. Scarabeo 8 is a Saipem semi-submersible drilling rig able to work in harsh environments. It is a dual derrick Deepwater unit with a dynamic positioning system and with enhanced mooring capabilities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Offshore Oilfield Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Offshore Oilfield Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Offshore Oilfield Services Market?

To stay informed about further developments, trends, and reports in the Offshore Oilfield Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence