Key Insights

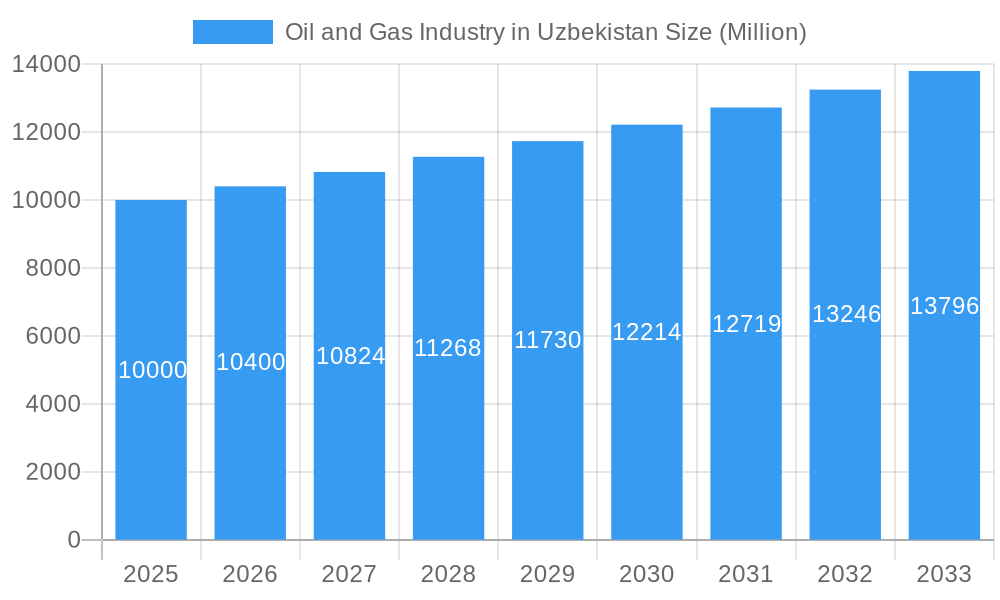

The Uzbekistan oil and gas industry is forecast to grow at a Compound Annual Growth Rate (CAGR) of 4%, reaching an estimated market size of $10.3 billion in the base year of 2024. This expansion is underpinned by rising domestic energy consumption driven by economic development and Uzbekistan's strategic geopolitical positioning along vital energy transit routes. Upstream operations, particularly natural gas exploration and production, are expected to lead this growth, supported by substantial investments in exploration and the modernization of existing assets. The midstream sector will benefit from enhanced pipeline capacities and advanced gas processing capabilities. Simultaneously, the downstream segment will experience growth from increased domestic demand for refined products and potential export market development. Key challenges include the necessity for significant infrastructure investment, adoption of advanced technologies for efficiency and environmental compliance, and mitigation of geopolitical risks. State-owned entity JSC Uzbekneftegaz will remain a pivotal player, though increased engagement from international oil companies such as Lukoil and TotalEnergies is anticipated, fostering competition and technological advancement.

Oil and Gas Industry in Uzbekistan Market Size (In Billion)

The projected CAGR of over 4% signifies consistent market value appreciation, with the market anticipated to reach approximately $14.6 billion by 2033. This growth trajectory is influenced by strategic government policies aimed at attracting foreign direct investment, ongoing exploration initiatives leading to new resource discoveries, and Uzbekistan's evolving role as a regional energy hub. Addressing challenges such as aging infrastructure and the need for skilled workforce development will be critical. The overall outlook for the Uzbekistan oil and gas industry is optimistic, presenting significant opportunities for both local and international stakeholders throughout the forecast period. A strategic diversification into renewable energy sources will be essential for long-term sustainability and enhanced energy security.

Oil and Gas Industry in Uzbekistan Company Market Share

Oil and Gas Industry in Uzbekistan: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Oil and Gas Industry in Uzbekistan, covering the period from 2019 to 2033. It offers crucial insights into market dynamics, competitive landscapes, and future growth potential, empowering stakeholders with actionable intelligence for strategic decision-making. The report leverages extensive data analysis and incorporates expert opinions to provide a holistic view of this vital sector in Uzbekistan. This report is ideal for investors, industry professionals, government agencies, and anyone seeking a detailed understanding of the Uzbekistani oil and gas market.

Oil and Gas Industry in Uzbekistan Market Concentration & Innovation

This section analyzes the market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and mergers & acquisitions (M&A) activities within Uzbekistan's oil and gas sector.

The Uzbek oil and gas market exhibits moderate concentration, with JSC Uzbekneftegaz holding a significant market share, estimated at xx% in 2025. Other key players like China National Petroleum Corporation (CNPC), NK Lukoil PAO, TotalEnergies SE, and Gazprom PAO hold smaller but still substantial shares, contributing to a competitive landscape. Innovation is driven primarily by the need to enhance efficiency in extraction, processing, and transportation, as well as exploration for new reserves. The regulatory framework, while undergoing reforms, still presents some challenges to foreign investment. The primary substitute for natural gas is coal, but its use is limited due to environmental concerns. End-user trends are heavily influenced by government policies promoting energy security and diversification. M&A activity has been relatively modest in recent years, with total deal values estimated at xx Million USD during the period 2019-2024. Future M&A activity is anticipated to increase driven by the need for enhanced resources and technological capabilities.

Oil and Gas Industry in Uzbekistan Industry Trends & Insights

This section explores the key trends and insights shaping Uzbekistan's oil and gas industry. The market has demonstrated consistent growth over the historical period (2019-2024), with a Compound Annual Growth Rate (CAGR) of xx%. Market penetration for natural gas in domestic consumption is high, estimated at xx% in 2025, with ongoing efforts to expand natural gas distribution networks to reach underserved areas. Technological advancements, including enhanced oil recovery techniques and improved pipeline infrastructure, are driving operational efficiency gains. Consumer preferences are shifting towards cleaner energy sources, prompting the government to focus on diversification and environmental considerations. Competitive dynamics are marked by increasing foreign investment, necessitating strategic alliances and technological innovation among established players. The forecast period (2025-2033) projects continued growth, driven by a CAGR of xx%, as Uzbekistan seeks to leverage its resources to fuel economic development and regional energy security.

Dominant Markets & Segments in Oil and Gas Industry in Uzbekistan

This section identifies the leading segments within Uzbekistan's oil and gas sector.

Upstream: The upstream segment currently dominates the Uzbekistani oil and gas industry. Key drivers include significant proven reserves of natural gas, ongoing exploration activities, and supportive government policies aimed at attracting foreign investment. JSC Uzbekneftegaz plays a crucial role in this segment. The sector is characterized by large-scale projects and high capital expenditure.

Midstream: This segment is growing as Uzbekistan enhances its gas processing and pipeline infrastructure. Key drivers include increased investment in pipeline expansion and modernization, crucial for efficient gas transportation to domestic and international markets. Growth is also being driven by the government's efforts to improve logistics and transportation capabilities.

Downstream: While relatively less developed compared to upstream and midstream, the downstream sector is expected to experience considerable growth in the coming years. Key drivers include increasing domestic demand for refined products and ongoing investments in refinery upgrades. The July 2022 agreement between Sanoat Energetika Guruhi and AD Ports group signifies a crucial step towards enhancing Uzbekistan's ability to access international markets.

Oil and Gas Industry in Uzbekistan Product Developments

Product innovation in Uzbekistan's oil and gas sector focuses on improving efficiency and reducing environmental impact. Technological advancements in extraction techniques, such as enhanced oil recovery methods, are being implemented to maximize resource utilization. Furthermore, investments in pipeline infrastructure and gas processing facilities are crucial for improving the overall quality and efficiency of the sector. The market fit for these innovations is strong, driven by the government's commitment to modernization and foreign investment initiatives.

Report Scope & Segmentation Analysis

This report segments the Uzbek oil and gas market based on Upstream, Midstream, and Downstream activities. The Upstream segment encompasses exploration, drilling, and production of crude oil and natural gas. Growth projections for this segment are optimistic, fueled by substantial reserves and investment. Market size is estimated to reach xx Million USD by 2033. The Midstream segment involves processing, transportation, and storage of oil and gas. Its growth is linked to infrastructure development. This segment is anticipated to reach a market size of xx Million USD by 2033. The Downstream segment covers refining, marketing, and distribution of petroleum products. Its growth is tied to increasing domestic consumption and export opportunities. It is estimated to reach a market size of xx Million USD by 2033.

Key Drivers of Oil and Gas Industry in Uzbekistan Growth

Several factors are driving growth in Uzbekistan's oil and gas industry. First, substantial hydrocarbon reserves provide a strong foundation for expansion. Second, government initiatives to attract foreign investment and modernize infrastructure are boosting capacity. Third, increasing domestic demand for energy fuels sector development. Finally, opportunities for regional gas exports contribute to further growth.

Challenges in the Oil and Gas Industry in Uzbekistan Sector

The Uzbek oil and gas sector faces challenges including the need for significant infrastructure upgrades, regulatory complexities that sometimes hinder investment, and the need for enhanced environmental protection measures. These issues may create temporary constraints on growth, but ongoing government reforms and increased investment aim to mitigate these challenges.

Emerging Opportunities in Oil and Gas Industry in Uzbekistan

Emerging opportunities include the expansion of regional gas exports, particularly to neighboring countries, and the development of downstream refining capabilities to meet domestic demand. Further investment in renewable energy sources alongside hydrocarbons are key to achieving energy security and sustainability goals.

Leading Players in the Oil and Gas Industry in Uzbekistan Market

- China National Petroleum Corporation (CNPC)

- JSC Uzbekneftegaz

- NK Lukoil PAO

- TotalEnergies SE

- Gazprom PAO

Key Developments in Oil and Gas Industry in Uzbekistan Industry

- December 2022: Uzbekistan temporarily halted natural gas exports to China due to domestic energy shortages, impacting export revenue and highlighting the importance of domestic energy security.

- July 2022: The Sanoat Energetika Guruhi (SEG) – AD Ports group agreement enhanced Uzbekistan's refined product export capabilities, improving access to global markets.

Strategic Outlook for Oil and Gas Industry in Uzbekistan Market

The Uzbek oil and gas industry holds significant potential for future growth. Ongoing investments in exploration, infrastructure development, and downstream refining will drive expansion. The strategic focus on regional energy security and export diversification positions the sector for sustained growth in the coming years. The industry's long-term success hinges on addressing challenges related to infrastructure, environmental considerations and maintaining a stable regulatory framework to encourage continued foreign investment.

Oil and Gas Industry in Uzbekistan Segmentation

-

1. Sector

- 1.1. Upstream

- 1.2. Midstream

- 1.3. Downstream

Oil and Gas Industry in Uzbekistan Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Oil and Gas Industry in Uzbekistan Regional Market Share

Geographic Coverage of Oil and Gas Industry in Uzbekistan

Oil and Gas Industry in Uzbekistan REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Vehicle Ownership4.; Government Initiatives

- 3.3. Market Restrains

- 3.3.1. 4.; Volatile Crude Oil Prices

- 3.4. Market Trends

- 3.4.1. Upstream Sector is Likely to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Oil and Gas Industry in Uzbekistan Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Upstream

- 5.1.2. Midstream

- 5.1.3. Downstream

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. North America Oil and Gas Industry in Uzbekistan Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 6.1.1. Upstream

- 6.1.2. Midstream

- 6.1.3. Downstream

- 6.1. Market Analysis, Insights and Forecast - by Sector

- 7. South America Oil and Gas Industry in Uzbekistan Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 7.1.1. Upstream

- 7.1.2. Midstream

- 7.1.3. Downstream

- 7.1. Market Analysis, Insights and Forecast - by Sector

- 8. Europe Oil and Gas Industry in Uzbekistan Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 8.1.1. Upstream

- 8.1.2. Midstream

- 8.1.3. Downstream

- 8.1. Market Analysis, Insights and Forecast - by Sector

- 9. Middle East & Africa Oil and Gas Industry in Uzbekistan Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 9.1.1. Upstream

- 9.1.2. Midstream

- 9.1.3. Downstream

- 9.1. Market Analysis, Insights and Forecast - by Sector

- 10. Asia Pacific Oil and Gas Industry in Uzbekistan Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Sector

- 10.1.1. Upstream

- 10.1.2. Midstream

- 10.1.3. Downstream

- 10.1. Market Analysis, Insights and Forecast - by Sector

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 China National Petroleum Corporation (CNPC)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 JSC Uzbekneftegaz

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 NK Lukoil PAO

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 TotalEnergies SE

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Gazprom PAO

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.1 China National Petroleum Corporation (CNPC)

List of Figures

- Figure 1: Global Oil and Gas Industry in Uzbekistan Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Oil and Gas Industry in Uzbekistan Revenue (billion), by Sector 2025 & 2033

- Figure 3: North America Oil and Gas Industry in Uzbekistan Revenue Share (%), by Sector 2025 & 2033

- Figure 4: North America Oil and Gas Industry in Uzbekistan Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Oil and Gas Industry in Uzbekistan Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America Oil and Gas Industry in Uzbekistan Revenue (billion), by Sector 2025 & 2033

- Figure 7: South America Oil and Gas Industry in Uzbekistan Revenue Share (%), by Sector 2025 & 2033

- Figure 8: South America Oil and Gas Industry in Uzbekistan Revenue (billion), by Country 2025 & 2033

- Figure 9: South America Oil and Gas Industry in Uzbekistan Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Oil and Gas Industry in Uzbekistan Revenue (billion), by Sector 2025 & 2033

- Figure 11: Europe Oil and Gas Industry in Uzbekistan Revenue Share (%), by Sector 2025 & 2033

- Figure 12: Europe Oil and Gas Industry in Uzbekistan Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Oil and Gas Industry in Uzbekistan Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa Oil and Gas Industry in Uzbekistan Revenue (billion), by Sector 2025 & 2033

- Figure 15: Middle East & Africa Oil and Gas Industry in Uzbekistan Revenue Share (%), by Sector 2025 & 2033

- Figure 16: Middle East & Africa Oil and Gas Industry in Uzbekistan Revenue (billion), by Country 2025 & 2033

- Figure 17: Middle East & Africa Oil and Gas Industry in Uzbekistan Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Oil and Gas Industry in Uzbekistan Revenue (billion), by Sector 2025 & 2033

- Figure 19: Asia Pacific Oil and Gas Industry in Uzbekistan Revenue Share (%), by Sector 2025 & 2033

- Figure 20: Asia Pacific Oil and Gas Industry in Uzbekistan Revenue (billion), by Country 2025 & 2033

- Figure 21: Asia Pacific Oil and Gas Industry in Uzbekistan Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Oil and Gas Industry in Uzbekistan Revenue billion Forecast, by Sector 2020 & 2033

- Table 2: Global Oil and Gas Industry in Uzbekistan Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Oil and Gas Industry in Uzbekistan Revenue billion Forecast, by Sector 2020 & 2033

- Table 4: Global Oil and Gas Industry in Uzbekistan Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States Oil and Gas Industry in Uzbekistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada Oil and Gas Industry in Uzbekistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Mexico Oil and Gas Industry in Uzbekistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Global Oil and Gas Industry in Uzbekistan Revenue billion Forecast, by Sector 2020 & 2033

- Table 9: Global Oil and Gas Industry in Uzbekistan Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Brazil Oil and Gas Industry in Uzbekistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Argentina Oil and Gas Industry in Uzbekistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America Oil and Gas Industry in Uzbekistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Global Oil and Gas Industry in Uzbekistan Revenue billion Forecast, by Sector 2020 & 2033

- Table 14: Global Oil and Gas Industry in Uzbekistan Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Oil and Gas Industry in Uzbekistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Germany Oil and Gas Industry in Uzbekistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: France Oil and Gas Industry in Uzbekistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Italy Oil and Gas Industry in Uzbekistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Spain Oil and Gas Industry in Uzbekistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Russia Oil and Gas Industry in Uzbekistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Benelux Oil and Gas Industry in Uzbekistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Nordics Oil and Gas Industry in Uzbekistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Oil and Gas Industry in Uzbekistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Global Oil and Gas Industry in Uzbekistan Revenue billion Forecast, by Sector 2020 & 2033

- Table 25: Global Oil and Gas Industry in Uzbekistan Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Turkey Oil and Gas Industry in Uzbekistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Israel Oil and Gas Industry in Uzbekistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: GCC Oil and Gas Industry in Uzbekistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: North Africa Oil and Gas Industry in Uzbekistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: South Africa Oil and Gas Industry in Uzbekistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa Oil and Gas Industry in Uzbekistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Oil and Gas Industry in Uzbekistan Revenue billion Forecast, by Sector 2020 & 2033

- Table 33: Global Oil and Gas Industry in Uzbekistan Revenue billion Forecast, by Country 2020 & 2033

- Table 34: China Oil and Gas Industry in Uzbekistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: India Oil and Gas Industry in Uzbekistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Japan Oil and Gas Industry in Uzbekistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: South Korea Oil and Gas Industry in Uzbekistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: ASEAN Oil and Gas Industry in Uzbekistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Oceania Oil and Gas Industry in Uzbekistan Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific Oil and Gas Industry in Uzbekistan Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oil and Gas Industry in Uzbekistan?

The projected CAGR is approximately 4%.

2. Which companies are prominent players in the Oil and Gas Industry in Uzbekistan?

Key companies in the market include China National Petroleum Corporation (CNPC), JSC Uzbekneftegaz, NK Lukoil PAO, TotalEnergies SE, Gazprom PAO.

3. What are the main segments of the Oil and Gas Industry in Uzbekistan?

The market segments include Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.3 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Vehicle Ownership4.; Government Initiatives.

6. What are the notable trends driving market growth?

Upstream Sector is Likely to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Volatile Crude Oil Prices.

8. Can you provide examples of recent developments in the market?

December 2022: Uzbekistan ordered state-run gas producer Uzbekneftegaz and Russia's Lukoil, the second-largest gas producer in the country, to temporarily halt natural gas exports to China as the country deals with a wave of blackouts and disruptions to local gas networks.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oil and Gas Industry in Uzbekistan," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oil and Gas Industry in Uzbekistan report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oil and Gas Industry in Uzbekistan?

To stay informed about further developments, trends, and reports in the Oil and Gas Industry in Uzbekistan, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence