Key Insights

The Oman small home appliance market, projected to reach $175.5 million by 2024, is experiencing robust expansion. This growth is fueled by increasing disposable incomes, rapid urbanization, and a growing consumer demand for convenient, time-saving solutions. The market is forecasted to grow at a Compound Annual Growth Rate (CAGR) of 4.21% from 2024 to 2033. Key drivers include the adoption of modern lifestyles and the significant rise of online retail, enhancing appliance accessibility for consumers.

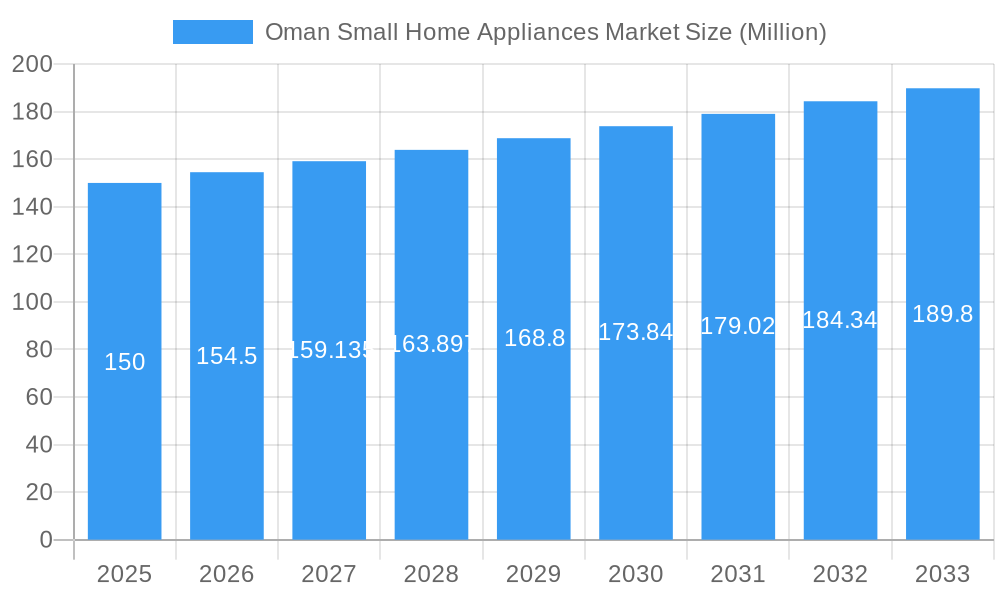

Oman Small Home Appliances Market Market Size (In Million)

The market is segmented by product type, including vacuum cleaners, food processors, coffee machines, irons, toasters, hair dryers, grills & roasters, and others. Distribution channels comprise supermarkets/hypermarkets, specialty stores, online stores, specialist retailers, and others. Online channels are a significant growth area, driven by expanding e-commerce penetration and consumer preference for digital purchasing convenience.

Oman Small Home Appliances Market Company Market Share

Segmentation analysis reveals diverse growth patterns across product categories. High-demand items like coffee machines and food processors are anticipated to lead growth, reflecting evolving consumer preferences for healthier eating and convenient food preparation. The increasing prominence of online marketplaces presents substantial opportunities for brands investing in digital marketing and effective e-commerce strategies.

Furthermore, brands emphasizing energy efficiency and sustainable manufacturing practices are poised for a competitive edge due to heightened consumer environmental awareness. The market features prominent players such as Power, Sure, Hoover, Kenwood, Philips, Moulinex, Beko, Tefal, Pigeon, and Clikon, underscoring a dynamic and competitive landscape. Future success hinges on adapting to evolving consumer needs, embracing emerging technologies, and maintaining competitive pricing strategies.

Oman Small Home Appliances Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Oman small home appliances market, covering market size, segmentation, key players, growth drivers, challenges, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. This report is essential for industry stakeholders, investors, and market researchers seeking actionable insights into this dynamic market.

Study Period: 2019–2033 Base Year: 2025 Estimated Year: 2025 Forecast Period: 2025–2033 Historical Period: 2019–2024

Oman Small Home Appliances Market Concentration & Innovation

The Oman small home appliance market exhibits a moderately concentrated landscape, with a few dominant players and several smaller niche players competing for market share. Market concentration is influenced by factors such as brand recognition, distribution networks, and product innovation. While precise market share figures for individual players are xx for this report, Power and Sure (List Not Exhaustive) are observed as significant players. The market witnesses continuous innovation driven by consumer demand for energy-efficient, smart, and aesthetically pleasing appliances. Regulatory frameworks, such as those related to energy efficiency and product safety, influence market dynamics. Product substitutes, such as traditional methods of cooking or cleaning, still hold a presence but are gradually declining as consumers adopt convenience. End-user trends reveal a growing preference for multi-functional appliances and smart home integration.

- M&A Activity: The Oman small home appliance market has seen limited M&A activity in recent years. While specific deal values are unavailable (xx Million), future consolidation among players is anticipated to reshape market dynamics.

Oman Small Home Appliances Market Industry Trends & Insights

The Oman small home appliances market is experiencing robust growth, driven by rising disposable incomes, urbanization, and a shift towards modern lifestyles. The market is witnessing a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by increasing demand for convenience, technological advancements leading to sophisticated features (smart connectivity, energy efficiency), and evolving consumer preferences favoring premium brands and designs. Market penetration for key product segments, such as vacuum cleaners and coffee machines, remains significant with scope for further expansion in the less penetrated segments. However, factors like economic fluctuations and the impact of global supply chain issues create challenges. Competitive dynamics are characterized by intense rivalry, requiring players to continuously innovate and offer competitive pricing strategies.

Dominant Markets & Segments in Oman Small Home Appliances Market

Within the Oman small home appliances market, the Muscat region shows the highest market share due to its higher population density and purchasing power. Among product segments, vacuum cleaners and coffee machines dominate due to their high demand across urban and suburban households. Supermarkets/hypermarkets constitute the leading distribution channel owing to their wide reach and accessibility.

Key Drivers for Dominant Segments:

- Vacuum Cleaners: Rising awareness of hygiene and convenience.

- Coffee Machines: Increasing coffee consumption and preference for convenience.

- Supermarkets/Hypermarkets: Extensive reach, accessibility, and promotional activities.

Oman Small Home Appliances Market Product Developments

Recent product innovations focus on smart features, energy efficiency, and user-friendly designs. Smart home integration, allowing for remote control and automated functionalities, is gaining traction. Manufacturers are emphasizing energy-efficient models to appeal to environmentally conscious consumers. Compact and versatile designs cater to space-constrained urban households. These developments create a competitive advantage by offering superior functionality, convenience, and value proposition.

Report Scope & Segmentation Analysis

This report segments the Oman small home appliances market by product type (Vacuum Cleaners, Food Processors, Coffee Machines, Irons, Toasters, Hair Dryers, Grills & Roasters, Other Products) and distribution channel (Supermarkets/Hypermarkets, Specialty Stores, Online Stores, Specialist Retailers, Other Distribution Channels). Each segment's growth projection, market size, and competitive dynamics are analyzed individually. Market size for each segment is projected to reach xx Million by 2033. For example, the online stores segment is expected to witness high growth due to increasing internet penetration and e-commerce adoption.

Key Drivers of Oman Small Home Appliances Market Growth

Several factors contribute to the growth of the Oman small home appliances market. Rising disposable incomes among the middle class fuel increased spending on household appliances. Urbanization and changing lifestyles create a demand for time-saving and efficient appliances. Government initiatives promoting energy efficiency also stimulate the adoption of advanced appliances. Furthermore, the increasing influence of global brands and the rise of e-commerce channels broaden the reach and accessibility of small home appliances.

Challenges in the Oman Small Home Appliances Market Sector

Challenges faced by the Oman small home appliances market include fluctuating oil prices impacting consumer spending, intense competition from both domestic and international players, potential supply chain disruptions due to global geopolitical events, and strict regulatory compliance requirements. These factors create uncertainties and necessitate strategic adaptation from market players to sustain growth.

Emerging Opportunities in Oman Small Home Appliances Market

Emerging opportunities exist in the growing demand for eco-friendly and energy-efficient appliances. The increasing popularity of smart home technology creates an opportunity to integrate appliances into smart home ecosystems. Expanding e-commerce channels present opportunities to reach a wider customer base. Finally, focusing on niche product segments with unmet needs, such as specialized kitchen appliances, can drive market growth.

Leading Players in the Oman Small Home Appliances Market Market

- Power

- Sure

- Hoover

- Kenwood

- Philips

- Moulinex

- Beko

- Tefal

- Pigeon

- Clikon

Key Developments in Oman Small Home Appliances Market Industry

- May 2022: Retail giant Jashanmal expanded its regional footprint with a new store in Mall of Oman, potentially boosting small home appliance sales.

- May 2022: LG Electronics launched its 2022 Smart Home Appliances portfolio, introducing innovative products with refined designs, which might influence consumer choices and market competition.

Strategic Outlook for Oman Small Home Appliances Market Market

The Oman small home appliances market presents substantial growth potential. Continued investments in product innovation, strategic partnerships, and expanding distribution networks will be crucial for success. Focusing on consumer preferences for smart, energy-efficient, and aesthetically pleasing appliances will be essential for capturing market share. The market is expected to witness robust growth in the coming years.

Oman Small Home Appliances Market Segmentation

-

1. Product

- 1.1. Vacuum Cleaners

- 1.2. Food Processors

- 1.3. Coffee Machines

- 1.4. Irons

- 1.5. Toasters

- 1.6. Hair Dryers

- 1.7. Grills & Roasters

- 1.8. Other Products

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Specialty Stores

- 2.3. Online Stores

- 2.4. Specialist Retailers

- 2.5. Other Distribution Channels

Oman Small Home Appliances Market Segmentation By Geography

- 1. Oman

Oman Small Home Appliances Market Regional Market Share

Geographic Coverage of Oman Small Home Appliances Market

Oman Small Home Appliances Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.21% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Functional Flour

- 3.3. Market Restrains

- 3.3.1. Availability of Alternatives

- 3.4. Market Trends

- 3.4.1. Rise in Demand of Vacuum Cleaners

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Oman Small Home Appliances Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Vacuum Cleaners

- 5.1.2. Food Processors

- 5.1.3. Coffee Machines

- 5.1.4. Irons

- 5.1.5. Toasters

- 5.1.6. Hair Dryers

- 5.1.7. Grills & Roasters

- 5.1.8. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Specialty Stores

- 5.2.3. Online Stores

- 5.2.4. Specialist Retailers

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Oman

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Power

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sure**List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hoover

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Kenwood

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Philips

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Moulinex

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Beko

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Tefal

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Pigeon

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Clikon

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Power

List of Figures

- Figure 1: Oman Small Home Appliances Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Oman Small Home Appliances Market Share (%) by Company 2025

List of Tables

- Table 1: Oman Small Home Appliances Market Revenue million Forecast, by Product 2020 & 2033

- Table 2: Oman Small Home Appliances Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Oman Small Home Appliances Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Oman Small Home Appliances Market Revenue million Forecast, by Product 2020 & 2033

- Table 5: Oman Small Home Appliances Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Oman Small Home Appliances Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oman Small Home Appliances Market?

The projected CAGR is approximately 4.21%.

2. Which companies are prominent players in the Oman Small Home Appliances Market?

Key companies in the market include Power, Sure**List Not Exhaustive, Hoover, Kenwood, Philips, Moulinex, Beko, Tefal, Pigeon, Clikon.

3. What are the main segments of the Oman Small Home Appliances Market?

The market segments include Product, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 175.5 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Functional Flour.

6. What are the notable trends driving market growth?

Rise in Demand of Vacuum Cleaners.

7. Are there any restraints impacting market growth?

Availability of Alternatives.

8. Can you provide examples of recent developments in the market?

On May 2022, Retail giant Jashanmal is all set to expand its regional footprint with the launch of its first store in Mall of Oman, said Shuja Jashanmal, group chief officer for department stores, Jashanmal National Company.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oman Small Home Appliances Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oman Small Home Appliances Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oman Small Home Appliances Market?

To stay informed about further developments, trends, and reports in the Oman Small Home Appliances Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence