Key Insights

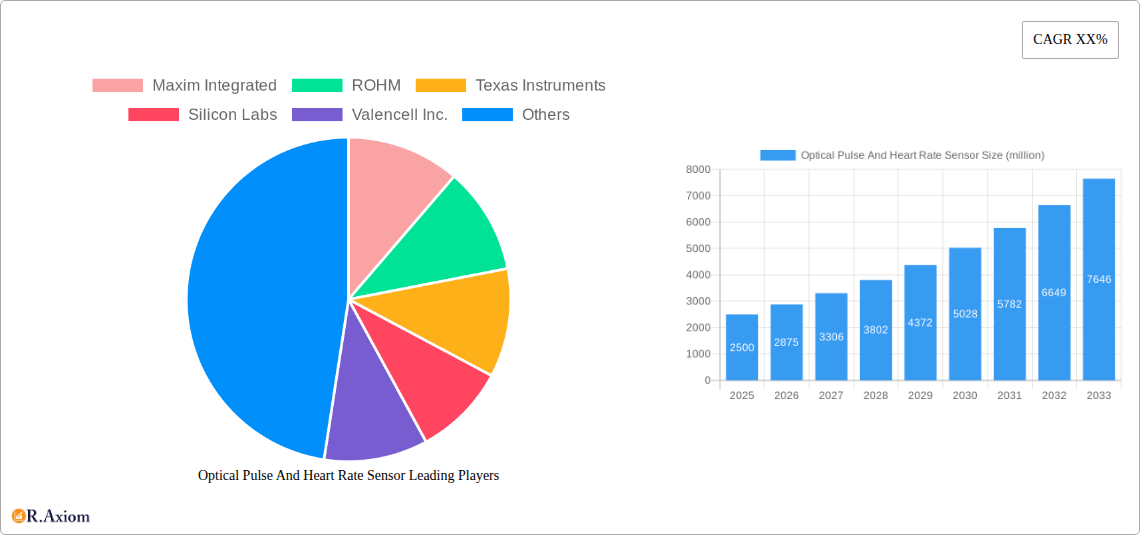

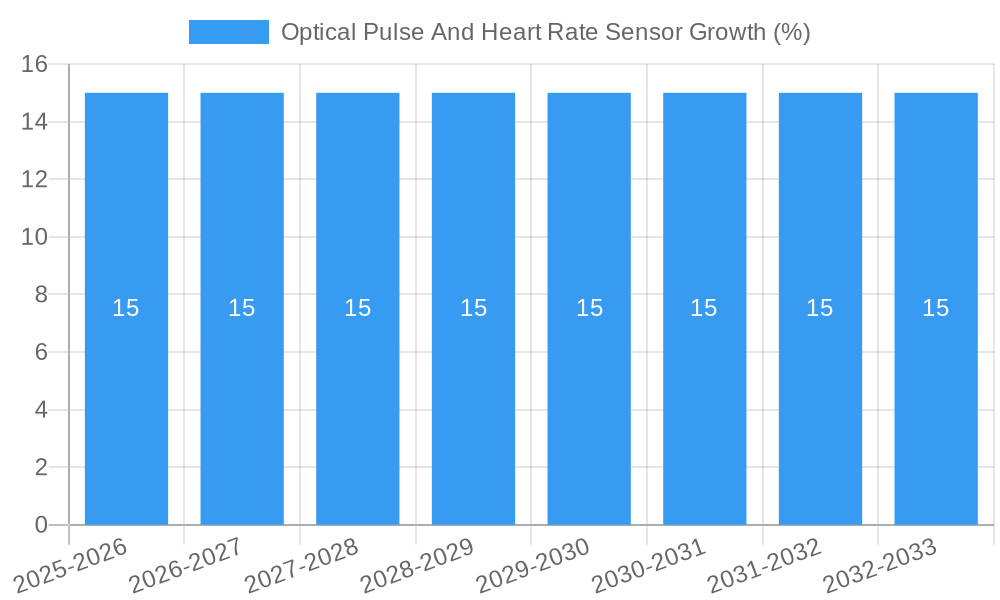

The global Optical Pulse and Heart Rate Sensor market is poised for significant expansion, projected to reach approximately USD 2.5 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 15% over the forecast period of 2025-2033. This growth is propelled by escalating demand for wearable technology in consumer electronics, the increasing integration of health monitoring features in everyday devices, and a growing awareness of personal health and fitness among a wider demographic. The healthcare sector, particularly hospitals and diagnostic centers, represents a substantial segment, driven by the need for continuous patient monitoring and advanced diagnostic tools. Ambulatory surgical centers also contribute to this demand as they increasingly adopt portable and non-invasive monitoring solutions. The market’s dynamism is further fueled by technological advancements leading to more accurate, miniaturized, and power-efficient sensors.

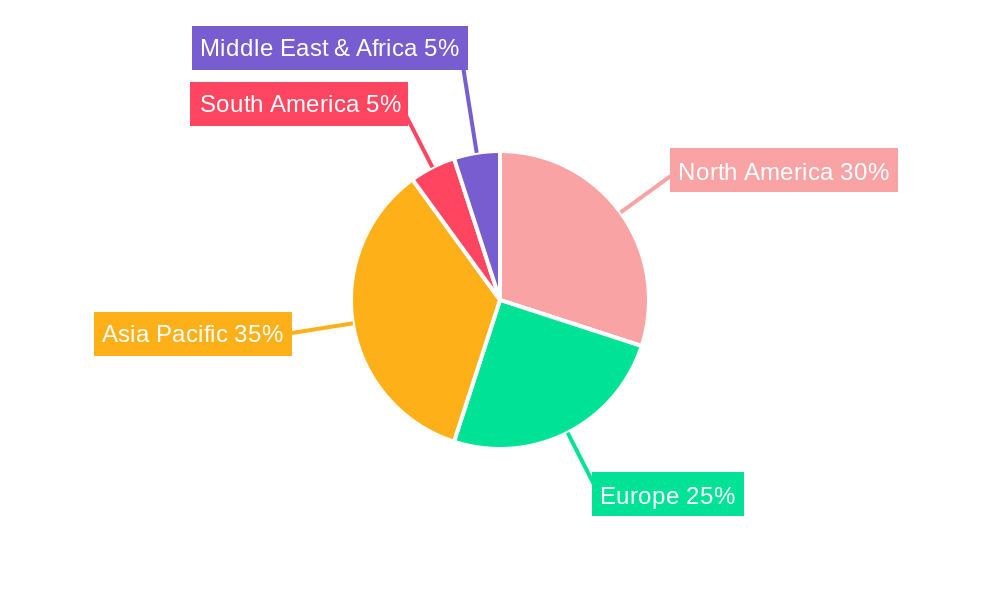

Key drivers for this market include the widespread adoption of smartwatches and fitness trackers, the rising prevalence of chronic diseases requiring constant health monitoring, and the expanding application of these sensors in non-medical fields like sports and industrial safety. While the market benefits from these strong growth factors, certain restraints, such as the high cost of advanced sensor development and the need for stringent regulatory approvals for medical applications, could temper the pace of expansion. Nevertheless, emerging trends like the development of photoplethysmography (PPG) sensors for a wider range of physiological parameter monitoring and the integration of AI for data analysis are expected to create new avenues for growth. The Asia Pacific region is anticipated to witness the fastest growth due to a burgeoning middle class, increasing disposable income, and a growing acceptance of wearable technology.

This report provides an in-depth analysis of the global Optical Pulse and Heart Rate Sensor market, offering strategic insights for stakeholders seeking to navigate this dynamic industry. Covering the historical period from 2019 to 2024, the base year of 2025, and a forecast period extending to 2033, this study delves into market concentration, key trends, dominant segments, product developments, and emerging opportunities. The report is meticulously segmented to offer granular analysis of applications including Hospitals, Diagnostic Centers, Ambulatory Surgical Centres, Consumer Electronics, and Others, alongside sensor types such as Transmission and Reflection.

Optical Pulse And Heart Rate Sensor Market Concentration & Innovation

The Optical Pulse and Heart Rate Sensor market exhibits a moderate level of concentration, with key players like Maxim Integrated, ROHM, Texas Instruments, and Silicon Labs holding significant market share. The market is driven by continuous innovation in sensor miniaturization, accuracy, and power efficiency, fueled by advancements in photoplethysmography (PPG) technology. Regulatory frameworks, particularly concerning medical device certifications and data privacy, play a crucial role in shaping market entry and product development. While direct product substitutes are limited, advancements in alternative physiological monitoring techniques could pose a long-term challenge. End-user trends indicate a growing demand for wearable health trackers and non-invasive diagnostic tools, pushing manufacturers to integrate sophisticated sensing capabilities. Mergers and acquisitions (M&A) are present, though large-scale consolidation is not the dominant strategy. Notable M&A deal values in the past have been in the range of several million dollars, indicating strategic tuck-in acquisitions for technology or market access. The market share of leading players is estimated to be around 15-25% each, with a collective share of over 60% held by the top five companies.

Optical Pulse And Heart Rate Sensor Industry Trends & Insights

The Optical Pulse and Heart Rate Sensor market is projected to experience robust growth, driven by a confluence of technological advancements, increasing healthcare awareness, and the pervasive adoption of wearable technology. The Compound Annual Growth Rate (CAGR) for the period 2025-2033 is estimated to be approximately 12.5%, reaching a market size of over one hundred million dollars by the end of the forecast period. Technological disruptions are at the forefront, with ongoing research into enhanced optical sensors capable of detecting a wider range of physiological parameters beyond just heart rate, including blood oxygen saturation (SpO2) and even early indicators of cardiovascular conditions. The increasing integration of these sensors into consumer electronics, from smartwatches and fitness trackers to smart home devices, is significantly expanding market penetration. Consumer preferences are increasingly leaning towards personalized health monitoring and preventative care, fueling the demand for accurate, real-time physiological data. This shift necessitates the development of sophisticated algorithms and data analytics platforms to translate raw sensor data into actionable health insights. The competitive dynamics are characterized by a blend of established semiconductor manufacturers and specialized sensor companies, each vying for dominance through product differentiation, strategic partnerships, and expanding application portfolios. Market penetration is expected to exceed 40% in developed regions by 2033, driven by affordability and increased consumer understanding of the benefits of continuous health monitoring.

Dominant Markets & Segments in Optical Pulse And Heart Rate Sensor

The global Optical Pulse and Heart Rate Sensor market is experiencing significant growth across various geographical regions and application segments. North America is anticipated to dominate the market, largely propelled by its advanced healthcare infrastructure, high disposable incomes, and a strong consumer appetite for wearable technology. The United States, in particular, is a key driver, with substantial investments in medical research and development and a well-established ecosystem for consumer electronics. Economic policies in these regions often support technological innovation and healthcare accessibility, further bolstering market growth.

Within the application segments, Consumer Electronics is poised to be the largest and fastest-growing segment. The proliferation of smartwatches, fitness bands, and other wearable devices, which are increasingly incorporating advanced optical sensors for continuous heart rate monitoring, sleep tracking, and activity recognition, is a primary catalyst. The market size for optical pulse and heart rate sensors in consumer electronics is projected to reach over seventy million dollars by 2033.

- Key Drivers in Consumer Electronics:

- Rising Disposable Incomes: Enabling wider consumer adoption of premium wearable devices.

- Growing Health and Wellness Awareness: Consumers are proactively seeking tools to monitor and improve their well-being.

- Technological Advancements: Miniaturization, power efficiency, and improved accuracy of sensors make integration easier and more appealing.

- Ubiquitous Connectivity: Seamless integration with smartphones and cloud platforms for data analysis and sharing.

The Hospitals segment also represents a significant and growing market. The increasing need for continuous patient monitoring in critical care units, operating rooms, and general wards, coupled with the growing trend of remote patient monitoring, is driving demand for accurate and reliable optical pulse and heart rate sensors. These sensors offer a non-invasive and cost-effective solution for tracking vital signs, allowing healthcare professionals to make timely interventions. The market size for this segment is estimated to exceed twenty million dollars by 2033.

- Key Drivers in Hospitals:

- Advancements in Telemedicine and Remote Patient Monitoring: Enabling continuous care outside traditional hospital settings.

- Demand for Non-Invasive Monitoring: Reducing patient discomfort and infection risks.

- Improved Patient Outcomes: Early detection of physiological abnormalities leading to timely treatment.

- Cost-Effectiveness: Compared to traditional wired monitoring systems, optical sensors can offer a more economical solution for large-scale deployment.

Diagnostic Centers are another important application area, where optical sensors are utilized for pre-screening and diagnostic purposes, offering portability and ease of use. Ambulatory Surgical Centres are also increasingly adopting these sensors for pre- and post-operative patient monitoring. The "Others" category, encompassing research laboratories, sports science, and industrial applications, also contributes to market diversification.

In terms of sensor types, the Reflection type segment is expected to maintain its dominance due to its suitability for wearable devices and its ability to capture signals from the skin surface, requiring less complex integration compared to the transmission type. The market size for reflection type sensors is estimated to be around eighty million dollars by 2033.

- Key Drivers for Reflection Type Sensors:

- Compact Form Factor: Ideal for integration into small wearable devices.

- Ease of Implementation: Requires minimal physical contact, simplifying device design.

- Versatile Placement: Can be incorporated into wrists, fingers, ears, and other body parts.

The Transmission type, while having niche applications, is expected to grow at a steady pace, particularly in medical-grade devices where higher signal penetration might be required. The market size for transmission type sensors is projected to reach approximately thirty million dollars by 2033.

Optical Pulse And Heart Rate Sensor Product Developments

Recent product developments in the Optical Pulse and Heart Rate Sensor market are focused on enhancing accuracy, reducing power consumption, and integrating multi-parameter sensing capabilities. Innovations include advanced photodetectors and LEDs for improved signal-to-noise ratios, sophisticated algorithms for motion artifact rejection, and miniaturized sensor modules for seamless integration into wearables and compact medical devices. Companies are also developing sensors that can simultaneously measure blood oxygen levels, respiration rate, and even body temperature, providing a more comprehensive health overview. These developments aim to address the growing demand for non-invasive, real-time physiological monitoring for both consumer and clinical applications, offering significant competitive advantages.

Report Scope & Segmentation Analysis

This report comprehensively analyzes the Optical Pulse and Heart Rate Sensor market, segmented by Application and Type. The application segmentation includes Hospitals, Diagnostic Centers, Ambulatory Surgical Centres, Consumer Electronics, and Others. The market size for Hospitals is projected to reach over twenty million dollars by 2033, driven by increased adoption in patient monitoring. Diagnostic Centers are expected to see a market size of approximately ten million dollars, fueled by the demand for portable diagnostic tools. Ambulatory Surgical Centres will contribute around five million dollars, with growth tied to post-operative care advancements. The dominant Consumer Electronics segment is estimated to reach over seventy million dollars by 2033 due to the burgeoning wearable technology market. The Others segment, encompassing research and niche applications, is projected to be around five million dollars.

The segmentation by Type includes Transmission and Reflection. The Reflection type is forecast to be the larger segment, estimated at over eighty million dollars by 2033, owing to its widespread use in wearables. The Transmission type, while smaller, is expected to reach approximately thirty million dollars, serving specialized medical applications. The analysis includes market size projections, growth rates, and competitive landscapes for each of these segments.

Key Drivers of Optical Pulse And Heart Rate Sensor Growth

The growth of the Optical Pulse and Heart Rate Sensor market is propelled by several key factors. Technological Advancements in sensor accuracy, miniaturization, and power efficiency are crucial, enabling their integration into a wider range of devices. The Increasing Prevalence of Chronic Diseases and a growing emphasis on preventative healthcare are driving demand for continuous physiological monitoring. Furthermore, the Explosion of Wearable Technology in the consumer electronics sector, coupled with increasing consumer awareness of health and wellness, provides a substantial market opportunity. Supportive Government Initiatives promoting digital health and remote patient monitoring also play a significant role in market expansion.

Challenges in the Optical Pulse And Heart Rate Sensor Sector

Despite its growth potential, the Optical Pulse and Heart Rate Sensor sector faces several challenges. Accuracy Limitations in Challenging Conditions, such as poor perfusion or excessive motion, can impact reliability, especially in non-clinical settings. Regulatory Hurdles and Certifications for medical-grade devices require significant investment and time. Interoperability and Standardization issues across different platforms and devices can hinder seamless data integration. Intense Competitive Pressures from a growing number of manufacturers and the constant need for innovation to stay ahead also present a challenge. Supply chain disruptions and component availability can also impact production volumes and costs, potentially affecting market growth by millions of dollars.

Emerging Opportunities in Optical Pulse And Heart Rate Sensor

Emerging opportunities in the Optical Pulse and Heart Rate Sensor market are diverse and promising. The development of Multi-Parameter Sensing capabilities beyond heart rate, such as blood oxygen, respiration, and even non-invasive blood pressure estimation, presents a significant opportunity for value-added products. The expanding use of these sensors in Remote Patient Monitoring (RPM) for managing chronic conditions and post-operative care opens up new revenue streams for healthcare providers and device manufacturers. Furthermore, the integration of advanced AI and machine learning algorithms with sensor data can unlock Predictive Health Analytics, enabling early disease detection and personalized wellness plans. The growing market for Smart Home Health Devices also presents an untapped potential for these sensors.

Leading Players in the Optical Pulse And Heart Rate Sensor Market

- Maxim Integrated

- ROHM

- Texas Instruments

- Silicon Labs

- Valencell Inc.

- TE Connectivity

- Microchip Technology Inc.

- Fitbit Inc.

- Apple

- OSRAM Group

Key Developments in Optical Pulse And Heart Rate Sensor Industry

- 2023/Q4: Launch of advanced, low-power optical sensor modules with enhanced motion artifact rejection for next-generation wearables.

- 2023/Q3: Strategic partnership formed between a leading sensor manufacturer and a prominent AI company to develop predictive health analytics platforms.

- 2023/Q2: Introduction of a new optical sensor capable of measuring blood oxygen saturation with medical-grade accuracy in consumer devices.

- 2023/Q1: A major consumer electronics company announced the integration of enhanced optical sensing capabilities into its flagship smartwatch, driving significant market interest.

- 2022/Q4: Acquisition of a specialized PPG sensor technology company by a semiconductor giant to bolster its medical device portfolio.

- 2022/Q3: Development of novel algorithms for non-invasive blood pressure monitoring using optical sensor data, showing promising results in clinical trials.

Strategic Outlook for Optical Pulse And Heart Rate Sensor Market

- 2023/Q4: Launch of advanced, low-power optical sensor modules with enhanced motion artifact rejection for next-generation wearables.

- 2023/Q3: Strategic partnership formed between a leading sensor manufacturer and a prominent AI company to develop predictive health analytics platforms.

- 2023/Q2: Introduction of a new optical sensor capable of measuring blood oxygen saturation with medical-grade accuracy in consumer devices.

- 2023/Q1: A major consumer electronics company announced the integration of enhanced optical sensing capabilities into its flagship smartwatch, driving significant market interest.

- 2022/Q4: Acquisition of a specialized PPG sensor technology company by a semiconductor giant to bolster its medical device portfolio.

- 2022/Q3: Development of novel algorithms for non-invasive blood pressure monitoring using optical sensor data, showing promising results in clinical trials.

Strategic Outlook for Optical Pulse And Heart Rate Sensor Market

The strategic outlook for the Optical Pulse and Heart Rate Sensor market remains exceptionally positive, driven by the relentless integration of these essential components into a vast array of devices, from sophisticated medical equipment to everyday consumer electronics. The future growth trajectory will be significantly shaped by ongoing innovation in miniaturization, accuracy, and multi-parameter sensing capabilities. The increasing global focus on proactive health management and the expansion of telehealth services will continue to fuel demand, particularly in the consumer electronics and healthcare segments. Strategic investments in research and development, coupled with a focus on addressing regulatory complexities and enhancing data security, will be paramount for sustained success. The market is poised to witness continued expansion, with opportunities for differentiation arising from advanced algorithm development and the creation of integrated health ecosystems, leading to an estimated market value of over one hundred million dollars by the end of the forecast period.

Optical Pulse And Heart Rate Sensor Segmentation

-

1. Application

- 1.1. Hospitals

- 1.2. Diagnostic Centers

- 1.3. Ambulatory Surgical Centres

- 1.4. Consumer Electronics

- 1.5. Others

-

2. Types

- 2.1. Transmission

- 2.2. Reflection

Optical Pulse And Heart Rate Sensor Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Optical Pulse And Heart Rate Sensor REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Optical Pulse And Heart Rate Sensor Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Hospitals

- 5.1.2. Diagnostic Centers

- 5.1.3. Ambulatory Surgical Centres

- 5.1.4. Consumer Electronics

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Transmission

- 5.2.2. Reflection

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Optical Pulse And Heart Rate Sensor Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Hospitals

- 6.1.2. Diagnostic Centers

- 6.1.3. Ambulatory Surgical Centres

- 6.1.4. Consumer Electronics

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Transmission

- 6.2.2. Reflection

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Optical Pulse And Heart Rate Sensor Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Hospitals

- 7.1.2. Diagnostic Centers

- 7.1.3. Ambulatory Surgical Centres

- 7.1.4. Consumer Electronics

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Transmission

- 7.2.2. Reflection

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Optical Pulse And Heart Rate Sensor Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Hospitals

- 8.1.2. Diagnostic Centers

- 8.1.3. Ambulatory Surgical Centres

- 8.1.4. Consumer Electronics

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Transmission

- 8.2.2. Reflection

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Optical Pulse And Heart Rate Sensor Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Hospitals

- 9.1.2. Diagnostic Centers

- 9.1.3. Ambulatory Surgical Centres

- 9.1.4. Consumer Electronics

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Transmission

- 9.2.2. Reflection

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Optical Pulse And Heart Rate Sensor Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Hospitals

- 10.1.2. Diagnostic Centers

- 10.1.3. Ambulatory Surgical Centres

- 10.1.4. Consumer Electronics

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Transmission

- 10.2.2. Reflection

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Maxim Integrated

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ROHM

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Texas Instruments

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Silicon Labs

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Valencell Inc.

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 TE Connectivity

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Microchip Technology Inc.

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Fitbit Inc.

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Apple

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 OSRAM Group

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Maxim Integrated

List of Figures

- Figure 1: Global Optical Pulse And Heart Rate Sensor Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Optical Pulse And Heart Rate Sensor Revenue (million), by Application 2024 & 2032

- Figure 3: North America Optical Pulse And Heart Rate Sensor Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Optical Pulse And Heart Rate Sensor Revenue (million), by Types 2024 & 2032

- Figure 5: North America Optical Pulse And Heart Rate Sensor Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Optical Pulse And Heart Rate Sensor Revenue (million), by Country 2024 & 2032

- Figure 7: North America Optical Pulse And Heart Rate Sensor Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Optical Pulse And Heart Rate Sensor Revenue (million), by Application 2024 & 2032

- Figure 9: South America Optical Pulse And Heart Rate Sensor Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Optical Pulse And Heart Rate Sensor Revenue (million), by Types 2024 & 2032

- Figure 11: South America Optical Pulse And Heart Rate Sensor Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Optical Pulse And Heart Rate Sensor Revenue (million), by Country 2024 & 2032

- Figure 13: South America Optical Pulse And Heart Rate Sensor Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Optical Pulse And Heart Rate Sensor Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Optical Pulse And Heart Rate Sensor Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Optical Pulse And Heart Rate Sensor Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Optical Pulse And Heart Rate Sensor Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Optical Pulse And Heart Rate Sensor Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Optical Pulse And Heart Rate Sensor Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Optical Pulse And Heart Rate Sensor Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Optical Pulse And Heart Rate Sensor Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Optical Pulse And Heart Rate Sensor Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Optical Pulse And Heart Rate Sensor Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Optical Pulse And Heart Rate Sensor Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Optical Pulse And Heart Rate Sensor Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Optical Pulse And Heart Rate Sensor Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Optical Pulse And Heart Rate Sensor Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Optical Pulse And Heart Rate Sensor Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Optical Pulse And Heart Rate Sensor Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Optical Pulse And Heart Rate Sensor Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Optical Pulse And Heart Rate Sensor Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Optical Pulse And Heart Rate Sensor Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Optical Pulse And Heart Rate Sensor Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Optical Pulse And Heart Rate Sensor Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Optical Pulse And Heart Rate Sensor Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Optical Pulse And Heart Rate Sensor Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Optical Pulse And Heart Rate Sensor Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Optical Pulse And Heart Rate Sensor Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Optical Pulse And Heart Rate Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Optical Pulse And Heart Rate Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Optical Pulse And Heart Rate Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Optical Pulse And Heart Rate Sensor Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Optical Pulse And Heart Rate Sensor Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Optical Pulse And Heart Rate Sensor Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Optical Pulse And Heart Rate Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Optical Pulse And Heart Rate Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Optical Pulse And Heart Rate Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Optical Pulse And Heart Rate Sensor Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Optical Pulse And Heart Rate Sensor Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Optical Pulse And Heart Rate Sensor Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Optical Pulse And Heart Rate Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Optical Pulse And Heart Rate Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Optical Pulse And Heart Rate Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Optical Pulse And Heart Rate Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Optical Pulse And Heart Rate Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Optical Pulse And Heart Rate Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Optical Pulse And Heart Rate Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Optical Pulse And Heart Rate Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Optical Pulse And Heart Rate Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Optical Pulse And Heart Rate Sensor Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Optical Pulse And Heart Rate Sensor Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Optical Pulse And Heart Rate Sensor Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Optical Pulse And Heart Rate Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Optical Pulse And Heart Rate Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Optical Pulse And Heart Rate Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Optical Pulse And Heart Rate Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Optical Pulse And Heart Rate Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Optical Pulse And Heart Rate Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Optical Pulse And Heart Rate Sensor Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Optical Pulse And Heart Rate Sensor Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Optical Pulse And Heart Rate Sensor Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Optical Pulse And Heart Rate Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Optical Pulse And Heart Rate Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Optical Pulse And Heart Rate Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Optical Pulse And Heart Rate Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Optical Pulse And Heart Rate Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Optical Pulse And Heart Rate Sensor Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Optical Pulse And Heart Rate Sensor Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Optical Pulse And Heart Rate Sensor?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Optical Pulse And Heart Rate Sensor?

Key companies in the market include Maxim Integrated, ROHM, Texas Instruments, Silicon Labs, Valencell Inc., TE Connectivity, Microchip Technology Inc., Fitbit Inc., Apple, OSRAM Group.

3. What are the main segments of the Optical Pulse And Heart Rate Sensor?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Optical Pulse And Heart Rate Sensor," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Optical Pulse And Heart Rate Sensor report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Optical Pulse And Heart Rate Sensor?

To stay informed about further developments, trends, and reports in the Optical Pulse And Heart Rate Sensor, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence