Key Insights

The global Outsourcing Services Market is poised for significant expansion, projected to reach a substantial size in the coming years. Driven by increasing demand for cost-efficiency, access to specialized talent, and the strategic advantage of focusing on core competencies, businesses across various industries are increasingly turning to outsourcing solutions. Key growth drivers include the digital transformation imperative, the need for agility in rapidly evolving market landscapes, and the continuous pursuit of operational excellence. The market is segmented across Business Process Outsourcing (BPO), Information Technology Outsourcing (ITO), Human Resource Outsourcing (HRO), and Knowledge Process Outsourcing (KPO), each catering to distinct business needs and contributing to the overall market dynamism. Emerging technologies such as AI, automation, and cloud computing are further reshaping the outsourcing landscape, enabling more sophisticated and value-added services.

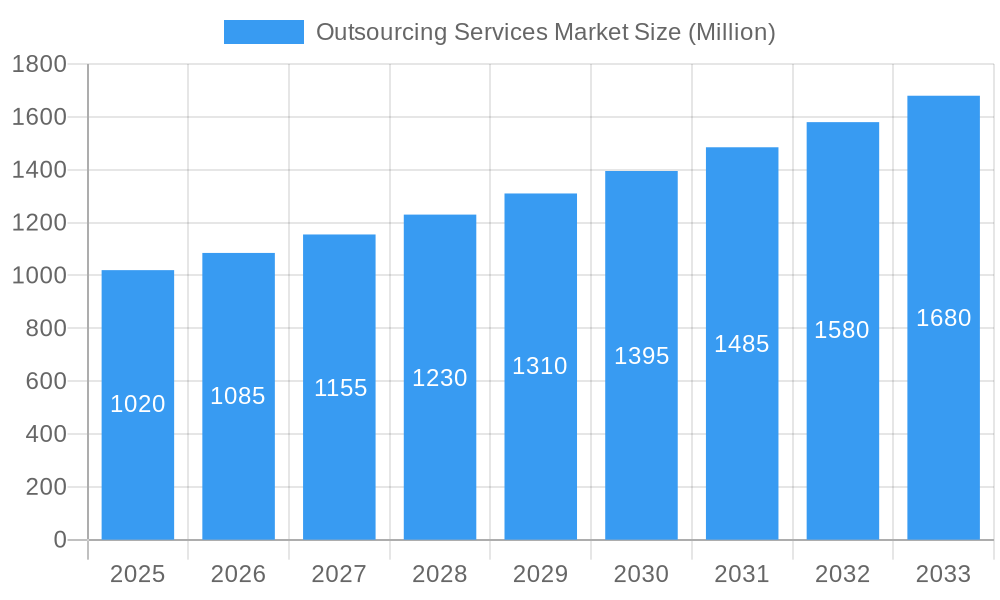

Outsourcing Services Market Market Size (In Billion)

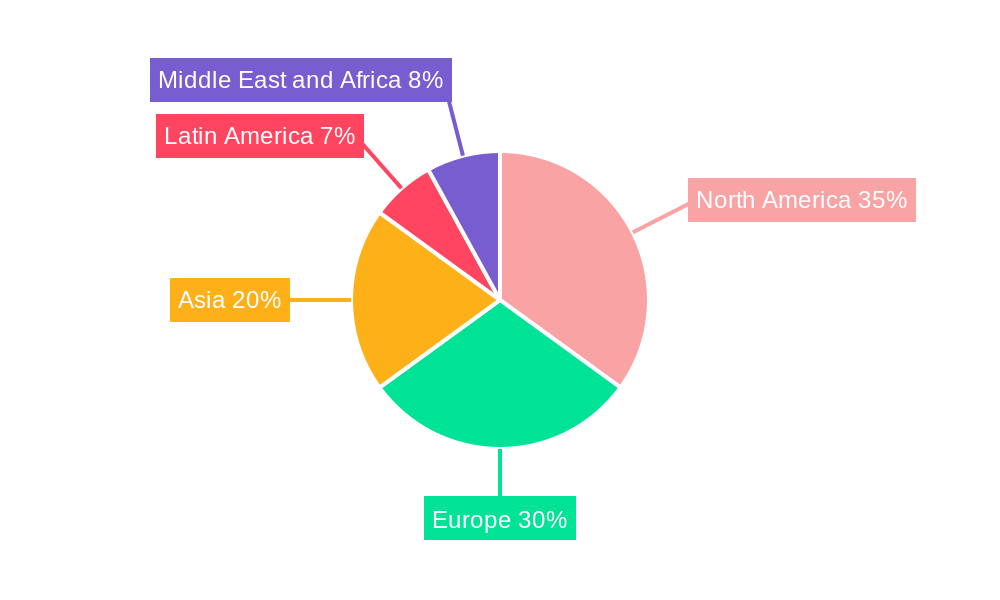

The market is expected to witness a robust Compound Annual Growth Rate (CAGR) of 6.40% over the forecast period, indicating sustained and healthy expansion. This growth will be propelled by several key trends, including the rise of hybrid and remote work models facilitating global talent access, the growing adoption of specialized niche outsourcing services, and the emphasis on data security and compliance within outsourcing partnerships. While the market presents immense opportunities, certain restraints such as data privacy concerns, potential vendor lock-in, and the complexity of managing offshore relationships need careful consideration. Geographically, North America and Europe are anticipated to remain dominant markets, with strong contributions from Asia, particularly India and China, due to their vast talent pools and cost advantages. Latin America and the Middle East & Africa are emerging as significant growth regions.

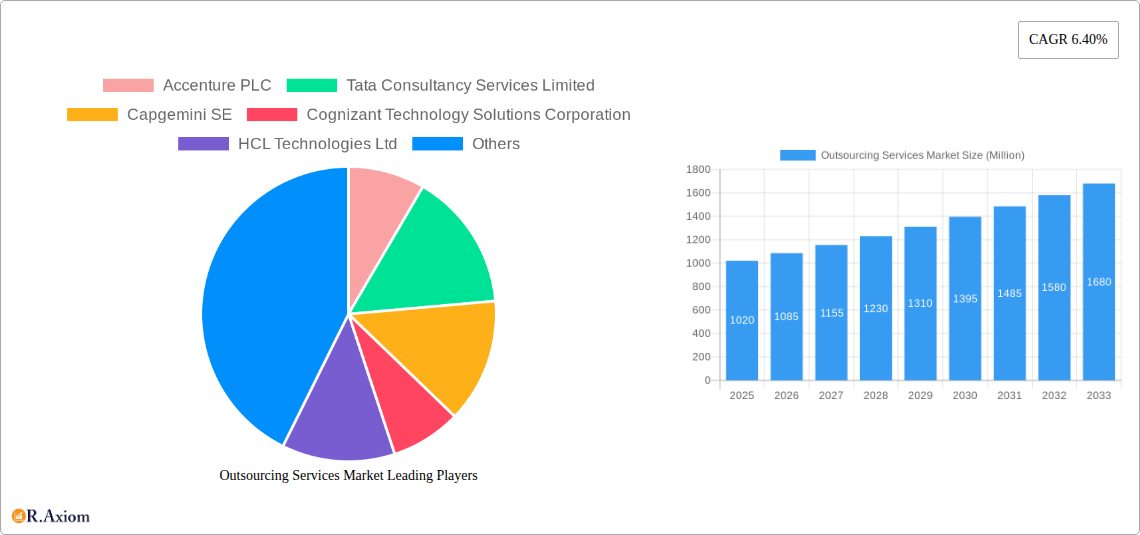

Outsourcing Services Market Company Market Share

This detailed report offers an in-depth analysis of the global Outsourcing Services Market, encompassing historical trends, current dynamics, and future projections from 2019 to 2033. With a base year of 2025, the report provides critical insights into market size, growth drivers, challenges, and opportunities, catering to industry stakeholders, investors, and business strategists. The study leverages high-traffic keywords such as "outsourcing solutions," "BPO services," "ITO market," "global outsourcing," and "digital transformation" to enhance search visibility and engagement.

Outsourcing Services Market Market Concentration & Innovation

The Outsourcing Services Market exhibits a moderate level of concentration, characterized by the presence of several large global players alongside a significant number of specialized niche providers. Key companies like Accenture PLC, Tata Consultancy Services Limited, Capgemini SE, Cognizant Technology Solutions Corporation, and Infosys BPM (Infosys Limited) command substantial market share, driven by their comprehensive service portfolios and extensive client networks. Innovation within the market is primarily fueled by advancements in digital technologies such as artificial intelligence (AI), machine learning (ML), robotic process automation (RPA), and cloud computing. These technologies enable service providers to offer more efficient, scalable, and intelligent solutions, thereby enhancing competitive advantages. Regulatory frameworks, while varying by region, generally focus on data privacy, security, and labor laws, influencing the operational strategies of outsourcing firms. Product substitutes, while present in the form of in-house capabilities or alternative service delivery models, are increasingly being outweighed by the cost-effectiveness, specialization, and agility offered by outsourcing. End-user trends reveal a growing demand for specialized services, a preference for outcome-based pricing, and an increasing focus on digital transformation initiatives. Mergers and acquisition (M&A) activities are significant, as companies seek to expand their service offerings, geographic reach, and technological capabilities. For instance, the divestment of Alight Inc.'s Payroll & Professional Services business to HIG Capital for up to USD 1.2 billion signifies strategic portfolio realignment. Similarly, iSON Xperiences' acquisition of EC Outsourcing Company highlights consolidation aimed at expanding service delivery and market access, particularly in emerging regions.

Outsourcing Services Market Industry Trends & Insights

The global Outsourcing Services Market is poised for robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 10.5% between 2025 and 2033. This expansion is underpinned by several key growth drivers, including the relentless pursuit of cost optimization by businesses across industries, the escalating complexity of technology landscapes demanding specialized expertise, and the strategic imperative for companies to focus on core competencies. The ongoing digital transformation wave acts as a significant catalyst, compelling organizations to adopt advanced technologies and innovative solutions that are often best delivered through outsourcing partnerships. The market penetration of cloud-based solutions, AI-driven automation, and data analytics services is rapidly increasing, reshaping the service delivery models and value propositions of outsourcing providers. Consumer preferences are evolving towards more flexible, agile, and outcome-driven service agreements, moving away from traditional, rigid contracts. This shift necessitates outsourcing partners to be highly adaptable and customer-centric. Competitive dynamics are intensifying, with established players continually innovating and smaller, agile firms carving out specialized niches. The rise of hybrid work models and the increasing globalization of talent pools are also influencing service delivery strategies, enabling providers to leverage diverse workforces and offer round-the-clock support. Geopolitical factors and evolving trade policies can also present both opportunities and challenges, influencing the geographical distribution of outsourcing activities. The market is witnessing a growing demand for business process outsourcing (BPO) and information technology outsourcing (ITO) services, driven by their potential to enhance operational efficiency and drive innovation.

Dominant Markets & Segments in Outsourcing Services Market

The global Outsourcing Services Market is largely dominated by Information Technology Outsourcing (ITO), which consistently captures the largest market share. This dominance is attributed to the critical role of technology in modern business operations, the rapid pace of technological innovation, and the significant cost savings and access to specialized skills that ITO provides.

- Key Drivers for ITO Dominance:

- Digital Transformation Imperative: Businesses globally are investing heavily in digital transformation, requiring sophisticated IT infrastructure, software development, cloud migration, cybersecurity, and data analytics, all of which are core to ITO.

- Cost Efficiency: Outsourcing IT functions allows companies to reduce capital expenditure on hardware, software, and specialized IT personnel, leading to substantial operational cost savings.

- Access to Specialized Skills: The IT landscape is rapidly evolving, and it can be challenging for in-house teams to keep pace with the latest technologies and expertise. ITO providers offer access to a deep pool of skilled professionals in areas like AI, machine learning, blockchain, and cybersecurity.

- Scalability and Flexibility: ITO enables businesses to scale their IT resources up or down based on demand, providing crucial flexibility in a dynamic market.

- Focus on Core Business: By outsourcing IT operations, companies can redirect their internal resources and management attention to their core business functions, fostering strategic growth and innovation.

Business Process Outsourcing (BPO) stands as the second-largest segment, driven by the need for operational efficiency, improved customer experience, and cost reduction in non-core business functions. This includes customer support, human resources, finance and accounting, and back-office operations. The increasing adoption of automation technologies within BPO is further enhancing its attractiveness.

- Key Drivers for BPO Dominance:

- Streamlining Operations: BPO allows companies to outsource repetitive and time-consuming tasks, freeing up internal staff for more strategic activities.

- Enhanced Customer Experience: Specialized BPO providers often possess the expertise and technology to deliver superior customer service, improving customer satisfaction and loyalty.

- Cost Savings: Outsourcing non-core functions to BPO providers, especially in regions with lower labor costs, can lead to significant cost reductions.

- Access to Best Practices: BPO firms often implement industry best practices, bringing efficiency and quality improvements to outsourced processes.

Knowledge Process Outsourcing (KPO) is a rapidly growing segment, focusing on high-value, knowledge-intensive tasks that require specialized domain expertise and analytical skills. This includes research and development, financial analysis, legal process outsourcing, and market research. The increasing complexity of business challenges and the demand for data-driven insights are fueling KPO growth.

- Key Drivers for KPO Growth:

- Demand for Expertise: Businesses require specialized knowledge and analytical capabilities that are not always available in-house.

- Data-Driven Decision Making: The rise of big data analytics necessitates sophisticated analysis and interpretation, a key strength of KPO.

- Innovation and R&D Support: KPO providers can support companies in their innovation and research efforts, accelerating product development and market entry.

Human Resource Outsourcing (HRO) is also a significant segment, as organizations seek to streamline HR processes such as payroll, benefits administration, talent acquisition, and training. This allows HR departments to focus on strategic talent management and employee engagement.

- Key Drivers for HRO Growth:

- HR Compliance: Navigating complex HR regulations can be challenging; HRO providers ensure compliance and mitigate risks.

- Talent Acquisition Efficiency: Outsourcing recruitment can speed up hiring processes and improve the quality of candidates.

- Focus on Strategic HR: By outsourcing administrative tasks, HR teams can concentrate on strategic initiatives like employee development and retention.

Other Service Types encompass a broad range of outsourced functions, including supply chain management, procurement, marketing, and sales support, which are increasingly being adopted by businesses looking to optimize their operations and gain a competitive edge.

Geographically, North America and Europe currently lead the market due to their established business ecosystems and high adoption rates of outsourcing. However, the Asia-Pacific region is experiencing rapid growth, driven by its large talent pool, cost advantages, and increasing focus on digital transformation.

Outsourcing Services Market Product Developments

Product developments in the Outsourcing Services Market are largely driven by technological advancements and the evolving needs of businesses. Innovations center on AI-powered automation for BPO, advanced analytics for ITO, and specialized domain expertise for KPO. Companies are developing platforms that integrate RPA, machine learning, and predictive analytics to offer more intelligent and efficient solutions. The competitive advantage for providers lies in their ability to deliver customized, scalable, and secure outsourcing solutions that address specific industry challenges and leverage emerging technologies like blockchain for enhanced transparency and security. These developments are crucial for maintaining market relevance and capturing new opportunities.

Report Scope & Segmentation Analysis

The Outsourcing Services Market is segmented by Service Type, including Business Process Outsourcing (BPO), Information Technology Outsourcing (ITO), Human Resource Outsourcing (HRO), Knowledge Process Outsourcing (KPO), and Other Service Types.

Business Process Outsourcing (BPO) is expected to witness substantial growth, driven by the demand for operational efficiency and enhanced customer engagement, with an estimated market size of USD 250 Billion by 2025 and a projected CAGR of 9.8% during the forecast period.

Information Technology Outsourcing (ITO) will continue to dominate the market, fueled by digital transformation initiatives and the need for specialized IT expertise. Its market size is projected to reach USD 350 Billion by 2025, with a CAGR of 11.2%.

Human Resource Outsourcing (HRO) is anticipated to experience steady growth, as companies focus on streamlining HR functions and strategic talent management, with a market size of USD 80 Billion by 2025 and a CAGR of 7.5%.

Knowledge Process Outsourcing (KPO) is poised for high growth due to the increasing demand for specialized analytical and research capabilities, with an estimated market size of USD 60 Billion by 2025 and a CAGR of 12.5%.

Other Service Types, encompassing areas like supply chain and procurement outsourcing, will also see significant expansion, driven by a holistic approach to business optimization.

Key Drivers of Outsourcing Services Market Growth

The Outsourcing Services Market is propelled by several significant growth drivers.

- Cost Optimization: Businesses consistently seek to reduce operational expenses by leveraging the cost efficiencies offered by outsourcing, particularly in labor-intensive functions.

- Access to Specialized Skills and Technology: Outsourcing provides access to niche expertise, cutting-edge technologies, and skilled talent that may be difficult or costly to acquire in-house.

- Focus on Core Competencies: By delegating non-core business activities, companies can concentrate their resources and strategic efforts on their core business operations, fostering innovation and competitive advantage.

- Digital Transformation Initiatives: The ongoing digital transformation across industries necessitates the adoption of new technologies and advanced solutions, often best delivered through outsourcing partnerships.

- Scalability and Flexibility: Outsourcing allows businesses to scale operations up or down rapidly in response to market demands, providing crucial agility.

Challenges in the Outsourcing Services Market Sector

Despite its growth, the Outsourcing Services Market faces several challenges.

- Data Security and Privacy Concerns: Protecting sensitive client data from cyber threats and ensuring compliance with evolving data privacy regulations (e.g., GDPR, CCPA) remains a paramount concern.

- Quality Control and Service Level Management: Maintaining consistent quality and ensuring that outsourced services meet agreed-upon service level agreements (SLAs) can be challenging.

- Cultural and Communication Barriers: Differences in culture, language, and time zones can sometimes lead to misunderstandings and impact collaboration effectiveness.

- Vendor Lock-in and Contractual Complexities: Businesses may face difficulties in switching providers or renegotiating contracts, leading to potential vendor lock-in.

- Geopolitical Instability and Regulatory Changes: Political unrest, trade wars, and changes in regulatory environments in outsourcing locations can disrupt operations and impact service delivery.

Emerging Opportunities in Outsourcing Services Market

The Outsourcing Services Market is ripe with emerging opportunities. The accelerating adoption of AI and machine learning is creating demand for intelligent automation solutions across BPO and KPO. The growing emphasis on cybersecurity is driving opportunities in specialized security outsourcing. The expansion of cloud computing services presents further avenues for ITO. Furthermore, the increasing focus on sustainability and ESG (Environmental, Social, and Governance) factors is creating opportunities for outsourcing providers to offer services aligned with these objectives. The growth of emerging economies and the increasing adoption of digital technologies in these regions also represent significant untapped potential.

Leading Players in the Outsourcing Services Market Market

- Accenture PLC

- Tata Consultancy Services Limited

- Capgemini SE

- Cognizant Technology Solutions Corporation

- HCL Technologies Ltd

- Teleperformance SE

- Evelyn Partners Group Limited

- Thomson Reuters Corporation

- TTEC Holdings Inc

- Trinitar Solutions LLP

- Amdocs Limited

- Infosys Bpm (Infosys Limited)

- Automatic Data Processing Inc

- General Outsourcing Public Company Limited

- Concentrix Corporation

Key Developments in Outsourcing Services Market Industry

- March 2024: Alight Inc. entered a definitive agreement to divest its professional services segment and its payroll and HCM outsourcing businesses, collectively known as the "Payroll & Professional Services business," to an affiliate of HIG Capital. The deal, valued at up to USD 1.2 billion, is subject to specific adjustments, valuing the business at approximately 10 times its estimated 2023 adjusted EBITDA.

- March 2024: iSON Xperiences, a global customer experience management (CXM) firm, acquired EC Outsourcing Company, a United Kingdom-based BPO. This acquisition strategically expands iSON Xperiences' reach and provides clients with direct access to BPO services from Africa, leveraging iSON's extensive knowledge of the African delivery landscape.

Strategic Outlook for Outsourcing Services Market Market

The strategic outlook for the Outsourcing Services Market remains exceptionally positive, driven by the persistent need for efficiency, specialized expertise, and digital transformation. Companies are increasingly viewing outsourcing not just as a cost-saving measure but as a strategic partnership to drive innovation, enhance agility, and achieve business resilience. The continued evolution of technologies like AI, cloud computing, and automation will further shape service offerings and create new avenues for growth. Strategic alliances, focused M&A activities, and investments in developing highly skilled workforces will be crucial for sustained success. As businesses navigate an increasingly complex global landscape, the demand for reliable, innovative, and scalable outsourcing solutions is set to rise significantly, positioning the market for robust long-term expansion.

Outsourcing Services Market Segmentation

-

1. Service Type

- 1.1. Business Process Outsourcing

- 1.2. Information Technology Outsourcing

- 1.3. Human Resource Outsourcing

- 1.4. Knowledge Process Outsourcing

- 1.5. Other Service Types

Outsourcing Services Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Ireland

- 2.5. Sweden

-

3. Asia

- 3.1. China

- 3.2. India

- 3.3. Japan

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. South Africa

Outsourcing Services Market Regional Market Share

Geographic Coverage of Outsourcing Services Market

Outsourcing Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Ongoing Migration Toward the Cloud and Adoption of Virtualized Infrastructure; Growing Demand for Efficiency and Scalable IT Infrastructure; Internet of Things for Efficient Delivery of BPO Services

- 3.3. Market Restrains

- 3.3.1. Ongoing Migration Toward the Cloud and Adoption of Virtualized Infrastructure; Growing Demand for Efficiency and Scalable IT Infrastructure; Internet of Things for Efficient Delivery of BPO Services

- 3.4. Market Trends

- 3.4.1. The Information Technology Outsourcing Segment to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Outsourcing Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Business Process Outsourcing

- 5.1.2. Information Technology Outsourcing

- 5.1.3. Human Resource Outsourcing

- 5.1.4. Knowledge Process Outsourcing

- 5.1.5. Other Service Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. North America Outsourcing Services Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Business Process Outsourcing

- 6.1.2. Information Technology Outsourcing

- 6.1.3. Human Resource Outsourcing

- 6.1.4. Knowledge Process Outsourcing

- 6.1.5. Other Service Types

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Europe Outsourcing Services Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Business Process Outsourcing

- 7.1.2. Information Technology Outsourcing

- 7.1.3. Human Resource Outsourcing

- 7.1.4. Knowledge Process Outsourcing

- 7.1.5. Other Service Types

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Asia Outsourcing Services Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Business Process Outsourcing

- 8.1.2. Information Technology Outsourcing

- 8.1.3. Human Resource Outsourcing

- 8.1.4. Knowledge Process Outsourcing

- 8.1.5. Other Service Types

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Latin America Outsourcing Services Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Business Process Outsourcing

- 9.1.2. Information Technology Outsourcing

- 9.1.3. Human Resource Outsourcing

- 9.1.4. Knowledge Process Outsourcing

- 9.1.5. Other Service Types

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. Middle East and Africa Outsourcing Services Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 10.1.1. Business Process Outsourcing

- 10.1.2. Information Technology Outsourcing

- 10.1.3. Human Resource Outsourcing

- 10.1.4. Knowledge Process Outsourcing

- 10.1.5. Other Service Types

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Accenture PLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Tata Consultancy Services Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Capgemini SE

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Cognizant Technology Solutions Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 HCL Technologies Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Teleperformance SE

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Evelyn Partners Group Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Thomson Reuters Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 TTEC Holdings Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Trinitar Solutions LLP

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Amdocs Limited

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Infosys Bpm (Infosys Limited)

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Automatic Data Processing Inc

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 General Outsourcing Public Company Limited

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Concentrix Corporatio

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Accenture PLC

List of Figures

- Figure 1: Global Outsourcing Services Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Outsourcing Services Market Volume Breakdown (Trillion, %) by Region 2025 & 2033

- Figure 3: North America Outsourcing Services Market Revenue (Million), by Service Type 2025 & 2033

- Figure 4: North America Outsourcing Services Market Volume (Trillion), by Service Type 2025 & 2033

- Figure 5: North America Outsourcing Services Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 6: North America Outsourcing Services Market Volume Share (%), by Service Type 2025 & 2033

- Figure 7: North America Outsourcing Services Market Revenue (Million), by Country 2025 & 2033

- Figure 8: North America Outsourcing Services Market Volume (Trillion), by Country 2025 & 2033

- Figure 9: North America Outsourcing Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Outsourcing Services Market Volume Share (%), by Country 2025 & 2033

- Figure 11: Europe Outsourcing Services Market Revenue (Million), by Service Type 2025 & 2033

- Figure 12: Europe Outsourcing Services Market Volume (Trillion), by Service Type 2025 & 2033

- Figure 13: Europe Outsourcing Services Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 14: Europe Outsourcing Services Market Volume Share (%), by Service Type 2025 & 2033

- Figure 15: Europe Outsourcing Services Market Revenue (Million), by Country 2025 & 2033

- Figure 16: Europe Outsourcing Services Market Volume (Trillion), by Country 2025 & 2033

- Figure 17: Europe Outsourcing Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Outsourcing Services Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Asia Outsourcing Services Market Revenue (Million), by Service Type 2025 & 2033

- Figure 20: Asia Outsourcing Services Market Volume (Trillion), by Service Type 2025 & 2033

- Figure 21: Asia Outsourcing Services Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 22: Asia Outsourcing Services Market Volume Share (%), by Service Type 2025 & 2033

- Figure 23: Asia Outsourcing Services Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Asia Outsourcing Services Market Volume (Trillion), by Country 2025 & 2033

- Figure 25: Asia Outsourcing Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Outsourcing Services Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Latin America Outsourcing Services Market Revenue (Million), by Service Type 2025 & 2033

- Figure 28: Latin America Outsourcing Services Market Volume (Trillion), by Service Type 2025 & 2033

- Figure 29: Latin America Outsourcing Services Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 30: Latin America Outsourcing Services Market Volume Share (%), by Service Type 2025 & 2033

- Figure 31: Latin America Outsourcing Services Market Revenue (Million), by Country 2025 & 2033

- Figure 32: Latin America Outsourcing Services Market Volume (Trillion), by Country 2025 & 2033

- Figure 33: Latin America Outsourcing Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Latin America Outsourcing Services Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Middle East and Africa Outsourcing Services Market Revenue (Million), by Service Type 2025 & 2033

- Figure 36: Middle East and Africa Outsourcing Services Market Volume (Trillion), by Service Type 2025 & 2033

- Figure 37: Middle East and Africa Outsourcing Services Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 38: Middle East and Africa Outsourcing Services Market Volume Share (%), by Service Type 2025 & 2033

- Figure 39: Middle East and Africa Outsourcing Services Market Revenue (Million), by Country 2025 & 2033

- Figure 40: Middle East and Africa Outsourcing Services Market Volume (Trillion), by Country 2025 & 2033

- Figure 41: Middle East and Africa Outsourcing Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East and Africa Outsourcing Services Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Outsourcing Services Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: Global Outsourcing Services Market Volume Trillion Forecast, by Service Type 2020 & 2033

- Table 3: Global Outsourcing Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Outsourcing Services Market Volume Trillion Forecast, by Region 2020 & 2033

- Table 5: Global Outsourcing Services Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 6: Global Outsourcing Services Market Volume Trillion Forecast, by Service Type 2020 & 2033

- Table 7: Global Outsourcing Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Global Outsourcing Services Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 9: United States Outsourcing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: United States Outsourcing Services Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 11: Canada Outsourcing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada Outsourcing Services Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 13: Global Outsourcing Services Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 14: Global Outsourcing Services Market Volume Trillion Forecast, by Service Type 2020 & 2033

- Table 15: Global Outsourcing Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Outsourcing Services Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 17: United Kingdom Outsourcing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United Kingdom Outsourcing Services Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 19: Germany Outsourcing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Outsourcing Services Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 21: France Outsourcing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: France Outsourcing Services Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 23: Ireland Outsourcing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Ireland Outsourcing Services Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 25: Sweden Outsourcing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Sweden Outsourcing Services Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 27: Global Outsourcing Services Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 28: Global Outsourcing Services Market Volume Trillion Forecast, by Service Type 2020 & 2033

- Table 29: Global Outsourcing Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Outsourcing Services Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 31: China Outsourcing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: China Outsourcing Services Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 33: India Outsourcing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: India Outsourcing Services Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 35: Japan Outsourcing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Japan Outsourcing Services Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 37: Global Outsourcing Services Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 38: Global Outsourcing Services Market Volume Trillion Forecast, by Service Type 2020 & 2033

- Table 39: Global Outsourcing Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Global Outsourcing Services Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 41: Brazil Outsourcing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Brazil Outsourcing Services Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 43: Mexico Outsourcing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Mexico Outsourcing Services Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 45: Global Outsourcing Services Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 46: Global Outsourcing Services Market Volume Trillion Forecast, by Service Type 2020 & 2033

- Table 47: Global Outsourcing Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Global Outsourcing Services Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 49: United Arab Emirates Outsourcing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: United Arab Emirates Outsourcing Services Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 51: Saudi Arabia Outsourcing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Saudi Arabia Outsourcing Services Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 53: South Africa Outsourcing Services Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: South Africa Outsourcing Services Market Volume (Trillion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Outsourcing Services Market?

The projected CAGR is approximately 6.40%.

2. Which companies are prominent players in the Outsourcing Services Market?

Key companies in the market include Accenture PLC, Tata Consultancy Services Limited, Capgemini SE, Cognizant Technology Solutions Corporation, HCL Technologies Ltd, Teleperformance SE, Evelyn Partners Group Limited, Thomson Reuters Corporation, TTEC Holdings Inc, Trinitar Solutions LLP, Amdocs Limited, Infosys Bpm (Infosys Limited), Automatic Data Processing Inc, General Outsourcing Public Company Limited, Concentrix Corporatio.

3. What are the main segments of the Outsourcing Services Market?

The market segments include Service Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.02 Million as of 2022.

5. What are some drivers contributing to market growth?

Ongoing Migration Toward the Cloud and Adoption of Virtualized Infrastructure; Growing Demand for Efficiency and Scalable IT Infrastructure; Internet of Things for Efficient Delivery of BPO Services.

6. What are the notable trends driving market growth?

The Information Technology Outsourcing Segment to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Ongoing Migration Toward the Cloud and Adoption of Virtualized Infrastructure; Growing Demand for Efficiency and Scalable IT Infrastructure; Internet of Things for Efficient Delivery of BPO Services.

8. Can you provide examples of recent developments in the market?

March 2024: Alight Inc., a provider of cloud-based human capital technology and services, entered a definitive agreement to divest its professional services segment and its payroll and HCM outsourcing businesses, collectively known as the "Payroll & Professional Services business," to an affiliate of HIG Capital. The deal, valued at up to USD 1.2 billion, is subject to specific adjustments. This values the Payroll & Professional Services business at a multiple of approximately 10 times its estimated 2023 adjusted EBITDA and 24 times its estimated unlevered free cash flow.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Trillion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Outsourcing Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Outsourcing Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Outsourcing Services Market?

To stay informed about further developments, trends, and reports in the Outsourcing Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence