Key Insights

The PC-based automation market is set for substantial expansion, propelled by the increasing adoption of advanced control systems across various industrial sectors. Anticipated to reach a market size of $40.3 billion with a Compound Annual Growth Rate (CAGR) of 5.15% from 2024, this sector exhibits robust potential. Key growth drivers include the proliferation of smart manufacturing initiatives, the Industrial Internet of Things (IIoT), and the escalating demand for enhanced operational efficiency. Industries such as Automotive, Oil and Gas, Food and Beverage, Electronics, and Energy and Power are significantly investing in PC-based automation to optimize production, improve product quality, and reduce operational expenditures. The inherent flexibility, scalability, and cost-effectiveness of PC-based systems, compared to traditional PLC-based solutions, further bolster adoption. Advancements in software and hardware integration, including the development of powerful embedded and industrial PCs, are also broadening application scope.

PC Based Automation Market Market Size (In Billion)

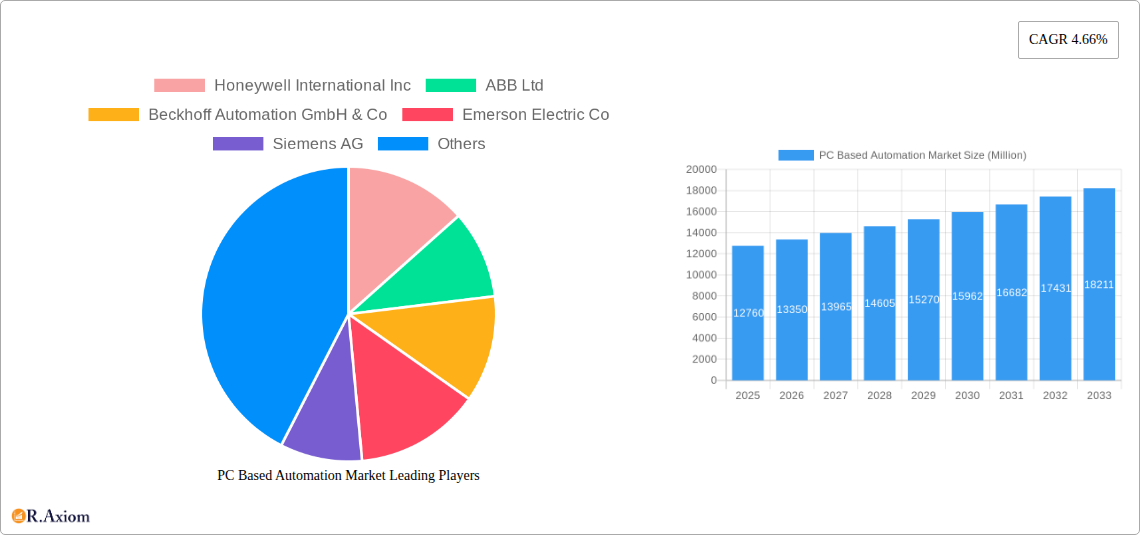

Market trends are shaped by the integration of AI and machine learning for predictive maintenance and process optimization, a rising demand for industrial automation cybersecurity, and the shift towards cloud-based deployment for improved accessibility and data management. Potential restraints include initial capital investment for system upgrades, the need for skilled personnel, and cybersecurity vulnerabilities. However, ongoing digital transformation and Industry 4.0 objectives are expected to drive sustained and dynamic market growth. Leading competitors include Honeywell International Inc., ABB Ltd., Siemens AG, and Emerson Electric Co., all actively innovating to meet evolving industry requirements.

PC Based Automation Market Company Market Share

This comprehensive report provides an in-depth analysis of the PC Based Automation Market, offering critical insights for industry stakeholders. Covering the forecast period of 2024–2033, with a base year of 2024, this report meticulously examines market dynamics, trends, and future projections. We deliver actionable intelligence on market concentration, technological advancements, dominant segments, and competitive landscapes, enabling businesses to make informed strategic decisions in this rapidly evolving sector. The forecast period of 2024–2033 provides a clear roadmap for future growth and investment opportunities.

PC Based Automation Market Market Concentration & Innovation

The PC Based Automation Market exhibits a moderately consolidated structure, driven by significant investments in research and development by key players such as Siemens AG, Honeywell International Inc., and ABB Ltd. Innovation in this space is primarily fueled by the increasing demand for advanced analytics, AI integration, and the Industrial Internet of Things (IIoT) capabilities within automation solutions. These advancements are crucial for enhancing operational efficiency, predictive maintenance, and real-time data processing across diverse end-user industries like Automotive and Energy and Power. Regulatory frameworks are evolving to support the adoption of smart manufacturing and Industry 4.0 initiatives, further stimulating innovation. However, the presence of potent product substitutes, such as PLC-based systems, necessitates continuous innovation to maintain market share. End-user trends highlight a growing preference for scalable, flexible, and integrated PC-based automation solutions. Mergers and acquisitions (M&A) remain a significant factor, with recent deals valued in the hundreds of millions of dollars aimed at consolidating market position and acquiring new technological capabilities. For instance, M&A activities in the past year alone accounted for over $500 Million in deal values, reflecting a strategic consolidation among leading entities.

PC Based Automation Market Industry Trends & Insights

The PC Based Automation Market is poised for robust expansion, driven by a confluence of technological advancements and evolving industrial demands. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 8.5% during the forecast period (2025–2033). This growth is significantly propelled by the increasing adoption of Industry 4.0 principles, where PC-based automation serves as the foundational technology for smart factories and connected manufacturing environments. The integration of artificial intelligence (AI) and machine learning (ML) into PC-based automation systems is a key trend, enabling sophisticated data analysis, predictive maintenance, and autonomous decision-making. This technological disruption allows industries to optimize production processes, reduce downtime, and enhance product quality. Consumer preferences are shifting towards highly customizable and flexible automation solutions that can adapt to dynamic production needs, a demand that PC-based systems are well-equipped to meet.

The competitive dynamics within the PC Based Automation Market are characterized by fierce competition among established global players and emerging innovators. Companies are focusing on developing integrated hardware and software solutions that offer seamless connectivity, enhanced cybersecurity, and user-friendly interfaces. The trend towards digitalization and automation is not limited to large enterprises; Small and Medium-sized Enterprises (SMEs) are also increasingly investing in PC-based automation to remain competitive. This expanding market penetration, currently estimated at around 45% across key sectors, offers significant opportunities for growth. The growing emphasis on energy efficiency and sustainability in manufacturing processes is also driving the demand for intelligent automation systems that can optimize resource utilization. Furthermore, the increasing complexity of manufactured goods and the need for precision control further amplify the importance of PC-based automation. The ongoing advancements in processing power and software capabilities of PCs are making them increasingly viable and cost-effective alternatives to traditional automation controllers, thereby fueling market penetration and growth. The drive towards global supply chain resilience and localized manufacturing also presents a significant opportunity, as businesses seek to implement agile and responsive production systems.

Dominant Markets & Segments in PC Based Automation Market

The PC Based Automation Market is experiencing significant growth across various segments, with distinct regional and industry-specific dominance.

Deployment: On-premise vs. Cloud

On-premise deployment continues to hold a substantial market share, particularly in industries where data security, proprietary information, and stringent regulatory compliance are paramount. Sectors like Oil and Gas and Energy and Power often favor on-premise solutions due to the critical nature of their operations and the need for direct control over their infrastructure. The estimated market share for on-premise solutions is around 60% of the total market. Key drivers for on-premise dominance include:

- Established IT infrastructure and legacy systems.

- Perceived higher security for sensitive operational data.

- Greater control over system updates and maintenance schedules.

- Reduced reliance on internet connectivity for core operations.

Cloud deployment is witnessing rapid growth, driven by the scalability, flexibility, and cost-effectiveness it offers. Industries such as Electronics and Food and Beverage are increasingly adopting cloud-based PC automation for its ability to facilitate remote monitoring, data analytics, and easier integration with other cloud services. The market share for cloud solutions is projected to reach 40% by 2030, with a CAGR of over 10%. Drivers for cloud adoption include:

- Reduced upfront infrastructure costs and operational expenses.

- Enhanced scalability to meet fluctuating production demands.

- Facilitation of remote access and collaboration.

- Access to advanced analytics and AI services hosted in the cloud.

End-user Industry Dominance

Automotive: This sector is a major consumer of PC-based automation, leveraging it for assembly line control, robotics integration, quality inspection, and supply chain management. The increasing trend of electric vehicle (EV) production and advanced driver-assistance systems (ADAS) further accelerates demand for sophisticated automation. The automotive segment is estimated to contribute over 25% of the total market revenue, projected to reach approximately $15 Billion by 2030. Drivers of dominance include:

- High-volume production requirements and need for precision.

- Significant investment in R&D for advanced manufacturing.

- Demand for customized and flexible production lines.

Energy and Power: This industry utilizes PC-based automation for grid management, renewable energy integration, power plant monitoring, and predictive maintenance of critical assets. The growing focus on smart grids and the transition to renewable energy sources are key growth catalysts. The Energy and Power segment is projected to account for around 18% of the market, with an estimated value of $11 Billion by 2030. Key drivers include:

- Need for reliable and efficient energy distribution.

- Integration of distributed energy resources (DERs).

- Emphasis on operational safety and asset longevity.

Oil and Gas: While traditionally reliant on specialized control systems, the Oil and Gas sector is increasingly adopting PC-based automation for process control, safety systems, and data acquisition, especially in upstream and midstream operations. The focus on digitalization and operational efficiency in challenging environments drives adoption. This segment is estimated to hold approximately 15% of the market share, valued around $9 Billion by 2030. Drivers include:

- Requirement for robust control in hazardous environments.

- Advancements in exploration and production technologies.

- Demand for real-time monitoring and data analysis.

Food and Beverage: This industry employs PC-based automation for process control, packaging, quality assurance, and traceability. The growing demand for personalized food products and stringent food safety regulations are pushing for more sophisticated automation. This segment is expected to contribute about 12% of the market value, reaching $7.2 Billion by 2030. Key drivers:

- Need for hygienic and food-safe manufacturing processes.

- Demand for efficient and high-speed production lines.

- Emphasis on product quality and consistency.

Electronics: The rapid pace of innovation and miniaturization in the electronics industry necessitates highly precise and flexible automation for manufacturing printed circuit boards (PCBs), semiconductors, and consumer electronics. This sector represents a significant growth area, projected to capture approximately 10% of the market share, valued at $6 Billion by 2030. Drivers include:

- Demand for high precision and repeatability.

- Rapid product life cycles and need for agile manufacturing.

- Integration of advanced inspection and testing systems.

Other End-user Industries: This broad category includes sectors like pharmaceuticals, aerospace, manufacturing, and logistics, all of which are increasingly adopting PC-based automation to improve efficiency, safety, and quality. The cumulative share of these industries is expected to be around 20%, with substantial growth potential driven by broader industrial digitalization trends.

PC Based Automation Market Product Developments

Product developments in the PC Based Automation Market are centered around enhanced processing power, integrated software platforms, and intelligent functionalities. Leading companies are focusing on ruggedized industrial PCs designed for harsh environments, incorporating advanced cooling systems and extended temperature ranges. Innovations include the seamless integration of IIoT connectivity, enabling real-time data exchange and remote monitoring capabilities. AI and machine learning algorithms are being embedded to facilitate predictive maintenance, optimize production workflows, and improve quality control through sophisticated analytics. The development of user-friendly graphical interfaces and virtual engineering tools further streamlines deployment and operation, offering a competitive advantage by reducing setup times and improving overall system efficiency.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the PC Based Automation Market, segmented by Deployment and End-user Industry. The Deployment segmentation includes:

- On-premise: This segment focuses on automation solutions installed and managed within the end-user's facilities. It is characterized by robust control and data security, with an estimated market size of $36 Billion in 2025 and projected growth to $65 Billion by 2033.

- Cloud: This segment encompasses automation solutions delivered via cloud-based platforms, offering scalability and remote accessibility. It is expected to grow from an estimated $24 Billion in 2025 to $50 Billion by 2033, driven by flexibility and cost efficiencies.

The End-user Industry segmentation includes:

- Automotive: Estimated at $9 Billion in 2025, growing to $18 Billion by 2033, driven by EV production and advanced manufacturing.

- Oil and Gas: Estimated at $7.5 Billion in 2025, growing to $14 Billion by 2033, influenced by digitalization and efficiency demands.

- Food and Beverage: Estimated at $6 Billion in 2025, growing to $12 Billion by 2033, fueled by safety regulations and consumer demand.

- Electronics: Estimated at $5 Billion in 2025, growing to $11 Billion by 2033, supported by innovation and miniaturization trends.

- Energy and Power: Estimated at $8 Billion in 2025, growing to $16 Billion by 2033, driven by smart grid development and renewable energy integration.

- Other End-user Industries: Estimated at $10 Billion in 2025, growing to $20 Billion by 2033, encompassing diverse sectors adopting automation for efficiency gains.

Key Drivers of PC Based Automation Market Growth

The PC Based Automation Market is propelled by several key drivers, including the relentless pursuit of operational efficiency and cost reduction across industries. The escalating adoption of Industry 4.0 technologies, such as IoT, AI, and Big Data analytics, necessitates robust PC-based automation systems for data acquisition, processing, and control. Furthermore, the increasing complexity of manufacturing processes and the demand for higher product quality and consistency are significant catalysts. Government initiatives promoting industrial modernization and digitalization, coupled with the growing need for enhanced safety and regulatory compliance in hazardous environments (e.g., Oil & Gas), also contribute significantly to market expansion. The inherent flexibility and scalability of PC-based solutions make them ideal for adapting to evolving market demands and enabling agile manufacturing.

Challenges in the PC Based Automation Market Sector

Despite its promising growth trajectory, the PC Based Automation Market faces several challenges. Cybersecurity threats remain a significant concern, as connected industrial systems are vulnerable to cyberattacks that can disrupt operations and compromise sensitive data. The high initial investment cost for comprehensive PC-based automation solutions can be a barrier for some SMEs. Moreover, the availability of skilled personnel capable of deploying, managing, and maintaining these advanced systems is a bottleneck in certain regions. Integration challenges with legacy systems and the need for standardization across different hardware and software platforms can also pose obstacles. Finally, global supply chain disruptions and geopolitical uncertainties can impact the availability of essential components and affect production timelines.

Emerging Opportunities in PC Based Automation Market

Emerging opportunities in the PC Based Automation Market are abundant and diverse. The rapid growth of the Industrial Internet of Things (IIoT) ecosystem presents a significant opportunity for PC-based automation to act as the central control and data processing hub for connected devices. The increasing demand for edge computing solutions, where data is processed closer to the source, further enhances the relevance of powerful industrial PCs. The expanding adoption of artificial intelligence (AI) and machine learning (ML) in manufacturing creates a need for sophisticated PC-based platforms capable of handling complex algorithms for predictive maintenance, quality control, and process optimization. Furthermore, the growing focus on sustainability and energy efficiency in industrial operations opens avenues for PC-based automation solutions that can monitor and optimize resource consumption. The development of more intuitive human-machine interfaces (HMIs) and the rise of digital twins also represent burgeoning areas of opportunity.

Leading Players in the PC Based Automation Market Market

- Honeywell International Inc.

- ABB Ltd

- Beckhoff Automation GmbH & Co

- Emerson Electric Co

- Siemens AG

- Omron Corporation

- Robert Bosch GmbH

- Advantech Co Ltd

- General Electric Company

Key Developments in PC Based Automation Market Industry

- 2023 November: Siemens AG launched a new generation of industrial PCs featuring enhanced processing power and AI capabilities, aimed at accelerating Industry 4.0 adoption.

- 2023 October: ABB Ltd acquired a company specializing in collaborative robotics, integrating its solutions with its PC-based automation offerings for enhanced flexibility.

- 2023 September: Honeywell International Inc. announced expanded IIoT functionalities for its industrial automation suite, emphasizing cloud-based data analytics.

- 2023 July: Beckhoff Automation GmbH & Co introduced new high-performance industrial PCs with integrated safety functions, enhancing operational security.

- 2023 May: Emerson Electric Co. unveiled a new platform for cloud-connected industrial automation, focusing on remote monitoring and predictive maintenance for the process industries.

- 2022 December: Omron Corporation launched a series of compact industrial PCs designed for space-constrained applications in the electronics manufacturing sector.

- 2022 August: Advantech Co Ltd expanded its portfolio of rugged industrial PCs with advanced thermal management for extreme environment applications.

- 2022 June: Robert Bosch GmbH showcased advancements in AI-powered PC-based vision systems for automated quality inspection.

- 2021 November: General Electric Company announced strategic partnerships to enhance the cybersecurity of its industrial PC-based automation solutions.

Strategic Outlook for PC Based Automation Market Market

The strategic outlook for the PC Based Automation Market is exceptionally positive, driven by the pervasive digital transformation initiatives across global industries. The continued integration of AI, machine learning, and IIoT into manufacturing processes will further solidify the role of PC-based automation as a core component of smart factories. Companies that can offer comprehensive, secure, and scalable solutions that seamlessly integrate hardware and software will be best positioned for success. Strategic focus on developing user-friendly interfaces, robust cybersecurity measures, and advanced data analytics capabilities will be crucial. Furthermore, exploring emerging markets and catering to the specific needs of industries like renewable energy, electric vehicles, and pharmaceuticals presents significant growth catalysts for the future. The increasing demand for automation in SMEs, coupled with the ongoing trend towards decentralized manufacturing, will continue to fuel market expansion.

PC Based Automation Market Segmentation

-

1. Deployment

- 1.1. On-premise

- 1.2. Cloud

-

2. End-user Industry

- 2.1. Automotive

- 2.2. Oil and Gas

- 2.3. Food and Beverage

- 2.4. Electronics

- 2.5. Energy and Power

- 2.6. Other End-user Industries

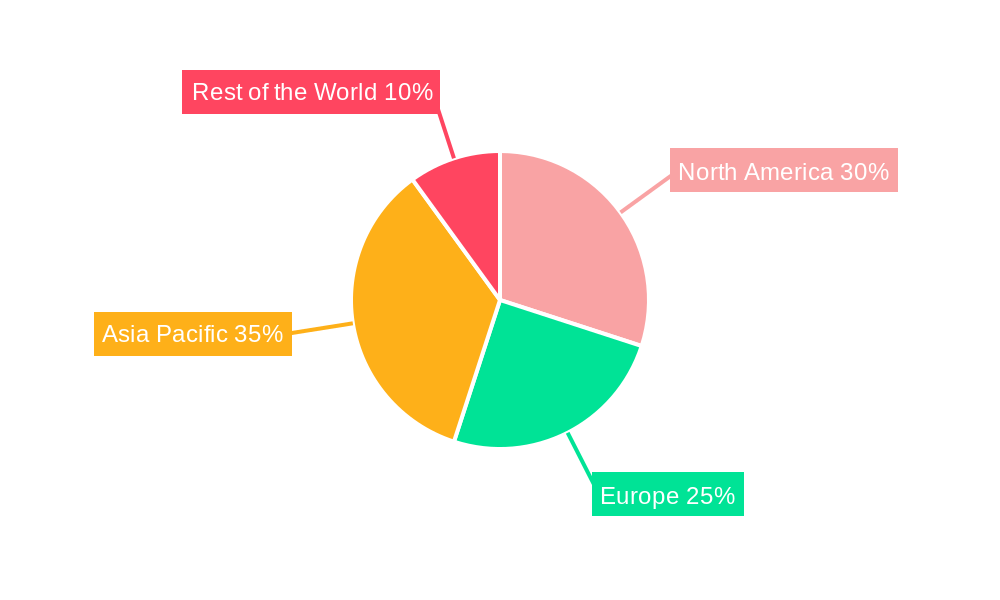

PC Based Automation Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

PC Based Automation Market Regional Market Share

Geographic Coverage of PC Based Automation Market

PC Based Automation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.15% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Need for Better Compliance; Evolution of Industrial Internet of Things and Increase in Demand for Smart Automation Solutions

- 3.3. Market Restrains

- 3.3.1. High Switching Costs May Act as a Restraint

- 3.4. Market Trends

- 3.4.1. Evolution of Industrial Internet of Things and Increase in Demand for Smart Automation Solutions

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global PC Based Automation Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 5.1.1. On-premise

- 5.1.2. Cloud

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Automotive

- 5.2.2. Oil and Gas

- 5.2.3. Food and Beverage

- 5.2.4. Electronics

- 5.2.5. Energy and Power

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 6. North America PC Based Automation Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 6.1.1. On-premise

- 6.1.2. Cloud

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Automotive

- 6.2.2. Oil and Gas

- 6.2.3. Food and Beverage

- 6.2.4. Electronics

- 6.2.5. Energy and Power

- 6.2.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 7. Europe PC Based Automation Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 7.1.1. On-premise

- 7.1.2. Cloud

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Automotive

- 7.2.2. Oil and Gas

- 7.2.3. Food and Beverage

- 7.2.4. Electronics

- 7.2.5. Energy and Power

- 7.2.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 8. Asia Pacific PC Based Automation Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 8.1.1. On-premise

- 8.1.2. Cloud

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Automotive

- 8.2.2. Oil and Gas

- 8.2.3. Food and Beverage

- 8.2.4. Electronics

- 8.2.5. Energy and Power

- 8.2.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 9. Rest of the World PC Based Automation Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 9.1.1. On-premise

- 9.1.2. Cloud

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Automotive

- 9.2.2. Oil and Gas

- 9.2.3. Food and Beverage

- 9.2.4. Electronics

- 9.2.5. Energy and Power

- 9.2.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Honeywell International Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 ABB Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Beckhoff Automation GmbH & Co

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Emerson Electric Co

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Siemens AG

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Omron Corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Robert Bosch GmbH

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Advantech Co Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 General Electric Company

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global PC Based Automation Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America PC Based Automation Market Revenue (billion), by Deployment 2025 & 2033

- Figure 3: North America PC Based Automation Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 4: North America PC Based Automation Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 5: North America PC Based Automation Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America PC Based Automation Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America PC Based Automation Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe PC Based Automation Market Revenue (billion), by Deployment 2025 & 2033

- Figure 9: Europe PC Based Automation Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 10: Europe PC Based Automation Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 11: Europe PC Based Automation Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe PC Based Automation Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe PC Based Automation Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific PC Based Automation Market Revenue (billion), by Deployment 2025 & 2033

- Figure 15: Asia Pacific PC Based Automation Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 16: Asia Pacific PC Based Automation Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 17: Asia Pacific PC Based Automation Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Asia Pacific PC Based Automation Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific PC Based Automation Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World PC Based Automation Market Revenue (billion), by Deployment 2025 & 2033

- Figure 21: Rest of the World PC Based Automation Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 22: Rest of the World PC Based Automation Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 23: Rest of the World PC Based Automation Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Rest of the World PC Based Automation Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Rest of the World PC Based Automation Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global PC Based Automation Market Revenue billion Forecast, by Deployment 2020 & 2033

- Table 2: Global PC Based Automation Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: Global PC Based Automation Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global PC Based Automation Market Revenue billion Forecast, by Deployment 2020 & 2033

- Table 5: Global PC Based Automation Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: Global PC Based Automation Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global PC Based Automation Market Revenue billion Forecast, by Deployment 2020 & 2033

- Table 8: Global PC Based Automation Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 9: Global PC Based Automation Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global PC Based Automation Market Revenue billion Forecast, by Deployment 2020 & 2033

- Table 11: Global PC Based Automation Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 12: Global PC Based Automation Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global PC Based Automation Market Revenue billion Forecast, by Deployment 2020 & 2033

- Table 14: Global PC Based Automation Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 15: Global PC Based Automation Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the PC Based Automation Market?

The projected CAGR is approximately 5.15%.

2. Which companies are prominent players in the PC Based Automation Market?

Key companies in the market include Honeywell International Inc, ABB Ltd, Beckhoff Automation GmbH & Co, Emerson Electric Co, Siemens AG, Omron Corporation, Robert Bosch GmbH, Advantech Co Ltd, General Electric Company.

3. What are the main segments of the PC Based Automation Market?

The market segments include Deployment, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 40.3 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Need for Better Compliance; Evolution of Industrial Internet of Things and Increase in Demand for Smart Automation Solutions.

6. What are the notable trends driving market growth?

Evolution of Industrial Internet of Things and Increase in Demand for Smart Automation Solutions.

7. Are there any restraints impacting market growth?

High Switching Costs May Act as a Restraint.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "PC Based Automation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the PC Based Automation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the PC Based Automation Market?

To stay informed about further developments, trends, and reports in the PC Based Automation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence