Key Insights

The Philippines Data Center Server Market is projected for substantial growth, anticipating a market size of $559.44 million by the base year 2025, at a CAGR of 6.5%. This expansion is driven by increasing digital service demand, cloud adoption, and the exponential growth of data across industries. Key catalysts include government digitalization initiatives, ongoing IT and telecommunication infrastructure investments, and the critical data processing needs of the BFSI and Media & Entertainment sectors. The adoption of advanced server form factors like blade and rack servers, enhancing density and efficiency, is a defining trend. The competitive landscape features global leaders such as Huawei Technologies, Fujitsu, HP Enterprise, Dell, Oracle, IBM, and Lenovo, alongside specialists like Super Micro Computer and Kingston Technology.

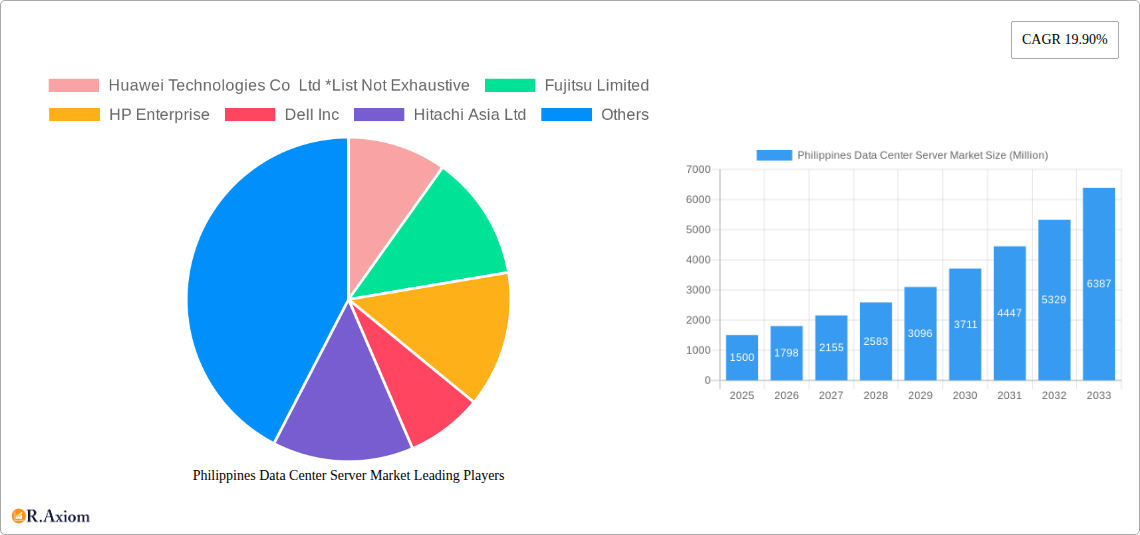

Philippines Data Center Server Market Market Size (In Million)

Market emphasis is on performance, scalability, and energy efficiency to meet escalating data and processing demands. Initial high hardware costs and the need for specialized expertise are being mitigated by innovative pricing and growing IT professional availability. Segmentation reveals a strong preference for efficient rack and blade servers over traditional tower servers, particularly in enterprise settings. As the Philippines advances its digital transformation, sophisticated data center server solutions will remain pivotal for national technological infrastructure and economic progress.

Philippines Data Center Server Market Company Market Share

This comprehensive report offers in-depth analysis and actionable intelligence on the Philippines Data Center Server Market. Covering the historical period 2019-2024, with 2025 as the base year and a forecast extending to 2033, this research examines market dynamics, technological advancements, and competitive strategies. It is an essential resource for understanding the Philippines' expanding data center infrastructure and server market.

Philippines Data Center Server Market Market Concentration & Innovation

The Philippines Data Center Server Market is characterized by a moderate level of concentration, with key global players vying for market share. Innovation is primarily driven by the relentless demand for enhanced processing power, energy efficiency, and scalability to support the nation's digital transformation. Regulatory frameworks, while evolving, are increasingly supportive of data localization and digital infrastructure development, fostering a conducive environment for market growth. Product substitutes, such as cloud-based solutions, present a competitive challenge, but the need for dedicated on-premises and hybrid infrastructure remains significant for certain applications and industries. End-user trends are dominated by the rapid adoption of cloud computing, AI, and Big Data analytics, which in turn fuels the demand for advanced server technologies. Mergers and acquisitions (M&A) activities, while not extensively publicized, are expected to play a crucial role in consolidating market presence and acquiring technological expertise, with estimated M&A deal values in the tens of millions. The market is projected to see significant investment in high-performance computing and specialized servers for AI workloads.

Philippines Data Center Server Market Industry Trends & Insights

The Philippines Data Center Server Market is poised for substantial growth, projected at a Compound Annual Growth Rate (CAGR) of XX%, driven by a confluence of technological advancements, expanding digital economies, and increasing government initiatives. The rapid digitalization across various sectors, including IT & Telecommunication, BFSI, and Government, is a primary catalyst. Businesses are increasingly investing in robust data infrastructure to support cloud adoption, big data analytics, artificial intelligence, and the Internet of Things (IoT). The escalating volume of data generated necessitates powerful and efficient server solutions. Furthermore, the Philippine government's commitment to fostering a digital economy through initiatives like the National Broadband Plan and the push for e-governance services are significant growth enablers. The expansion of cloud services, both public and private, directly translates into increased demand for server hardware. The competitive dynamics are shaped by global technology giants and emerging local players, focusing on offering a diverse range of server form factors and configurations to meet varied enterprise needs. Consumer preferences are shifting towards servers that offer higher performance, better energy efficiency, and enhanced security features, with a growing emphasis on solutions that can handle intensive workloads such as AI inferencing and advanced analytics. Market penetration of advanced server technologies is expected to deepen as businesses recognize the strategic importance of data center infrastructure for operational efficiency and competitive advantage. The demand for high-density computing solutions and specialized servers for AI and machine learning applications is a notable trend.

Dominant Markets & Segments in Philippines Data Center Server Market

The Rack Server segment is projected to maintain its dominance within the Philippines Data Center Server Market, driven by its versatility, scalability, and cost-effectiveness for a wide range of applications. This form factor is the backbone of most enterprise data centers, supporting diverse workloads from web hosting to critical business applications. The IT & Telecommunication end-user segment is a significant contributor to this dominance, with telecommunication providers continually expanding their infrastructure to meet the ever-growing demand for data and connectivity. Their need for high-density, reliable server solutions makes rack servers an ideal choice.

- Rack Server Dominance:

- Versatility: Adaptable to various deployment needs, from small server rooms to large-scale data centers.

- Scalability: Easy to add more servers to increase capacity and performance as demand grows.

- Cost-Effectiveness: Offers a strong balance between performance and price for most enterprise workloads.

- Industry Support: Widely supported by server manufacturers and IT infrastructure providers.

The IT & Telecommunication sector's continuous investment in 5G infrastructure, cloud services, and network expansion directly fuels the demand for rack servers. Following closely is the BFSI sector, which requires robust and secure server solutions for handling financial transactions, data analytics, and regulatory compliance. The increasing adoption of digital banking and fintech services further amplifies this demand.

- Key Drivers for IT & Telecommunication and BFSI Dominance:

- Digital Transformation Initiatives: Government and private sector drives for digitalization.

- Cloud Adoption: Increasing reliance on cloud infrastructure necessitates powerful server backends.

- Data Growth: Exponential increase in data generation and processing requirements.

- Security and Compliance: Stringent requirements for data protection and regulatory adherence.

While Blade Servers offer high-density computing and power efficiency, their adoption is more focused on highly specialized, high-performance computing environments. Tower Servers, on the other hand, cater to small to medium-sized businesses (SMBs) or specific departmental needs where rack infrastructure might not be feasible. The Government sector is also a growing segment, driven by e-governance initiatives and the need for secure data storage and processing capabilities. Media & Entertainment is another area experiencing growth due to the increasing demand for streaming services and content creation, requiring significant server resources for storage and processing.

Philippines Data Center Server Market Product Developments

Recent product developments highlight a strong emphasis on performance, energy efficiency, and advanced capabilities. The introduction of new server generations featuring energy-efficient processors is a key trend, enabling data centers to reduce operational costs and environmental impact. Innovations in memory technology, such as the release of higher-speed DDR5 ECC Unbuffered DIMMs and SODIMMs, are crucial for boosting server performance and handling intensive workloads. These advancements are vital for supporting demanding applications like AI inferencing, cloud gaming, and data analytics, providing competitive advantages to companies adopting these cutting-edge solutions.

Report Scope & Segmentation Analysis

This report meticulously analyzes the Philippines Data Center Server Market across several key segments. In terms of Form Factor, the market is segmented into Blade Server, Rack Server, and Tower Server. The Rack Server segment is expected to hold the largest market share due to its widespread adoption and versatility, projected to reach a market size of approximately $XX Million by 2033, with a projected CAGR of XX%. The Blade Server segment, while smaller, will experience robust growth driven by high-performance computing needs, with an estimated market size of $XX Million by 2033. Tower Servers will continue to serve the SMB segment, with a projected market size of $XX Million by 2033. The End-User segmentation includes IT & Telecommunication, BFSI, Government, Media & Entertainment, and Other End-User. The IT & Telecommunication segment is the leading end-user, driven by massive infrastructure upgrades and cloud service expansion, expected to command a market share of XX% by 2033.

Key Drivers of Philippines Data Center Server Market Growth

The Philippines Data Center Server Market is propelled by several key drivers. The rapid digitalization of the economy, fueled by increasing internet penetration and smartphone adoption, creates an insatiable demand for data storage and processing. Government initiatives aimed at fostering digital transformation and e-governance are crucial, encouraging investment in robust IT infrastructure. The expansion of cloud computing services, both domestic and international, requires substantial server capacity to support cloud-native applications and hybrid cloud strategies. Furthermore, the burgeoning adoption of emerging technologies such as Artificial Intelligence (AI), Machine Learning (ML), and the Internet of Things (IoT) necessitates high-performance and scalable server solutions. Economic growth and increasing foreign direct investment in technology sectors also contribute significantly to the demand for advanced data center infrastructure.

Challenges in the Philippines Data Center Server Market Sector

Despite its promising growth trajectory, the Philippines Data Center Server Market faces several challenges. High power consumption and the associated electricity costs in the Philippines can significantly impact operational expenses for data centers. Ensuring a stable and reliable power supply is paramount, and frequent outages can disrupt services. Regulatory hurdles and compliance requirements, while evolving, can sometimes pose complexities for new market entrants and established players. Supply chain disruptions, particularly for specialized server components and advanced technologies, can lead to extended lead times and increased costs. Intense competition from established global players and the increasing preference for fully managed cloud services can also present challenges for local server providers.

Emerging Opportunities in Philippines Data Center Server Market

Emerging opportunities in the Philippines Data Center Server Market are diverse and significant. The growing demand for edge computing solutions, driven by latency-sensitive applications like real-time analytics and IoT deployments, presents a substantial growth avenue. The increasing focus on sustainability and energy efficiency is creating opportunities for vendors offering green data center technologies and power-efficient servers. The continued expansion of the BPO (Business Process Outsourcing) sector and the rise of digital nomads will drive demand for robust and scalable IT infrastructure. Furthermore, government investments in smart city initiatives and digital infrastructure projects will open new avenues for server deployments. The development of specialized server solutions for AI and machine learning workloads, catering to the needs of research institutions and innovative enterprises, is another promising area.

Leading Players in the Philippines Data Center Server Market Market

- Huawei Technologies Co Ltd

- Fujitsu Limited

- HP Enterprise

- Dell Inc

- Hitachi Asia Ltd

- Oracle Corporation

- IBM Corporation

- Lenovo Group Limited

- Kingston Technology Corporation

- Super Micro Computer Inc

Key Developments in Philippines Data Center Server Market Industry

- August 2023: Hewlett Packard Enterprise announced that phoenixNAP is expanding its Bare Metal Cloud platform with cloud-native HPE ProLiant RL300 Gen11 servers, using energy-efficient processors from Ampere Computing. The expanded services support AI inferencing, cloud gaming, and other cloud-native workloads with improved performance and energy efficiency.

- June 2023: Kingston Technology announced the release of its 32 GB and 16 GB Server Premier DDR5 5600 MT/s and 5200 MT/s ECC Unbuffered DIMMs and ECC SODIMMs. Server Premier is Kingston's industry-standard server class memory solution sold by the specification for use in white-box systems and is the Intel platform validated and qualified by leading motherboard/system manufacturers.

Strategic Outlook for Philippines Data Center Server Market Market

The strategic outlook for the Philippines Data Center Server Market is one of robust and sustained growth. Key growth catalysts include the ongoing digital transformation initiatives across all sectors, the continued expansion of cloud computing infrastructure, and the increasing adoption of advanced technologies like AI and IoT. Investments in high-density computing, energy-efficient server solutions, and specialized hardware for data analytics and AI will be crucial for market players. The government's commitment to digital infrastructure development and the growing demand from emerging sectors like edge computing and smart cities present significant opportunities. Companies that can offer innovative, scalable, and cost-effective server solutions, coupled with strong technical support and a focus on sustainability, are well-positioned to capitalize on the evolving market landscape. The market's future hinges on its ability to meet the increasing demand for localized data processing and storage capabilities, supporting the nation's ambition to become a digital economic hub in Southeast Asia.

Philippines Data Center Server Market Segmentation

-

1. Form Factor

- 1.1. Blade Server

- 1.2. Rack Server

- 1.3. Tower Server

-

2. End-User

- 2.1. IT & Telecommunication

- 2.2. BFSI

- 2.3. Government

- 2.4. Media & Entertainment

- 2.5. Other End-User

Philippines Data Center Server Market Segmentation By Geography

- 1. Philippines

Philippines Data Center Server Market Regional Market Share

Geographic Coverage of Philippines Data Center Server Market

Philippines Data Center Server Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Rollout Towards Fiber Connectivity and 5G Deployment; Demand for Cloud Computing Among Enterprises

- 3.3. Market Restrains

- 3.3.1. High CapEx for Building Data Center Along With Security Challenges

- 3.4. Market Trends

- 3.4.1. IT and Telecom to Hold Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Philippines Data Center Server Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Form Factor

- 5.1.1. Blade Server

- 5.1.2. Rack Server

- 5.1.3. Tower Server

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. IT & Telecommunication

- 5.2.2. BFSI

- 5.2.3. Government

- 5.2.4. Media & Entertainment

- 5.2.5. Other End-User

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Philippines

- 5.1. Market Analysis, Insights and Forecast - by Form Factor

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Huawei Technologies Co Ltd *List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Fujitsu Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 HP Enterprise

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Dell Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hitachi Asia Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Oracle Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 IBM Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Lenovo Group Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Kingston Technology Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Super Micro Computer Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Huawei Technologies Co Ltd *List Not Exhaustive

List of Figures

- Figure 1: Philippines Data Center Server Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Philippines Data Center Server Market Share (%) by Company 2025

List of Tables

- Table 1: Philippines Data Center Server Market Revenue million Forecast, by Form Factor 2020 & 2033

- Table 2: Philippines Data Center Server Market Revenue million Forecast, by End-User 2020 & 2033

- Table 3: Philippines Data Center Server Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Philippines Data Center Server Market Revenue million Forecast, by Form Factor 2020 & 2033

- Table 5: Philippines Data Center Server Market Revenue million Forecast, by End-User 2020 & 2033

- Table 6: Philippines Data Center Server Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Philippines Data Center Server Market?

The projected CAGR is approximately 6.5%.

2. Which companies are prominent players in the Philippines Data Center Server Market?

Key companies in the market include Huawei Technologies Co Ltd *List Not Exhaustive, Fujitsu Limited, HP Enterprise, Dell Inc, Hitachi Asia Ltd, Oracle Corporation, IBM Corporation, Lenovo Group Limited, Kingston Technology Corporation, Super Micro Computer Inc.

3. What are the main segments of the Philippines Data Center Server Market?

The market segments include Form Factor, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 559.44 million as of 2022.

5. What are some drivers contributing to market growth?

Government Rollout Towards Fiber Connectivity and 5G Deployment; Demand for Cloud Computing Among Enterprises.

6. What are the notable trends driving market growth?

IT and Telecom to Hold Significant Growth.

7. Are there any restraints impacting market growth?

High CapEx for Building Data Center Along With Security Challenges.

8. Can you provide examples of recent developments in the market?

August 2023 - Hewlett Packard Enterprise announced that phoenixNAP is expanding its Bare Metal Cloud platform with cloud-native HPE ProLiant RL300 Gen11 servers, using energy-efficient processors from AmpereComputing. The expanded services support AI inferencing, cloud gaming, and other cloud-native workloads with improved performance and energy efficiency.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Philippines Data Center Server Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Philippines Data Center Server Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Philippines Data Center Server Market?

To stay informed about further developments, trends, and reports in the Philippines Data Center Server Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence